Agilent delivers outstanding quarter wrapping

up an excellent 2018

Highlights:

Fourth Quarter

- Q4 revenue of $1.29 billion,

representing growth of 9 percent with core revenue growth of 9

percent(1)

- Q4 GAAP net income of $195 million, or

$0.61 per share

- Q4 non-GAAP net income of $262 million,

or $0.81 per share(2), an increase of 21 percent from 2017

- Board authorizes new $1.75 billion

share repurchase program

Full Year

- Full year revenue of $4.91 billion,

representing 10 percent growth and core growth of 7 percent(1)

- Full year GAAP net income of $316

million, or $0.97 per share

- Full year non-GAAP net income of $907

million, or $2.79 per share(2), an increase of 18 percent from

2017

Outlook

- Fiscal year 2019 revenue guidance of

$5.13 billion to $5.17 billion, representing growth of 4.4 to 5.2

percent and core growth of 5.0 to 5.5 percent(1). Non-GAAP earnings

guidance of $3.00 to $3.05 per share(3)

- First-quarter fiscal year 2019 revenue

guidance of $1.265 billion to $1.280 billion, representing growth

of 4.4 to 5.7 percent and core revenue growth of 4.5 to 5.5

percent(1). Non-GAAP earnings guidance of $0.71 to $0.73 per

share(3)

Agilent Technologies, Inc. (NYSE: A) today reported revenue

of $1.29 billion for the fourth-quarter ended October 31, 2018, up

9 percent year over year (up 9 percent on a core basis(1)).

Fourth-quarter GAAP net income was $195 million, or $0.61 per

share. Last year’s fourth-quarter GAAP net income was $177 million,

or $0.54 per share.

“The Agilent team delivered an outstanding quarter to wrap up

the fiscal year with revenues and earnings per share ahead of

expectations,” said Mike McMullen, Agilent CEO and President. “Our

performance this quarter caps off an excellent 2018 as we achieved

our highest annual core growth rate and profitability since

becoming a stand-alone life sciences company in 2014.”

“During the quarter we continued our investment in growth

introducing new and differentiated products and services,”

continued McMullen. “We leveraged our strong balance sheet

completing several acquisitions to further strengthen our

portfolio. We also returned over $600 million to shareholders

through stock buybacks and dividends this year.

“We enter fiscal 2019 with momentum. Our focus remains on

executing our shareholder value creation model to deliver superior

earnings growth.”

Financial Highlights

Life Sciences and Applied Markets Group

Fourth-quarter revenue of $597 million from Agilent’s Life

Sciences and Applied Markets Group (LSAG) grew 8 percent year over

year (up 9 percent on a core basis(1)), with broad-based strength

across major end markets, platforms and regions. LSAG’s operating

margin for the quarter was 25.9 percent. Full-year revenue of $2.3

billion grew 9 percent year over year (up 7 percent on a core

basis(1)). LSAG’s operating margin for the year was 24.1

percent.

Agilent CrossLab Group

Fourth-quarter revenue of $441 million from Agilent CrossLab

Group (ACG) grew 9 percent year over year (up 9 percent on a core

basis(1)). Demand was excellent across both services and

consumables. ACG’s operating margin for the quarter was 24.7

percent. Full-year revenue of $1.7 billion grew 11 percent year

over year (up 8 percent on a core basis(1)). ACG’s operating margin

for the year was 23.3 percent.

Diagnostics and Genomics Group

Fourth-quarter revenue of $256 million from Agilent’s

Diagnostics and Genomics Group (DGG) grew 9 percent year over year

(up 5 percent on a core basis(1)) led by pharma growth and strong

demand for genomics and NASD products. DGG’s operating margin for

the quarter was 23.3 percent. Full-year revenue of $943 million

grew 10 percent year over year (up 5 percent on a core basis(1)).

DGG’s operating margin for the year was 18.9 percent.

2019 First Quarter and Full Year Outlook

For fiscal year 2019, Agilent expects revenue of $5.13 billion

to $5.17 billion, representing growth of 4.4 to 5.2 percent and

core growth of 5.0 to 5.5 percent(1). Full-year 2019 non-GAAP

earnings of $3.00 to $3.05 per share(3). The guidance is based on

October 31, 2018 currency exchange rates.

