UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| |

☒ |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2023

or

| |

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period to

Commission File Number 814-00098

EQUUS TOTAL RETURN, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

76-0345915 |

|

(State or other jurisdiction of

incorporation or organization) |

(I.R.S. Employer

Identification No.) |

| |

|

|

700 Louisiana St., 48th Floor

Houston, Texas |

77002 |

| (Address of principal executive offices) |

(Zip Code) |

(Former Name, Former Address and Former Fiscal

Year, if Changed Since Last Report)

Registrant’s telephone number, including area

code: (713) 529-0900

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

Name of each exchange

on which registered |

| Common Stock |

New York Stock Exchange |

☐

Indicate by check mark whether the registrant (1) has filed all reports

required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter

period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No

☐

Indicate by check mark whether the registrant has submitted electronically every

Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding

12 months (or for such shorter period that the registrant was required to submit such files). Yes ☐

No ☐

☐

Indicate by check mark whether the registrant is a large accelerated filer,

an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule

12b-2 of the Exchange Act.

| Large accelerated filer ☐ |

Accelerated filer ☐ |

Non-accelerated filer ☒ |

Smaller Reporting Company ☐ |

Emerging Growth Company ☐ |

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Indicate by check mark whether the registrant is a shell company. Yes

☐ No

☒

There were 13,518,146 shares

of the registrant’s common stock, $.001 par value, outstanding, as of June 30, 2023.

EQUUS TOTAL RETURN, INC.

(A Delaware Corporation)

INDEX

EQUUS TOTAL RETURN, INC.

CONDENSED BALANCE SHEETS

(Unaudited)

Part I. Financial Information

Item 1. Unaudited Condensed Financial Statements

| | |

June 30, 2023 | |

December 31,

2022 |

| | |

| |

|

| (in thousands, except shares and per share amounts) | |

| |

|

| Assets | |

| |

|

| Investments in portfolio securities at fair value: | |

| |

|

| Control investments (cost at $8,861 and $8,111, respectively) | |

$ | 23,200 | | |

$ | 15,650 | |

| Total investments in portfolio securities at fair value | |

| 23,200 | | |

| 15,650 | |

| Temporary cash investments | |

| 12,989 | | |

| 5,998 | |

| Cash and cash equivalents | |

| 16,407 | | |

| 19,224 | |

| Restricted cash | |

| 130 | | |

| 60 | |

| Accounts receivable from affiliates | |

| 328 | | |

| 350 | |

| Accrued interest | |

| 8 | | |

| — | |

| Other assets | |

| 35 | | |

| 382 | |

| Total assets | |

| 53,097 | | |

| 41,664 | |

| Liabilities and net assets | |

| | | |

| | |

| Accounts payable | |

| 53 | | |

| 107 | |

| Accrued compensation | |

| 3 | | |

| 321 | |

| Accounts payable to related parties | |

| 1 | | |

| 1 | |

| Borrowing under margin account | |

| 12,989 | | |

| 5,998 | |

| Total liabilities | |

| 13,046 | | |

| 6,427 | |

| | |

| | | |

| | |

| Commitments and contingencies (See Note 2) | |

| | | |

| | |

| | |

| | | |

| | |

| Net assets | |

| | | |

| | |

| Common stock, $.001 par value per share; 100,000,000 shares authorized and 13,518,000 shares issued and outstanding as of June 30, 2023 and December 31, 2022, respectively | |

| | | |

| | |

| | |

| | | |

| | |

| Preferred stock, $.001 par value per share; 10,000,000 shares authorized as of June 30, 2023 and December 31, 2022 respectively | |

| | | |

| | |

| Common stock, par value | |

$ | 13 | | |

$ | 13 | |

| Capital in excess of par value | |

| 74,685 | | |

| 74,685 | |

| Accumulated deficit | |

| (34,647 | ) | |

| (39,461 | ) |

| Total net assets | |

$ | 40,051 | | |

$ | 35,237 | |

| Net asset value per share | |

$ | 2.96 | | |

$ | 2.61 | |

The accompanying notes are an integral part

of these financial statements.

EQUUS TOTAL RETURN, INC.

CONDENSED STATEMENTS OF OPERATIONS

(Unaudited)

| | |

Three Months Ended June 30, | |

Six Months ended June 30, |

| (in thousands, except per share amounts) | |

2023 | |

2022 | |

2023 | |

2022 |

| Investment income: | |

| |

| |

| |

|

| Control investments | |

$ | 8 | | |

$ | — | | |

$ | 8 | | |

$ | — | |

| Total interest and dividend income | |

| 8 | | |

| — | | |

| 8 | | |

| — | |

| Interest from temporary cash investments | |

| 4 | | |

| — | | |

| 10 | | |

| — | |

| Total investment income | |

| 12 | | |

| — | | |

| 18 | | |

| — | |

| | |

| | | |

| | | |

| | | |

| | |

| Expenses: | |

| | | |

| | | |

| | | |

| | |

| Compensation expense | |

| 393 | | |

| 345 | | |

| 810 | | |

| 689 | |

| Professional fees | |

| 126 | | |

| 106 | | |

| 526 | | |

| 456 | |

| Professional liability expenses | |

| 181 | | |

| 177 | | |

| 365 | | |

| 298 | |

| Director fees and expenses | |

| 103 | | |

| 92 | | |

| 183 | | |

| 168 | |

| General and administrative expenses | |

| 35 | | |

| 31 | | |

| 70 | | |

| 61 | |

| Mailing, printing and other expenses | |

| 30 | | |

| 29 | | |

| 52 | | |

| 36 | |

| Taxes | |

| 7 | | |

| — | | |

| 7 | | |

| — | |

| Interest expense | |

| 1 | | |

| — | | |

| 2 | | |

| 2 | |

| Total expenses | |

| 876 | | |

| 780 | | |

| 2,015 | | |

| 1,710 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net investment loss | |

| (864 | ) | |

| (780 | ) | |

| (1,997 | ) | |

| (1,710 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net realized gain: | |

| | | |

| | | |

| | | |

| | |

| Temporary cash investments | |

| 9 | | |

| — | | |

| 11 | | |

| — | |

| Net realized gain | |

| 9 | | |

| — | | |

| 11 | | |

| — | |

| | |

| | | |

| | | |

| | | |

| | |

| Net unrealized appreciation of portfolio securities: | |

| | | |

| | | |

| | | |

| | |

| Control investments | |

| 6,800 | | |

| 500 | | |

| 6,800 | | |

| 2,500 | |

| Net change in net unrealized appreciation of portfolio securities | |

| 6,800 | | |

| 500 | | |

| 6,800 | | |

| 2,500 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net increase (decrease) in net assets resulting from operations | |

$ | 5,945 | | |

$ | (280 | ) | |

$ | 4,814 | | |

$ | 790 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net increase (decrease) in net assets resulting from operations per share: | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted | |

$ | 0.44 | | |

$ | (0.02 | ) | |

$ | 0.36 | | |

$ | 0.06 | |

| Weighted average shares outstanding: | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted | |

| 13,518 | | |

| 13,518 | | |

| 13,518 | | |

| 13,518 | |

The

accompanying notes are an integral part of these financial statements.

EQUUS TOTAL RETURN, INC.

