As filed with the Securities and Exchange Commission on February 22, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

OPENLANE, Inc.

(Exact name of registrant as specified in its charter)

| | | | | |

| Delaware | 20-8744739 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) |

11299 N. Illinois Street

Carmel, Indiana 46032

(800) 923-3725

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Charles S. Coleman

Executive Vice President, Chief Legal Officer & Secretary

OPENLANE, Inc.

11299 N. Illinois Street

Carmel, Indiana 46032

(800) 923-3725

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Dwight S. Yoo

Skadden, Arps, Slate, Meagher & Flom LLP

One Manhattan West

New York, New York 10001

(212) 735-3000

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box.

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box.

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | | Accelerated filer | |

| Non-accelerated filer | | Smaller reporting company | |

| | Emerging growth company | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

Prospectus

OPENLANE, Inc.

Up to 634,305 Shares of Series A Convertible Preferred Stock

Up to 36,051,606 Shares of Common Stock

This prospectus relates to the resale from time to time of: (i) up to 634,305 shares of our Series A Convertible Preferred Stock, par value $0.01 per share (the “Series A Preferred Stock”) held by the selling stockholders as of February 15, 2024 and (ii) up to 36,051,606 shares of our common stock, par value $0.01 per share (the “common stock”), issuable upon conversion of 634,305 shares of Series A Preferred Stock held by the selling stockholders as of February 15, 2024.

The selling stockholders may offer and sell shares of our common stock and Series A Preferred Stock in amounts, at prices and on terms that will be determined at the time of the offering. We will not receive any proceeds from the sale of any shares of our common stock or Series A Preferred Stock by the selling stockholders, but we have agreed to pay certain registration expenses, other than underwriting discounts and commissions and applicable transfer taxes, in connection with offerings by the selling stockholders.

We are registering the resale of shares of our common stock and Series A Preferred Stock in connection with the exercise by the selling stockholders of their registration rights pursuant to the Registration Rights Agreements described under “Description of Capital Stock,” but the registration of such shares does not necessarily mean that any of such shares will be offered or sold by the selling stockholders pursuant to this prospectus or at all.

This prospectus describes the general manner in which the shares of our common stock and Series A Preferred Stock may be offered and sold by the selling stockholders. Any prospectus supplement may add, update, or change information contained in this prospectus. You should carefully read this prospectus and any applicable prospectus supplement, as well as the documents incorporated by reference herein or therein, before you invest in our common stock or Series A Preferred Stock.

Our common stock is listed on the New York Stock Exchange (the “NYSE”) under the symbol “KAR.” The Series A Preferred Stock is not listed on an exchange and we do not intend to list the Series A Preferred Stock on any exchange.

Investing in our common stock or Series A Preferred Stock involves risks. See “Risk Factors” beginning on page 4 of this prospectus and “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2023, and in other documents that we subsequently file with the Securities and Exchange Commission (“SEC”) that are incorporated by reference into this prospectus to read about factors you should consider before investing in our common stock or Series A Preferred Stock.

Neither the SEC nor any state or other domestic or foreign securities commission or regulatory authority has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is February 22, 2024.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of an “automatic shelf” registration statement that we filed with the SEC as a “well-known seasoned issuer” as defined in Rule 405 under the Securities Act. By using a shelf registration statement, the selling stockholders may sell our common stock or Series A Preferred Stock from time to time and in one or more offerings.

This prospectus provides you with a general description of the common stock and Series A Preferred Stock that the selling stockholders may offer. Each time a selling stockholder sells shares of our common stock or Series A Preferred Stock using this prospectus, to the extent necessary, we will provide a prospectus supplement that will contain specific information about the terms of that offering, the number of shares being offered, the manner of distribution, the identity of any underwriters or other counterparties and other specific terms related to the offering. The prospectus supplement may also add, update or change information contained or incorporated by reference in this prospectus. If there is any inconsistency between the information in this prospectus and any prospectus supplement, you should rely on the information provided in the prospectus supplement. This prospectus does not contain all of the information included in the registration statement of which the prospectus forms a part. The registration statement filed with the SEC includes or incorporates by reference exhibits that provide more details about the matters discussed in this prospectus. You should carefully read the entirety of this prospectus, the related exhibits filed with the SEC and any prospectus supplement, together with the additional information described below under the headings “Incorporation by Reference” and “Where You Can Find Additional Information,” before making an investment decision.

In this prospectus, except as otherwise indicated or as the context suggests otherwise, references in this prospectus to the “Company,” “we,” “us” or “our” are to OPENLANE, Inc. and its subsidiaries. The term “selling stockholders” includes pledgees, donees, assignees, transferees or other successors-in-interest who may later hold the selling stockholders’ interests.

Neither we nor the selling stockholders have authorized anyone to give you any information or to make any representation other than those contained in this prospectus, in any applicable prospectus supplement, in any documents that are incorporated by reference herein or therein or in any other documents to which we refer you. If anyone provides you with different or inconsistent information, you should not rely on it. No selling stockholder is making an offer to sell or seeking an offer to buy shares of our common stock or Series A Preferred Stock in any jurisdiction where an offer or sale is not permitted.

You should not assume that the information appearing in this prospectus or any applicable prospectus supplement or the documents incorporated by reference herein or therein is accurate as of any date other than their respective dates. Our business, financial condition, results of operations and prospects may have changed since those dates.

FORWARD-LOOKING STATEMENTS

This prospectus contains or incorporates by reference forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and which are subject to certain risks, trends and uncertainties. In particular, statements made in this prospectus that are not historical facts (including, but not limited to, expectations, estimates, assumptions and projections regarding the industry, business, future operating results, potential acquisitions and anticipated cash requirements) may be forward-looking statements. Words such as “should,” “may,” “will,” “can,” “of the opinion,” “confident,” “anticipates,” “expects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “continues,” “outlook,” “initiatives,” “goals,” “opportunities,” and similar expressions identify forward-looking statements. Such statements, including statements regarding adverse market conditions; our future growth; anticipated cost savings, revenue increases, credit losses and capital expenditures; contractual obligations; dividend declarations and payments; common stock repurchases; tax rates and assumptions; strategic initiatives, acquisitions and dispositions; our competitive position and retention of customers; and our continued investment in information technology, are not guarantees of future performance and are subject to risks and uncertainties that could cause actual results to differ materially from the results projected, expressed or implied by these forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed under the heading “Risk Factors” in this prospectus and in our Annual Report on Form 10-K for the year ended December 31, 2023, and those described from time to time in our future reports filed with the Securities and Exchange Commission. Many of these risk factors are outside of our control, and as such, they involve risks which are not currently known that could cause actual results to differ materially from those discussed or implied herein. The forward-looking statements in this prospectus are made as of the date on which they are made and we do not undertake to update our forward-looking statements.

OUR COMPANY

We are a leading digital marketplace for used vehicles, connecting sellers and buyers across North America and Europe to facilitate fast, easy and transparent transactions. Our portfolio of integrated technology, data analytics, financing, logistics, reconditioning and other remarketing solutions, combined with our vehicle logistics centers in Canada, help advance our purpose: to make wholesale easy so our customers can be more successful.

We provide sellers and buyers across the global wholesale used vehicle industry with innovative, technology-driven remarketing solutions. Our unique end-to-end platform supports whole car, financing, logistics and other ancillary and related services. Our integrated marketplaces reduce risk, improve transparency and streamline transactions for customers around the globe. Headquartered in Carmel, Indiana, we have employees across the United States, Canada, Europe, Uruguay and the Philippines.

