Management reaffirms commitment to achieving

EBITDA profitability in 2023 as the company continues to focus on

delivering differentiated value to the home purchase market

First Quarter 2022 Business Highlights(1):

- Market share of 1.4%, up 40% versus Q1 2021(2)

- Total revenues of $112 million, down (12)% versus Q1 2021

- Retained premiums and fees of $52 million, down (10)% versus Q1

2021

- Gross profit of $7 million, down (73)% versus Q1 2021

- Adjusted gross profit of $10 million, down (64)% versus Q1

2021

- Closed orders down (16)% versus Q1 2021, Enterprise closed

orders up 38% versus Q1 2021

- Open orders down (14)% versus Q1 2021

Doma Holdings, Inc. (NYSE: DOMA) ("Doma" or the "Company"), a

leading force for disruptive change in the real estate industry,

today reported quarterly financial results and key operating data

for the three months ended March 31, 2022(3). Doma’s results

demonstrate further market share gains led by the continued

adoption of its proprietary, machine intelligence-driven

technology, despite the US mortgage industry's dramatic shift into

an environment of rapidly rising interest rates and extraordinarily

low housing supply.

"Doma's mission is, and always has been, to make it easier for

people to buy a home," said Max Simkoff, CEO of Doma. "The recent

shifts in the mortgage industry have only emphasized the need to

deliver a better, faster, and more affordable home closing

experience, and Doma's market share gains are continued proof that

the industry sees value in our proprietary, machine learning-driven

technology that is transforming the closing process. Our Q1 2022

results reflect the downturn we are seeing in the broader market,

but this also gives us the conviction that our investment in moving

purchase transactions onto the Doma Intelligence platform is

absolutely one that will benefit home buyers and sellers, real

estate professionals, and lenders in a unique and differentiated

way."

Doma's year over year decline in retained premiums and fees

reflects the challenges faced by the overall mortgage market, which

saw a steep decline in refinance transactions in Q1 2022 and a

tightening purchase market. Doma's market share gains were driven

by outperformance in refinance transactions which were down 20%

year over year, compared to the industry's 63% decline. In

anticipation of further market challenges throughout the remainder

of the year, Doma took steps in Q1 2022 to protect its path to

achieve EBITDA profitability in 2023 by reducing costs and

refocusing resources on a narrower set of strategic initiatives

which will allow the Company to aggressively focus on the

transition of additional purchase transactions onto the Doma

Intelligence platform.

"While we believe the mortgage market will continue to face

significant challenges this year, we are confident in our ability

to continue to drive market share gains in both the refinance and

purchase markets," said Mike Smith, Chief Accounting Officer and

future Acting Chief Financial Officer at Doma. "In an environment

of rising interest rates and low housing inventory, Doma's value

proposition becomes even more attractive to lenders and real estate

professionals who are looking to close loans faster and minimize

costs for home buyers and sellers."

(1)

Reconciliations of retained premiums and

fees, adjusted gross profit, and the other financial measures used

in this press release that are not calculated in accordance with

generally accepted accounting principles in the United States

(“GAAP”) to the nearest measures prepared in accordance with GAAP

have been provided in this press release in the accompanying

tables. An explanation of these measures is also included below

under the heading “Non-GAAP Financial Measures.”

(2)

To calculate market share, Doma's purchase

and refinance closed orders are divided by total industry purchase

and refinance closed order statistics as published by the Mortgage

Bankers Association.

(3)

Doma completed its business combination

with Capitol Investment Corp. V ("Capitol") on July 28, 2021. The

financial results and key operating data included in this first

quarter release include operating results of Doma prior to

completion of the business combination and operating results of the

combined company subsequent to completion of the business

combination.

