Form 8-K - Current report

February 27 2024 - 4:55PM

Edgar (US Regulatory)

0001173514false00011735142024-02-272024-02-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

_______________________________________________________________________________________________________________________________________________________________________________________________________

FORM 8-K | | |

| CURRENT REPORT |

| Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934 |

|

| | | | | | | | |

| Date of Report (Date of earliest event reported): | February 27, 2024 |

| | |

| HYSTER-YALE MATERIALS HANDLING, INC. |

| (Exact name of registrant as specified in its charter) |

| | |

| Delaware | 000-54799 | 31-1637659 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | |

| 5875 Landerbrook Drive, Suite 300 | | |

| Cleveland | (440) | |

| OH | 449-9600 | 44124-4069 |

| (Address of principal executive offices) | (Registrant's telephone number, including area code) | (Zip code) |

| N/A | |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A Common Stock, $0.01 par value per share | HY | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition and

Item 7.01 Regulation FD Disclosure.

On February 27, 2024, Hyster-Yale Materials Handling, Inc. (the “Company”) will post on its website at www.hyster-yale.com additional historical quarterly financial data and update the schedules that were previously posted to the website for the fourth quarter 2023 results. A copy of the data is attached as Exhibit 99 to this Current Report on Form 8-K.

This Current Report on Form 8-K and the information attached hereto are being furnished by the Company pursuant to Item 2.02 of Form 8-K, insofar as they disclose historical information regarding the Company's results of operations.

The information in this Current Report on Form 8-K, including Exhibit 99, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liability of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

As described in Item 2.02 and 7.01 of this Current Report on Form 8-K, the following Exhibit is furnished as part of this Current Report on Form 8-K.

| | | | | | | | |

| (d) Exhibits | | |

| | |

| 99 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | |

| Date: | February 27, 2024 | | HYSTER-YALE MATERIALS HANDLING, INC. |

| | | |

| | By: | /s/ Jennifer M. Langer |

| | | Jennifer M. Langer |

| | | Title: Vice President, Controller and Chief Accounting Officer |

| | | |

EXHIBIT 99 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Hyster-Yale Materials Handling, Inc. |

| (in millions of $, except percentage data) |

| | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Revenues - Consolidated | | | Revenues - Consolidated - % change yr. over yr. | |

| Q1 | Q2 | Q3 | Q4 | FY | | | Q1 | Q2 | Q3 | Q4 | FY | |

| 2019 | 834.8 | | 856.2 | | 766.0 | | 834.8 | | 3,291.8 | | | 2019 | 5.9 | % | 11.8 | % | -2.3 | % | -0.7 | % | 3.5 | % | |

| 2020 | 785.7 | | 654.4 | | 652.4 | | 719.6 | | 2,812.1 | | | 2020 | -5.9 | % | -23.6 | % | -14.8 | % | -13.8 | % | -14.6 | % | |

| 2021 | 732.2 | | 765.6 | | 748.2 | | 829.7 | | 3,075.7 | | | 2021 | -6.8 | % | 17.0 | % | 14.7 | % | 15.3 | % | 9.4 | % | |

| 2022 | 827.6 | | 895.4 | | 840.1 | | 985.2 | | 3,548.3 | | | 2022 | 13.0 | % | 17.0 | % | 12.3 | % | 18.7 | % | 15.4 | % | |

| 2023 | 999.3 | | 1,090.6 | | 1,001.2 | | 1,027.2 | | 4,118.3 | | | 2023 | 20.7 | % | 21.8 | % | 19.2 | % | 4.3 | % | 16.1 | % | |

| | | | | | | | | | | | | |

| Gross Profit (6) | | | Gross Profit % (6) | |

| Q1 | Q2 | Q3 | Q4 | FY | | | Q1 | Q2 | Q3 | Q4 | FY | |

| 2019 | 126.2 | | 139.4 | | 135.0 | | 141.2 | | 541.8 | | | 2019 | 15.1 | % | 16.3 | % | 17.6 | % | 16.9 | % | 16.5 | % | |

| 2020 | 136.7 | 103.6 | 103.4 | 121.7 | 465.4 | | | 2020 | 17.4 | % | 15.8 | % | 15.8 | % | 16.9 | % | 16.5 | % | |

| 2021 | 118.4 | | 116.4 | | 65.1 | | 63.5 | | 363.4 | | | 2021 | 16.2 | % | 15.2 | % | 8.7 | % | 7.7 | % | 11.8 | % | |

| 2022 | 101.2 | 99.1 | 86.9 | 146.7 | 433.9 | | | 2022 | 12.2 | % | 11.1 | % | 10.3 | % | 14.9 | % | 12.2 | % | |

| 2023 | 174.4 | 197.9 | 203.6 | 209.7 | 785.6 | | | 2023 | 17.5 | % | 18.1 | % | 20.3 | % | 20.4 | % | 19.1 | % | |

| | | | | | | | | | | | | |

| Operating Expenses (6)(7)(8) | | | Operating Expenses as a % of Revenue (6)(7)(8) | |

| Q1 | Q2 | Q3 | Q4 | FY | | | Q1 | Q2 | Q3 | Q4 | FY | |

| 2019 | 122.8 | | 116.5 | | 115.5 | | 133.1 | | 487.9 | | | 2019 | 14.7 | % | 13.6 | % | 15.1 | % | 15.9 | % | 14.8 | % | |

| 2020 | 116.5 | | 94.9 | | 96.1 | | 108.0 | | 415.5 | | | 2020 | 14.8 | % | 14.5 | % | 14.7 | % | 15.0 | % | 14.8 | % | |

