Filed pursuant to Rule 424(b)(3)

Registration Statement No. 333-258942

Prospectus Supplement No. 5

(To Prospectus dated March 30, 2022)

Doma Holdings, Inc.

UP TO 17,333,333 SHARES OF COMMON STOCK ISSUABLE UPON

THE EXERCISE OF WARRANTS

UP TO 265,389,572 SHARES OF COMMON STOCK

UP TO 5,833,333 WARRANTS

This prospectus supplement updates, amends and supplements the prospectus dated March 30, 2022 (as supplemented or amended from time to time, the “Prospectus”), which forms a part of our Registration Statement on Form S-1 (Registration No. 333-258942). Capitalized terms used in this prospectus supplement and not otherwise defined herein have the meanings specified in the Prospectus.

The Prospectus and this prospectus supplement relate to: (1) the issuance by us of up to 17,333,333 shares of common stock that are issuable upon the exercise of the warrants consisting of (i) up to 11,500,000 shares of common stock that are issuable upon the exercise of the public warrants and (ii) up to 5,833,333 shares of common stock that are issuable upon the exercise of the private placement warrants and (2) the offer and sale, from time to time, by the Selling Securityholders identified in the Prospectus, or their permitted transferees, of (a) up to 265,389,572 shares of common stock, consisting of (i) up to 10,309,215 PIPE shares; (ii) up to 224,250,982 of Old Doma stockholder shares; (iii) up to 5,302,659 Sponsor shares; (iv) up to 5,833,333 shares of common stock issuable upon the exercise of the private placement warrants; (v) up to 1,024,912 shares of exchanged restricted common stock; (vi) up to 4,602,844 shares of common stock reserved for issuance upon the exercise of options; (vii) up to 12,739,963 Earnout Shares; and (viii) up to 1,325,664 Sponsor Covered Shares and (b) up to 5,833,333 private placement warrants.

This prospectus supplement is being filed to update, amend and supplement the information included in the Prospectus with the information contained or incorporated by reference below.

This prospectus supplement is not complete without the Prospectus. This prospectus supplement should be read in conjunction with the Prospectus, which is to be delivered with this prospectus supplement, and is qualified by reference thereto, except to the extent that the information in this prospectus supplement updates or supersedes the information contained in the Prospectus. If there is any inconsistency between the information in the Prospectus and this prospectus supplement, you should rely on the information in this prospectus supplement. Please keep this prospectus supplement with your Prospectus for future reference.

We are a “smaller reporting company” and “emerging growth company” as defined in Section 2(a) of the Securities Act of 1933, as amended, and are subject to reduced reporting requirements.

Doma Holdings, Inc.’s common stock and warrants are quoted on the New York Stock Exchange under the symbols “DOMA” and “DOMA.WS,” respectively. On July 7, 2022, the closing prices of our common stock and warrants were $0.95 and $0.13, respectively.

INVESTING IN OUR SECURITIES INVOLVES CERTAIN RISKS. SEE “RISK FACTORS” BEGINNING ON PAGE 13 OF THE PROSPECTUS. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if the Prospectus or this prospectus supplement is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is July 8, 2022

_________________________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (date of earliest event reported): July 7, 2022

(Exact name of Registrant, as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-39754 | | 84-1956909 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification Number) |

101 Mission Street, Suite 740

San Francisco, California 94105

(Address of principal executive offices) (Zip code)

650-419-3827

(Registrant's telephone number, including area code)

Not Applicable

(Former name or address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common stock, par value $0.0001 per share | | DOMA | | The New York Stock Exchange |

| Warrants to purchase common stock | | DOMA.WS | | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

At the Annual Meeting of Stockholders (the “Annual Meeting”) of Doma Holdings, Inc. (the “Company”) held on Thursday, July 7, 2022, the Company’s stockholders approved the Amended and Restated Omnibus Incentive Plan (the “Omnibus Incentive Plan”). The Omnibus Incentive Plan had previously been approved by the Company’s Board of Directors, subject to stockholder approval. The Omnibus Incentive Plan provides for grants of stock options (both nonqualified and incentive stock options), stock appreciation rights, restricted stock units, performance awards and other cash- and stock-based awards to the Company’s employees and non-employee directors.

The principal features of the Omnibus Incentive Plan are described in detail under “Proposal No. 3 –Approval of the Amended and Restated Omnibus Incentive Plan” of the Company’s Definitive Proxy Statement on Schedule 14A for the Annual Meeting filed by the Company with the Securities and Exchange Commission (the “SEC”) on May 27, 2022 (the “Proxy Statement”). The description of the principal features of the Omnibus Incentive Plan included in the Proxy Statement is incorporated by reference in this Current Report on Form 8-K. The foregoing description of the principal features of the Omnibus Incentive Plan is qualified in its entirety by reference to the full text of the Omnibus Incentive Plan, which is filed as Exhibit 10.1 and incorporated by reference in this Current Report on Form 8-K.

Item 5.07 Submission of Matters to a Vote of Security Holders.

On July 7, 2022, the Company held the Annual Meeting. At the Annual Meeting, the following proposals were submitted to a vote of the Company’s stockholders, with the voting results indicated below:

Proposal No. 1 – Election of Directors. The Company’s stockholders elected the following three Class II directors to hold office until the 2025 Annual Meeting of Stockholders or until their successors have been duly elected and qualified.

| | | | | | | | | | | |

| Name | For | Withheld | Broker Non-Votes |

| Stuart Miller | 213,296,621 | 4,085,004 | 43,613,384 |

| Charles Moldow | 214,411,773 | 2,969,852 | 43,613,384 |

| Karen Richardson | 210,496,901 | 6,884,724 | 43,613,384 |

Proposal No. 2 – Ratification of the Appointment of Deloitte & Touche LLP. The Company’s stockholders ratified the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2022.

| | | | | | | | | | | |

| For | Against | Abstain | Broker Non-Votes |

| 260,825,409 | 143,996 | 25,604 | -- |

Proposal No. 3 – Approval of the Omnibus Incentive Plan. The Company’s stockholders approved the Omnibus Incentive Plan.

| | | | | | | | | | | |

| For | Against | Abstain | Broker Non-Votes |

| 199,913,101 | 17,405,569 | 62,955 | 43,613,384 |

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | |

| Exhibit No. | |

| 10.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: July 8, 2022

| | | | | | | | |

| | |

| | | |

| | By: | /s/ Eric Watson |

| | Name: | Eric Watson |

| | Title: | General Counsel & Secretary |

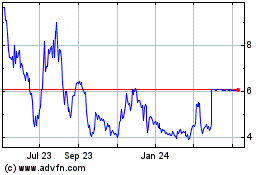

Doma (NYSE:DOMA)

Historical Stock Chart

From Mar 2024 to Apr 2024

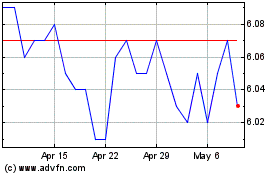

Doma (NYSE:DOMA)

Historical Stock Chart

From Apr 2023 to Apr 2024