Statement of Beneficial Ownership (sc 13d)

February 12 2020 - 6:03AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 13D

UNDER THE SECURITIES EXCHANGE ACT OF

1934

(Amendment No.)*

ShockWave

Medical, Inc.

(Name of Issuer)

Common Stock, par value $0.001 per share

(Title of Class of Securities)

82489T 104

(CUSIP Number)

Armance Bordes

Sofinnova Partners

7-11 boulevard Hausmann

75009 Paris

France

+33 1 76 23 4109

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

December 31, 2019

(Date of Event Which Requires Filing of

this Statement)

If the filing person has previously filed

a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because

of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ¨

Note: Schedules filed in paper format

shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7 for other parties to whom

copies are to be sent.

* The remainder of this cover page shall

be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for

any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder

of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of

1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions

of the Act (however, see the Notes).

|

CUSIP No. 82489T 104

|

Page 2 of 14

|

|

1.

|

Name

of Reporting Persons

Sofinnova Capital VII FCPR (“SC VII”)

EIN: 98-1028040

|

|

2.

|

Check

the Appropriate Box if a Member of a Group (see instructions)

(a)

(b)

|

¨

x

|

|

3.

|

SEC USE ONLY

|

|

4.

|

Source

of Funds (see instructions)

WC

|

|

5.

|

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

|

¨

|

|

6.

|

Citizenship

or Place of Organization

France

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With

|

7.

|

Sole Voting Power

3,394,206 shares of common stock, except that Sofinnova Partners SAS (“SP SAS”), a French corporation and the management company of SC VII, may be deemed to have sole power to dispose of these shares, and Denis Lucquin (“Lucquin”), Antoine Papiernik (“Papiernik”), Monique Saulnier (“Saulnier”), Graziano Seghezzi (“Seghezzi”) and Henrijette Richter (“Richter”), the managing partners of SP SAS, may be deemed to have shared power to dispose of such shares.

|

|

8.

|

Shared Voting Power

See row 7.

|

|

9.

|

Sole Dispositive Power

3,394,206 shares of common stock, except that SP SAS, a French corporation and the management company of SC VII, may be deemed to have sole power to dispose of these shares, and Lucquin, Papiernik, Saulnier, Seghezzi and Richter, the managing partners of SP SAS, may be deemed to have shared power to dispose of such shares.

|

|

10.

|

Shared Dispositive Power

See row 9.

|

|

11.

|

Aggregate Amount Beneficially Owned by Each Reporting Person

3,394,206

|

|

12.

|

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (see instructions)

|

¨

|

|

13.

|

Percent

of Class Represented by Amount in Row 11

12.0%(1)

|

|

14.

|

Type of Reporting Person (see instructions)

00

|

|

(1) The percentage is calculated based upon 28,300,080 shares of common stock outstanding, as reported on the Issuer’s Form 10-Q for the quarterly period ended September 30, 2019 filed with the Commission on November 8, 2019 (the “10-Q”).

|

|

CUSIP No. 82489T 104

|

Page 3 of 14

|

|

1.

|

Name of Reporting Persons

Sofinnova Partners SAS (“SP SAS”)

|

|

2.

|

Check the Appropriate Box if a Member of a Group (see instructions)

(a)

(b)

|

¨

x

|

|

3.

|

SEC USE ONLY

|

|

4.

|

Source of Funds (see instructions)

00

|

|

5.

|

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

|

¨

|

|

6.

|

Citizenship or Place of Organization

France

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With

|

7.

|

Sole Voting Power

3,394,206 shares of common stock, all of which are owned directly by of SC VII. SP SAS, the management

company of SC VII, may be deemed to have sole voting power, and Lucquin, Papiernik, Saulnier, Seghezzi and Richter, the managing

partners of SP SAS, may be deemed to have shared power to vote these shares.

|

|

8.

|

Shared Voting Power

See row 7.

|

|

9.

