Payment of Filing Fee (Check the appropriate box):

| | | | | | | | |

ý | No fee required. |

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0‑11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

o | Fee paid previously with preliminary materials. |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| | |

| (2) | Form, Schedule or Registration Statement No.: |

| | |

| (3) | Filing Party: |

| | |

| (4) | Date Filed:

|

The following contains an email sent by Vlad Coric, Chief Executive Officer of Registrant, to employees of Registrant on May 10, 2022, and a transcript of the video linked in the email.

To All Employees –

Please see here an important press release issued this morning announcing that Pfizer will acquire Biohaven for approximately $12 billion in value to gain full access to our innovative calcitonin gene-related peptide (CGRP) franchise, including our breakthrough all-in-one migraine therapy, Nurtec® ODT (rimegepant), which is on a path to blockbuster status.

Today’s announcement is the best next step in Biohaven’s mission to deliver our migraine medicines to even more patients. Under the Pfizer umbrella, Nurtec ODT will be well positioned to continue to thrive, ensuring even greater access to a life-changing migraine medicine that helps bring a debilitating disease under control for many of the one billion people worldwide. As a global drug development powerhouse, Pfizer will also unlock the full potential of our entire CGRP franchise, building upon the work we have done, including advancing zavegepant, the only small molecule CGRP antagonist in an intranasal formulation for the acute treatment of migraine, and a portfolio of five preclinical CGRP assets. Many of you, who have been so instrumental to our success to date, will continue on the journey with the CGRP franchise to Pfizer and move our patient-first mission forward with an outstanding company.

Since our IPO on May 9, 2017, I’ve seen our team accomplish so much. Today’s event, five years later, reflects the tremendous value you have created for patients and shareholders. Our potential has always been boundless. You have consistently reached higher to turn Biohaven into an admired and respected company that delivers extraordinary value to patients and our shareholders. Your hard work and dedication make this strategic evolution of our company possible, and I thank you.

I understand that the sense of pride you feel about our accomplishments may be overcome by concerns of not knowing what comes next. Let me share with you the information we have today and offer a commitment to answer your questions in a timely manner in the weeks ahead. As part of the transaction, all commercial employees and some additional employees hired to support the CGRP franchise growth trajectory will join Pfizer after the acquisition is finalized. Until the transaction closes, no later than early 2023, there will be no change to ongoing commercial operations or other job functions.

For a number of our current employees, this also creates a new day. Simultaneously with today’s transaction, Biohaven announced it will spin-out all of the non-CGRP assets in our portfolio to establish a new independent, neuroscience discovery and development company, which I will lead as CEO and Chairman of the Board. Because of your incredible success we have been able to significantly expand our portfolio with multiple clinical-stage assets for the near term and a robust discovery pipeline at Biohaven Labs that will continue to feed new programs into the clinic and deliver value to patients around the world. This new company will be publicly traded as that access to the capital equity markets is important to fund future value growth. Our vision for the new company is the same one we have always had for Biohaven: to create a world-class neuroscience company with the largest portfolio in our industry as we strive to continue our trajectory of growth.

Understandably, many of you will have additional questions on what today’s announcement means for Biohaven and your ongoing role. In the spirit of transparency and open communications that has been so critical to our culture, we will aim to answer all your questions and allay your concerns in the days and weeks ahead. Until the transaction closes, it will be business as usual. So, let’s continue to keep our eyes focused on what we do best: advancing science and propelling innovation across all aspects of our business to deliver meaningful benefits to the lives of patients.

Thank you for all you do to make Biohaven a truly special place. Please visit this link for a video from me on this breaking news.

Sincerely,

Vlad

VLAD CORIC

CHIEF EXECUTIVE OFFICER

Good morning, everyone. Today’s announcement that Biohaven is being acquired by Pfizer represents a culmination of all we have accomplished as a team in just the last five years since our IPO. As you take the time to process this morning’s news, I hope you will take a minute to feel proud of all we have achieved together. You deserve it.

It is understandable if the sense of pride you feel is overcome by mixed feelings and feelings of uncertainty about what comes next in the days ahead. Change is difficult and transitions are hard. That’s especially true here at Biohaven – where we have built a culture that is defined by a special bond among all of our employees. But as we move forward and find the clarity that will help us adapt to change, I encourage you to look at today as a new chapter in our enduring mission to improve the lives of people with neurological and neuropshysicatric diseases.

