UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant

to Section 14(a) of the

Securities Exchange Act

of 1934

Filed by the Registrant

x

Filed by a Party other

than the Registrant ¨

Check the appropriate box:

|

|

¨

|

Preliminary

Proxy Statement

|

|

|

¨

|

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

¨

|

Definitive

Proxy Statement

|

|

|

x

|

Definitive

Additional Materials

|

|

|

¨

|

Soliciting

Material Pursuant to § 240.14a-12

|

VILLAGE

BANK AND TRUST FINANCIAL CORP.

(Name of Registrant

as Specified In Its Charter)

(Name of Person(s)

Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check

the appropriate box):

|

|

¨

|

Fee

computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

|

|

|

(1)

|

Title

of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate

number of securities to which transaction applies:

|

|

|

(3)

|

Per

unit price or other underlying value of transaction computed pursuant to Exchange Act

Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it

was determined:)

|

|

|

(4)

|

Proposed

maximum aggregate value of transaction:

|

|

|

¨

|

Fee

paid previously with preliminary materials.

|

|

¨

|

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and

identify the filing for which the offsetting fee was paid previously. Identify

the previous filing by registration statement number, or the Form or Schedule and the

date of its filing.

|

|

|

1)

|

Amount

Previously Paid:

|

|

|

2)

|

Form,

Schedule or Registration Statement No.:

|

March 29, 2021

Dear Fellow Shareholder,

We hope this message finds you safe and well. Since the beginning of

the pandemic, we have all been adapting continuously to a steady flow of information, directives, challenges and opportunities. The pandemic

forced us to move rapidly to limit our branch service to drive-through only, encourage remote online banking, and transition most of our

non-branch work force to working from home. Throughout these times our primary focus has been to protect our clients and teammates. We

believe that this crisis, as terrible as it’s been, has given us an opportunity to really engage with clients in meaningful and

lasting ways and to make those investments to emerge stronger.

During 2020, we were able to distinguish ourselves by funding $185

million Paycheck Protection Program (“PPP”) Round-1 loans, through which we helped approximately 1,500 businesses save 20,000

jobs in our community, and added a significant number of new small business clients who were in desperate need of these funds. Our ability

to react nimbly allowed us to fund PPP loans in an aggregate amount equal to 43% of our outstanding loans as of December 31, 2019. We

provided loan payment deferrals to both consumer and commercial clients struggling with lost jobs or business closures. Our mortgage company

supported our clients through purchasing or refinancing their homes, while achieving record application volume with a partially remote

work force. At the time of this writing, we are supporting the SBA’s PPP Round-2 loan applications for both new and existing clients

and have received SBA approval on $70.4 million in PPP loans supporting 699 businesses in PPP Round-2. This crisis has allowed us to prove

how we are different from other financial institutions. Village Bank’s resolve to treat our clients like a neighbor and not a number

has never shone brighter.

We will continue to pursue strategies that we believe will help us

achieve our goal of delivering long-term total shareholder returns that rank in the top quartile of a nationwide peer group while pursuing

our purpose to support the economic health of our community and improve our clients’ lives. We will achieve this goal if we

deliver top quartile return on equity, produce sustainable earnings growth, achieve best quartile earnings volatility in our industry

and deliver best quartile asset quality in the worst part of the economic cycle. We successfully battled to grow earnings in 2020 in a

difficult economic environment where margins were under pressure. Our efforts to fund PPP loans, control expenses, and leverage our mortgage

banking segment allowed us to grow earnings and to add new clients with the potential to expand these relationships in the future. For

the year, we produced a 17.98% return on average equity, 89% earnings per share growth, and maintained stable asset quality. We are particularly

pleased by the outstanding contribution from our mortgage banking segment, which produced net income of $3.9 million for 2020 compared

to $979,000 for 2019. Finally, we successfully navigated leadership transitions, both on the executive team and board of directors, mentioned

in previous filings.