On May 15, 2023, the name of the Company was changed from KAR Auction Services, Inc. to OPENLANE, Inc. The address of our principal executive office is 11299 N. Illinois Street, Carmel, Indiana 46032. Our phone number is (800) 923-3725. Our website address is corporate.openlane.com. We are not incorporating the contents of our website into this prospectus.

RISK FACTORS

Investing in our common stock or Series A Preferred Stock involves risks. Before making an investment decision, you should carefully read and consider the information set forth under the heading “Risk Factors” in our most recent Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q and periodic reports we have filed and may file with the SEC from time to time, as well as the other information contained or incorporated by reference in this prospectus or in any applicable prospectus supplement. See “Where You Can Find More Information” elsewhere in this prospectus. Our business and financial results may also be adversely affected by risks and uncertainties not presently known to us or that we currently believe to be immaterial. If any of those risks or uncertainties should occur or other risks arise or develop, our business, prospects, financial condition, results of operations and cash flows, as well as the trading price of our common stock, may be materially and adversely affected, causing you to lose all or part of the money you paid to buy our common stock or Series A Preferred Stock.

Risks Related to the Series A Preferred Stock

The Series A Preferred Stock will rank junior to all of our and our subsidiaries’ liabilities in the event of a bankruptcy, liquidation or winding-up.

In the event of bankruptcy, liquidation or winding-up, our assets will be available to pay obligations on the Series A Preferred Stock only after all of our liabilities have been paid. In addition, the Series A Preferred Stock effectively ranks junior to all existing and future liabilities of our subsidiaries. The rights of holders of the Series A Preferred Stock to participate in the assets of our subsidiaries upon any liquidation or reorganization of any subsidiary will rank junior to the prior claims of that subsidiary’s creditors. In the event of bankruptcy, liquidation or winding-up, there may not be sufficient assets remaining, after paying our liabilities and our subsidiaries’ liabilities, to pay amounts due on the Series A Preferred Stock.

An active trading market for the Series A Preferred Stock does not exist and may not develop.

The Series A Preferred Stock has no established trading market and is not listed on any securities exchange. Since the Series A Preferred Stock has no stated maturity date, investors seeking liquidity will be limited to selling their shares in the secondary market. We cannot assure you that an active trading market in the Series A Preferred Stock will develop and, even if it develops, we cannot assure you that it will last. In either case, the trading price of the Series A Preferred Stock could be adversely affected and holders’ ability to transfer shares of Series A Preferred Stock will be limited.

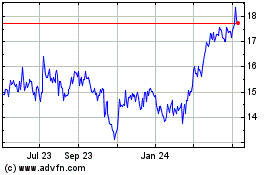

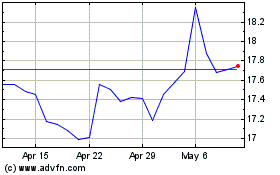

The market price of the Series A Preferred Stock will be directly affected by the market price of our common stock, which may be volatile.

To the extent that a secondary market for the Series A Preferred Stock develops, we believe that the market price of the Series A Preferred Stock will be significantly affected by the market price of our common stock. The trading price of our common stock may be highly volatile and could be subject to wide fluctuations in response to various factors, including the risk factors described in the section entitled “Risk Factors” contained in our most recent Annual Report on Form 10-K and our subsequent Quarterly Reports on Form 10-Q and other factors which are beyond our control. See “Risks Related to the Common Stock—The market price and trading volume of our common stock may be volatile, which could result in rapid and substantial losses for our stockholders and could expose us to securities class action litigation.”

In addition, the stock market in general has experienced extreme price and volume fluctuations that have often been unrelated or disproportionate to our business, financial condition or results of operations. Following periods of volatility in the market price of a company’s securities, securities class action litigation could be initiated. If such litigation were introduced against us, it could result in substantial costs and a diversion of our attention and resources, which could have a material adverse effect on our business.

We cannot predict how shares of our common stock will trade in the future, but fluctuations that may adversely affect the market prices of our common stock, may, in turn, adversely affect the price of Series A Preferred Stock. This may result in greater volatility in the market price of the Series A Preferred Stock than would be expected for nonconvertible preferred stock. In addition, we expect that the market price of the Series A Preferred Stock will be influenced by yield and interest rates in the capital markets and our perceived creditworthiness.

Future offerings of debt securities, which would rank senior to the common stock and Series A Preferred Stock, may adversely affect the market price of the common stock and Series A Preferred Stock.

If, in the future, we decide to issue debt securities, it is likely that such securities will be governed by an indenture or other instrument containing covenants restricting our operating flexibility. We and, indirectly, our stockholders, will bear the cost of issuing and servicing such securities. Because our decision to issue debt securities in any future offering will depend on market conditions and other factors beyond our control, we cannot predict or estimate the amount, timing or nature of our future offerings. Thus, holders of the common stock and Series A Preferred Stock will bear the risk of our future offerings reducing the market price of the common stock and Series A Preferred Stock.

In addition, each share of Series A Preferred Stock will initially be convertible at the option of the holder thereof into shares of our common stock. The conversion of some or all of the Series A Preferred Stock will dilute the ownership interest of our existing holders of common stock. Any sales in the public market of our common stock issuable upon such conversions could adversely affect prevailing market prices of the outstanding shares of our common stock and Series A Preferred Stock. In addition, the existence of our Series A Preferred Stock may encourage short selling or arbitrage trading activity by market participants because the conversion of our Series A Preferred Stock could depress the price of our equity securities. As noted above, a decline in the market price of the common stock may negatively impact the market price for the Series A Preferred Stock.

The Series A Preferred Stock is subject to conversion at our option in certain circumstances based on the trading price of our common stock.

If, at any time, the closing price of the common stock exceeds $31.0625 per share for at least 20 trading days in any period of 30 consecutive trading days, we will be entitled, but not required, to convert all or any portion of the Series A Preferred Stock, at a conversion price equal to the sum of the liquidation preference and accrued dividends with respect to each share of Series A Preferred Stock as of the mandatory conversion date divided by the conversion price of such share in effect as of the mandatory conversion date. Following any such conversion, a holder will no longer be entitled to the dividend or other rights associated with the Series Convertible A Preferred Stock.

The Series A Preferred Stock has not been rated.

The Series A Preferred Stock has not been rated by any nationally recognized statistical rating organization. This may affect the market price of the Series A Preferred Stock.

The Series A Preferred Stock may only be redeemed at the option of the holder in limited circumstances.

The shares of Series A Preferred Stock, unlike indebtedness, will not give rise to a claim for payment of a principal amount at a particular date. As a result, holders of the Series A Preferred Stock may be required to bear the financial risks of an investment in the Series A Preferred Stock for an extended period of time.

We have the right, but not the obligation, to redeem shares of Series A Preferred Stock in limited circumstances.

We are entitled, but not required, to redeem all or a portion of the shares of Series A Preferred Stock following the six-year year anniversary of the original issue date. See “Description of Capital Stock—Series A Preferred Stock—Redemption Features.” Therefore, holders should not expect that they have a right to perpetual payment of dividends and should be aware that a proposed redemption of the Series A Preferred Stock may make it difficult or impossible to sell shares of Series A Preferred Stock for a higher price, even if the market price for such shares had previously been higher.