Let me explain why.

Through your hard work and dedication, you have helped create a bold and innovative company that is breaking new boundaries in neuroscience drug development. We are fearlessly tackling the status quo and delivering extraordinary value to patients. Our efforts are embodied in Nurtec ODT, our breakthrough all-in-one migraine therapy that is on a path to blockbuster status.

Pfizer recognized the value we have built with Nurtec and has acquired Biohaven to gain full access to this migraine medication and our CGRP franchise. Under the Pfizer umbrella, all we have done to make Nurtec successful will continue to flourish and grow. And the beneficiaries will be, of course, our patients who have always been the north star of all we do.

Pfizer is the ideal company to ensure that Nurtec continues to fulfill its bold promise on behalf of the one billion people worldwide with migraine. As the journey of Nurtec ODT and our CGRP franchise marches on, those of you who have been so instrumental to our success to date will see our patient-first mission continue with an outstanding company.

As part of the transaction, and to support the CGRP franchise growth, commercial employees and some additional employees will join Pfizer after the acquisition is finalized. Until the transaction closes, there will be no change to ongoing commercial operations or other job functions.

For a number of our current employees, this also creates a new day. Simultaneously with today’s transaction, Biohaven will spin off its development stage, non-CGRP assets in our portfolio to form a new independent, neuroscience discovery and development company, which I will lead as CEO and will also include other members of our current team.

Because of your incredible success we have been able to significantly expand our portfolio with multiple clinical-stage assets for the near term and a robust discovery pipeline that will continue to feed new programs into the clinic. This new company will be a publicly traded company, as access to the capital equity markets is important to fund future value growth.

Our vision for the new company is the same one we have always had for Biohaven: to create a world-class neuroscience company with the largest portfolio in our industry as we strive to continue our growth. I am confident we can do just that.

Understandably, you will continue to have questions on what this all means for Biohaven and your ongoing role. What I can promise you today and moving forward until the transaction closes, is that we will continue to be a united team, pursuing a common mission, that always puts patients first.

So, let’s not lose sight of the important job we have right now by staying focused on our current goals across all areas of our business. Patient are counting on us to continue to be our best – a bar each and every one of you have reached time and again.

I personally want to thank you each one of you for making Biohaven so special.

Disclosure Notice

This release contains forward-looking information about Pfizer’s proposed acquisition of Biohaven, Biohaven’s related spin-off of its development stage pipeline compounds, Biohaven’s commercial and pipeline portfolio, including rimegepant and zavegepant, expected best-in-class and growth potential, and Pfizer’s Internal Medicine portfolio and growth potential, including their potential benefits, that involve substantial risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. Risks and uncertainties include, among other things, risks related to the satisfaction or waiver of the conditions to closing the proposed acquisition (including the failure to obtain necessary regulatory approvals and failure to obtain the requisite vote by Biohaven shareholders) in the anticipated timeframe or at all, including the possibility that the proposed acquisition does not close; the possibility that competing offers may be made; risks related to the ability to realize the anticipated benefits of the proposed acquisition, including the possibility that the expected benefits from the acquisition will not be realized or will not be realized within the expected time period; the risk that the businesses will not be integrated successfully; disruption from the transaction making it more difficult to maintain business and operational relationships; risks related to diverting management’s attention from Biohaven’s ongoing business operation; negative effects of this announcement or the consummation of the proposed acquisition on the market price of Pfizer’s common stock, Biohaven’s common shares and/or their respective operating results; significant transaction costs; unknown liabilities; the risk of litigation and/or regulatory actions related to the proposed acquisition, spin-off or Biohaven’s business; risks and costs related to the implementation of the separation of New Biohaven, including timing anticipated to complete the separation and any changes to the configuration of the businesses included in the separation if implemented; the risk that the integration of Biohaven and Pfizer will be more difficult, time consuming or costly than expected; other business effects and uncertainties, including the effects of industry, market, business, economic, political or regulatory conditions; future exchange and interest rates; changes in tax and other laws, regulations, rates and policies; future business combinations or disposals; the uncertainties inherent in research and development, including the ability to meet anticipated clinical endpoints, commencement and/or completion dates for clinical trials, regulatory submission dates, regulatory approval dates and/or launch dates, as well as the possibility of unfavorable new clinical data and further analyses of existing clinical data; risks associated with interim data; the risk that clinical trial data are subject to differing interpretations and assessments by regulatory authorities; whether

