Abaxx Technologies Inc. (NEO:ABXX)(OTCQX:ABXXF)

(“Abaxx” or the “Company”), a financial software and market

infrastructure company, majority shareholder of the

Abaxx

Commodity Exchange and Clearinghouse (“Abaxx Singapore”),

and producer of the

SmarterMarkets™ Podcast,

summarizes development activities over the past quarter and the

general progress of the Company’s business plans.

The Company plans to host an investor call and presentation on

Thursday, August 17th, with details outlined in this release.

Highlights:

Abaxx Exchange and Clearing Developments Highlights:

- Risk and Regulatory: Concluded

public consultation on Exchange and Clearing House rules; ongoing

engagement with MAS for ACH and RMO licensing.

- Commercial: Broad interactions with

market participants including significant meetings and interactions

at The 20th International Conference & Exhibition on Liquefied

Natural Gas (LNG2023), where Abaxx Singapore was the sole global

exchange and clearing group represented amongst over 400 LNG

Traders and 3,000 delegates; selected to present the Abaxx physical

futures white paper and suite of LNG benchmark contracts at the

upcoming global GasTech conference in Singapore.

- Systems and Operations: Hired a new

Chief Technology Officer with global exchange experience and

progressed integration of third-party clearing and exchange

independent software vendors (ISVs) into production.

- Exchange Product Development:

Advanced development of Nickel futures contract; efforts on carbon

and precious metals market solutions continue.

- Abaxx Console Apps and ID++

Protocol: Completed upgrade to ID++ V2 core protocol; prototyping

tools for carbon markets with improved privacy and accountability

(Abaxx Project Venice).

Abaxx Corporate Update Highlights:

- First Revenues from Base Carbon

Revenue Royalties: Abaxx Technologies achieved its first revenues

from a 2.5% royalty on Base Carbon sales, following the successful

issuance and sale of 1,116,221 Verified Carbon Units (VCUs) related

to a Vietnam Project's cookstove and water purifier components to

the project’s offtaker, Citigroup.

- Signing of Strategic Financing

Investor: Abaxx Singapore has executed a definitive investment

agreement with a global market infrastructure operator to make a

cash investment in Abaxx Singapore, subject to closing conditions,

as previously announced on August 14, 2023.

- U.S. Listing Application: Abaxx

pursing intralisting on Cboe Global Listings to expand capital

markets reach and engage global investors, subject to all

regulatory requirements, as previously announced on June 2,

2023.

Dear Shareholders,

Abaxx Technologies has made significant progress in its

strategic initiatives over the recent months. The Company's efforts

have been centered around technological advancements, regulatory

engagements, and expanding its market presence, all of which are

crucial in addressing global challenges, including the ongoing

energy transition and global supply chain investment cycle.

Your continued support and trust are greatly appreciated as

Abaxx pursues its outlined objectives.

Abaxx Exchange and Clearing Developments

Risk and Regulatory: Since our last update, the Company

concluded its public consultation on the rules and procedures of

the Exchange and Clearing House. Engagements with the Monetary

Authority of Singapore (“MAS”) maintained pace to close off any

remaining regulatory review and licensing requirement for the

Approved Clearing House (ACH), Approved Holding Company (AHC) and

Recognised Market Operator (RMO) licenses. These licensing

requirements are still subject to final regulatory approval.

Commercial: Continuing our broad interaction with relevant

market participants across all intended product verticals, the

Abaxx Commercial team met with over 20 energy-specific Chief Risk

Officers at the CCRO Summer Meeting in Boston and had significant

meetings and interactions amongst the 3,000 delegates and 400

Senior LNG traders attending the LNG2023 Conference in Vancouver in

July. Our engagements also included one-on-one meetings with

Futures Clearing firms involved in the upcoming launch of Abaxx

Exchange. We are preparing for a busy quarter including our second

annual reception during S&P’s APPEC event and our first

presentation at the global GasTech conference in Singapore which

will attract over 40,000 delegates. Chief Commercial Officer, Joe

Raia, and Abaxx Singapore President Dan McElduff will present

Abaxx’s thesis on the need for physically-settled LNG benchmarks —

chosen out of the over seven hundred abstracts submitted.

Systems and Operations: Abaxx Singapore is pleased to announce

the addition of a new Chief Technology Officer to its team in

anticipation of the upcoming launch. The Chief Technology Officer’s

extensive experience, obtained from a previous role at a globally

recognized exchange, will be an asset to the Company, where they

are expected to leverage their background to enhance Abaxx

Singapore's technological capabilities, drive innovation and

solidify the Company's position in the global market infrastructure

landscape.

The Company also progressed integration of third-party clearing

and exchange ISVs into production environments.

Exchange Product Development: Abaxx Singapore is

finalizing Stage 3 of its nickel-related product development —

focused on industry, risk, and regulatory considerations.

