GUESS INC0000912463false1/5/2024Delaware00009124632024-01-052024-01-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 5, 2024

GUESS?, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 1-11893 | 95-3679695 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

Strada Regina 44, Bioggio, Switzerland CH-6934

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: +41 91 809 5000

Not applicable

(Former name or former address, if changed since last report)

| | | | | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| | | | |

| Title of each class | | Trading symbol(s) | | Name of each exchange on which registered |

| | | | | |

| Common Stock, par value $0.01 per share | | GES | | New York Stock Exchange |

| | | | |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). |

| | | | | | | | |

| Emerging growth company | ☐ | |

| | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o |

Item 1.01. Entry into a Material Definitive Agreement.

On January 5, 2024, Guess?, Inc. (the “Company”) and certain of its subsidiaries amended (such amendment, “Amendment No. 2”) their amended and restated senior secured asset-based revolving credit facility with Bank of America, N.A., as agent and a lender and the other lenders party thereto to permit, among other things, the exchange and subscription offering and certain transactions related thereto referred to in Item 8.01 below.

The foregoing description of Amendment No. 2 does not purport to be complete and is qualified in its entirety by reference to Amendment No. 2, filed as Exhibit 10.1 hereto, and which is incorporated herein by reference.

Item 8.01. Other Events.

On January 5, 2024, the Company issued a press release relating to an exchange, whereby the Company agreed with a limited number of holders of its 2.00% convertible senior notes due 2024 (the “2024 Convertible Notes”) (pursuant to exemptions from registration under the Securities Act of 1933, as amended (the “Securities Act”)), to exchange approximately $67.1 million aggregate principal amount of such holders’ 2024 Convertible Notes for approximately $64.8 million aggregate principal amount of additional 3.75% convertible senior notes due 2028 (the “2028 Convertible Notes”). In connection with the exchange, the Company also engaged in share repurchase transactions, whereby the Company agreed to repurchase 915,467 of its outstanding shares of common stock, $0.01 par value per share, for cash, at a price per share of $23.05. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference into this Item 8.01.

The material terms of the 2028 Convertible Notes are described in the Notes to Condensed Consolidated Financial Statements of the Company’s Form 10-Q filed on December 1, 2023, incorporated by reference herein.

Neither this Current Report on Form 8-K nor the press release constitutes an offer to sell, or the solicitation of an offer to buy, the 2028 Convertible Notes or the Company’s common stock, if any, issuable upon conversion of the 2028 Convertible Notes.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | Description |

| | Amendment Number Two to Amended & Restated Loan, Guaranty and Security Agreement, dated as of December 20, 2022, by and among Guess?, Inc., Guess? Retail, Inc., Guess.com, Inc., Guess? Canada Corporation, the guarantors party thereto, Bank of America, N.A., as agent for the lenders, and each of the lenders party thereto. |

| | |

| | |

| | |

| 104 | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, Guess?, Inc. has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

Dated: | January 8, 2024 | GUESS?, INC. |

| | |

| | By: | /s/ Markus Neubrand |

| | | Markus Neubrand Chief Financial Officer

|

Exhibit 10.1

AMENDMENT NUMBER TWO TO

AMENDED AND RESTATED LOAN, GUARANTY AND SECURITY AGREEMENT

This AMENDMENT NUMBER TWO TO AMENDED AND RESTATED LOAN, GUARANTY AND SECURITY AGREEMENT (this “Amendment”), dated as of January 5, 2024, is entered into by and among GUESS ?, INC., a Delaware corporation (“Parent”), GUESS? RETAIL, INC., a Delaware corporation (“Retail”), GUESS.COM, INC., a Delaware corporation (“Com”; and together with Parent, and Retail, each a “U.S. Borrower” and collectively, the “U.S. Borrowers”), GUESS? CANADA CORPORATION, a company amalgamated under the laws of the province of Nova Scotia, Canada (“Canadian Borrower”; and together with U.S. Borrowers, each a “Borrower” and collectively, the “Borrowers”), Parent and certain Subsidiaries of Parent party to the Loan Agreement as guarantor (each, a “Guarantor” and collectively, the “Guarantors”), the financial institutions party thereto from time to time as lenders (the “Lenders”), and BANK OF AMERICA, N.A., a national banking association, as agent for the Lenders and solely with respect to the loan servicing requirements of the Canadian Borrowers, Bank of America-Canada Branch (the “Agent”).