You may not receive any future dividends on the Series A Preferred Stock.

We are not required to declare cash dividends on the Series A Preferred Stock. Future dividend decisions will be based on and affected by a variety of factors, including our financial condition and results of operations, contractual restrictions, including restrictive covenants contained in our debt agreements, capital requirements and other factors that our board of directors (the “Board”) deems relevant. Therefore, no assurance can be given as to whether any future dividends may be declared by our Board or the amount thereof.

Any debt agreements that we enter into in the future may limit our ability to pay cash dividends on our capital stock, including the Series A Preferred Stock, and our ability to make any cash payment upon conversion, redemption or repurchase of the Series A Preferred Stock.

Under applicable Delaware law, a Delaware corporation generally may not make a distribution if, after giving effect to the distribution, the corporation would not be able to pay its liabilities as the liabilities become due in the usual course of business, or generally if the corporation’s total assets would be less than the sum of its total liabilities plus, unless the corporation’s charter provides otherwise, the amount that would be needed if the corporation were dissolved at the time of the distribution, to satisfy the preferential rights upon dissolution of the stockholders whose preferential rights are superior to those receiving the distribution.

The conversion rate of the Series A Preferred Stock may not be adjusted for all dilutive events that may adversely affect the market price of the Series A Preferred Stock or the common stock issuable upon conversion of the Series A Preferred Stock.

The number of shares of our common stock that holders are entitled to receive upon conversion of a share of Series A Preferred Stock is subject to adjustment for certain events. See “Description of Capital Stock—Series A Preferred Stock—Conversion Features.” However, there can be no assurance that an event that adversely affects the value of the Series A Preferred Stock, but does not result in an adjustment to the conversion rate, will not occur. Further, if any of these other events adversely affects the market price of our common stock, it may also adversely affect the market price of the Series A Preferred Stock. In addition, other than in certain instances, we are not restricted from offering common stock in the future or engaging in other transactions that may dilute our common stock.

Holders may have to pay taxes if we adjust the conversion rate of the Series A Preferred Stock in certain circumstances, even though holders would not receive any cash.

Upon certain adjustments to (or certain failures to make adjustments to) the conversion rate of the Series A Preferred Stock, holders may be deemed to have received a distribution from us, resulting in taxable income to them for U.S. federal income tax purposes, even though holders would not receive any cash in connection with such adjustment to (or failure to adjust) the conversion rate. If you are a Non-U.S. Holder (as defined in “United States Federal Income Tax Considerations”) of the Series A Preferred Stock, any deemed dividend may be subject to U.S. federal withholding tax at a 30% rate, or such lower rate as may be specified by an applicable treaty. Please consult your tax advisor and read “United States Federal Income Tax Considerations” regarding the U.S. federal income tax consequences of an adjustment to the conversion rate of the Series A Preferred Stock.

Holders may have to pay taxes if we make distributions of additional Series A Preferred Stock on the Series A Preferred Stock, even if holders do not receive any cash.

We may make distributions on the Series A Preferred Stock in the form of additional shares of Series A Preferred Stock rather than in cash. Although it is not free from doubt, we expect such distributions generally to be tax-free, provided that we do not have outstanding indebtedness that is convertible into common shares, other equity linked securities, or any class of stock in which the holders of the Series A Preferred Stock do not participate in dividends, and cash payments are made or accrued on such instruments. The Internal Revenue Service (the “IRS”), however, may disagree with our tax analysis and take the position that distributions in the form of additional shares of Series A Preferred Stock will be subject to tax in the same manner as cash distributions. If such position is successful or certain unexpected circumstances occur, in years in which we have current or accumulated earnings and profits, holders will generally recognize dividend income in an amount equal to the fair market value of the additional shares of Series A Preferred Stock. In such a case, a holder’s tax liability may exceed the cash such holder receives from the Series A Preferred Stock. Thus, holders of the Series A Preferred Stock would be required to use

funds from other sources to satisfy their tax liabilities arising from their ownership of the Series A Preferred Stock. In addition, if you are a Non-U.S. Holder of the Series A Preferred Stock, any such dividend may be subject to U.S. federal withholding tax at a 30% rate, or such lower rate as may be specified by an applicable treaty. Please consult your tax advisor and read “U.S. Federal Income Tax Considerations” regarding the U.S. federal income tax consequences of distributions on the Series A Preferred Stock.

Accrued dividends with respect to the Series A Preferred Stock may be treated as taxable dividends even though holders would not receive any cash.

Dividends on the Series A Preferred Stock may be accrued rather than paid at the Company’s sole discretion. While accrued dividends will be taken into account in any future liquidation, redemption or conversion event, accrued dividends will not formally be added to the liquidation preference or redemption amounts of the Series A Preferred Stock under the terms of such stock.

The tax treatment of dividends accrued on the Series A Preferred Stock is a matter of uncertainty and may depend, in part, on whether the Series A Preferred Stock is treated as participating in corporate growth to any significant extent as determined under the applicable Treasury Regulations. The Company takes the position that the Series A Preferred Stock will be treated as participating in corporate growth to a significant extent. This position, however, is not free from doubt and there can be no assurance that the IRS will not take the position that the Series A Preferred Stock should not be treated as participating in corporate growth to any significant extent as determined under the Treasury Regulations. In the event the Series A Preferred Stock is treated as not participating in corporate growth to any significant extent, the unpaid accrued dividends may be treated as “redemption premium.” This redemption premium may be treated as a taxable deemed distribution under Sections 305(b) and 305(c) of the U.S. Internal Revenue Code of 1986, as amended (the “Code”), if the redemption premium is in excess of a statutory de minimis amount. Such taxable deemed distributions generally are required to be taken into account under timing principles similar to those governing the inclusion of accrued original issue discount under Section 1272(a) of the Code. Under such circumstances, holders may have taxable income for U.S. federal income tax purposes, even though they would not receive any cash or property in connection with the increase in accrued dividends.

Section 305(c) of the Code and the Treasury Regulations promulgated thereunder also contemplate other circumstances in which a taxable deemed distribution may be treated as having occurred. Section 305(c) of the Code and the applicable Treasury Regulations do not clearly address whether accrued dividends will be treated as redemption premium or otherwise might give rise to a deemed distribution under the Code. The Company takes the position that the accrual of dividends on the Series A Preferred Stock will not be includible in the holder’s taxable income as disguised redemption premium or otherwise until such dividends are authorized by our Board, or any duly authorized committee thereof, and declared by the Company and paid in cash. Further, the Company has agreed in the Investment Agreements that it will not treat such accruals as includible in the holder’s income until such dividends are declared and paid in cash. If the IRS were to take a contrary position and treat an increase in the amount of accrued dividends as a current distribution, then holders may have taxable income to them for U.S. federal income tax purposes, even though holders would not receive any cash in connection with the increase in accrued dividends.

Please consult your tax advisor and read “United States Federal Income Tax Considerations” regarding the U.S. federal income tax consequences of the accrual of dividends on the Series A Preferred Stock.

We may not have sufficient earnings and profits in order for dividends on the Series A Preferred Stock to be treated as dividends for U.S. federal income tax purposes.