Agilent expects first-quarter 2019 revenue in the range of

$1.265 billion to $1.280 billion, representing growth of 4.4 to 5.7

percent and core revenue growth of 4.5 to 5.5 percent(1).

First-quarter 2019 non-GAAP earnings are expected to be in the

range of $0.71 to $0.73 per share(3).

New Share Repurchase Program

Agilent’s Board of Directors approved a new share repurchase

program authorizing the purchase of up to $1.75 billion of common

stock. The 2018 share repurchase program commences on November 21,

2018, replacing the previous program.

The number of shares to be repurchased and the timing of any

repurchases will depend on factors such as the share price,

economic and market conditions, and corporate and regulatory

requirements. The share repurchase program may be suspended,

amended or discontinued at any time.

Conference Call

Agilent’s management will present more details about its

fourth-quarter FY2018 financial results on a conference call with

investors today at 1:30 p.m. (Pacific Time). This event will be

webcast live in listen-only mode. Listeners may log on at

www.investor.agilent.com and select “Q4 2018 Agilent Technologies

Inc. Earnings Conference Call” in the “News & Events Calendar

of Events” section. The webcast will remain available on the

company’s website for 90 days.

Additional information regarding financial results can be found

at www.investor.agilent.com by selecting “Financial Results” in the

“Financial Information” section.

In addition, a telephone replay of the conference call will be

available at approximately November 19, 2018 at 4:30 p.m. (Pacific

Time) after the call and through November 26 by dialing +1

855-859-2056 (or +1 404-537-3406 from outside the United States)

and entering pass code 6519506.

About Agilent Technologies

Agilent Technologies Inc. (NYSE: A) is a global leader in life

sciences, diagnostics and applied chemical markets. With more than

50 years of insight and innovation, Agilent instruments, software,

services, solutions and people provide trusted answers to its

customers’ most challenging questions. The company generated

revenues of $4.91 billion in fiscal 2018 and employs 14,500 people

worldwide. Information about Agilent is available at

www.agilent.com.

Forward-Looking Statements

This news release contains forward-looking statements as defined

in the Securities Exchange Act of 1934 and is subject to the safe

harbors created therein. The forward-looking statements contained

herein include, but are not limited to, information regarding

Agilent’s future revenue, earnings and profitability; planned new

products; market trends; the future demand for the company’s

products and services; customer expectations; information regarding

the company’s share repurchase programs, and revenue and non-GAAP

earnings guidance for the first quarter and full fiscal year 2019.

These forward-looking statements involve risks and uncertainties

that could cause Agilent’s results to differ materially from

management’s current expectations. Such risks and uncertainties

include, but are not limited to, unforeseen changes in the strength

of our customers’ businesses; unforeseen changes in the demand for

current and new products, technologies, and services; unforeseen

changes in the currency markets; customer purchasing decisions and

timing, and the risk that we are not able to realize the savings

expected from integration and restructuring activities. In

addition, other risks that Agilent faces in running its operations

include the ability to execute successfully through business

cycles; the ability to meet and achieve the benefits of its

cost-reduction goals and otherwise successfully adapt its cost

structures to continuing changes in business conditions; ongoing

competitive, pricing and gross-margin pressures; the risk that our

cost-cutting initiatives will impair our ability to develop

products and remain competitive and to operate effectively; the

impact of geopolitical uncertainties and global economic conditions

on our operations, our markets and our ability to conduct business;

the ability to improve asset performance to adapt to changes in

demand; the ability of our supply chain to adapt to changes in

demand; the ability to successfully introduce new products at the

right time, price and mix; the ability of Agilent to successfully

integrate recent acquisitions; the ability of Agilent to

successfully comply with certain complex regulations; and other

risks detailed in Agilent’s filings with the Securities and

Exchange Commission, including our quarterly report on Form 10-Q

for the fiscal quarter ended July 31, 2018. Forward-looking

statements are based on the beliefs and assumptions of Agilent’s

management and on currently available information. Agilent

undertakes no responsibility to publicly update or revise any

forward-looking statement.