|

Sole Dispositive Power

3,394,206 shares of common stock, all of which are owned

directly by of SC VII. SP SAS, the management company of SC VII, may be deemed to have sole voting power, and Lucquin, Papiernik,

Saulnier, Seghezzi and Richter, the managing partners of SP SAS, may be deemed to have shared power to vote these shares.

|

|

10.

|

Shared Dispositive Power

See row 9.

|

|

11.

|

Aggregate Amount Beneficially Owned by Each Reporting Person

3,394,206

|

|

12.

|

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (see instructions)

|

¨

|

|

13.

|

Percent of

Class Represented by Amount in Row 11

12.0%(1)

|

|

14.

|

Type of Reporting Person (see instructions)

00

|

|

(1) The percentage is calculated based upon 28,300,080 shares of common stock outstanding, as reported on the 10-Q.

|

|

CUSIP No. 82489T 104

|

Page 4 of 14

|

|

1.

|

Name of Reporting Persons

Denis Lucquin (“Lucquin”)

|

|

2.

|

Check the Appropriate Box if a Member of a Group (see instructions)

(a)

(b)

|

¨

x

|

|

3.

|

SEC USE ONLY

|

|

4.

|

Source of Funds (see instructions)

00

|

|

5.

|

Check if Disclosure of Legal Proceedings Is Required

Pursuant to Items 2(d) or 2(e)

|

¨

|

|

6.

|

Citizenship or Place of Organization

French Citizen

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With

|

7.

|

Sole Voting Power

0

|

|

8.

|

Shared Voting Power

3,394,206 shares of common stock, all of which are owned directly by of SC VII. SP SAS, the management company of SC VII, may be deemed to have sole voting power, and Lucquin, a managing partner of SP SAS, may be deemed to have shared power to vote these shares.

|

|

9.

|

Sole Dispositive Power

0

|

|

10.

|

Shared Dispositive Power

3,394,206 shares of common stock, all of which are owned directly by of SC VII. SP SAS, the management company of SC VII, may be deemed to have sole voting power, and Lucquin, a managing partner of SP SAS, may be deemed to have shared power to vote these shares.

|

|

11.

|

Aggregate Amount Beneficially Owned by Each Reporting Person

3,394,206

|

|

12.

|

Check if the Aggregate Amount in Row (11) Excludes Certain

Shares (see instructions)

|

¨

|

|

13.

|

Percent of Class Represented by Amount in Row 11

12.0%(1)

|

|

14.

|

Type of Reporting Person (see instructions)

IN

|

|

(1) The percentage is calculated based upon 28,300,080 shares of common stock outstanding, as reported on the 10-Q.

|

|

CUSIP No. 82489T 104

|

Page 5 of 14

|

|

1.

|

Name of Reporting Persons

Antoine Papiernik (“Papiernik”)

|

|

2.

|

Check the Appropriate Box if a Member of a Group (see instructions)

(a)

(b)

|

¨

x

|

|

3.

|

SEC USE ONLY

|

|

4.

|

Source of Funds (see instructions)

00

|

|

5.

|

Check if Disclosure of Legal Proceedings Is Required

Pursuant to Items 2(d) or 2(e)

|

¨

|

|

6.

|

Citizenship or Place of Organization

French Citizen

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With

|

7.

|

Sole Voting Power

0

|

|

8.

|

Shared Voting Power

3,394,206 shares of

common stock, all of which are owned directly by of SC VII. SP SAS, the management company of SC VII, may be deemed to have sole

voting power, and Papiernik, a managing partner of SP SAS, may be deemed to have shared power to vote these shares.

|

|

9.

|

Sole Dispositive Power

0

|

|

10.

|

Shared Dispositive Power

3,394,206 shares

of common stock, all of which are owned directly by of SC VII. SP SAS, the management company of SC VII, may be deemed to have

sole voting power, and Papiernik, a managing partner of SP SAS, may be deemed to have shared power to vote these shares.