Cash dividends and other transactions treated as distributions under Sections 305(b) or 305(c) of the Code payable by us on the Series A Preferred Stock may exceed our current and accumulated earnings and profits, as calculated for U.S. federal income tax purposes. If that occurs, it will result in the amount of the dividends that exceed such earnings and profits being treated for U.S. federal income tax purposes first as a return of capital to the extent of the holder’s adjusted tax basis in the Series A Preferred Stock, and the excess, if any, over such adjusted tax basis as capital gain. Such treatment will generally be unfavorable for corporate holders and may also be unfavorable for other holders.

Risks Related to the Common Stock

The market price of our common stock could be negatively affected by sales of substantial amounts of our common stock in the public market.

Future sales by the selling stockholders of substantial amounts of our common stock in the public market, or the perception that these sales may occur, could cause the market price of our common stock to decline. These sales also could impede our ability to raise future capital. Under our Charter (as defined below), we are authorized to issue up to 400,000,000 shares of common stock, of which 108,045,559 shares of common stock were outstanding as of February 15, 2024. In addition, pursuant to a registration statement under the Securities Act, we have registered shares of common stock reserved for issuance in respect of stock options and other incentive awards granted to our officers and certain of our employees. If any of these holders cause a large number of securities to be sold in the public market, including common stock issuable upon conversion of the Series A Preferred Stock, the sales could reduce the trading price of our common stock. We cannot predict the size of future sales of shares of our common stock or the effect, if any, that future sales, or the perception that such sales may occur, would have on the market price of our common stock.

The market price and trading volume of our common stock may be volatile, which could result in rapid and substantial losses for our stockholders and could expose us to securities class action litigation.

You should consider an investment in our common stock to be risky, and you should invest in our common stock only if you can withstand a significant loss and wide fluctuations in the market value of your investment. Many factors could cause the market price of our common stock to rise and fall, including but not limited to the following:

•announcements by us or our competitors of significant business developments, new offerings, acquisitions or strategic investments;

•changes in earnings estimates or recommendations by securities analysts, if any, who cover our common stock;

•results of operations that are below our announced guidance or below securities analysts’ or consensus estimates or expectations;

•fluctuations in our quarterly financial results or the quarterly financial results of companies perceived to be similar to us;

•changes in our capital structure, such as future issuances of securities, sales of large blocks of common stock by our stockholders or our incurrence of additional debt;

•repurchases of our common stock pursuant to our share repurchase program;

•investors’ general perception of us and our industry;

•changes in general economic and market conditions;

•changes in industry conditions (including changes in anticipated future market size and growth rate); and

•changes in regulatory and other dynamics.

In addition, if the market for stocks in our industry, or the stock market in general, experiences a loss of investor confidence, the trading price of our common stock could decline for reasons unrelated to our business, financial condition or results of operations. If any of the foregoing occurs, it could cause our stock price to fall and may expose us to lawsuits that, even if successfully defended, could be costly to defend and a distraction to management. Likewise, following periods of volatility in the market price of a company's securities, securities class action litigation could be initiated. If such litigation were introduced against us, it could result in substantial costs and a diversion of our attention and resources, which could have a material adverse effect on our business.

None of the proceeds from the sale of shares of our common stock by the selling stockholders in this offering will be available to us.

We will not receive any proceeds from the sale of shares of our common stock by the selling stockholders in this offering. The selling stockholders will receive all proceeds from the sale of such shares. Consequently, none of the proceeds from such sale by the selling stockholders will be available to us for our use. See “Use of Proceeds.”

USE OF PROCEEDS

We will not receive any proceeds from the sale of any shares of our common stock or our Series A Preferred Stock by the selling stockholders, but we have agreed to pay certain registration expenses, other than underwriting discounts and commissions and applicable transfer taxes, in connection with offerings by the selling stockholders.

SELLING STOCKHOLDERS

On June 10, 2020 (the “Original Issuance Date”), we issued 500,000 shares of Series A Preferred Stock to Ignition Acquisition Holdings LP (“Ignition Acquisition Holdings LP”), a Delaware limited partnership and affiliate fund of Apax Partners, L.P. (“Apax”), in a private offering pursuant to the Investment Agreement, dated as of May 26, 2020, by and between the Company and Ignition Parent LP (“Ignition Parent”), an affiliate of Ignition Acquisition Holdings LP (the “Apax Investment Agreement”). On June 10, 2020 and June 29, 2020, we issued an aggregate of 50,000 shares of Series A Preferred Stock to Periphas Kanga Holdings, LP (“Periphas” and, together with Ignition Acquisition Holdings LP, the “selling stockholders”), a Delaware limited partnership and affiliate of Periphas Capital GP, LLC (“Periphas Capital”), in private offerings pursuant to the Investment Agreement, dated as of May 26, 2020, by and between the Company and Periphas Capital (the “Periphas Investment Agreement” and, together with the Apax Investment Agreement, the “Investment Agreements”). As of February 15, 2024, 634,305 shares of Series A Preferred Stock were held by the selling stockholders, all of which were issued pursuant to the Certificate of Designations filed with the Secretary of State of the State of Delaware on June 9, 2020 (the “Certificate of Designations”).

We are registering the securities offered by this prospectus on behalf of the selling stockholders pursuant to the registration rights agreement, dated as of June 10, 2020, by and between the Company and Ignition Acquisition Holdings LP (the “Apax Registration Rights Agreement”) and the registration rights agreement, dated as of June 29, 2020, by and between the Company and Periphas (the “Periphas Registration Rights Agreement” and, together with the Apax Registration Rights Agreement, the “Registration Rights Agreements”).

The selling stockholders may from time to time offer and sell pursuant to this prospectus any or all of the shares of Series A Preferred Stock listed below that have been issued to them, and any or all of the shares of common stock issuable upon conversion of such shares of Series A Preferred Stock.

In the table below, the number of shares of common stock that may be offered pursuant to this prospectus is calculated based on an assumed conversion as of the date of this prospectus, at a liquidation preference per share of Series A Preferred Stock of $1,000, and a conversion price of $17.75 per share of Series A Preferred Stock. The number of shares of common stock into which the Series A Preferred Stock is convertible is subject to adjustment under certain circumstances. Accordingly, the number of shares of common stock issuable upon conversion of the Series A Preferred Stock and beneficially owned and offered by the selling stockholders pursuant to this prospectus may increase or decrease from that set forth in the below table. The table below is based on (1) 108,045,559 shares of common stock outstanding as of February 15, 2024; and (2) the assumed conversion as of the date of this prospectus of all shares of Series A Preferred Stock into 36,051,606 shares of common stock.

The information set forth below is based on information provided by or on behalf of the selling stockholders prior to the date hereof. Information concerning the selling stockholders may change from time to time. The selling stockholders may from time to time offer and sell any or all of the securities under this prospectus. Because the selling stockholders are not obligated to sell the offered securities, we cannot state with certainty the amount of our securities that the selling stockholders will hold upon consummation of any such sales. In addition, since the date on which the selling stockholders provided this information to us, such selling stockholders may have sold, transferred or otherwise disposed of all or a portion of the offered securities. We are registering the shares to permit the selling stockholders to resell the shares when they deem appropriate, subject to the restrictions on transfer set forth under “Plan of Distribution.”