While this strong momentum has placed us in a more resilient

position, we know we will be faced with economic head winds in 2021 from a continued low rate environment, high levels of liquidity,

competition driving spreads tighter and underwriting standards looser, and the health of the economy as the virus is brought under

control. We recognize that the economic benefit provided by the PPP opportunity as well the favorable rate environment for

residential mortgage loans are not sustainable, but, we see opportunity in these clients. As described in prior filings, we are

expanding our relationships with the approximately 400 new clients won during the first round of PPP, leveraging our new Treasury

Management Services team, increasing our presence through our new branch in the vibrant Scott’s Addition area in Richmond,

Virginia, encouraging mortgage loan demand, and strategically deploying excess liquidity to support net interest margin. We are optimistic

about 2021 and laying the foundation for 2022.

We cannot close out this letter without expressing our gratitude for

the leadership, commitment and service of Bill Foster and Charlie Walton, our recent retirees as Chief Executive Officer and Director,

respectively. We want to share a few comments on their special contributions:

We thank Bill Foster for his leadership in transforming Village

into an organization that performs exceptionally well for our clients, shareholders, team members and community. His business

instincts and judgment helped to create a path to recovery for the bank after the Great Recession. We are indebted to Bill

for all of those things and will miss him. Charlie Walton infuses every question and observation with highly developed business instincts

and judgment. With his CPA and business background, he brought a focus on the critical details that drive performance. Charlie

was a source of optimism and positive energy during the difficult years following the recession. We wish them good health and a joyful

journey in the years ahead.

We hope that you share our pride in how Village Bank distinguished

itself in 2020 both in terms of financial results and in the depth of commitment to our community. Please join us at the virtual shareholders

meeting on May 18, 2021, and thank you for your continued support.

Regards,

|

|

|

James E. Hendricks, Jr.

|

Craig D. Bell

|

|

President and Chief Executive Officer

|

Chairman, Board of Directors

|

Forward-Looking Statements

In addition to historical information, this letter may contain forward-looking

statements. For this purpose, any statement that is not a statement of historical fact may be deemed to be a forward-looking statement.

Forward-looking statements are subject to numerous assumptions, risks and uncertainties, and actual results could differ materially from

historical results or those anticipated by such statements. There are many factors that could cause actual results to differ materially

from those expressed in the forward-looking statements including, but not limited to, changes in interest rates, the effects of future

economic, business and market conditions, legislative and regulatory changes, governmental monetary and fiscal policies, changes in accounting

policies, rules and practices, the impact of the ongoing coronavirus (COVID-19) pandemic, and other factors described from time to time

in our reports filed with the Securities and Exchange Commission (“SEC”). For further information, contact Donald M. Kaloski,

Jr., Executive Vice President and Chief Financial Officer, at 804-897-3900 or dkaloski@villagebank.com.

Additional Information

This letter may be deemed to be solicitation material in respect of

the Company’s 2021 annual meeting of shareholders. The Company filed a definitive proxy statement with the SEC on April 5, 2021

in connection with the annual meeting. Shareholders are urged to read the proxy statement and any other relevant documents that the Company

files with the SEC because they will contain important information. The Company, its directors and certain of its executive officers will

be participants in the solicitation of proxies from shareholders in connection with the annual meeting. Information about the Company’s

directors and executive officers is included in the proxy statement. Investors and shareholders may obtain a copy of the proxy statement

and other documents filed by the Company free of charge from the SEC’s website at www.sec.gov. Shareholders may obtain a copy of

the proxy statement free of charge by writing to the Company’s Corporate Secretary, Deborah Golding, whose address is P.O. Box 330,

Midlothian, Virginia, 23113-0330, or from the Company’s website at www.villagebank.com.

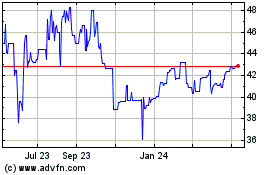

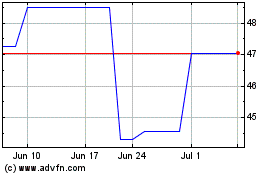

Village Bank and Trust F... (NASDAQ:VBFC)

Historical Stock Chart

From Aug 2024 to Sep 2024

Village Bank and Trust F... (NASDAQ:VBFC)

Historical Stock Chart

From Sep 2023 to Sep 2024