|

|

11.

|

Aggregate Amount Beneficially Owned by Each Reporting Person

3,394,206

|

|

12.

|

Check if the Aggregate Amount in Row (11) Excludes Certain

Shares (see instructions)

|

¨

|

|

13.

|

Percent of Class Represented by Amount in Row 11

12.0%(1)

|

|

14.

|

Type of Reporting Person (see instructions)

IN

|

|

(1) The percentage is calculated based upon 28,300,080 shares of common stock outstanding, as reported on the 10-Q.

|

|

CUSIP No. 82489T 104

|

Page 6 of 14

|

|

1.

|

Name of Reporting Persons

Henrijette Richter (“Richter”)

|

|

2.

|

Check the Appropriate Box if a Member of a Group (see

instructions)

(a)

(b)

|

¨

x

|

|

3.

|

SEC USE ONLY

|

|

4.

|

Source of Funds (see instructions)

00

|

|

5.

|

Check if Disclosure of Legal Proceedings Is Required

Pursuant to Items 2(d) or 2(e)

|

¨

|

|

6.

|

Citizenship or Place of Organization

Danish Citizen

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With

|

7.

|

Sole Voting Power

0

|

|

8.

|

Shared Voting Power

3,394,206 shares of common stock, all of which are owned directly by of SC VII. SP SAS, the management company of SC VII, may be deemed to have sole voting power, and Richter, a managing partner of SP SAS, may be deemed to have shared power to vote these shares.

|

|

9.

|

Sole Dispositive Power

0

|

|

10.

|

Shared Dispositive Power

3,394,206 shares of common stock, all of which are owned directly by of SC VII. SP SAS, the management company of SC VII, may be deemed to have sole voting power, and Richter, a managing partner of SP SAS, may be deemed to have shared power to vote these shares.

|

|

11.

|

Aggregate Amount Beneficially Owned by Each Reporting Person

3,394,206

|

|

12.

|

Check if the Aggregate Amount in Row (11) Excludes Certain

Shares (see instructions)

|

¨

|

|

13.

|

Percent of Class Represented by Amount in Row 11

12.0%(1)

|

|

14.

|

Type of Reporting Person (see instructions)

IN

|

|

(1) The percentage is calculated based upon 28,300,080 shares of common stock outstanding, as reported on the 10-Q.

|

|

CUSIP No. 82489T 104

|

Page 7 of 14

|

|

1.

|

Name of Reporting Persons

Monique Saulnier (“Saulnier”)

|

|

2.

|

Check the Appropriate Box if a Member of a Group (see instructions)

(a)

(b)

|

¨

x

|

|

3.

|

SEC USE ONLY

|

|

4.

|

Source of Funds (see instructions)

00

|

|

5.

|

Check if Disclosure of Legal Proceedings Is Required

Pursuant to Items 2(d) or 2(e)

|

¨

|

|

6.

|

Citizenship or Place of Organization

French Citizen

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With

|

7.

|

Sole Voting Power

0

|

|

8.

|

Shared Voting Power

3,394,206 shares of common stock, all of which are owned directly by of SC VII. SP SAS, the management company of SC VII, may be deemed to have sole voting power, and Saulnier, a managing partner of SP SAS, may be deemed to have shared power to vote these shares.

|

|

9.

|

Sole Dispositive Power

0

|

|

10.

|

Shared Dispositive Power

3,394,206 shares of common stock, all of which are owned directly by of SC VII. SP SAS, the management company of SC VII, may be deemed to have sole voting power, and Saulnier, a managing partner of SP SAS, may be deemed to have shared power to vote these shares.

|

|

11.

|

Aggregate Amount Beneficially Owned by Each Reporting Person

3,394,206

|

|

12.

|

Check if the Aggregate Amount in Row (11) Excludes Certain

Shares (see instructions)

|

¨

|

|

13.

