Abaxx Technologies Inc., (NEO:ABXX)(OTCQX:ABXXF)

(“Abaxx” or the “Company”), a financial software and market

infrastructure company, majority shareholder of the

Abaxx

Commodity Exchange and Clearinghouse (“

Abaxx

Singapore”), and producer of the

SmarterMarkets™

Podcast, announces that Abaxx Singapore Pte. Ltd.’s

subsidiary, Abaxx Exchange Pte. Ltd., has submitted a Notification

of Impending Listing of Futures Contracts to the Monetary Authority

of Singapore (MAS).

Highlights:

- Abaxx Exchange Pte. Ltd

submitted innovative nickel sulphate futures contract

specifications, which are subject to regulatory review and final

approval.

- The initial Nickel Sulphate

futures contract will include a new approach to the legacy

warehouse structure of current base metals contracts.

- Abaxx developed the

innovative futures product in close consultation with major global

mining and metals trading companies, automotive and electric

vehicle battery manufacturers, commodity market makers and

financial institution market participants.

On August 17th, 2023 Abaxx Exchange Pte. Ltd.

submitted a Notification of Impending Listing of Futures Contracts

to the Monetary Authority of Singapore (MAS). The futures contract

is designed to address the price discovery and risk management

needs of battery metals-market participants trading nickel sulphate

in addition to developing an innovative approach required for the

delivery of the underlying nickel sulphate product. The submission

is subject to regulatory review and an approval process required

for all new products.

The energy transition to electrification

requires the use of nickel sulphate to produce the requisite

lithium-ion batteries. Global demand for nickel sulphate is

projected to grow at a rapid 22% compound annual growth

rate from 2020 to 2030 (Roskill 2020). Supplying the nickel

sulphate necessary to meet this demand is expected to require high

levels of investment, thus creating a unique opportunity for a

well-functioning futures market, critical to discovering and

hedging the price risk associated with these investments and

unlocking the capital required.

The primary historical use of nickel has been in

the production of stainless steel. The large and growing demand for

nickel sulphate for batteries has led nickel producers to find

other less expensive ways to create nickel sulphate than through

the use of the traditional trading in warehoused refined nickel

metal on existing exchanges. This supply chain transformation has

created a growing disconnect between the forms of nickel being

produced and traded in the physical market and the form being

traded in legacy contracts, which Abaxx hopes to bridge with its

innovative technologies.

Abaxx’s nickel sulphate futures contract is the

result of collaboration with 21 firms, including a broad spectrum

of industry market participants. Over the past 12 months, the Abaxx

commercial team has been engaged in a series of comprehensive

bilateral and group discussions about what would best serve the

market related to the construction of battery units required for

electric vehicle (EV) production. Our work involved two major

global auto manufacturers, two global mining companies, six

merchant trading firms, two EV battery manufacturers, three nickel

sulphate producers and four bank/broker trading firms.

The launch of this first-of-its-kind futures

contract is subject to review by the Monetary Authority of

Singapore (MAS) as well as the final draw down of our Recognized

Market Operator (RMO) and Approved Clearing House (ACH) licenses.

The additional contract submission will not delay the orderly

process of satisfying the final conditions related to the

Registered Market Operator and Approved Clearing House

licenses.

This announcement has been prepared for

publication in Canada and may not be released to U.S. wire services

or distributed in the United States.

About Abaxx Technologies

Abaxx is a development-stage financial software

and market infrastructure company creating proprietary

technological infrastructure for both global commodity exchanges

and digital marketplaces. The company’s formative technology

increases transaction velocity, data security, and facilitates

improved risk management in the majority-owned Abaxx Commodity

Exchange (Abaxx Singapore Pte. Ltd.) - a commodity futures exchange

seeking final regulatory approvals as a Recognized Market Operator

(“RMO”) and Approved Clearing House (“ACH”) with the Monetary

Authority of Singapore (“MAS”). Abaxx is a founding shareholder in

Base Carbon Inc. and the creator and producer of the

SmarterMarkets™ podcast.

For more information please visit abaxx.tech, abaxx.exchange and

smartermarkets.media.

For more information about this press release, please

contact:

Steve Fray, CFOTel: 416-786-4381

Media and investor inquiries:

Abaxx Technologies Inc.Investor Relations TeamTel: +1 246 271

0082E-mail: ir@abaxx.tech

Forward-Looking Statements

This News Release includes certain

"forward-looking information" (sometimes also referred to as

“forward- looking statements”) which does not consist of historical

facts. Forward-looking information includes estimates and

statements that describe Abaxx or the Company’s future plans,

objectives, or goals, including words to the effect that Abaxx

expects a stated condition or result to occur. Forward-looking

information may be identified by such terms as “seeking”,

“believes”, “anticipates”, “expects”, “estimates”, “may”, “could”,

“would”, “will”, or “plan”. Since forward-looking information is

based on assumptions and address future events and conditions, by

their very nature they involve inherent risks and uncertainties.