CONDENSED STATEMENTS OF CHANGES IN NET ASSETS

(Unaudited)

| | |

Common Stock | |

| |

|

| (in thousands) | |

Number of Shares | |

Par Value | |

Capital in Excess of Par Value | |

Accumulated Deficit | |

Total Net Assets |

| | |

| |

| |

| |

| |

|

| Balances as of January 1, 2022 | |

| 13,518 | | |

$ | 13 | | |

$ | 74,685 | | |

$ | (38,333 | ) | |

$ | 36,365 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net increase in net assets resulting from operations | |

| — | | |

| — | | |

| — | | |

| 1,070 | | |

| 1,070 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balances as of March 31, 2022 | |

| 13,518 | | |

$ | 13 | | |

$ | 74,685 | | |

$ | (37,263 | ) | |

$ | 37,435 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net decrease in net assets resulting from operations | |

| — | | |

| — | | |

| — | | |

| (280 | ) | |

| (280 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balances as of June 30, 2022 | |

| 13,518 | | |

$ | 13 | | |

$ | 74,685 | | |

$ | (37,543 | ) | |

$ | 37,155 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balances as of January 1, 2023 | |

| 13,518 | | |

$ | 13 | | |

$ | 74,685 | | |

$ | (39,461 | ) | |

$ | 35,237 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net decrease in net assets resulting from operations | |

| — | | |

| — | | |

| — | | |

| (1,131 | ) | |

| (1,131 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balances as of March 31, 2023 | |

| 13,518 | | |

$ | 13 | | |

$ | 74,685 | | |

$ | (40,592 | ) | |

$ | 34,106 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net increase in net assets resulting from operations | |

| — | | |

| — | | |

| — | | |

| 5,945 | | |

| 5,945 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balances as of June 30, 2023 | |

| 13,518 | | |

$ | 13 | | |

$ | 74,685 | | |

$ | (34,647 | ) | |

$ | 40,051 | |

The accompanying notes are an integral part of these

financial statements.

EQUUS TOTAL RETURN, INC.

CONDENSED STATEMENTS OF CASH FLOWS

(Unaudited)

| | |

Six months ended June 30, |

| (in thousands) | |

2023 | |

2022 |

| Reconciliation of increase in net assets resulting from operations to net cash | |

| |

|

| used in operating activities: | |

| |

|

| Net increase in net assets resulting from operations | |

$ | 4,814 | | |

$ | 790 | |

| Adjustments to reconcile net increase in net assets resulting from operations to net cash used in operating activities: | |

| | | |

| | |

| Net realized gain: | |

| | | |

| | |

| Temporary cash investments | |

| (11 | ) | |

| — | |

| Net change in unrealized appreciation of portfolio securities: | |

| | | |

| | |

| Control investments | |

| (6,800 | ) | |

| (2,500 | ) |

| Purchase of portfolio securities | |

| (750 | ) | |

| — | |

| Purchase of temporary cash investments, net | |

| (6,980 | ) | |

| (1,500 | ) |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Accounts receivable from affiliates | |

| 22 | | |

| — | |

| Accrued interest and dividend receivable | |

| (8 | ) | |

| — | |

| Accrued escrow receivable | |

| — | | |

| — | |

| Other assets | |

| 347 | | |

| 299 | |

| Accounts payable and accrued liabilities | |

| (372 | ) | |

| (472 | ) |

| Accounts payable to related parties | |

| 0 | | |

| (12 | ) |

| Net cash used in operating activities | |

| (9,738 | ) | |

| (3,395 | ) |

| Cash flows from financing activities: | |

| | | |

| | |

| Borrowings under margin account | |

| 22,980 | | |

| 7,000 | |

| Repayments under margin account | |

| (15,989 | ) | |

| (5,500 | ) |

| Net cash provided by financing activities | |

| 6,991 | | |

| 1,500 | |

| Net decrease in cash and cash equivalents | |

| (2,747 | ) | |

| (1,895 | ) |

| Cash and cash equivalents and restricted cash at beginning of period | |

| 19,284 | | |

| 23,490 | |

| | |

| | | |

| | |

| Cash and cash equivalents and restricted cash at end of period | |

$ | 16,537 | | |

$ | 21,595 | |

| Supplemental disclosure of cash flow information: | |

| | | |

| | |

| Interest paid | |

$ | 2 | | |

$ | 2 | |

| Income taxes paid | |

$ | 7 | | |

$ | 38 | |

The accompanying notes are an integral part of these

financial statements.

EQUUS TOTAL RETURN, INC.

SUPPLEMENTAL INFORMATION—SELECTED PER SHARE

DATA AND RATIOS

(Unaudited)

| | |

Six months ended June 30, |

| | |

2023 | |

2022 |

| | |

| |

|

| Expenses | |

$ | (0.15 | ) | |

$ | (0.13 | ) |

| | |

| | | |

| | |

| Net investment loss | |

| (0.15 | ) | |

| (0.13 | ) |

| | |

| | | |

| | |

| Net change in unrealized appreciation of portfolio securities | |

| 0.50 | | |

| 0.19 | |

| Net increase in net assets | |

| 0.35 | | |

| 0.06 | |

| Net assets at beginning of period | |

| 2.61 | | |

| 2.69 | |

| Net assets at end of period, basic and diluted | |

$ | 2.96 | | |

$ | 2.75 | |

| Weighted average number of shares outstanding during period, | |

| | | |

| | |

| in thousands | |

| 13,518 | | |

| 13,518 | |

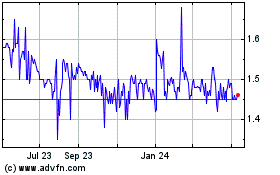

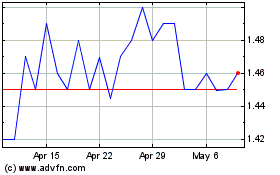

| Market price per share: | |

| | | |

| | |

| Beginning of period | |

$ | 1.43 | | |

$ | 2.38 | |

| End of period | |

$ | 1.52 | | |

$ | 2.61 | |

| Selected information and ratios: | |

| | | |

| | |

| Ratio of expenses to average net assets | |

| (5.35 | %) | |

| 4.65 | % |

| Ratio of net investment loss to average net assets | |

| (5.30 | %) | |

| (4.65 | %) |

| Ratio of net increase in net assets resulting from operations to average net assets | |

| 12.79 | % | |

| 2.15 | % |

| Return on net asset value | |

| (3.45 | %) | |

| 2.23 | % |

| Total return on market price (1) | |

| 6.29 | % | |

| 9.66 | % |

| |

(1) |

Total return = [(ending market price per share - beginning price per share) / beginning market price per share]. |

The accompanying notes are an integral part

of these financial statements.

EQUUS TOTAL RETURN, INC.

SCHEDULE OF INVESTMENTS

JUNE 30, 2023

(Unaudited)

(in thousands, except share data)

| Name and Location of |

| |

Date of Initial | |

| |

| |

Cost of | |

Fair |

| Portfolio Company | |

Industry | |

Investment | |

Investment | |

Principal | |

Investment | |

Value(1) |

| | |

| |

| |

| |

|

| Control Investments: Majority-owned (2): | |

| | | |

| |

| | | |

| | | |

| | |

Equus Energy, LLC (3)

Houston,

TX | |

| Energy | | |

| December 2011 | | |

Member interest (100%) | |

| | | |

$ | 8,111 | | |

$ | 15,650 | |

Morgan E&P, LLC (3)

Houston,

TX | |

| Energy | | |

| April 2023 | | |

Member interest (100%) | |

| | | |

| — | | |

| 6,800 | |

| | |

| | | |

| | | |

12% senior secured promissory note due 5/26 (4) | |

$ | 750 | | |

| 750 | | |

| 750 | |

| | |

| | | |

| | | |

| |

| | | |

| 750 | | |

| 7,550 | |

| Total Control Investments: Majority-owned (represents 64.1% of total investments at fair value) | | |

| 8,861 | | |

| 23,200 | |

| Temporary Cash Investments | |

| | | |

| |

| | | |

| | | |

| | |

| U.S. Treasury Bill | |

| Government | | |

| June 2023 | | |

UST 0% 7/23 | |

| 12,989 | | |

| 12,989 | | |

| 12,989 | |

| Total Temporary Cash Investments (represents 35.9% of total investments at fair value) |

| | | |

| 12,989 | | |

| 12,989 | |

| Total Investments | |

| | | |

| | | |

| |

| | | |

$ | 21,850 | | |

$ | 36,189 | |

(1)See Note 3 to the financial statements, Valuation of Investments.

