Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

September 07 2021 - 7:31AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF

FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 or

15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of September 2021

Commission File Number: 001-14946

CEMEX, S.A.B. de C.V.

(Translation of Registrant’s name into English)

Avenida

Ricardo Margáin Zozaya #325, Colonia Valle del Campestre

San Pedro Garza García, Nuevo León, 66265

México

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Contents

On September 7, 2021, CEMEX, S.A.B. de C.V. (NYSE: CX) (“CEMEX”) announced that the company has finalized a sustainability-linked financing

framework (the “Framework”) that establishes CEMEX’s guiding principles when issuing new sustainability linked financing instruments, including public or private notes offerings, loans, derivative transactions, working capital

solutions and other financing instruments. The Framework seeks to further align CEMEX’s corporate sustainability commitments to its financing strategy. Sustainalytics, a leading independent firm that specializes in providing environmental,

social and governance research, ratings, and data to institutional investors and companies, validated the Framework’s alignment with the Sustainability-Linked Bond Principles, the International Capital Market Association’s Climate

Transition Finance Handbook, and the Loan Market Association’s Sustainability-Linked Loan Principles. CEMEX has included the following three key performance indicators in the Framework: (1) net CO2 emissions per ton of cementitious

product, (2) clean electricity consumption and (3) alternative fuels rate, all of which were qualified by Sustainalytics as relevant, material, ambitious, and aligned with CEMEX’s climate action strategy. The Framework is available in

CEMEX’s corporate website in the following link: www.cemex.com/sustainable-finance.

CEMEX assumes no obligation to update or correct the

information contained in this document or the framework referred to herein. This document, as well as the framework referred herein, contains forward-looking statements within the meaning of the U.S. federal securities laws. CEMEX intends these

forward-looking statements to be covered by the safe harbor provisions for forward-looking statements in the U.S. federal securities laws. These forward-looking statements reflect CEMEX’s current expectations and projections about future events

based on CEMEX’s knowledge of present facts and circumstances and assumptions about future events, as well as CEMEX’s current plans based on such facts and circumstances. These statements necessarily involve risks and uncertainties that

could cause actual results to differ materially from CEMEX’s expectations. The content of this document, and the framework herein referred, is for informational purposes only, and you should not construe any such information or other material

as legal, tax, investment, financial, or other advice.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, CEMEX, S.A.B. de C.V. has duly caused this report to be signed on its

behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CEMEX, S.A.B. de C.V.

|

|

|

|

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

Date: September 7, 2021

|

|

|

|

By:

|

|

/s/ Rafael Garza

|

|

|

|

|

|

|

|

Name: Rafael Garza

|

|

|

|

|

|

|

|

Title: Chief Comptroller

|

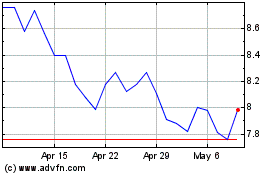

Cemex SaB De Cv (NYSE:CX)

Historical Stock Chart

From Aug 2024 to Sep 2024

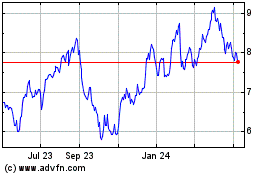

Cemex SaB De Cv (NYSE:CX)

Historical Stock Chart

From Sep 2023 to Sep 2024