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Series A Preferred Stock | | Common Stock |

| Number of shares beneficially owned and offered hereby(1) | Percentage of shares beneficially owned | Number of shares owned after completion of the offering(2) | Percentage of shares beneficially owned after completion of the offering | | Number of shares beneficially owned and offered hereby(1) | Percentage of shares beneficially owned | Number of shares owned after completion of the offering(2) | Percentage of shares beneficially owned after completion of the offering |

| Name of selling stockholder | |

| Ignition Acquisition Holdings LP | | | | | | | | |

|

| Series A Preferred Stock(3) | 576,645 | 90.91% | — | — | | 32,774,423 | 23.27% | — | — |

| Periphas Kanga Holdings, LP | | | | | | | | | |

| Series A Preferred Stock(4) | 57,660 | 9.09% | — | — | | 3,277,183 | 2.94% | — | — |

(1)Unless otherwise indicated, the selling stockholders may offer any or all of the Series A Preferred Stock they beneficially own and the common stock issuable upon conversion of the Series A Preferred Stock.

(2)Assumes the sale of all shares of Series A Preferred Stock and common stock offered pursuant to this prospectus.

(3)Represents shares of Series A Preferred Stock held by Ignition Acquisition Holdings LP and shares of common stock into which such shares of Series A Preferred Stock are convertible. Ignition Acquisition Holdings GP, LLC, as the general partner of Ignition Acquisition Holdings LP, Ignition Parent LP, as the sole member of Ignition Acquisition Holdings GP, LLC, Ignition GP LLC, as the general partner of Ignition Parent LP, Ignition Topco Ltd, as the sole member of Ignition GP LLC, Apax X GP Co. Limited, as investment manager of the relevant investment vehicles in the fund known as Apax X which is the sole shareholder of Ignition Topco Ltd, and Apax Guernsey (Holdco) PCC Limited Apax X Cell, as the sole parent of Apax X GP Co. Limited, may be deemed to be the beneficial owners having shared voting and investment power with respect to the securities described in this footnote. Apax X GP Co. Limited is controlled by its board of directors that is comprised of the following persons: Elizabeth Burne, Simon Cresswell, Andrew Guille, Martin Halusa, Paul Meader and Jeremy Latham. The principal business address of Ignition Acquisition Holdings LP, Ignition Acquisition Holdings GP, LLC, Ignition Parent LP and Ignition GP LLC is c/o Apax Partners US, LLC, 601 Lexington Avenue, New York, NY 10022. The principal business address of Apax X GP Co. Limited is Third Floor, Royal Bank Place, 1 Glategny Esplanade, St. Peter Port, Guernsey, GY1 2HJ.

(4)Represents shares of Series A Preferred Stock held by Periphas Kanga Holdings, LP and shares of common stock into which such shares of Series A Preferred Stock are convertible. Periphas Kanga Holdings GP, LLC as the general partner of Periphas Kanga Holdings, LP, SKM LLC, as the managing member of Periphas Kanga Holdings GP, LLC and Sanjeev Mehra, as the managing member of SKM LLC, may be deemed to be the beneficial owners having shared voting and investment power with respect to the securities described in this footnote. Mr. Mehra disclaims beneficial ownership of such securities except to the extent of his pecuniary interest therein. The principal business address of each of the individuals and entities identified in this paragraph is 745 Fifth Avenue, 16th Floor, New York, NY 10151.

The selling stockholders have each entered into certain agreements with us that provide them with certain rights and privileges. See “Description of Capital Stock—Investment Agreements” and “Description of Capital Stock—Registration Rights Agreements.”

Information about other selling stockholders, if any, will be set forth in a prospectus supplement, in a post-effective amendment to the registration statement of which this prospectus forms a part, or in filings we make with the SEC under the Exchange Act, that are incorporated by reference herein.

DESCRIPTION OF CAPITAL STOCK

General

Our authorized capital stock consists of 400,000,000 shares of common stock, par value $0.01 per share, and 100,000,000 shares of preferred stock, par value $0.01 per share (the “Preferred Stock”). As of February 15, 2024, we had 108,045,559 shares of common stock outstanding and 634,305 shares of Preferred Stock, consisting entirely of Series A Preferred Stock, outstanding.

The following is a description of the material terms of our capital stock, as well as certain provisions of our amended and restated certificate of incorporation (our “Charter”), our second amended and restated by-laws (“By-Laws”) and relevant sections of the Delaware General Corporation Law (the “DGCL”). The following summary of the terms of our capital stock does not purport to be complete and is subject to, and qualified in its entirety by reference to, our Charter and By-Laws, which are filed as exhibits to the registration statement of which this prospectus forms a part.

Common Stock

We have one class of common stock. All holders of our common stock are entitled to the same rights and privileges, as described below:

Dividend Rights

Subject to the prior rights of holders of Preferred Stock, holders of our common stock are entitled to receive dividends, if any, as may be declared from time to time by our Board.

Voting Rights

Each holder of our common stock is entitled to one vote for each share on all matters submitted to a vote of the holders of our common stock, voting together as a single class, including the election of directors. Our stockholders do not have cumulative voting rights in the election of directors. Directors standing for election at an annual meeting of stockholders, or any special meeting of stockholders called for the purpose of electing directors, will be elected by a majority of the votes cast in an uncontested election.

Other Rights

Holders of our common stock have no preemptive, subscription, redemption or conversion rights. All of our outstanding shares of common stock are fully paid and non-assessable.

Liquidation and Dissolution

Subject to the prior rights of our creditors and the satisfaction of any liquidation preference granted to the holders of any then-outstanding shares of our Preferred Stock, in the event of our liquidation, dissolution or winding up, holders of our common stock will be entitled to share ratably in the net assets legally available for distribution to stockholders.

Preferred Stock

Under our Charter, we are authorized to issue up to 100,000,000 shares of Preferred Stock in one or more series. Our Board has the authority, without action by our stockholders, to issue Preferred Stock and to fix voting powers for each class or series of Preferred Stock, and to provide that any class or series may be subject to redemption, entitled to receive dividends, entitled to rights upon dissolution, or convertible or exchangeable for shares of any other class or classes of capital stock. The rights with respect to a series or class of Preferred Stock may be greater than the rights attached to our common stock. It is not possible to state the actual effect of the issuance of any shares

of our Preferred Stock on the rights of holders of our common stock until our Board determines the specific rights attached to that Preferred Stock. The effect of issuing Preferred Stock could include, among other things, one or more of the following:

•restricting dividends in respect of our common stock;

•diluting the voting power of our common stock or providing that holders of Preferred Stock have the right to vote on matters as a class;

•impairing the liquidation rights of our common stock; or

•delaying or preventing a change of control of us.

Series A Preferred Stock

In June 2020, we filed the Certificate of Designations with the Secretary of State of the State of Delaware classifying the Series A Preferred Stock and establishing the voting powers, designations, preferences and relative, participating, optional or other special rights, and the qualifications, limitations and restrictions of the shares of our Series A Preferred Stock. The following is a description of the material terms of our Series A Preferred Stock. The following summary of the terms of the Series A Preferred Stock does not purport to be complete and is subject to, and qualified in its entirety by reference to, the actual terms of the Series A Preferred Stock and the Certificate of Designations (as defined herein), which is filed as an exhibit to the registration statement of which this prospectus forms a part.

