0001178253false00011782532024-01-052024-01-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): January 05, 2024 |

SCYNEXIS, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-36365 |

56-2181648 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

1 Evertrust Plaza 13th Floor |

|

Jersey City, New Jersey |

|

07302-6548 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 201 884-5485 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $0.001 per share |

|

SCYX |

|

The Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

On January 5, 2024, SCYNEXIS, Inc. (the “Company”) updated its investor slide presentation (“Corporate Presentation”). The Corporate Presentation is available on the Company’s website and is furnished as Exhibit 99.1 hereto.

The information in this Item 7.01 and Exhibit 99.1 hereto are being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

|

|

Exhibit No. |

|

Description |

99.1 |

|

Corporate Presentation |

100 |

|

Cover Page Interactive Data File (formatted as Inline XBRL). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

SCYNEXIS, Inc. |

|

|

|

|

Date: |

January 5, 2024 |

By: |

/s/ David Angulo, M.D. |

|

|

Name: |

David Angulo, M.D. |

|

|

Its: |

Chief Executive Officer |

A dynamic force in the fight against infectious disease January 2024

Forward-Looking Statement Certain statements regarding SCYNEXIS, Inc. (the “Company”) made in this presentation constitute forward-looking statements, including, but not limited to, statements regarding our business strategies and goals, plans and prospects, market size, adoption rate, potential revenue, clinical validity and utility, growth opportunities, future products and product pipeline. Forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from our expectations. These risks and uncertainties include, but are not limited, to: BREXAFEMME may not be accepted by physicians and patients at the rate SCYNEXIS expects; risks inherent in SCYNEXIS’ ability to successfully develop and obtain FDA approval for ibrexafungerp for additional indications; unexpected delays may occur in the timing of acceptance by the FDA of an NDA submission; the expected costs of commercializing BREXAFEMME or of clinical studies and when they might begin or be concluded; SCYNEXIS’ need for additional capital resources; and SCYNEXIS’ reliance on third parties to conduct SCYNEXIS’ clinical studies and commercialize its products. The use of words such as “anticipates,” “expects,” “intends,” “plans,” “could,” “should,” “would,” “may,” “will,” “believes,” “estimates,” “potential,” or “continue” and variations or similar expressions are intended to identify forward-looking statements, but not all forward-looking statements may be so identified. These statements are based upon the current expectations and beliefs of management and are subject to certain risks and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. These risks and uncertainties include, but are not limited to, risks and uncertainties discussed in the Company’s most recent reports filed with the Securities and Exchange Commission (“SEC”), including under the caption “Risk Factors” in the Company’s annual report on Form 10-K for the year ended December 31, 2022, and in the Company’s subsequent quarterly reports on Form 10-Q, which factors are incorporated herein by reference. Readers are cautioned not to place undue reliance on any of these forward-looking statements. The Company undertakes no obligation to update any of these forward-looking statements to reflect events or circumstances after the date of this presentation, or to reflect actual outcomes.