| 2021 | 115.3 | | 110.5 | | 119.4 | | 170.5 | | 515.7 | | | 2021 | 15.7 | % | 14.4 | % | 16.0 | % | 20.5 | % | 16.8 | % | |

| 2022 | 119.5 | | 114.8 | | 111.8 | | 126.9 | | 473.0 | | | 2022 | 14.4 | % | 12.8 | % | 13.3 | % | 12.9 | % | 13.3 | % | |

| 2023 | 131.8 | | 139.1 | | 145.0 | | 161.0 | | 576.9 | | | 2023 | 13.2 | % | 12.8 | % | 14.5 | % | 15.7 | % | 14.0 | % | |

| | | | | | | | | | | | | |

| Operating Profit (Loss) (6)(7)(8) | | | Operating Profit (Loss) % | |

| Q1 | Q2 | Q3 | Q4 | FY | | | Q1 | Q2 | Q3 | Q4 | FY | |

| 2019 | 3.4 | | 22.9 | | 19.5 | | 8.1 | | 53.9 | | | 2019 | 0.4 | % | 2.7 | % | 2.5 | % | 1.0 | % | 1.6 | % | |

| 2020 | 20.2 | | 8.7 | | 7.3 | | 13.7 | | 49.9 | | | 2020 | 2.6 | % | 1.3 | % | 1.1 | % | 1.9 | % | 1.8 | % | |

| 2021 | 3.1 | | 5.9 | | (54.3) | | (107.0) | | (152.3) | | | 2021 | 0.4 | % | 0.8 | % | -7.3 | % | -12.9 | % | -5.0 | % | |

| 2022 | (18.3) | | (15.7) | | (24.9) | | 19.8 | | (39.1) | | | 2022 | -2.2 | % | -1.8 | % | -3.0 | % | 2.0 | % | -1.1 | % | |

| 2023 | 42.6 | | 58.8 | | 58.6 | | 48.7 | | 208.7 | | | 2023 | 4.3 | % | 5.4 | % | 5.9 | % | 4.7 | % | 5.1 | % | |

| | | | | | | | | | | | | |

| Interest (Income) Expense | | | | | | | | |

| Q1 | Q2 | Q3 | Q4 | FY | | | | | | | | |

| 2019 | 4.1 | | 4.7 | | 5.1 | | 4.1 | | 18.0 | | | | | | | | | |

| 2020 | 3.8 | | 3.0 | | 2.7 | | 2.8 | | 12.3 | | | | | | | | | |

| 2021 | 2.7 | | 3.7 | | 4.0 | | 4.5 | | 14.9 | | | | | | | | | |

| 2022 | 4.9 | | 5.9 | | 7.3 | | 9.2 | | 27.3 | | | | | | | | | |

| 2023 | 9.6 | | 7.8 | | 8.9 | | 8.4 | | 34.7 | | | | | | | | | |

| | | | | | | | | | | | | |

| Income (Loss) Before Taxes | | | Effective Income Tax Rate (9) | |

| Q1 | Q2 | Q3 | Q4 | FY | | | Q1 | Q2 | Q3 | Q4 | FY | |

| 2019 | 4.7 | | 21.3 | | 18.0 | | 3.9 | | 47.9 | | | 2019 | 31.9 | % | 20.7% | 27.2 | % | 12.8 | % | 23.6 | % | |

| 2020 | 19.7 | | 1.7 | | 6.4 | | 14.4 | | 42.2 | | | 2020 | 20.8 | % | n.m. | 10.9 | % | 8.3 | % | 8.8 | % | |

| 2021 | 8.5 | | (0.1) | | (56.3) | | (107.0) | | (154.9) | | | 2021 | 28.2 | % | n.m. | -36.4 | % | -7.3 | % | -18.3 | % | |

| 2022 | (21.3) | | (21.8) | | (32.4) | | 13.1 | | (62.4) | | | 2022 | -13.6 | % | 14.2% | -13.0 | % | 39.7 | % | -14.7 | % | |

| 2023 | 35.9 | | 50.8 | | 52.6 | | 41.7 | | 181.0 | | | 2023 | 24.2 | % | 23.6% | 30.8 | % | 38.4 | % | 29.2 | % | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Hyster-Yale Materials Handling, Inc. |

| (in millions of $, except percentage data) |

| | | | | | | | | | | | | |

| Net Income (Loss) Attributable to Stockholders (9) | | | | | | | | |

| Q1 | Q2 | Q3 | Q4 | FY | | | | | | | | |

| 2019 | 3.4 | | 16.2 | | 12.8 | | 3.4 | | 35.8 | | | | | | | | | |

| 2020 | 15.3 | | 3.6 | | 5.1 | | 13.1 | | 37.1 | | | | | | | | | |

| 2021 | 5.6 | | 1.9 | | (77.2) | | (103.3) | | (173.0) | | | | | | | | | |

| 2022 | (25.0) | | (19.4) | | (37.3) | | 7.6 | | (74.1) | | | | | | | | | |

| 2023 | 26.6 | | 38.3 | | 35.8 | | 25.2 | | 125.9 | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Depreciation and Amortization Expense | | | | | | | | |

| Q1 | Q2 | Q3 | Q4 | FY | | | | | | | | |

| 2019 | 11.2 | | 10.8 | | 10.3 | | 11.0 | | 43.3 | | | | | | | | | |

| 2020 | 10.4 | | 10.4 | | 11.0 | | 11.1 | | 42.9 | | | | | | | | | |

| 2021 | 11.7 | | 11.6 | | 11.4 | | 11.5 | | 46.2 | | | | | | | | | |

| 2022 | 11.1 | | 11.0 | | 10.9 | | 10.4 | | 43.4 | | | | | | | | | |

| 2023 | 11.2 | | 11.3 | | 11.3 | | 11.3 | | 45.1 | | | | | | | | | |

| | | | | | | | | | | | | |

| Net Working Capital (1) | | | Net Working Capital as % of Revenue (2) | |

| Q1 | Q2 | Q3 | Q4 | FY | | | Q1 | Q2 | Q3 | Q4 | FY | |

| 2019 | 594.3 | | 679.7 | | 643.0 | | 611.1 | | 611.1 | | | 2019 | 18.4 | % | 20.5 | % | 19.5 | % | 18.6 | % | 18.6 | % | |

