FALSE000147511500014751152024-02-272024-02-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________________________

FORM 8-K

___________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

February 27, 2024

_________________________________________________________________________________

EVENTBRITE, INC.

(Exact Name of Registrant as Specified in Charter)

_________________________________________________________________________________ | | | | | | | | |

Delaware | 001-38658 | 14-1888467 |

(State or Other Jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

95 Third Street, 2nd Floor,

San Francisco, California 94103

(Address of principal executive offices) (Zip Code)

(415) 692-7779

(Registrant’s telephone number, include area code)

Not applicable

(Former name or former address, if changed since last report)

_____________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading symbol(s) | Name of each exchange on which registered |

| Class A common stock, par value $0.00001 per share | EB | New York Stock Exchange LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On February 27, 2024, Eventbrite, Inc. (the "Company") issued a press release and Shareholder Letter (the "Letter") announcing its financial results for the quarter and fiscal year ended December 31, 2023. Copies of the issued press release and the Letter are attached hereto as Exhibits 99.1 and 99.2, respectively, and each of the press release and the Letter are incorporated herein by reference. Additional supplemental financial information (the "Supplemental Information") has been posted to the Investor Relations section of the Company's website at investor.eventbrite.com.

In the Letter, the Company also announced that it would be holding a live webcast on February 27, 2024, at 2:00 p.m. Pacific Time to discuss its financial results for the quarter and fiscal year ended December 31, 2023. A copy of the unofficial transcript of the webcast will be available after the webcast on the Investor Relations section of the Company's website at investor.eventbrite.com.

The Company is making reference to non-GAAP financial information in the Letter, the Supplemental Information and the webcast. Reconciliations of these non-GAAP financial measures to their nearest GAAP equivalents are provided in the Letter and the Supplemental Information, as applicable.

The information furnished pursuant to Item 2.02 of this Form 8-K, including Exhibits 99.1 and 99.2 attached hereto, shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any other filing under the Securities Act of 1933, as amended (the "Securities Act"), or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| | |

| 104.1 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | |

Date: February 27, 2024 | EVENTBRITE, INC. |

| | |

| By: | | /s/ Julia Hartz |

| | | Julia Hartz |

| | | Chief Executive Officer |

Eventbrite Reports Fourth Quarter and Fiscal Year 2023 Financial Results

Fourth quarter net revenue of $87.8 million grew 23% year-over-year and fiscal year 2023 net revenue grew 25% to $326.1 million

Marketplace revenue from non-ticketing sources exceeded 10% of net revenue in the fourth quarter

Gross ticket sales of $3.6 billion and total ticket volume of 302 million in fiscal year 2023

2/27/24

SAN FRANCISCO -- (BUSINESS WIRE) -- Eventbrite, Inc. (NYSE: EB), a global events marketplace, reported its financial results for the fourth quarter and full year ended December 31, 2023. The Fourth Quarter 2023 Shareholder Letter can be found on Eventbrite’s Investor Relations website at https://investor.eventbrite.com.

“We delivered record fourth quarter revenue and strong double-digit revenue growth for 2023, built on our marketplace strategy,” said Julia Hartz, Co-Founder and Chief Executive Officer. “In 2023, we powered over 300 million free and paid tickets, helping people around the world enjoy more in-person, live experiences. Looking ahead, we have confidence that our strategic roadmap will spur this marketplace flywheel, helping creators grow their audiences and bringing more consumers to the events they love.”

Fourth Quarter 2023 Highlights

•Net revenue of $87.8 million, up 23% year over year. Marketplace-related revenue from organizer fees and Eventbrite Ads grew to over 10% of net revenue.

•Total free and paid ticket volume of 70.6 million tickets across 1.4 million events.

•Gross margin of 70.1% vs 66.1% a year ago.

•Net loss of ($0.9) million compared to net income of $4.0 million in the same period last year.

•Adjusted EBITDA of $8.8 million, which includes $1.1 million of restructuring and other charges, and Adjusted EBITDA margin of 10%.1

Fiscal Year 2023 Highlights

•Net revenue of $326.1 million, up 25% year over year.

•Total free and paid ticket volume of 302 million tickets across 5.2 million events.

•Gross margin of 68.4% vs 65.2% a year ago.

•Net loss of ($26.5) million compared to ($55.4) million in the same period last year.

•Adjusted EBITDA of $28.7 million, which includes $10.1 million of restructuring and other charges, and Adjusted EBITDA margin of 9%.1

1 For more information on these non-GAAP financial measures, please see "―About non-GAAP financial measures" and the tables under "―Reconciliation of GAAP to non-GAAP financial results" included at the end of this release.

Summary consolidated financial results (in thousands, except percentages, unaudited):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2023 | | 2022 | | % Change | | 2023 | | 2022 | | % Change |

| Gross ticket sales | $ | 871,510 | | | $ | 868,445 | | | 0 | % | | $ | 3,560,304 | | | $ | 3,274,358 | | | 9 | % |

| Net revenue | $ | 87,764 | | | $ | 71,539 | | | 23 | % | | $ | 326,134 | | | $ | 260,927 | | | 25 | % |

| Gross profit | $ | 61,499 | | | $ | 47,258 | | | 30 | % | | $ | 223,004 | | | $ | 170,181 | | | 31 | % |

| Gross profit margin | 70 | % | | 66 | % | | | | 68 | % | | 65 | % | | |

| Net income (loss) | $ | (937) | | | $ | 4,013 | | | (123) | % | | $ | (26,479) | | | $ | (55,384) | | | (52) | % |

| Net income (loss) margin | (1) | % | | 6 | % | | | | (8) | % | | (21) | % | | |

| Adjusted EBITDA (non-GAAP) | $ | 8,797 | | | $ | 11,071 | | | (21) | % | | $ | 28,655 | | | $ | 22,323 | | | 28 | % |

| Adjusted EBITDA margin (non-GAAP) | 10 | % | | 15 | % | | | | 9 | % | | 9 | % | | |

Operating Highlights

Key operating metrics (in thousands, except average ticket value and percentages, unaudited):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2023 | | 2022 | | % Change | | 2023 | | 2022 | | % Change |

| Total tickets | 70,570 | | | 76,782 | | | (8) | % | | 301,863 | | | 283,596 | | | 6 | % |

| Paid tickets | 24,103 | | | 25,110 | | | (4) | % | | 93,443 | | | 87,056 | | | 7 | % |

| Total events | 1,446 | | | 1,474 | | | (2) | % | | 5,159 | | | 5,029 | | | 3 | % |

| Paid events | 546 | | | 536 | | | 2 | % | | 1,819 | | | 1,716 | | | 6 | % |

| Total creators | 380 | | | 389 | | | (2) | % | | 850 | | | 798 | | | 7 | % |

| Paid creators | 183 | | | 177 | | | 3 | % | | 396 | | | 367 | | | 8 | % |

| Average ticket value (ATV) | $ | 36.16 | | | $ | 34.59 | | | 5 | % | | $ | 38.10 | | | $ | 37.61 | | | 1 | % |

| Total ticket buyers | 29,319 | | | 32,199 | | | (9) | % | | 92,860 | | | 89,973 | | | 3 | % |

Outlook

The company expects first quarter 2024 net revenue will be within a range of $84 to $87 million and full year 2024 net revenue will be within a range of $359 million to $372 million. The company expects Adjusted EBITDA margin to be in the low- to mid-teens for the full year 2024, excluding the impact of restructuring costs, reserve adjustments, and other items.