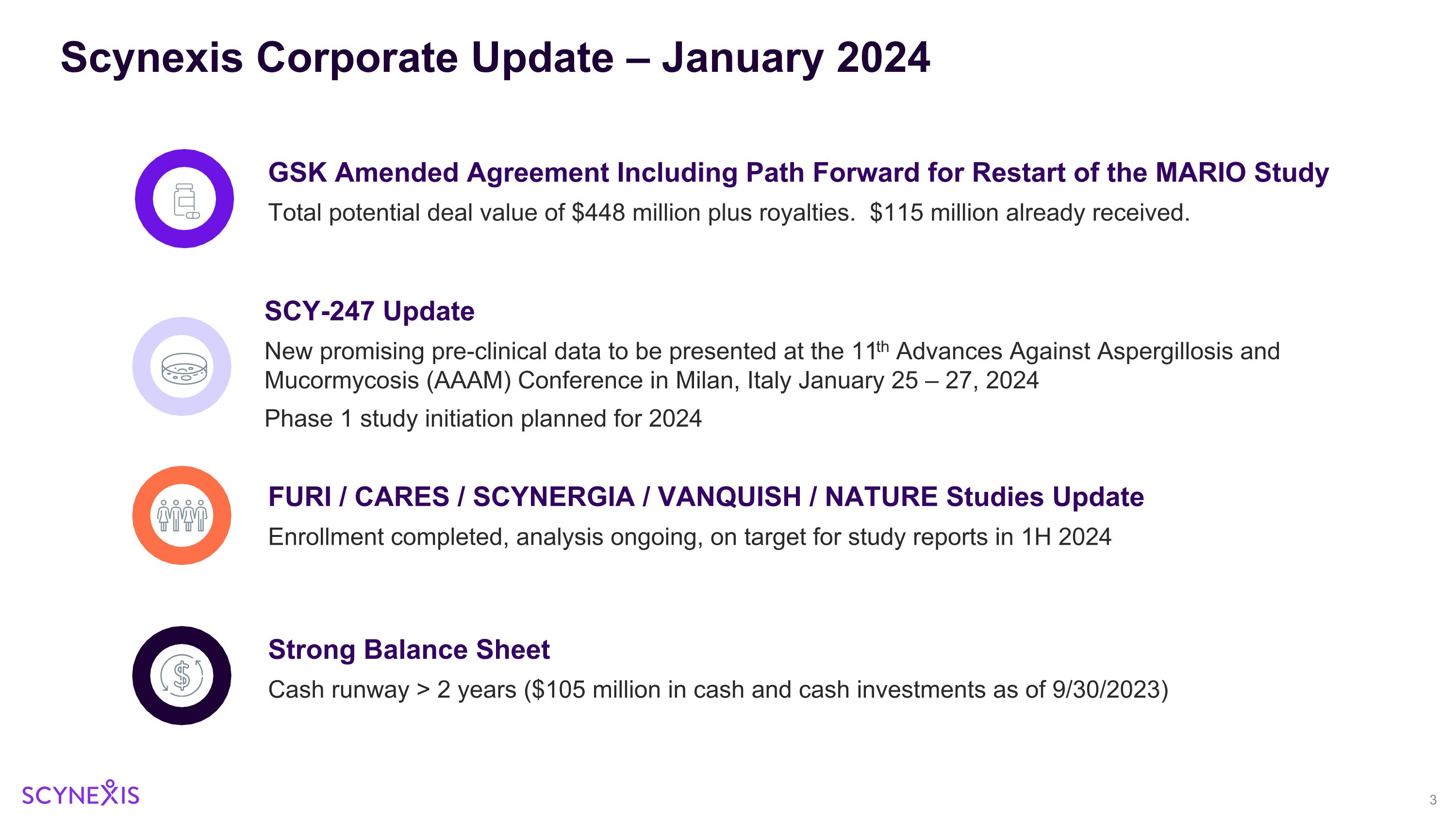

Scynexis Corporate Update – January 2024 SCY-247 Update New promising pre-clinical data to be presented at the 11th Advances Against Aspergillosis and Mucormycosis (AAAM) Conference in Milan, Italy January 25 – 27, 2024 Phase 1 study initiation planned for 2024 FURI / CARES / SCYNERGIA / VANQUISH / NATURE Studies Update Enrollment completed, analysis ongoing, on target for study reports in 1H 2024 GSK Amended Agreement Including Path Forward for Restart of the MARIO Study Total potential deal value of $448 million plus royalties. $115 million already received. Strong Balance Sheet Cash runway > 2 years ($105 million in cash and cash investments as of 9/30/2023)