First Quarter 2022 Growth Drivers and Recent Business

Highlights

- Market share growth of 40% year over year, climbing to 1.4% in

Q1 2022 vs. 1.0% in Q1 2021

- Strong outperformance in refinance order volume in our

enterprise segment, representing closed order growth of 38% year

over year, driven by the continued adoption of our Doma

Intelligence technology among lender referral partners, including

by 11 new bank and non-bank mortgage originators and the expansion

of existing enterprise business into new states

- A refocusing of resources to a narrower set of strategic

initiatives that will allow the Company to target investment almost

exclusively within the home purchase market and drive

differentiated, tech-led value to home buyers and sellers in a time

when interest rates have risen at a rate not seen in 28 years and

where housing inventory remains at historic lows, including:

- The exploration of a Doma Intelligence-driven purchase offering

for existing and new lender referral partners.

- Significant reductions in cost structure across the Company to

align with reduced refinance volume and investment in moving

additional purchase transactions onto the Doma Intelligence

platform. This includes the recent workforce reduction that will

result in approximately $4 million of second quarter charges but an

overall annualized compensation expense savings of approximately

$30 million.

- A re-scoped and streamlined investment plan across efforts to

expand into home warranty and appraisal; and

- Optimization of customer acquisition strategies and geographic

expansion within the home purchase market that facilitate faster

and more cost-effective growth.

- Management affirmation that the Company remains on its

previously communicated timeline to achieve adjusted EBITDA

profitability in 2023

- Named as one of Inc.'s Best Workplaces of 2022, for the second

year in a row

2022 Full Year Outlook (1):

- GAAP Financial Measures

- For the full year, Doma expects gross profit of between $71

million and $86 million

- Non-GAAP Financial Measures

- Doma expects retained premiums and fees of between $220 million

and $240 million

- Doma expects ratio of adjusted gross profit to retained

premiums and fees between 39% and 42%

- Doma expects adjusted EBITDA between negative $120 million and

negative $100 million

- Doma intends to reach adjusted EBITDA positive in 2023

Non-GAAP Financial Measures

Some of the financial information and data contained in this

press release, such as retained premiums and fees, adjusted gross

profit and adjusted EBITDA, have not been prepared in accordance

with United States generally accepted accounting principles

("GAAP"). Retained premiums and fees is defined as revenue less

premiums retained by third-party agents. Adjusted gross profit is

defined as gross profit, plus depreciation and amortization.

Adjusted EBITDA is defined as net loss before interest expense,

income taxes, depreciation and amortization, stock-based

compensation and change in fair value of warrant and sponsor

covered shares liabilities. Doma believes that the use of retained

premiums and fees, adjusted gross profit and adjusted EBITDA

provides additional tools to assess operational performance and

trends in, and in comparing Doma's financial measures with, other

similar companies, many of which present similar non-GAAP financial

measures to investors. Doma’s non-GAAP financial measures may be

different from non-GAAP financial measures used by other companies.

The presentation of non-GAAP financial measures is not intended to

be considered in isolation or as a substitute for, or superior to,

financial measures determined in accordance with GAAP. Because of

the limitations of non-GAAP financial measures, you should consider

the non-GAAP financial measures presented herein in conjunction

with Doma’s financial statements and the related notes thereto.

Please refer to the non-GAAP reconciliations in this press release

for a reconciliation of these non-GAAP financial measures to the

most comparable financial measure prepared in accordance with

GAAP.

Conference Call Information

Doma will host a conference call at 5:00 PM Eastern Time on

Tuesday, May 10, to present its first quarter 2022 financial

results.

The telephonic version of the call can be

accessed by dialing:

Participant Toll Free Dial-In Number: (844)

615-6508

Participant International Dial-In Number:

(918) 922-3146

Conference ID: 5534256

The live webcast of the call will be accessible on the Company’s

website at investor.doma.com. Approximately two hours after

conclusion of the live event, an archived webcast of the conference

call will be accessible from the Investor Relations section of the

Company’s website for twelve months.

About Doma Holdings, Inc.