Although forward-looking information is based on information

currently available to Abaxx, Abaxx does not provide any assurance

that actual results will meet management’s expectations. Risks,

uncertainties, and other factors involved with forward-looking

information could cause actual events, results, performance,

prospects, and opportunities to differ materially from those

expressed or implied by such forward-looking information.

Forward-looking information in this news release includes but is

not limited to, Abaxx’s objectives, goals or future plans, the

Company’s expectations concerning listing its common shares on a

U.S. exchange, the Company’s predictions for commodities supply and

demand, the Company’s anticipated listing of futures contracts, the

Company’s timing on operating futures exchanges, statements

regarding status of regulatory approvals, statements regarding

anticipated financings and expectations regarding the use of

proceeds thereof, both current and future, including the size,

pricing, terms, and timing of closing thereof, receipt of

regulatory approvals and licenses, including the RMO and ACH

licenses, timing of the commencement of operations, financial

predictions, and estimates of market conditions. Such factors

include, among others: risks relating to the global economic

climate; dilution; the Company’s limited operating history; future

capital needs and uncertainty of additional financing, including

the Company’s ability to utilize the Company’s at- the-market

equity offering program (the “ATM Program”) and the prices at which

the Company may sell Common Shares in the ATM Program, as well as

capital market conditions in general; the competitive nature of the

industry; currency exchange risks; the need for Abaxx to manage its

planned growth and expansion; the effects of product development

and need for continued technology change; protection of proprietary

rights; the effect of government regulation and compliance on Abaxx

and the industry; failure to obtain the requisite licenses from the

regulatory authorities in a timely fashion or at all, including the

RMO and ACH licenses; failure to operate a futures market in a

timely fashion or a tall; changes in demand for Nickel and other

metals; the ability to list the Company’s securities on stock

exchanges and receive the necessary approvals therefore in a timely

fashion or at all; network security risks; the ability of Abaxx to

maintain properly working systems; reliance on key personnel;

global economic and financial market deterioration impeding access

to capital or increasing the cost of capital; and volatile

securities markets impacting security pricing unrelated to

operating performance. In addition, particular factors which could

impact future results of the business of Abaxx include but are not

limited to: operations in foreign jurisdictions; protection of

intellectual property rights; contractual risk and third-party

risk; clearinghouse risk, malicious actor risks, third-party

software license risk, system failure risk, risk of technological

change and dependence on technical infrastructure; capital market

conditions and share dilution resulting from the ATM Program and

from other equity issuances; an inability of Abaxx Tech to raise

sufficient funds to complete funding responsibilities in respect of

the Abaxx Singapore strategic financing; and restriction on labor

and international travel and supply chains. Abaxx has also assumed

that no significant events occur outside of Abaxx’s normal course

of business.

Abaxx cautions that the foregoing list of

material factors is not exhaustive. In addition, although Abaxx has

attempted to identify important factors that could cause actual

results to differ materially, there may be other factors that cause

results not to be as anticipated, estimated, or intended. When

relying on Abaxx's forward-looking information to make decisions,

investors and others should carefully consider the foregoing

factors and other uncertainties and potential events. Abaxx has

assumed that the material factors referred to in the previous

paragraph will not cause such forward-looking information to differ

materially from actual results or events. However, the list of

these factors is not exhaustive and is subject to change and there

can be no assurance that such assumptions will reflect the actual

outcome of such items or factors. The forward-looking information

contained in this press release represents the expectations of

Abaxx as of the date of this press release and, accordingly, is

subject to change after such date. Readers should not place undue

importance on forward-looking information and should not rely upon

this information as of any other date.

Abaxx does not undertake to update this

information at any particular time except as required in accordance

with applicable laws. CBOE Canada does not accept responsibility

for the adequacy or accuracy of this press release.

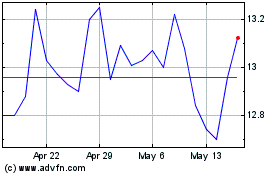

Abaxx Technologies (NEO:ABXX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Abaxx Technologies (NEO:ABXX)

Historical Stock Chart

From Apr 2023 to Apr 2024