RECITALS

A. WHEREAS, Borrowers, Guarantors, Agent, and Lenders are parties to that certain Amended and Restated Loan, Guaranty and Security Agreement, dated as of December 20, 2022 (as amended and in effect on the date hereof prior to giving effect to this Amendment, the “Existing Loan Agreement”, and as such agreement may be amended, restated amended and restated, supplemented, extended or otherwise modified in writing from time to time, including by this Amendment, the “Loan Agreement”); and

B. WHEREAS, Borrowers have requested and Agent and Lenders agreed to amend the Loan Agreement in certain respects, pursuant to the terms and subject to the conditions, as set forth in this Amendment.

AGREEMENT

NOW, THEREFORE, in consideration of the foregoing and the mutual covenants herein contained, and for good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereby agree as follows:

ARTICLE I

DEFINITIONS; RECITALS

Section 1.01. Definitions. Initially capitalized terms used but not defined in this Amendment have the respective meanings set forth in the Loan Agreement, as amended hereby.

Section 1.02.Recitals. The Recitals above are incorporated herein as though set forth in full and the Obligors stipulate to the accuracy of each of the Recitals.

ARTICLE II

AMENDMENTS TO LOAN AGREEMENT

Section 2.01.New Definitions. The following new definitions are hereby added to Section 1.1 of the Existing Loan Agreement in alphabetical order to read in their entirety as follows:

Second A&R Amendment: that certain Amendment Number Two to Amended and Restated Loan, Guaranty and Security Agreement dated as of the Second A&R Amendment Effective Date by and among Borrowers, Guarantors, Agent and Lenders.

Second A&R Amendment Effective Date: January 5, 2024.

Section 2.02.Amendment to the Definition “Permitted Asset Disposition” in Section 1.1 of the Existing Loan Agreement. The definition “Permitted Asset Disposition” in Section 1.1 of the Existing Loan Agreement is hereby amended by amending and restating clause (r) thereof in its entirety to read as follows:

(r) the unwinding of any Hedging Agreements in connection with the Permitted Convertible Note Debt including those entered into by Parent on or about the Second Amendment Effective Date or around the First A&R Amendment Effective Date or the Second A&R Amendment Effective Date and any Hedging Agreements entered into by Parent in connection with any permitted refinancing of any Permitted Convertible Note Debt, in each case, in accordance with their terms in connection with the payment repurchase or conversion of the Permitted Convertible Notes;

Section 2.03.Amendment to the Definition “Permitted Convertible Note Debt (2023)” in Section 1.1 of the Existing Loan Agreement. The definition “Permitted Convertible Note Debt (2023)” in Section 1.1. of the Existing Loan Agreement is hereby amended by amending and restating the definition in its entirety to read as follows:

Permitted Convertible Note Debt (2023): the Debt and other obligations incurred by Parent around the First A&R Amendment Effective Date and the Second A&R Amendment Effective Date pursuant to the Permitted Convertible Note Documents (2023) which include (i) the Permitted Convertible Notes (2023) and (ii) any Debt and other obligations under the Hedging Agreements and other agreements, in each case, entered into in connection with the Permitted Convertible Note Debt (2023) and Permitted Convertible Note Documents (2023), and any renewals, extensions or refinancings thereof, as long as each Refinancing Condition is satisfied.

Section 2.04Amendment to the Definition “Permitted Convertible Notes (2023)” in Section 1.1 of the Existing Loan Agreement. The definition “Permitted Convertible Notes (2023)” in Section 1.1. of the Existing Loan Agreement is hereby amended by amending and restating the definition in its entirety to read as follows:

Permitted Convertible Notes (2023): convertible notes in an aggregate principal amount up to but not exceeding $350,000,000 issued around the First A&R Amendment Effective Date and the Second A&R Amendment Effective Date pursuant to the Permitted

Convertible Note Documents (2023), in each case, as amended, replaced, supplemented, extended, refinanced or otherwise modified from time to time so long as, in the case of any renewal, extension or refinancing, each Refinancing Condition is satisfied.