The company has not provided an outlook for GAAP net income (loss) or GAAP net income (loss) margin or reconciliations of expected Adjusted EBITDA to GAAP net income (loss) or expected Adjusted EBITDA margin to GAAP net income (loss) margin, because GAAP net income (loss) and GAAP net income (loss) margin on a forward-looking basis are not available without unreasonable efforts due to the potential variability and complexity of the items that are excluded from Adjusted EBITDA and Adjusted EBITDA margin, such as share-based compensation expense, foreign exchange loss, and other non-recurring expenses.

Earnings Webcast Information

Event: Eventbrite Fourth Quarter and Fiscal Year 2023 Earnings Conference Call

Date: Tuesday, February 27, 2024

Time: 2:00 p.m. Pacific Time (5:00 p.m. Eastern Time)

Live Webcast Site: https://investor.eventbrite.com

An archived webcast of the conference call will be accessible on Eventbrite’s Investor Relations page, https://investor.eventbrite.com.

About Eventbrite

Eventbrite is a global events marketplace that serves event creators and event goers in nearly 180 countries. Since inception, Eventbrite has been at the center of the experience economy, transforming the way people organize and attend events. The company was founded by Julia Hartz, Kevin Hartz and Renaud Visage, with a vision to build a self-service platform that would make it possible for anyone to create and sell tickets to live experiences. With over 300 million tickets distributed for over 5 million total events in 2023, Eventbrite is where people all over the world discover new things to do or new ways to do more of what they love. Eventbrite has also earned industry recognition as a top employer with special designations that include a coveted spot on Fast Company’s prestigious The World’s 50 Most Innovative Companies and Fast Company’s Brands That Matter lists, the Great Place to Work® Award in the U.S., and Inc.'s Best-Led Companies honor. Learn more at www.eventbrite.com.

Eventbrite Investor Relations

investors@eventbrite.com

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that involve substantial risks and uncertainties. All statements other than statements of historical fact could be deemed forward-looking, including, but not limited to, statements regarding the future performance of Eventbrite, Inc. and its consolidated subsidiaries (the “Company”); the Company’s business model and investments to support growth, including the impact on results; the Company’s expectations regarding the development of its platform and products; the Company’s long-term growth strategy, creator growth, pursuit of profitability, and value creation; the Company’s expectations with respect to its operating model; and the Company’s expectations described under “Business Outlook” above. In some cases, forward-looking statements can be identified by terms such as “may,” “will,” “appears,” “shall,” “should,” “expects,” “plans,” “anticipates,” “could,” “intends,” “target,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential,” or “continue,” or the negative of these words or other similar terms or expressions that concern the Company’s expectations, strategy, plans, or intentions. Such statements are subject to a number of known and unknown risks, uncertainties, assumptions, and other factors that may cause the Company’s actual results, performance, or achievements to differ materially from results expressed or implied in this press release, including those more fully described in the Company’s filings with the Securities and Exchange Commission, including the Company’s Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. Further information on potential risks that could affect actual results will be included in the subsequent periodic and current reports and other filings that the Company makes with the Securities and Exchange Commission from time to time. Investors are cautioned not to place undue reliance on these statements. Actual results could differ materially from those expressed or implied. All forward-looking statements are based on information and estimates available to the Company at the time of this release, and are not guarantees of future performance, and reported results should not be considered as an indication of future performance. Except as required by law, the Company assumes no obligation to update any of the statements in this press release.

Disclaimer Regarding Ticketing, Creator and Event Metrics

This press release includes certain measures related to our ticketing business, such as paid tickets, paid creators, and paid events. We believe that the use of these metrics is helpful to our investors as these metrics are used by management in assessing the health of our business and our operating performance. These metrics are based on what we believe to be reasonable estimates for the applicable period of measurement. There are inherent challenges in measuring these metrics, and we regularly review and may adjust our processes for calculating our internal metrics to improve their accuracy. You should not consider these metrics in isolation or as substitutes for analysis of our results of operations as reported under GAAP.

Condensed Consolidated Balance Sheets

(in thousands; unaudited)

| | | | | | | | | | | |

| December 31, |

| 2023 | | 2022 |

| Assets | | | |

| Current assets | | | |

| Cash and cash equivalents | $ | 489,200 | | | $ | 539,299 | |

| Funds receivable | 48,773 | | | 43,525 | |

| Short-term investments, at amortized cost | 153,746 | | | 84,224 | |

| Accounts receivable, net | 2,814 | | | 2,266 | |

| Creator signing fees, net | 634 | | | 645 | |

| Creator advances, net | 2,804 | | | 721 | |

| Prepaid expenses and other current assets | 13,880 | | | 12,479 | |

| Total current assets | 711,851 | | | 683,159 | |

| Restricted cash | — | | | 875 | |

| Creator signing fees, noncurrent | 1,303 | | | 1,103 | |

| Property and equipment, net | 9,384 | | | 6,348 | |

| Operating lease right-of-use assets | 177 | | | 5,179 | |

| Goodwill | 174,388 | | | 174,388 | |

| Acquired intangible assets, net | 13,314 | | | 21,907 | |

| Other assets | 2,913 | | | 2,420 | |

| Total assets | $ | 913,330 | | | $ | 895,379 | |

| Liabilities and Stockholders’ Equity | | | |

| Current liabilities | | | |

| Accounts payable, creators | $ | 303,436 | | | $ | 309,313 | |

| Accounts payable, trade | 1,821 | | | 1,032 | |

| Chargebacks and refunds reserve | 8,088 | | | 13,136 | |

| Accrued compensation and benefits | 17,522 | | | 11,635 | |

| Accrued taxes | 8,796 | | | 12,515 | |

| Operating lease liabilities | 1,523 | | | 2,810 | |

| Other accrued liabilities | 16,425 | | | 10,538 | |

| Total current liabilities | 357,611 | | | 360,979 | |

| Accrued taxes, noncurrent | 4,526 | | | 8,820 | |

| Operating lease liabilities, noncurrent | 1,768 | | | 3,345 | |

| Long-term debt | 357,668 | | | 355,580 | |

| Other liabilities | — | | | 100 | |

| Total liabilities | 721,573 | | | 728,824 | |

| Stockholders’ equity | | | |

| Common stock | 1 | | | 1 | |

| Additional paid-in capital | 1,007,190 | | | 955,509 | |

| Accumulated deficit | (815,434) | | | (788,955) | |

| Total stockholders’ equity | 191,757 | | | 166,555 | |

| Total liabilities and stockholders’ equity | $ | 913,330 | | | $ | 895,379 | |

Condensed Consolidated Statement of Operations

(in thousands, except share and per share amounts; unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Year Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Net revenue | $ | 87,764 | | | $ | 71,539 | | | $ | 326,134 | | | $ | 260,927 | |

| Cost of net revenue | 26,265 | | | 24,281 | | | 103,130 | | | 90,746 | |

| Gross profit | 61,499 | | | 47,258 | | | 223,004 | | | 170,181 | |

| Operating expenses: | | | | | | | |

| Product development | 25,203 | | | 23,038 | | | 98,294 | | | 86,346 | |

| Sales, marketing and support | 20,772 | | | 7,426 | | | 74,574 | | | 49,292 | |

| General and administrative | 24,588 | | | 22,377 | | | 91,269 | | | 81,285 | |

| Total operating expenses | 70,563 | | | 52,841 | | | 264,137 | | | 216,923 | |

| Loss from operations | (9,064) | | | (5,583) | | | (41,133) | | | (46,742) | |

| Interest income | 7,547 | | | 4,025 | | | 27,495 | | | 6,432 | |

| Interest expense | (2,826) | | | (2,808) | | | (11,185) | | | (11,269) | |

| Other income (expense), net | 3,565 | | | 8,546 | | | 335 | | | (3,679) | |

| Loss before income taxes | (778) | | | 4,180 | | | (24,488) | | | (55,258) | |

| Income tax provision | 159 | | | 167 | | | 1,991 | | | 126 | |

| Net loss | $ | (937) | | | $ | 4,013 | | | $ | (26,479) | | | $ | (55,384) | |

| Net loss per share, basic and diluted | $ | (0.01) | | | $ | 0.04 | | | $ | (0.26) | | | $ | (0.56) | |

| Weighted-average number of shares outstanding used to compute net loss per share, basic and diluted | 101,097 | | | 98,956 | | | 100,299 | | | 98,305 | |