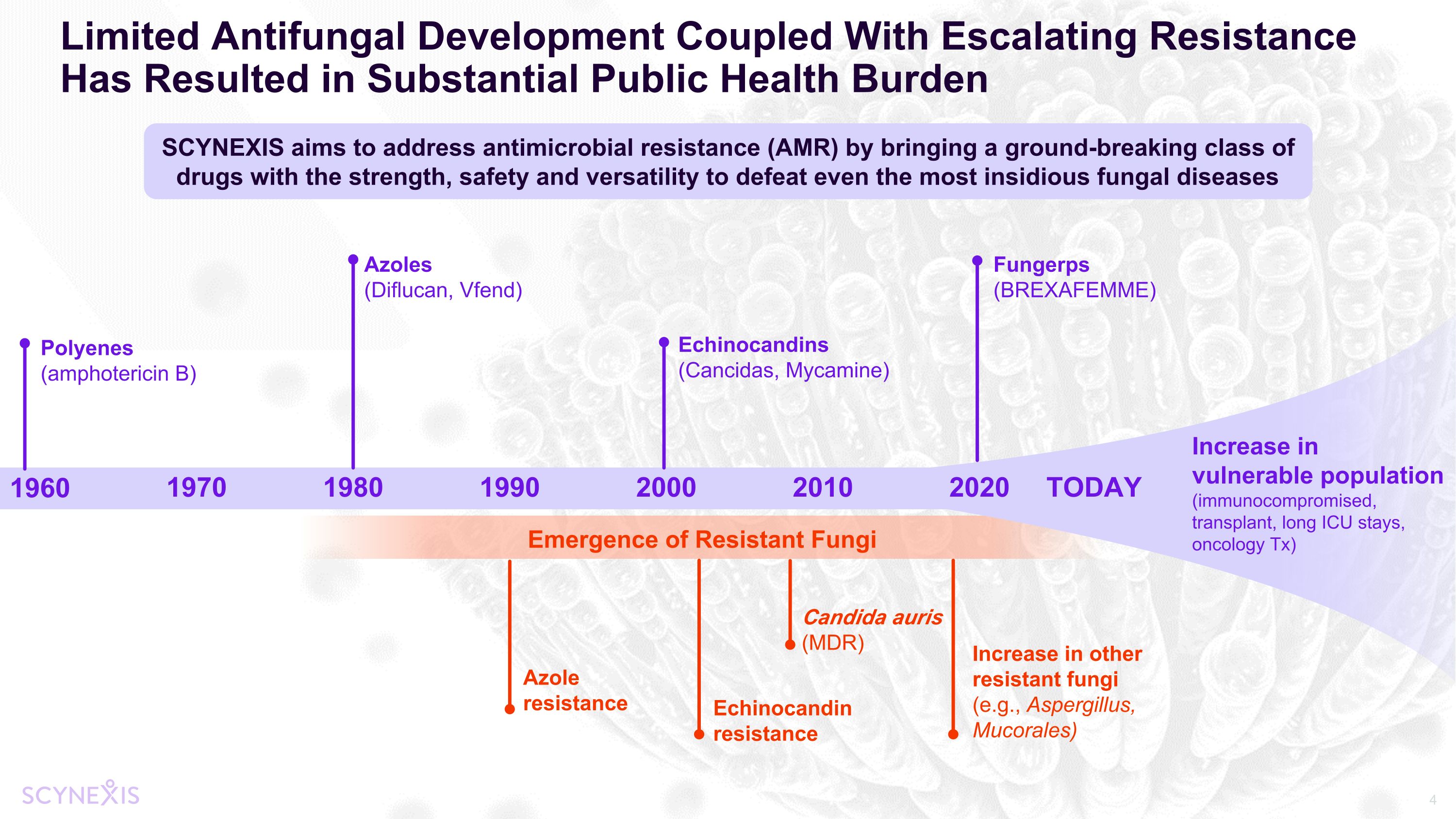

Limited Antifungal Development Coupled With Escalating Resistance Has Resulted in Substantial Public Health Burden 1960 1970 1980 1990 2000 Emergence of Resistant Fungi Polyenes (amphotericin B) Azoles (Diflucan, Vfend) Echinocandins (Cancidas, Mycamine) Fungerps (BREXAFEMME) Echinocandin resistance Azole resistance Candida auris (MDR) SCYNEXIS aims to address antimicrobial resistance (AMR) by bringing a ground-breaking class of drugs with the strength, safety and versatility to defeat even the most insidious fungal diseases Increase in vulnerable population (immunocompromised, transplant, long ICU stays, oncology Tx) 2010 2020 TODAY Increase in other resistant fungi (e.g., Aspergillus, Mucorales)

WHO Releases First-Ever List of Priority Deadly Fungal Pathogens CDC Identifies Drug Resistant Candida spp. and C. auris as Serious and Urgent Threats BARDA New Priority: Antifungals Fungal Resistance a Growing, Global, Public Health Threat Antifungal development is a well-recognized priority PASTEUR Act renews focus on antimicrobial resistance Fungal Outbreaks Increasing