Section 2.05. Amendment to Clause (e) in Section 10.2.4 of the Existing Loan Agreement. Clause (e) in Section 10.2.4 of the Existing Loan Agreement is hereby amended and restated in its entirety to read as follows:

(e) Permitted Share Repurchases and, for the avoidance of doubt, (A) payments on or about the Second Amendment Effective Date pursuant to the Hedging Agreements entered into in connection with the Permitted Convertible Note Debt (2019), (B) payments around the First A&R Amendment Effective Date and the Second A&R Amendment Effective Date pursuant to the Hedging Agreements entered into in connection with the Permitted Convertible Note Debt (2023), (C) payments pursuant to any Hedging Agreements entered into by Parent in connection with any permitted refinancing of the applicable Permitted Convertible Note Debt, and (D) the settlement of any related Hedging Agreement entered into in connection with the applicable Permitted Convertible Note Debt or any permitted refinancing thereof under which Parent may be obligated to deliver common Equity Interests of the Parent, including (i) by delivery of common Equity Interests of the Parent or (ii) by (x) payment of a net amount in cash in respect of any early termination or maturity of any Hedging Agreement entered into in connection with the applicable Permitted Convertible Note Debt or (y) delivery of common Equity Interests of the Parent or payment of a net amount in cash upon an early termination or maturity of any such Hedging Agreement;

For the avoidance of doubt, Section 10.2.4 shall otherwise remain in full force and effect.

Section 2.06. Amendment to Clause (b) in Section 10.2.8 of the Existing Loan Agreement. Clause (b) in Section 10.2.8 of the Existing Loan Agreement is hereby amended by (x) deleting the word “and” appearing prior to clause (viii), (y) adding a new word “and” at the end of clause (viii) and (z) adding a new clause (ix) at the end thereof as follows:

(ix) on or around the Second A&R Amendment Effective Date, exchanges of Permitted Convertible Notes (2019) for an approximately equal principal amount of Permitted Convertible Notes (2023) and repurchases or repayments of such Permitted Convertible Notes (2019) with the proceeds of such Permitted Convertible Notes (2023) and payment of interest and fees on the Permitted Convertible Notes (2019) that are being exchanged, repurchased or repaid; provided that immediately before and after such exchanges, repurchases or repayments (i) no Default or Event of Default exists and (ii) Availability is in an amount equal to or greater than 17.5% of the aggregate Borrowing Base (calculated based on the most recently delivered Borrowing Base Report) on average during the thirty (30) days immediately before giving effect thereto and immediately after giving pro forma effect thereto and Parent shall have delivered a certificate to Agent certifying the satisfaction of clauses (i) and (ii) above.

ARTICLE III

CONDITIONS TO EFFECTIVENESS; MISCELLANEOUS

Section 3.01.Conditions to Effectiveness. The parties hereto agree that the amendments set forth herein shall not be effective until the satisfaction of each of the following conditions precedent:

(a)Executed Amendment. The Agent shall have received a fully executed copy of this Amendment signed by the Borrowers, Guarantors, Agent and Lenders.

Section 3.02.Miscellaneous.

(a)Survival of Representations and Warranties. All representations and warranties made in the Loan Agreement or any other document or documents relating thereto, including, without limitation, any Loan Document furnished in connection with this Amendment, shall survive the execution and delivery of this Amendment and the other Loan Documents, and no investigation by Agent or the Lenders shall affect the representations and warranties or the right of the Lenders or Agent to rely thereon.

(b)Reference to Loan Agreement. The Loan Agreement, each of the Loan Documents, and any and all other agreements, documents or instruments now or hereafter executed and delivered pursuant to the terms hereof, or pursuant to the terms of the Loan Agreement as amended hereby, are hereby amended so that any reference therein to the Loan Agreement shall mean a reference to the Loan Agreement as amended hereby.

(c)Loan Agreement Remains in Effect. The Loan Agreement and the Loan Documents, as amended hereby, remain in full force and effect and each Borrower and each Guarantor ratifies and confirms its agreements and covenants contained therein. Each Borrower and each Guarantor hereby confirms that to the best of its knowledge no Event of Default or Default exists.

(d)Severability. Any provision of this Amendment held by a court of competent jurisdiction to be invalid or unenforceable shall not impair or invalidate the

remainder of this Amendment and the effect thereof shall be confined to the provision so held to be invalid or unenforceable.