Condensed Consolidated Statements of Cash Flows

(in thousands; unaudited)

| | | | | | | | | | | |

| Year Ended December 31, |

| 2023 | | 2022 |

| Cash flows from operating activities | | | |

| Net loss | $ | (26,479) | | | $ | (55,384) | |

| Adjustments to reconcile net loss to net cash provided by operating activities: | | | |

| Depreciation and amortization | 13,760 | | | 14,860 | |

| Stock-based compensation expense | 55,056 | | | 53,356 | |

| Non-cash operating lease expense | 5,137 | | | 3,423 | |

| Amortization of debt discount and issuance costs | 2,088 | | | 2,016 | |

| Unrealized (gain) loss on foreign currency exchange | (2,703) | | | 6,013 | |

| Accretion on short-term investments | (7,362) | | | (298) | |

| Amortization of creator signing fees | 980 | | | 1,189 | |

| Changes related to creator advances, creator signing fees, and allowance for credit losses | (1,340) | | | (2,727) | |

| Provision for chargebacks and refunds | 12,435 | | | 8,126 | |

| Other | 1,161 | | | 835 | |

| Changes in operating assets and liabilities, net of impact of acquisitions: | | | |

| Accounts receivable | (1,352) | | | (2,221) | |

| Funds receivable | (4,692) | | | (25,550) | |

| Creator signing fees and creator advances | (1,108) | | | 4,405 | |

| Prepaid expenses and other assets | (1,894) | | | 4,734 | |

| Accounts payable, creators | (8,599) | | | 31,358 | |

| Accounts payable, trade | 822 | | | (57) | |

| Chargebacks and refunds reserve | (17,483) | | | (16,385) | |

| Accrued compensation and benefits | 5,887 | | | 725 | |

| Accrued taxes | (8,707) | | | (3,170) | |

| Operating lease liabilities | (2,999) | | | (4,301) | |

| Other accrued liabilities | 6,410 | | | (12,337) | |

| Net cash provided by operating activities | 19,018 | | | 8,610 | |

| Cash flows from investing activities | | | |

| Purchase of short-term investments | (370,160) | | | (83,926) | |

| Maturities of short-term investments | 308,000 | | | — | |

| Purchases of property and equipment | (1,097) | | | (1,425) | |

| Capitalized internal-use software development costs | (6,073) | | | (3,026) | |

| Cash paid for acquisitions, net of cash acquired | — | | | (1,125) | |

| Net cash used in investing activities | (69,330) | | | (89,502) | |

| Cash flows from financing activities | | | |

| Proceeds from exercise of stock options | 1,297 | | | 3,146 |

| Purchases under employee stock purchase plan | 1,137 | | | 1,437 | |

| Taxes paid related to net share settlement of equity awards | (7,342) | | | (6,591) | |

| Other | — | | | (71) | |

| Net cash (used in) provided by financing activities | (4,908) | | | (2,079) | |

| Effect of exchange rate changes on cash, cash equivalents and restricted cash | 4,246 | | | (13,014) | |

| Net (decrease) increase in cash, cash equivalents and restricted cash | (50,974) | | | (95,985) | |

| Cash, cash equivalents and restricted cash | | | |

| Beginning of period | 540,174 | | | 636,159 | |

| End of period | $ | 489,200 | | | $ | 540,174 | |

Reconciliation of Net Income (Loss) to Adjusted EBITDA and the Calculation of Adjusted EBITDA Margin

(in thousands; unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Year Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

Net loss(1) | $ | (937) | | | $ | 4,013 | | | $ | (26,479) | | | $ | (55,384) | |

| Add: | | | | | | | |

| Depreciation and amortization | 3,826 | | | 3,801 | | | 13,760 | | | 14,860 | |

| Stock-based compensation | 13,895 | | | 12,738 | | | 55,056 | | | 53,356 | |

| Interest income | (7,547) | | | (4,025) | | | (27,495) | | | (6,432) | |

| Interest expense | 2,826 | | | 2,808 | | | 11,185 | | | 11,269 | |

| Employer taxes related to employee equity transactions | 140 | | | 115 | | | 972 | | | 849 | |

| Other (income) expense, net | (3,565) | | | (8,546) | | | (335) | | | 3,679 | |

| Income tax provision (benefit) | 159 | | | 167 | | | 1,991 | | | 126 | |

Adjusted EBITDA(1) | $ | 8,797 | | | $ | 11,071 | | | $ | 28,655 | | | $ | 22,323 | |

| | | | | | | |

| Net revenue | $ | 87,764 | | | $ | 71,539 | | | $ | 326,134 | | | $ | 260,927 | |

| Adjusted EBITDA margin | 10 | % | | 15 | % | | 9 | % | | 9 | % |

(1)Net Loss and Adjusted EBITDA includes restructuring and other costs totaling $1.1 million in the fourth quarter of 2023 and $(7.7) million benefit in the fourth quarter of 2022. Net Loss and Adjusted EBITDA includes restructuring and other costs totaling $10.1 million in fiscal 2023 and $(10.3) million benefit in fiscal 2022.

About Non-GAAP Financial Measures

We believe that the use of Adjusted EBITDA, Adjusted EBITDA margin and Available Liquidity is helpful to our investors in understanding and evaluating our results of operations and useful measures for period-to-period comparisons of our business performance as they are metrics used by management in assessing the health of our business and our operating performance, making operating decisions, and performing strategic planning and annual budgeting. These measures are not prepared in accordance with GAAP and have limitations as an analytical tool, and you should not consider them in isolation or as a substitute for analysis of our results of operations as reported under GAAP. In addition, other companies may not calculate non-GAAP financial measures in the same manner as we calculate them, limiting their usefulness as comparative measures. You are encouraged to evaluate the adjustments and the reasons we consider them appropriate. Some amounts in this press release may not add due to rounding.

Adjusted EBITDA

We calculate Adjusted EBITDA as net income (loss) adjusted to exclude depreciation and amortization, stock-based compensation expense, interest expense, loss on debt extinguishment, direct and indirect acquisition related costs, employer taxes related to employee transactions and other (income) expense net, which consisted of interest income, foreign exchange rate gains and losses, and income tax provision (benefit). Adjusted EBITDA should not be considered as an alternative to net income (loss) or any other measure of financial performance calculated and presented in accordance with GAAP.