(1) Core revenue growth excludes the impact

of currency and acquisitions and divestitures within the past 12

months. Core revenue is a non-GAAP measure. A reconciliation

between Q4 FY18 and full fiscal year 2018 GAAP revenue and core

revenue is set forth on pages 6 and 7 of the attached tables along

with additional information regarding the use of this non-GAAP

measure. Core revenue growth rate as projected for Q1 FY19 and full

fiscal year 2019 excludes the impact of currency, acquisitions and

divestitures within the past 12 months. Most of the excluded

amounts pertain to events that have not yet occurred and are not

currently possible to estimate with a reasonable degree of accuracy

and could differ materially. Therefore, no reconciliation to GAAP

amounts has been provided for the projection.

(2) Non-GAAP net income and non-GAAP earnings

per share primarily exclude the impacts of non-cash asset

impairments and intangibles amortization, business exit and

divestiture costs, transformational initiatives, acquisition and

integration costs, pension settlement gain, gain on step

acquisition of Lasergen, Nucleic Acid Solutions Division (“NASD”)

site costs and special compliance costs. We also exclude any tax

benefits or expenses that are not directly related to ongoing

operations and which are either isolated or are not expected to

occur again with any regularity or predictability. A reconciliation

between non-GAAP net income and GAAP net income is set forth on

page 4 of the attached tables along with additional information

regarding the use of this non-GAAP measure.

(3) Non-GAAP earnings per share as projected

for Q1 FY19 and full fiscal year 2019 excludes primarily the

impacts of non-cash asset impairments and intangibles amortization,

business exit and divestiture costs, transformational initiatives,

acquisition and integration costs, pension settlement gain, Nucleic

Acid Solutions Division (“NASD”) site costs and special compliance

costs. We also exclude any tax benefits that are not directly

related to ongoing operations and which are either isolated or are

not expected to occur again with any regularity or predictability,

including the impact of U.S. Tax Cuts and Jobs Act (Tax Reform).

Most of these excluded amounts that pertain to events that have not

yet occurred and are not currently possible to estimate with a

reasonable degree of accuracy and could differ materially.

Therefore, no reconciliation to GAAP amounts has been provided.

Future amortization of intangibles is expected to be approximately

$26 million per quarter.

NOTE TO EDITORS: Further technology,

corporate citizenship and executive news is available on the

Agilent news site at www.agilent.com/go/news.

AGILENT TECHNOLOGIES, INC. CONDENSED

CONSOLIDATED STATEMENT OF OPERATIONS (In millions, except

per share amounts) (Unaudited) PRELIMINARY

Three Months Ended Years Ended October

31, October 31, 2018

2017 2018 2017

Net revenue $ 1,294 $ 1,189 $ 4,914 $ 4,472

Costs and expenses: Cost of products and services 585 542 2,227

2,063 Research and development 104 89 385 339 Selling, general and

administrative 356 325 1,374

1,229 Total costs and expenses 1,045

956 3,986 3,631

Income from operations 249 233 928 841 Interest

income 10 7 38 22 Interest expense (18 ) (20 ) (75 ) (79 ) Other

income (expense), net 3 6 55

19 Income before taxes 244 226 946 803

Provision for income taxes 49 49 630 119

Net income $ 195 $ 177 $ 316 $

684 Net income per share: Basic $ 0.61

$ 0.55 $ 0.98 $ 2.12 Diluted $ 0.61 $ 0.54 $ 0.97 $ 2.10

Weighted average shares used in computing net income per share:

Basic 319 322 321 322 Diluted 322 326 325 326 Cash dividends

declared per common share $ 0.149 $ 0.132 $ 0.596 $ 0.528

The preliminary income statement is estimated based

on our current information. Page 1

AGILENT

TECHNOLOGIES, INC. CONDENSED CONSOLIDATED BALANCE SHEET

(In millions, except par value and share amounts)