| 2020 | 595.7 | | 577.4 | | 517.5 | | 493.4 | | 493.4 | | | 2020 | 18.4 | % | 19.0 | % | 17.7 | % | 17.5 | % | 17.5 | % | |

| 2021 | 539.7 | | 645.9 | | 692.4 | | 697.0 | | 697.0 | | | 2021 | 19.6 | % | 22.8 | % | 23.3 | % | 22.7 | % | 22.7 | % | |

| 2022 | 704.7 | | 751.9 | | 686.2 | | 715.7 | | 715.7 | | | 2022 | 22.2 | % | 22.8 | % | 20.2 | % | 20.2 | % | 20.2 | % | |

| 2023 | 763.0 | | 809.0 | | 777.8 | | 783.0 | | 783.0 | | | 2023 | 20.5 | % | 20.7 | % | 19.1 | % | 19.0 | % | 19.0 | % | |

| | | | | | | | | | | | | |

| Capital Expenditures | | | | | | | | |

| Q1 | Q2 | Q3 | Q4 | FY | | | | | | | | |

| 2019 | 8.6 | | 9.8 | | 13.0 | | 18.3 | | 49.7 | | | | | | | | | |

| 2020 | 17.6 | | 12.3 | | 7.3 | | 14.5 | | 51.7 | | | | | | | | | |

| 2021 | 7.7 | | 10.4 | | 11.4 | | 14.8 | | 44.3 | | | | | | | | | |

| 2022 | 9.7 | | 5.6 | | 4.4 | | 9.1 | | 28.8 | | | | | | | | | |

| 2023 | 3.3 | | 7.3 | | 8.3 | | 16.5 | | 35.4 | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Net Cash Provided By (Used For) Operating Activities | | | | | | | | |

| Q1 | Q2 | Q3 | Q4 | FY | | | | | | | | |

| 2019 | (22.4) | | (48.5) | | 53.6 | | 94.0 | | 76.7 | | | | | | | | | |

| 2020 | (45.7) | | 33.7 | | 88.1 | | 90.8 | | 166.9 | | | | | | | | | |

| 2021 | (47.1) | | (53.6) | | (91.1) | | (61.7) | | (253.5) | | | | | | | | | |

| 2022 | 59.1 | | (58.9) | | 34.1 | | 6.3 | | 40.6 | | | | | | | | | |

| 2023 | 9.0 | | 35.8 | | 60.3 | | 45.6 | | 150.7 | | | | | | | | | |

| | | | | | | | | | | | | |

| Net Cash Provided By (Used For) Investing Activities | | | | | | | | |

| Q1 | Q2 | Q3 | Q4 | FY | | | | | | | | |

| 2019 | (8.0) | | (9.6) | | (6.9) | | (17.5) | | (42.0) | | | | | | | | | |

| 2020 | (17.4) | | (5.9) | | (6.5) | | (13.9) | | (43.7) | | | | | | | | | |

| 2021 | 9.5 | | (8.7) | | (10.9) | | (14.4) | | (24.5) | | | | | | | | | |

| 2022 | (9.3) | | (13.6) | | (4.3) | | (8.2) | | (35.4) | | | | | | | | | |

| 2023 | (5.0) | | (6.9) | | (7.9) | | (14.7) | | (34.5) | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Hyster-Yale Materials Handling, Inc. |

| (in millions of $, except percentage data) |

| | | | | | | | | | | | | |

| Cash Flow Before Financing Activities (3) | | | | | | | | |

| Q1 | Q2 | Q3 | Q4 | FY | | | | | | | | |

| 2019 | (30.4) | | (58.1) | | 46.7 | | 76.5 | | 34.7 | | | | | | | | | |

| 2020 | (63.1) | | 27.8 | | 81.6 | | 76.9 | | 123.2 | | | | | | | | | |

| 2021 | (37.6) | | (62.3) | | (102.0) | | (76.1) | | (278.0) | | | | | | | | | |