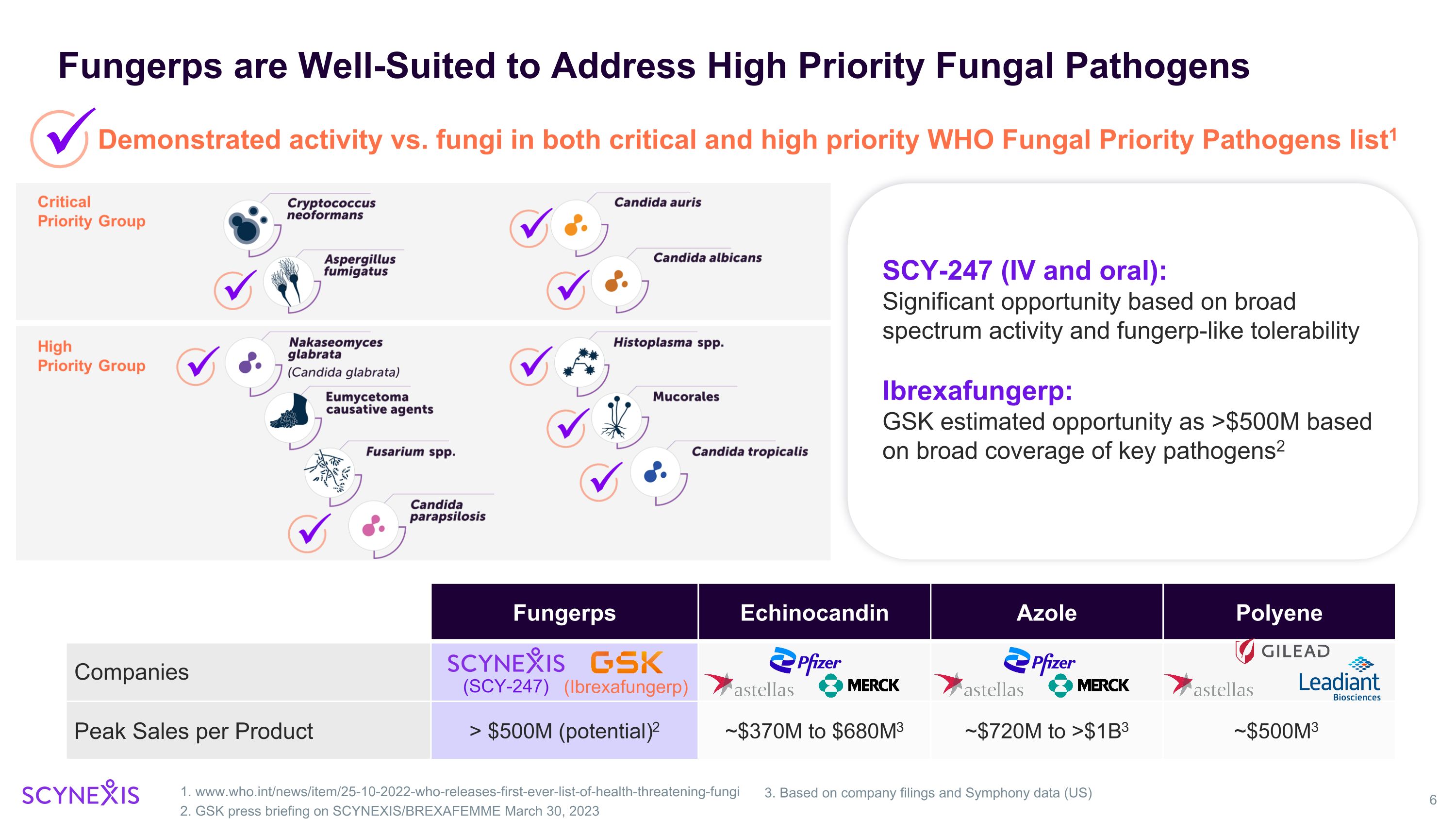

Fungerps are Well-Suited to Address High Priority Fungal Pathogens 1. www.who.int/news/item/25-10-2022-who-releases-first-ever-list-of-health-threatening-fungi 2. GSK press briefing on SCYNEXIS/BREXAFEMME March 30, 2023 Demonstrated activity vs. fungi in both critical and high priority WHO Fungal Priority Pathogens list1 SCY-247 (IV and oral): Significant opportunity based on broad spectrum activity and fungerp-like tolerability Ibrexafungerp: GSK estimated opportunity as >$500M based on broad coverage of key pathogens2 Fungerps Echinocandin Azole Polyene Companies Peak Sales per Product > $500M (potential)2 ~$370M to $680M3 ~$720M to >$1B3 ~$500M3 3. Based on company filings and Symphony data (US) (SCY-247) (Ibrexafungerp)