(Unaudited) PRELIMINARY October

31, October 31, 2018 2017 ASSETS

Current assets: Cash and cash equivalents $ 2,247 $ 2,678 Accounts

receivable, net 776 724 Inventory 638 575 Other current assets

187 192 Total current assets 3,848

4,169 Property, plant and equipment, net 822 757 Goodwill

and other intangible assets, net 3,464 2,968 Long-term investments

68 138 Other assets 339 394 Total

assets $ 8,541 $ 8,426 LIABILITIES AND EQUITY

Current liabilities: Accounts payable $ 340 $ 305 Employee

compensation and benefits 304 276 Deferred revenue 324 291

Short-term debt — 210 Other accrued liabilities 203

181 Total current liabilities 1,171 1,263

Long-term debt 1,799 1,801 Retirement and post-retirement benefits

239 234 Other long-term liabilities 761 293

Total liabilities 3,970 3,591

Total Equity: Stockholders' equity: Preferred stock; $0.01

par value; 125 million shares authorized; none issued and

outstanding — — Common stock; $0.01 par value, 2 billion shares

authorized; 318 million shares at October 31, 2018 and 322 million

shares at October 31, 2017, issued 3 3 Additional paid-in-capital

5,308 5,300 Accumulated deficit (336 ) (126 ) Accumulated other

comprehensive loss (408 ) (346 ) Total stockholders'

equity 4,567 4,831 Non-controlling interest 4

4 Total equity 4,571 4,835 Total

liabilities and equity $ 8,541 $ 8,426

The preliminary balance sheet is estimated based on our

current information. Page 2

AGILENT

TECHNOLOGIES, INC. CONDENSED CONSOLIDATED STATEMENT OF CASH

FLOWS (In millions) (Unaudited)

PRELIMINARY Years Ended

October 31, October 31, 2018 2017 Cash

flows from operating activities: Net income $ 316 $ 684

Adjustments to reconcile net income to net cash provided by (used

in) operating activities: Depreciation and amortization 210 212

Share-based compensation 70 60 Excess and obsolete inventory

related charges 26 24 Gain on step acquisition of Lasergen (20 ) —

Asset impairment charges 21 — Other non-cash expenses, net 9 7

Changes in assets and liabilities: Accounts receivable, net (65 )

(81 ) Inventory (83 ) (61 ) Accounts payable 40 2 Employee

compensation and benefits 31 38 Change in assets and liabilities

due to Tax Act 552 — Other assets and liabilities (20 )

4 Net cash provided by operating activities (a) 1,087

889 Cash flows from investing activities: Investments in

property, plant and equipment (177 ) (176 ) Proceeds from sale of

property, plant and equipment 1 — Payment to acquire cost method

investments (11 ) (1 ) Proceeds from divestitures — 2 Change in

restricted cash and cash equivalents, net 1 (1 ) Payment in

exchange for convertible note (2 ) (1 ) Acquisition of businesses

and intangible assets, net of cash acquired (516 )

(128 ) Net cash used in investing activities (704 ) (305 )

Cash flows from financing activities: Issuance of common stock

under employee stock plans 56 66 Payment of taxes related to net

share settlement of equity awards (30 ) (14 ) Payment of dividends

(191 ) (170 ) Proceeds from revolving credit facility 483 400

Repayment of debt and revolving credit facility (693 ) (290 )

Treasury stock repurchases (422 ) (194 ) Net cash

used in financing activities (797 ) (202 ) Effect of

exchange rate movements (17 ) 7 Net increase (decrease) in

cash and cash equivalents (431 ) 389 Cash and cash

equivalents at beginning of period 2,678 2,289

Cash and cash equivalents at end of period $ 2,247

$ 2,678 (a) Cash payments included in

operating activities: Income tax payments (refunds), net $ 102 $ 63

Interest payments $ 80 $ 82 The preliminary

cash flow is estimated based on our current information.