Doma is a real estate technology company that is disrupting a

century-old industry by building an instant and frictionless home

closing experience for buyers and sellers. Doma uses proprietary

machine intelligence technology and deep human expertise to create

a vastly more simple and affordable experience for everyone

involved in a residential real estate transaction, including

current and prospective homeowners, mortgage lenders, title agents,

and real estate professionals. With Doma, what used to take days

can now be done in minutes, replacing an arcane and cumbersome

process with a digital experience designed for today’s world. To

learn more visit doma.com.

Forward-Looking Statements Legend

This press release includes “forward-looking statements” within

the meaning of the “safe harbor” provisions of the United States

Private Securities Litigation Reform Act of 1995. Forward-looking

statements may be identified by the use of words such as

"estimate," "plan," "project," "forecast," "intend," "will,"

"expect," "anticipate," "believe," "seek," "target" or other

similar expressions that predict or indicate future events or

trends or that are not statements of historical matters. The

absence of these words does not mean that a statement is not

forward-looking. Such statements are based on the beliefs of, as

well as assumptions made by information currently available to Doma

management. These forward-looking statements include, but are not

limited to, statements regarding estimates and forecasts of

financial and performance metrics, projections of market

opportunity, total addressable market ("TAM"), market share and

competition. These statements are based on various assumptions,

whether or not identified in this press release, and on the current

expectation of Doma’s management and are not predictions of actual

performance. These forward-looking statements are provided for

illustrative purposes only and are not intended to serve as, and

must not be relied on by any investor as, a guarantee, an

assurance, a prediction or a definitive statement of fact or

probability. Actual events and circumstances are difficult or

impossible to predict, will differ from assumptions and are beyond

the control of Doma.

These forward-looking statements are subject to a number of

risks and uncertainties, including changes in business, market,

financial, political and legal conditions; risks relating to the

uncertainty of the projected financial information with respect to

Doma; future global, regional or local economic, political, market

and social conditions, including due to the COVID-19 pandemic; the

development, effects and enforcement of laws and regulations,

including with respect to the title insurance industry; Doma’s

ability to manage its future growth or to develop or acquire

enhancements to its platform; the effects of competition on Doma’s

future business; the outcome of any potential litigation,

government and regulatory proceedings, investigations and

inquiries; and those other factors described in the "Risk Factors"

section of the documents filed by Doma from time to time with the

SEC.

If any of these risks materialize or Doma’s assumptions prove

incorrect, actual results could differ materially from the results

implied by these forward-looking statements. There may be

additional risks that Doma does not presently know or that Doma

currently believes are immaterial that could also cause actual

results to differ from those contained in the forward-looking

statements. In addition, forward-looking statements reflect Doma’s

expectations, plans or forecasts of future events and views as of

the date of this press release. Doma anticipates that subsequent

events and developments will cause Doma’s assessments to change.

However, while Doma may elect to update these forward-looking

statements at some point in the future, Doma specifically disclaims

any obligation to do so, except as required by law. These

forward-looking statements should not be relied upon as

representing Doma’s assessment as of any date subsequent to the

date of this press release. Accordingly, undue reliance should not

be placed upon the forward-looking statements.

Key Operating and Financial

Indicators

Three Months Ended March

31,

2022

2021

(in thousands, except for open

and closed order numbers)

Key operating data:

Opened orders

35,192

41,084

Closed orders

27,347

32,650

GAAP financial data:

Revenue (1)

$

112,207

$

127,796

Gross profit (2)

$

7,134

$

26,414

Net loss (3)

$

(50,026

)

$

(11,758

)

Non-GAAP financial data (4):

Retained premiums and fees

$

51,605

$

57,458

Adjusted gross profit

$

10,370

$

29,121

Ratio of adjusted gross profit to retained

premiums and fees

20

%

51

%

Adjusted EBITDA

$

(44,905

)

$

(3,277

)

_________________

(1)

Revenue is comprised of (i) net premiums

written, (ii) escrow, other title-related fees and other, and (iii)

investment, dividend and other income.