|

Percent of Class Represented by Amount in Row 11

12.0%(1)

|

|

14.

|

Type of Reporting Person (see instructions)

IN

|

|

(1) The percentage is calculated based upon 28,300,080 shares of common stock outstanding, as reported on the 10-Q.

|

|

CUSIP No. 82489T 104

|

Page 8 of 14

|

|

1.

|

Name of Reporting Persons

Graziano Seghezzi (“Seghezzi”)

|

|

2.

|

Check the Appropriate Box if a Member of a Group (see instructions)

(a)

(b)

|

¨

x

|

|

3.

|

SEC USE ONLY

|

|

4.

|

Source of Funds (see instructions)

00

|

|

5.

|

Check if Disclosure of Legal Proceedings Is Required

Pursuant to Items 2(d) or 2(e)

|

¨

|

|

6.

|

Citizenship or Place of Organization

Italian Citizen

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With

|

7.

|

Sole

Voting Power

0

|

|

8.

|

Shared

Voting Power

3,394,206

shares of common stock, all of which are owned directly by of SC VII. SP SAS, the management company of SC VII, may be deemed to

have sole voting power, and Seghezzi, a managing partner of SP SAS, may be deemed to have shared power to vote these shares.

|

|

9.

|

Sole

Dispositive Power

0

|

|

10.

|

Shared

Dispositive Power

3,394,206

shares of common stock, all of which are owned directly by of SC VII. SP SAS, the management company of SC VII, may be deemed to

have sole voting power, and Seghezzi, a managing partner of SP SAS, may be deemed to have shared power to vote these shares.

|

|

11.

|

Aggregate Amount Beneficially Owned by Each Reporting Person

3,394,206

|

|

12.

|

Check if the Aggregate Amount in Row (11) Excludes Certain

Shares (see instructions)

|

¨

|

|

13.

|

Percent of Class Represented by Amount in Row 11

12.0%(1)

|

|

14.

|

Type of Reporting Person (see instructions)

IN

|

|

(1) The percentage is calculated based upon 28,300,080 shares of common stock outstanding, as reported on the 10-Q.

|

|

CUSIP No. 82489T 104

|

Page 9 of 14

|

|

|

Item 1.

|

Security and Issuer

|

|

|

(a)

|

This statement on Schedule 13D relates to the common stock, $0.001 par value per share, of ShockWave

Medical, Inc., a Delaware corporation (the “Issuer”).

|

|

|

(b)

|

5403 Betsy Ross

Drive, Santa Clara, California 95054.

|

|

|

Item 2.

|

Identity and Background

|

|

|

(a)

|

The persons and entities filing this Schedule 13D are Sofinnova Capital VII FCPR (“SC VII”),

Sofinnova Partners SAS, a French corporation (“SP SAS”), and Denis Lucquin (“Lucquin”), Antoine Papiernik

(“Papiernik”), Henrijette Richter (“Richter”), Monique Saulnier (“Saulnier”), and Graziano

Seghezzi (“Seghezzi”), the managing partners of SP SAS (collectively, the “Listed Persons” and together

with SC VII and SP SAS, the “Reporting Persons”).

|

|

|

(b)

|

The address of the principal place of business for each of the Reporting Persons is Sofinnova Partners

SAS, 7-11 boulevard Hausmann, 75009 Paris, France.

|

|

|

(c)

|

The principal occupation of each of the Reporting Persons is the venture capital investment business.

