0001527599false00015275992024-02-122024-02-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): February 12, 2024 |

SYNLOGIC, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-37566 |

26-1824804 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

301 Binney St. Suite 402 |

|

Cambridge, Massachusetts |

|

02142 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (617) 401-9975 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $0.001 per share |

|

SYBX |

|

The NASDAQ Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR § 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR § 240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On February 8, 2024, Synlogic, Inc. (the “Company”) issued a press release providing the following financial information. The Company’s cash, cash equivalents and short-term investments balance at December 31, 2023 was $47.7 million. The full text of the press release is attached as Exhibit 99.1 hereto and incorporated herein by reference.

The cash, cash equivalents and short-term investments balance information above is based on preliminary unaudited information and management estimates for the year ended December 31, 2023, is not a comprehensive statement of the Company’s financial results as of and for the fiscal year ended December 31, 2023, and is subject to completion of the Company’s financial closing procedures. The Company’s independent registered public accounting firm has not conducted an audit or review of, and does not express an opinion or any other form of assurance with respect to, this preliminary estimate.

The information contained in this item is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 2.05 Costs Associated with Exit or Disposal Activities.

On February 8, 2024, the Company announced that it is implementing a reduction in workforce by approximately 90%. The decision was based on cost-reduction initiatives intended to reduce the Company’s ongoing operating expenses and maximize shareholder value as the Company plans to pursue strategic options. The Company expects to complete substantially all of the reduction in workforce by the end of the fiscal quarter ending March 31, 2024. The Company estimates that it will incur approximately $6 million of costs in connection with the reduction in workforce related to severance pay and other related termination benefits. The charges the Company expects to incur in connection with this reduction in workforce are subject to a number of assumptions, risks and uncertainties, and actual results may materially differ. The Company may also incur other material charges not currently contemplated due to events that may occur as a result of, or associated with, these actions.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

In connection with the reduction in workforce, the Company and Aoife Brennan, M.B. Ch.B., the Company’s President and Chief Executive Officer, agreed on February 8, 2024 that Dr. Brennan’s employment with the Company will terminate effective as of March 9, 2024. The Company expects to enter into a consulting arrangement with Dr. Brennan in connection with her separation.

On February 8, 2024, Dr. Brennan also resigned from the Company’s Board of Directors, effective March 9, 2024. Dr. Brennan’s resignation was not as a result of any disagreement between Dr. Brennan and the Company on any matter relating to the Company’s operations, policies or practices.

Item 8.01. Other Events.

On February 8, 2024, the Company issued a press release announcing the discontinuation of Synpheny-3, the ongoing pivotal study of labafenogene marselecobac (SYNB1934) as a potential treatment for phenylketonuria. As a result, the Company’s management and its Board of Directors have made the decision to cease operations, evaluate strategic options for the Company and reduce its workforce by approximately 90%. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and incorporated by reference herein.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

Date: February 12, 2024 |

Synlogic, Inc. |

|

|

By: |

/s/ Aoife Brennan |

|

|

Name: Title: |

Aoife Brennan

President and Chief Executive Officer |

Exhibit 99.1

Synlogic Announces Decision to Discontinue Synpheny-3 Study and

Provides Corporate Update

Decision to end trial follows internal review of initial data indicating study unlikely to meet primary endpoint

Data review found treatment to be safe and well-tolerated

Board of Directors plans to perform assessment of strategic options

Cambridge, Mass. February 8, 2024 – Synlogic, Inc. (Nasdaq: SYBX), a biopharmaceutical company advancing novel therapeutics to transform the care of serious diseases, announced today the decision to discontinue Synpheny-3, its ongoing pivotal study of labafenogene marselecobac (SYNB1934) as a potential treatment for phenylketonuria (PKU). As a result, Synlogic’s management and its Board of Directors have made the decision to evaluate strategic options for the Company.

The decision to end Synpheny-3 is based on results of an internal review in advance of an upcoming independent Data Monitoring Committee (DMC) assessment, which indicated the trial was unlikely to meet its primary endpoint. The decision was not based on concerns regarding safety or tolerability. Synlogic will now work with the Synpheny-3 clinical trial sites involved to implement the discontinuation.