(2)

Gross profit, calculated in accordance

with GAAP, is calculated as total revenue, minus premiums retained

by third-party agents, direct labor expense (including mainly

personnel expense for certain employees involved in the direct

fulfillment of policies) and direct non-labor expense (including

mainly title examination expense, provision for claims, and

depreciation and amortization). In our consolidated income

statements, depreciation and amortization is recorded under the

“other operating expenses” caption.

(3)

Net loss is made up of the components of

revenue and expenses.

(4)

Retained premiums and fees, adjusted gross

profit and adjusted EBITDA are non-GAAP financial measures.

Non-GAAP Financial Measures

Retained premiums and fees

The following table reconciles our retained

premiums and fees to our gross profit, the most closely comparable

GAAP financial measure, for the periods indicated:

Three Months Ended March

31,

2022

2021

(in thousands)

Revenue

$

112,207

$

127,796

Minus:

Premiums retained by third-party

agents

60,602

70,338

Retained premiums and fees

$

51,605

$

57,458

Minus:

Direct labor

27,798

17,979

Provision for claims

4,611

3,249

Depreciation and amortization

3,236

2,707

Other direct costs (1)

8,826

7,109

Gross Profit

$

7,134

$

26,414

__________________

(1)

Includes title examination expense, office

supplies, and premium and other taxes.

Adjusted gross profit

The following table reconciles our adjusted

gross profit to our gross profit, the most closely comparable GAAP

financial measure, for the periods indicated:

Three Months Ended March

31,

2022

2021

(in thousands)

Gross Profit

$

7,134

$

26,414

Adjusted for:

Depreciation and amortization

3,236

2,707

Adjusted Gross Profit

$

10,370

$

29,121

Adjusted EBITDA

The following table reconciles our adjusted

EBITDA to our net loss, the most closely comparable GAAP financial

measure, for the periods indicated:

Three Months Ended March

31,

2022

2021

(in thousands)

Net loss (GAAP)

$

(50,026

)

$

(11,758

)

Adjusted for:

Depreciation and amortization

3,236

2,707

Interest expense

4,207

3,360

Income taxes

185

125

EBITDA

$

(42,398

)

$

(5,566

)

Adjusted for:

Stock-based compensation

11,393

2,289

Change in fair value of Warrant and

Sponsor Covered shares liabilities

(13,900

)

—

Adjusted EBITDA

$

(44,905

)

$

(3,277

)

The following table reconciles our adjusted

gross profit to our adjusted EBITDA, for the periods indicated:

Three Months Ended March

31,

2022

2021

(in thousands)

Adjusted Gross Profit

$

10,370

$

29,121

Minus:

Customer acquisition costs

15,925

9,895

Other indirect costs (1)

39,350

22,503

Adjusted EBITDA

$

(44,905

)

$

(3,277

)

__________________

(1)

Includes corporate support, research and

development, and other operating costs.

Outlook reconciliations

The following tables reconcile the ranges of

expected retained premiums and fees to expected gross profit and

the ranges expected adjusted gross profit to expected gross profit,

which, in each case, is the most comparable GAAP measure, for the

full year ended December 31, 2022.

Year Ended December 31,

2022

Low

High

(in thousands)

Retained premiums and fees

$

220,000

$

240,000

Minus:

Estimated adjustments (1)

149,000

154,000

Gross Profit

$

71,000

$

86,000

Year Ended December 31,

2022

Low

High

(in thousands)

Gross Profit

$

71,000

$

86,000

Adjusted for:

Depreciation and amortization

15,000

15,000

Adjusted Gross Profit

$

86,000

$

101,000

Outlook for Other Key Operating

Indicators

Ratio of adjusted gross profit to retained

premiums and fees

39

%

42

%

Adjusted EBITDA

$

(120,000

)

$

(100,000

)

With respect to our guidance on adjusted EBITDA, the Company is

not able to provide a quantitative reconciliation without

unreasonable efforts to the most directly comparable GAAP financial

measure, which would be net loss, due to the high variability,

complexity and low visibility with respect to certain items such as

income taxes and changes in the fair value of Warrant and Sponsor

Covered shares liabilities. We expect the variability of these

items to have a potentially unpredictable and potentially

significant impact on future GAAP financial results, and, as such,

we also believe that any reconciliations provided would imply a

degree of precision that would be confusing or misleading to

investors.

