Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

July 26 2023 - 11:48AM

Edgar (US Regulatory)

PORTFOLIO

OF

INVESTMENTS

as

of

May

31,

2023

(Unaudited)

Voya

Asia

Pacific

High

Dividend

Equity

Income

Fund

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK

:

95

.1

%

Australia

:

15

.8

%

28,858

Ampol

Ltd.

$

589,518

0.7

63,432

ANZ

Group

Holdings

Ltd.

943,522

1.2

18,197

APA

Group

118,787

0.1

26,156

Aristocrat

Leisure

Ltd.

631,701

0.8

2,301

ASX

Ltd.

100,861

0.1

217,203

Aurizon

Holdings

Ltd.

502,753

0.6

68,546

BHP

Group

Ltd.

-

Class

DI

1,875,628

2.4

31,700

BlueScope

Steel

Ltd.

382,306

0.5

1,491

Cochlear

Ltd.

235,969

0.3

39,779

Coles

Group

Ltd.

464,831

0.6

2,761

Commonwealth

Bank

of

Australia

173,564

0.2

1,725

CSL

Ltd.

343,544

0.4

105,246

Dexus

561,929

0.7

17,283

Endeavour

Group

Ltd./

Australia

69,290

0.1

189,003

GPT

Group

514,841

0.7

50,290

IGO

Ltd.

467,052

0.6

63,117

Insurance

Australia

Group

Ltd.

212,855

0.3

11,895

Lottery

Corp.

Ltd.

38,492

0.0

697

Macquarie

Group

Ltd.

77,309

0.1

229,037

Medibank

Pvt

Ltd.

531,591

0.7

55,324

National

Australia

Bank

Ltd.

931,812

1.2

19,558

Origin

Energy

Ltd.

105,984

0.1

4,323

QBE

Insurance

Group

Ltd.

40,999

0.1

8,802

Rio

Tinto

Ltd.

613,358

0.8

318,122

Scentre

Group

560,590

0.7

17,577

Sonic

Healthcare

Ltd.

402,006

0.5

165,897

South32

Ltd.

424,123

0.5

36,081

Suncorp

Group

Ltd.

311,071

0.4

9,060

Treasury

Wine

Estates

Ltd.

68,453

0.1

29,767

Vicinity

Ltd.

35,902

0.0

4,976

WiseTech

Global

Ltd.

241,842

0.3

12,572,483

15.8

China

:

27

.8

%

116,000

Agricultural

Bank

of

China

Ltd.

-

Class

H

43,714

0.1

164,900

(1)

Alibaba

Group

Holding

Ltd.

1,641,147

2.1

240,000

Aluminum

Corp.

of

China

Ltd.

-

Class

H

106,209

0.1

8,600

Anhui

Gujing

Distillery

Co.

Ltd.

-

Class

B

140,916

0.2

19,200

Anhui

Yingjia

Distillery

Co.

Ltd.

-

Class

A

152,641

0.2

18,400

ANTA

Sports

Products

Ltd.

188,061

0.2

6,128

Autohome,

Inc.,

ADR

175,383

0.2

1,811,000

Bank

of

China

Ltd.

-

Class

H

708,929

0.9

168,800

Bank

of

Jiangsu

Co.

Ltd.

-

Class

A

176,330

0.2

16,500

BYD

Co.

Ltd.

-

Class

H

498,258

0.6

25,500

BYD

Electronic

International

Co.

Ltd.

74,227

0.1

48,595

By-health

Co.

Ltd.

-

Class

A

155,740

0.2

14,700

CETC

Cyberspace

Security

Technology

Co.

Ltd.

-

Class

A

61,217

0.1

2,133,000

China

Cinda

Asset

Management

Co.

Ltd.

-

Class

H

236,908

0.3

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

China:

(continued)

786,000

China

Communications

Services

Corp.

Ltd.

-

Class

H

$

373,807

0.5

60,000

China

Conch

Venture

Holdings

Ltd.

75,370

0.1

1,107,960

China

Construction

Bank

Corp.

-

Class

H

708,741

0.9

662,000

China

Everbright

Bank

Co.

Ltd.

-

Class

H

203,694

0.3

100,000

China

Hongqiao

Group

Ltd.