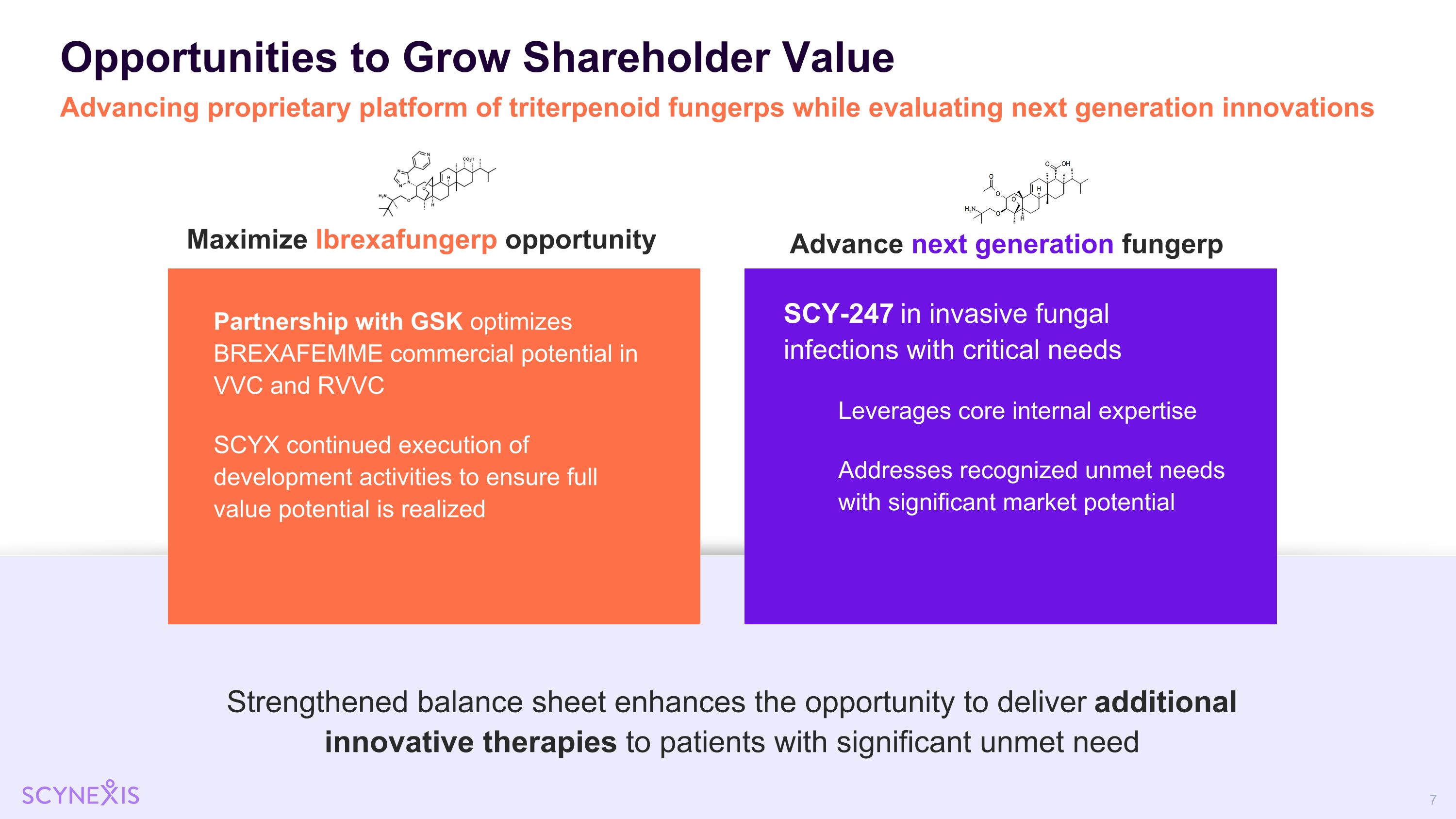

Opportunities to Grow Shareholder Value Advancing proprietary platform of triterpenoid fungerps while evaluating next generation innovations Maximize Ibrexafungerp opportunity Advance next generation fungerp Strengthened balance sheet enhances the opportunity to deliver additional innovative therapies to patients with significant unmet need SCY-247 in invasive fungal infections with critical needs Leverages core internal expertise Addresses recognized unmet needs with significant market potential Partnership with GSK optimizes BREXAFEMME commercial potential in VVC and RVVC SCYX continued execution of development activities to ensure full value potential is realized