(2)Majority owned investments are generally defined

under the 1940 Act as companies in which we own more than 50% of the voting securities of such company.

(3)Level 3 Portfolio Investment.

(4)Income producing.

The accompanying notes are an integral part of these

financial statements.

EQUUS TOTAL RETURN, INC.

SCHEDULE OF INVESTMENTS – (Continued)

JUNE 30, 2023

(Unaudited)

Our portfolio securities

are restricted from public sale without prior registration under the Securities Act of 1933 (hereafter, the “Securities Act”).

We typically negotiate certain aspects of the method and timing of the disposition of our investment in each portfolio company, including

registration rights and related costs.

As a business development

company (“BDC”), we may invest up to 30% of our assets in non-qualifying portfolio investments, as permitted by the Investment

Company Act of 1940 (the “1940 Act”). Specifically, we may invest up to 30% of our assets in entities that are not considered

“eligible portfolio companies” (as defined in the 1940 Act), including companies located outside of the United States, entities

that are operating pursuant to certain exceptions under the 1940 Act, and publicly-traded entities with a market capitalization exceeding

$250 million. As of June 30, 2023, we had invested 43.7% of our assets in securities of portfolio companies that constituted qualifying

investments under the 1940 Act. As of June 30, 2023, all of our investments are in enterprises that are considered eligible portfolio

companies under the 1940 Act. We provide significant managerial assistance to our portfolio companies that comprise 100% of the total

value of the investments in portfolio securities as of June 30, 2023.

We are classified as

a “non-diversified” investment company under the 1940 Act, which means we are not limited in the proportion of our assets

that may be invested in the securities of a single user. The value of one segment called “Energy” includes our two remaining

portfolio companies and was 57.9% of our net asset value, 43.7% of our total assets and 100% of our investments in portfolio company securities

(at fair value) as of June 30, 2023. Changes in business or industry trends or in the financial condition, results of operations, or the

market’s assessment of any single portfolio company will affect the net asset value and the market price of our common stock to

a greater extent than would be the case if we were a “diversified” company holding numerous investments.

Our investments in

portfolio securities consist of the following types of securities as of June 30, 2023 (in thousands):

| Type of Securities | |

Cost | |

Fair Value | |

Fair Value as Percentage of Net Assets |

| | |

| |

| |

|

| Limited liability company investments | |

$ | 8,111 | | |

$ | 22,450 | | |

| 56.0 | % |

| Secured and subordinated debt | |

| 750 | | |

| 750 | | |

| 1.9 | % |

| | |

| | | |

| | | |

| | |

| Total | |

$ | 8,861 | | |

$ | 23,200 | | |

| 57.9 | % |

The following is a

summary by industry of the Fund’s investments in portfolio securities as of June 30, 2023

(in thousands):

| Industry | |

Fair Value | |

Fair Value as Percentage of Net Assets |

| | Energy | | |

$ | 23,200 | | |

| 57.9 | % |

| | Total | | |

$ | 23,200 | | |

| 57.9 | % |

The accompanying notes are an integral part of these

financial statements.

EQUUS TOTAL RETURN, INC.

SCHEDULE OF INVESTMENTS

DECEMBER 31, 2022

(Unaudited)

(in thousands, except share data)

| Name and Location of | |

| |

Date of Initial | |

| |

| |

Cost of | |

Fair |

| Portfolio Company | |

Industry | |

Investment | |

Investment | |

Principal | |

Investment | |

Value(1) |

| | |

| |

| |

| |

|

| Control Investments: Majority-owned (2): | |

| |

| |

| |

|

Equus Energy, LLC (3)

Houston, TX | |

| Energy | | |

| December 2011 | | |

Member interest (100%) | |

$ | 8,111 | | |

$ | 8,111 | | |

$ | 15,650 | |

| | |

| | | |

| | | |

| |

| | | |

| | | |

| | |

| Total Control Investments: Majority-owned (represents 61.0% of total investments at fair value) | | | |

| 8,111 | | |

| 15,650 | |

| Temporary Cash Investments | |

| | | |

| | | |

| |

| | | |

| | | |

| | |

| U.S. Treasury Bill | |

| Government | | |

| March 2023 | | |

UST 0% 4/23 | |

| 9,992 | | |

| 9,992 | | |

| 9,992 | |

| Total Temporary Cash Investments (represents 39.0% of total investments

at fair value) | |

| | | |

| 9,992 | | |

| 9,992 | |

| Total Investments | |

| | | |

| | | |

| |

| | | |

$ | 18,103 | | |

$ | 25,642 | |

(1)See Note 3 to the financial statements, Valuation

of Investments.

(2)Majority owned investments are generally defined

under the 1940 Act as companies in which we own more than 50% of the voting securities of the company.

(3)Level 3 Portfolio Investment.

The accompanying notes are an integral part of these

financial statements.

EQUUS TOTAL RETURN, INC.

SCHEDULE OF INVESTMENTS – (Continued)

DECEMBER 31, 2022

(Unaudited)

(in thousands, except share data)

Our

portfolio securities are restricted from public sale without prior registration under the Securities Act of 1933 (hereafter, the “Securities

Act”). We typically negotiate certain aspects of the method and timing of the disposition of our investment in each portfolio company,

including registration rights and related costs.

As

an investment company classified as a business development company (“BDC”) under the Investment Company Act of 1940

(hereafter, the “1940 Act”), we may invest up to 30% of our assets in non-qualifying portfolio investments, as permitted

by the 1940 Act. Specifically, we may invest up to 30% of our assets in entities that are not considered “eligible portfolio

companies” (as defined in the 1940 Act), including companies located outside of the United States, entities that are operating

pursuant to certain exceptions under the 1940 Act, and publicly- traded entities with a market capitalization exceeding $250

million. As of December 31, 2022, we had invested 3 7.6% of our assets in securities of portfolio companies that constituted

qualifying investments under the 1940 Act. As of December 31, 2022, our investments are in enterprises that are considered eligible

portfolio companies under the 1940 Act. We provide significant managerial assistance to a portfolio company that comprises 100% of

the total value of the investments in portfolio securities as of December 31, 2022.

We

are classified as a “non-diversified” investment company under the 1940 Act, which means we are not limited in the proportion

of our assets that may be invested in the securities of a single user. The value of one segment called ‘Energy’ includes one

portfolio company and was 44.4% of our net asset value, 37.6% of our total assets and 100% of our investments in portfolio company securities

(at fair value) as of December 31, 2022. Changes in business or industry trends or in the financial condition, results of operations,

or the market’s assessment of any single portfolio company will affect the net asset value and the market price of our common stock

to a greater extent than would be the case if we were a “diversified” company holding numerous investments.

Our

investments in portfolio securities consist of the

following types of securities as of December 31, 2022 (in thousands):

| Type of Securities | |

Cost | |

Fair Value | |

Fair Value as Percentage of Net Assets |

| | |

| |

| |

|

| Limited liability company investments | |

$ | 8,111 | | |

$ | 15,650 | | |

| 44.4 | % |

| | |

| | | |

| | | |

| | |

| Total | |

$ | 8,111 | | |

$ | 15,650 | | |

| 44.4 | % |

The

following is a summary by industry of the Fund’s investments in portfolio securities

as of December 31, 2022 (in thousands):

| Industry | |

Fair Value | |

Fair Value as Percentage of Net Assets |

| | Energy | | |

$ | 15,650 | | |

| 44.4 | % |

| | Total | | |

$ | 15,650 | | |

| 44.4 | % |

The accompanying notes are an integral part of these

financial statements.