Each of the Listed Persons is employed at the offices of Sofinnova Partners SAS, 7-11 boulevard Hausmann, 75009 Paris, France.

|

|

|

(d)

|

During the last five years, none of the Reporting Persons has been convicted in any criminal proceeding

(excluding traffic violations or similar misdemeanors).

|

|

|

(e)

|

During the last five years, none of the Reporting Persons has been a party to a civil proceeding

of a judicial or administrative body of competent jurisdiction and as a result of such proceeding was or is subject to a judgment,

decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities

laws or finding any violation with respect to such laws.

|

|

|

(f)

|

SC VII is a French FCPR. SP SAS is a French Corporation. Lucquin, Papiernik and Saulnier are French

citizens. Richter is a Danish citizen. Seghezzi is an Italian citizen.

|

|

|

Item 3.

|

Source and Amount of Funds or Other Consideration.

|

In

July 2013 and January 2015, SC VII purchased a total of 18,579,294 shares of Series A1 preferred stock at $4.72 per share and a

total of 10,004,235 shares of Series A1 preferred stock at $2.54. In May 2015, SC VII purchased a total of 13,527,954 shares of

Series B preferred stock at $8.35 per share. In October 2016, SC VII purchased a total of 7,227,865 shares of Series C preferred

stock for $7.30 per share. In connection with the Issuer’s initial public offering, all of the Series A1 preferred

stock, Series B preferred stock and Series C preferred stock automatically converted into common stock for no additional consideration

in accordance with their respective terms.

No part of the purchase price was borrowed

by any Reporting Person for the purpose of acquiring any securities discussed in this Item 3, and all of the purchase price was

paid through working capital.

|

|

Item 4.

|

Purpose of Transaction.

|

The common stock acquired by SC VII

(described in Item 3 above) was acquired solely for investment purposes. SC VII may,

from time to time, acquire additional shares of common stock or sell all or a portion of the common stock held by SC

VII in the open market or in privately negotiated transactions, or may distribute the

common stock held by SC VII to its unitholders. Any actions SC VII might

undertake will be dependent upon its review of numerous factors, including, among other things, the market prices of the

common stock, general market and economic conditions, ongoing evaluation of the Issuer’s business, financial condition,

operations and prospects, the relative attractiveness of alternative business and investment opportunities,

investors’ need for liquidity, and other future developments.

|

CUSIP No. 82489T 104

|

Page 10 of 14

|

As of the date of this Schedule 13D and

the date of the event to which this Schedule 13D related, and except as provided herein, SC VII has no plans or proposals relating

to or that would result in: (a) the acquisition by any person of additional securities of the Issuer or the disposition of securities

of the Issuer; (b) an extraordinary corporate transaction, such as a merger, reorganization or liquidation, involving the Issuer

or any of its subsidiaries; (c) a sale or transfer of a material amount of assets of the Issuer or any of its subsidiaries; (d)

any change in the present Board of Directors or management of the Issuer, including any plans or proposals to change the number

or terms of directors or to fill any existing vacancies on the Board of Directors of the Issuer; (e) any material change in the

present capitalization or dividend policy of the Issuer; (f) any other material change in the Issuer’s business or corporate

structure; (g) any changes in the Issuer’s charter, by-laws or instruments corresponding thereto or other actions which may

impede the acquisition of control of the Issuer by any person; (h) a class of securities of the Issuer being delisted from a national

securities exchange or ceasing to be authorized to be quoted in an inter-dealer quotation system of a registered national securities

association; (i) a class of equity securities of the Issuer becoming eligible for termination of registration pursuant to Section

12(g)(4) of the Exchange Act; or (j) any action similar to those enumerated above. On December 6, 2019, SCVII entered into a Rule

10b5-1 trading plan (the “10b5-1 Plan”) to sell common stock of the Issuer pursuant to SEC Rule 144.

|

|

Item 5.

|

Interest in Securities of the Issuer.

|

|

|

(a)

|

See Rows 11 and 13 of the cover page for each of the Reporting Persons.

|

|

|

(b)

|

See Rows 7, 8, 9, and 10 for each Reporting Person.