70,969

0.1

66,000

China

Longyuan

Power

Group

Corp.

Ltd.

-

Class

H

74,085

0.1

146,000

China

Medical

System

Holdings

Ltd.

205,551

0.3

76,000

China

Meidong

Auto

Holdings

Ltd.

97,808

0.1

26,000

China

Mengniu

Dairy

Co.

Ltd.

101,053

0.1

105,000

China

Merchants

Bank

Co.

Ltd.

-

Class

H

488,266

0.6

91,683

China

Merchants

Port

Holdings

Co.

Ltd.

132,995

0.2

110,000

China

Oilfield

Services

Ltd.

-

Class

H

111,998

0.1

104,200

China

Pacific

Insurance

Group

Co.

Ltd.

-

Class

H

263,749

0.3

236,000

China

Railway

Group

Ltd.

-

Class

H

155,509

0.2

16,000

China

Resources

Land

Ltd.

59,887

0.1

101,000

(2)

China

Resources

Pharmaceutical

Group

Ltd.

96,965

0.1

51,500

China

Shenhua

Energy

Co.

Ltd.

-

Class

H

162,808

0.2

33,200

China

Taiping

Insurance

Holdings

Co.

Ltd.

34,556

0.0

1,942,000

(2)

China

Tower

Corp.

Ltd.

-

Class

H

213,294

0.3

112,000

CITIC

Securities

Co.

Ltd.

-

Class

H

206,230

0.3

50,000

COSCO

SHIPPING

Holdings

Co.

Ltd.

-

Class

H

44,059

0.1

126,000

COSCO

SHIPPING

Ports

Ltd.

79,334

0.1

18,000

Country

Garden

Services

Holdings

Co.

Ltd.

20,983

0.0

44,480

CSPC

Pharmaceutical

Group

Ltd.

38,753

0.0

43,600

Dong-E-E-Jiao

Co.

Ltd.

-

Class

A

302,447

0.4

508,000

Dongfeng

Motor

Group

Co.

Ltd.

-

Class

H

219,991

0.3

17,500

ENN

Natural

Gas

Co.

Ltd.

-

Class

A

47,675

0.1

364,000

Far

East

Horizon

Ltd.

305,006

0.4

146,500

Fosun

International

Ltd.

96,622

0.1

4,645

G-bits

Network

Technology

Xiamen

Co.

Ltd.

-

Class

A

366,054

0.5

192,000

Geely

Automobile

Holdings

Ltd.

223,679

0.3

25,500

Hengan

International

Group

Co.

Ltd.

108,414

0.1

PORTFOLIO

OF

INVESTMENTS

as

of

May

31,

2023

(Unaudited)

(continued)

Voya

Asia

Pacific

High

Dividend

Equity

Income

Fund

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

China:

(continued)

44,200

Hubei

Xingfa

Chemicals

Group

Co.

Ltd.

-

Class

A

$

133,025

0.2

600

Imeik

Technology

Development

Co.

Ltd.

-

Class

A

38,103

0.0

770,414

Industrial

&

Commercial

Bank

of

China

Ltd.

-

Class

H

411,432

0.5

62,600

Industrial

Bank

Co.

Ltd.

-

Class

A

145,903

0.2

59,200

Inner

Mongolia

ERDOS

Resources

Co.

Ltd.

-

Class

A

115,398

0.1

29,700

Inner

Mongolia

Yitai

Coal

Co.

Ltd.

-

Class

B

38,316

0.0

18,202

Jafron

Biomedical

Co.

Ltd.

-

Class

A

70,832

0.1

24,654

JD.com,

Inc.

-

Class

A

401,653

0.5

126,500

Joincare

Pharmaceutical

Group

Industry

Co.

Ltd.

-

Class

A

244,406

0.3

5,060

Joinn

Laboratories

China

Co.

Ltd.

-

Class

A

32,249

0.0

71,500

Kingboard

Holdings

Ltd.

192,651

0.2

83,000

Kingsoft

Corp.

Ltd.

301,744

0.4

334,000

Kunlun

Energy

Co.

Ltd.

266,414

0.3

29,500

Li

Ning

Co.

Ltd.

158,504

0.2

30,500

LONGi

Green

Energy

Technology

Co.

Ltd.