Some of the limitations of Adjusted EBITDA include (i) Adjusted EBITDA does not properly reflect capital spending that occurs off of the income statement or account for future contractual commitments, (ii) although depreciation and amortization are non-cash charges, the underlying assets may need to be replaced and Adjusted EBITDA does not reflect these capital expenditures and (iii) Adjusted EBITDA does not reflect the interest and principal required to service our indebtedness. In evaluating Adjusted EBITDA, you should be aware that in the future we expect to incur expenses similar

to the adjustments in this release. Our presentation of Adjusted EBITDA should not be construed as an inference that our future results will be unaffected by these expenses or any unusual or non-routine items. When evaluating our performance, you should consider Adjusted EBITDA alongside other financial performance measures, including our net income (loss) and other GAAP results.

Adjusted EBITDA Margin

Adjusted EBITDA Margin is defined as Adjusted EBITDA divided by net revenue. Because of the limitations described above, you should consider Adjusted EBITDA and Adjusted EBITDA Margin alongside other financial performance measures, including net income (loss) and our other GAAP results.

Shareholder Letter Th e N or th C ar ol in a A rb or et um / A sh ev ille , N C Q4 2023 Feb 27, 2024

Net Revenue Paid Tickets Gross Ticket Sales Net Revenue Per Ticket (1) Includes restructuring costs and other items totaling $1.1 million in the fourth quarter. (2) Adjusted EBITDA is a financial measure that is not calculated in accordance with U.S. generally accepted accounting principles (“GAAP”). See the section in this letter titled “About Non-GAAP Financial Measures” for information regarding Adjusted EBITDA, including the limitations of non-GAAP measures, and see the end of this letter for a reconciliation of Adjusted EBITDA to the most directly comparable GAAP measure. Q4 2023 Highlights Net revenue of $87.8 million grew 23% year-over-year, a new quarterly record, based on greater mix of marketplace-related revenue and improved take rate. Consumer reach rose to its highest level in 2023 during the fourth quarter, with 29 million free and paid ticket buyers across our marketplace. Paid Creators Net Loss (1) Paid Buyers Adjusted EBITDA(1)(2) +3% Y/Y -2% Y/Y 183K ($0.9M) 11M $8.8M Q4 2023 Q4 2022 $72M $88M +23% Y/Y Q4 2023 Q4 2022 $868M $872M FLAT Y/Y Q4 2023 Q4 2022 25M 24M -4% Y/Y Q4 2023 Q4 2022 $2.85 $3.64 +28% Y/Y Non-ticketing revenue, including organizer fees and advertising, grew to more than 10% of fourth quarter net revenue. Page 2Eventbrite Q4 2023 Shareholder Letter

Dear Eventbrite Shareholder, In 2023, we advanced our marketplace strategy, powering over $870 million in gross ticket sales in the fourth quarter and pushing our total gross ticket sales to $3.6 billion for the year. By the fourth quarter, we reached a new revenue record as contributions from non-ticketing sources surpassed 10% of total revenue mix. We also delivered 25% revenue growth for the full year, capturing gains from increased paid tickets year-over-year, our adjusted fee structure, new pricing plans, and expansion of our advertising business. This top-line performance, along with record gross margin, drove further progress toward profitability and conveyed the financial benefits of our marketplace strategy. Our two-sided, demand-generating marketplace enables creators and consumers to invent, discover and enjoy live experiences at scale. Over 850,000 creators listed events on Eventbrite during 2023, trusting our technology and products to seamlessly and reliably connect them to their audiences. Most meaningfully, we upgraded the creator experience by making our full suite of social media and email marketing tools available to promote any event by any creator listed on Eventbrite. For the 93 million consumers who came to Eventbrite to buy tickets during 2023, we have designed new changes to personalization and search and discovery aimed at making it easier to find events in popular categories and locations where demand is highest. We plan to continue to build on this strong foundation in 2024 by attracting in-demand creators and events, elevating the consumer experience, and furthering our demand generation capabilities, to position Eventbrite as a leading destination for live events and drive ticket volume and financial growth and returns. Detroit Auto Show Detroit, MI Detroit Auto Show The Detroit Auto Show has been a fixture of the Motor City for more than a century, showcasing the latest vehicles rolling off of assembly lines locally, nationally, and internationally. Each year, hundreds of thousands of attendees come to Huntington Place in downtown Detroit to look under the hood and get behind the wheel of the newest models. In 2023, the convention’s organizers made the decision to drop their previous ticketing provider in favor of Eventbrite, impressed by the more intuitive online experience that we offer to ticket buyers. Within a single week, the Detroit Auto Show sold 58,000 paid advance tickets to its 2023 event — and organizers are confident that the 2025 edition will build on that success. The convention is returning to its January time slot, with Detroit Auto Dealers Association controller Steve Henry predicting, “we are going to do two times, two-and-a-half times, hopefully three times that one-week sales number in January 2025.” Page 3Eventbrite Q4 2023 Shareholder Letter

Financial Update Net revenue of $87.8 million set a quarterly record, growing 23% year-over- year. Revenue take rate reached 10.1% in the fourth quarter with a record net revenue per ticket of $3.64, reflecting improved ticketing monetization, the introduction of organizer fees, and the growth of Eventbrite Ads. Fourth quarter paid ticket volume of 24.1 million was down 4% year-over-year, reflecting our transition to a marketplace strategy, which includes the introduction of organizer fees, a heightened emphasis on demand generation, and an increased focus on creators who most value those marketplace capabilities. We are focused on improving paid ticket volume trends as we build on our marketplace strategy in 2024 to attract creators seeking audience growth and to showcase appealing events that feed strong consumer demand. Gross margin was 70.1% in the fourth quarter, a 10-point improvement over the gross margin achieved in our prior record fourth quarter at the end of 2019. This improvement in revenue model efficiency has enabled greater investment in supporting our marketplace initiatives through product and brand marketing and outbound sales. Sales, Marketing and Support expenses accounted for the majority of overall cost increases year-over-year. Meanwhile, operating expenses for Product and Engineering and General and Administrative rose an aggregate 10% year-over-year. Looking ahead, we are focused on improving sales and marketing efficiency, and we expect future revenue leverage from these areas as our investments moderate. Net loss was ($0.9) million for the fourth quarter, compared to net income of $4.0 million in the same period of 2022. Our fourth quarter 2023 net loss included $1.1 million in restructuring and other expenses, while our fourth quarter 2022 net income included $7.7 million in reserve-related benefits. 2,000000 2,214286 2,428571 2,642857 2,857143 3,071429 3,285714 3,500000 Q4 2023 Q4 2022 Q4 2019 $2.85 $2.85 7.3% 8.2% 10.1% $3.64 Net Revenue per Ticket and Take Rate OpEx Investment Profile Q4 2023 35% General & Administrative 36% 29% Product Development Sales & Marketing As reported Page 4Eventbrite Q4 2023 Shareholder Letter

