UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2023

Commission File Number: 001-38527

Uxin Limited

21/F, Donghuang Building,

No. 16 Guangshun South Avenue

Chaoyang District,

Beijing 100102

People’s Republic of China

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Exhibit Index

Exhibit 99.1—Uxin Reports Unaudited First Quarter of Fiscal Year 2024 Financial Results

Exhibit 99.2—Uxin Reports Unaudited Second Quarter of Fiscal Year 2024 Financial Results

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

UXIN LIMITED |

|

|

|

By |

: |

/s/Feng Lin |

|

Name |

: |

Feng Lin |

|

Title |

: |

Chief Financial Officer |

Date: November 28 , 2023

Exhibit 99.1

Uxin Reports Unaudited First Quarter of Fiscal Year 2024 Financial Results

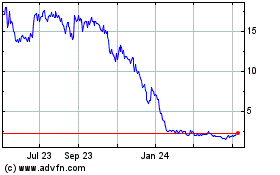

BEIJING, Nov.28,2023–Uxin Limited (“Uxin” or the “Company”) (Nasdaq: UXIN), China's leading used car retailer, today announced its unaudited financial results for the first quarter ended June 30, 2023.

Highlights for the Quarter Ended June 30, 2023

•Transaction volume was 3,254 units for the three months ended June 30, 2023, a decrease of 9.8% from 3,607 units in the last quarter and a decrease of 40.6% from 5,475 units in the same period last year.

•Retail transaction volume was 1,687 units, a decrease of 25.3% from 2,259 units in the last quarter and a decrease of 29.9% from 2,407 units in the same period last year.

•Total revenues were RMB289.0 million (US$39.9 million) for the three months ended June 30, 2023, a decrease of 15.9% from RMB343.8 million in the last quarter and a decrease of 53.8% fromRMB626.2 million in the same period last year.

•Gross margin was 6.1% for the three months ended June 30, 2023, compared with 2.3% in the last quarter and 1.1% in the same period last year.

•Non-GAAP adjusted EBITDA was a loss of RMB46.6 million (US$6.4 million), compared with a loss of RMB40.8 million in the last quarter and RMB76.3 million in the same period last year.

Financial Results for the Quarter Ended June 30, 2023

Total revenues were RMB289.0 million (US$39.9 million) for the three months ended June 30, 2023, a decrease of 15.9% from RMB343.8 million in the last quarter and a decrease of 53.8% from RMB626.2 million in the same period last year. The decreases were mainly due to the decline of total transaction volume.

Retail vehicle sales revenue was RMB186.8million (US$25.8 million) for the three months ended June 30, 2023, representing a decrease of 29.1% from RMB263.7 million in the last quarter and a decrease of 46.4% from RMB348.4 million in the same period last year. For the three months ended June 30, 2023, retail transaction volume was 1,687 units, a decrease of 25.3% from 2,259 units last quarter and a decrease of 29.9% from 2,407 units in the same period last year. The decreases in retail transaction volume were mainly due to the market factors. Starting from March 2023, the aggressive pricing promotion in China’s new car sector had a significant impact on the used car sector, with customers showing stronger wait-and-see sentiment to buy used cars. Accordingly, the Company has maintained a prudent inventory procurement strategy and has not significantly increased its inventory, which constrained retail sales growth. Additionally, with the proactive optimization of inventory structure, the retail average selling price (ASP) declined.

Wholesale vehicle sales revenue was RMB94.6 million (US$13.1 million) for the three months ended June 30, 2023, compared with RMB73.6 million in the last quarter and RMB264.0 million in the same period last year. For the three months ended June 30, 2023, wholesale transaction volume was 1,567 units, representing an increase of 16.2% from 1,348 units last quarter and a decrease of 48.9% from 3,068 units in the same period last year. The quarter-over-quarter increase was mainly due to the natural increase in vehicle acquisition volume and wholesale transaction volume after the Spring Festival, which is normally the off-peak season. Compared with the same period last year, as the Company continued to improve its inventory capacity and reconditioning capabilities, an increased number of acquired vehicles were reconditioned to meet the Company’s retail standards, rather than being sold through wholesale channels. As a result, the wholesale vehicle sales revenue declined.

Other revenue was RMB7.6 million (US$1.0 million) for the three months ended June 30, 2023, compared with RMB6.5 million in the last quarter and RMB13.8 million in the same period last year.

Cost of revenues was RMB271.4 million (US$37.4 million) for the three months ended June 30, 2023, compared with RMB336.0 million in the last quarter and RMB619.4 million in the same period last year.

Gross margin was 6.1% for the three months ended June 30, 2023, compared with 2.3% in the last quarter and 1.1% in the same period last year. The increases in gross margin were due to the combination of several factors. The penetration rate of value-added services, which have high gross margins, continues to improve. In the meanwhile, with the improving inventory structure and vehicle pricing capabilities, both the sales margin and the sales turnover rate increased. Moreover, along with Xi’an IRC’s operation which enhanced the Company’s reconditioning capability, the Company’s reconditioning cost per retail vehicle has decreased significantly, which further fueled the Company’s gross margin resurgence.

Total operating expenses were RMB87.8 million (US$12.1 million) for the three months ended June 30, 2023. Total operating expenses excluding the impact of share-based compensation were RMB77.7 million.

•Sales and marketing expenses were RMB46.5 million (US$6.4 million) for the three months ended June 30, 2023, a decrease of 11.2% from RMB52.4 million in the last quarter and a decrease of 28.2% from RMB64.8 million in the same period last year. The decreases were mainly due to decline in marketing expenses driven by the adoption of more cost-effective promotion measures.

•General and administrative expenses were RMB33.1 million (US$4.6 million) for the three months ended June 30, 2023, representing a decrease of 13.6% from RMB38.3 million in the last quarter and a decrease of 27.4% from RMB45.6 million in the same period last year. The decreases were mainly due to the declines in professional fees.

•Research and development expenses were RMB8.9 million (US$1.2 million) for the three months ended June 30, 2023, representing a decrease of 5.0% from RMB9.3 million in the last quarter and a decrease of 1.1% from RMB9.0 million in the same period last year.

Other operating income, net was RMB7.0 million (US$1.0million) for the three months ended June 30, 2023, representing a decrease of 85.4% from RMB47.9 million in the last quarter. The decrease was mainly due to the decline in liability waiver gain.

Loss from operations was RMB63.2 million (US$8.7 million) for the three months ended June 30, 2023, compared with RMB57.4 million for the last quarter and RMB96.6 million in the same period last year.

Fair value impact related to the senior convertible preferred shares resulted in a loss of RMB36.9 million (US$5.1 million) for the three months ended June 30, 2023, compared with a gain of RMB0.5million in the last quarter. The impact was mainly due to the fair value change of the warrants issued in relation to the senior convertible preferred shares during the period. The fair value impact was a non-cash loss.

Net (loss)/income from operations was RMB91.6 million (US$12.6 million) for the three months ended June 30, 2023, compared with net loss of RMB79.8 million for the last quarter and net income of RMB160.0 million for the same period last year.

Non-GAAP adjusted EBITDA was a loss of RMB46.6 million (US$6.4million) for the three months ended June 30, 2023, compared with RMB40.8 million in the last quarter and RMB76.3 million in the same period last year.