-

Class

A

123,677

0.2

50,230

(1)(2)

Meituan

-

Class

B

705,293

0.9

33,200

NetEase,

Inc.

564,694

0.7

12,000

(2)

Nongfu

Spring

Co.

Ltd.

-

Class

H

64,339

0.1

10,500

Ovctek

China,

Inc.

-

Class

A

41,322

0.1

5,759

(1)

PDD

Holdings,

Inc.,

ADR

376,178

0.5

978,000

People's

Insurance

Co.

Group

of

China

Ltd.

-

Class

H

369,794

0.5

384,000

PetroChina

Co.

Ltd.

-

Class

H

248,214

0.3

32,750

(2)

Pharmaron

Beijing

Co.

Ltd.

-

Class

H

120,955

0.2

372,000

PICC

Property

&

Casualty

Co.

Ltd.

-

Class

H

443,763

0.6

21,100

Ping

An

Bank

Co.

Ltd.

-

Class

A

34,493

0.0

56,500

Ping

An

Insurance

Group

Co.

of

China

Ltd.

-

Class

H

358,560

0.5

370,000

(2)

Postal

Savings

Bank

of

China

Co.

Ltd.

-

Class

H

232,474

0.3

5,445

Qifu

Technology,

Inc.

74,869

0.1

35,600

Shandong

Weigao

Group

Medical

Polymer

Co.

Ltd.

-

Class

H

52,566

0.1

16,640

Shanghai

Baosight

Software

Co.

Ltd.

-

Class

B

55,323

0.1

32,500

Shanghai

Fosun

Pharmaceutical

Group

Co.

Ltd.

-

Class

H

88,520

0.1

3,400

Shanxi

Xinghuacun

Fen

Wine

Factory

Co.

Ltd.

-

Class

A

100,564

0.1

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

China:

(continued)

2,403

Shenzhen

Mindray

Bio-

Medical

Electronics

Co.

Ltd.

-

Class

A

$

101,801

0.1

56,400

Shenzhen

Senior

Technology

Material

Co.

Ltd.

-

Class

A

128,510

0.2

204,000

SITC

International

Holdings

Co.

Ltd.

354,390

0.4

5,700

Sunny

Optical

Technology

Group

Co.

Ltd.

53,654

0.1

32,100

Suzhou

Dongshan

Precision

Manufacturing

Co.

Ltd.

-

Class

A

114,748

0.1

59,400

Tencent

Holdings

Ltd.

2,350,716

3.0

42,000

Tingyi

Cayman

Islands

Holding

Corp.

62,915

0.1

151,000

(2)

Topsports

International

Holdings

Ltd.

117,331

0.1

106,000

TravelSky

Technology

Ltd.

-

Class

H

193,376

0.2

162,000

Uni-President

China

Holdings

Ltd.

140,790

0.2

21,568

Weihai

Guangwei

Composites

Co.

Ltd.

-

Class

A

89,000

0.1

608,500

(2)

WH

Group

Ltd.

318,120

0.4

33,300

Xiamen

C

&

D,

Inc.

-

Class

A

54,432

0.1

54,400

Yintai

Gold

Co.

Ltd.

-

Class

A

99,154

0.1

4,940

YongXing

Special

Materials

Technology

Co.

Ltd.

-

Class

A

44,013

0.1

3,937

Yum

China

Holdings,

Inc.

222,283

0.3

26,845

Zangge

Mining

Co.

Ltd.

-

Class

A

86,821

0.1

54,000

Zhejiang

Expressway

Co.

Ltd.

-

Class

H

39,993

0.0

40,600

Zhuzhou

CRRC

Times

Electric

Co.

Ltd.

170,857

0.2

132,000

Zijin

Mining

Group

Co.

Ltd.

-

Class

H

179,540

0.2

93,800

ZTE

Corp.

-

Class

H

288,009

0.4

2,270

ZTO

Express

Cayman,

Inc.,

ADR

57,295

0.1

21,924,008

27.8

Hong

Kong

:

4

.8

%

87,574

AIA

Group

Ltd.

841,866

1.1

248,000

Bosideng

International

Holdings

Ltd.

102,965

0.1

47,000

CK

Asset

Holdings

Ltd.