Marketplace Highlights We believe the marketplace initiatives we undertook in the fourth quarter added to our long-term growth flywheel and advanced our objectives of becoming a demand generation partner for creators and the leading event discovery destination for consumers. We diversified our revenue base through organizer fees, improved the uptake and efficacy of promoted listings, and enhanced search and discovery for a better browsing experience. Our paid creator base was up 3% year-over-year, growing for the eleventh consecutive period, and we served over 380,000 total free and paid creators during the fourth quarter. Over 1.4 million paid and free events were ticketed on Eventbrite and nearly 70 million free and paid tickets were transacted in the quarter. As we continue to execute on our marketplace strategy and product roadmap, we are focused on generating paid ticket volume growth while also sustaining better monetization, a growing Ads business, and strong creator and consumer affinity. During the fourth quarter, we diversified our revenue base with the widespread release of marketing and demand generation tools for all listed events on Eventbrite. Organizer fees from this launch contributed $6.6 million during the fourth quarter, quickly becoming our largest non-ticketing source of revenue as fees were implemented across all eligible events. Full access to our former Boost subscription product now allows all creators to benefit from these tools, marking a significant step in our repositioning of Eventbrite as an audience growth engine. We believe our efforts to democratize and demystify online advertising are resonating with creators, with 75% of creators surveyed in the fourth quarter viewing Eventbrite as a demand generation partner. Looking ahead, we see opportunity to help creators harness the full power of social media and email advertising and are focused on ramping usage of these tools in the coming quarters. Sorted Food Started by a group of friends in London, Sorted Food has gone on to become one of the world’s biggest online food communities, with over 2.8 million followers watching their highly entertaining (and often chaotic!) series on YouTube. Think burrito battles and chef challenges! A decade since launching, Sorted Food have enhanced their hugely successful formula by serving up live virtual events to their loyal and engaged followers around the world. SF saw ticket sales on Eventbrite tripling in 2023 compared to 2022, with 28% of attendees being repeat customers. Even Prince William is a fan of watching both trained and home chefs encouraging viewers to explore, learn and have fun around food, while “battling to become awesome home cooks” in the process. Page 5Eventbrite Q4 2023 Shareholder Letter

Eventbrite Ads revenue grew nearly threefold year-over-year in the fourth quarter as advertisers responded to improved product efficacy. We approached $2.5 million in Ads revenue, attracted a record number of monthly active advertisers and delivered better results for their campaigns: • With the ability to optimize for either clicks or impressions, we are now better positioned to serve advertiser objectives and we delivered significant improvement to campaign efficiency in the fourth quarter. • The introduction of location targeting gives creators more control over the markets in which their ads are displayed and helped drive user adoption during the quarter. • Ads debuted on Evenbrite’s iOS native app in December, expanding creators’ advertising reach to our highest-intent consumers. With strong momentum as we expand into promoted listings for mobile and offer more customizable advertising campaigns, we believe we can drive further Ads performance over time. Caveat There’s a loose, relaxed vibe at the Lower East Side comedy space Caveat, which celebrates what it calls “nerdy art.” Since joining Eventbrite in 2017, Caveat has hosted more than 2,600 events. You might catch a science-themed game show on a Friday night, an improvised musical on Valentine’s Day, a comedy competition modeled on “Project Runway,” or a group of NYC comedy writers trying out new jokes after they get off work. Eventbrite’s consumer reach and Eventbrite Ads have also helped the basement venue regularly fill its 100-plus seats. Comedy fans flock to Caveat because the space nurtures new talent — while also drawing established names like Aparna Nancherla, Jason Mantzoukas, and “SNL’s” James Austen Johnson for regular shows and surprise drop-ins — and by keeping things fresh with a rotating stable of regular and one- off shows. Page 6Eventbrite Q4 2023 Shareholder Letter

We strengthened our consumer brand and experience in the fourth quarter as we focused on elevating the appeal of our marketplace. Eventbrite helped over 29 million ticket buyers find and attend events from our diverse catalog during the quarter. We won new, large events in key cities and categories over this period, reflective of our emphasis on event scale and quality. An improving consumer web and mobile app experience is also helping us effectively showcase events. For example, better curation and targeted marketing has made Nightlife one of our highest purchase converting pages in the fourth quarter. Meanwhile, travelers and staycationers alike can now plan and browse for events near popular points of interest with new search filters. Our collaboration with TikTok and Instagram influencers also produced encouraging results for holiday campaigns and we plan to continue leveraging this playbook for future seasonal moments. We are focused on building on these successes and growing our share of the consumer market to become the leading destination for live events discovery. Dino Fest It’s no secret: kids love dinosaurs. So imagine their delight when the prehistoric creatures come roaring into town with the hugely popular touring attraction DinoFest. Held in outdoor venues such as botanical gardens and parks across Australia and New Zealand, the attraction transports attendees back to the Jurassic and Cretaceous periods. DinoFest ticket sales have been dino-mite (excuse the pun) since joining Eventbrite in 2023, with 65,706 ticket sales in under a year and 32% of sales coming from Eventbrite channels. In its first year alone, DinoFest has already become one of the most popular Australian creators on Eventbrite! Milk and Cookies Since 2015, Milk & Cookies has been an influential force in the concert and live events industry, captivating audiences with unforgettable performances from renowned musical acts. Now, newly in partnership with Eventbrite since 2023, they have sold thousands of tickets — with 27% driven by Eventbrite and EventbriteAds. Milk & Cookies’ love for music manifests in many different ways, as they partner with conferences, corporations, and global brands to create mesmerizing experiences via stage production, marketing campaigns, and more. In 2024, they plan to launch the Milk & Cookies Festival in Atlanta, expanding their immersive world to new audiences. Page 7Eventbrite Q4 2023 Shareholder Letter

Lastly, we believe our brand ubiquity, consumer reach, and trusted marketplace continued to positively influence ticket sales for events listed on Eventbrite in the fourth quarter. In an effort to bring the definition of Eventbrite-driven tickets in-line with standard market practices, we recently updated our attribution methodology by introducing creator affiliate codes. Previously we tracked only Eventbrite-driven tickets through direct channels and our mobile app, which did not fully distinguish our search engine optimization, content distribution, and other marketing efforts from creators’ own marketing. Starting in 2023, we added affiliate codes for creators to use in their direct advertising and promotional activities, providing new visibility into our demand funnel and Eventbrite-driven demand. Under this new methodology, Eventbrite-driven tickets accounted for 47% of paid ticket volume in the fourth quarter. These refinements better clarify the value to creators of listing events on Eventbrite, helping us drive creator success and growth over time. Summary In 2023, we significantly enhanced the performance of our two-sided marketplace, helping creators drive more event success and changing how consumers use Eventbrite for event discovery. By executing on our marketplace strategy, we achieved record quarterly revenue, diversified our revenue base, and made further progress toward profitability. We are poised to make more strides on our consumer and demand generation initiatives in 2024, and are committed to reaccelerating paid ticket growth as we deepen our marketplace differentiation. Thank you for your continued support on this journey and we look forward to updating you on our progress. Sincerely, Julia Hartz CEO Lanny Baker CFO The North Carolina Arboretum Getting back to nature was one of the key trends highlighted in our TRNDS 2024 eport, and cultivating connections between people, plants and places is something The North Carolina Arboretum has plenty of experience in - over 35 years-worth, in fact. Situated amid a 434-acre public garden, the Arboretum is surrounded and crisscrossed by forested coves and meandering creeks in the botanically diverse Southern Appalachian Mountains, one of the most beautiful natural settings in America. Newly signed to Eventbrite in 2023, this creator has already exceeded their expected ticketing revenue by double digits, selling 25,000 tickets last year alone. With 69% of event goers in our survey keen to go green by connecting or immersing themselves in nature this year, the Arboretum is set to reach new heights in 2024 and beyond. Page 8Eventbrite Q4 2023 Shareholder Letter