EQUUS TOTAL RETURN, INC.

NOTES TO CONDENSED FINANCIAL STATEMENTS

JUNE 30, 2023

(Unaudited)

(1) Description

of Business and Basis of Presentation

Description of Business—Equus

Total Return, Inc. (“we,” “us,” “our,” “Equus” the “Company” and the “Fund”),

a Delaware corporation, was formed by Equus Investments II, L.P. (the “Partnership”) on August 16, 1991. On July 1, 1992,

the Partnership was reorganized and all of the assets and liabilities of the Partnership were transferred to the Fund in exchange for

shares of common stock of the Fund. Our shares trade on the New York Stock Exchange (“NYSE”) under the symbol ‘EQS’.

On August 11, 2006, our shareholders approved the change of the Fund’s investment strategy to a total return investment objective.

This strategy seeks to provide the highest total return, consisting of capital appreciation and current income. In connection with this

strategic investment change, the shareholders also approved the change of name from Equus II Incorporated to Equus Total Return, Inc.

As of June 30, 2023, we had 100,000,000 shares of common stock and 10,000,000 shares of preferred stock authorized for issuance, of which

13,518,146 shares of common stock and no shares of preferred stock were outstanding.

We attempt to maximize

the return to stockholders in the form of current investment income and long-term capital gains by investing in the debt and equity securities

of companies with a total enterprise value between $5.0 million and $75.0 million, although we may engage in transactions with smaller

or larger investee companies from time to time. We seek to invest primarily in companies pursuing growth either through acquisition or

organically, leveraged buyouts, management buyouts and recapitalizations of existing businesses or special situations. Our income-producing

investments consist principally of debt securities including subordinated debt, debt convertible into common or preferred stock, or debt

combined with warrants and common and preferred stock. Debt and preferred equity financing may also be used to create long-term capital

appreciation through the exercise and sale of warrants received in connection with the financing. We seek to achieve capital appreciation

by making investments in equity and equity-oriented securities issued by privately-owned companies in transactions negotiated directly

with such companies. Given market conditions over the past several years and the performance of our portfolio, our Management and Board

of Directors believe it prudent to continue to review alternatives to refine and further clarify the current strategies.

We elected to be treated

as a BDC under the Investment Company Act of 1940 Act (“1940 Act”), although our shareholders authorized us to withdraw this

election in previous years (which authorization has since expired) and will likely do so again in the future. We currently qualify as

a regulated investment company (“RIC”) for federal income tax purposes and, therefore, are not required to pay corporate income

taxes on any income or gains that we distribute to our stockholders. We have two wholly-owned taxable subsidiaries (“Taxable Subsidiary”)

which hold one or more of our portfolio investments listed on our Schedules of Investments. The purpose of these and other Taxable Subsidiaries

we may form is to permit us to hold certain income- producing investments or portfolio companies organized as limited liability companies,

or LLCs, (or other forms of pass-through entities) and still satisfy the RIC tax requirement that at least 90% of our gross revenue for

income tax purposes must consist of investment income. Absent the Taxable Subsidiaries, a portion of the gross income of these income-producing

investments or of any LLC (or other pass-through entity) portfolio investment, as the case may be, would flow through directly to us for

the 90% test. To the extent that such income did not consist of investment income, it could jeopardize our ability to qualify as a RIC

and, therefore, cause us to incur significant federal income taxes. The income of the LLCs (or other pass-through entities) owned by Taxable

Subsidiaries is taxed to the Taxable Subsidiaries and does not flow through to us, thereby helping us preserve our RIC status and resultant

tax advantages. We do not consolidate the Taxable Subsidiaries for income tax purposes, with the exception of Texas Margins Tax, which

is an entity level tax. The Taxable Subsidiaries may generate income tax expense because of the Taxable Subsidiaries’ ownership

of the portfolio companies. We reflect any such income tax expense on our Statements of Operations.

Impact of Economic

and Geopolitical Events on the Oil and Gas Sector— The substantial volatility in world markets has been prominent in the oil

and gas sector, with WTI oil prices reaching a multi-year high of $130.00 per barrel in March 2022, and gas prices also reaching a multi-year

high in mid-year, both due in part to increased demand, the reluctance of U.S. producers and OPEC nations to generate additional supply,

and the conflict in Ukraine. Beginning in the second and third quarters of 2022 and largely due to recessionary headwinds and other macroeconomic

factors, oil and natural gas prices have retreated substantially. In the case of natural gas, prices have continued to decline through

the first quarter of 2023 before stabilizing during the second quarter of 2023. However, recent oil price stability has been a significant

factor in increased consolidation activity in the Permian Basin and the Williston Basin where Equus Energy and Morgan E&P, LLC, respectively,

hold most of their development rights.

Basis of Presentation—In

accordance with Article 6 of Regulation S-X under the Securities Act and the Securities Exchange Act of 1934, as amended (“Exchange

Act”), we do not consolidate portfolio company investments, including those in which we have a controlling interest. Our interim

unaudited financial statements were prepared in accordance with accounting principles generally accepted in the United States of America

(“GAAP”), for interim financial information and in accordance with the requirements of reporting on Form 10-Q and Article

10 of Regulation S-X, under the Exchange Act. Accordingly, they are unaudited and exclude some disclosures required for annual financial

statements. We believe that we have made all adjustments, consisting solely of normal recurring accruals, necessary for the fair presentation

of these interim financial statements.

The results of operations

for the three months ended June 30, 2023 are not necessarily indicative of results that ultimately may be achieved for the remainder of

the year. The interim unaudited financial statements and notes thereto should be read in conjunction with the financial statements and

notes thereto included in the Fund’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, as filed with the SEC.

(2) Liquidity

and Financing Arrangements

Liquidity—There

are several factors that may materially affect our liquidity during the reasonably foreseeable future. We are evaluating the impact of

current market conditions on our portfolio company valuations and their ability to provide current income. We have followed valuation

techniques in a consistent manner; however, we are cognizant of current market conditions that might affect future valuations of portfolio

securities.

Cash and Cash Equivalents—As

of June 30, 2023, we had cash and cash equivalents of $16.5 million. We had $23.2 million of our net assets of $40.1 million invested

in portfolio securities.

As of December 31, 2022, we had cash and

cash equivalents of $19.3 million. We had $15.7 million of our net assets of $35.2 million invested in portfolio securities.

We exclude “Restricted

Cash and Temporary Cash Investments” used for purposes of complying with RIC requirements from cash equivalents.

Restricted Cash

and Temporary Cash Investments—As of June 30, 2023, we had $13.1 million of restricted cash and temporary cash investments,

including primarily the proceeds of a quarter-end margin loan that we incurred to maintain the diversification requirements applicable

to a RIC. Of this amount, $13.0 million was invested in U.S. Treasury bills and $0.1 million represented a required 1% brokerage margin

deposit. These securities were held by a securities brokerage firm and pledged along with other assets to secure repayment of the margin

loan. The U.S. Treasury bills matured on July 6, 2023 and we subsequently repaid this margin loan, plus interest.

As of December 31,

2022, we had $6.0 million of restricted cash and of temporary cash investments, including primarily the proceeds of a quarter-end margin

loan that we incurred to maintain the diversification requirements applicable to a RIC. Of this amount, $6.0 million was invested in U.S.