Dividend Rights and Liquidation Preferences. The Series A Preferred Stock ranks senior to our common stock with respect to dividend rights and rights on the distribution of assets on any liquidation, dissolution or winding up of the affairs of the Company. In the event of any liquidation, dissolution or winding up of the affairs of the Company, holders of the Series A Preferred Stock shall be entitled, before any distribution may be made to holders of any junior classes of our stock, and subject to the rights of the holders of any senior stock or parity stock and the rights of the Company’s existing and future creditors, to receive a liquidating distribution in cash and in the amount per share of Series A Preferred Stock equal to the greater of (i) the sum of (A) the liquidation preference plus (B) the accrued dividends with respect to such share of Series A Preferred Stock as of the date of such voluntary or involuntary liquidation, dissolution or winding up of the affairs of the Company and (ii) the amount such holders of the Series A Preferred Stock would have received had such holders of the Series A Preferred Stock, immediately prior to such liquidation, dissolution or winding up of the affairs of the Company, converted such shares of Series A Preferred Stock into common stock. The Series A Preferred Stock has a liquidation preference of $1,000 per share.

Holders of the Series A Preferred Stock are entitled to a cumulative dividend at the rate of 7% per annum, accruing daily and payable quarterly in arrears. There will be no restriction on the repurchase or redemption of shares of the Series A Preferred Stock in the event of any arrearage in the payment of dividends. Dividends will be payable in kind through the issuance of additional shares of Series A Preferred Stock for the first eight dividend payments following the initial issuance of Series A Preferred Stock, and thereafter, in cash or in kind, or any combination thereof, at the option of the Company. In addition, holders of the Series A Preferred Stock shall participate, on an as-converted basis, in any dividends or distributions on our common stock.

Conversion Features. The Series A Preferred Stock is convertible, in whole or in part, at any time, into shares of common stock at an initial conversion price of $17.75 per share of Series A Preferred Stock and an initial conversion rate of 56.3380 shares of common stock per share of Series A Preferred Stock, subject to certain anti-dilution adjustments set forth in the Certificate of Designations, including subdivisions, splits, and combinations of the common stock, certain issuances of securities at a conversion price lower than the conversion price of the Series A Preferred Stock then in effect, self-tender offers and exchange offers and certain other actions by us that modify our capital structure. As the three-year anniversary of the Original Issuance Date has occurred, if the closing price of the common stock exceeds 175% of the conversion price (initially a threshold of $31.0625 per share) for at least 20 trading days in any period of 30 consecutive trading days, all or any portion of the Series A Preferred Stock may be converted into the relevant number of shares of common stock. Pursuant to the terms of the Certificate of

Designations, unless and until approval of the Company’s stockholders is obtained as contemplated by NYSE listing rule 312.03(d) (the “Stockholder Approval”), no Holder of Series A Preferred Stock will have the right to acquire shares of common stock if and solely to the extent that such conversion would result in such Holder beneficially owning a number of shares of common stock that could trigger a change of control under NYSE listing rules (such limitation, the “Ownership Limitation”). The Company has the right to settle any conversion over the Ownership Limitation of a Holder of Series A Preferred Stock in cash if the Stockholder Approval is not obtained. As of February 15, 2024, the Series A Preferred Stock was convertible into 36,051,606 shares of common stock.

Redemption Features. At any time after the six-year anniversary of the Original Issuance Date, the Company may redeem some or all of the Series A Preferred Stock for a per share amount in cash equal to (i) the sum of (x) 100% of the liquidation preference plus (y) all accrued and unpaid dividends, multiplied by (ii) (A) 105% if the redemption occurs at any time after the six-year anniversary of the Original Issuance Date and prior to the seven-year anniversary of the Original Issuance Date or (B) 100% if the redemption occurs at any time after the seven-year anniversary of the Original Issuance Date.

Voting Rights. Following the receipt on June 22, 2020 of early termination of the applicable waiting period under the HSR Act, holders of the Series A Preferred Stock are entitled to vote with holders of common stock as a single class. Holders of the Series A Preferred Stock will be entitled to a separate class vote with respect to, among other things, any amendment to the Company’s organizational documents that have an adverse effect on the rights, preferences, privileges or voting power of the Series A Preferred Stock or any Holder thereof, authorization or issuance by the Company of securities that are senior, or equal in priority to, the Series A Preferred Stock, increase or decrease in the number of authorized shares of Series A Preferred Stock and issuance of shares of Series A Preferred Stock after the Original Issuance Date, each of such actions requiring consent of the holders of a majority of the shares of Series A Preferred Stock outstanding at such time. In addition, Ignition Parent and its permitted transferees under the Apax Investment Agreement who hold Series A Preferred Stock are entitled, by majority vote, to elect to the Board the Ignition Designee designated by Ignition Parent, as described below under “—Investment Agreements.”

Change of Control Put. Upon certain change of control or delisting events involving the Company and subject to certain limitations set forth in the Certificate of Designations, each Holder of Series A Preferred Stock may elect to either (i) receive such number of shares of common stock into which such Holder is entitled to convert all or a portion of such Holder’s shares of Series A Preferred Stock at the then-current conversion price, (ii) receive, in respect of all or a portion of such Holder’s shares of Series A Preferred Stock, the greater of (x) the amount per share of Series A Preferred Stock that such Holder would have received had such Holder, immediately prior to such change of control, converted such share of Series A Preferred Stock into common stock and (y) a purchase price per share of Series A Preferred Stock, payable in cash, equal to the product of (A) 105% multiplied by (B) the sum of the liquidation preference and accrued dividends with respect to such share of Series A Preferred Stock, or (iii) unless the consideration in such change of control event is payable entirely in cash, retain all or a portion of such Holder’s shares of Series A Preferred Stock.

Preemptive Rights. Except for the right to participate in any issuance of new equity securities by the Company as set forth in the Investment Agreements, the holders of the Series A Preferred Stock shall not have any preemptive rights. Pursuant to the Investment Agreements, after the Original Issuance Date and so long as the selling stockholder continues to beneficially own at all times shares of Series A Preferred Stock and/or shares of common stock that represent in the aggregate and on an as converted basis, at least 25% of the number of shares of common stock that were beneficially owned by such selling stockholder on an as converted basis, if the Company makes any public or non-public offering of any capital stock of, other equity or voting interests in, or equity-linked securities of, the Company or any securities that are convertible or exchangeable into (or exercisable for) capital stock of, other equity or voting interests in, or equity-linked securities of, the Company, the selling stockholder and each person to which the selling stockholder later transfers any shares of Series A Preferred Stock or common stock issued upon conversion of Series A Preferred Stock will have the opportunity to acquire from the Company the portion of such new securities equal to the total number of such new securities multiplied by the fraction equal to the number of Series A Preferred Stock and/or shares of common stock (in the aggregate and on an as converted basis) held by the selling stockholder or such person divided by the aggregate number of shares of common stock (on an as

converted basis) outstanding as of such date, for the same price as that offered to the other purchasers of such new securities, subject to certain conditions described in the Investment Agreements.

Investment Agreements

For so long as Ignition Parent or its affiliates beneficially own at least 25% of the shares of Series A Preferred Stock purchased pursuant to the Apax Investment Agreement on an as-converted basis, Ignition Parent will have the right to designate one director nominee for election to the Board. At the June 2, 2023 annual meeting of the Company's stockholders, Roy Mackenzie, a director nominee designated by Apax, was re-elected to the Board for a term expiring at the 2024 annual meeting of the Company’s stockholders and until his successor is duly elected and qualified. In addition, for so long as Ignition Parent or its affiliates beneficially own at least 50% of the shares of Series A Preferred Stock purchased pursuant to the Ignition Parent Investment Agreement on an as-converted basis, Ignition Parent will have the right to appoint one non-voting Board observer to the Board.

