UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of December 2023

Commission file number: 001-38307

RETO ECO-SOLUTIONS, INC.

(Registrant’s name)

c/o Beijing REIT Technology Development Co.,

Ltd.

X-702, 60 Anli Road, Chaoyang District, Beijing

People’s Republic of China 100101

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

INFORMATION CONTAINED

IN THIS FORM 6-K REPORT

Attached

as Exhibit 99.1 to this report is a press release of ReTo Eco-Solutions, Inc. (the “Company”), dated December 27, 2023, regarding

the Company’s unaudited financial results for the six months ended June 30, 2023.

INCORPORATION BY REFERENCE

This

report, including Exhibit 99.1 hereto, shall be deemed to be incorporated by reference into the registration statement on Form F-3, as

amended (No. 333-267101) of the Company and to be a part thereof from the date on which this report is filed, to the extent not superseded

by documents or reports subsequently filed or furnished.

CAUTIONARY STATEMENT

REGARDING FORWARD-LOOKING STATEMENTS

This

report on Form 6-K and the exhibits hereto contain “forward-looking statements” for purposes of the safe harbor provisions

of the Private Securities Litigation Reform Act of 1995 that represent the Company’s beliefs, projections and predictions about

future events. All statements other than statements of historical fact are “forward-looking statements,” including any projections

of earnings, revenue or other financial items, any statements of the plans, strategies and objectives of management for future operations,

any statements concerning proposed new projects or other developments, any statements regarding future economic conditions or performance,

any statements of management’s beliefs, goals, strategies, intentions and objectives, and any statements of assumptions underlying

any of the foregoing. Words such as “may,” “will,” “should,” “could,” “would,”

“predicts,” “potential,” “continue,” “expects,” “anticipates,” “future,”

“intends,” “plans,” “believes,” “estimates” and similar expressions, as well as statements

in the future tense, identify forward-looking statements.

These

statements are necessarily subjective and involve known and unknown risks, uncertainties and other important factors that could cause

the Company’s actual results, performance or achievements, or industry results, to differ materially from any future results, performance

or achievements described in or implied by such statements. Actual results may differ materially from expected results described in the

Company’s forward-looking statements, including with respect to correct measurement and identification of factors affecting the

Company’s business or the extent of their likely impact, and the accuracy and completeness of the publicly available information

with respect to the factors upon which the Company’s business strategy is based or the success of the Company’s business.

Forward-looking

statements should not be read as a guarantee of future performance or results, and will not necessarily be accurate indications of whether,

or the times by which, the Company’s performance or results may be achieved. Forward-looking statements are based on information

available at the time those statements are made and management’s belief as of that time with respect to future events, and are subject

to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by

the forward-looking statements. Important factors that could cause such differences include, but are not limited to, those factors discussed

more fully under the heading “Item 3. Key Information—D. Risk Factors” and elsewhere in the Company’s Form

20-F filed with the Securities and Exchange Commission on May 1, 2023, as well as in this report on Form 6-K and the exhibits hereto.

EXHIBIT INDEX

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| Date: December 27, 2023 |

RETO ECO-SOLUTIONS, INC. |

| |

|

| |

By: |

/s/ Hengfang Li |

| |

Name: |

Hengfang Li |

| |

Title: |

Chief Executive Officer |

2

Exhibit 99.1

ReTo Eco-Solutions, Inc. Announces First Half

2023 Financial Results

BEIJING, December 27, 2023 -- (BUSINESS WIRE) -- ReTo Eco-Solutions, Inc. (Nasdaq: RETO) (the “Company”), a provider of technology

solutions and operation services for intelligent ecological environments and internet of things technology development services in China

and other countries, today announced its financial results for the six months ended June 30, 2023.