Liquidity

The Company has incurred accumulated and recurring losses from operations, and cash outflows from operating activities. In addition, the Company’s current liabilities exceeded its current assets by approximately RMB272.6 million as of June 30, 2023.

The Company’s ability to continue as a going concern is dependent on management’s ability to increase sales, achieve higher gross profit margin and control operating costs and expenses to reduce the cash that will be used in operating cash flows, and to seek financing arrangements, including but not limited to proceeds from the subscription of the Company’s senior convertible preferred shares issued from exercise of the warrants, and funds from renewal of the existing borrowings and new facilities and equity financings. There is uncertainty regarding the execution of these business and financing plans, which raises substantial doubt about the Company’s ability to continue as a going concern. The accompanying unaudited financial information does not include any adjustment that is reflective of these uncertainties.

About Uxin

Uxin is China's leading used car retailer, pioneering industry transformation with advanced production, new retail experiences, and digital empowerment. We offer high-quality and value-for-money vehicles as well as superior after-sales services through a reliable, one-stop, and hassle-free transaction experience. Under our omni-channel strategy, we are able to leverage our pioneering online platform to serve customers nationwide and establish market leadership in selected regions through offline inspection and reconditioning centers. Leveraging our extensive industry data and continuous technology innovation throughout more than ten years of operation, we have established strong used car management and operation capabilities. We are committed to upholding our customer-centric approach and driving the healthy development of the used car industry.

Use of Non-GAAP Financial Measures

In evaluating the business, the Company considers and uses certain non-GAAP measures, including adjusted EBITDA and adjusted net loss from operations per share – basic and diluted, as supplemental measures to review and assess its operating performance. The presentation of the non-GAAP financial measure is not intended to be considered in isolation or as a substitute for the financial information prepared and presented in accordance with U.S. GAAP. The Company defines adjusted EBITDA as EBITDA excluding share-based compensation, fair value impact of the issuance of senior convertible preferred shares, foreign exchange losses, other income/(expenses) and dividend from long-term investment. The Company defines adjusted net loss attributable to ordinary shareholders per share – basic and diluted as net loss attributable to ordinary shareholders per share excluding impact of share-based compensation, fair value impact of the issuance of senior convertible preferred shares and deemed dividend to preferred shareholders due to triggering of a down round feature. The Company presents the non-GAAP financial measures because they are used by the management to evaluate the operating performance and formulate business plans. The Company also believes that the use of the non-GAAP measures facilitate investors' assessment of its operating performance as this measure excludes certain finance or non-cash items that the Company does not believe directly reflect its core operations. We believe that excluding these items enables us to more effectively evaluate our performance period-over-period and relative to our competitors.

The non-GAAP financial measures are not defined under U.S. GAAP and are not presented in accordance with U.S. GAAP. The non-GAAP financial measures have limitations as analytical tools. One of the key limitations of using adjusted EBITDA is that it does not reflect all items of income and expenses that affect the Company’s operations. Share-based compensation, fair value impact of the issuance of senior convertible preferred shares, other income/(expenses) and dividend from long-term investment have been and may continue to be incurred in the business. Further, the non-GAAP measures may differ from the non-GAAP information used by other companies, including peer companies, and therefore their comparability may be limited.

The Company compensates for these limitations by reconciling the non-GAAP financial measure to the nearest U.S. GAAP performance measure, all of which should be considered when evaluating the Company’s performance. The Company encourages you to review its financial information in its entirety and not rely on a single financial measure.

Reconciliations of Uxin’s non-GAAP financial measures to the most comparable U.S. GAAP measure are included at the end of this press release.

Exchange Rate Information

This announcement contains translations of certain RMB amounts into U.S. dollars (“US$”) at specified rates solely for the convenience of the reader, except for those transaction amounts that were actually settled in U.S. dollars. Unless otherwise stated, all translations from RMB to US$ were made at the rate of RMB7.2513 to US$1.00, representing the index rate as of June 30, 2023 set forth in the H.10 statistical release of the Board of Governors of the Federal Reserve System. The Company makes no representation that the RMB or US$ amounts referred could be converted into US$ or RMB, as the case may be, at any particular rate or at all.

Safe Harbor Statement

This announcement contains forward-looking statements. These statements are made under the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as “will,” “expects,” “anticipates,” “future,” “intends,” “plans,” “believes,” “estimates” and similar statements. Among other things, the business outlook and quotations from management in this announcement, as well as Uxin’s strategic and operational plans, contain forward-looking statements. Uxin may also make written or oral forward-looking statements in its periodic reports to the SEC, in its annual report to shareholders, in press releases and other written materials and in oral statements made by its officers, directors or employees to third parties. Statements that are not historical facts, including statements about Uxin’s beliefs and expectations, are forward-looking statements. Forward-looking statements involve inherent risks and uncertainties. A number of factors could cause actual results to differ materially from those contained in any forward-looking statement, including but not limited to the following: Uxin’s goal and strategies; its expansion plans; its future business development, financial condition and results of operations; Uxin’s expectations regarding demand for, and market acceptance of, its services; its ability to provide differentiated and superior customer experience, maintain and enhance customer trust in its platform, and assess and mitigate various risks, including credit; its expectations regarding maintaining and expanding its relationships with business partners, including financing partners; trends and competition in China’s used car e-commerce industry; the laws and regulations relating to Uxin’s industry; the general economic and business conditions; and assumptions underlying or related to any of the foregoing. Further information regarding these and other risks is included in Uxin’s filings with the SEC. All information provided in this press release and in the attachments is as of the date of this press release, and Uxin does not undertake any obligation to update any forward-looking statement, except as required under applicable law.

For investor and media enquiries, please contact:

Uxin Limited Investor Relations

Uxin Limited

Phone: +86 10 5691-6765

Email: ir@xin.com

The Blueshirt Group

Mr. Jack Wang

Phone: +86 166-0115-0429

Email: Jack@blueshirtgroup.com

Uxin Limited

Unaudited Consolidated Statements of Comprehensive Loss

(In thousands except for number of shares and per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the three months ended June 30, |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