Pursuant to the Periphas Investment Agreement, for so long as Periphas or its affiliates beneficially own at least 50% of the shares of Series A Preferred Stock purchased pursuant to the Periphas Investment Agreement on an as-converted basis, Periphas will have the right to appoint one non-voting Board observer.

Additionally, the selling stockholders will be subject to certain standstill restrictions, including that the selling stockholders will be restricted from acquiring additional equity securities of the Company, until the later of the three year anniversary of the Original Issuance Date and, in the case of Ignition Parent, the fall-away of Board nomination rights, and, in the case of Periphas, the fall-away of Board observer rights.

The foregoing descriptions of the Investment Agreements do not purport to be complete and are subject to, and qualified in their entirety by, the full text of the Investment Agreements, which are filed herewith as Exhibits 4.2 and 4.3, respectively, and are incorporated herein by reference.

Registration Rights Agreements

On June 10, 2020 and June 29, 2020, the Company entered into the Registration Rights Agreements with Ignition Acquisition Holdings LP and Periphas, respectively, pursuant to which the Company agreed to provide to the selling stockholders and each other Holder party thereto from time to time, following a one-year lockup period (the “lock-up period”), certain customary registration rights with respect to each Holder’s shares of the Series A Preferred Stock and the common stock, issued in connection with any future conversion of the Series A Preferred Stock (together, the “Registrable Securities”) until such Holder’s Registrable Securities have been sold (subject to certain exceptions), or in the case of any shares of common stock held by such Holder, all shares of common stock held by such Holder, on an as converted basis, constitute less than 1% of the Company’s total outstanding shares of common stock and may be sold in a single day pursuant to Rule 144 under the Securities Act.

This prospectus and the shelf registration statement to which this prospectus forms a part is being filed pursuant to the Company’s obligations under the Registration Rights Agreements. The holders of the Series A Preferred Stock also have the right to request up to three underwritten offerings, or shelf take-downs, equal to at least $50 million per request, pursuant to this prospectus during any 365-day period (subject to certain cut-back priorities and certain other exceptions) and the holders of the Series A Preferred Stock have the right to request unlimited non-underwritten shelf take-downs. Additionally, the Registration Rights Agreement grants each Holder customary demand registration rights for a minimum number of Registrable Securities equal to at least $50 million per demand which includes underwritten offerings (subject to certain cut-back priorities and certain other restrictions), subject to a cool-off period of at least sixty days after effectiveness of the previous demand registration. Holders of the Series A Preferred Stock are entitled to deliver a maximum of two notices involving substantial marketing efforts in any 365-day period, and a maximum of four notices involving substantial marketing efforts in the aggregate.

The Registration Rights Agreements also grant each Holder customary “piggyback” registration rights. If, following the lock-up period, the Company proposes to register any shares of common stock, whether or not for its own account, each Holder will be entitled, subject to certain exceptions, to include its Registrable Securities in the registration, subject to certain cut-back priorities. The Registration Rights Agreements permit the Company to

postpone the filing or use of a registration statement for a certain period (such period, a “Postponement Period”) if the filing or continued use of the registration statement would, in the good faith judgment of the Board (i) require the Company to disclose material non-public information that, in the Company’s good faith judgment, the Company has a bona fide business purpose for not disclosing publicly or (ii) materially interfere with any material proposed acquisition, disposition, financing, reorganization, recapitalization or similar transaction involving the Company or any of its subsidiaries then under consideration. There will not be more than one Postponement Period in any 180-day period and no single Postponement Period will exceed 60 days.

The foregoing descriptions of the Registration Rights Agreements do not purport to be complete and are subject to, and qualified in their entirety by, the full text of the Registration Rights Agreements, which are filed herewith as Exhibits 4.4 and 4.5, respectively, and are incorporated herein by reference.

Anti-Takeover Effects of Certain Provisions of Delaware Law, Our Charter and Our By-Laws

Provisions of the DGCL and our Charter and By-Laws could make it more difficult to acquire the Company by means of a tender offer, a proxy contest or otherwise, or to remove incumbent officers and directors. These provisions, summarized below, are expected to discourage certain types of coercive takeover practices and takeover bids that our Board may consider inadequate and to encourage persons seeking to acquire control of the Company to first negotiate with our Board. The summary of the provisions set forth below does not purport to be complete and is qualified in its entirety by reference to our Charter and By-Laws and the DGCL.

We elected in our Charter not to be subject to Section 203 of the DGCL, an anti-takeover law. In general, Section 203 of the DGCL prohibits a publicly held Delaware corporation from engaging in a “business combination,” such as a merger, with a person or group owning 15% or more of the corporation’s voting stock for a period of three years following the date the person became an interested stockholder, unless (with certain exceptions) the business combination or the transaction in which the person became an interested stockholder is approved in a prescribed manner. Accordingly, we will not be subject to any anti-takeover effects of Section 203.

Certain other provisions of our Charter and By-Laws may be considered to have an anti-takeover effect and may delay or prevent a tender offer or other corporate transaction that a stockholder might consider to be in its best interest, including those transactions that might result in payment of a premium over the market price for our shares. These provisions are designed to discourage certain types of transactions that may involve an actual or threatened change of control of us without prior approval of our Board. These provisions are meant to encourage persons interested in acquiring control of us to first consult with our Board to negotiate terms of a potential business combination or offer. We believe that these provisions protect against an unsolicited proposal for a takeover of us that might affect the long term value of our stock or that may be otherwise unfair to our stockholders. These provisions may also prevent or discourage attempts to remove and replace incumbent directors. These provisions include:

•rules regarding how our stockholders may present proposals or nominate directors for election at stockholder meetings;

•permitting our Board to issue preferred stock without stockholder approval;

•granting to the Board, and not to the stockholders, the sole power to set the number of directors;

•authorizing vacancies on our Board to be filled only by a vote of the majority of the directors then in office and specifically denying our stockholders the right to fill vacancies in the Board;

•authorizing the removal of directors, with or without cause, only upon the affirmative vote of holders of a majority of the outstanding shares of our common stock entitled to vote for the election of directors;

•prohibiting stockholders from calling special meetings of stockholders; and

•prohibiting stockholder action by written consent.

Limitations on Liability and Indemnification of Directors and Officers

Our Charter and By-Laws provide that our directors will not be personally liable to us or our stockholders for monetary damages for breach of a fiduciary duty as a director, except for:

•any breach of the director’s duty of loyalty to us or our stockholders;

•intentional misconduct or a knowing violation of law;

•liability under Delaware corporate law for an unlawful payment of dividends or an unlawful stock purchase or redemption of stock; or

•any transaction from which the director derives an improper personal benefit.

Our Charter provides that we must indemnify our directors and officers to the fullest extent permitted by Delaware law. We are also expressly authorized to advance certain expenses (including attorneys’ fees and disbursements and court costs) to our directors and officers and carry directors’ and officers’ insurance providing indemnification for our directors and officers for some liabilities. We believe that these indemnification provisions and insurance are useful to attract and retain qualified directors and executive officers.

Transfer Agent

The registrar and transfer agent for our common stock is Equiniti Trust Company, LLC (formerly, American Stock Transfer & Trust Company, LLC).