| 2022 | 49.8 | | (72.5) | | 29.8 | | (1.9) | | 5.2 | | | | | | | | | |

| 2023 | 4.0 | | 28.9 | | 52.4 | | 30.9 | | 116.2 | | | | | | | | | |

| | | | | | | | | | | | | |

| Net Cash Provided By (Used For) Financing Activities | | | | | | | | |

| Q1 | Q2 | Q3 | Q4 | FY | | | | | | | | |

| 2019 | 3.6 | | 52.5 | | (31.1) | | (76.6) | | (51.6) | | | | | | | | | |

| 2020 | 53.1 | | (18.7) | | (53.5) | | (21.5) | | (40.6) | | | | | | | | | |

| 2021 | (8.0) | | 45.5 | | 77.2 | | 78.9 | | 193.6 | | | | | | | | | |

| 2022 | (50.9) | | 84.4 | | (35.4) | | (9.0) | | (10.9) | | | | | | | | | |

| 2023 | (2.5) | | (26.4) | | (40.2) | | (31.4) | | (100.5) | | | | | | | | | |

| | | | | | | | | | | | | |

| Dividends Paid to Stockholders | | | | | | | | |

| Q1 | Q2 | Q3 | Q4 | FY | | | | | | | | |

| 2019 | 5.2 | | 5.2 | | 5.3 | | 5.3 | | 21.0 | | | | | | | | | |

| 2020 | 5.3 | | 5.3 | | 5.4 | | 5.3 | | 21.3 | | | | | | | | | |

| 2021 | 5.3 | | 5.4 | | 5.5 | | 5.4 | | 21.6 | | | | | | | | | |

| 2022 | 5.4 | | 5.5 | | 5.5 | | 5.4 | | 21.8 | | | | | | | | | |

| 2023 | 5.6 | | 5.5 | | 5.6 | | 5.6 | | 22.3 | | | | | | | | | |

| | | | | | | | | | | | | |

| Total Debt | | | Debt to Total Capitalization (4) | |

| Q1 | Q2 | Q3 | Q4 | FY | | | Q1 | Q2 | Q3 | Q4 | FY | |

| 2019 | 309.4 | | 370.9 | | 351.1 | | 287.0 | | 287.0 | | | 2019 | 35.9 | % | 39.4 | % | 39.1 | % | 33.9 | % | 33.9 | % | |

| 2020 | 340.1 | | 337.7 | | 297.7 | | 289.2 | | 289.2 | | | 2020 | 38.5 | % | 37.5 | % | 33.1 | % | 30.8 | % | 30.8 | % | |

| 2021 | 285.4 | | 345.7 | | 428.0 | | 518.5 | | 518.5 | | | 2021 | 31.7 | % | 35.4 | % | 45.6 | % | 57.5 | % | 57.5 | % | |

| 2022 | 479.0 | | 580.6 | | 545.0 | | 552.9 | | 552.9 | | | 2022 | 57.7 | % | 72.2 | % | 80.1 | % | 71.1 | % | 71.1 | % | |

| 2023 | 560.6 | | 542.3 | | 510.6 | | 494.0 | | 494.0 | | | 2023 | 67.3 | % | 63.9 | % | 61.4 | % | 54.8 | % | 54.8 | % | |

| | | | | | | | | | | | | |

| Permanent Equity | | | Return on Equity (5) | |

| Q1 | Q2 | Q3 | Q4 | FY | | | Q1 | Q2 | Q3 | Q4 | FY | |

| 2019 | 551.4 | | 570.1 | | 542.5 | | 577.0 | | 577.0 | | | 2019 | 4.0 | % | 5.9 | % | 5.5 | % | 6.4 | % | 6.4 | % | |

| 2020 | 542.7 | | 563.7 | | 602.6 | | 651.1 | | 651.1 | | | 2020 | 8.6 | % | 6.3 | % | 4.8 | % | 6.3 | % | 6.3 | % | |

| 2021 | 615.8 | | 630.0 | | 510.2 | | 382.9 | | 382.9 | | | 2021 | 4.6 | % | 4.2 | % | -9.4 | % | -31.0 | % | -31.0 | % | |

| 2022 | 351.5 | | 207.5 | | 121.5 | | 210.9 | | 210.9 | | | 2022 | -40.9 | % | -54.0 | % | -58.8 | % | -29.1 | % | -29.1 | % | |

| 2023 | 257.6 | | 292.3 | | 306.2 | | 392.0 | | 392.0 | | | 2023 | -9.8 | % | 16.1 | % | 45.6 | % | 43.1 | % | 43.1 | % | |

| | | | | | | | | | | | | |

| (1) | | Net working capital is equal to accounts receivable, net plus inventories, net less accounts payable. |

| (2) | | Net working capital as a percentage of revenue is equal to net working capital divided by the previous 4 quarters revenue. |

| (3) | | Cash flow before financing activities is equal to net cash provided by (used for) operating activities plus net cash provided by (used for) investing activities. |

| (4) | | Debt to total capitalization is equal to total debt divided by total debt plus permanent equity. |

| (5) | | Return on equity is equal to the sum of the previous 4 quarters net income divided by average equity calculated over the last 5 quarters. |

| (6) | | During the third and fourth quarters of 2021, Nuvera reduced its inventory to its estimated net realizable value by $14.8 million and $1.3 million, respectively. |

| (7) | | During the third quarter of 2021, Nuvera recognized a $10.0 million impairment charge of property, plant and equipment. |

| (8) | | During the fourth quarter of 2021, JAPIC recognized a $55.6 million goodwill impairment charge, of which $11.7 million related to the non-controlling interest share. |

| (9) | | During the third and fourth quarters of 2021, the Company recognized a valuation allowance of $38.4 million and $20.2 million, respectively, provided against deferred tax assets. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Hyster-Yale Materials Handling, Inc. |

| (in millions of $, except percentage data) |

| | | | | | | | | | | | | |

| Non-GAAP Reconciliation of ROTCE |

| | | | | | | | | 2019 | 2020 | 2021 | 2022 | 2023 |

Average Stockholders' Equity (1) | | | | 527.8 | 554.5 | 525.5 | 241.9 | 288.9 |

Average Debt (1) | | | | 324.0 | 310.3 | 373.4 | 535.2 | 532.2 |

Average Cash (1) | | | | (63.4) | (83.4) | (93.8) | (66.8) | (69.3) |

| Average Capital Employed | | | | 788.4 | 781.4 | 805.1 | 710.3 | 751.8 |

| | | | | | | | | | | | | |

| Net Income (Loss) | | | | 35.8 | 37.1 | (173.0) | (74.1) | 125.9 |

| Plus: Interest Expense, Net | | | | 18.0 | 12.3 | 14.9 | 27.3 | 34.7 |

| Less: Income Taxes on Interest Expense, Net | | | | (4.7) | (3.2) | (3.9) | (6.8) | (8.7) |