__________________

(1)

Estimated adjustments include direct

labor, provision for claims, depreciation and amortization, and

other direct costs (which includes title examination expense,

office supplies, and premium and other taxes).

Doma Holdings, Inc.

Consolidated Statements of

Operations

Three months ended March

31,

(In thousands, except share and per share

information)

2022

2021

Revenues:

Net premiums written (1)

$

95,666

$

107,992

Escrow, other title-related fees and

other

16,113

18,575

Investment, dividend and other income

428

1,229

Total revenues

$

112,207

$

127,796

Expenses:

Premiums retained by Third-Party Agents

(2)

$

60,602

$

70,338

Title examination expense

5,981

4,853

Provision for claims

4,611

3,249

Personnel costs

77,793

43,464

Other operating expenses

22,754

14,165

Total operating expenses

$

171,741

$

136,069

Loss from operations

$

(59,534

)

$

(8,273

)

Other (expense) income:

Change in fair value of Warrant and

Sponsor Covered Shares liabilities

13,900

—

Interest expense

(4,207

)

(3,360

)

Loss before income taxes

$

(49,841

)

$

(11,633

)

Income tax expense

(185

)

(125

)

Net loss

$

(50,026

)

$

(11,758

)

Earnings per share:

Net loss per share attributable to

stockholders - basic and diluted

$

(0.15

)

$

(0.17

)

Weighted average shares outstanding common

stock - basic and diluted

323,890,562

67,418,142

__________________

(1)

Net premiums written includes revenues

from a related party of $27.7 million and $24.7 million during the

three months ended March 31, 2022 and 2021, respectively.

(2)

Premiums retained by Third-Party Agents

includes expenses associated with a related party of $22.5 million

and $19.9 million during the three months ended March 31, 2022 and

2021, respectively.

Doma Holdings, Inc.

Consolidated Balance

Sheets

(In thousands, except share

information)

March 31, 2022

December 31, 2021

Assets

Cash and cash equivalents

$

319,436

$

379,702

Restricted cash

2,784

4,126

Investments:

Fixed maturities

Held-to-maturity debt securities, at

amortized cost (net of allowance for credit losses of $382 at March

31, 2022 and $0 at December 31, 2021)

62,416

67,164

Mortgage loans

1,141

2,022

Other long-term investments

325

325

Total investments

$

63,882

$

69,511

Receivables (net of allowance for credit

losses of $1,226 at March 31, 2022 and $1,082 at December 31,

2021)

12,496

15,498

Prepaid expenses, deposits and other

assets

10,844

15,692

Lease right-of-use assets

26,701

—

Fixed assets (net of accumulated

depreciation of $22,323 at March 31, 2022 and $19,543 at December

31, 2021)

52,801

45,953

Title plants

13,952

13,952

Goodwill

111,487

111,487

Total assets

$

614,383

$

655,921

Liabilities and stockholders’

equity

Accounts payable

$

3,891

$

6,930

Accrued expenses and other liabilities

35,477

54,149

Lease liabilities

27,659

—

Senior secured credit agreement, net of

debt issuance costs and original issue discount

144,858

141,769

Liability for loss and loss adjustment

expenses

82,534

80,267

Warrant liabilities

6,067

16,467

Sponsor Covered Shares liability

1,916

5,415

Total liabilities

$

302,402

$

304,997

Stockholders’ equity:

Common stock, 0.0001 par value;

2,000,000,000 shares authorized at March 31, 2022; 324,348,254 and

323,347,806 shares issued and outstanding as of March 31, 2022 and

December 31, 2021, respectively

33

33

Additional paid-in capital

554,552

543,070

Accumulated deficit

(242,604

)