Listing

Our common stock is listed on the New York Stock Exchange under the symbol “KAR.”

PLAN OF DISTRIBUTION

The selling stockholders may, from time to time, offer the shares of our common stock or our Series A Preferred Stock registered by this prospectus in one or more transactions (which may involve underwritten offerings on a firm commitment or best efforts basis, cross sales or block transactions) on the NYSE or otherwise, in secondary distributions pursuant to and in accordance with the rules of the NYSE, through one or more electronic trading platforms or services, in the over-the-counter market, in negotiated transactions, directly to one or more purchasers, including affiliates, through the writing of options on the shares (whether such options are listed on an options exchange or otherwise), short sales or a combination of such methods of sale or any other method permitted by applicable law, at fixed prices, at market prices or varying prices prevailing at the time of sale, at prices related to such prevailing market prices or at negotiated prices, including pursuant to one or more “10b5-1” trading plans or similar plans. The selling stockholders may also engage in short sales against the box, puts and calls, writing options, hedging transactions and other transactions in our securities or derivatives of our securities and may sell or deliver the shares of our common stock and our Series A Preferred Stock registered pursuant to this prospectus in connection with these trades as permitted by applicable law, including, without limitation, delivering such shares to a lender in satisfaction of all or part of stock borrowed from such lender in connection with a short sale. In certain circumstances, the selling stockholders may pledge or grant a security interest in some or all of the shares of our common stock and our Series A Preferred Stock registered by this prospectus owned by them and, if they default in the performance of their secured obligations, the pledgees or secured parties may offer and sell such shares from time to time under this prospectus. In addition, any shares of common stock or Series A Preferred Stock that qualify for sale under Rule 144 under the Securities Act may be sold under that rule rather than pursuant to this prospectus.

The selling stockholders may effect such transactions by selling the shares of our common stock and our Series A Preferred Stock registered by this prospectus to or through broker-dealers or through other agents, including electronic trading platforms or similar services, and such broker-dealers or agents may receive compensation in the form of commissions, discounts or fees from the selling stockholders and/or the purchasers of shares for whom they may act as agent. Sales effected with a broker-dealer may involve ordinary brokerage transactions, transactions in which the broker-dealer solicits purchasers or transactions in which the broker-dealer is principal and resells for its account. The selling stockholders and any agents or broker-dealers that participate in the distribution of the shares of common stock or Series A Preferred Stock registered by this prospectus may be deemed to be “underwriters” within the meaning of the Securities Act, and any commissions or discounts received by them and any profit on the sale of registered shares may be deemed to be underwriting commissions or discounts under the Securities Act.

In the event of a “distribution” of the shares of our common stock or our Series A Preferred Stock registered by this prospectus, the selling stockholders, any selling broker-dealer or agent and any “affiliated purchasers” may be subject to Regulation M under the Exchange Act, which would prohibit, with certain exceptions, each such person from bidding for or purchasing any security which is the subject of such distribution until his participation in that distribution is completed. In addition, Regulation M under the Exchange Act prohibits certain “stabilizing bids” or “stabilizing purchases” for the purpose of pegging, fixing or stabilizing the price of shares of common stock and Series A Preferred Stock.

At a time a particular offering of shares of our common stock or our Series A Preferred Stock is made, a prospectus supplement, if required, may be distributed that will set forth the name or names of any dealers or agents and any commissions and other terms constituting compensation from the selling stockholders and any other required information.

In order to comply with the securities laws of some states, if applicable, the common stock or Series A Preferred Stock must be sold in such jurisdictions only through registered or licensed brokers or dealers. In addition, in some states the common stock or Series A Preferred Stock may not be sold unless it has been registered or qualified for sale in the applicable state or an exemption from registration or qualification requirements is available and is complied with.

Pursuant to the Registration Rights Agreements, we have agreed to indemnify the selling stockholders in certain circumstances against certain liabilities under the Securities Act, and the selling stockholders have agreed to indemnify us in certain circumstances against certain liabilities, including certain liabilities under the Securities Act. The selling stockholders may indemnify any underwriter that participates in transactions involving the sale of shares of common stock or Series A Preferred Stock against certain liabilities, including liabilities arising under the Securities Act.

The Series A Preferred Stock is not listed on an exchange and we do not intend to list the Series A Preferred Stock on any exchange. Our common stock is listed on the NYSE under the symbol “KAR.” On February 15, 2024, the closing price of our common stock as reported on the NYSE was $14.52 per share.

UNITED STATES FEDERAL INCOME TAX CONSIDERATIONS

The following is a general discussion of the U.S. federal income tax considerations with respect to the ownership, disposition and conversion of the Series A Preferred Stock and the ownership and disposition of any common stock received upon conversion of our Series A Preferred Stock. This discussion is based on the Code, Treasury Regulations and judicial decisions and administrative interpretations thereof, all as of the date hereof and all of which are subject to change, possibly with retroactive effect. This discussion is limited to investors that hold the Series A Preferred Stock (and the common stock) as capital assets (generally, assets held for investment) for U.S. federal income tax purposes. Furthermore, this discussion does not address all aspects of U.S. federal income taxation that may be applicable to investors in light of their particular circumstances, or to investors subject to special treatment under U.S. federal income tax law, such as financial institutions, insurance companies, tax-exempt organizations, entities that are treated as partnerships for U.S. federal income tax purposes, dealers in securities or currencies, expatriates, persons deemed to sell the Series A Preferred Stock under the constructive sale provisions of the Code, persons that hold the Series A Preferred Stock as part of a straddle, hedge, conversion transaction or other integrated investment, U.S. Holders (as defined below) whose functional currency is not the U.S. dollar and persons who are required to recognize income for U.S. federal income tax purposes no later than when such income is taken into account in applicable financial statements. Furthermore, this discussion does not address considerations relating to the alternative minimum tax, the Medicare tax, any U.S. federal estate or gift tax consequences or any state, local or foreign tax consequences. No assurance can be given that the IRS would not assert, or that a court would not sustain, a position contrary to any of those set forth below.

This discussion is not intended to be tax advice. Potential investors should consult their tax advisors as to the particular U.S. federal income tax consequences to them of owning and disposing of the Series A Preferred Stock (and the common stock), as well as the effects of other U.S. federal tax laws or state, local and non-U.S. tax laws.

For purposes of this summary, the term “U.S. Holder” means a beneficial owner of Series A Preferred Stock (or common stock) other than a partnership or other entity or arrangement treated as a partnership for U.S. federal income tax purposes that is, for U.S. federal income tax purposes:

(1) an individual who is a citizen or resident of the United States,

(2) a corporation, or other entity treated as a corporation for U.S. federal income tax purposes, that is created or organized under the laws of the United States, any of the states or the District of Columbia,

(3) an estate the income of which is subject to U.S. federal income taxation regardless of its source, or

(4) a trust (A) if a court within the United States is able to exercise primary supervision over its administration and one or more U.S. persons have the authority to control all substantial decisions of the trust, or (B) that has made a valid election to be treated as a U.S. person for U.S. federal income tax purposes.

For purposes of this summary, the term “Non-U.S. Holder” means a beneficial owner of Series A Preferred Stock (or common stock), other than a partnership or other entity or arrangement treated as a partnership for U.S. federal income tax purposes, who is not a U.S. Holder.