Financial Discussion Fourth Quarter and Fiscal Year 2023 Results All financial comparisons are on a year-over-year basis unless otherwise noted. Financial statement tables, including the reconciliation of non-GAAP financial measures, can be found at the end of this letter. Net Revenue Net revenue of $87.8 million in the fourth quarter of 2023 was up 23%, benefiting from higher ticketing fees, greater contribution of fees from new pricing plans, and revenue from advertising. Net revenue per paid ticket was $3.64, compared to $2.85 a year ago, while take rate of 10.1% was 183 basis points higher and a fourth consecutive quarterly record. Net revenue per paid ticket included a $0.39 contribution from Eventbrite Ads promoted listings and organizer fees. Net revenue of $326.1 million in fiscal year 2023 was up 25%, driven by year-over-year paid ticket volume growth, higher ticketing and service fees, growth of Eventbrite Ads, and a new revenue stream from the launch of pricing plans and organizer fees in the second half of the year. Net revenue per paid ticket was $3.49 in 2023 compared to $3.00 in 2022, including a $0.20 contribution from marketplace-related revenue. Take rate was 9.2% and rose 119 basis points year-over-year to an all-time high. Q4 2023Q3 2023Q2 2023Q1 2023Q4 2022 $72M $78M $79M $82M $88M Paid Ticket Volume Paid ticket volume of 24.1 million in the fourth quarter of 2023 was down 4%. Our catalog mixed toward smaller events in the quarter and yielded 6% lower average paid tickets per event compared to the prior year quarter. For fiscal 2023, paid ticket volume of 93.4 million grew 7% year-over-year and reached its highest level since 2019. Page 9Eventbrite Q4 2023 Shareholder Letter

Paid ticket volume for events outside of the U.S. represented 41% of total paid tickets in the fourth quarter, slightly higher than 39% in the year-ago period. In fiscal 2023, international paid tickets made up 40% of total volume and grew 10% year-over-year. Gross Profit Gross profit was $61.5 million in the fourth quarter of 2023 and gross margin of 70.1% improved four points year-over-year, both setting quarterly records. Fiscal 2023 gross profit was $223.0 million and gross margin was 68.4%. Gross profit included restructuring and other costs totaling $0.3 million for the fourth quarter and $1.2 million for fiscal 2023. Gross profit impact from restructuring costs in Q4 2023 Restructure expense Total gross profit impact Recorded Amount ($M) (0.3) ($0.3) As reported Q4 2023Q3 2023Q2 2023Q1 2023Q4 2022 $52M $54M $56M $61M $47M Q4 2023Q3 2023Q2 2023Q1 2023Q4 2022 25M 23M 23M 23M 24M Operating Expenses Operating expense was $70.6 million in the fourth quarter of 2023, up 34% year-over- year. For fiscal 2023, operating expense of $264.1 million was up 22% compared to revenue growth of 25%. Reported operating expenses included restructuring and other costs totaling $0.8 million for the fourth quarter and $8.9 million for fiscal 2023. Page 10Eventbrite Q4 2023 Shareholder Letter

OpEx impact from restructuring and other items in Q4 2023 Restructure expense for Product Development Restructure expense for Sales, Marketing, and Support Restructure expense for General & Administrative APO reserve release Litigation matter Increase to upfront impairment reserves Total operating expense impact Recorded Amount ($M) (0.2) (0.1) (0.6) 1.4 (1.2) (0.1) ($0.8) Product development expenses were $25.2 million for the fourth quarter of 2023, and grew 9% year-over-year as we invested in our marketplace and consumer strategy. Looking ahead, we expect to continue to invest in consumer and marketplace functionality to aid paid ticket volume growth and further our strategy. Sales, marketing, and support expenses were $20.8 million in the fourth quarter of 2023 and included a $1.4 million benefit from release of reserves. In the fourth quarter, targeted expansion of our brand and consumer presence and opportunistic seasonal marketing campaigns collectively supported our goal of repositioning as a demand generating marketplace. Additionally, we added sales resources to better compete for and win highly popular events aligned to our marketplace strategy. We expect incremental expense growth in these categories to moderate in coming quarters as our sales and consumer marketing efforts mature. General and administrative expenses were $24.6 million in the fourth quarter of 2023, growing 10% year-over-year, and included $1.9 million in restructuring and other costs. G&A costs grew 12% on a full year basis, the slowest rate of all operating expense categories, and we expect to continue to manage controllable corporate costs as we emphasize efficiency in these functions. Product Development Sales, Marketing & Support General & Administrative $22M $7M $23M $53M Q4 2022 $25M $21M $25M $71M Q4 2023 As reported Page 11Eventbrite Q4 2023 Shareholder Letter

Adjusted EBITDA Adjusted EBITDA of $8.8 million in the fourth quarter of 2023 included $1.1 million in restructuring and other costs. Q4 2023Q3 2023Q2 2023Q1 2023Q4 2022 $2M $6M $11M $11M $9M $2M Balance Sheet and Cash Flow Cash and cash equivalents totaled $489.2 million at the end of the fourth quarter of 2023, down from $567.6 million as of September 30, 2023. To evaluate Eventbrite’s liquidity, the company adds funds receivable from ticket sales within the last five business days of the period to creator advances, short-term investments, and cash and cash equivalents, and then reduces the balance by funds payable and creator payables. On that basis, the company’s available liquidity as of December 31, 2023 was $391.1 million compared to $380.7 million as of September 30, 2023. Long-term debt as of December 31, 2023 was $357.7 million compared to $357.1 million as of September 30, 2023. Adj. EBITDA impact from restructuring and other items in Q4 Impact to Cost of net revenue Impact to Operating expense Total Adjusted EBITDA impact Available Liquidity as of Q4 2023 Cash and cash equivalents Funds receivable Short term investments Creator advances, net Accounts payable, creators Available liquidity Recorded Amount ($M) Recorded Amount ($M) $489.2 48.8 153.7 2.8 (303.4) (0.3) (0.8) ($1.1) $391.1 As reported Net Income (Loss) Net loss was ($0.9) million for the fourth quarter of 2023 compared with net income of $4 million in the same period in 2022. Q4 2023Q3 2023Q2 2023Q1 2023Q4 2022 ($13M) ($3M) ($1M) $4M ($10M) Page 12Eventbrite Q4 2023 Shareholder Letter

Business Outlook Based upon current information, we anticipate first quarter 2024 net revenue will be within a range of $84 million to $87 million and full year 2024 net revenue will be within a range of $359 million to $372 million. We expect Adjusted EBITDA margin to be in the low- to mid-teens for the full year 2024, excluding the impact of restructuring costs, reserve adjustments, and other items. *We have not provided an outlook for GAAP net income (loss) or GAAP net income (loss) margin or reconciliations of expected Adjusted EBITDA to GAAP net income (loss) or expected Adjusted EBITDA margin to GAAP net income (loss) margin, because GAAP net income (loss) and GAAP net income (loss) margin on a forward-looking basis are not available without unreasonable efforts due to the potential variability and complexity of the items that are excluded from Adjusted EBITDA and Adjusted EBITDA margin, such as share-based compensation expense, foreign exchange loss, and other non-recurring expenses. Page 13Eventbrite Q4 2023 Shareholder Letter

About Eventbrite Eventbrite is a global self-service ticketing, marketing, and experience technology platform that connects hundreds of thousands of event creators with audiences in nearly 180 countries. Since inception, Eventbrite has been at the center of the experience economy, transforming the way people organize and attend events. The company was founded by Julia Hartz, Kevin Hartz and Renaud Visage, with a vision to build a highly- scalable self-service platform that would make it possible for anyone to create, promote and sell tickets to live experiences. Eventbrite enables creators to grow their audience reach and generate demand for events, while also helping event seekers find experiences ranging from annual culinary festivals to professional webinars to weekly yoga workshops. With over 300 million tickets distributed for over 5 million total events in 2023, Eventbrite is where people all over the world discover new things to do or new ways to do more of what they love. Eventbrite has also earned industry recognition as a top employer with special designations that include coveted spots on Fast Company’s prestigious The World’s 50 Most Innovative Companies and Fast Company’s Brands That Matter lists, the Great Place to Work® Award in the U.S., and Inc.'s Best-Led Companies honor. Learn more at www.eventbrite.com. Page 14Eventbrite Q4 2023 Shareholder Letter