Treasury bills and $0.06 million represented a required 1% brokerage margin deposit. These securities were held by a securities brokerage

firm and pledged along with other assets to secure repayment of the margin loan. The U.S. Treasury bills matured on January 4, 2023 and

we subsequently repaid this margin loan, plus interest.

Dividends—So

long as we remain a BDC, we will pay out net investment income and/or realized net capital gains, if any, on an annual basis as required

under the 1940 Act.

Investment Commitments—Under

certain circumstances, we may be called on to make follow-on investments in certain portfolio companies. If we do not have sufficient

funds to make follow-on investments, the portfolio company in need of the investment may be negatively impacted. Also, our equity interest

in the estimated fair value of the portfolio company could be reduced. We had no follow-on commitments as of

December 31, 2022.

We have committed to invest up to $10.0 million, via

a senior secured debt facility, into Morgan E&P, LLC, our wholly-owned subsidiary engaged in oil and gas development in the Williston

Basin region. As of June 30, 2023, Morgan had drawn approximately $750,000 under this facility.

RIC Borrowings,

Restricted Cash and Temporary Cash Investments—We may periodically borrow sufficient funds to maintain the Fund’s RIC

status by utilizing a margin account with a securities brokerage firm. We cannot assure you that any such arrangement will be available

in the future. If we are unable to borrow funds to make qualifying investments, we may no longer qualify as a RIC. We would then be subject

to corporate income tax on the Fund’s net investment income and realized capital gains, and distributions to stockholders would

be subject to income tax as ordinary dividends. If we remain a BDC and do not become an operating company as described in Note 6 –

Conversion to an Operating Company below, our failure to continue to qualify as a RIC could be materially adverse to us and our

stockholders.

As of June 30, 2023,

we borrowed $13.0 million to maintain our RIC status by utilizing a margin account with a securities brokerage firm. We collateralized

such borrowings with restricted cash and temporary cash investments in U.S. Treasury bills of $13.1 million.

As of December 31,

2022, we borrowed $6.0 million to maintain our RIC status by utilizing a margin account with a securities brokerage firm. We collateralized

such borrowings with restricted cash and temporary cash investments in U.S. Treasury bills of $6.06 million.

Asset Coverage

Ratio—Under the 1940 Act, BDCs are required to have an asset coverage ratio of 200%, meaning that the maximum debt that may

be incurred by a BDC is the BDC’s net asset value. Pursuant to amendments made to the 1940 Act in March 2018, BDCs may now, with

stockholder or board of directors approval, reduce this ratio to 150%, meaning that the maximum debt that may be incurred by a BDC is

two times the BDC’s net asset value. In November 2019, we obtained approval of our shareholders to reduce our asset coverage ratio

to 150%. This authorization permits Equus to borrow up to twice the value of the Fund’s net assets. Other than the margin loan obtained

by the Fund from time to time to acquire U.S. Treasury bills to maintain our RIC status as described above, we have not yet undertaken

any other additional borrowings.

Certain Risks and

Uncertainties—Market and economic volatility which has become endemic in the past few years, together with the economic dislocation

caused by the onset of the coronavirus, has constrained the availability of debt financing for small and medium-sized companies such as

Equus and its portfolio companies. Such debt financing generally has shorter maturities, higher interest rates and fees, and more restrictive

terms than debt facilities available in the past. In addition, during these years and continuing into the second quarter of 2023, the

price of our common stock remained well below our net asset value, thereby making it undesirable to issue additional shares of our common

stock below net asset value.

Because of these challenges,

our near-term strategies shifted from originating debt and equity investments to preserving liquidity necessary to meet our operational

needs. Key initiatives that we have previously undertaken to provide necessary liquidity include monetizations, the suspension of dividends

and the internalization of management. We are also evaluating potential opportunities that could enable us to effect a change to our business

and become an operating company as described in Note 6 – Conversion to an Operating Company. We believe we have sufficient

liquidity to meet our operating requirements for 12 months from the date of this filing.

(3) Significant

Accounting Policies

The following is a

summary of significant accounting policies followed by the Fund in the preparation of our financial statements:

Use of Estimates—The

preparation of financial statements in accordance with GAAP requires us to make estimates and assumptions that affect the reported amounts

and disclosures in the financial statements. Although we believe the estimates and assumptions used in preparing these financial statements

and related notes are reasonable in light of known facts and circumstances, actual results could differ from those estimates.

Valuation of Investments—For

most of our investments, market quotations are not available. With respect to investments for which market quotations are not readily

available or when such market quotations are deemed not to represent fair value, our Board has approved a multi-step valuation process

each quarter, as described below:

| |

1. |

Each portfolio company or investment is reviewed by our investment professionals; |

| |

2. |

With certain exceptions as determined by our Management, with respect to investments with a fair value exceeding $2.5 million that have been held for more than one year, we engage independent valuation firms to assist our investment professionals. These independent valuation firms conduct independent valuations and make their own independent assessments; |

| |

3. |

Our Management produces a report that summarizes each of our portfolio investments and recommends a fair value of each such investment as of the date of the report; |

| |

4. |

The Audit Committee of our Board reviews and discusses the preliminary valuation of our portfolio investments as recommended by Management in their report and any reports or recommendations of the independent valuation firms, and then approves and recommends the fair values of our investments so determined to our Board for final approval; and |

| |

5. |

The Board discusses valuations and determines the fair value of each portfolio investment in good faith based on the input of our Management, the respective independent valuation firm, as applicable, and the Audit Committee. |

Investments

are valued utilizing various methodologies and approaches, including a yield analysis, enterprise value (“EV”) analysis, net

asset value analysis, liquidation analysis, discounted cash flow analysis, or a combination of methods, as appropriate. The yield analysis

uses loan spreads and other relevant information implied by market data involving identical or comparable assets or liabilities. Under

the EV analysis, the EV of a portfolio company is first determined and allocated over the portfolio company’s securities in order

of their preference relative to one another (i.e., “waterfall” allocation). To determine the EV, we typically use a market

multiples approach that considers relevant and applicable market trading data of guideline public companies, transaction metrics from

precedent M&A transactions and/or a discounted cash flow analysis. The net asset value analysis is used to derive a value of an underlying

investment (such as real estate property) by dividing a relevant earnings stream by an appropriate capitalization rate. For this purpose,

we consider capitalization rates for similar properties as may be obtained from guideline public companies and/or relevant transactions.

The liquidation analysis is intended to approximate the net recovery value of an investment based on, among other things, assumptions

regarding liquidation proceeds based on a hypothetical liquidation of a portfolio company’s assets. The discounted cash flow analysis

uses valuation techniques to convert future cash flows or earnings to a range of fair values from which a single estimate may be derived

utilizing an appropriate discount rate. The measurement is based on the net present value indicated by current market expectations about

those future amounts.

In estimating

the fair values of our equity interest in Equus Energy, we have given more emphasis to a market approach that examines developed and undeveloped

reserves and mineral acreage values, as well as a market approach that examines comparable industry transactions involving oil and gas

assets in proximity to the leasehold interests held by Equus Energy. In estimating the fair values of our equity interest in Morgan E&P,

LLC (“Morgan”), we have given more emphasis to a market approach that examines Morgan’s reserves and production multiples,

as well as an income approach that examines expected cash flows from the development of leasehold interests held by Morgan. Our management

received advice and assistance from a third-party valuation firm to support our determination of the fair value of these investments.