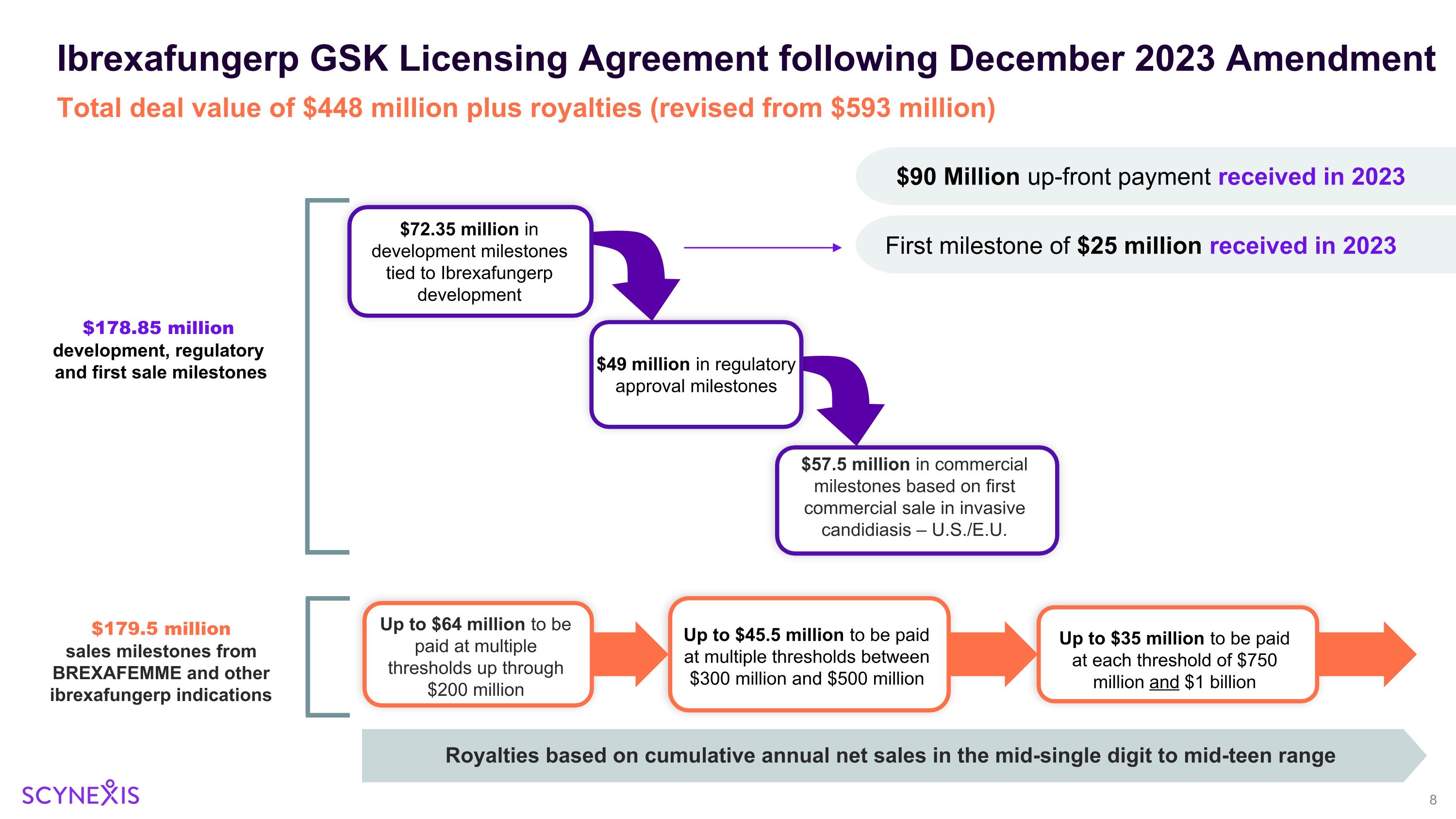

Up to $35 million to be paid at each threshold of $750 million and $1 billion Ibrexafungerp GSK Licensing Agreement following December 2023 Amendment $72.35 million in development milestones tied to Ibrexafungerp development $49 million in regulatory approval milestones $57.5 million in commercial milestones based on first commercial sale in invasive candidiasis – U.S./E.U. Up to $45.5 million to be paid at multiple thresholds between $300 million and $500 million Up to $64 million to be paid at multiple thresholds up through $200 million $178.85 million development, regulatory and first sale milestones $179.5 million sales milestones from BREXAFEMME and other ibrexafungerp indications Total deal value of $448 million plus royalties (revised from $593 million) $90 Million up-front payment received in 2023 Royalties based on cumulative annual net sales in the mid-single digit to mid-teen range First milestone of $25 million received in 2023