Actual Return on Capital Employed (2) | | | | 49.1 | 46.2 | (162.0) | (53.6) | 151.9 |

Actual Return on Capital Employed Percentage (3) | | | | 6.2% | 5.9% | (20.1)% | (7.5)% | 20.2% |

| | | | | | | | | | | | | |

| (1) | | Average stockholder's equity, debt and cash are calculated using the quarter ends and year ends of each respective year. |

| (2) | | Tax rate used is the Company's target U.S. marginal tax rate. Rates used were 26% for 2019, 2020 and 2021 and 25% for 2022 and 2023. |

| (3) | | Return on capital employed is provided solely as a supplemental disclosure with respect to income generation because management believes it provides useful information with respect to earnings in a form that is comparable to the Company's cost of capital employed, which includes both equity and debt securities, net of cash. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Lift Truck Business |

| (in millions of $, except percentage data) |

| | | | | | | | | | | | | |

| Backlog (in thousands) | | | | | | | | |

| Q1 | Q2 | Q3 | Q4 | FY | | | | | | | | |

| 2019 | 40.2 | | 44.1 | | 43.4 | | 41.2 | | 41.2 | | | | | | | | | |

| 2020 | 37.3 | | 31.5 | | 33.6 | | 40.6 | | 40.6 | | | | | | | | | |

| 2021 | 60.7 | | 84.9 | | 98.8 | | 105.3 | | 105.3 | | | | | | | | | |

| 2022 | 114.1 | | 112.0 | | 108.2 | | 102.1 | | 102.1 | | | | | | | | | |

| 2023 | 99.2 | | 92.8 | | 85.3 | | 78.4 | | 78.4 | | | | | | | | | |

| | | | | | | | | | | | | |

| Unit Shipments (in thousands) | | | | | | | | |

| Q1 | Q2 | Q3 | Q4 | FY | | | | | | | | |

| 2019 | 25.7 | | 26.3 | | 23.5 | | 24.8 | | 100.3 | | | | | | | | | |

| 2020 | 23.3 | | 20.1 | | 20.6 | | 21.5 | | 85.5 | | | | | | | | | |

| 2021 | 22.3 | | 22.7 | | 23.2 | | 26.7 | | 94.9 | | | | | | | | | |

| 2022 | 23.9 | | 25.3 | | 24.5 | | 27.1 | | 100.8 | | | | | | | | | |

| 2023 | 25.2 | | 27.7 | | 25.7 | | 23.6 | | 102.2 | | | | | | | | | |

| | | | | | | | | | | | | |

| Revenues - Americas | | | Revenues - Americas - % change yr. over yr. | |

| Q1 | Q2 | Q3 | Q4 | FY | | | Q1 | Q2 | Q3 | Q4 | FY | |

| 2019 | 534.5 | | 537.7 | | 505.8 | | 545.3 | | 2,123.3 | | | 2019 | 7.8 | % | 14.0 | % | 0.4 | % | 5.7 | % | 6.8 | % | |

| 2020 | 550.7 | | 454.8 | | 426.9 | | 458.8 | | 1,891.2 | | | 2020 | 3.0 | % | -15.4 | % | -15.6 | % | -15.9 | % | -10.9 | % | |

| 2021 | 459.7 | | 479.1 | | 494.3 | | 551.5 | | 1,984.6 | | | 2021 | -16.5 | % | 5.3 | % | 15.8 | % | 20.2 | % | 4.9 | % | |

| 2022 | 557.7 | | 596.6 | | 571.3 | | 679.8 | | 2,405.4 | | | 2022 | 21.3 | % | 24.5 | % | 15.6 | % | 23.3 | % | 21.2 | % | |

| 2023 | 685.9 | | 788.5 | | 716.5 | | 708.4 | | 2,899.3 | | | 2023 | 23.0 | % | 32.2 | % | 25.4 | % | 4.2 | % | 20.5 | % | |

| | | | | | | | | | | | | |

| Revenues - EMEA | | | Revenues - EMEA - % change yr. over yr. | |

| Q1 | Q2 | Q3 | Q4 | FY | | | Q1 | Q2 | Q3 | Q4 | FY | |

| 2019 | 190.1 | | 202.1 | | 161.7 | | 197.3 | | 751.2 | | | 2019 | -3.9 | % | 5.8 | % | -6.1 | % | -5.0 | % | -2.3 | % | |

| 2020 | 152.1 | | 120.1 | | 143.8 | | 172.6 | | 588.6 | | | 2020 | -20.0 | % | -40.6 | % | -11.1 | % | -12.5 | % | -21.6 | % | |

| 2021 | 170.7 | | 175.1 | | 153.4 | | 179.7 | | 678.9 | | | 2021 | 12.2 | % | 45.8 | % | 6.7 | % | 4.1 | % | 15.3 | % | |

| 2022 | 169.7 | | 184.8 | | 159.4 | | 190.3 | | 704.2 | | | 2022 | -0.6 | % | 5.5 | % | 3.9 | % | 5.9 | % | 3.7 | % | |

| 2023 | 214.9 | | 200.6 | | 183.9 | | 221.1 | | 820.5 | | | 2023 | 26.6 | % | 8.5 | % | 15.4 | % | 16.2 | % | 16.5 | % | |

| | | | | | | | | | | | | |

| Revenues - JAPIC | | | Revenues - JAPIC - % change yr. over yr. | |

| Q1 | Q2 | Q3 | Q4 | FY | | | Q1 | Q2 | Q3 | Q4 | FY | |

| 2019 | 63.4 | | 72.9 | | 57.8 | | 55.6 | | 249.7 | | | 2019 | 28.1 | % | 26.8 | % | -10.7 | % | -21.0 | % | 3.1 | % | |