Forward-Looking Statements This letter contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that involve substantial risks and uncertainties. All statements other than statements of historical fact could be deemed forward-looking, including, but not limited to, statements regarding the future performance of Eventbrite, Inc. and its consolidated subsidiaries (the “Company”); the Company’s business model and investments to support growth, including the Company’s marketplace strategy and impact on results; the Company’s expectations regarding the development of its marketplace and products; the Company’s long-term growth strategy, growth areas, pursuit of profitability, operating expenses, and investment initiatives and focus areas; the Company’s expectations with respect to its operating model, financial results and trends; and the Company’s expectations described under “Business Outlook” above. In some cases, forward- looking statements can be identified by terms such as “may,” “will,” “appears,” “shall,” “should,” “expects,” “plans,” “anticipates,” “could,” “intends,” “target,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential,” or “continue,” or the negative of these words or other similar terms or expressions that concern the Company’s expectations, strategy, plans, or intentions. Such statements are subject to a number of known and unknown risks, uncertainties, assumptions, and other factors that may cause the Company’s actual results, performance, or achievements to differ materially from results expressed or implied in this letter, including those more fully described in the Company’s filings with the Securities and Exchange Commission, including the Company’s Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. Further information on potential risks that could affect actual results will be included in the subsequent periodic and current reports and other filings that the Company makes with the Securities and Exchange Commission from time to time. Investors are cautioned not to place undue reliance on these statements. Actual results could differ materially from those expressed or implied. All forward-looking statements are based on information and estimates available to the Company at the time of this letter, and are not guarantees of future performance, and reported results should not be considered as an indication of future performance. Except as required by law, the Company assumes no obligation to update any of the statements in this letter. Disclaimer Regarding Ticketing and Creator Metrics This letter includes certain measures related to our ticketing business, such as free and paid tickets, paid creators, paid buyers, and Eventbrite Boost and Ads. We believe that the use of these metrics is helpful to our investors as these metrics are used by management in assessing the health of our business and our operating performance. These metrics are based on what we believe to be reasonable estimates for the applicable period of measurement. There are inherent challenges in measuring these metrics, and we regularly review and may adjust our processes for calculating our internal metrics to improve their accuracy. You should not consider these metrics in isolation or as substitutes for analysis of our results of operations as reported under GAAP. About Non-GAAP Financial Measures We believe that the use of Adjusted EBITDA, Adjusted EBITDA margin and Available Liquidity is helpful to our investors in understanding and evaluating our results of operations and useful measures for period-to-period comparisons of our business performance as they are metrics used by management in assessing the health of our business and our operating performance, making operating decisions, and performing strategic planning and annual budgeting. These measures are not prepared in accordance with GAAP and have limitations as an analytical tool, and you should not consider them in isolation or as a substitute for analysis of our results of operations as reported under GAAP. In addition, other companies may not calculate non-GAAP financial measures in the same manner as we calculate them, limiting their usefulness as comparative measures. You are encouraged to evaluate the adjustments and the reasons we consider them appropriate. Some amounts in this shareholder letter may not sum due to rounding. Adjusted EBITDA We calculate Adjusted EBITDA as net income (loss) adjusted to exclude depreciation and amortization, stock-based compensation expense, interest income, interest expense, employer taxes related to employee transactions and other (income) expense net, and income tax provision (benefit). Adjusted EBITDA should not be considered as an alternative to net income (loss) or any other measure of financial performance calculated and presented in accordance with GAAP. Some of the limitations of Adjusted EBITDA include (i) Adjusted EBITDA does not properly reflect capital spending that occurs off of the income statement or account for future contractual commitments, (ii) although depreciation and amortization are non-cash charges, the underlying assets may need to be Page 15Eventbrite Q4 2023 Shareholder Letter

replaced and Adjusted EBITDA does not reflect these capital expenditures and (iii) Adjusted EBITDA does not reflect the interest and principal required to service our indebtedness. In evaluating Adjusted EBITDA, you should be aware that in the future we expect to incur expenses similar to the adjustments in this letter. Our presentation of Adjusted EBITDA should not be construed as an inference that our future results will be unaffected by these expenses or any unusual or non-routine items. When evaluating our performance, you should consider Adjusted EBITDA alongside other financial performance measures, including our net income (loss) and other GAAP results. Adjusted EBITDA Margin Adjusted EBITDA Margin is defined as Adjusted EBITDA divided by net revenue. Because of the limitations described above, you should consider Adjusted EBITDA and Adjusted EBITDA Margin alongside other financial performance measures, including net income (loss) and our other GAAP results. Available Liquidity To evaluate Eventbrite’s liquidity, the Company adds funds receivable from ticket sales within the last five business days of the period to creator advances, short-term investments, and cash and cash equivalents, and then reduces the balance by funds payable and creator payables. Page 16Eventbrite Q4 2023 Shareholder Letter

Net revenue Cost of net revenue(1) Gross profit Operating expenses (1): Product development Sales, marketing and support General and administrative Total operating expenses Loss from operations Interest income Interest expense Other income (expense), net Profit (Loss) before income taxes Income tax provision Net income (loss) Net income (loss) per share, basic and diluted Weighted-average number of shares outstanding used to compute net loss per share, basic and diluted Cost of net revenue Product development Sales, marketing and support General and administrative Total 87,764 26,265 61,499 25,203 20,772 24,588 70,563 (9,064) 7,547 (2,826) 3,565 (778) 159 (937) (0.01) 101,097 206 5,875 2,417 5,397 13,895 $ $ $ $ 184 4,447 2,237 5,870 12,738 $ $ $ $ $ $ 71,539 24,281 47,258 23,038 7,426 22,377 52,841 (5,583) 4,025 (2,808) 8,546 4,180 167 4,013 0.04 98,956 Consolidated Statements of Operations ($ in thousands, except per share data)(unaudited) Three Months Ended December 31, 2023 2022 326,134 103,130 223,004 98,294 74,574 91,269 264,137 (41,133) 27,495 (11,185) 335 (24,488) 1,991 (26,479) (0.26) 100,299 842 21,018 9,455 23,741 55,056 $ $ $ $ 809 19,686 8,302 24,559 53,356 $ $ $ $ $ $ 260,927 90,746 170,181 86,346 49,292 81,285 216,923 (46,742) 6,432 (11,269) (3,679) (55,258) 126 (55,384) (0.56) 98,305 Year Ended December 31, 2023 2022 (1) Includes stock-based compensation as follows: Page 17Eventbrite Q4 2023 Shareholder Letter

