Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

June 10 2022 - 8:14AM

Edgar (US Regulatory)

Free Writing Prospectus

Filed pursuant to Rule 433

Supplementing the

Preliminary Prospectus Supplement, dated June 6, 2022

Registration No. 333-236740

West Bancorporation, Inc.

$60,000,000

5.25% Fixed-to-Floating Rate Subordinated Notes

due 2032

Term Sheet

| Issuer: |

West Bancorporation, Inc., an Iowa corporation and a financial holding company (the “Company”) |

| |

|

| Security: |

5.25% Fixed-to-Floating Rate Subordinated Notes due 2032 (the “Notes”) |

| |

|

| Aggregate Principal Amount: |

$60,000,000 |

| |

|

| Ratings: |

BBB+ by Egan-Jones Ratings Company

A rating is not a recommendation to buy, sell

or hold securities. Ratings may be subject to revision or withdrawal at any time by the assigning rating organization. Each rating should

be evaluated independently of any other rating. |

| |

|

| Trade Date: |

June 9, 2022 |

| |

|

| Settlement Date: |

June 14, 2022 (T + 3) |

| |

|

| Final Maturity Date (if not previously redeemed): |

June 15, 2032 |

| |

|

| Coupon: |

5.25% per annum, from and including the Settlement Date, to but excluding June 15, 2027, payable semi-annually in arrears. From and including June 15, 2027 to, but excluding the maturity date or earlier redemption date, a floating per annum rate equal to the then current three-month term SOFR (as defined in the prospectus supplement under “Description of the Notes — Interest”), provided, however, that in the event three-month term SOFR is less than zero, three-month term SOFR shall be deemed to be zero, plus 241 basis points, payable quarterly in arrears. |

| |

|

|

Interest Payment Dates: |

Interest on the Notes will be payable on June 15 and December 15 of each year through, but not including, June 15, 2027, and quarterly thereafter on March 15, June 15, September 15 and December 15 of each year to, but excluding, the maturity date or earlier redemption date. The first interest payment will be made on December 15, 2022. |

| |

|

| Record Dates: |

The 15th calendar day immediately preceding the applicable interest payment date |

| |

|

| Day Count Convention: |

30/360 to but excluding June 15, 2027, and, thereafter, a 360-day year and the number of days actually elapsed. |

|

Optional Redemption: |

The Company may, at its option, beginning with the interest payment date of June 15, 2027 and on any interest payment date thereafter, redeem the Notes, in whole or in part, from time to time, subject to obtaining the prior approval of the Federal Reserve and the holders of our senior indebtedness to the extent such approval is then required under the capital adequacy rules of the Federal Reserve and terms governing our senior indebtedness, respectively, at a redemption price equal to 100% of the principal amount of the Notes being redeemed plus accrued and unpaid interest to, but excluding, the date of redemption. |

| |

|

| Special Redemption: |

The Company may redeem the Notes, in whole but not in part, at any time, including prior to June 15, 2027, subject to obtaining the prior approval of the Federal Reserve and the holders of our senior indebtedness to the extent such approval is then required under the capital adequacy rules of the Federal Reserve or terms governing our senior indebtedness, respectively, if (1) the Company receives an opinion from independent tax counsel to the effect that (a) there has been an amendment or change (including any announced prospective amendment or change) in law, (b) an administrative or judicial action has been announced or taken, (c) there has been an amendment to or change in any official position with respect to, or interpretation of, an administrative or judicial action or a law or regulation that differs from the previously generally accepted position or interpretation, or (d) there is a threatened challenge in connection with an audit of the Company or a similar issuer, in each case, as a result of which, there is a more than insubstantial increase in the risk that interest payable by the Company on the Notes is not, or within 90 days of the date of such opinion, will not be deductible by the Company, in whole or in part, for U.S. federal income tax purposes; (2) the Company makes a good faith determination that as a result of a change or proposed change in law, rules or regulation, or an official administration action or pronouncement, there is a more than an insubstantial risk that the Notes could not be recognized as Tier 2 Capital for regulatory capital purposes, or (3) the Company is required to register as an investment company under the Investment Company Act of 1940, as amended, in each case, at a redemption price equal to 100% of the principal amount of the Notes being redeemed plus any accrued and unpaid interest to, but excluding, the redemption date. |

| |

|

| Denominations: |

$1,000 minimum denominations and $1,000 integral multiples thereof. |

| |

|

| Use of Proceeds: |

The Company intends to use the net proceeds from this offering for general corporate purposes, including providing capital to support organic growth and for investing in West Bank as regulatory capital. The precise amounts and timing of our use of the net proceeds will depend on the Company’s and West Bank’s funding requirements and the availability of other funds. |

| |

|

| Price to Public: |

100.00% |

| |

|

| Underwriters’ Discount: |

1.50% of principal amount |

| |

|

| Proceeds to the Company (after underwriters’ discount, but before expenses): |

$59,100,000 |

| Ranking: |

The Notes will be unsecured, subordinated obligations

of the Company and:

· will

rank junior in right of payment and upon the Company’s liquidation to any of the Company’s existing and all future Senior

Debt (as defined in the indenture pursuant to which the Notes will be issued and described under “Description of the Notes”

in the preliminary prospectus supplement);

· will

rank equal in right of payment and upon our liquidation with any of the Company’s existing and all of its future indebtedness the

terms of which provide that such indebtedness ranks equally with the Notes;

· will rank senior in right of payment and upon the Company’s liquidation to (i) its existing junior subordinated

debentures and (ii) any of its future indebtedness the terms of which provide that such indebtedness ranks junior in right of

payment to note indebtedness such as the Notes; and

· will

be effectively subordinated to the Company’s future secured indebtedness to the extent of the value of the collateral securing such

indebtedness, and structurally subordinated to the existing and future indebtedness of the Company’s subsidiaries, including without

limitation West Bank’s depositors, liabilities to general creditors and liabilities arising in the ordinary course of business or

otherwise.

As of March 31, 2022, on a consolidated

basis, the Company’s outstanding debt and deposits totaled approximately $3.3 billion, which included approximately $3.1 billion

of deposit liabilities at West Bank. In addition, as of March 31, 2022, the Company (at the holding company level) had $40 million

of indebtedness that would rank senior to the Notes, no indebtedness that would rank pari passu to the Notes, and $20.5 million

of indebtedness that would rank junior to the Notes. |

| |

|

| CUSIP/ISIN: |

95123P AB2 / US95123PAB22 |

| |

|

| Sole Book-Running Manager: |

Piper Sandler & Co. |

We

expect that delivery of the Notes will be made against payment for the Notes on or about Settlement Date indicated above, which will be

the third business day following the trade date of June 9, 2022 (this settlement cycle being referred to as “T+3”).

Under Rule 15c6-1 of the Securities Exchange Act of 1934, as amended, trades in the secondary market generally will be required to

settle in two business days, unless the parties to any such trade expressly agree otherwise. Accordingly, purchasers who wish to trade

the Notes on any date prior to the second business day preceding the Settlement Date will be required, by virtue of the fact that the

notes will initially settle in 3 business days (T+3), to specify alternative settlement arrangements to prevent a failed settlement and

should consult their own investment advisor.]

This

Pricing Term Sheet is qualified in its entirety by reference to the Preliminary Prospectus Supplement. The information in this Pricing

Term Sheet supplements the Preliminary Prospectus Supplement and supersedes the information in the Preliminary Prospectus Supplement to

the extent it is inconsistent with the information in the Preliminary Prospectus Supplement. Other information (including other financial

information) presented in the Preliminary Prospectus Supplement is deemed to have changed to the extent affected by the information contained

herein. Capitalized terms used in this Pricing Term Sheet but not defined have the meanings given them in the Preliminary Prospectus Supplement.

The Company has filed a registration statement (including a prospectus) and a preliminary prospectus supplement with the Securities and

Exchange Commission (“SEC”) for the offering to which this communication relates. Before you invest, you should read the prospectus

in that registration statement, the preliminary prospectus supplement and other documents the Company has filed with the SEC for more

complete information about the Company and this offering. You may get these documents for free by visiting EDGAR on the SEC’s website

at www.sec.gov. Alternatively, the Company, any underwriter or any dealer participating in the offering will arrange to send you

the prospectus and the related preliminary prospectus supplement if you request it by calling Piper Sandler & Co. toll-free at

(866) 805-4128 or emailing fsg-dcm@psc.com.

ANY DISCLAIMERS OR OTHER NOTICES THAT MAY APPEAR

BELOW ARE NOT APPLICABLE TO THIS COMMUNICATION AND SHOULD BE DISREGARDED. SUCH DISCLAIMERS OR OTHER NOTICES WERE AUTOMATICALLY GENERATED

AS A RESULT OF THIS COMMUNICATION BEING SENT VIA BLOOMBERG OR ANOTHER EMAIL SYSTEM.

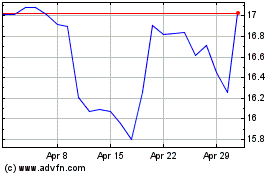

West Bancorporation (NASDAQ:WTBA)

Historical Stock Chart

From Mar 2024 to Apr 2024

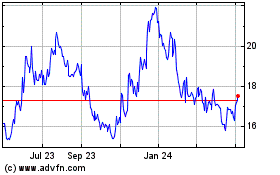

West Bancorporation (NASDAQ:WTBA)

Historical Stock Chart

From Apr 2023 to Apr 2024