(e)Counterparts; Facsimile. This Amendment may be executed in one or more counterparts, each of which when so executed shall be deemed to be an original, but all of which when taken together shall constitute one and the same instrument. Delivery of an executed counterpart to this Amendment by facsimile or other electronic means (including in “.pdf” or “.tif” format) shall be effective as an original.

(f)Headings. The headings, captions and arrangements used in this Amendment are for convenience only and shall not affect the interpretation of this Amendment.

(g)NO ORAL AGREEMENTS. THIS AMENDMENT, TOGETHER WITH THE OTHER LOAN DOCUMENTS AS WRITTEN, REPRESENTS THE FINAL AGREEMENT BETWEEN LENDERS, AGENT, BORROWERS AND GUARANTORS AND MAY NOT BE CONTRADICTED BY EVIDENCE OF PRIOR, CONTEMPORANEOUS OR SUBSEQUENT ORAL AGREEMENTS OF THE PARTIES. THERE ARE NO UNWRITTEN ORAL AGREEMENTS BETWEEN AGENT, LENDERS, BORROWERS AND GUARANTORS.

(h)GOVERNING LAW. THIS AMENDMENT SHALL BE GOVERNED BY THE LAWS OF THE STATE OF NEW YORK, WITHOUT GIVING EFFECT TO ANY CONFLICT OF LAW PRINCIPLES (BUT GIVING EFFECT TO FEDERAL LAWS RELATING TO NATIONAL BANKS); PROVIDED, HOWEVER, THAT IF THE LAWS OF ANY JURISDICTION OTHER THAN NEW YORK SHALL GOVERN IN REGARD TO THE VALIDITY, PERFECTION OR EFFECT OF PERFECTION OF ANY LIEN OR IN REGARD TO PROCEDURAL MATTERS AFFECTING ENFORCEMENT OF ANY LIENS IN COLLATERAL, SUCH LAWS OF SUCH OTHER JURISDICTIONS SHALL CONTINUE TO APPLY TO THAT EXTENT.

[Signature Pages to Follow]

IN WITNESS WHEREOF, the parties hereto have caused this Amendment to be duly executed by its authorized officers as of the day and year first above written.

OBLIGORS:

GUESS ?, INC.,

a Delaware corporation,

as a U.S. Borrower and a U.S. Guarantor

By: /s/ Carlos Alberini

Name: Carlos Alberini

Title: Chief Executive Officer

GUESS? RETAIL, INC.,

a Delaware corporation,

as a U.S. Borrower and a U.S. Guarantor

By: /s/ Carlos Alberini

Name: Carlos Alberini

Title: Chief Executive Officer

GUESS.COM, INC.,

a Delaware corporation,

as a U.S. Borrower and a U.S. Guarantor

By: /s/ Carlos Alberini

Name: Carlos Alberini

Title: Chief Executive Officer

GUESS? CANADA CORPORATION,

a company amalgamated under the laws of the province of Nova Scotia, Canada, as Canadian Borrower

By: /s/ Carlos Alberini

Name: Carlos Alberini

Title: Chief Executive Officer

GUESS? VALUE LLC,

a Virginia limited liability company,

as a U.S. Guarantor

By: /s/ Carlos Alberini

Name: Carlos Alberini

Title: Chief Executive Officer

AMENDMENT NUMBER TWO TO

AMENDED AND RESTATED LOAN, GUARANTY AND SECURITY AGREEMENT

(GUESS?)

SIGNATURE PAGE

AGENT AND LENDERS:

BANK OF AMERICA, N.A.,

as Agent, a U.S. Lender and an Issuing Bank

By: /s/ Bryn MacGillivray

Name: Bryn MacGillivray

Title: VP

AMENDMENT NUMBER TWO TO

AMENDED AND RESTATED LOAN, GUARANTY AND SECURITY AGREEMENT

(GUESS?)

SIGNATURE PAGE

BANK OF AMERICA, N.A.

(acting through its Canada branch),

as a Canadian Lender and an Issuing Bank

By: /s/ Sylwia Durkiewicz

Name: Sylwia Durkiewicz

Title: Vice President

AMENDMENT NUMBER TWO TO

AMENDED AND RESTATED LOAN, GUARANTY AND SECURITY AGREEMENT

(GUESS?)

