Statement of Changes in Beneficial Ownership (4)

November 12 2020 - 6:45PM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Jackson Investment Group, LLC |

2. Issuer Name and Ticker or Trading Symbol

Staffing 360 Solutions, Inc.

[

STAF

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

_____ Director __X__ 10% Owner

_____ Officer (give title below) _____ Other (specify below)

|

|

(Last)

(First)

(Middle)

2655 NORTHWINDS PARKWAY |

3. Date of Earliest Transaction

(MM/DD/YYYY)

1/21/2020 |

|

(Street)

ALPHARETTA, GA 30009

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

___ Form filed by One Reporting Person

_

X

_ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

| Common Stock (1) | 1/21/2020 (1) | | J(1) | | 100000 (1) | A | $0.00 (1) | 1668696 (2)(3) | D (2) | |

| Common Stock (1) | 2/7/2020 (1) | | J(1) | | 100000 (1) | A | $0.00 (1) | 1768696 (2)(3) | D (2) | |

| Common Stock (1) | 3/2/2020 (1) | | J(1) | | 100000 (1) | A | $0.00 (1) | 1868696 (2)(3) | D (2) | |

| Common Stock (1) | 4/1/2020 (1) | | J(1) | | 100000 (1) | A | $0.00 (1) | 1968696 (2)(3) | D (2) | |

| Common Stock (1) | 5/1/2020 (1) | | J(1) | | 100000 (1) | A | $0.00 (1) | 2068696 (2)(3) | D (2) | |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Warrant to purchase Common Stock | $1.66 (4) | 10/26/2020 | | J (4) | | | 905508 | (4) | 1/26/2024 | Common Stock | 905508 | $0 | 0 | D (2) | |

| Warrant to purchase Common Stock | $1.00 (4) | 10/26/2020 | | J (4) | | 905508 | | (4) | 1/26/2026 (4) | Common Stock | 905508 | $0 | 905508 | D (2) | |

| Series E Convertible Preferred Stock | $1.78 (5) | 10/26/2020 | | J (5) | | | 13000 | 10/31/2020 (5) | (5) | Common Stock | 7293000 | $1000 | 0 | D (2) | |

| Series E Convertible Preferred Stock | $1.00 (5) | 10/26/2020 | | J (5) | | 13000 | | 10/31/2022 (5) | (5) | Common Stock | 13000000 (5) | $1000 | 0 (5) | D (2) | |

| Series E-1 Convertible Preferred Stock | $1.66 (6) | 10/26/2020 | | J (6) | | | 1267 | 11/15/2020 (6) | (6) | Common Stock | 763253 | $1000 | 0 | D (2) | |

| Series E-1 Convertible Preferred Stock | $1.00 (6) | 10/26/2020 | | J (6) | | 1267 | | 10/31/2020 (6) | (6) | Common Stock | 1267139 (6) | $1000 | 1267139 (6) | D (2) | |

| Explanation of Responses: |

| (1) | On each of January 21, 2020, February 7, 2020, March 2, 2020, April 1, 2020 and May 1, 2020, Jackson Investment Group, LLC ("JIG LLC") received 100,000 shares of Common Stock of the Issuer as a result of certain defaults under the loan agreement between JIG LLC and the Issuer. |

| (2) | Richard L. Jackson, the sole manager and controlling owner of JIG LLC, may be deemed the indirect beneficial owner, but he disclaims beneficial ownership of the reported securities except to the extent of his pecuniary interest therein. |

| (3) | Total does not include 144 shares of common stock personally owned by Richard L. Jackson, the chief executive officer of JIG LLC. These shares are directly and beneficially owned by Richard L. Jackson, one of the Reporting Persons; however, they are not owned by JIG LLC, the designated Reporting Person. |

| (4) | JIG LLC and the Issuer amended that certain Amended and Restated Warrant, dated April 25, 2018, as amended on August 27, 2018 and November 15, 2018, by entering into that certain Amendment No. 3 to the Amended and Restated Warrant Agreement, dated October 26, 2020 between the Issuer and JIG LLC. The transaction involved an amendment to an outstanding warrant, resulting in a reduced exercise price of $1.00 and extended expiration date of January 26, 2026. These shares are included as being beneficially owned in Table II. |

| (5) | When originally issued, the Series E Convertible Preferred Stock ("Series E Stock") was convertible at the holder's option at any time after October 31, 2020 or upon the occurrence of an event of default specified in the Certificate of Designation of Series E Convertible Preferred Stock (the "Certificate") at a conversion price of $1.78. Pursuant to the Second Certificate of Amendment to the Certificate dated October 23, 2020 (the "Second Amendment"), each share of Series E Stock is now convertible at the holder's option at any time after October 31, 2022 or upon an event of default specified therein at a conversion price of $1.00. The resulting change in the terms of the Series E Stock is being reported in Table II as a disposition and acquisition of the Series E Stock, but such shares are not included as being beneficially owned in Table II because they are not convertible within 60 days. |

| (6) | When originally issued, the Series E-1 Convertible Preferred Stock ("Series E-1 Stock") was convertible at the holder's option at any time after November 15, 2020 or upon the occurrence of an event of default specified in the Certificate at a conversion price of $1.66. Pursuant to the Second Amendment, each share of Series E-1 Stock is now convertible at the holder's option at any time after October 31, 2020 or upon an event of default specified therein at a conversion price of $1.00. The resulting change in the terms of the Series E-1 Stock is being reported in Table II as a disposition and acquisition of the Series E-1 Stock and such shares are included as being beneficially owned in Table II. |

Remarks:

This form is filed by both JIG LLC and Richard L. Jackson, the sole manager and controlling owner of JIG LLC. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

Jackson Investment Group, LLC

2655 NORTHWINDS PARKWAY

ALPHARETTA, GA 30009 |

| X |

|

|

Jackson Richard Lee

2655 NORTHWINDS PARKWAY

ALPHARETTA, GA 30009 |

| X |

|

|

Signatures

|

| /s/ Richard L. Jackson Signature of Jackson Investment Group, LLC By: Richard L. Jackson, Manager and CEO | | 11/10/2020 |

| **Signature of Reporting Person | Date |

| /s/ Richard L. Jackson | | 11/10/2020 |

| **Signature of Reporting Person | Date |

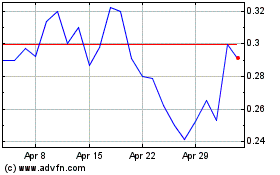

Staffing 360 Solutions (NASDAQ:STAF)

Historical Stock Chart

From Mar 2024 to Apr 2024

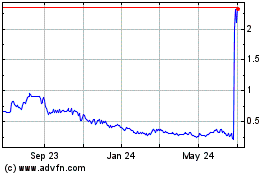

Staffing 360 Solutions (NASDAQ:STAF)

Historical Stock Chart

From Apr 2023 to Apr 2024