253,338

0.3

63,500

CK

Hutchison

Holdings

Ltd.

382,822

0.5

3,000

Country

Garden

Services

Holdings

Co.

Ltd.

3,497

0.0

42,000

Hang

Lung

Properties

Ltd.

66,519

0.1

3,100

Hong

Kong

Exchanges

&

Clearing

Ltd.

113,528

0.1

10,300

Jardine

Matheson

Holdings

Ltd.

493,896

0.6

201,500

Kingboard

Laminates

Holdings

Ltd.

184,404

0.2

7,400

Link

REIT

43,031

0.1

PORTFOLIO

OF

INVESTMENTS

as

of

May

31,

2023

(Unaudited)

(continued)

Voya

Asia

Pacific

High

Dividend

Equity

Income

Fund

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

Hong

Kong:

(continued)

91,000

New

World

Development

Co.

Ltd.

$

217,404

0.3

105,500

Power

Assets

Holdings

Ltd.

568,098

0.7

27,000

Swire

Pacific

Ltd.

-

Class

A

180,275

0.2

160,200

Swire

Properties

Ltd.

381,892

0.5

3,833,535

4.8

India

:

12

.4

%

10,626

Aurobindo

Pharma

Ltd.

84,535

0.1

50,678

Axis

Bank

Ltd.

559,276

0.7

133,988

Bank

of

Baroda

298,922

0.4

246,851

Bharat

Electronics

Ltd.

334,295

0.4

18,234

Bharat

Petroleum

Corp.

Ltd.

80,063

0.1

16,305

Cholamandalam

Investment

and

Finance

Co.

Ltd.

206,869

0.3

22,748

Cipla

Ltd./India

261,891

0.3

37,690

HCL

Technologies

Ltd.

520,697

0.7

53,542

Hindustan

Petroleum

Corp.

Ltd.

168,759

0.2

97,002

ICICI

Bank

Ltd.

1,109,281

1.4

3,634

Info

Edge

India

Ltd.

178,598

0.2

60,731

Infosys

Ltd.

965,443

1.2

96,950

ITC

Ltd.

521,478

0.7

17,048

Kotak

Mahindra

Bank

Ltd.

414,127

0.5

19,296

Larsen

&

Toubro

Ltd.

513,556

0.7

13,165

Mahindra

&

Mahindra

Ltd.

209,628

0.3

4,338

Mphasis

Ltd.

101,871

0.1

116,621

NTPC

Ltd.

244,571

0.3

158,456

Oil

&

Natural

Gas

Corp.

Ltd.

296,313

0.4

113,747

Power

Grid

Corp.

of

India

Ltd.

321,228

0.4

5,978

Reliance

Industries

Ltd.

178,233

0.2

13,903

Shriram

Finance

Ltd.

234,950

0.3

2,949

SRF

Ltd.

89,689

0.1

31,167

Sun

Pharmaceutical

Industries

Ltd.

367,484

0.5

16,902

Tata

Consultancy

Services

Ltd.

670,993

0.9

16,259

Tech

Mahindra

Ltd.

218,793

0.3

46,152

UPL

Ltd.

381,669

0.5

56,618

Vedanta

Ltd.

190,176

0.2

9,723,388

12.4

Indonesia

:

0

.2

%

426,800

Adaro

Energy

Indonesia

Tbk

PT

57,998

0.1

65,100

United

Tractors

Tbk

PT

96,658

0.1

154,656

0.2

Malaysia

:

1

.7

%

53,400

AMMB

Holdings

Bhd

42,094

0.1

120,200

CIMB

Group

Holdings

Bhd

125,474

0.2

251,300

Genting

Bhd

228,490

0.3

607,900

Genting

Malaysia

Bhd

330,404

0.4

30,800

Hong

Leong

Bank

Bhd

129,215

0.2

197,400

RHB

Bank

Bhd

228,784

0.3

147,500

Telekom

Malaysia

Bhd

162,788

0.2

1,247,249

1.7

Philippines

:

0

.9

%

89,376

BDO

Unibank,

Inc.

216,559

0.3

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

Philippines:

(continued)

18,440

International

Container

Terminal

Services,

Inc.

$

64,033

0.1

280,900

Metropolitan

Bank

&

Trust

Co.