SIGNATURE PAGE

BMO BANK N.A.,

successor in interest to Bank of The West,

as a U.S. Lender

By: /s/ Angela Ranudo

Name: Angela Ranudo

Title: Director

BMO BANK N.A.,

successor in interest to Bank of The West,

as a Canadian Lender

By: /s/ Angela Ranudo

Name: Angela Ranudo

Title: Director

AMENDMENT NUMBER TWO TO

AMENDED AND RESTATED LOAN, GUARANTY AND SECURITY AGREEMENT

(GUESS?)

SIGNATURE PAGE

HSBC BANK USA, NATIONAL

ASSOCIATION,

as a U.S. Lender

By: /s/ Steven A Alves

Name: Steven A Alves

Title: Senior Vice President

HSBC BANK USA, NATIONAL

ASSOCIATION,

as a Canadian Lender

By: /s/ Steven A Alves

Name: Steven A Alves

Title: Senior Vice President

AMENDMENT NUMBER TWO TO

AMENDED AND RESTATED LOAN, GUARANTY AND SECURITY AGREEMENT

(GUESS?)

SIGNATURE PAGE

Exhibit 99.1

GUESS?, INC. ANNOUNCES ISSUANCE OF APPROXIMATELY $64.8 MILLION OF ADDITIONAL 3.75% CONVERTIBLE NOTES DUE 2028 AND RETIREMENT OF APPROXIMATELY $67.1 MILLION OF EXISTING 2.00% CONVERTIBLE NOTES DUE 2024

| | | | | | | | |

| Ø | The additional convertible senior notes due 2028 issued in exchange for our existing convertible senior notes due 2024 will augment the exchange and subscription transactions completed by Guess in April 2023 |

| Ø | Guess has entered into bond hedge and warrant transactions with a warrant strike price of $41.37 per share, which are generally intended to limit potential dilution from the private placement transaction |

| Ø | Guess intends to retire approximately $67.1 million of the existing convertible senior notes due in 2024 pursuant to the exchange, and to use cash on hand, together with proceeds from the termination and unwinding of the related convertible note hedge and warrant transactions entered into in connection with the issuance of the existing convertible senior notes due 2024, to repurchase 915,467 shares of its common stock for approximately $21.1 million and to enter into the bond hedge and warrant transactions |

LOS ANGELES – January 5, 2024 – Guess?, Inc. (NYSE: GES) (the “Company”) announced today that it has entered into separate, privately negotiated exchange and subscription agreements (the “Exchange and Subscription Agreements”) with a limited number of holders of its 2.00% convertible senior notes due 2024 (the “2024 Notes”), pursuant to exemptions from registration under the Securities Act of 1933, as amended (the “Securities Act”). Pursuant to the Exchange and Subscription Agreements, the Company will exchange approximately $67.1 million in aggregate principal amount of the 2024 Notes for approximately $64.8 million in aggregate principal amount of additional 3.75% convertible senior notes due 2028 (the “2028 Notes”) (collectively, the “Transactions”). The Transactions are expected to settle on or about January 10, 2024, subject to customary closing conditions.

The 2028 Notes will have the same terms as, and constitute a single series with, the $275.0 million aggregate principal amount of 3.75% Convertible Senior Notes due 2028 (the “Existing 2028 Notes”) that the Company originally issued on April 17, 2023. The 2028 Notes will have the same CUSIP number as the Existing 2028 Notes and will be issued as additional notes under the indenture governing the Existing 2028 Notes. The 2028 Notes are expected to trade interchangeably with the Existing 2028 Notes immediately upon settlement and be fungible with the Existing 2028 Notes. As a result, upon completion of the Transactions, the aggregate principal amount of the 2024 Notes outstanding will be approximately $48.1 million, and the aggregate principal amount of the 2028 Notes outstanding will be approximately $339.8 million.

The 2028 Notes will be convertible in certain circumstances into cash, shares of the Company’s common stock or a combination of cash and shares of common stock, at the Company’s election. If and when issued, the 2028 Notes will be unsecured senior obligations of the Company. The conversion rate of the 2028 Notes is approximately 40.9077 shares per $1,000 principal amount of the 2028 Notes, which is equivalent to an initial conversion price of approximately $24.45 per share of common stock, and is subject to adjustment upon the occurrence of certain events. The 2028 Notes will be convertible only upon the occurrence of certain events and during certain periods. The 2028 Notes will bear interest at a rate of 3.75% per year, payable semi-annually in arrears on April 15 and October 15 of each year, beginning on April 15, 2024. The 2028 Notes will mature on April 15, 2028, unless earlier repurchased or converted in accordance with their terms.