In applying these methodologies,

additional factors that we consider in fair value pricing our investments may include, as we deem relevant: security covenants, call protection

provisions, and information rights; the nature and realizable value of any collateral; the portfolio company’s ability to make payments;

the principal markets in which the portfolio company does business; publicly available financial ratios of peer companies; the principal

market; and enterprise values, among other factors. Also, any failure by a portfolio company to achieve its business plan or obtain and

maintain its financing arrangements could result in increased volatility and result in a significant and rapid change in its value.

Our general intent

is to hold our loans to maturity when appraising our privately held debt investments. As such, we believe that the fair value will not

exceed the cost of the investment. However, in addition to the previously described analysis involving allocation of value to the debt

instrument, we perform a yield analysis assuming a hypothetical current sale of the security to determine if a debt security has been

impaired. The yield analysis considers changes in interest rates and changes in leverage levels of the portfolio company as compared to

the market interest rates and leverage levels. Assuming the credit quality of the portfolio company remains stable, the Fund will use

the value determined by the yield analysis as the fair value for that security if less than the cost of the investment.

We record unrealized

depreciation on investments when we determine that the fair value of a security is less than its cost basis, and will record unrealized

appreciation when we determine that the fair value is greater than its cost basis.

Fair Value Measurement—Fair

value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants

at the measurement date and sets out a fair value hierarchy. The fair value hierarchy gives the highest priority to quoted prices in active

markets for identical assets or liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3). Inputs are broadly defined

as assumptions market participants would use in pricing an asset or liability. The three levels of the fair value hierarchy are described

below:

Level 1—Unadjusted

quoted prices in active markets for identical assets or liabilities that the reporting entity has the ability to access at the measurement

date.

Level 2—Inputs

other than quoted prices within Level 1 that are observable for the asset or liability, either directly or indirectly; and fair value

is determined through the use of models or other valuation methodologies.

Level 3—Inputs

are unobservable for the asset or liability and include situations where there is little, if any, market activity for the asset or liability.

The inputs into the determination of fair value are based upon the best information under the circumstances and may require significant

management judgment or estimation.

In certain cases, the

inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, an investment’s level

within the fair value hierarchy is based on the lowest level of input that is significant to the fair value measurement. Our assessment

of the significance of a particular input to the fair value measurement in its entirety requires judgment and considers factors specific

to the investment.

Investments for which

prices are not observable are generally private investments in the debt and equity securities of operating companies. A primary valuation

method used to estimate the fair value of these Level 3 investments is the discounted cash flow method (although a liquidation analysis,

option theoretical, or other methodology may be used when more appropriate). The discounted cash flow approach to determine fair value

(or a range of fair values) involves applying an appropriate discount rate(s) to the estimated future cash flows using various relevant

factors depending on investment type, including comparing the latest arm’s length or market transactions involving the subject security

to the selected benchmark credit spread, assumed growth rate (in cash flows), and capitalization rates/multiples (for determining terminal

values of underlying portfolio companies). The valuation based on the inputs determined to be the most reasonable and probable is used

as the fair value of the investment. In the case of our investments in Equus Energy and Morgan, we also examine acreage values in comparable

transactions and assess the impact upon the working interests held by these two portfolio companies. The determination of fair value using

these methodologies may take into consideration a range of factors including, but not limited to, the price at which the investment was

acquired, the nature of the investment, local market conditions, trading values on public exchanges for comparable securities, current

and projected operating performance, financing transactions subsequent to the acquisition of the investment and anticipated financing

transactions after the valuation date.

To assess the reasonableness

of the discounted cash flow approach, the fair value of equity securities, including warrants, in portfolio companies may also consider

the market approach—that is, through analyzing and applying to the underlying portfolio companies, market valuation multiples of

publicly-traded firms engaged in businesses similar to those of the portfolio companies. The market approach to determining the fair value

of a portfolio company’s equity security (or securities) will typically involve: (1) applying to the portfolio company’s trailing

twelve months (or current year projected) earnings before interest, taxes, depreciation, and amortization (“EBITDA”) a low

to high range of enterprise value to EBITDA multiples that are derived from an analysis of publicly-traded comparable companies, in order

to arrive at a range of enterprise values for the portfolio company; (2) subtracting from the range of calculated enterprise values the

outstanding balances of any debt or equity securities that would be senior in right of payment to the equity securities we hold; and (3)

multiplying the range of equity values derived therefrom by our ownership share of such equity tranche in order to arrive at a range of

fair values for our equity security (or securities). Application of these valuation methodologies involves a significant degree of judgment

by Management.

Due to the inherent

uncertainty of determining the fair value of Level 3 investments that do not have a readily available market value, the fair value of

the investments may differ significantly from the values that would have been used had a ready market existed for such investments and

may differ materially from the values that may ultimately be received or settled. Further, such investments are generally subject to legal

and other restrictions or otherwise are less liquid than publicly traded instruments. If we were required to liquidate a portfolio investment

in a forced or liquidation sale, we might realize significantly less than the value at which such investment had previously been recorded.

With respect to Level 3 investments, where sufficient market quotations are not readily available or for which no or an insufficient number

of indicative prices from pricing services or brokers or dealers have been received, we undertake, on a quarterly basis, our valuation

process as described above.

We assess the levels

of the investments at each measurement date, and transfers between levels are recognized on the subsequent measurement date closest in

time to the actual date of the event or change in circumstances that caused the transfer. There were no transfers to or from Level 3 for

the six months ended June 30, 2023 and the year ended December 31, 2022.

As of June 30, 2023,

investments measured at fair value on a recurring basis are categorized in the tables below based on the lowest level of significant input

to the valuations:

| |

|

Fair

Value Measurements as of June 30, 2023 |

| (in thousands) | |

Total | |

Quoted

Prices in

Active

Markets

for

Identical

Assets

(Level

1) | |

Significant

Other

Observable

Inputs

(Level

2) | |

Significant

Unobservable

Inputs

(Level

3) |

| Assets |

| | | |

| | | |

| | | |

| | |

| Investments: |

| | | |

| | | |

| | | |

| | |

| Control investments |

$ | 23,200 | | |

$ | — | | |

$ | — | | |

$ | 23,200 | |

| Total investments |

| 23,200 | | |

| — | | |

| — | | |

| 23,200 | |

| Temporary cash investments |

| 12,989 | | |

| 12,989 | | |

| — | | |

| — | |

| Total investments and temporary cash investments |

$ | 36,189 | | |

$ | 12,989 | | |

$ | — | | |

$ | 23,200 | |

As of December 31,

2022, investments measured at fair value on a recurring basis are categorized in the tables below based on the lowest level of significant

input to the valuations:

| |

|

Fair

Value Measurements as of December 31, 2022 |

| (in thousands) | |

Total | |

Quoted

Prices in

Active

Markets

for

Identical

Assets

(Level

1) | |

Significant

Other

Observable

Inputs

(Level

2) | |

Significant

Unobservable

Inputs

(Level

3) |

| Assets |

| | | |

| | | |

| | | |

| | |

| Investments: |

| | | |

| | | |

| | | |

| | |

| Control investments |

$ | 15,650 | | |

$ | — | | |

$ | — | | |

$ | 15,650 | |

| Total investments |

| 15,650 | | |

| — | | |

| — | | |

| 15,650 | |

| Temporary cash investments |

| 5,998 | | |

| 5,998 | | |

| — | | |

| — | |

| Total investments and temporary cash investments |

$ | 21,648 | | |

$ | 5,998 | | |

$ | — | | |

$ | 15,650 | |

The following table

provides a reconciliation of fair value changes during the six months ended June 30, 2023 for all investments for which we determine fair

value using unobservable (Level 3) factors:

| | |

| |

Fair value

measurements using significant unobservable inputs (Level 3) |

| (in thousands) | |

Control Investments | |

Affiliate Investments | |

Non-affiliate Investments | |

Total |

| Fair value as of January 1, 2023 | |

| | | |

$ | 15,650 | | |

$ | — | | |

$ | — | | |

$15,650 |

| Change in unrealized appreciation | |

| | | |

| 6,800 | | |

| — | | |

| — | | |

6,800 |

| Purchases of portfolio securities | |

| | | |

| 750 | | |

| — | | |

| — | | |

750 |

| Fair value as of June 30, 2023 | |

| | | |

$ | 23,200 | | |

$ | — | | |

$ | — | | |

$23,200 |

The following table provides

a reconciliation of fair value changes during the six months ended June 30, 2022 for all investments for which we determine fair value

using unobservable (Level 3) factors:

| | |

| |

Fair

value measurements using significant unobservable inputs (Level 3) |

| (in thousands) | |

Control Investments | |

Affiliate Investments | |

Non-affiliate Investments | |

Total |

| Fair value as of January 1, 2022 | |

| | | |

$ | 13,000 | | |

$ | — | | |

$ | — | | |

$13,000 |

| Change in unrealized appreciation | |

| | | |

| 2,500 | | |

| — | | |

| — | | |

2,500 |

| Fair value as of June 30, 2022 | |

| | | |

$ | 15,500 | | |

$ | — | | |

$ | — | | |

$15,500 |

Fair value measurements

can be sensitive to changes in one or more of the valuation inputs. Changes in discount rates, EBITDA or EBITDA multiples (or revenue

or revenue multiples), each in isolation, may change the fair value of certain of our investments. Generally, an increase/(decrease) in

market yields, discount rates, or an increase/(decrease) in EBITDA or EBITDA multiples (or revenue or revenue multiples) may result in

a corresponding increase/(decrease), respectively, in the fair value of certain of our investments. In the case of our holdings in Equus

Energy and Morgan, we also consider acreage value, proved reserve multiples, daily production multiples, and discount rates.

Finally, industry trends, market

forecasts, and comparable transactions in sectors in which we hold a Level 3 investment are also taken into account when assessing the

value of these investments.

The following table summarizes

the significant non-observable inputs in the fair value measurements of our Level 3 investments by category of investment and valuation

technique as of June 30, 2023 (fair value expressed in thousands; acreage range expressed in dollars and not rounded):

| |

|

|

|

|

|

|

|

Range |

| (in thousands) |

|

Fair Value |

|

Valuation Techniques |

|

Unobservable Inputs |

|

Minimum |

|

Maximum |

|

Weighted Average |

| Limited liability company investments |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

Acreage Value (per acre) |

|

$1,500 |

|

$11,000 |

|

$4,062 |

| Equus Energy, LLC |

|

$ 15,650 |

|

Guideline Transaction Method |

|

Proved Reserve Multiple |

|

4.5x |

|

11.9x |

|

10.2x |

| |

|

|

|

|

|

Daily Production Multiple |

|

18,578.7x |

|

50,861.2x |

|

45,069.6x |

| |

|

|

|

|

|

Discount Rate |

|

11.3% |

|

11.3% |

|

11.3% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Guideline Public Company Method |

|

Proved Reserve Multiple |

|

9,198x |

|

11,337x |

|

10,267.5x |

| |

|

|

|

|

Daily Production Multiple |

|

34,150x |

|

53,622x |

|

43,886x |

| Morgan E&P, LLC |

|

6,800 |

|

Guideline Transaction Method |

|

Proved Reserve Multiple |

|

8,878x |

|

12,716x |

|

10,797x |

| |

|

|

|

|

Daily Production Multiple |

|

36,221x |

|

60,083x |

|

48,152x |

| |

|

|

|

Discounted Cash Flow |

|

Discount Rate |

|

10.7% |

|

12.3% |

|

11.3% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Senior debt |

|

|

|

|

|

|

|

|

|

|

|

|

| Morgan E&P, LLC |

|

750 |

|

Yield analysis |

|

Discount for lack of marketability |

|

12.0% |

|

12.1% |

|

12.05% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

$ 23,200 |

|

|

|

|

|

|

|

|

|

|

The following table summarizes

the significant non-observable inputs in the fair value measurements of our Level 3 investments by category of investment and valuation

technique as of December 31, 2022 (fair value expressed in thousands; acreage range expressed in dollars and not rounded):

| |

|

|

|

|

|

|

|

Range |

| (in thousands) |

|

Fair Value |

|

Valuation Techniques |

|

Unobservable Inputs |

|

Minimum |

|

Maximum |

|

Weighted Average |

| Limited liability company investments |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

Acreage Value (per acre) |

|

$1,500 |

|

$11,000 |

|

$4,062 |

| Equus Energy, LLC |

|

$15,650 |

|

Guideline Transaction Method |

|

Proved Reserve Multiple |

|

4.0x |

|

9.5x |

|

8.2x |

| |

|

|

|

|

|

Daily Production Multiple |

|

18,578.7x |

|

47,513.7x |

|

40,284.4x |

| |

|

|

|

Discounted Cash Flow |

|

Discount Rate |

|

11.0% |

|

11.0% |

|

11.0% |

Because of the inherent uncertainty

of the valuation of portfolio securities which do not have readily ascertainable market values, amounting to $23.2 million as of June

30, 2023 and $15.7 million as of December 31, 2022, respectively, our fair value determinations may materially differ from the values

that would have been used had a ready market existed for these securities.

We adjust our net asset

value for the changes in the value of our publicly held securities, if applicable, and material changes in the value of private securities,

generally determined on a quarterly basis or as announced in a press release, and report those amounts to Lipper Analytical Services,

Inc. Our net asset value appears in various publications, including Barron’s and The Wall Street Journal.

Investment Transactions—Investment

transactions are recorded on the accrual method. Realized gains and losses on investments sold are computed on a specific identification

basis.

We classify our investments

in accordance with the requirements of the 1940 Act. Under the 1940 Act, “Control Investments” are defined as investments

in companies in which the Fund owns more than 25% of the voting securities or maintains greater than 50% of the board representation.

Under the 1940 Act, “Affiliate Investments” are defined as those non-control investments in companies in which we own between

5% and 25% of the voting securities. Under the 1940 Act, “Non-affiliate Investments” are defined as investments that are neither

Control Investments nor Affiliate Investments. See also Note 4 for discussion of related party investment transactions.

Interest and Dividend

Income Recognition—We record interest income, adjusted for amortization of premium and accretion of discount, on an accrual

basis to the extent that we expect to collect such amounts. We accrete or amortize discounts and premiums on securities purchased over

the life of the respective security using the effective yield method. The amortized cost of investments represents the original cost adjusted

for the accretion of discount and/or amortization of premium on debt securities. We stop accruing interest on investments when we determine

that interest is no longer collectible. We may also impair the accrued interest when we determine that all or a portion of the current

accrual is uncollectible. If we receive any cash after determining that interest is no longer collectible, we treat such cash as payment

on the principal balance until the entire principal balance has been repaid, before we recognize any additional interest income. We will

write off uncollectible interest upon the occurrence of a definitive event such as a sale, bankruptcy, or reorganization of the relevant

portfolio interest. Dividend income is recorded as dividends are declared by the portfolio company

or at the point an obligation exists for the portfolio company to make a distribution.

Net Realized Gains

or Losses and Net Change in Unrealized Appreciation or Depreciation—Realized gains or losses are measured by the difference

between the net proceeds from the sale or redemption of an investment or a financial instrument and the cost basis of the investment or

financial instrument, without regard to unrealized appreciation or depreciation previously recognized, and includes investments written-off

during the period net of recoveries and realized gains or losses from in-kind redemptions. Net change in unrealized appreciation or depreciation

reflects the net change in the fair value of the portfolio company investments and financial instruments and the reclassification of any

prior period unrealized appreciation or depreciation on exited investments and financial instruments to realized gains or losses.