RMB |

|

|

|

RMB |

|

|

US$ |

|

Revenues |

|

|

|

|

|

|

|

|

|

|

Retail vehicle sales |

|

|

348,393 |

|

|

|

|

186,849 |

|

|

|

25,768 |

|

Wholesale vehicle sales |

|

|

263,956 |

|

|

|

|

94,647 |

|

|

|

13,052 |

|

Others |

|

|

13,821 |

|

|

|

|

7,526 |

|

|

|

1,038 |

|

Total revenues |

|

|

626,170 |

|

|

|

|

289,022 |

|

|

|

39,858 |

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenues |

|

|

(619,411 |

) |

|

|

|

(271,381 |

) |

|

|

(37,425 |

) |

Gross profit |

|

|

6,759 |

|

|

|

|

17,641 |

|

|

|

2,433 |

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses |

|

|

|

|

|

|

|

|

|

|

Sales and marketing |

|

|

(64,798 |

) |

|

|

|

(46,548 |

) |

|

|

(6,419 |

) |

General and administrative |

|

|

(45,575 |

) |

|

|

|

(33,103 |

) |

|

|

(4,565 |

) |

Research and development |

|

|

(8,960 |

) |

|

|

|

(8,861 |

) |

|

|

(1,222 |

) |

Reversal of credit losses, net |

|

|

377 |

|

|

|

|

696 |

|

|

|

96 |

|

Total operating expenses |

|

|

(118,956 |

) |

|

|

|

(87,816 |

) |

|

|

(12,110 |

) |

|

|

|

|

|

|

|

|

|

|

|

Other operating income, net |

|

|

15,580 |

|

|

|

|

6,985 |

|

|

|

963 |

|

|

|

|

|

|

|

|

|

|

|

|

Loss from operations |

|

|

(96,617 |

) |

|

|

|

(63,190 |

) |

|

|

(8,714 |

) |

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

|

270 |

|

|

|

|

102 |

|

|

|

14 |

|

Interest expenses |

|

|

(5,448 |

) |

|

|

|

(5,120 |

) |

|

|

(706 |

) |

Other income |

|

|

14,249 |

|

|

|

|

2,367 |

|

|

|

326 |

|

Other expenses |

|

|

(1,727 |

) |

|

|

|

(272 |

) |

|

|

(38 |

) |

Foreign exchange losses |

|

|

(2,748 |

) |

|

|

|

(425 |

) |

|

|

(59 |

) |

Fair value impact of the issuance of senior convertible preferred shares |

|

|

252,190 |

|

|

|

|

(36,869 |

) |

|

|

(5,084 |

) |

Income/(loss) before income tax expense |

|

|

160,169 |

|

|

|

|

(103,407 |

) |

|

|

(14,261 |

) |

Dividend from long-term investment |

|

- |

|

|

|

|

11,970 |

|

|

|

1,651 |

|

Equity in loss of affiliates and dividend from affiliate, net of tax |

|

|

(38 |

) |

|

|

|

- |

|

|

|

- |

|

Income tax expense |

|

|

(151 |

) |

|

|

|

(165 |

) |

|

|

(23 |

) |

Net income/(loss), net of tax |

|

|

159,980 |

|

|

|

|

(91,602 |

) |

|

|

(12,633 |

) |

Less: net loss attributable to non-controlling interests shareholders |

|

|

(3 |

) |

|

|

|

(2 |

) |

|

|

- |

|

Net income/(loss) attributable to UXIN LIMITED's ordinary shareholders |

|

|

159,983 |

|

|

|

|

(91,600 |

) |

|

|

(12,633 |

) |

|

|

|

|

|

|

|

|

|

|

|

Net income/(loss), net of tax |

|

|

159,980 |

|

|

|

|

(91,602 |

) |

|

|

(12,633 |

) |

Foreign currency translation, net of tax nil |

|

|

(58,660 |

) |

|

|

|

3,314 |

|

|

|

457 |

|

|

|

|

|

|

|

|

|

|

|

|

Total comprehensive income/(loss) |

|

|

101,320 |

|

|

|

|

(88,288 |

) |

|

|

(12,176 |

) |

Less: total comprehensive loss attributable to non-controlling interests shareholders |

|

|

(3 |

) |

|

|

|

(2 |

) |

|

|

- |

|

Total comprehensive income/(loss) attributable to UXIN LIMITED's ordinary shareholders |

|

|

101,323 |

|

|

|

|

(88,286 |

) |

|

|

(12,176 |

) |

|

|

|

|

|

|

|

|

|

|

|

Net income/(loss) attributable to UXIN LIMITED's ordinary shareholders |

|

|

159,983 |

|

|

- |

|

|

(91,600 |

) |

|

|

(12,633 |

) |

Weighted average shares outstanding – basic |

|

|

1,189,841,431 |

|

|

|

|

1,423,659,403 |

|

|

|

1,423,659,403 |

|

Weighted average shares outstanding – diluted |

|

|

1,193,043,619 |

|

|

|

|

1,423,659,403 |

|

|

|

1,423,659,403 |

|

|

|

|

|

|

|

|

|

|

|

|

Net income/(loss) per share for ordinary shareholders, basic |

|

|

0.09 |

|

|

|

|

(0.06 |

) |

|

|

(0.01 |

) |

Net income/(loss) per share for ordinary shareholders, diluted |

|

|

0.09 |

|

|

|

|

(0.06 |

) |

|

|

(0.01 |

) |

Uxin Limited

Unaudited Consolidated Balance Sheets

(In thousands except for number of shares and per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of March 31, |

|

|

As of June 30, |

|

|

|

2023 |

|

|

2023 |

|

|

|

RMB |

|

|

RMB |

|

|

US$ |

|

ASSETS |

|

|

|

|

|

|

|

|

|

Current assets |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

|

92,713 |

|

|

|

63,679 |

|

|

|

8,782 |

|

Restricted cash |

|

|

618 |

|

|

|

715 |

|

|

|

99 |

|

Accounts receivable, net |

|

|

790 |

|

|

|

1,052 |

|

|

|

147 |

|

Loans recognized as a result of payments under guarantees, net of provision for credit losses of RMB10,337 and RMB8,686 as of March 31, 2023 and June 30, 2023, respectively |

|

|

- |

|

|

|

- |

|

|

|

- |

|

Other receivables, net of provision for credit losses of RMB26,541 and RMB26,559 as of March 31, 2023 and June 30, 2023, respectively |

|

|

15,345 |

|

|

|

15,342 |

|

|

|

2,116 |

|

Inventory, net |

|

|

110,893 |

|

|

|

112,413 |

|

|

|

15,502 |

|

Prepaid expenses and other current assets |

|

|

61,390 |

|

|

|

61,856 |

|

|

|

8,530 |

|

Total current assets |

|

|

281,749 |

|

|

|

255,057 |

|

|

|

35,176 |

|

|

|

|

|

|

|

|

|

|

|

Non-current assets |

|

|

|

|

|

|

|

|

|

Property, equipment and software, net |

|

|

63,725 |

|

|

|

68,746 |

|

|

|

9,481 |

|

Long-term investments |

|

|

288,712 |

|

|

|

288,712 |

|

|

|

39,815 |

|

Right-of-use assets, net |

|

|

84,461 |

|

|

|

115,883 |

|

|

|

15,981 |

|

Total non-current assets |

|

|

436,898 |

|

|

|

473,341 |

|

|

|

65,277 |

|

|

|

|

|

|

|

|

|

|

|

Total assets |

|

|

718,647 |

|

|

|

728,398 |

|

|

|

100,453 |

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES, MEZZANINE EQUITY AND SHAREHOLDERS’ DEFICIT |

|

|

|

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

|

80,668 |

|

|

|

80,776 |

|

|

|

11,140 |

|

Warrant liabilities (i) |

|

|

8 |

|

|

|

38,010 |

|

|

|

5,242 |

|

Other payables and other current liabilities |

|

|

344,502 |

|

|

|

372,741 |

|

|

|

51,403 |

|

Short-term borrowing (ii) |

|

|

20,000 |

|

|

|

36,177 |

|

|

|

4,989 |

|

Current portion of long-term debt (iii) |

|

|

158,736 |

|

|

|

- |

|

|

|

- |

|

Total current liabilities |

|

|

603,914 |

|

|

|

527,704 |

|

|

|

72,774 |

|

|

|

|

|

|

|

|

|

|

|

Non-current liabilities |

|

|

|

|

|

|

|

|

|

Long-term borrowings |

|

|

291,950 |

|

|

|

291,950 |

|

|

|

40,262 |

|

Consideration payable to WeBank |

|

|

58,559 |

|

|

|

29,256 |

|

|

|

4,035 |

|

Operating lease liabilities |

|

|

77,462 |

|

|

|

106,774 |

|

|

|

14,725 |

|

Long-term debt (iii) |

|

|

264,560 |

|

|

|

- |

|

|

|

- |

|

Total non-current liabilities |

|

|

692,531 |

|

|

|

427,980 |

|

|

|

59,022 |

|

|

|

|

|

|

|

|

|

|

|

Total liabilities |

|

|

1,296,445 |

|

|

|

955,684 |

|

|

|

131,796 |

|

|

|

|

|

|

|

|

|

|

|

Mezzanine equity |

|

|

|

|

|

|

|

|

|

Senior convertible preferred shares (US$0.0001 par value, 1,720,000,000 shares authorized as of March 31, 2023 and June 30, 2023; 1,151,221,338 shares issued and outstanding as of March 31, 2023 and June 30, 2023) |