| 2020 | 44.6 | | 48.0 | | 48.0 | | 52.5 | | 193.1 | | | 2020 | -29.7 | % | -34.2 | % | -17.0 | % | -5.6 | % | -22.7 | % | |

| 2021 | 60.5 | | 65.0 | | 56.1 | | 52.3 | | 233.9 | | | 2021 | 35.7 | % | 35.4 | % | 16.9 | % | -0.4 | % | 21.1 | % | |

| 2022 | 51.7 | | 64.9 | | 65.5 | | 67.9 | | 250.0 | | | 2022 | -14.5 | % | -0.2 | % | 16.8 | % | 29.8 | % | 6.9 | % | |

| 2023 | 47.9 | | 49.6 | | 51.6 | | 52.0 | | 201.1 | | | 2023 | -7.4 | % | -23.6 | % | -21.2 | % | -23.4 | % | -19.6 | % | |

| | | | | | | | | | | | | |

| Revenues - Lift Truck Business | | | Revenues - Lift Truck Business - % change yr. over yr. | |

| Q1 | Q2 | Q3 | Q4 | FY | | | Q1 | Q2 | Q3 | Q4 | FY | |

| 2019 | 788.0 | | 812.7 | | 725.3 | | 798.2 | | 3,124.2 | | | 2019 | 6.0 | % | 12.9 | % | -2.1 | % | 0.5 | % | 4.2 | % | |

| 2020 | 747.4 | | 622.9 | | 618.7 | | 683.9 | | 2,672.9 | | | 2020 | -5.2 | % | -23.4 | % | -14.7 | % | -14.3 | % | -14.4 | % | |

| 2021 | 690.9 | | 719.2 | | 703.8 | | 783.5 | | 2,897.4 | | | 2021 | -7.6 | % | 15.5 | % | 13.8 | % | 14.6 | % | 8.4 | % | |

| 2022 | 779.1 | | 846.3 | | 796.2 | | 938.0 | | 3,359.6 | | | 2022 | 12.8 | % | 17.7 | % | 13.1 | % | 19.7 | % | 16.0 | % | |

| 2023 | 948.7 | | 1,038.7 | | 952.0 | | 981.5 | | 3,920.9 | | | 2023 | 21.8 | % | 22.7 | % | 19.6 | % | 4.6 | % | 16.7 | % | |

| | | | | | | | | | | | | |

| Gross Profit | | | Gross Profit % | |

| Q1 | Q2 | Q3 | Q4 | FY | | | Q1 | Q2 | Q3 | Q4 | FY | |

| 2019 | 112.6 | | 126.9 | | 125.0 | | 130.5 | | 495.0 | | | 2019 | 14.3 | % | 15.6 | % | 17.2 | % | 16.3 | % | 15.8 | % | |

| 2020 | 123.5 | | 94.8 | | 94.3 | | 112.2 | | 424.8 | | | 2020 | 16.5 | % | 15.2 | % | 15.2 | % | 16.4 | % | 15.9 | % | |

| 2021 | 105.4 | | 103.2 | | 66.9 | | 54.4 | | 329.9 | | | 2021 | 15.3 | % | 14.3 | % | 9.5 | % | 6.9 | % | 11.4 | % | |

| 2022 | 85.9 | | 81.3 | | 74.6 | | 129.2 | | 371.0 | | | 2022 | 11.0 | % | 9.6 | % | 9.4 | % | 13.8 | % | 11.0 | % | |

| 2023 | 155.6 | | 177.0 | | 186.0 | | 192.8 | | 711.4 | | | 2023 | 16.4 | % | 17.0 | % | 19.5 | % | 19.6 | % | 18.1 | % | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Lift Truck Business |

| (in millions of $, except percentage data) |

| | | | | | | | | | | | | |

| Operating Expenses(1) | | | Operating Expenses as a % of revenues(1) | |

| Q1 | Q2 | Q3 | Q4 | FY | | | Q1 | Q2 | Q3 | Q4 | FY | |

| 2019 | 101.8 | | 97.8 | | 97.0 | | 112.8 | | 409.4 | | | 2019 | 12.9 | % | 12.0 | % | 13.4 | % | 14.1 | % | 13.1 | % | |

| 2020 | 95.5 | | 77.8 | | 78.1 | | 87.8 | | 339.2 | | | 2020 | 12.8 | % | 12.5 | % | 12.6 | % | 12.8 | % | 12.7 | % | |

| 2021 | 93.2 | | 87.8 | | 88.2 | | 147.6 | | 416.8 | | | 2021 | 13.5 | % | 12.2 | % | 12.5 | % | 18.8 | % | 14.4 | % | |

| 2022 | 96.6 | 93.0 | | 89.8 | | 102.0 | | 381.4 | | | 2022 | 12.4 | % | 11.0 | % | 11.3 | % | 10.9 | % | 11.4 | % | |

| 2023 | 107.8 | 114.5 | | 120.9 | | 138.6 | | 481.8 | | | 2023 | 11.4 | % | 11.0 | % | 12.7 | % | 14.1 | % | 12.3 | % | |

| | | | | | | | | | | | | |

| Operating Profit (Loss)(1) | | | Operating Profit (Loss) %(1) | |

| Q1 | Q2 | Q3 | Q4 | FY | | | Q1 | Q2 | Q3 | Q4 | FY | |

| 2019 | 10.8 | | 29.1 | | 28.0 | | 17.7 | | 85.6 | | | 2019 | 1.4 | % | 3.6 | % | 3.9 | % | 2.2 | % | 2.7 | % | |

