Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

April 09 2020 - 6:12AM

Edgar (US Regulatory)

Filed Pursuant to Rule 433

Registration Statement No. 333-229396

Pricing Term Sheet

¥195,500,000,000

BERKSHIRE HATHAWAY INC.

Pricing Term Sheet

¥56,300,000,000 0.674% Senior Notes due 2023

¥41,600,000,000 0.879% Senior Notes due 2025

¥29,000,000,000 1.002% Senior Notes due 2027

¥18,300,000,000 1.110% Senior Notes due 2030

¥25,800,000,000 1.585% Senior Notes due 2040

¥18,500,000,000 1.779% Senior Notes due 2050

¥6,000,000,000 2.000% Senior Notes due 2060

|

|

|

|

|

Issuer:

|

|

Berkshire Hathaway Inc.

|

|

Offering Format:

|

|

SEC Registered

|

|

Trade Date:

|

|

April 9, 2020

|

|

Settlement Date:

|

|

April 16, 2020 (T+5)

|

|

Expected Ratings*:

|

|

Moody’s Aa2/S&P AA

|

|

|

|

|

Title of Securities:

|

|

0.674% Senior Notes due 2023 (“2023 Notes”)

0.879% Senior Notes due 2025 (“2025 Notes”)

1.002%

Senior Notes due 2027 (“2027 Notes”)

1.110% Senior Notes due 2030 (“2030 Notes”)

1.585% Senior Notes due 2040 (“2040 Notes”)

1.779%

Senior Notes due 2050 (“2050 Notes”)

2.000% Senior Notes due 2060 (“2060 Notes”)

|

|

|

|

|

Principal Amount:

|

|

¥56,300,000,000 (2023 Notes)

¥41,600,000,000 (2025 Notes)

¥29,000,000,000 (2027

Notes)

¥18,300,000,000 (2030 Notes)

¥25,800,000,000

(2040 Notes)

¥18,500,000,000 (2050 Notes)

¥6,000,000,000 (2060 Notes)

|

|

|

|

|

Maturity Date:

|

|

April 14, 2023 (2023 Notes)

April 16, 2025 (2025 Notes)

April 16, 2027 (2027

Notes)

April 16, 2030 (2030 Notes)

April 16, 2040

(2040 Notes)

April 15, 2050 (2050 Notes)

April 15,

2060 (2060 Notes)

|

|

|

|

|

|

|

|

|

Issue Price (Price to Public):

|

|

100% of face amount (2023 Notes)

100% of

face amount (2025 Notes)

100% of face amount (2027 Notes)

100% of face amount (2030 Notes)

100% of face amount (2040

Notes)

100% of face amount (2050 Notes)

100% of face amount

(2060 Notes)

|

|

|

|

|

Gross Spread:

|

|

15 bps (2023 Notes)

25 bps (2025 Notes)

30 bps (2027 Notes)

35 bps (2030 Notes)

55 bps (2040 Notes)

65 bps (2050 Notes)

65 bps (2060 Notes)

|

|

|

|

|

Proceeds to Issuer:

|

|

¥194,859,350,000

|

|

|

|

|

Interest Rate:

|

|

0.674% per annum (2023 Notes)

0.879% per

annum (2025 Notes)

1.002% per annum (2027 Notes)

1.110% per

annum (2030 Notes)

1.585% per annum (2040 Notes)

1.779% per

annum (2050 Notes)

2.000% per annum (2060 Notes)

|

|

|

|

|

Reference Rate:

|

|

-0.026% (2023 Notes)

-0.021% (2025

Notes)

0.002% (2027 Notes)

0.060% (2030 Notes)

0.185% (2040 Notes)

0.229% (2050 Notes)

|

|

|

|

|

Spread to Reference Rate:

|

|

70 bps (2023 Notes)

90 bps (2025 Notes)

100 bps (2027 Notes)

105 bps (2030 Notes)

140 bps (2040 Notes)