|

|

1,245,721 |

|

|

|

1,245,721 |

|

|

|

173,448 |

|

Subscription receivable from shareholders (iii) |

|

|

(550,074 |

) |

|

|

(121,425 |

) |

|

|

(18,400 |

) |

Total Mezzanine equity |

|

|

695,647 |

|

|

|

1,124,296 |

|

|

|

155,048 |

|

|

|

|

|

|

|

|

|

|

|

Shareholders’ deficit |

|

|

|

|

|

|

|

|

|

Ordinary shares |

|

|

806 |

|

|

|

806 |

|

|

|

111 |

|

Additional paid-in capital |

|

|

15,451,803 |

|

|

|

15,461,954 |

|

|

|

2,132,301 |

|

Accumulated other comprehensive income |

|

|

220,185 |

|

|

|

223,499 |

|

|

|

30,822 |

|

Accumulated deficit |

|

|

(16,946,064 |

) |

|

|

(17,037,664 |

) |

|

|

(2,349,601 |

) |

Total Uxin’s shareholders’ deficit |

|

|

(1,273,270 |

) |

|

|

(1,351,405 |

) |

|

|

(186,367 |

) |

Non-controlling interests |

|

|

(175 |

) |

|

|

(177 |

) |

|

|

(24 |

) |

Total shareholders’ deficit |

|

|

(1,273,445 |

) |

|

|

(1,351,582 |

) |

|

|

(186,391 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities, mezzanine equity and shareholders’ deficit |

|

|

718,647 |

|

|

|

728,398 |

|

|

|

100,453 |

|

(i) On June 30, 2023, the Company entered into an amendment agreement (“2023 Warrant Agreement”) with Alpha Wealth Global Limited (“Alpha”) and Joy Capital, regarding certain warrants in accordance with 2021 Subscription Agreement. Pursuant to the foregoing definitive agreement and certain assignments of warrants among Alpha, NIO Capital and Joy Capital, Alpha and Joy Capital (either together or separately) are entitled, at their discretion, to exercise their respective warrants in full to subscribe for a total of 480,629,186 senior convertible preferred shares of the Company in an aggregate amount of US$21,964,754 at an amended exercise price of US$0.0457 per share or US$1.37 per ADS, representing a modification from the prior exercise price of US$0.3433 per share or US$10.3 per ADS (or US$1.03 per ADS prior to the ADS Ratio Change) no later than September 30, 2023. During the reported quarter, a loss of approximately US$5.1 million (equivalent to RMB36.9 million) was recorded in fair value impact of the issuance of senior convertible preferred shares.

(ii) In March 2023, the Company obtained inventory-pledging facilities with two reputable banks in the PRC pursuant to which the banks will finance the Company's future purchases of used car inventories, up to an aggregate amount of RMB250 million (equivalent to approximately US $34.5 million). As of June 30, 2023, a total of RMB16.2 million of inventory-pledging loans were recorded in "short-term borrowing".

(iii) On April 4, 2023, NIO Capital, NBNW Investment Limited (“NBNW”, an affiliate of NIO Capital) and the long-term debt holders of the Company, namely WP, TPG, and Magic Carpet, entered into assignment agreements to assign all the rights under the then outstanding long-term debt of US$61.6 million to NBNW and then further assign to NIO Capital. Concurrently, the Company entered into a supplemental agreement with NIO Capital, agreeing to offset its subscription receivable by US$61.6 million with its obligation under long-term debt due to NIO Capital after the assignment. In April 2023, US$1.6million was received and the remaining subscription receivable of US$18.4million is expected to be received no later than December 31, 2023.

* Share-based compensation charges included are as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the three months ended June 30, |

|

|

|

2022 |

|

|

2023 |

|

|

|

RMB |

|

|

RMB |

|

|

US$ |

|

Sales and marketing |

|

|

- |

|

|

|

332 |

|

|

|

46 |

|

General and administrative |

|

|

11,690 |

|

|

|

9,425 |

|

|

|

1,300 |

|

Research and development |

|

|

- |

|

|

|

394 |

|

|

|

54 |

|

Uxin Limited

Unaudited Reconciliations of GAAP And Non-GAAP from Continuing Operation Results

(In thousands except for number of shares and per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the three months ended June 30, |

|

|

|

2022 |

|

|

2023 |

|

|

|

RMB |

|

|

RMB |

|

|

US$ |

|

Net income/(loss), net of tax |

|

|

159,980 |

|

|

|

(91,602 |

) |

|

|

(12,633 |

) |

|

|

|

|

|

|

|

|

|

|

Add: Income tax expense |

|

|

151 |

|

|

|

165 |

|

|

|

23 |

|

Interest income |

|

|

(270 |

) |

|

|

(102 |

) |

|

|

(14 |

) |

Interest expenses |

|

|

5,448 |

|

|

|

5,120 |

|

|

|

706 |

|

Depreciation |

|

|

8,705 |

|

|

|

6,413 |

|

|

|

884 |

|

EBITDA |

|

|

174,014 |

|

|

|

(80,006 |

) |

|

|

(11,034 |

) |

|

|

|

|

|

|

|

|

|

|

Add: Share-based compensation expenses |

|

|

11,690 |

|

|

|

10,151 |

|

|

|

1,400 |

|

- Sales and marketing |

|

|

- |

|

|

|

332 |

|

|

|

46 |

|

- General and administrative |

|

|

11,690 |

|

|

|

9,425 |

|

|

|

1,300 |

|

- Research and development |

|

|

- |

|

|

|

394 |

|

|

|

54 |

|

Other income |

|

|

(14,249 |

) |

|

|

(2,367 |

) |

|

|

(326 |

) |

Other expenses |

|

|

1,727 |

|

|

|

272 |

|

|

|

38 |

|

Foreign exchange losses |

|

|

2,748 |

|

|

|

425 |

|

|

|

59 |

|

Dividend from long-term investment |

|

|

- |

|

|

|

(11,970 |

) |

|

|

(1,651 |

) |

Fair value impact of the issuance of senior convertible preferred shares |

|

|

(252,190 |

) |

|

|

36,869 |

|

|

|

5,084 |

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP adjusted EBITDA |

|

|

(76,260 |

) |

|

|

(46,626 |

) |

|

|

(6,430 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

For the three months ended June 30, |

|

|

|

2022 |

|

|

2023 |

|

|

|

RMB |

|

|

RMB |

|

|

US$ |

|

Net income/( loss) attributable to ordinary shareholders |

|

|

159,983 |

|

|

|

(91,600 |

) |

|

|

(12,633 |

) |

Add: Share-based compensation expenses |

|

|

11,690 |

|

|

|

10,151 |

|

|

|

1,400 |

|

- Sales and marketing |

|

|

- |

|

|

|

332 |

|

|

|

46 |

|

- General and administrative |

|

|

11,690 |

|

|

|

9,425 |

|

|

|

1,300 |

|

- Research and development |

|

|

- |

|

|

|

394 |

|

|

|

54 |

|

Fair value impact of the issuance of senior convertible preferred shares |

|

|

(252,190 |

) |

|

|

36,869 |

|

|

|

5,084 |

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP adjusted net loss attributable to ordinary shareholders |