Concurrently with the pricing of the 2028 Notes, the Company agreed to repurchase 915,467 shares of its common stock for approximately $21.1 million from holders who are exchanging their 2024 Notes for 2028 Notes and the Remaining 2024 Hedge Counterparty described below in privately negotiated transactions (the “Share Repurchase Transactions”) for settlement concurrently with the closing of the Transactions, pursuant to the Company’s existing share repurchase program, as augmented to permit the Share Repurchase Transactions. The purchase price per share of the common stock to be repurchased in such transactions will equal the closing sale price of the Company’s common stock on January 5, 2024, which was $23.05 per share.

The Company expects to use cash on hand together with the proceeds from the termination and unwinding of the related convertible note hedge and warrant transactions that the Company entered into in connection with the issuance of the 2024 Notes (as described below) to pay the cost of the convertible note hedge transactions described below (after such cost is partially offset by the proceeds from the sale of warrants pursuant to the warrant transactions described below). These transactions are generally intended to reduce dilution on the 2028 Notes. The warrant strike price is initially $41.37, consistent with the note hedge and warrant transactions entered into in connection with the Existing 2028 Notes.

Certain Concurrent Transactions

In connection with the pricing of the 2028 Notes, the Company entered into convertible note hedge and warrant transactions with a financial institution (the “hedge counterparty”). The convertible note hedge transactions covered the number of shares of common stock that initially underlies the 2028 Notes, subject to anti-dilution adjustments substantially similar to those applicable to the Existing 2028 Notes, and are expected to generally reduce the potential dilution with respect to the Company’s common stock upon conversion of the 2028 Notes and/or to offset any cash payments the Company is required to make in excess of the principal amount of converted 2028 Notes, as the case may be. The warrants relate to the same number of shares of common stock as underlies the 2028 Notes, subject to customary anti-dilution adjustments. The strike price of the warrant transactions will initially be $41.37 per share, and is subject to certain adjustments under the terms of the warrant transactions. The warrant transactions separately could have a dilutive effect with respect to the Company’s common stock to the extent that the market price per share of the common stock exceeds the strike price of the warrants.

The Company has been advised that, in connection with establishing their initial hedge positions with respect to the convertible note hedge and warrant transactions, the hedge counterparty or its respective affiliates expect to purchase shares of the common stock and/or enter into various derivative transactions with respect to the Company’s common stock concurrently with, or shortly after, the pricing of the 2028 Notes. These activities could result in an increase, or prevent a decrease in, the market price of the common stock or the 2028 Notes.

In addition, the hedge counterparty or its respective affiliates may modify their hedge positions by entering into or unwinding various derivatives with respect to the Company’s common stock and/or purchasing or selling common stock or other securities of the Company in secondary market transactions following the pricing of the 2028 Notes and prior to the maturity of the 2028 Notes (and are likely to do so during any observation period related to a conversion of 2028 Notes). This activity could also cause or avoid an increase or a decrease in the market price of the Company’s common stock or the 2028 Notes, which could affect the ability of holders to convert the 2028 Notes, and, to the extent the activity occurs during any observation period related to a conversion of 2028 Notes, could affect the number of shares and value of the consideration that holders receive upon conversion of the 2028 Notes.

In connection with the Transactions, the Company expects that the holders of 2024 Notes that participate in the Transactions will seek to sell the Company’s common stock and/or enter into various derivative positions with respect to the Company’s common stock to establish hedge positions with respect to the 2028 Notes. This activity could decrease (or reduce the size of any increase in) the market price of the Company’s common stock, the 2024 Notes or the 2028 Notes at that time. Additionally, the Share Repurchase Transactions could increase (or reduce the size of any decrease in), the market price of the Company’s common stock, the 2024 Notes or the 2028 Notes at that time.