First Half 2023 Financial Review

| ● | Revenues decreased by approximately $1.7 million, or 57%, to $1.2 million

for the six months ended June 30, 2023 from approximately $2.9 million for the six months ended June 30, 2022. |

| ● | Cost of revenues decreased by approximately $1.4 million, or 55%, to approximately

$1.1 million for the six months ended June 30, 2023 from $2.5 million for the six months ended June 30, 2022. |

| ● | Operating expenses increased by approximately $35.1 million, or 582%, to

approximately $41.1 million for the six months ended June 30, 2023 from $6.0 million for the six months ended June 30, 2022. |

| ● | Net loss increased by approximately $39.9 million, or 692%, to approximately

$45.7 million for the six months ended June 30, 2023 from $5.8 million for the six months ended June 30, 2022. |

Financial Results for the First Half 2023

Revenues

Revenues decreased by approximately $1.7 million,

or 57%, to $1.2 million for the six months ended June 30, 2023 from approximately $2.9 million for the six months ended June 30, 2022.

Revenue from machinery and equipment sales decreased by approximately $1.0 million, or 49%, to

$1.0 million for the six months ended June 30, 2023 from approximately $2.0 million for the six months ended June 30, 2022. The

decrease is mainly due to slowdown of the construction industry and less demand for the Company’s products. Sales of the Company’s

environmental-friendly construction materials decreased by approximately $0.2 million, or 72%, to approximately $0.09 million for six

months ended June 30, 2023 from approximately $0.3 million for the six months ended June 30, 2022 due

to the decrease in demand resulting from the downturn of the national real estate market. Revenue from other services decreased by approximately

$0.3 million, or 79%, to approximately $0.09 million for six months ended June 30, 2023 from approximately $0.4 million for the

six months ended June 30, 2022 due to less demand for the Company’s technological consulting

service and roadside assistance service.

Cost of revenues

Cost of revenues decreased by approximately $1.4

million, or 55%, to approximately $1.1 million for the six months ended June 30, 2023 from $2.5 million for the six months ended June

30, 2022. The decrease in cost of revenues was in line with the decrease in revenues.

Gross profit

Gross profit decreased by approximately $0.3 million,

or 75%, to approximately $0.1 million for the six months ended June 30, 2023 from $0.4 million for the six months ended June 30, 2022.

Gross margin was 8% for the six months ended June 30, 2023 as compared to 13% for the six months ended June 30, 2022. The decrease in

gross profit was primarily attributable to (i) a decrease of approximately $147,000 in gross profit in machinery and equipment business

due to the significant decrease in domestic and overseas market demand of machinery and equipment; and (ii) a decrease of approximately

$155,000 in gross profit in other services due to decreased customer orders. Because other services with higher gross profit margin accounted

for 7% of total revenue in the six months ended June 30, 2023 as compared to 15% of total revenue for the six months ended June 30, 2022,

the Company’s gross profit margin decreased to 8% for the six months ended June 30, 2023 as compared to 13% of total revenue for

the six months ended June 30, 2022.

Operating expenses

For the six months ended June 30, 2023 and 2022,

the Company’s selling expenses were approximately $0.3 million for both periods.

General and administrative expenses increased by $33.7 million, or

572%, to $39.6 million for the six months ended June 30, 2023 from $5.9 million for the six months ended June 30, 2022. The increase was

due to $33.8 million increase in share-based compensation, partially offset by decreased payroll expenses.

Bad debt expenses amounted to approximately $0.5

million for the six months ended June 30, 2023, as compared to a bad debt recovery of approximately $0.7 million for the six months ended

June 30, 2022.

Research and development expenses increased by

$0.3 million, or 60%, to $0.8 million for the six months ended June 30, 2023 from $0.5 million for the six months ended June 30, 2022.

The increase was due to an increase of approximately $0.3 million in expert fees.

Interest expense

The Company’s interest expenses were approximately

$0.2 million for both six-month periods ended June 30, 2023 and 2022.

Change in fair value in convertible debt

Due to change in fair value of convertible loans,

the Company recorded an unrealized loss of $57,985 and $204,331 in other expense for the six months ended June 30, 2023 and 2022, respectively.

Other income (expense), net

Other expense was $4.4 million for the six months

ended June 30, 2023 as compared to $0.3 million for the six months ended June 30, 2022. The increase was due to a one-time charge of $4.7

million from a terminated project.