288,228

0.4

2,560

SM

Investments

Corp.

42,334

0.1

611,154

0.9

Singapore

:

3

.8

%

43,100

(2)

BOC

Aviation

Ltd.

316,463

0.4

227,200

CapitaLand

Ascendas

REIT

453,455

0.6

740,200

Genting

Singapore

Ltd.

552,623

0.7

125,400

Keppel

Corp.

Ltd.

584,761

0.7

17,000

Oversea-Chinese

Banking

Corp.

Ltd.

154,106

0.2

1,019,585

(1)

Seatrium

Ltd.

92,640

0.1

87,400

Singapore

Airlines

Ltd.

414,121

0.5

194,800

Singapore

Telecommunications

Ltd.

358,333

0.5

15,500

UOL

Group

Ltd.

72,799

0.1

2,999,301

3.8

South

Korea

:

9

.5

%

476

Amorepacific

Corp.

37,451

0.0

2,257

BGF

retail

Co.

Ltd.

324,123

0.4

12,086

Cheil

Worldwide,

Inc.

166,898

0.2

4,711

CJ

Corp.

314,262

0.4

3,341

DB

Insurance

Co.

Ltd.

186,490

0.2

1,277

E-MART,

Inc.

81,089

0.1

10,095

GS

Holdings

Corp.

292,885

0.4

17,882

Hana

Financial

Group,

Inc.

557,828

0.7

1,289

Hanmi

Pharm

Co.

Ltd.

283,636

0.4

4,012

HD

Hyundai

Co.

Ltd.

172,666

0.2

2,164

Hyundai

Mobis

Co.

Ltd.

363,274

0.5

3,240

Hyundai

Motor

Co.

487,543

0.6

24,971

Kangwon

Land,

Inc.

342,762

0.4

13,586

KB

Financial

Group,

Inc.

489,926

0.6

9,077

Kia

Corp.

586,426

0.7

264

LG

Chem

Ltd.

137,589

0.2

635

LG

Innotek

Co.

Ltd.

146,618

0.2

14,107

LG

Uplus

Corp.

119,443

0.1

4,795

Lotte

Shopping

Co.

Ltd.

288,635

0.4

490

Orion

Corp./Republic

of

Korea

47,680

0.1

4,433

S-1

Corp.

181,452

0.2

1,895

Samsung

Fire

&

Marine

Insurance

Co.

Ltd.

321,866

0.4

907

Samsung

SDI

Co.

Ltd.

489,961

0.6

17,617

Samsung

Securities

Co.

Ltd.

487,572

0.6

12,853

Shinhan

Financial

Group

Co.

Ltd.

338,643

0.4

41,285

Woori

Financial

Group,

Inc.

372,257

0.5

7,618,975

9.5

Taiwan

:

16

.0

%

26,000

Accton

Technology

Corp.

298,111

0.4

47,000

ASE

Technology

Holding

Co.

Ltd.

169,837

0.2

7,000

Chailease

Holding

Co.

Ltd.

46,062

0.1

60,000

Delta

Electronics,

Inc.

616,138

0.8

29,000

E

Ink

Holdings,

Inc.

194,953

0.2

5,000

eMemory

Technology,

Inc.

298,100

0.4

PORTFOLIO

OF

INVESTMENTS

as

of

May

31,

2023

(Unaudited)

(continued)

Voya

Asia

Pacific

High

Dividend

Equity

Income

Fund

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

Taiwan:

(continued)

28,000

Evergreen

Marine

Corp.

Taiwan

Ltd.

$

138,958

0.2

28,000

Globalwafers

Co.

Ltd.

457,826

0.6

236,000

Hon

Hai

Precision

Industry

Co.

Ltd.

816,508

1.0

138,000

Inventec

Corp.

165,399

0.2

179,000

Lite-On

Technology

Corp.

517,894

0.7

26,000

MediaTek,

Inc.

638,914

0.8

13,000

Nan

Ya

Printed

Circuit

Board

Corp.

127,600

0.2

9,000

Novatek

Microelectronics

Corp.

124,257

0.2

23,000

President

Chain

Store

Corp.

209,117

0.3

11,000

Realtek

Semiconductor

Corp.

136,325

0.2

303,627

Taiwan

Semiconductor

Manufacturing

Co.

