Amended Current Report Filing (8-k/a)

March 11 2020 - 9:32AM

Edgar (US Regulatory)

true

0000910612

0000915140

0000910612

2020-02-06

2020-02-06

0000910612

cbl:CBLAssociatesLimitedPartnershipMember

2020-02-06

2020-02-06

0000910612

us-gaap:CommonClassAMember

2020-02-06

2020-02-06

0000910612

cbl:ASevenPointThreeSevenFiveSeriesDCumulativeRedeemablePreferredStockZeroPointZeroOneParValueMember

2020-02-06

2020-02-06

0000910612

cbl:ASixPointSixTwoFiveSeriesECumulativeRedeemablePreferredStockZeroPointZeroOneParValueMember

2020-02-06

2020-02-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

(Amendment No. 1)

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): February 6, 2020

CBL & ASSOCIATES PROPERTIES INC

CBL & ASSOCIATES LIMITED PARTNERSHIP

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

|

|

|

|

Delaware

|

|

1-12494

|

|

62-1545718

|

|

Delaware

|

|

333-182515-01

|

|

62-1542285

|

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification No.)

|

2030 Hamilton Place Blvd., Suite 500, Chattanooga, TN 37421-6000

(Address of principal executive office, including zip code)

423-855-0001

(Registrant's telephone number, including area code)

N/A

(Former name, former address and former fiscal year, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered under Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

Title of each Class

|

|

Trading

Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, $0.01 par value

|

|

CBL

|

|

New York Stock Exchange

|

|

7.375% Series D Cumulative Redeemable Preferred Stock, $0.01 par value

|

|

CBLprD

|

|

New York Stock Exchange

|

|

6.625% Series E Cumulative Redeemable Preferred Stock, $0.01 par value

|

|

CBLprE

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Explanatory Note

This Amendment No. 1 to the Current Report on Form 8-K (“Amendment”) is being furnished to amend Items 2.02 and 9.01 of the Current Report on Form 8-K furnished on February 7, 2020 reporting the Company’s results for the three months and year ended December 31, 2019.

ITEM 2.02 Results of Operations and Financial Condition

On March 11, 2020, CBL & Associates Properties, Inc. (the “Company”) issued a corrected press release announcing the Company’s results for the three months and year ended December 31, 2019. The news release was issued to correct the amount of gain on investments/deconsolidation reported for the three months and year ended December 31, 2019. Subsequent to the issuance of its earnings release on February 6, 2020, the Company reassessed the accounting treatment for the deconsolidation of one joint venture. This resulted in a decrease of $28.3 million in gain on investments/deconsolidation for the three months and year ended December 31, 2019.

The Company has prepared and furnished as Exhibit 99.1 to this Amendment a corrected earnings release and supplemental financial and operating information for the three months and year ended December 31, 2019. The correction did not change the Company’s Same-Center Net Operating Income and Funds From Operations, as adjusted, for the three months and year ended December 31, 2019 that was provided in the original earnings release.

The information in this Amendment and the Exhibit attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, except as shall be expressly set forth by specific reference in such filing.

ITEM 9.01 Financial Statements and Exhibits

|

|

(a)

|

Financial Statements of Businesses Acquired

|

Not applicable

|

|

(b)

|

Pro Forma Financial Information

|

Not applicable

|

|

(c)

|

Shell Company Transactions

|

Not applicable

|

|

(a)

|

Incorporated by reference from the Company’s Current Report on Form 8-K, dated February 6, 2020, filed on February 7, 2020.**

|

** Commisson File No. 1-12494 and 333-182515-01

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

CBL & ASSOCIATES PROPERTIES, INC.

|

|

|

|

|

|

|

|

|

/s/ Farzana Khaleel

|

|

|

|

|

|

Farzana Khaleel

|

|

|

Executive Vice President -

|

|

|

Chief Financial Officer and Treasurer

|

|

|

|

|

|

CBL & ASSOCIATES LIMITED PARTNERSHIP

|

|

|

|

|

|

By: CBL HOLDINGS I, INC., its general partner

|

|

|

|

|

|

|

|

|

/s/ Farzana Khaleel

|

|

|

|

|

|

Farzana Khaleel

|

|

|

Executive Vice President -

|

|

|

Chief Financial Officer and Treasurer

|

|

|

|

|

Date: March 11, 2020

|

|

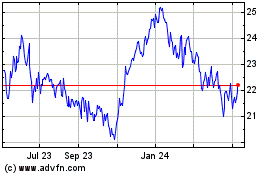

CBL and Associates Prope... (NYSE:CBL)

Historical Stock Chart

From Mar 2024 to Apr 2024

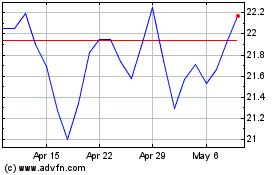

CBL and Associates Prope... (NYSE:CBL)

Historical Stock Chart

From Apr 2023 to Apr 2024