Loss before income taxes

The Company’s loss before income taxes was

approximately $45.7 million for the six months ended June 30, 2023, an increase of approximately $39.9 million as compared to loss before

income taxes of approximately $5.8 million for the six months ended June 30, 2022. The increase was primarily attributable to decrease

in revenue and increase in operating expenses and other expense.

Provision for income taxes

The Company’s subsidiaries in the People’s Republic of

China (“PRC”) are subject to PRC income tax, which is computed according to the relevant laws and regulations in the PRC.

Under the Enterprise Income Tax Law, the corporate income tax rate applicable to all companies, including both domestic and foreign-invested

companies, is 25%. However, two subsidiaries of the Company, Beijing REIT Technology Development Co., Ltd. and Hainan Yile IoT Technology

Co., Ltd., are recognized as High and New Technology Enterprises by the PRC government and thus subject to a favorable income tax rate

of 15%. As the Company had losses before income tax, its income tax expenses amounted to $52 and $28,767 for the six months ended June

30, 2023 and 2022, respectively.

Net loss

As a result of the foregoing, net loss amounted

to approximately $45.7 million and $5.8 million for the six months ended June 30, 2023 and 2022, respectively.

Cash

Cash was approximately $0.2 million as of June 30, 2023, reflecting

an increase of approximately $0.1 million from approximately $0.1 million as of December 31, 2022.

About ReTo Eco-Solutions, Inc.

Founded in 1999, ReTo Eco-Solutions, Inc., through

its proprietary technologies, systems and solutions, is striving to bring clean water and fertile soil to communities worldwide. The Company,

through its operating subsidiaries in China, is engaged in the ecological restoration and solid waste treatment, manufacturing and distribution

of eco-friendly construction materials (aggregates, bricks, pavers and tiles) made from mining waste (iron tailings), and soil remediation

materials transformed from solid waste (iron tailings), as well as equipment used for the production of these eco-friendly construction

materials and soil remediation materials. In addition, the Company provides consultation, design, project implementation and construction

of urban ecological protection projects and parts, engineering support, consulting, technical advice and service, and other project-related

solutions for its manufacturing equipment and environmental protection projects. The Company also offers roadside assistance services

and technology development services utilizing Internet of Things technologies. For more information, please visit: http://en.retoeco.com.

Forward-Looking Statements

This press release contains forward-looking statements.

Forward-looking statements include statements concerning plans, objectives, goals, strategies, future events or performance, and underlying

assumptions and other statements that are other than statements of historical facts. These statements include, among others, statements

regarding the Company’s plans to regain compliance with the minimum bid price requirement. The Company’s actual results may

differ materially from those expressed in any forward-looking statements as a result of various factors and uncertainties. The reports

filed by the Company with the Securities and Exchange Commission discuss these and other important factors and risks that may affect the

Company’s business, results of operations and financial conditions. For these reasons, among others, investors are cautioned not

to place undue reliance upon any forward-looking statements in this press release. The Company undertakes no obligation to publicly revise

these forward-looking statements to reflect events or circumstances that arise after the date hereof.

For more information, please contact:

ReTo Eco-Solutions, Inc.