|

|

(80,517 |

) |

|

|

(44,580 |

) |

|

|

(6,149 |

) |

|

|

|

|

|

|

|

|

|

|

Net income/(loss) per share for ordinary shareholders - basic |

|

|

0.09 |

|

|

|

(0.06 |

) |

|

|

(0.01 |

) |

Net income/(loss) per share for ordinary shareholders – diluted |

|

|

0.09 |

|

|

|

(0.06 |

) |

|

|

(0.01 |

) |

Non-GAAP adjusted net loss to ordinary shareholders per share – basic and diluted |

|

|

(0.07 |

) |

|

|

(0.03 |

) |

|

|

- |

|

Weighted average shares outstanding – basic |

|

|

1,189,841,431 |

|

|

|

1,423,659,403 |

|

|

|

1,423,659,403 |

|

Weighted average shares outstanding – diluted |

|

|

1,193,043,619 |

|

|

|

1,423,659,403 |

|

|

|

1,423,659,403 |

|

Note: The conversion of Renminbi (RMB) into U.S. dollars (USD) is based on the certified exchange rate of USD1.00 = RMB7.2513 as of June 30, 2023 set forth in the H.10 statistical release of the Board of Governors of the Federal Reserve System.

Exhibit 99.2

Uxin Reports Unaudited Second Quarter of Fiscal Year 2024 Financial Results

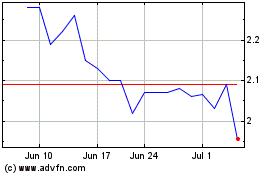

BEIJING, November 28, 2023 –Uxin Limited (“Uxin” or the “Company”) (Nasdaq: UXIN), China's leading used car retailer, today announced its unaudited financial results for the second quarter ended September 30, 2023.

Highlights for the Quarter Ended September 30, 2023

•Transaction volume was 3,884 units for the three months ended September 30, 2023, an increase of 19.4% from 3,254 units in the last quarter and a decrease of 35.8% from 6,050 units in the same period last year.

•Retail transaction volume was 2,287 units, an increase of 35.6% from 1,687 units in the last quarter and a decrease of 26.4% from 3,109 units in the same period last year.

•Total revenues were RMB356.1 million (US$48.8 million) for the three months ended September 30, 2023, an increase of 23.2% from RMB289.0 million in the last quarter and a decrease of 42.5% fromRMB618.8 million in the same period last year.

•Gross margin was 6.2% for the three months ended September 30, 2023, compared with 6.1% in the last quarter and 1.3% in the same period last year.

•Loss from operations was RMB66.4 million (US$9.1 million) for the three months ended September 30, 2023, compared with RMB63.2 million in the last quarter and RMB106.4 million in the same period last year.

•Non-GAAP adjusted EBITDA was a loss of RMB45.9 million (US$6.3 million), a decrease of 1.5% from a loss of RMB46.6 million in the last quarter and a decrease of 47.1% from a loss of RMB86.9 million in the same period last year.

Mr. Kun Dai, Founder, Chairman and Chief Executive Officer of Uxin, commented, “Despite the challenging overall economic climate and the Chinese used car industry, we have achieved significant growth that surpassed the market. The retail sales volume in the second quarter reached 2,287 units, representing a growth of 35.6% compared to the first quarter. In addition, our Hefei flagship factory store, jointly established with Hefei City, started trial operation in September. With a total construction area of 450,000 square meters, it is equipped with the world's most advanced used car remanufacturing factory and the world’s largest used car retail superstore, capable of accommodating up to 10,000 retail vehicles. Hefei superstore will continuously drive our business growth in the coming years.

After two years of refinement, our superstore business model has been successfully validated. The overall turnover days for vehicles sold have remained stable at less than 45 days, and the gross margin has increased from 1.3% in the same period last year to 6.2% this year. The Net Promoter Score (NPS) of our customers has consistently remained around 60 for seven consecutive quarters, which is the highest level in the industry. As a result, the Xi'an superstore achieved EBITDA profitability in September.

In the upcoming quarters, we will increase inventory levels according to market conditions to achieve a higher level of scalable profitability. We aim to achieve EBITDA profitability at all superstore level by March 2024 and achiever whole company EBITDA profitability by September 2024. We have full confidence in the long-term high-quality development prospects of Uxin.”

Mr. Feng Lin, Chief Financial Officer of Uxin, said: “In the second quarter of the fiscal year 2024, our total revenue increased by 23.2% compared to the first quarter, with retail vehicle sales revenue growing by 33.2% quarter-on-quarter. As a result of accelerated sales turnover, steadily increasing value-added service revenue, and decreasing per-vehicle costs driven by advanced factory production, our gross margin has significantly improved. In the second quarter of the fiscal year 2024, our gross margin reached 6.2%, an increase of 4.9 percentage points compared to the same period last year.

With a significant improvement in gross profit and continuous optimization of cost and expenses, our capability to achieve profitability has greatly improved. Our Xi'an superstore achieved EBITDA profitability in September. In the second quarter, the adjusted EBITDA loss was RMB45.9 million, a decrease in loss of 47% compared to the same period last year.

We are confident in achieving the profitability targets outlined by DK and will provide adequate financial support. In September, we signed an equity investment agreement and Hefei local government platform will invest up to RMB1.5 billion in our subsidiary over the next decade. The first tranche of about RMB150 million had been essentially completed. Recently, we have obtained new inventory financing from two major financial institutions, contributing to an aggregated credit line of nearly RMB300 million. In addition, we are in the process of completing the remaining delivery of the previous financing transactions of approximately USD30 million by the end of the year.”

Financial Results for the Quarter Ended September 30, 2023

Total revenues were RMB356.1 million (US$48.8 million) for the three months ended September 30, 2023, an increase of 23.2% from RMB289.0 million in the last quarter and a decrease of 42.5% from RMB618.8 million in the same period last year. The quarter-over-quarter increases were mainly driven by increased retail vehicle sales revenue. The year-over-year decreases were mainly due to the decline of wholesale vehicle sales revenue.