In connection with issuing the 2024 Notes, the Company entered into convertible note hedge and warrant transactions (the “2024 Call Spread Transactions”) with a financial institution, a portion of which 2024 Call Spread Transactions were terminated in April 2023 such that there remains only one hedge counterparty in respect of the 2024 Notes (the “Remaining 2024 Hedge Counterparty”). As part of the Transactions, the Company anticipates entering into agreements with the Remaining 2024 Hedge Counterparty to terminate a portion of the 2024 Call Spread Transactions in a notional amount corresponding to the amount of 2024 Convertible Notes that will be exchanged. In connection with the terminations described in the foregoing sentence, the Company would expect the Remaining 2024 Hedge Counterparty or its affiliates to unwind a portion of its related hedge positions by selling common stock concurrently with the pricing of the 2028 Notes. Such hedge unwind activity could decrease (or reduce the size of any increase in) the market price of the Company’s common stock, the 2024 Notes or the 2028 Notes at that time. There can be no assurance the termination of such 2024 Call Spread Transactions will be completed.

In connection with the Transactions, the Company and certain of its subsidiaries also amended their amended and restated senior secured asset-based revolving credit facility with Bank of America, N.A., as agent and a lender and the other lenders party thereto to permit, among other things, the exchange and subscription offering and certain transactions related thereto.

Other Matters

The offer and sale of the 2028 Notes and the issuance of shares of common stock, if any, issuable upon conversion of the 2028 Notes have not been and will not be registered under the Securities Act or the securities laws of any other jurisdiction, and the 2028 Notes and such shares may not be offered or sold in the United States absent registration or an applicable exemption from such registration requirements.

This press release does not and shall not constitute an offer to sell nor the solicitation of an offer to buy any securities of the Company, nor shall there be any sale of any such securities in any state or jurisdiction in which such an offer, solicitation or sale would be unlawful.

Notice Regarding Forward-Looking Statements

This press release includes certain forward-looking statements related to the Company within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements, which are frequently indicated by terms such as “expect,” “continue,” “remain,” “look,” “path” and similar terms, are only expectations, and involve known and unknown risks and uncertainties, which may cause actual results in future periods to differ materially from what is currently anticipated. All statements, other than statements of historical facts, including all statements regarding the Transactions, the anticipated closing of the Transactions, the anticipated sources and use of proceeds, the Share Repurchase Transactions and the effects of entering into the convertible note hedge and warrant transactions are forward-looking statements. These statements are based on management’s current estimates, assumptions, expectations or beliefs and are subject to uncertainty and changes in circumstances. These forward-looking statements are estimates reflecting the judgment of the Company’s senior management, and actual results may vary materially from those expressed or implied by the forward-looking statements herein.

The statements in this press release are made as of the date of this press release. The Company undertakes no obligation to update information contained in this press release, except as may be required by law. The Company undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by law. For further information regarding risks and uncertainties associated with the Company’s businesses, please refer to the section entitled “Risk Factors” in the Company’s Securities and Exchange Commission (the “SEC”) filings, including, but not limited to, its most recent Annual Report on Form 10-K and its most recent Quarterly Reports on Form 10-Q, copies of which are on file with the SEC and available on the SEC’s website at www.sec.gov.

About Guess?, Inc.

Guess?, Inc. designs, markets, distributes and licenses a lifestyle collection of contemporary apparel, denim, handbags, watches, eyewear, footwear and other related consumer products. Guess? products are distributed through branded Guess? stores as well as better department and specialty stores around the world. As of October 28, 2023, the Company directly operated 1,015 retail stores in Europe, the Americas and Asia. The Company’s partners operated 544 additional retail stores worldwide. As of October 28, 2023, the Company and its partners and distributors operated in approximately 100 countries worldwide.

Contact Information:

Guess?, Inc.

Fabrice Benarouche

Senior Vice President of Finance and Investor Relations and

Chief Accounting Officer

(213) 765-5578

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLine items represent financial concepts included in a table. These concepts are used to disclose reportable information associated with domain members defined in one or many axes to the table.

| Name: |

dei_EntityAddressesLineItems |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

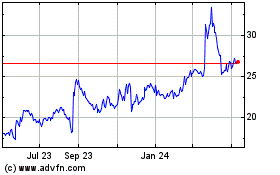

Guess (NYSE:GES)

Historical Stock Chart

From Mar 2024 to Apr 2024

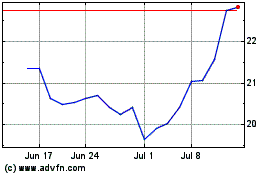

Guess (NYSE:GES)

Historical Stock Chart

From Apr 2023 to Apr 2024