Angela Hu

Tel: +86-010-64827328

Email: ir@retoeco.com or 310@reit.cc

RETO ECO-SOLUTIONS INC. AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

| | |

June 30, | | |

December 31, | |

| | |

2023 | | |

2022 | |

| ASSETS | |

(Unaudited) | | |

| |

| Current Assets: | |

| | |

| |

| Cash and cash equivalents | |

$ | 233,839 | | |

$ | 113,895 | |

| Accounts receivable, net | |

| 475,303 | | |

| 2,150,450 | |

| Accounts receivable, net - related party | |

| 79,639 | | |

| 83,736 | |

| Advances to suppliers, net | |

| 707,775 | | |

| 453,894 | |

| Advances to suppliers, net - related party | |

| 1,598,977 | | |

| 3,787,036 | |

| Inventories, net | |

| 820,590 | | |

| 337,798 | |

| Prepayments and other current assets | |

| 114,287 | | |

| 402,151 | |

| Due from related parties | |

| 483,369 | | |

| 208,225 | |

| Due from third parties | |

| 678,223 | | |

| - | |

| Total Current Assets | |

| 5,192,002 | | |

| 7,537,185 | |

| | |

| | | |

| | |

| Property, plant and equipment, net | |

| 8,028,957 | | |

| 8,722,435 | |

| Intangible assets, net | |

| 4,548,402 | | |

| 4,869,654 | |

| Long-term investment in equity investee | |

| 2,301,850 | | |

| 2,503,944 | |

| Right-of-use assets | |

| 271,972 | | |

| 424,999 | |

| Total Assets | |

$ | 20,343,183 | | |

$ | 24,058,217 | |

| | |

| | | |

| | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | |

| | | |

| | |

| | |

| | | |

| | |

| Current Liabilities: | |

| | | |

| | |

| Short-term loans | |

$ | 5,274,916 | | |

| 1,319,490 | |

| Convertible debt | |

| 3,004,000 | | |

| 3,922,686 | |

| Advances from customers | |

| 2,072,983 | | |

| 2,551,216 | |

| Advances from customers-related party | |

| 166,275 | | |

| - | |

| Due to a minority shareholder | |

| 413,719 | | |

| 725,000 | |

| Deferred grants - current | |

| 264 | | |

| 18,563 | |

| Accounts payable | |

| 2,934,058 | | |

| 2,624,701 | |

| Accrued and other liabilities | |

| 2,433,692 | | |

| 2,717,432 | |

| Loans from third parties | |

| 1,356,113 | | |

| 1,106,233 | |

| Taxes payable | |

| 1,922,345 | | |

| 2,077,088 | |

| Operating lease liabilities, current | |

| 150,420 | | |

| 277,036 | |

| Deferred tax liability | |

| 309,664 | | |

| 325,593 | |

| Total Current Liabilities | |

| 20,038,449 | | |

| 17,665,038 | |

| | |

| | | |

| | |

| Loans from third parties-noncurrent | |

| 1,048,088 | | |

| 1,160,000 | |

| Operating lease liabilities - noncurrent | |

| 83,407 | | |

| 158,650 | |

| Total Liabilities | |

| 21,169,944 | | |

| 18,983,688 | |

| | |

| | | |

| | |

| Commitments and Contingencies | |

| | | |

| | |

| | |

| | | |

| | |

| Shareholders’ Equity: | |

| | | |

| | |

| Common Share, $0.01 par value, 20,000,000 shares authorized, 7,725,848 shares and 4,339,889 shares issued and outstanding as of June 30, 2023 and December 31, 2022, respectively | |