|

|

|

(c)

|

See Item 3 above. SCVII sold common stock of the Issuer on the following dates at the daily average

prices indicated below:

|

|

Date

|

|

Shares

|

|

|

Per Share

Average Price

|

|

|

How Effected

|

|

|

January 14, 2020

|

|

|

58,747

|

|

|

$

|

43.20

|

|

|

|

Open Market

|

|

|

January 15, 2020

|

|

|

58,333

|

|

|

$

|

43.06

|

|

|

|

Open Market

|

|

|

January 16, 2020

|

|

|

61,459

|

|

|

$

|

44.06

|

|

|

|

Open Market

|

|

|

January 17, 2020

|

|

|

97,091

|

|

|

$

|

44.64

|

|

|

|

Open Market

|

|

|

January 21, 2020

|

|

|

169,450

|

|

|

$

|

43.99

|

|

|

|

Open Market

|

|

|

January 22, 2020

|

|

|

54,920

|

|

|

$

|

43.93

|

|

|

|

Open Market

|

|

|

Total:

|

|

|

500,000

|

|

|

|

|

|

|

|

|

|

|

|

(d)

|

Under certain circumstances set forth in the by-laws of SC VII, the equity holders of SC VII and

SP SAS may be deemed to have the right to receive dividends from, or the proceeds from, the sale of shares of common stock owned

by SC VII.

|

|

|

Item 6.

|

Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer.

|

Papiernik, a managing

partner of SC VII, is a member of the Issuer’s board of directors.

SC VII is party to an Amended and Restated Investors’

Rights Agreement by and among the Issuer, SC VII and other shareholders (the “IRA”). Subject to the terms of the IRA,

holders of shares of common stock having registration rights can demand that the Issuer file a registration statement or request

that their shares be covered by a registration statement that the Issuer is otherwise filing. The IRA is incorporated herein by

reference to Exhibit 4.2 to the Issuer’s Registration Statement on Form S-1 (File No. 333-229590) filed with the SEC on February

8, 2019.

|

CUSIP No. 82489T 104

|

Page 11 of 14

|

SCVII is a party to a Lock-Up Agreement by and among the Issuer,

the underwriters and certain other parties. SC VII agreed that, subject to specified limited exceptions, for a period of 180 days

from the date of the Prospectus, it would not, without the prior written consent of Morgan Stanley & Co. LLC and Merrill Lynch,

Pierce, Fenner & Smith Incorporated, offer, sell, contract, sell, pledge or otherwise dispose of, including the filing of a

registration statement in respect of, or hedge any of their shares of common stock or any securities convertible into, or exercisable

or exchangeable for common stock; provided, that these restrictions would not apply to common stock purchased in the Offering,

among other exceptions. Morgan Stanley & Co. LLC and Merrill Lynch, Pierce, Fenner & Smith Incorporated, in their sole

discretion may release any of the securities subject to these lock-up agreements at any time, which, in the case of officers and

directors, shall be with notice.

|

|

Item 7.

|

Material to Be Filed as Exhibits.

|

|

CUSIP No. 82489T 104

|

Page 12 of 14

|

SIGNATURE

After reasonable inquiry and to the best

of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: February 11, 2020

|

SOFINNOVA CAPITAL VII FCPR

|

|

By:

|

Sofinnova Partners SAS

|

|

|

|

|

By:

|

/s/ Denis Lucquin

|

|

Name:

|

Denis Lucquin

|

|

Title:

|

Managing Partner

|

|

|

|

|

SOFINNOVA PARTNERS SAS

|

|

|

|

|

By:

|

/s/ Denis Lucquin

|

|

Name:

|

Denis Lucquin

|

|

Title:

|

Managing Partner

|

|

|

|

|

By:

|

/s/ Denis Lucquin

|

|

Name:

|

Denis Lucquin

|

|

|

|

|

By:

|

/s/ Antoine Papiernik

|

|

Name:

|

Antoine Papiernik

|

|

|

|

|

By:

|

/s/ Henrijette Richter

|

|

Name:

|

Henrijette Richter

|

|

|

|

|

By:

|

/s/ Monique Saulnier

|

|

Name:

|

Monique Saulnier

|

|

|

|

|

By:

|

/s/ Graziano Seghezzi

|

|

Name:

|

Graziano Seghezzi

|

|

CUSIP No. 82489T 104

|

Page 13 of 14

|

EXHIBITS

|

A.