(192,179

)

Accumulated other comprehensive income

—

—

Total stockholders’ equity

$

311,981

$

350,924

Total liabilities and stockholders’

equity

$

614,383

$

655,921

Quarterly Results of Operations and Other

Data

The following tables set forth our selected

unaudited quarterly consolidated statements of operations data for

each of the quarters indicated. The information for each quarter

has been prepared on a basis consistent with our audited

consolidated financial statements, and reflect, in the opinion of

management, all adjustments, which consist only of a normal,

recurring nature that are necessary for a fair statement of the

financial information contained in those financial statements. Our

historical results are not necessarily indicative of the results

that may be expected in the future. The following quarterly

financial data should be read in conjunction with our consolidated

financial statements.

Consolidated Statements of

Operations

Three Months Ended

(In thousands)

March 31, 2020

June 30, 2020

September 30, 2020

December 31, 2020

March 31, 2021

June 30, 2021

September 30, 2021

December 31, 2021

March 31, 2022

Revenues:

Net premiums written

$

56,817

$

86,334

$

103,587

$

98,870

$

107,992

$

109,271

$

141,491

$

116,598

$

95,666

Escrow, other title-related fees and

other

13,174

13,382

16,742

17,977

18,575

20,065

20,452

20,493

16,113

Investment, dividend and other income

818

707

743

663

1,229

650

639

588

428

Total revenues

$

70,809

$

100,423

$

121,072

$

117,510

$

127,796

$

129,986

$

162,582

$

137,679

$

112,207

Expenses:

Premiums retained by Third-Party

Agents

$

33,102

$

56,006

$

67,024

$

64,011

$

70,338

$

65,181

$

91,596

$

71,330

$

60,602

Title examination expense

3,865

3,322

4,624

4,393

4,853

5,500

5,289

6,495

5,981

Provision for claims

1,783

3,040

5,242

5,272

3,249

6,807

6,685

4,594

4,611

Personnel costs

35,718

32,737

36,197

38,874

43,464

53,954

62,410

78,306

77,793

Other operating expenses

10,640

10,286

10,210

12,149

14,165

17,181

21,693

26,912

22,754

Total operating expenses

$

85,108

$

105,391

$

123,297

$

124,699

$

136,069

$

148,623

$

187,673

$

187,637

$

171,741

Loss from operations

$

(14,299

)

$

(4,968

)

$

(2,225

)

$

(7,189

)

$

(8,273

)

$

(18,637

)

$

(25,091

)

$

(49,958

)

$

(59,534

)

Other income (expense):

Change in fair value of warrant and

Sponsor Covered Shares liabilities

—

—

—

—

—

—

(4,478

)

11,169

13,900

Interest expense

(2,112

)

(1,123

)

(1,193

)

(1,151

)

(3,360

)

(4,451

)

(4,531

)

(4,519

)

(4,207

)

Loss before income taxes

$

(16,411

)

$

(6,091

)

$

(3,418

)

$

(8,340

)

$

(11,633

)

$

(23,088

)

$

(34,100

)

$

(43,308

)

$

(49,841

)

Income tax expense

(175

)

(241

)

(204

)

(223

)

(125

)

(211

)

(170

)

(421

)

(185

)

Net loss

(16,586

)

(6,332

)

(3,622

)

(8,563

)

(11,758

)

(23,299

)

(34,270

)

(43,729

)

(50,026

)

Reconciliation of GAAP to Non-GAAP

Measures

The following tables present our

reconciliation of GAAP measures to non-GAAP measures for the

historical periods indicated.