Page 3

AGILENT TECHNOLOGIES,

INC. NON-GAAP NET INCOME AND DILUTED EPS RECONCILIATIONS

(In millions, except per share amounts) (Unaudited)

PRELIMINARY Three Months Ended Years

Ended October 31, October 31, 2018

Diluted EPS

2017

Diluted EPS

2018

Diluted EPS

2017

Diluted EPS

GAAP net income $ 195 $ 0.61 $ 177 $ 0.54 $ 316 $ 0.97 $ 684

$ 2.10 Non-GAAP adjustments: Asset impairments 21 0.06 — — 21 0.06

— — Intangible amortization 29 0.09 28 0.09 105 0.32 117 0.36

Business exit and divestiture costs — — — — 9 0.03 — —

Transformational initiatives 11 0.03 7 0.02 25 0.08 12 0.04

Acquisition and integration costs 9 0.03 5 0.02 23 0.07 32 0.10

Pension settlement gain — — — — (5 ) (0.02 ) (32 ) (0.10 ) Gain on

step acquisition of Lasergen — — — — (20 ) (0.06 ) — — NASD site

costs 2 0.01 — — 8 0.02 — — Special compliance costs 1 — — — 4 0.01

— — Other 2 0.01 — — (10 ) (0.03 ) 5 0.02 Adjustment for Tax Reform

19 0.06 — — 552 1.70 — — Adjustment for taxes (a) (27 )

(0.09 ) 1 — (121 ) (0.36 )

(50 ) (0.16 ) Non-GAAP net income $ 262 $ 0.81

$ 218 $ 0.67 $ 907 $ 2.79 $ 768 $ 2.36

(a) The adjustment for taxes excludes tax

benefits that management believes are not directly related to

on-going operations and which are either isolated or cannot be

expected to occur again with any regularity or predictability. For

the three months and year ended October 31, 2018 and 2017,

management uses a non-GAAP effective tax rate of 18.0%. We

provide non-GAAP net income and non-GAAP net income per share

amounts in order to provide meaningful supplemental information

regarding our operational performance and our prospects for the

future. These supplemental measures exclude, among other things,

charges related to asset impairments, amortization of intangibles,

business exit and divestiture costs, transformational initiatives,

acquisition and integration costs, pension settlement gain, gain on

step acquisition of Lasergen, NASD site costs, special compliance

costs, and adjustment for Tax Reform.

Asset

impairments include assets that have been written down to their

fair value.

Business exit and divestiture costs

include costs associated with business divestitures.

Transformational initiatives include expenses associated

with targeted cost reduction activities such as manufacturing

transfers including costs to move manufacturing due to new tariffs

and tariff remediation actions, small site consolidations, legal

entity and other business reorganizations, insourcing or

outsourcing of activities. Such costs may include move and

relocation costs, one-time termination benefits and other one-time

reorganization costs. Included in this category are also expenses

associated with company programs to transform our product lifecycle

management (PLM) system, human resources and financial systems.

Acquisition and Integration costs include all

incremental expenses incurred to effect a business combination.

Such acquisition costs may include advisory, legal, accounting,

valuation, and other professional or consulting fees. Such

integration costs may include expenses directly related to

integration of business and facility operations, the transfer of

assets and intellectual property, information technology systems

and infrastructure and other employee-related costs.

Pension settlement gain resulted from transfer of the

substitutional portion of our Japanese pension plan to the

government.

Gain on step acquisition of Lasergen

resulted from the measurement at fair value of our equity interest

held at the date of business combination.

NASD site

costs include all the costs related to the expansion of our

manufacturing of nucleic acid active pharmaceutical ingredients

incurred prior to the commencement of commercial manufacturing.

Special compliance costs include costs associated

with transforming our processes to implement new regulations such

as the EU's General Data Protection Regulation (GDPR), revenue

recognition and certain tax reporting requirements.

Other includes certain legal costs and settlements in

addition to other miscellaneous adjustments.

Adjustment

for Tax Reform primarily consists of an estimated provision of

$499 million for U.S. transition tax and correlative items on

deemed repatriated earnings of non-U.S. subsidiaries and an

estimated provision of $53 million associated with the decrease in

the U.S. corporate tax rate from 35% to 21% and its impact on our

U.S. deferred tax assets and liabilities. The taxes payable

associated with the transition tax, net of tax attributes, on

deemed repatriation of foreign earnings is approximately $426

million, payable over 8 years. Our management uses non-GAAP

measures to evaluate the performance of our core businesses, to

estimate future core performance and to compensate employees. Since

management finds this measure to be useful, we believe that our

investors benefit from seeing our results “through the eyes” of

management in addition to seeing our GAAP results. This information

facilitates our management’s internal comparisons to our historical

operating results as well as to the operating results of our

competitors. Our management recognizes that items such as

amortization of intangibles can have a material impact on our cash

flows and/or our net income. Our GAAP financial statements

including our statement of cash flows portray those effects.