Retail vehicle sales revenue was RMB248.9 million (US$34.1 million) for the three months ended September 30, 2023, representing an increase of 33.2% from RMB186.8 million in the last quarter and an decrease of 33.1% from RMB371.9 million in the same period last year. For the three months ended September 30, 2023, retail transaction volume was 2,287 units, an increase of 35.6% from 1,687 units in the last quarter and a decrease of 26.4% from 3,109 units in the same period last year. The quarter-over-quarter increases in retail transaction volume were mainly driven by the increase of inventory turnover rate by enhancing the sale capacity under the constraint of a relatively low inventory level, while partially offset by temporary effect from relocation to the new used car super store (“Changfeng Superstore”) in Changfeng country, Hefei City. The year-over-year decreases in retail transaction volume were mainly related to the lower inventory level. The Company has maintained a prudent inventory procurement strategy and keeps a low inventory level as compared with the same period last year, which constrained retail sales growth.

Wholesale vehicle sales revenue was RMB99.3 million (US$13.6 million) for the three months ended September 30, 2023, an increase of 5.0% from RMB94.6 million in the last quarter and a decrease of 58.2% from RMB237.8 million in the same period last year. For the three months ended September 30, 2023, wholesale transaction volume was 1,597 units, representing an increase of 1.9% from 1,567 units in the last quarter and a decrease of 45.7% from 2,941 units in the same period last year. Compared with the same period last year, as the Company continued to improve its inventory capacity and reconditioning capabilities, an increased number of acquired vehicles were reconditioned to meet the Company’s retail standards, rather than being sold through wholesale channels. As a result, the wholesale vehicle sales revenue declined.

Other revenue was RMB7.9 million (US$1.1 million) for the three months ended September 30, 2023, compared with RM7.6 million in the last quarter and RMB9.1 million in the same period last year.

Cost of revenues was RMB334.0 million (US$45.8 million) for the three months ended September 30, 2023, compared with RMB271.4 million in the last quarter and RMB610.7 million in the same period last year.

Gross margin was 6.2% for the three months ended September 30, 2023, compared with 6.1% in the last quarter and 1.3% in the same period last year.The revenue from value-added services, which have high gross margins, continues to increase. In the meanwhile, with the improving inventory structure and vehicle pricing capabilities, both the sales margin and the sales turnover rate increased. Moreover, along with Xi’an City Superstore and Changfeng Superstore’s operation which enhanced the Company’s reconditioning capability, the Company’s reconditioning cost per retail vehicle have dropped significantly, which further fueled the Company’s gross margin resurgence.

Total operating expenses were RMB91.6 million (US$12.6 million) for the three months ended September 30, 2023. Total operating expenses excluding the impact of share-based compensation were RMB77.7 million.

•Sales and marketing expenses were RMB48.4 million (US$6.6 million) for the three months ended September 30, 2023, an increase of 4.1% from RMB46.5 million in the last quarter and a decrease of 24.5% from RMB64.2 million in the same period last year. The year-over-year decreases were mainly due to the decline in marketing expenses driven by the adoption of more cost-effective promotion measures.

•General and administrative expenses were RMB35.1 million (US$4.8 million) for the three months ended September 30, 2023, representing an increase of 6.1% from RMB33.1 million in the last quarter and a decrease of 15.6% from RMB41.6 million in the same period last year. The quarter-over-quarter increases were mainly due to the impact of share-based compensation expenses. The year-over-year decreases were mainly due to the declines in professional fees.

•Research and development expenses were RMB9.2 million (US$1.3 million) for the three months ended September 30, 2023, representing an increase of 4.0% from RMB8.9 million in the last quarter and an decrease of 7.6% from RMB10.0 million in the same period last year.

Other operating income, net was RMB3.2 million (US$0.4 million) for the three months ended September 30, 2023, compared with RMB7.0 million for the last quarter.

Loss from operations was RMB66.4 million (US$9.1 million) in the three months ended September 30, 2023, compared with RMB63.2 million for the last quarter and RMB106.4 million in the same period last year.

Fair value impact of the issuance of senior convertible preferred shares resulted in a gain of RMB5.0 million (US$0.7 million) for the three months ended September 30, 2023, compared with a loss of RMB36.9million in the last quarter. The impact was mainly due to the fair value change of the warrants issued in relation to the senior convertible preferred shares during the period. The fair value impact was a non-cash gain.

Net loss from operations was net loss of RMB57.1 million (US$7.8 million) for the three months ended September 30, 2023, compared with net loss of RMB91.6 million for the last quarter and net loss of RMB116.5 million for the same period last year.

Non-GAAP adjusted EBITDA was a loss of RMB45.9 million (US$6.3million) for the three months ended September 30, 2023, compared with RMB46.6 million in the last quarter and RMB86.9 million in the same period last year.

Liquidity

As of September 30, 2023, the Company had cash and cash equivalents of RMB17.6 million, compared to RMB92.7 million as of March 31, 2023.

The Company has incurred accumulated and recurring losses from operations, and cash outflows from operating activities. In addition, the Company’s current liabilities exceeded its current assets by approximately RMB443.6 million as of September 30, 2023.

The Company’s ability to continue as a going concern is dependent on management’s ability to increase sales, achieve higher gross profit margin and control operating costs and expenses to reduce the cash that will be used in operating cash flows, and to seek financing arrangements, including but not limited to proceeds from the subscription of the Company’s senior convertible preferred shares issued from exercise of the warrants, and funds from renewal of the existing borrowings and new facilities and equity financings. There is uncertainty regarding the execution of these business and financing plans, which raises substantial doubt about the Company’s ability to continue as a going concern. The accompanying unaudited financial information does not include any adjustment that is reflective of these uncertainties.

Business Outlook

For the three months ended December 31, 2023, the Company expects its retail transaction volume to be around 3,100 units and the average selling price (ASP) for retailed cars to be around RMB105,000. The Company also expects its wholesale transaction volume to be around 1,400 units with an expected ASP of around RMB67,000. The Company estimates that its total revenues including retail vehicle sales revenue, wholesale vehicle sales revenue and value-add-services revenue to be within the range of RMB410 million to RMB430 million. These forecasts reflect the Company’s current and preliminary views on the market and operational conditions, which are subject to changes.

Recent Update

In September 2023, Uxin announced the commencement of operations at its new Changfeng Superstore in the city of Hefei, after completing constructions and trial operations. The flagship superstore, encompassing a total area of 450,000 square meters, integrates the world's most advanced used car reconditioning factory and the largest used car sales area within its premises. Designed to accommodate up to 10,000 vehicles for display and sale at full capacity, this facility is now actively operational. Functioning as a strategic hub for Uxin's expansion in the used car market, the Hefei flagship superstore extends its services across Anhui province and supports nationwide sales. This collaboration aligns with Uxin's commitment to fostering the growth of the automotive aftermarket industry in Anhui province and reinforces its role in the evolution of China's used car industry.

In September 2023, Uxin entered into an equity investment agreement with Hefei Construction Investment North City Industrial Investment Co., Ltd. ("Hefei Construction Investment"). Pursuant to the agreement, Hefei Construction Investment has committed to invest up to RMB1.5 billion in Uxin's wholly-owned Hefei subsidiary, Youxin (Hefei) Automobile Intelligent Remanufacturing Co., Ltd. ("Uxin Hefei"), over the next decade in multiple instalments. This investment will support the operation and development of Uxin's used car super store ("Changfeng Superstore") in Changfeng County, Hefei City. Following the completion of the investment, Hefei Construction Investment's equity ownership in Uxin Hefei will not exceed 50% (exclusive), and Uxin retains the right to repurchase such equity stake. This investment will not dilute Uxin Limited's shares listed on NASDAQ. Currently, the first tranche of approximately RMB150 million of the investment from Hefei Construction Investment is in final completion stage.