Contingent on submission and review by the Monetary Authority of

Singapore (MAS), Abaxx will seek to include its first battery

metals futures contract on the launch slate with LNG and carbon

contracts. Abaxx is also progressing work on additional carbon

market solutions as the market continues implementing structure

around requirements of Article 6 of the Paris Agreement (Article

6). Precious metals solutions remain in Stage 3 of development. The

Company’s efforts in precious metals are broader than futures

market development, and we look forward to sharing more details at

the appropriate time.

Abaxx Console Apps and ID++ Protocol: In Q2 2023, our Digital

Product and Engineering Teams completed the upgrade of ID++ to

“Version 2” (V2) of the core protocol, and commenced prototyping a

suite of tools designed to improve privacy and accountability for

participants in carbon markets and beyond. ID++ V2 has been

re-engineered from its foundational elements to be more resilient,

secure, and interoperable than its predecessor. With the completion

of the software development kit (SDK), tools built using ID++ V2

core are ready to address enterprise requirements in a complex,

networked and evolving landscape with increased utilization of AI

and distributed systems.

With the internal code name Project Venice, our team is pairing

existing console apps with newly developed tools to prototype an

application suite that connects qualified participants looking to

transact in carbon credits, under Article 6. We intend to design a

secure bridge that connects the enterprise cloud to distributed

networks and becomes the workflow operating standard for

institutions and governments looking to trade mitigation outcomes.

We expect pilot and formalized partnership details to be announced

in future updates, along with a newly branded commercial platform

of Abaxx console tools.

Abaxx Corporate Update

Abaxx Group Development Company Base Carbon Delivers First

Revenues to Abaxx Technologies: In Q2-2023, Abaxx achieved an

important corporate milestone by recognizing first revenues on the

Company’s 2.5% gross revenue royalty on Base Carbon sales, the

first group revenue from an organic development project within

Abaxx.

In May 2023, Base Carbon Capital Partners Corp. issued 1,020,903

carbon credits, also referred to as verified carbon units (“VCUs”),

associated with the cookstove component of a Vietnam Project, in

exchange for a contractually agreed payment of $5,870,192 from

project off-taker, Citigroup, which generated a royalty payment

obligation to Abaxx.

Canadian At-the-Market Equity Program: On April 26, 2023, the

Company announced it had established a Canadian at‐the‐market

equity offering program (“the ATM Program” or “ATM”) that allows

the Company to issue, at its discretion, common shares of the

Company having an aggregate offering price of up to $30,000,000 to

the public from time to time through the Agent.

Distributions of Common Shares pursuant to the ATM Program, if

any, will be made in accordance with the terms of an equity

distribution agreement dated April 26, 2023 (the “Equity

Distribution Agreement”) entered into by the Company and the Agent.

The ATM Program will be effective until the earlier of the issuance

and sale of all of the Common Shares issuable pursuant to the ATM

Program and December 4, 2023, unless terminated earlier in

accordance with the terms of the Equity Distribution Agreement.

Common Shares issued under the ATM Program will be issued from

treasury and distributed directly on the Cboe Canada Exchange, or

such other recognized marketplaces to the extent permitted, at

prevailing market prices at the time of sale, all in accordance

with the terms of the Equity Distribution Agreement. For more

information about the ATM Program, please refer to our April 26th

Press Release.

Q2 2023 Business Update Investor Call

The Company plans to host a quarterly business update investor

presentation, to provide a business update and respond to investor

questions.

The Company will hold the investor presentation via Zoom

Meetings on Thursday, August 17th at 10:00 a.m. Eastern Standard

Time Zone (EST). The Company invites current and prospective

shareholders to attend this quarterly business update and Q&A

session with the Abaxx executive team. Attendees may email their

questions in advance to ir@abaxx.tech.

Registration will be required to access the meeting. Following

the presentation, a recording of the session will be made available

on the Abaxx Investor Relations website at

investors.abaxx.tech.

PRESENTATION DETAILS

DATE Thursday, August 17th, 2023 TIME 10:00 AM Eastern Standard

Time (EST) LOCATION Zoom Meeting To receive the meeting link and

passcode, please register here.

QUESTIONS Please submit questions ahead of the presentation to:

ir@abaxx.tech

This announcement has been prepared for publication in

Canada and may not be released to U.S. wire services or distributed

in the United States. This announcement does not constitute an

offer to sell, or a solicitation of an offer to buy, securities in

the United States or any other jurisdiction. Any securities

described in this announcement have not been, and will not be,

registered under the US Securities Act of 1933, as amended (the “US

Securities Act”), or any state securities laws, and may not be

offered or sold in the United States except in transactions exempt

from, or not subject to, registration under the US Securities Act

and applicable US state securities laws.

About Abaxx Technologies

Abaxx is a development-stage financial software and market

infrastructure company creating proprietary technological

infrastructure for both global commodity exchanges and digital

marketplaces. The Company’s formative technology increases

transaction velocity, data security, and facilitates improved risk

management in the majority-owned Abaxx Commodity Exchange (Abaxx

Singapore Pte. Ltd.) - a commodity futures exchange seeking final

regulatory approvals as a Recognized Market Operator (“RMO”) and

Approved Clearing House (“ACH”) with the Monetary Authority of

Singapore (“MAS”). Abaxx is a founding shareholder in Base Carbon

Inc. and the creator and producer of the SmarterMarkets™

podcast.