Assets Current assets Cash and cash equivalents Funds receivable Short-term investments, at amortized cost Accounts receivable, net Creator signing fees, net Creator advances, net Prepaid expenses and other current assets Total current assets Restricted cash Creator signing fees, noncurrent Property and equipment, net Operating lease right-of-use assets Goodwill Acquired intangible assets, net Other assets Total assets Liabilities and Stockholders’ Equity Current liabilities Accounts payable, creators Accounts payable, trade Chargebacks and refunds reserve Accrued compensation and benefits Accrued taxes Operating lease liabilities Other accrued liabilities Total current liabilities Accrued taxes, noncurrent Operating lease liabilities, noncurrent Long-term debt Other liabilities Total liabilities Stockholders’ equity Common stock, at par Additional paid-in capital Accumulated deficit Total stockholders' equity Total liabilities and stockholders' equity 489,200 48,773 153,746 2,814 634 2,804 13,880 711,851 — 1,303 9,384 177 174,388 13,314 2,913 913,330 303,436 1,821 8,088 17,522 8,796 1,523 16,425 357,611 4,526 1,768 357,668 — 721,573 1 1,007,190 (815,434) 191,757 913,330 $ $ $ $ $ $ $ $ 539,299 43,525 84,224 2,266 645 721 12,479 683,159 875 1,103 6,348 5,179 174,388 21,907 2,420 895,379 309,313 1,032 13,136 11,635 12,515 2,810 10,538 360,979 8,820 3,345 355,580 100 728,824 1 955,509 (788,955) 166,555 895,379 Consolidated Balance Sheets ($ in thousands)(unaudited) December 31, December 31, 2023 2022 Page 18Eventbrite Q4 2023 Shareholder Letter

Cash flows from operating activities Net loss Adjustments to reconcile net loss to net cash provided by operating activities: Depreciation and amortization Stock-based compensation expense Amortization of creator signing fees Non-cash operating lease expense Amortization of debt discount and issuance costs Unrealized (gain) loss on foreign currency exchange Accretion on short-term investments Changes related to creator advances, creator signing fees, and allowance for credit losses Provision for chargebacks and refunds Other Changes in operating assets and liabilities, liabilities, net of impact of acquisitions: Accounts receivable Funds receivable Creator signing fees and creator advances Prepaid expenses and other assets Accounts payable, creators Accounts payable, trade Chargebacks and refunds reserve Accrued compensation and benefits Accrued taxes Operating lease liabilities Other accrued liabilities Net cash provided by operating activities Cash flows from investing activities Purchase of short-term investments Maturities of short-term investments Purchases of property and equipment Capitalized internal-use software development costs Cash paid for acquisitions, net of cash acquired Net cash used in investing activities Cash flows from financing activities Proceeds from exercise of stock options Purchases under employee stock purchase plan Taxes paid related to net share settlement of equity awards Other Net cash used in financing activities (26,479) 13,760 55,056 980 5,137 2,088 (2,703) (7,362) (1,340) 12,435 1,161 (1,352) (4,692) (1,108) (1,894) (8,599) 822 (17,483) 5,887 (8,707) (2,999) 6,410 19,018 (370,160) 308,000 (1,097) (6,073) - (69,330) 1,297 1,137 (7,342) - (4,908) $ $ (55,384) 14,860 53,356 1,189 3,423 2,016 6,013 (298) (2,727) 8,126 835 (2,221) (25,550) 4,405 4,734 31,358 (57) (16,385) 725 (3,170) (4,301) (12,337) 8,610 (83,926) - (1,425) (3,026) (1,125) (89,502) 3,146 1,437 (6,591) (71) (2,079) Consolidated Statements of Cash Flows ($ in thousands)(unaudited) Year Ended December 31, 2023 2022 Page 19Eventbrite Q4 2023 Shareholder Letter

Effect of exchange rate changes on cash, cash equivalents and restricted cash Net decrease in cash, cash equivalents and restricted cash Cash, cash equivalents and restricted cash Beginning of period End of period Supplemental cash flow data Interest paid Income taxes paid, net of refunds Non-cash investing and financing activities Reduction of right of use asset due to modification or exit Purchases of property and equipment, accrued but unpaid $ $ $ $ $ $ Consolidated Statements of Cash Flows (cont.) ($ in thousands)(unaudited) Year Ended December 31, 2023 2022 4,246 (50,974) 540,174 489,200 9,086 902 3,917 30 (13,014) (95,985) 636,159 540,174 9,236 748 2,223 63 Page 20Eventbrite Q4 2023 Shareholder Letter

Net revenue Paid ticket volume Revenue per paid ticket Net Income (Loss) Add: Depreciation and amortization Stock-based compensation Interest income Interest expense Employer taxes related to employee equity transactions Other (income) expense, net Income tax provision (benefit) Adjusted EBITDA Adjusted EBITDA Margin Restructuring and other items Included in Net Income (Loss) and Adjusted EBITDA: Restructuring costs Processing fees credit APO reserve release Creator upfront reserves release Litigation settlement 87,764 24,101 3.64 (937) 3,826 13,895 (7,547) 2,826 140 (3,565) 159 8,797 10 1,162 — (1,393) 148 1,165 1,082 4,013 3,801 12,738 (4,025) 2,808 115 (8,546) 167 11,071 15 — — (7,000) (1,170) 484 (7,686) (26,479) 13,760 55,056 (27,495) 11,185 972 (335) 1,991 28,655 9 16,294 (781) (4,393) (2,155) 1,165 10,130 (55,384) 14,860 53,356 (6,432) 11,269 849 3,679 126 22,323 9 — — (7,000) (3,818) 484 (10,334) 71,539 25,110 2.85 $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ Key Operating Metrics and Non-GAAP Financial Measures (In thousands, except per ticket data)(Unaudited) Three Months Ended December 31, 2023 2022 326,134 93,443 3.49 260,927 87,056 3.00 $ $ $ $ Year Ended December 31, 2023 2022 Adjusted EBITDA Reconciliation % % % % Page 21Eventbrite Q4 2023 Shareholder Letter

Net Loss Add: Depreciation and amortization Stock-based compensation Interest income Interest expense Employer taxes related to employee equity transactions Other (income) expense, net Income tax provision (benefit) Adjusted EBITDA 3,515 12,094 (5,453) 2,752 356 953 611 2,142 3,193 14,599 (6,926) 2,786 203 (80) 459 11,313 3,226 14,468 (7,569) 2,821 273 2,357 762 6,403 $ $ $ $ $ $ (12,686) (2,921) (9,935) Adjusted EBITDA Reconciliation (In thousands)(Unaudited) Three Months Ended March 31 Three Months Ended June 30 Three Months Ended September 30 2023 2023 2023 Page 22Eventbrite Q4 2023 Shareholder Letter

v3.24.0.1

Cover

|

Feb. 27, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 27, 2024

|

| Entity Registrant Name |

EVENTBRITE, INC.

|

| Entity Central Index Key |

0001475115

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-38658

|

| Entity Tax Identification Number |

14-1888467

|

| Entity Address, Address Line One |

95 Third Street, 2nd Floor,

|

| Entity Address, City or Town |

San Francisco

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94103

|

| City Area Code |

415

|

| Local Phone Number |

692-7779

|

| Title of 12(b) Security |

Class A common stock, par value $0.00001 per share

|

| Trading Symbol |

EB

|

| Security Exchange Name |

NYSE

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

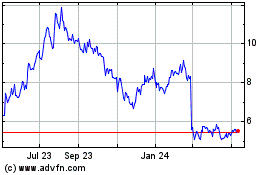

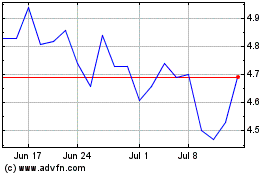

Eventbrite (NYSE:EB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Eventbrite (NYSE:EB)

Historical Stock Chart

From Apr 2023 to Apr 2024