| 77,259 | | |

| 43,400 | |

| Additional paid-in capital | |

| 98,689,295 | | |

| 53,331,093 | |

| Subscription receivable | |

| (5,887,546 | ) | |

| - | |

| Statutory reserve | |

| 1,069,882 | | |

| 1,066,554 | |

| Accumulated deficit | |

| (93,056,277 | ) | |

| (47,813,206 | ) |

| Accumulated other comprehensive loss | |

| (2,220,029 | ) | |

| (2,388,890 | ) |

| Total Shareholders’ Equity Attributable to ReTo Eco-Solutions Inc. | |

| (1,327,416 | ) | |

| 4,238,951 | |

| | |

| | | |

| | |

| Noncontrolling interest | |

| 500,655 | | |

| 835,578 | |

| Total Shareholders’ Equity | |

| (826,761 | ) | |

| 5,074,529 | |

| | |

| | | |

| | |

| Total Liabilities and Shareholders’ Equity | |

$ | 20,343,183 | | |

| 24,058,217 | |

RETO ECO-SOLUTIONS INC. AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS

OF INCOME AND COMPREHENSIVE INCOME

| | |

For the Six Months Ended June 30, | |

| | |

2023 | | |

2022 | |

| | |

| | |

| |

| Revenues – third party customers | |

$ | 1,022,919 | | |

$ | 2,882,792 | |

| Revenues – related parties | |

| 210,864 | | |

| 6,987 | |

| Total revenues | |

| 1,233,783 | | |

| 2,889,779 | |

| Cost of revenues – third party customers | |

| 780,794 | | |

| 1,957,829 | |

| Cost of revenues – related parties | |

| 359,398 | | |

| 557,145 | |

| Total Cost | |

| 1,140,192 | | |

| 2,514,974 | |

| Gross Profit | |

| 93,591 | | |

| 374,805 | |

| | |

| | | |

| | |

| Operating Expenses: | |

| | | |

| | |

| Selling expenses | |

| 289,730 | | |

| 288,552 | |

| General and administrative expenses | |

| 39,559,187 | | |

| 5,888,849 | |

| Bad debt expenses (recovery) | |

| 460,116 | | |

| (650,776 | ) |

| Research and development expenses | |

| 809,979 | | |

| 505,847 | |

| Total Operating Expenses | |

| 41,119,012 | | |

| 6,032,472 | |

| | |

| | | |

| | |

| Loss from Operations | |

| (41,025,421 | ) | |

| (5,657,667 | ) |

| | |

| | | |

| | |

| Other Income (expenses): | |

| | | |

| | |

| Interest expenses | |

| (180,772 | ) | |

| (189,755 | ) |

| Interest income | |

| 1,509 | | |

| 2,293 | |

| Other income (expenses), net | |

| (4,356,224 | ) | |

| 348,266 | |

| Change in fair value of convertible debt | |

| (57,985 | ) | |

| (204,331 | ) |

| Gain from disposal of subsidiaries | |

| 38,394 | | |

| - | |

| Share of losses in equity method investments | |

| (83,307 | ) | |

| (38,885 | ) |

| Total Other Expenses, Net | |

| (4,638,385 | ) | |

| (82,412 | ) |

| | |

| | | |

| | |

| Loss Before Income Taxes | |

| (45,663,806 | ) | |

| (5,740,079 | ) |

| Provision for Income Taxes | |

| 52 | | |

| 28,767 | |

| Net Loss | |

| (45,663,858 | ) | |

| (5,768,846 | ) |

| | |

| | | |

| | |

| Less: net loss attributable to noncontrolling interest | |

| (424,115 | ) | |

| (92,866 | ) |

| Net Loss Attributable to ReTo Eco-Solutions, Inc. | |

$ | (45,239,743 | ) | |

$ | (5,675,980 | ) |

| | |

| | | |

| | |

| Net Loss | |

$ | (45,663,858 | ) | |

$ | (5,768,846 | ) |

| Other comprehensive gain (loss): | |

| | | |

| | |

| Foreign currency translation adjustment | |

| 258,053 | | |

| (723,421 | ) |

| Comprehensive Loss | |

| (45,405,805 | ) | |

| (6,492,267 | ) |

| Less: comprehensive loss attributable to noncontrolling interest | |

| (334,923 | ) | |

| (22,981 | ) |

| Comprehensive Loss Attributable to ReTo Eco-Solutions, Inc | |

$ | (45,070,882 | ) | |

$ | (6,469,286 | ) |

| | |

| | | |

| | |

| Loss Per Share | |

| | | |

| | |

| Basic and diluted | |

$ | (8.32 | ) | |

$ | (1.65 | ) |

| | |

| | | |

| | |

| Weighted Average Number of Shares | |

| | | |

| | |

| Basic and diluted | |

| 5,437,853 | | |

| 3,443,338 | |

5

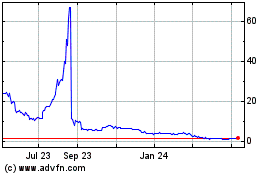

ReTo Eco Solutions (NASDAQ:RETO)

Historical Stock Chart

From Mar 2024 to Apr 2024

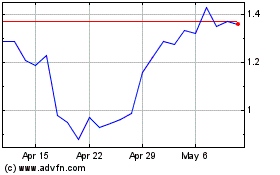

ReTo Eco Solutions (NASDAQ:RETO)

Historical Stock Chart

From Apr 2023 to Apr 2024