For more information please

visit abaxx.tech, abaxx.exchange

and smartermarkets.media.

Media and investor inquiries:

Abaxx Technologies Inc.Investor Relations TeamTel: +1 246 271

0082E-mail: ir@abaxx.tech

Forward-Looking Statements

This News Release includes certain

"forward-looking information" (sometimes also referred to as

“forward-looking statements”) which does not consist of historical

facts. Forward-looking information includes estimates and

statements that describe Abaxx or the Company’s future plans,

objectives, or goals, including words to the effect that Abaxx

expects a stated condition or result to occur. Forward-looking

information may be identified by such terms as “seeking”,

“believes”, “anticipates”, “expects”, “estimates”, “may”, “could”,

“would”, “will”, or “plan”. Since forward-looking information is

based on assumptions and address future events and conditions, by

their very nature they involve inherent risks and uncertainties.

Although forward-looking information is based on information

currently available to Abaxx, Abaxx does not provide any assurance

that actual results will meet management’s expectations. Risks,

uncertainties, and other factors involved with forward-looking

information could cause actual events, results, performance,

prospects, and opportunities to differ materially from those

expressed or implied by such forward-looking information.

Forward-looking information in this news release includes but is

not limited to, Abaxx’s objectives, goals or future plans, the

Company’s expectations concerning listing its common shares on a

U.S. exchange, statements regarding anticipated financings and

expectations regarding the use of proceeds thereof, both current

and future, including the size, pricing, terms, and timing of

closing thereof, receipt of regulatory approvals and licenses,

including the RMO and ACH licenses, timing of the commencement of

operations, financial predictions, and estimates of market

conditions. Such factors include, among others: risks relating to

the global economic climate; dilution; the Company’s limited

operating history; future capital needs and uncertainty of

additional financing, including the Company’s ability to utilize

the Company’s at-the-market equity offering program (the “ATM

Program”) and the prices at which the Company may sell Common

Shares in the ATM Program, as well as capital market conditions in

general; the competitive nature of the industry; currency exchange

risks; the need for Abaxx to manage its planned growth and

expansion; the effects of product development and need for

continued technology change; protection of proprietary rights; the

effect of government regulation and compliance on Abaxx and the

industry; failure to obtain the requisite licenses from the

regulatory authorities in a timely fashion or at all, including the

RMO and ACH licenses; the ability to list the Company’s securities

on stock exchanges and receive the necessary approvals therefor in

a timely fashion or at all; network security risks; the ability of

Abaxx to maintain properly working systems; reliance on key

personnel; global economic and financial market deterioration

impeding access to capital or increasing the cost of capital; and

volatile securities markets impacting security pricing unrelated to

operating performance. In addition, particular factors which could

impact future results of the business of Abaxx include but are not

limited to: operations in foreign jurisdictions; protection of

intellectual property rights; contractual risk and third-party

risk; clearinghouse risk, malicious actor risks, third-party

software license risk, system failure risk, risk of technological

change and dependence on technical infrastructure; capital market

conditions and share dilution resulting from the ATM Program and

from other equity issuances; an inability of Abaxx Tech to raise

sufficient funds to complete funding responsibilities in respect of

the Abaxx Singapore strategic financing; and restriction on labor

and international travel and supply chains. Abaxx has also assumed

that no significant events occur outside of Abaxx’s normal course

of business.

Abaxx cautions that the foregoing list of

material factors is not exhaustive. In addition, although Abaxx has

attempted to identify important factors that could cause actual

results to differ materially, there may be other factors that cause

results not to be as anticipated, estimated, or intended. When

relying on Abaxx's forward-looking information to make decisions,

investors and others should carefully consider the foregoing

factors and other uncertainties and potential events. Abaxx has

assumed that the material factors referred to in the previous

paragraph will not cause such forward-looking information to differ

materially from actual results or events. However, the list of

these factors is not exhaustive and is subject to change and there

can be no assurance that such assumptions will reflect the actual

outcome of such items or factors. The forward-looking information

contained in this press release represents the expectations of

Abaxx as of the date of this press release and, accordingly, is

subject to change after such date. Readers should not place undue

importance on forward-looking information and should not rely upon

this information as of any other date. Abaxx does not undertake to

update this information at any particular time except as required

in accordance with applicable laws. CBOE Canada does not accept

responsibility for the adequacy or accuracy of this press

release.

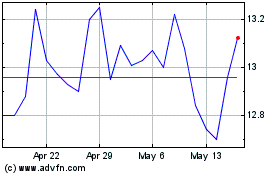

Abaxx Technologies (NEO:ABXX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Abaxx Technologies (NEO:ABXX)

Historical Stock Chart

From Apr 2023 to Apr 2024