Ltd.

5,494,990

7.0

71,000

Unimicron

Technology

Corp.

415,297

0.5

84,000

Uni-President

Enterprises

Corp.

202,947

0.3

361,000

United

Microelectronics

Corp.

604,236

0.8

9,000

Wiwynn

Corp.

338,362

0.4

28,000

Yang

Ming

Marine

Transport

Corp.

55,252

0.1

82,000

Zhen

Ding

Technology

Holding

Ltd.

308,676

0.4

12,375,759

16.0

Thailand

:

2

.2

%

290,100

Bangkok

Dusit

Medical

Services

PCL

-

Class

F

235,190

0.3

15,500

Bumrungrad

Hospital

PCL

99,241

0.1

46,500

Electricity

Generating

PCL

193,000

0.2

43,000

Kasikornbank

PCL

159,943

0.2

207,700

Land

&

Houses

PCL

50,700

0.1

162,400

Minor

International

PCL

157,361

0.2

55,600

PTT

Exploration

&

Production

PCL

222,634

0.3

276,900

PTT

Global

Chemical

PCL

280,196

0.4

105,800

SCB

X

PCL

314,416

0.4

1,712,681

2.2

Total

Common

Stock

(Cost

$78,302,110)

74,773,189

95.1

EXCHANGE-TRADED

FUNDS

:

2

.1

%

25,891

iShares

MSCI

All

Country

Asia

ex

Japan

ETF

1,677,996

2.1

Total

Exchange-Traded

Funds

(Cost

$1,720,837)

1,677,996

2.1

PREFERRED

STOCK

:

1

.8

%

South

Korea

:

1

.8

%

31,622

Samsung

Electronics

Co.

Ltd.

1,392,799

1.8

Total

Preferred

Stock

(Cost

$938,016)

1,392,799

1.8

Shares

RA

Value

Percentage

of

Net

Assets

PREFERRED

STOCK:

(continued)

South

Korea:

(continued)

Total

Long-Term

Investments

(Cost

$80,960,963)

$

77,843,984

99.0

SHORT-TERM

INVESTMENTS

:

0

.4

%

Mutual

Funds:

0.4%

334,000

(3)

Morgan

Stanley

Institutional

Liquidity

Funds

-

Government

Portfolio

(Institutional

Share

Class),

5.000%

(Cost

$334,000)

334,000

0.4

Total

Short-Term

Investments

(Cost

$334,000)

334,000

0.4

Total

Investments

in

Securities

(Cost

$81,294,963)

$

78,177,984

99.4

Assets

in

Excess

of

Other

Liabilities

511,226

0.6

Net

Assets

$

78,689,210

100.0

ADR

American

Depositary

Receipt

(1)

Non-income

producing

security.

(2)

Securities

with

purchases

pursuant

to

Rule

144A

or

section

4(a)(2),

under

the

Securities

Act

of

1933

and

may

not

be

resold

subject

to

that

rule

except

to

qualified

institutional

buyers.

(3)

Rate

shown

is

the

7-day

yield

as

of

May

31,

2023.

Sector

Diversification

Percentage

of

Net

Assets

Information

Technology

22

.4

%

Financials

21

.6

Consumer

Discretionary

11

.9

Industrials

8

.1

Materials

7

.5

Communication

Services

6

.3

Health

Care

4

.8

Real

Estate

4

.4

Consumer

Staples

4

.3

Energy

3

.1

Utilities

2

.5

Exchange-Traded

Funds

2

.1

Short-Term

Investments

0

.4

Assets

in

Excess

of

Other

Liabilities

0

.6

Net

Assets

100

.0

%

Portfolio

holdings

are

subject

to

change

daily.