| 2020 | 28.0 | | 17.0 | | 16.2 | | 24.4 | | 85.6 | | | 2020 | 3.7 | % | 2.7 | % | 2.6 | % | 3.6 | % | 3.2 | % | |

| 2021 | 12.2 | | 15.4 | | (21.3) | | (93.2) | | (86.9) | | | 2021 | 1.8 | % | 2.1 | % | -3.0 | % | -11.9 | % | -3.0 | % | |

| 2022 | (10.7) | | (11.7) | | (15.2) | | 27.2 | | (10.4) | | | 2022 | -1.4 | % | -1.4 | % | -1.9 | % | 2.9 | % | -0.3 | % | |

| 2023 | 47.8 | | 62.5 | | 65.1 | | 54.2 | | 229.6 | | | 2023 | 5.0 | % | 6.0 | % | 6.8 | % | 5.5 | % | 5.9 | % | |

| | | | | | | | | | | | | |

| (1) | During the fourth quarter of 2021, JAPIC recognized a $55.6 million goodwill impairment charge, of which $11.7 million related to the non-controlling interest share. |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Bolzoni |

| (in millions of $, except percentage data) |

| | | | | | | | | | | | | |

| Revenues | | | Revenues - Bolzoni - % change yr. over yr. | |

| Q1 | Q2 | Q3 | Q4 | FY | | | Q1 | Q2 | Q3 | Q4 | FY | |

| 2019 | 91.8 | | 90.8 | | 75.8 | | 87.0 | | 345.4 | | | 2019 | 2.6 | % | 3.2 | % | -10.2 | % | -0.1 | % | -1.0 | % | |

| 2020 | 87.9 | | 64.2 | | 63.3 | | 68.3 | | 283.7 | | | 2020 | -4.2 | % | -29.3 | % | -16.5 | % | -21.5 | % | -17.9 | % | |

| 2021 | 79.5 | | 84.8 | | 90.0 | | 93.5 | | 347.8 | | | 2021 | -9.6 | % | 32.1 | % | 42.2 | % | 36.9 | % | 22.6 | % | |

| 2022 | 95.1 | | 86.4 | | 82.2 | | 92.0 | | 355.7 | | | 2022 | 19.6 | % | 1.9 | % | -8.7 | % | -1.6 | % | 2.3 | % | |

| 2023 | 98.6 | | 96.6 | | 92.8 | | 87.3 | | 375.3 | | | 2023 | 3.7 | % | 11.8 | % | 12.9 | % | -5.1 | % | 5.5 | % | |

| | | | | | | | | | | | | |

| Gross Profit (Loss) | | | Gross Profit % | |

| Q1 | Q2 | Q3 | Q4 | FY | | | Q1 | Q2 | Q3 | Q4 | FY | |

| 2019 | 15.6 | | 15.5 | | 13.0 | | 14.0 | | 58.1 | | | 2019 | 17.0 | % | 17.1 | % | 17.2 | % | 16.1 | % | 16.8 | % | |

| 2020 | 16.9 | | 11.5 | | 12.1 | | 12.9 | | 53.4 | | | 2020 | 19.2 | % | 17.9 | % | 19.1 | % | 18.9 | % | 18.8 | % | |

| 2021 | 16.4 | | 15.8 | | 15.2 | | 14.1 | | 61.5 | | | 2021 | 20.6 | % | 18.6 | % | 16.9 | % | 15.1 | % | 17.7 | % | |

| 2022 | 18.8 | | 18.9 | | 13.7 | | 19.3 | | 70.7 | | | 2022 | 19.8 | % | 21.9 | % | 16.7 | % | 21.0 | % | 19.9 | % | |

| 2023 | 20.7 | | 22.6 | | 19.5 | | 19.4 | | 82.2 | | | 2023 | 21.0 | % | 23.4 | % | 21.0 | % | 22.2 | % | 21.9 | % | |

| | | | | | | | | | | | | |

| Operating Expenses | | | Operating Expenses as a % of revenues | |

| Q1 | Q2 | Q3 | Q4 | FY | | | Q1 | Q2 | Q3 | Q4 | FY | |

| 2019 | 14.4 | | 13.2 | | 12.3 | | 13.5 | | 53.4 | | | 2019 | 15.7 | % | 14.5 | % | 16.2 | % | 15.5 | % | 15.5 | % | |

| 2020 | 14.2 | | 12.0 | | 12.0 | | 14.2 | | 52.4 | | | 2020 | 16.2 | % | 18.7 | % | 19.0 | % | 20.8 | % | 18.5 | % | |

| 2021 | 15.6 | | 16.2 | | 15.2 | | 16.3 | | 63.3 | | | 2021 | 19.6 | % | 19.1 | % | 16.9 | % | 17.4 | % | 18.2 | % | |

| 2022 | 16.7 | | 15.5 | | 15.0 | | 17.3 | | 64.5 | | | 2022 | 17.6 | % | 17.9 | % | 18.2 | % | 18.8 | % | 18.1 | % | |

| 2023 | 16.3 | | 17.2 | | 16.6 | | 16.8 | | 66.9 | | | 2023 | 16.5 | % | 17.8 | % | 17.9 | % | 19.2 | % | 17.8 | % | |

| | | | | | | | | | | | | |

| Operating Profit (Loss) | | | Operating Profit (Loss) % | |

| Q1 | Q2 | Q3 | Q4 | FY | | | Q1 | Q2 | Q3 | Q4 | FY | |

| 2019 | 1.2 | | 2.3 | | 0.7 | | 0.5 | | 4.7 | | | 2019 | 1.3 | % | 2.5 | % | 0.9 | % | 0.6 | % | 1.4 | % | |