Retained premiums and fees

Three Months Ended

(In thousands)

March 31, 2020

June 30, 2020

September 30, 2020

December 31, 2020

March 31, 2021

June 30, 2021

September 30, 2021

December 31, 2021

March 31, 2022

Revenue

$

70,809

$

100,423

$

121,072

$

117,510

$

127,796

$

129,986

$

162,582

$

137,679

$

112,207

Minus:

Premiums retained by Third-Party

Agents

33,102

56,006

67,024

64,011

70,338

65,181

91,596

71,330

60,602

Retained premiums and fees

$

37,707

$

44,417

$

54,048

$

53,499

$

57,458

$

64,805

$

70,986

$

66,349

$

51,605

Minus:

Direct labor

16,314

13,898

14,892

17,050

17,979

20,902

23,948

26,787

27,798

Provision for claims

1,783

3,040

5,242

5,272

3,249

6,807

6,685

4,594

4,611

Depreciation and amortization

1,116

899

1,221

2,579

2,707

3,021

1,978

2,615

3,236

Other direct costs(1)

5,137

4,898

6,314

4,186

7,109

7,561

10,073

10,322

8,826

Gross Profit

$

13,357

$

21,682

$

26,379

$

24,412

$

26,414

$

26,514

$

28,302

$

22,031

$

7,134

__________________

(1)

Includes title examination expense, office

supplies, and premium and other taxes.

Adjusted gross profit

Three Months Ended

(in thousands)

March 31, 2020

June 30, 2020

September 30, 2020

December 31, 2020

March 31, 2021

June 30, 2021

September 30, 2021

December 31, 2021

March 31, 2022

Gross Profit

$

13,357

$

21,682

$

26,379

$

24,412

$

26,414

$

26,514

$

28,302

$

22,031

$

7,134

Adjusted for:

Depreciation and amortization

1,116

899

1,221

2,579

2,707

3,021

1,978

2,615

3,236

Adjusted Gross Profit

$

14,473

$

22,581

$

27,600

$

26,991

$

29,121

$

29,535

$

30,280

$

24,646

$

10,370

Adjusted EBITDA

Three Months Ended

(in thousands)

March 31, 2020

June 30, 2020

September 30, 2020

December 31, 2020

March 31, 2021

June 30, 2021

September 30, 2021

December 31, 2021

March 31, 2022

Net loss (GAAP)

$

(16,586

)

$

(6,332

)

$

(3,622

)

$

(8,563

)

$

(11,758

)

$

(23,299

)

$

(34,270

)

$

(43,729

)

$

(50,026

)

Adjusted for:

Depreciation and amortization

1,116

899

1,221

2,579

2,707

3,021

1,978

2,615

3,236

Interest expense

2,112

1,123

1,193

1,151

3,360

4,451

4,531

4,519

4,207

Income taxes

175

241

204

223

125

211

170

421

185

EBITDA

$

(13,183

)

$

(4,069

)

$

(1,004

)

$

(4,610

)

$

(5,566

)

$

(15,616

)

$

(27,591

)

$

(36,174

)

$

(42,398

)

Adjusted for:

Stock-based compensation

308

282

355

1,550

2,289

3,713

3,004

11,040

11,393

COVID-related severance costs

—

1,385

—

—

—

—

—

—

—

Change in fair value of warrant and

Sponsor Covered Shares liabilities

—

—

—

—

—

—

4,478

(11,169

)

(13,900

)

Adjusted EBITDA

$

(12,875

)

$

(2,402

)

$

(649

)

$

(3,060

)

$

(3,277

)

$

(11,903

)

$

(20,109

)

$

(36,303

)

$

(44,905

)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220510005527/en/

Investor Contact: Beatriz Bartolome | Head of Investor

Relations for Doma | ir@doma.com

Media Contact: Camilla Whitmore | Lead, Public Relations

for Doma | press@doma.com

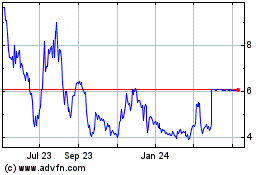

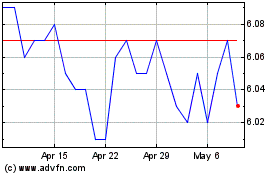

Doma (NYSE:DOMA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Doma (NYSE:DOMA)

Historical Stock Chart

From Apr 2023 to Apr 2024