PORTFOLIO

OF

INVESTMENTS

as

of

May

31,

2023

(Unaudited)

(continued)

Voya

Asia

Pacific

High

Dividend

Equity

Income

Fund

T

Fair

Value

Measurements

The

following

is

a

summary

of

the

fair

valuations

according

to

the

inputs

used

as

of

May

31,

2023

in

valuing

the

assets

and

liabilities:

Quoted

Prices

in

Active

Markets

for

Identical

Investments

(Level

1)

Significant

Other

Observable

Inputs

#

(Level

2)

Significant

Unobservable

Inputs

(Level

3)

Fair

Value

at

May

31,

2023

Asset

Table

Investments,

at

fair

value

Common

Stock

Australia

$

—

$

12,572,483

$

—

$

12,572,483

China

1,272,062

20,651,946

—

21,924,008

Hong

Kong

—

3,833,535

—

3,833,535

India

—

9,723,388

—

9,723,388

Indonesia

—

154,656

—

154,656

Malaysia

—

1,247,249

—

1,247,249

Philippines

—

611,154

—

611,154

Singapore

—

2,999,301

—

2,999,301

South

Korea

—

7,618,975

—

7,618,975

Taiwan

—

12,375,759

—

12,375,759

Thailand

—

1,712,681

—

1,712,681

Total

Common

Stock

1,272,062

73,501,127

—

74,773,189

Exchange-Traded

Funds

1,677,996

—

—

1,677,996

Preferred

Stock

—

1,392,799

—

1,392,799

Short-Term

Investments

334,000

—

—

334,000

Total

Investments,

at

fair

value

$

3,284,058

$

74,893,926

$

—

$

78,177,984

Liabilities

Table

Other

Financial

Instruments+

Written

Options

$

—

$

(

112,558

)

$

—

$

(

112,558

)

Total

Liabilities

$

—

$

(

112,558

)

$

—

$

(

112,558

)

+

Other

Financial

Instruments

may

include

open

forward

foreign

currency

contracts,

futures,

centrally

cleared

swaps,

OTC

swaps

and

written

options.

Forward

foreign

currency

contracts,

futures

and

centrally

cleared

swaps

are

fair

valued

at

the

unrealized

appreciation

(depreciation)

on

the

instrument.

OTC

swaps

and

written

options

are

valued

at

the

fair

value

of

the

instrument.

#

The

earlier

close

of

the

foreign

markets

gives

rise

to

the

possibility

that

significant

events,

including

broad

market

moves,

may

have

occurred

in

the

interim

and

may

materially

affect

the

value

of

those

securities.

To

account

for

this,

the

Fund

may

frequently

value

many

of

its

foreign

equity

securities

using

fair

value

prices

based

on

third

party

vendor

modeling

tools

to

the

extent

available.

Accordingly,

a

portion

of

the

Fund’s

investments

are

categorized

as

Level

2

investments.

At

May

31,

2023,

the

following

OTC

written

equity

options

were

outstanding

for

Voya

Asia

Pacific

High

Dividend

Equity

Income

Fund:

Description

Counterparty

Put/Call

Expiration

Date

Exercise

Price

Number

of

Contracts

Notional

Amount

Premiums

Received

Fair

Value

iShares

MSCI

Australia

ETF

Morgan

Stanley

Capital

Services

LLC

Call

06/16/23

USD

23.000

69,565

USD

1,493,560

$

21,648

$

(

925

)

iShares

MSCI

Emerging

Markets

ETF

UBS

AG

Call

06/16/23

USD

38.980

474,602

USD

17,982,670

250,685

(

111,633

)

$

272,333

$

(

112,558

)

Currency

Abbreviations:

USD

United

States

Dollar

PORTFOLIO

OF

INVESTMENTS

as

of

May

31,

2023

(Unaudited)

(continued)

Voya

Asia

Pacific

High

Dividend

Equity

Income

Fund

Net

unrealized

depreciation

consisted

of:

Gross

Unrealized

Appreciation

$

8,081,803

Gross

Unrealized

Depreciation

(

11,198,782

)

Net

Unrealized

Depreciation

$

(

6,233,958

)

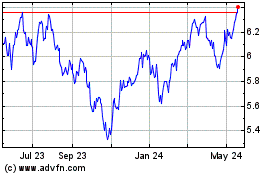

Voya Asia Pacific High D... (NYSE:IAE)

Historical Stock Chart

From Mar 2024 to Apr 2024

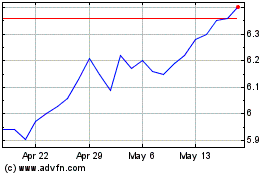

Voya Asia Pacific High D... (NYSE:IAE)

Historical Stock Chart

From Apr 2023 to Apr 2024