Conference Call

Uxin’s management team will host a conference call on Tuesday, November 28, 2023, at 8:00 A.M. U.S. Eastern Time (9:00 P.M. Beijing/Hong Kong time on the same day) to discuss the financial results. In advance of the conference call, all participants must use the following link to complete the online registration process. Upon registering, each participant will receive access details for this

conference including an event passcode, a unique access PIN, dial-in numbers, and an e-mail with detailed instructions to join the conference call.

Conference Call Preregistration: https://s1.c-conf.com/diamondpass/10034997-rdg1z4.html

A telephone replay of the call will be available after the conclusion of the conference call until December 6, 2023. The dial-in details for the replay are as follows:

U.S.: +1 855 883 1031

China: + 86 400 1209 216

Replay PIN: 10034997

A live webcast and archive of the conference call will be available on the Investor Relations section of Uxin’s website at http://ir.xin.com.

About Uxin

Uxin is China's leading used car retailer, pioneering industry transformation with advanced production, new retail experiences, and digital empowerment. We offer high-quality and value-for-money vehicles as well as superior after-sales services through a reliable, one-stop, and hassle-free transaction experience. Under our omni-channel strategy, we are able to leverage our pioneering online platform to serve customers nationwide and establish market leadership in selected regions through offline inspection and reconditioning centers. Leveraging our extensive industry data and continuous technology innovation throughout more than ten years of operation, we have established strong used car management and operation capabilities. We are committed to upholding our customer-centric approach and driving the healthy development of the used car industry.

Use of Non-GAAP Financial Measures

In evaluating the business, the Company considers and uses certain non-GAAP measures, including adjusted EBITDA and adjusted net loss from operations per share – basic and diluted, as supplemental measures to review and assess its operating performance. The presentation of the non-GAAP financial measure is not intended to be considered in isolation or as a substitute for the financial information prepared and presented in accordance with U.S. GAAP. The Company defines adjusted EBITDA as EBITDA excluding share-based compensation, fair value impact of the issuance of senior convertible preferred shares,foreign exchange losses, other income/(expenses) and dividend from long-term investment. The Company defines adjusted net loss attributable to ordinary shareholders per share – basic and diluted as net loss attributable to ordinary shareholders per share excluding impact of share-based compensation, fair value impact of the issuance of senior convertible preferred shares and deemed dividend to preferred shareholders due to triggering of a down round feature. The Company presents the non-GAAP financial measures because they are used by the management to evaluate the operating performance and formulate business plans. The Company also believes that the use of the non-GAAP measures facilitate investors' assessment of its operating performance as this measure excludes certain finance or non-cash items that the Company does not believe directly reflect its core operations. We believe that excluding these items enables us to more effectively evaluate our performance period-over-period and relative to our competitors.

The non-GAAP financial measures are not defined under U.S. GAAP and are not presented in accordance with U.S. GAAP. The non-GAAP financial measures have limitations as analytical tools. One of the key limitations of using adjusted EBITDA is that it does not reflect all items of income and expenses that affect the Company’s operations. Share-based compensation, fair value impact of the issuance of senior convertible preferred shares, other income/(expenses) and dividend from long-term investment have been and may continue to be incurred in the business. Further, the non-GAAP measures may differ from the non-GAAP information used by other companies, including peer companies, and therefore their comparability may be limited.

The Company compensates for these limitations by reconciling the non-GAAP financial measure to the nearest U.S. GAAP performance measure, all of which should be considered when evaluating the Company’s performance. The Company encourages you to review its financial information in its entirety and not rely on a single financial measure.

Reconciliations of Uxin’s non-GAAP financial measures to the most comparable U.S. GAAP measure are included at the end of this press release.

Exchange Rate Information

This announcement contains translations of certain RMB amounts into U.S. dollars (“US$”) at specified rates solely for the convenience of the reader, except for those transaction amounts that were actually settled in U.S. dollars. Unless otherwise stated, all translations from RMB to US$ were made at the rate of RMB7.2960 to US$1.00, representing the index rate as of September 29, 2023 set forth in the H.10 statistical release of the Board of Governors of the Federal Reserve System. The Company makes no representation that the RMB or US$ amounts referred could be converted into US$ or RMB, as the case may be, at any particular rate or at all.

Safe Harbor Statement

This announcement contains forward-looking statements. These statements are made under the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as “will,” “expects,” “anticipates,” “future,” “intends,” “plans,” “believes,” “estimates” and similar statements. Among other things, the business outlook and quotations from management in this announcement, as well as Uxin’s strategic and operational plans, contain forward-looking statements. Uxin may also make written or oral forward-looking statements in its periodic reports to the SEC, in its annual report to shareholders, in press releases and other written materials and in oral statements made by its officers, directors or employees to third parties. Statements that are not historical facts, including statements about Uxin’s beliefs and expectations, are forward-looking statements. Forward-looking statements involve inherent risks and uncertainties. A number of factors could cause actual results to differ materially from those contained in any forward-looking statement, including but not limited to the following: , Uxin’s goal and strategies; its expansion plans; its future business development, financial condition and results of operations; Uxin’s expectations regarding demand for, and market acceptance of, its services; its ability to provide differentiated and superior customer experience, maintain and enhance customer trust in its platform, and assess and mitigate various risks, including credit; its expectations regarding maintaining and expanding its relationships with business partners, including financing partners; trends and competition in China’s used car e-commerce industry; the laws and regulations relating to Uxin’s industry; the general economic and business conditions; and assumptions underlying or related to any of the foregoing. Further information regarding these and other risks is included in Uxin’s filings with the SEC. All information provided in this press release and in the attachments is as of the date of this press release, and Uxin does not undertake any obligation to update any forward-looking statement, except as required under applicable law.

For investor and media enquiries, please contact:

Uxin Limited Investor Relations

Uxin Limited

Phone: +86 10 5691-6765

Email: ir@xin.com

The Blueshirt Group

Mr. Jack Wang

Phone: +86 166-0115-0429

Email: Jack@blueshirtgroup.com

Uxin Limited

Unaudited Consolidated Statements of Comprehensive Loss

(In thousands except for number of shares and per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the three months ended September 30, |