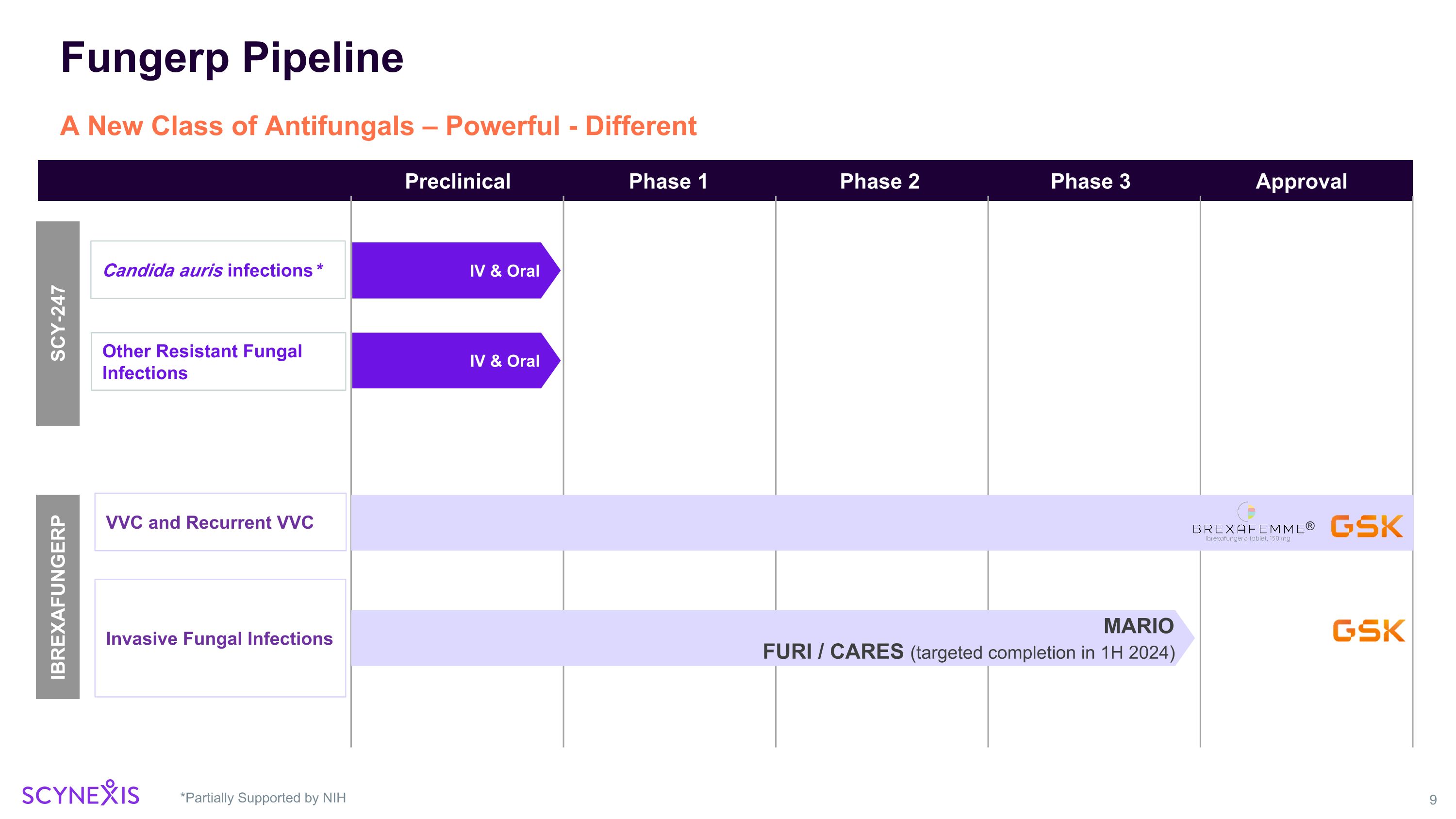

Fungerp Pipeline *Partially Supported by NIH A New Class of Antifungals – Powerful - Different IBREXAFUNGERP VVC and Recurrent VVC Invasive Fungal Infections Candida auris infections* Phase 3 Phase 1 Phase 2 Approval Preclinical MARIO FURI / CARES (targeted completion in 1H 2024) SCY-247 IV & Oral Other Resistant Fungal Infections IV & Oral ®