|

Joint Filing Agreement, dated as of February

11, 2020, by and among Sofinnova Capital VII FCPR, Sofinnova Partners SAS, Denis Lucquin, Antoine Papiernik, Henrijette Richter,

Monique Saulnier and Graziano Seghezzi.

|

|

|

|

|

B.

|

Form of Lock-Up Agreement entered into by and among the Issuer, the underwriters and certain others, filed on November 12, 2019

as Exhibit A to the Underwriting Agreement filed as Exhibit 1.1 to the Issuer’s Registration Statement on Form S-1 filed

with the Commission on November 12, 2019 (File No. 333-234640).

|

|

|

|

|

C.

|

Amended and Restated Investors’ Rights Agreement, between the Issuer and the investors listed on Exhibit A thereto (incorporated

by reference to Exhibit 4.2 to the Issuer’s Registration Statement on Form S-1 (File No. 333-229590) filed with

the SEC on February 8, 2019.

|

|

|

|

|

D.

|

Form of Indemnification Agreement by and between the Issuer and each of its directors and executive officers (incorporated by

reference to Exhibit 10.6 to the Issuer’s Registration Statement on Form S-1 (File No. 333-229590) filed with the SEC on

February 8, 2019.

|

|

CUSIP No. 82489T 104

|

Page 14 of 14

|

EXHIBIT A

JOINT FILING AGREEMENT

In accordance with

Rule 13d-1(k) under the Securities Exchange Act of 1934, as amended, the undersigned agree to the joint filing on behalf of each

of them of a statement on Schedule 13D (including amendments thereto) with respect to the common stock of ShockWave Medical, Inc.

and further agree that this agreement be included as an exhibit to such filing. Each party to the agreement expressly authorizes

each other party to file on its behalf any and all amendments to such statement. Each party to this agreement agrees that this

joint filing agreement may be signed in counterparts.

In evidence whereof, the undersigned have

caused this Agreement to be executed on their behalf this 11th day of February, 2020.

|

SOFINNOVA CAPITAL VII FCPR

|

|

By:

|

Sofinnova Partners SAS

|

|

|

|

|

By:

|

/s/ Denis Lucquin

|

|

Name:

|

Denis Lucquin

|

|

Title:

|

Managing Partner

|

|

|

|

|

SOFINNOVA PARTNERS SAS

|

|

|

|

|

By:

|

/s/ Denis Lucquin

|

|

Name:

|

Denis Lucquin

|

|

Title:

|

Managing Partner

|

|

|

|

|

By:

|

/s/ Denis Lucquin

|

|

Name:

|

Denis Lucquin

|

|

|

|

|

By:

|

/s/ Antoine Papiernik

|

|

Name:

|

Antoine Papiernik

|

|

|

|

|

By:

|

/s/ Henrijette Richter

|

|

Name:

|

Henrijette Richter

|

|

|

|

|

By:

|

/s/ Monique Saulnier

|

|

Name:

|

Monique Saulnier

|

|

|

|

|

By:

|

/s/ Graziano Seghezzi

|

|

Name:

|

Graziano Seghezzi

|

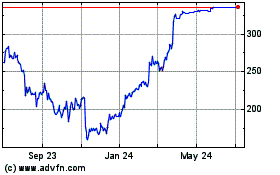

Shockwave Medical (NASDAQ:SWAV)

Historical Stock Chart

From Mar 2024 to Apr 2024

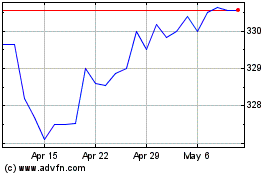

Shockwave Medical (NASDAQ:SWAV)

Historical Stock Chart

From Apr 2023 to Apr 2024