Payment in Kind

Interest (PIK)—From time to time, we have loans in our portfolio that may pay PIK interest. We add PIK interest, if any, computed

at the contractual rate specified in each loan agreement, to the principal balance of the loan and recorded as interest income. To maintain

our status as a RIC, we must pay out to stockholders this non-cash source of income in the form of dividends even if we have not yet collected

any cash in respect of such investments. To the extent we remain BDC and a RIC, we will continue to pay out net investment income and/or

realized capital gains, if any, on an annual basis as required under the 1940 Act.

Earnings Per Share—Basic

and diluted per share calculations are computed utilizing the weighted-average number of shares of common stock outstanding for the period.

In accordance with ASC 260, Earnings Per Share, the unvested shares of restricted stock awarded pursuant to our equity compensation plans

are participating securities and, therefore, are included in the basic earnings per share calculation. As a result, for all periods presented,

there is no difference between diluted earnings per share and basic earnings per share amounts.

Distributable Earnings—The

components that make up distributable earnings (accumulated undistributed deficit) on the Condensed Balance Sheet as of June

30, 2023 and December 31, 2022 are as follows:

| |

June 30, 2023 | |

December 31, 2022 |

| Accumulated undistributed net investment losses | |

$ | (49,428 | ) | |

$ | (47,430 | ) |

| Unrealized appreciation of portfolio securities, net | |

| 14,339 | | |

| 7,539 | |

| Accumulated undistributed net capital gains | |

| 442 | | |

| 430 | |

| Accumulated deficit | |

$ | (34,647 | ) | |

$ | (39,461 | ) |

Taxes—So

long as we remain a BDC, we intend to comply with the requirements of the Internal Revenue Code necessary to qualify as a RIC and, as

such, will not be subject to federal income taxes on otherwise taxable income (including net realized capital gains) which is distributed

to stockholders. We borrow money from time to time to maintain our tax status under the Internal Revenue Code as a RIC. See Note 1 for

discussion of Taxable Subsidiaries and see Note 2 for further discussion of the Fund’s RIC borrowings.

Texas margin tax applies

to legal entities conducting business in Texas. The margin tax is based on our Texas sourced taxable margin. The tax is calculated by

applying a tax rate to a base that considers both revenue and expenses and therefore has the characteristics of an income tax. As a result,

we have no provision for margin tax expense for the three months ended June 30, 2023, and we expect no in state income tax for the year

ended December 31, 2022.

Cash Flows—For

purposes of the Statements of Cash Flows, we consider all highly liquid temporary cash investments purchased with an original maturity

of three months or less to be cash equivalents. We exclude “Restricted Cash and Temporary Cash Investments” used for purposes

of complying with RIC requirements from cash equivalents.

The following table

provides a reconciliation of cash and cash equivalents and restricted cash as reported within the consolidated balance sheet that sums

to the total of the same amounts shown in the consolidated statement of cash flows as of June 30, 2023 and December 31, 2022:

| | |

June 30, 2023 | |

December 31, 2022 |

| Cash and cash equivalents at end of period | |

$ | 16,407 | | |

$ | 19,224 | |

| Restricted cash at end of period | |

| 130 | | |

| 60 | |

| Cash and cash equivalents and restricted cash at end of period | |

$ | 16,537 | | |

$ | 19,284 | |

Recent Accounting Standards—We

consider the applicability and impact of all accounting standard updates (“ASU”) issued by the Financial Accounting Standards

Board (“FASB”). ASUs not listed below were assessed and either determined to be not applicable or expected to have minimal

impact on our financial statements.

Accounting Standards Not

Yet Adopted— In June 2022, the FASB issued ASU 2022-03, “Fair Value Measurement (Topic 820) - Fair Value Measurement of

Equity Securities Subject to Contractual Sale Restrictions”, which was issued to (1) clarify the guidance in Topic 820, Fair Value

Measurement, when measuring the fair value of an equity security subject to contractual restrictions that prohibit the sale of an equity

security, (2) to amend a related illustrative example, and (3) to introduce new disclosure requirements for equity securities subject

to contractual sale restrictions that are measured at fair value in accordance with Topic 820. The new guidance is effective for interim

and annual periods beginning after December 15, 2023. The Fund is currently evaluating the impact of the new standard on the Company's

consolidated financial statements and related disclosures.

| |

(4) |

Related Party Transactions and Agreements |

Except as noted below,

as compensation for services to the Fund, each Independent Director receives an annual fee of $40,000 paid quarterly in arrears, a fee

of $2,000 for each meeting of the Board of Directors or committee thereof attended in person, a fee of $1,000 for participation in each

telephonic meeting of the Board or committee thereof, and reimbursement of all out-of-pocket expenses relating to attendance at such meetings.

The chair of each of our standing committees (audit, compensation, and nominating and governance) also receives an annual fee of $50,000,

payable quarterly in arrears. We may also pay other one-time or recurring fees to members of our Board of Directors in special circumstances.

None of our interested directors receive annual fees for their service on the Board of Directors.

In respect of services

provided to the Fund by members of the Board not in connection with their roles and duties as directors, the Fund pays a rate of $300

per hour for such services.

(5) Portfolio

Securities

During the six months ended June 30, 2023, we made a $0.75 million debt investment in Morgan E&P, LLC (“Morgan”)

and also invested $1.00 in the equity of Morgan. In May 2023, we entered into an agreement with Morgan to provide it up to $10.0 million

in senior debt financing, subject to a schedule of disbursements and draws that we determine. Morgan utilized $500,000 of this facility

to acquire 4,747.52 net acres, in the Bakken/Three Forks formation in the Williston Basin of North Dakota as described in Note 9 - Morgan

E&P, LLC below. As of June 30, 2023, Morgan had drawn $0.75 million under this facility. We recorded a change in fair value of $6.8

million. The increase was principally due to our expectation of Morgan drilling new wells and generating operating cash flow therefrom

in the near future in the Bakken shale region where it holds leasehold acreage rights.

During the

six months ended June 30, 2023, notwithstanding price decreases for oil and natural gas in the period, primarily due to stable prices

for mineral acreage transactions in the principal region where Equus Energy, LLC, holds its leasehold interests, we recorded no change

in the fair value of this investment.

During the

six months ended June 30, 2022, with respect to our holding in Equus Energy, LLC, we recorded an increase in the fair value of this investment

by $2.5 million. Such change in fair value was principally due to increases in mineral acreage prices and a substantial increase in short-and

long-term prices for crude oil and natural gas.

(6) Conversion

to an Operating Company

Authorization to

Withdraw BDC Election—In 2022, holders of a majority of the outstanding common stock of the Fund approved our cessation as a

BDC under the 1940 Act and authorized our Board to cause the Fund’s withdrawal of its election to be classified as a BDC, effective

as of a date designated by the Board and our Chief Executive Officer. Although this authorization has since expired, we expect to receive

a further authorization from our shareholders later in 2023 as a consequence of our expressed intent to transform Equus into an operating

company. Notwithstanding any such authorization to withdraw our BDC election, we will not submit any such withdrawal unless and until

Equus has entered into a definitive agreement to effect a transformative transaction. Further, even if we are again authorized to withdraw

our election as a BDC, we will require a subsequent affirmative vote from holders of a majority of our outstanding voting shares to enter

into any such definitive agreement or change the nature of our business. While we are presently evaluating various opportunities that

could enable us to accomplish this transformation, we cannot assure you that we will be able to do so within any particular time period