| 2020 | 2.7 | | (0.5) | | 0.1 | | (1.3) | | 1.0 | | | 2020 | 3.1 | % | -0.8 | % | 0.2 | % | -1.9 | % | 0.4 | % | |

| 2021 | 0.8 | | (0.4) | | — | | (2.2) | | (1.8) | | | 2021 | 1.0 | % | -0.5 | % | — | % | -2.4 | % | -0.5 | % | |

| 2022 | 2.1 | | 3.4 | | (1.3) | | 2.0 | | 6.2 | | | 2022 | 2.2 | % | 3.9 | % | -1.6 | % | 2.2 | % | 1.7 | % | |

| 2023 | 4.4 | | 5.4 | | 2.9 | | 2.6 | | 15.3 | | | 2023 | 4.5 | % | 5.6 | % | 3.1 | % | 3.0 | % | 4.1 | % | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nuvera |

| (in millions of $, except percentage data) |

| | | | | | | | | | | | | |

| Revenues | | | | |

| Q1 | Q2 | Q3 | Q4 | FY | | | | | | | | |

| 2019 | 4.5 | | 2.2 | | 2.4 | | 1.0 | | 10.1 | | | | | | | | | |

| 2020 | 1.4 | | 0.7 | | 0.7 | | 1.1 | | 3.9 | | | | | | | | | |

| 2021 | — | | 0.3 | | 0.2 | | 0.2 | | 0.7 | | | | | | | | | |

| 2022 | 0.6 | | 0.3 | | 1.2 | | 1.3 | | 3.4 | | | | | | | | | |

| 2023 | 1.6 | | 1.0 | | 1.5 | | 0.2 | | 4.3 | | | | | | | | | |

| | | | | | | | | | | | | |

| Gross Profit (Loss) (1) | | | | |

| Q1 | Q2 | Q3 | Q4 | FY | | | | | | | | |

| 2019 | (1.8) | | (2.7) | | (3.1) | | (3.6) | | (11.2) | | | | | | | | | |

| 2020 | (2.6) | | (3.2) | | (2.7) | | (3.7) | | (12.2) | | | | | | | | | |

| 2021 | (3.3) | | (2.5) | | (16.5) | | (4.4) | | (26.7) | | | | | | | | | |

| 2022 | (1.9) | | (1.6) | | (2.0) | | (1.7) | | (7.2) | | | | | | | | | |

| 2023 | (2.1) | | (1.8) | | (1.9) | | (2.4) | | (8.2) | | | | | | | | | |

| | | | | | | | | | | | | |

| Operating Expenses (2) | | | | |

| Q1 | Q2 | Q3 | Q4 | FY | | | | | | | | |

| 2019 | 6.6 | | 5.5 | | 6.2 | | 6.8 | | 25.1 | | | | | | | | | |

| 2020 | 6.8 | | 5.1 | | 6.0 | | 6.0 | | 23.9 | | | | | | | | | |

| 2021 | 6.5 | | 6.5 | | 16.0 | | 6.6 | | 35.6 | | | | | | | | | |

| 2022 | 6.2 | | 6.3 | | 7.0 | | 7.6 | | 27.1 | | | | | | | | | |

| 2023 | 7.7 | | 7.4 | | 7.5 | | 5.6 | | 28.2 | | | | | | | | | |

| | | | | | | | | | | | | |

| Operating Profit (Loss) (1)(2) | | | | |

| Q1 | Q2 | Q3 | Q4 | FY | | | | | | | | |

| 2019 | (8.4) | | (8.2) | | (9.3) | | (10.4) | | (36.3) | | | | | | | | | |

| 2020 | (9.4) | | (8.3) | | (8.7) | | (9.7) | | (36.1) | | | | | | | | | |

| 2021 | (9.8) | | (9.0) | | (32.5) | | (11.0) | | (62.3) | | | | | | | | | |

| 2022 | (8.1) | | (7.9) | | (9.0) | | (9.3) | | (34.3) | | | | | | | | | |

| 2023 | (9.8) | | (9.2) | | (9.4) | | (8.0) | | (36.4) | | | | | | | | | |

| | | | | | | | | | | | | |

| (1) | During the third and fourth quarters of 2021, Nuvera reduced its inventory to its estimated net realizable value by $14.8 million and $1.3 million, respectively. |

| (2) | During the third quarter of 2021, Nuvera recognized a $10.0 million impairment charge of property, plant and equipment. |

| | | | | | | | | | | | | |

v3.24.0.1

Cover Page Document

|

Feb. 27, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 27, 2024

|

| Entity Registrant Name |

HYSTER-YALE MATERIALS HANDLING, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

000-54799

|

| Entity Tax Identification Number |

31-1637659

|

| Entity Address, Address Line One |

5875 Landerbrook Drive, Suite 300

|

| Entity Address, City or Town |

Cleveland

|

| Entity Address, State or Province |

OH

|

| City Area Code |

(440)

|

| Local Phone Number |

449-9600

|

| Entity Address, Postal Zip Code |

44124-4069

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class A Common Stock, $0.01 par value per share

|

| Trading Symbol |

HY

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001173514

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

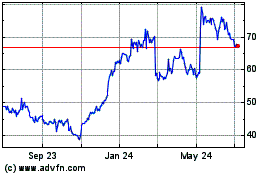

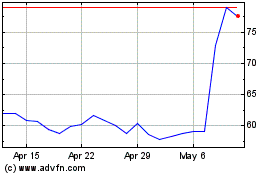

Hyster Yale Materials Ha... (NYSE:HY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Hyster Yale Materials Ha... (NYSE:HY)

Historical Stock Chart

From Apr 2023 to Apr 2024