155 bps (2050 Notes)

|

|

|

|

|

Yield:

|

|

0.674% (2023 Notes)

0.879% (2025 Notes)

1.002% (2027 Notes)

1.110% (2030 Notes)

1.585% (2040 Notes)

1.779% (2050 Notes)

2.000% (2060 Notes)

|

2

|

|

|

|

|

|

|

|

Day Count Convention:

|

|

30/360

|

|

|

|

|

Interest Payment Dates:

|

|

Semi-annually on April 16 and October 16 of each year, commencing on October 16, 2020 (short last coupon for the 2023, 2050 and 2060 Notes).

|

|

|

|

|

Redemption:

|

|

The Notes will not be redeemable prior to maturity unless certain events occur involving United States taxation as described in the Preliminary Prospectus Supplement dated March 25, 2020.

|

|

|

|

|

Minimum Denomination:

|

|

¥100,000,000 and integral multiples of ¥10,000,000 in excess thereof

|

|

|

|

|

CUSIP:

|

|

084670 CJ5 (2023 Notes)

084670 CK2 (2025

Notes)

084670 CL0 (2027 Notes)

084670 CM8 (2030 Notes)

084670 CQ9 (2040 Notes)

084670 CR7 (2050 Notes)

084670 CS5 (2060 Notes)

|

|

|

|

|

Common Code:

|

|

215001784 (2023 Notes)

215001865 (2025

Notes)

215002004 (2027 Notes)

215002098 (2030 Notes)

215002195 (2040 Notes)

215002217 (2050 Notes)

215002225 (2060 Notes)

|

|

|

|

|

ISIN:

|

|

XS2150017841 (2023 Notes)

XS2150018658 (2025

Notes)

XS2150020043 (2027 Notes)

XS2150020985 (2030

Notes)

XS2150021959 (2040 Notes)

XS2150022171 (2050

Notes)

XS2150022254 (2060 Notes)

|

|

|

|

|

Paying Agent:

|

|

The Bank of New York Mellon, London Branch

|

|

|

|

|

Listing:

|

|

None

|

3

Other Information

|

|

|

|

|

Joint Book-Running Managers:

|

|

Goldman Sachs International

J.P. Morgan

Securities plc

Merrill Lynch International

Mizuho Securities

USA LLC

|

*Note: A securities rating is not a recommendation to buy, sell or hold securities and may be subject to revision or

withdrawal at any time.

MiFID II professionals/ECPs-only/No PRIIPs KID: Manufacturer target market (MIFID II product governance) is eligible

counterparties and professional clients only (all distribution channels). No PRIIPs key information document (KID) has been prepared as the Securities are not available to retail investors in the EEA or in the United Kingdom.

Settlement Period: The closing will occur on April 16, 2020, which will be more than two Tokyo business days after the date of this pricing term sheet.

Rule 15c6-1 under the Securities Exchange Act of 1934 generally requires that securities trades in the secondary market settle in two business days, unless the parties to a trade expressly agree otherwise.

The issuer has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you

invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on

the SEC Web site at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling Goldman Sachs International toll-free at (866) 471-2526, J.P. Morgan Securities plc collect at +44-207-134-2468, Merrill Lynch International

toll-free at +1-800-294-1322 or Mizuho Securities USA LLC toll-free at (866) 271-7403.

4

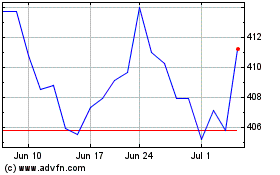

Berkshire Hathaway (NYSE:BRK.B)

Historical Stock Chart

From Mar 2024 to Apr 2024

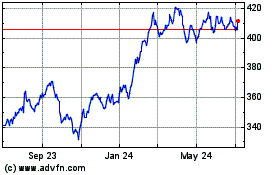

Berkshire Hathaway (NYSE:BRK.B)

Historical Stock Chart

From Apr 2023 to Apr 2024