|

|

For the six months ended September 30, |

|

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

|

RMB |

|

|

RMB |

|

|

US$ |

|

|

RMB |

|

|

RMB |

|

|

US$ |

|

Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Retail vehicle sales |

|

|

371,869 |

|

|

|

248,910 |

|

|

|

34,116 |

|

|

|

720,262 |

|

|

|

435,759 |

|

|

|

59,726 |

|

Wholesale vehicle sales |

|

|

237,818 |

|

|

|

99,335 |

|

|

|

13,615 |

|

|

|

501,774 |

|

|

|

193,982 |

|

|

|

26,587 |

|

Others |

|

|

9,095 |

|

|

|

7,822 |

|

|

|

1,072 |

|

|

|

22,916 |

|

|

|

15,348 |

|

|

|

2,104 |

|

Total revenues |

|

|

618,782 |

|

|

|

356,067 |

|

|

|

48,803 |

|

|

|

1,244,952 |

|

|

|

645,089 |

|

|

|

88,417 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenues |

|

|

(610,726 |

) |

|

|

(334,033 |

) |

|

|

(45,783 |

) |

|

|

(1,230,137 |

) |

|

|

(605,414 |

) |

|

|

(82,979 |

) |

Gross profit |

|

|

8,056 |

|

|

|

22,034 |

|

|

|

3,020 |

|

|

|

14,815 |

|

|

|

39,675 |

|

|

|

5,438 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales and marketing |

|

|

(64,165 |

) |

|

|

(48,443 |

) |

|

|

(6,640 |

) |

|

|

(128,963 |

) |

|

|

(94,991 |

) |

|

|

(13,020 |

) |

General and administrative |

|

|

(41,620 |

) |

|

|

(35,116 |

) |

|

|

(4,813 |

) |

|

|

(87,195 |

) |

|

|

(68,219 |

) |

|

|

(9,350 |

) |

Research and development |

|

|

(9,982 |

) |

|

|

(9,219 |

) |

|

|

(1,264 |

) |

|

|

(18,942 |

) |

|

|

(18,080 |

) |

|

|

(2,478 |

) |

(Provision for)/reversal of credit losses, net |

|

|

(704 |

) |

|

|

1,141 |

|

|

|

156 |

|

|

|

(327 |

) |

|

|

1,837 |

|

|

|

252 |

|

Total operating expenses |

|

|

(116,471 |

) |

|

|

(91,637 |

) |

|

|

(12,561 |

) |

|

|

(235,427 |

) |

|

|

(179,453 |

) |

|

|

(24,596 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other operating income, net |

|

|

2,046 |

|

|

|

3,214 |

|

|

|

441 |

|

|

|

17,626 |

|

|

|

10,199 |

|

|

|

1,398 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from operations |

|

|

(106,369 |

) |

|

|

(66,389 |

) |

|

|

(9,100 |

) |

|

|

(202,986 |

) |

|

|

(129,579 |

) |

|

|

(17,760 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

|

108 |

|

|

|

45 |

|

|

|

6 |

|

|

|

378 |

|

|

|

146 |

|

|

|

20 |

|

Interest expenses |

|

|

(5,151 |

) |

|

|

(7,710 |

) |

|

|

(1,057 |

) |

|

|

(10,599 |

) |

|

|

(12,829 |

) |

|

|

(1,758 |

) |

Other income |

|

|

992 |

|

|

|

11,435 |

|

|

|

1,567 |

|

|

|

15,241 |

|

|

|

13,802 |

|

|

|

1,892 |

|

Other expenses |

|

|

(1,775 |

) |

|

|

(378 |

) |

|

|

(52 |

) |

|

|

(3,502 |

) |

|

|

(650 |

) |

|

|

(89 |

) |

Losses from extinguishment of debt |

|

|

(2,778 |

) |

|

|

- |

|

|

|

- |

|

|

|

(2,778 |

) |

|

|

- |

|

|

|

- |

|

Foreign exchange (losses)/gains |

|

|

(391 |

) |

|

|

964 |

|

|

|

132 |

|

|

|

(3,139 |

) |

|

|

539 |

|

|

|

74 |

|

Fair value impact of the issuance of senior convertible preferred shares |

|

|

(11,459 |

) |

|

|

5,017 |

|

|

|

688 |

|

|

|

240,731 |

|

|

|

(31,852 |

) |

|

|

(4,366 |

) |

(Loss)/Income before income tax expense |

|

|

(126,823 |

) |

|

|

(57,016 |

) |

|

|

(7,816 |

) |

|

|

33,346 |

|

|

|

(160,423 |

) |

|

|

(21,987 |

) |

Income tax expense |

|

|

(58 |

) |

|

|

(108 |

) |

|

|

(15 |

) |

|

|

(209 |

) |

|

|

(273 |

) |

|

|

(37 |

) |

Dividend from long-term investment |

|

|

10,374 |

|

|

|

- |

|

|

|

- |

|

|

|

10,374 |

|

|

|

11,970 |

|

|

|

1,641 |

|

Equity in loss of affiliates and dividend from affiliate, net of tax |

|

|

(6 |

) |

|

|

- |

|

|

|

- |

|

|

|

(44 |

) |

|

|

- |

|

|

|

- |

|

Net (loss)/income, net of tax |

|

|

(116,513 |

) |

|

|

(57,124 |

) |

|

|

(7,831 |

) |

|

|

43,467 |

|

|

|

(148,726 |

) |

|

|

(20,383 |

) |

Less: net loss attributable to non-controlling interests shareholders |

|

- |

|

|

|

(19 |

) |

|

|

(3 |

) |

|

|

(3 |

) |

|

|

(21 |

) |

|

|

(3 |

) |

Net (loss)/income attributable to UXIN LIMITED |

|

|

(116,513 |

) |

|

|

(57,105 |

) |

|

|

(7,828 |

) |

|

|

43,470 |

|

|

|

(148,705 |

) |

|

|

(20,380 |

) |

Deemed dividend to preferred shareholders due to triggering of a down round feature (i) |

|

|

(755,635 |

) |

|

|

(278,800 |

) |

|

|

(38,213 |

) |

|

|

(755,635 |

) |

|

|

(278,800 |

) |

|

|

(38,213 |

) |

Net loss attributable to ordinary shareholders |

|

|

(872,148 |

) |

|

|

(335,905 |

) |

|

|

(46,041 |

) |

|

|

(712,165 |

) |

|

|

(427,505 |

) |

|

|

(58,593 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss)/income |

|

|

(116,513 |

) |

|

|

(57,124 |

) |

|

|

(7,831 |

) |

|

|

43,467 |

|

|

|

(148,726 |

) |

|

|

(20,383 |

) |

Foreign currency translation, net of tax nil |

|

|

(31,527 |

) |

|

|

292 |

|

|

|

40 |

|

|

|

(90,187 |

) |

|

|

3,606 |

|

|

|

494 |

|

Total comprehensive loss |

|

|

(148,040 |

) |

|

|

(56,832 |

) |

|

|

(7,791 |

) |

|

|

(46,720 |

) |

|

|

(145,120 |

) |

|

|

(19,889 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Less: total comprehensive loss attributable to non-controlling interests shareholders |

|

- |

|

|

|

(19 |

) |

|

|

(3 |

) |

|

|

(3 |

) |

|

|

(21 |

) |

|

|

(3 |

) |

Total comprehensive loss attributable to UXIN LIMITED |

|

|

(148,040 |

) |

|

|

(56,813 |

) |

|

|

(7,788 |

) |

|

|

(46,717 |

) |

|

|

(145,099 |

) |

|

|

(19,886 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss attributable to ordinary shareholders |

|

|

(872,148 |

) |

|

|

(335,905 |

) |

|

|

(46,041 |

) |

|

|

(712,165 |

) |

|

|

(427,505 |

) |

|

|

(58,593 |

) |

Weighted average shares outstanding – basic |

|

|

1,354,134,791 |

|

|

|

1,428,081,692 |

|

|

|

1,428,081,692 |

|

|

|

1,273,082,916 |

|

|

|

1,425,861,229 |

|

|

|

1,425,861,229 |

|

Weighted average shares outstanding – diluted |

|

|

1,354,134,791 |

|