American Tower Corporation Prices Senior Notes Offering

January 07 2020 - 4:54PM

Business Wire

American Tower Corporation (NYSE: AMT) today announced the

pricing of its registered public offering of senior unsecured notes

due 2025 and 2030, in aggregate principal amounts of $750.0 million

and $750.0 million, respectively. The 2025 notes will have an

interest rate of 2.400% per annum and are being issued at a price

equal to 99.905% of their face value. The 2030 notes will have an

interest rate of 2.900% per annum and are being issued at a price

equal to 99.560% of their face value. The net proceeds of the

offering are expected to be approximately $1,483.4 million, after

deducting underwriting discounts and estimated offering expenses.

American Tower intends to use the net proceeds to repay existing

indebtedness under its $2.25 billion senior unsecured revolving

credit facility, as amended and restated in December 2019.

BofA Securities, Citigroup, J.P. Morgan, Morgan Stanley and

Scotiabank are acting as Joint Book-Running Managers for the

offering.

This press release shall not constitute an offer to sell or a

solicitation to buy any securities, nor shall there be any sale of

these securities in any state or jurisdiction in which such an

offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of any such state or

jurisdiction. The offering was made only by means of a prospectus

and related prospectus supplement, which may be obtained by

visiting the Securities and Exchange Commission’s website at

www.sec.gov. Alternatively, you may request these documents by

calling BofA Securities, Inc. toll-free at 1-800-294-1322,

Citigroup Global Markets Inc. toll-free at 1-800-831-9146, J.P.

Morgan Securities LLC collect at 1-212-834-4533, Morgan Stanley

& Co. LLC toll-free at 1-800-624-1808 or Scotia Capital (USA)

Inc. toll-free at 1-800-372-3930.

About American Tower

American Tower, one of the largest global REITs, is a leading

independent owner, operator and developer of multitenant

communications real estate with a portfolio of approximately

179,000 communications sites.

Cautionary Language Regarding Forward-Looking

Statements

This press release contains statements about future events and

expectations, or “forward-looking statements,” all of which are

inherently uncertain. American Tower has based those

forward-looking statements on management’s current expectations and

assumptions and not on historical facts. Examples of these

statements include, but are not limited to, statements regarding

the expectations of the amount to be received in net proceeds,

American Tower’s ability to complete the offering and its

expectations for the use of proceeds from the offering. These

forward-looking statements involve a number of risks and

uncertainties. Among the important factors that could cause actual

results to differ materially from those indicated in such

forward-looking statements include market conditions for corporate

debt generally, for the securities of telecommunications companies

and for American Tower’s indebtedness in particular. For other

important factors that may cause actual results to differ

materially from those indicated in American Tower’s forward-looking

statements, we refer you to the information contained in the

prospectus supplement for this offering and Item 1A of the Form

10-K for the year ended December 31, 2018, as updated in Part II,

Item 1A, of the Form 10-Q for the quarter ended September 30, 2019,

under the caption “Risk Factors” and in other filings American

Tower makes with the Securities and Exchange Commission. American

Tower undertakes no obligation to update the information contained

in this press release to reflect subsequently occurring events or

circumstances.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200107006089/en/

Igor Khislavsky Vice President, Investor Relations Telephone:

(617) 375-7500

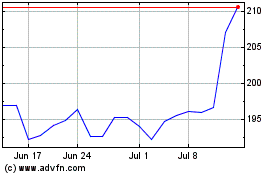

American Tower (NYSE:AMT)

Historical Stock Chart

From Aug 2024 to Sep 2024

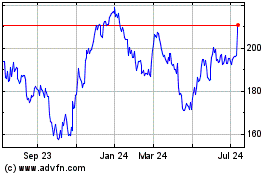

American Tower (NYSE:AMT)

Historical Stock Chart

From Sep 2023 to Sep 2024