Although we believe it is useful for investors to see core

performance free of special items, investors should understand that

the excluded items are actual expenses that may impact the cash

available to us for other uses. To gain a complete picture of all

effects on the company’s profit and loss from any and all events,

management does (and investors should) rely upon the GAAP income

statement. The non-GAAP numbers focus instead upon the core

business of the company, which is only a subset, albeit a critical

one, of the company’s performance. Readers are reminded that

non-GAAP numbers are merely a supplement to, and not a replacement

for, GAAP financial measures. They should be read in conjunction

with the GAAP financial measures. It should be noted as well that

our non-GAAP information may be different from the non-GAAP

information provided by other companies. The preliminary

non-GAAP net income and diluted EPS reconciliation is estimated

based on our current information. Page 4

AGILENT TECHNOLOGIES, INC. SEGMENT INFORMATION

(In millions, except where noted) (Unaudited)

PRELIMINARY Life Sciences and Applied Markets

Group Q4'18 Q4'17 Revenue $ 597 $ 550 Gross

Margin, % 62.0 % 61.1 % Income from Operations $ 155 $ 131

Operating margin, % 25.9 % 23.8 %

Diagnostics and

Genomics Group Q4'18 Q4'17 Revenue $ 256 $ 235

Gross Margin, % 59.1 % 55.6 % Income from Operations $ 59 $ 51

Operating margin, % 23.3 % 21.5 %

Agilent CrossLab

Group Q4'18 Q4'17 Revenue $ 441 $ 404 Gross

Margin, % 51.3 % 49.6 % Income from Operations $ 109 $ 92 Operating

margin, % 24.7 % 22.9 %

Life

Sciences and Applied Markets Group FY18 FY17

Revenue $ 2,270 $ 2,081 Gross Margin, % 61.3 % 60.2 % Income from

Operations $ 547 $ 468 Operating margin, % 24.1 % 22.5 %

Diagnostics and Genomics Group FY18

FY17 Revenue $ 943 $ 860 Gross Margin, % 56.5 % 55.2 %

Income from Operations $ 178 $ 168 Operating margin, % 18.9 % 19.5

%

Agilent CrossLab Group FY18

FY17 Revenue $ 1,701 $ 1,531 Gross Margin, % 50.7 % 49.5 %

Income from Operations $ 397 $ 338 Operating margin, % 23.3 % 22.1

% Income from operations reflect the results

of our reportable segments under Agilent's management reporting

system which are not necessarily in conformity with GAAP financial

measures. Income from operations of our reporting segments exclude,

among other things, charges related to asset impairments,

amortization of intangibles, business exit and divestiture costs,

transformational initiatives, acquisition and integration costs,

pension settlement gain, gain on step acquisition of Lasergen, NASD

site costs, and special compliance costs. Readers are

reminded that non-GAAP numbers are merely a supplement to, and not

a replacement for, GAAP financial measures. They should be read in

conjunction with the GAAP financial measures. It should be noted as

well that our non-GAAP information may be different from the

non-GAAP information provided by other companies. The

preliminary segment information is estimated based on our current

information. Page 5

AGILENT TECHNOLOGIES, INC. RECONCILIATIONS OF REVENUE BY

SEGMENT EXCLUDING ACQUISITIONS, DIVESTITURES AND THE IMPACT

OF CURRENCY ADJUSTMENTS (CORE) (in millions)

(Unaudited) PRELIMINARY Year-over-Year

GAAP Year-over-Year

GAAP Revenue by

Segment

Q4'18 Q4'17 % Change Life Sciences and

Applied Markets Group $ 597 $ 550 8 % Diagnostics and

Genomics Group 256 235 9 % Agilent CrossLab Group 441 404 9

% Agilent $ 1,294 $ 1,189 9 %

Non-GAAP

(excluding Acquisitions &

Divestitures)