regulatory authorities will be satisfied with the design of and results from the clinical studies; whether and when drug applications may be filed in particular jurisdictions for rimegepant or zavegepant or any other investigational products; whether and when any such applications may be approved by regulatory authorities, which will depend on myriad factors, including making a determination as to whether the product's benefits outweigh its known risks and determination of the product's efficacy and, if approved, whether rimegepant, zavegepant or any such other products will be commercially successful; decisions by regulatory authorities impacting labeling, manufacturing processes, safety and/or other matters that could affect the availability or commercial potential of rimegepant, zavegepant or any such other products; uncertainties regarding the impact of COVID-19; and competitive developments.

You should carefully consider the foregoing factors and the other risks and uncertainties that affect the businesses of Pfizer and Biohaven described in the “Risk Factors” and “Forward-Looking Information and Factors That May Affect Future Results” sections of their respective Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and other documents filed by either of them from time to time with the U.S. Securities and Exchange Commission (the “SEC”), all of which are available at www.sec.gov. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Pfizer and Biohaven assume no obligation to, and do not intend to, update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise, unless required by law. Neither Pfizer nor Biohaven gives any assurance that it will achieve its expectations.

Additional Information and Where to Find It

In connection with the proposed transaction, Biohaven will be filing documents with the SEC, including preliminary and definitive proxy statements relating to the proposed transaction. The definitive proxy statement will be mailed to Biohaven’s shareholders in connection with the proposed transaction. This communication is not a substitute for the proxy statement or any other document that may be filed by Biohaven with the SEC. BEFORE MAKING ANY VOTING DECISION, INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PRELIMINARY AND DEFINITIVE PROXY STATEMENTS AND ANY OTHER DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED TRANSACTION OR INCORPORATED BY REFERENCE IN THE PROXY STATEMENT WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Any vote in respect of resolutions to be proposed at Biohaven’s shareholder meeting to approve the proposed transaction or other responses in relation to the proposed transaction should be made only on the basis of the information contained in Biohaven’s proxy statement. Investors and security holders may obtain free copies of these documents (when they are available) and other related documents filed with the SEC at the SEC’s web site at www.sec.gov or on Biohaven’s website at https://www.biohavenpharma.com/investors.

No Offer or Solicitation

This communication is for information purposes only and is not intended to and does not constitute, or form part of, an offer, invitation or the solicitation of an offer or invitation to purchase, otherwise acquire, subscribe for, sell or otherwise dispose of any securities, or the solicitation of any vote or approval in any jurisdiction, pursuant to the proposed transaction or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law.

Participants in the Solicitation

Biohaven and certain of its directors, executive officers and employees may be deemed to be participants in the solicitation of proxies in connection with the proposed transaction. Information about Biohaven’s directors and executive officers is set forth in its proxy statement for its 2022 annual meeting of shareholders, which was filed with the SEC on March 11, 2022. Other information regarding participants in the proxy solicitations in connection with the proposed transaction, and a description of any interests that they have in the proposed transaction, by security holdings or otherwise, will be included in the proxy statement described above. These documents are available free of charge at the SEC’s web site at www.sec.gov and by going to Biohaven’s website at https://www.biohavenpharma.com/investors.

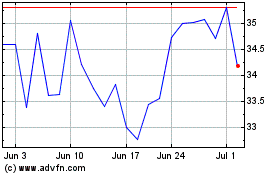

Biohaven (NYSE:BHVN)

Historical Stock Chart

From Aug 2024 to Sep 2024

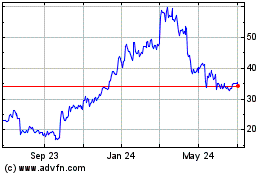

Biohaven (NYSE:BHVN)

Historical Stock Chart

From Sep 2023 to Sep 2024