Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses

March 04 2024 - 5:18PM

Edgar (US Regulatory)

Issuer Free Writing Prospectus

Filed pursuant to Rule 433

Registration Statement No. 333-265348

Final Term Sheet

AMERICAN TOWER CORPORATION

March 4, 2024

|

|

|

| Issuer: |

|

American Tower Corporation (“AMT”) |

|

|

| Coupon: |

|

5.200% Senior Notes due 2029 (the “2029 Notes”)

5.450% Senior Notes due 2034 (the “2034 Notes”) |

|

|

| Principal Amount: |

|

2029 Notes: $650,000,000 2034 Notes:

$650,000,000 |

|

|

| Maturity Date: |

|

2029 Notes: February 15, 2029 2034 Notes:

February 15, 2034 |

|

|

| Benchmark Treasury: |

|

2029 Notes: 4.250% UST due February 28, 2029

2034 Notes: 4.000% UST due February 15, 2034 |

|

|

| Benchmark Treasury Price and Yield: |

|

2029 Notes: 100-05; 4.215% 2034 Notes: 98-06;

4.225% |

|

|

| Spread to Benchmark Treasury: |

|

2029 Notes: T + 107 basis points 2034 Notes: T

+ 132 basis points |

|

|

| Yield to Maturity: |

|

2029 Notes: 5.285% 2034 Notes:

5.545% |

|

|

| Price to Public: |

|

2029 Notes: 99.638% 2034 Notes:

99.285% |

|

|

| Ratings(1): |

|

Baa3 (Stable) / BBB- (Stable) / BBB+ (Negative) (Moody’s / S&P / Fitch) |

|

|

| Interest Payment Dates: |

|

2029 Notes: Semi-annually on February 15 and August 15 of each year, commencing on August 15, 2024 (short first coupon)

2034 Notes: Semi-annually on February 15 and August 15 of each year,

commencing on August 15, 2024 (short first coupon) |

|

|

| Make-whole Call: |

|

2029 Notes: Prior to January 15, 2029 (one month prior to their maturity date), at greater of par and make-whole at discount rate of

Treasury plus 20 basis points 2034 Notes: Prior to November 15, 2033 (three

months prior to their maturity date), at greater of par and make-whole at discount rate of Treasury plus 20 basis points |

|

|

| Par Call: |

|

2029 Notes: At any time on or after January 15, 2029 (one month prior to their maturity date)

2034 Notes: At any time on or after November 15, 2033 (three months prior to their

maturity date) |

|

|

| Trade Date: |

|

March 4, 2024 |

|

|

| Settlement Date(2): |

|

March 7, 2024 (T+3) |

|

|

|

| CUSIP/ISIN: |

|

2029 Notes: 03027X CG3 / US03027XCG34 2034

Notes: 03027X CH1 / US03027XCH17 |

|

|

| Use of Proceeds: |

|

We intend to use the net proceeds to repay existing indebtedness under the 2021 Multicurrency Credit Facility. |

|

|

| Capitalization: |

|

The “as further adjusted” column in the “Capitalization” section of the Preliminary Prospectus Supplement gives effect to the receipt of approximately $1,281.3 million, after deducting discounts and

commissions payable to the underwriters and estimated expenses payable by us, and the use of all of the net proceeds to repay existing indebtedness under the 2021 Multicurrency Credit Facility. |

|

|

| Joint Book-Running Managers: |

|

BofA Securities, Inc. Citigroup Global Markets

Inc. J.P. Morgan Securities LLC Morgan Stanley & Co.

LLC SMBC Nikko Securities America, Inc. |

|

|

| Senior Co-Managers: |

|

Barclays Capital Inc. BBVA Securities Inc.

Chatham Financial Securities LLC Mizuho Securities USA LLC

PNC Capital Markets LLC RBC Capital Markets, LLC

Santander US Capital Markets LLC Scotia Capital (USA) Inc.

SG Americas Securities, LLC TD Securities (USA) LLC |

|

|

| Co-Manager: |

|

ING Financial Markets LLC Standard Chartered

Bank The Standard Bank of South Africa Limited |

| (1) |

These securities ratings have been provided by Moody’s, S&P and Fitch. None of these ratings is a

recommendation to buy, sell or hold these securities. Each rating may be subject to revision or withdrawal at any time, and should be evaluated independently of any other rating. |

| (2) |

We expect that the delivery of the notes will be made against payment on March 7, 2024, which is the third

business day following the date of this Final Term Sheet (this settlement cycle being referred to as “T+3”). Under Rule 15c6-1 of the Securities Exchange Act of 1934, as amended, trades in the

secondary market generally are required to settle in two business days, unless the parties to the trade expressly agree otherwise. Accordingly, purchasers who wish to trade the notes prior to the second business day preceding their date of delivery

may be required, by virtue of the fact that the notes initially will settle in T+3, to specify an alternate settlement cycle at the time of any such trade to prevent a failed settlement and should consult their own advisors. |

The information in this Final Term Sheet supplements the Preliminary Prospectus Supplement dated March 4, 2024 of AMT (the “Preliminary Prospectus

Supplement”) and supersedes the information in the Preliminary Prospectus Supplement to the extent inconsistent with the information in the Preliminary Prospectus Supplement. Defined terms used and not defined herein have the meaning ascribed

to them in the Preliminary Prospectus Supplement.

Standard Chartered Bank, The Standard Bank of South Africa Limited and any other non-U.S. registered broker-dealer will not effect any offers or sales of any notes in the United States unless it is through one or more U.S. registered broker-dealers as permitted by the regulations

of FINRA.

AMT has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you

invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on

the SEC Web site at www.sec.gov. Alternatively, the joint book-running managers can arrange to send you the prospectus if you request it by calling BofA Securities, Inc. at 1-800-294-1322, Citigroup Global Markets Inc. at 1-800-831-9146, J.P. Morgan

Securities LLC at 1-212-834-4533, Morgan Stanley & Co. LLC at 1-866-718-1649 or SMBC Nikko Securities America, Inc. at

1-888-868-6856.

2

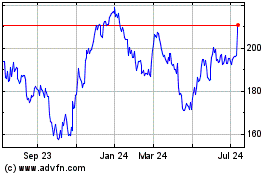

American Tower (NYSE:AMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

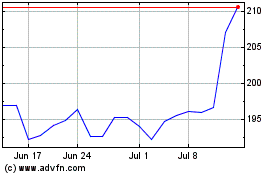

American Tower (NYSE:AMT)

Historical Stock Chart

From Apr 2023 to Apr 2024