SCY-247: �Next Generation Fungerp

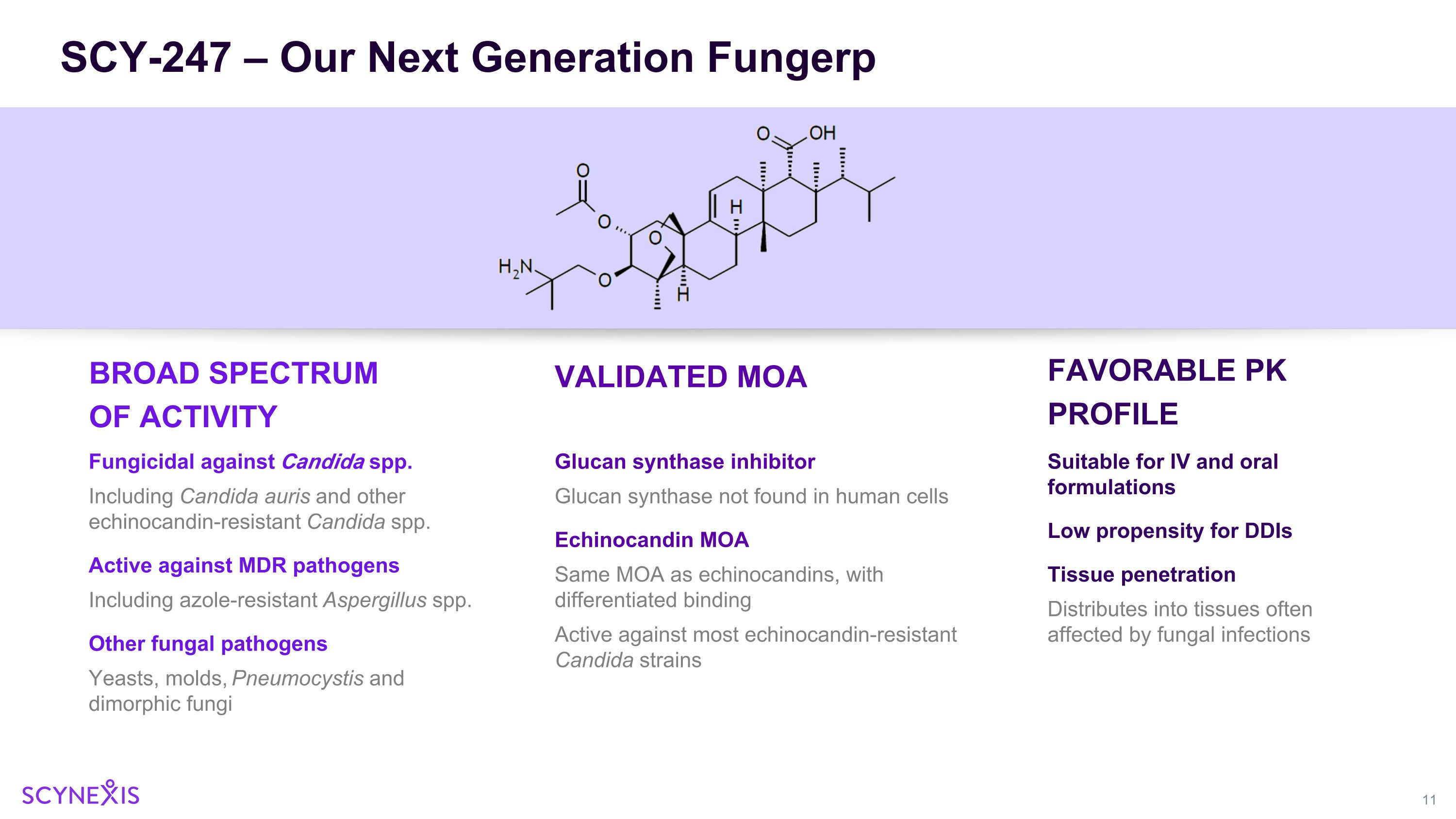

SCY-247 – Our Next Generation Fungerp BROAD SPECTRUM OF ACTIVITY Fungicidal against Candida spp. Including Candida auris and other echinocandin-resistant Candida spp. Active against MDR pathogens Including azole-resistant Aspergillus spp. Other fungal pathogens Yeasts, molds, Pneumocystis and dimorphic fungi VALIDATED MOA FAVORABLE PK PROFILE Suitable for IV and oral formulations Low propensity for DDIs Tissue penetration Distributes into tissues often affected by fungal infections Glucan synthase inhibitor Glucan synthase not found in human cells Echinocandin MOA Same MOA as echinocandins, with differentiated binding Active against most echinocandin-resistant Candida strains

SCY-247 – Our Next Generation Fungerp 11th Congress on Trends in Medical Mycology (TIMM) - October 2023 Potent and broad-spectrum in vitro activity, including against a large array of yeasts, molds and dimorphic fungi Extensive tissue distribution in animal models Fungicidal activity against multi-drug resistant strains, including Candida albicans and Candida auris In vivo efficacy in a mouse model of invasive candidiasis 11th Advances Against Aspergillosis and Mucormycosis (AAAM) Conference – to be Presented in January 2024 In vivo efficacy in treating a Mucorales pulmonary infection in immunosuppressed mice Efficacy of SCY-247 was equivalent to antifungals currently used to treat mucormycosis The combination of SCY-247 with liposomal amphotericin B resulted in a statistically significant survival improvement when compared to either monotherapy Scientific Meeting Data

SCY-247 – In Development Against Resistant Fungal Infections IP wholly owned by SCYNEXIS Development backed by NIH NIH provided ~$3M funding to Case Western University for development of SCY-247 against C. auris IND-enabling studies in progress Phase 1 study initiation anticipated in 2024 Anticipated Qualified Infectious Disease Product (QIDP) designation, Orphan Drug Designation and Fast Track (regulatory exclusivity of at least 10 years)

SCYNEXIS Strongly Positioned for Value Creation Demonstrated internal expertise, solid supply chain and long IP protection, and potential for next generation products and partnerships Global urgency to rapidly develop potent antifungals to treat emerging infectious threats Strong Balance Sheet with cash runway of more than 2 years Category leader in the fight against deadly fungal pathogens with new antifungal (SCY-247) in development

v3.23.4

Document And Entity Information

|

Jan. 05, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 05, 2024

|

| Entity Registrant Name |

SCYNEXIS, Inc.

|

| Entity Central Index Key |

0001178253

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

001-36365

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

56-2181648

|

| Entity Address, Address Line One |

1 Evertrust Plaza

|

| Entity Address, Address Line Two |

13th Floor

|

| Entity Address, City or Town |

Jersey City

|

| Entity Address, State or Province |

NJ

|

| Entity Address, Postal Zip Code |

07302-6548

|

| City Area Code |

201

|

| Local Phone Number |

884-5485

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

SCYX

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

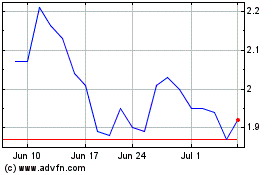

Scynexis (NASDAQ:SCYX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Scynexis (NASDAQ:SCYX)

Historical Stock Chart

From Apr 2023 to Apr 2024