“It is with a heavy heart that we share this news, and our resulting decision to end Synpheny-3. Based on the program’s progress and data to date, we had expected the study to demonstrate the potential for SYNB1934 to provide an important new treatment option for those affected by PKU,” said Aoife Brennan, M.B. Ch.B., Synlogic President and Chief Executive Officer. “We express our deep gratitude for the support and partnership we have received from the PKU community, including the clinical trial site investigators and staff.”

Process to Explore Strategic Alternatives

Synlogic’s Board of Directors plans to conduct an assessment of strategic options to enhance shareholder value, which will include, but are not limited to, an acquisition, merger, reverse merger, other business combination, sales of assets, dissolution or other strategic transactions. There can be no assurance that the exploration of strategic alternatives will result in any agreements or transactions, or that, if completed, any agreements will be reached, or transactions will be successfully consummated or on attractive terms.

The Company has not set a timetable for completion of this strategic review and does not intend to comment further on the status of this process unless or until its Board of Directors has approved a definitive course of action, or it is determined that other disclosure is appropriate or required.

As a result of this process, Synlogic will cease operations, and reduce its workforce by more than 90%, retaining only certain employees to assist in the strategic review and assist in the discontinuation of the study. The majority of impacted roles will end in February 2024. Our cash, cash equivalents and short-term investments balance at December 31, 2023 was $47.7 million (unaudited). Dr. Brennan is also departing as President and Chief Executive Officer as part of the reduction, and stepping down from the Board of Directors.

“I want to express my deepest thanks and appreciation to every person who has been part of Synlogic, and in so doing contributed to the science we have advanced and special company we have built,” said Dr. Brennan.

About Synlogic

Synlogic is a biopharmaceutical company advancing novel therapeutics to transform the care of serious diseases in need of new treatment options. Synlogic designs, develops and manufactures these drug candidates, which are produced by applying precision genetic engineering to well-characterized probiotics.

Forward Looking Statements

This press release contains "forward-looking statements" that involve substantial risks and uncertainties for purposes of the safe harbor provided by the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical facts, included in this press release regarding strategy, future operations, clinical development plans, future financial position, future revenue, projected expenses, prospects, plans and objectives of management are forward-looking statements. In addition, when or if used in this press release, the words "may," "could," "should," "anticipate," "believe," "look forward," "estimate," "expect," “focused on,” "intend," "on track, " "plan," "predict" and similar expressions and their variants, as they relate to Synlogic, may identify forward-looking statements. Actual results could differ materially from those contained in any forward-looking statements as a result of various factors, including: the Company may not execute its planned exploration and evaluation of strategic alternatives; the availability of suitable third parties with which to conduct contemplated strategic transactions; the risk that the Company's reduction in force efforts may not generate their intended benefits to the extent or as quickly as anticipated; and the risk that the Company's reduction in force efforts may negatively impact the Company's business operations and reputation as well as those risks identified under the heading "Risk Factors" in Synlogic's filings with the U.S. Securities and Exchange Commission. The forward-looking statements contained in this press release reflect Synlogic's current views with respect to future events. Synlogic anticipates that subsequent events and developments will cause its views to change. However, while Synlogic may elect to update these forward-looking statements in the future, Synlogic specifically disclaims any obligation to do so. These forward-looking statements should not be relied upon as representing Synlogic's view as of any date subsequent to the date hereof.

Contact: info@synlogictx.com

v3.24.0.1

Document And Entity Information

|

Feb. 12, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 12, 2024

|

| Entity Registrant Name |

SYNLOGIC, INC.

|

| Entity Central Index Key |

0001527599

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

001-37566

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

26-1824804

|

| Entity Address, Address Line One |

301 Binney

|

| Entity Address, Address Line Two |

St.

|

| Entity Address, Address Line Three |

Suite 402

|

| Entity Address, City or Town |

Cambridge

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

02142

|

| City Area Code |

(617)

|

| Local Phone Number |

401-9975

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

SYBX

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

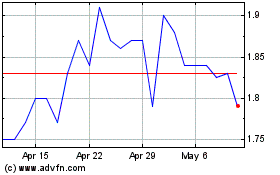

Synlogic (NASDAQ:SYBX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Synlogic (NASDAQ:SYBX)

Historical Stock Chart

From Apr 2023 to Apr 2024