Year-over-Year

at Constant Currency (a)

Year-over-Year Year-over-Year

Non GAAP Revenue

by Segment

Q4'18 Q4'17 % Change % Change

Percentage PointImpact from

Currency

Current QuarterCurrency

Impact (b)

Life Sciences and Applied Markets Group $ 596 $ 550 8 % 9 %

-1 ppt $ (6 ) Diagnostics and Genomics Group 245 235 4 % 5 %

-1 ppt (2 ) Agilent CrossLab Group 435 404 8 % 9 % -1 ppt (7

) Agilent (Core) $ 1,276 $ 1,189 7 % 9 % -1

ppt $ (15 ) We compare the year-over-year

change in revenue excluding the effect of recent acquisitions and

divestitures and foreign currency rate fluctuations to assess the

performance of our underlying business. (a) The constant

currency year-over-year growth percentage is calculated by

recalculating all periods in the comparison period at the foreign

currency exchange rates used for accounting during the last month

of the current quarter, and then using those revised values to

calculate the year-over-year percentage change. (b) The

dollar impact from the current quarter currency impact is equal to

the total year-over-year dollar change less the constant currency

year-over-year change. The preliminary reconciliation of

GAAP revenue adjusted for recent acquisitions and divestitures and

impact of currency is estimated based on our current information.

Page 6

AGILENT TECHNOLOGIES,

INC. RECONCILIATIONS OF REVENUE BY SEGMENT EXCLUDING

ACQUISITIONS, DIVESTITURES AND THE IMPACT OF CURRENCY

ADJUSTMENTS (CORE) (in millions) (Unaudited)

PRELIMINARY

Year-over-Year GAAP Year-over-Year

GAAP Revenue by

Segment

FY18 FY17 % Change Life Sciences and

Applied Markets Group $ 2,270 $ 2,081 9 % Diagnostics and

Genomics Group 943 860 10 % Agilent CrossLab Group 1,701

1,531 11 % Agilent $ 4,914 $ 4,472 10 %

Non-GAAP

(excluding Acquisitions &

Divestitures)

Year-over-Year

at Constant Currency (a)

Year-over-Year Year-over-Year

Non GAAP Revenue

by Segment

FY18 FY17 % Change % Change

Percentage Point Impact from

Currency

Current Year Currency Impact

(b)

Life Sciences and Applied Markets Group $ 2,261 $ 2,081 9 %

7 % 2 ppts $ 39 Diagnostics and Genomics Group 924 860 7 % 5

% 2 ppts 20 Agilent CrossLab Group 1,696 1,531 11 % 8 % 3

ppts 36 Agilent (Core) $ 4,881 $ 4,472 9 % 7 %

2 ppts $ 95 We compare the year-over-year

change in revenue excluding the effect of recent acquisitions and

divestitures and foreign currency rate fluctuations to assess the

performance of our underlying business. (a) The constant

currency year-over-year growth percentage is calculated by

recalculating all periods in the comparison period at the foreign

currency exchange rates used for accounting during the last month

of the current quarter, and then using those revised values to

calculate the year-over-year percentage change. (b) The

dollar impact from the current year currency impact is equal to the

total year-over-year dollar change less the constant currency

year-over-year change. The preliminary reconciliation of

GAAP revenue adjusted for recent acquisitions and divestitures and

impact of currency is estimated based on our current information.

Page 7

View source

version on businesswire.com: https://www.businesswire.com/news/home/20181119005749/en/

INVESTOR CONTACT:Alicia Rodriguez+1 408 345

8948alicia_rodriguez@agilent.com

EDITORIAL CONTACT:Stefanie Notaney+1 408 345

8955stefanie.notaney@agilent.com

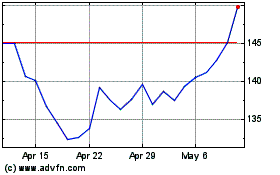

Agilent Technologies (NYSE:A)

Historical Stock Chart

From Mar 2024 to Apr 2024

Agilent Technologies (NYSE:A)

Historical Stock Chart

From Apr 2023 to Apr 2024