PACIFIC PREMIER BANCORP INC0001028918false00010289182024-02-012024-02-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

| | | | | | | | | | | | | | |

| Date of Report (Date of earliest event reported) | February 1, 2024 |

| PACIFIC PREMIER BANCORP, INC. |

| (Exact name of registrant as specified in its charter) |

| Delaware | 0-22193 | 33-0743196 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| |

| |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17901 Von Karman Avenue, Suite 1200, Irvine, CA 92614

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code (949) 864-8000

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol | | Name of Each Exchange on Which Registered |

| Common Stock, par value $0.01 per share | | PPBI | | NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 7.01 REGULATION FD DISCLOSURE

On January 29, 2024, Pacific Premier Bancorp, Inc. (the “Company”) hosted a conference call to discuss its financial results for the quarter ended December 31, 2023. A copy of the conference call transcript is attached hereto as Exhibit 99.1. An archived version of the conference call webcast is available on the Investor Relations section of the Company’s website at www.ppbi.com.

The information furnished under Item 7.01 and Item 9.01 of this Current Report on Form 8-K, including Exhibit 99.1 to this Current Report on Form 8-K, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to liabilities under that Section, nor shall it be deemed incorporated by reference in any registration statement or other filings of PPBI under the Securities Act of 1933, as amended, except as shall be set forth by specific reference in such filing. The furnishing of the transcript is not intended to constitute a representation that such furnishing is required by Regulation FD or that the transcript includes material investor information that is not otherwise publicly available.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits

| | | | | |

| 99.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | PACIFIC PREMIER BANCORP, INC. |

| | | | |

| Dated: | February 1, 2024 | By: | /s/ STEVEN R. GARDNER |

| | | | Steven R. Gardner |

| | | | Chairman, Chief Executive Officer, and President |

| | |

| Pacific Premier Bancorp |

| Fourth Quarter 2023 Conference Call |

| January 29, 2024, at 12:00 p.m. Eastern |

|

CORPORATE PARTICIPANTS Steve Gardner - Chairman and CEO Ron Nicolas – Chief Financial Officer |

PRESENTATION

Operator

Good morning. Welcome to the Pacific Premier Bancorp Fourth Quarter 2023 Conference Call. All participants will be in listen only mode. If you need assistance, please signal a conference specialist by pressing the star key followed by zero. After today’s presentation there will be an opportunity to ask questions. To ask a question, you may press star then one on your telephone keypad. To withdraw your question, please press star then two. Please note, this event is being recorded.

I would now like to turn the conference over to Steve Gardner, Chairman and CEO. Please go ahead.

Steve Gardner

Thank you, Gary. Good morning, everyone. I appreciate you joining us today. As you're all aware, we released our earnings report for the fourth quarter of 2023 earlier this morning. We have also published an updated investor presentation with additional information and disclosures on our financial results. If you have not done so already, we encourage you to visit our Investor Relations website to download a copy of the presentation and related materials.

I note that our earnings release and investor presentation include a safe harbor statement relative to the forward-looking comments. I encourage each of you to carefully read that statement.

On today's call, I'll walk through some of the notable items related to our fourth quarter performance. Ron Nicolas, our CFO, will also review a few of the details surrounding our financial results, and then we'll open up the call to questions.

Our team delivered another solid quarter to close out 2023, which was an extraordinary year for the banking industry. Rapidly rising interest rates, high profile bank failures in rapid succession, and heightened regulatory expectations brought challenging dynamics to the market. Throughout it all, we maintained our focus on prudent and proactive capital liquidity and credit risk management. We have built our organization to be dynamic and adaptable to various operating environments. This served us and our stakeholders extremely well in 2023. For example, our bankers responded quickly to the industry challenges throughout the year, collaborating across business lines to meet clients' needs and to reinforce the strength of our franchise. This responsiveness and engagement deepened existing relationships and led to new business development opportunities for our teams.

During the fourth quarter, we leveraged the strength of our balance sheet and strong capital levels to proactively reposition our securities portfolio. This transaction enhanced our future earnings profile, provided additional liquidity and is reflective of the optionality we have created within the franchise. The securities repositioning produced immediate results, expanding our net interest margin by 16 basis points.

I'd like to highlight a few key areas as many of the trends were similar to what we observed in the third quarter. Although we reported a quarterly net loss of $1.44 per share, excluding the one-time effects of the FDIC special assessment and our securities portfolio repositioning, our operating earnings per share was $0.51. We saw some nice lift from our fee-based businesses as well as a reduction in noninterest expense compared to the third quarter excluding the FDIC special assessment.

Our commitment to capital accumulation in the current environment continues to drive our strong capital ratios, which remain top tier among our peers, even after layering in the impact of the loss on the securities portfolio sale. In the fourth quarter, our TCE ratio increased 85 basis points to 10.72% and our tangible book value per share increased $0.33 to $20.22. Our CET1 ratio came in at 14.32% and our total risk-based capital ratio was a healthy 17.29%. Our ability to deepen our relationships with existing customers and attract new clients to the bank

Pacific Premier Bancorp

January 29, 2024, at 12:00 p.m. Eastern

generated meaningful growth in new deposit account openings while maintaining pricing discipline.

The new account opening activity, coupled with our ability to opportunistically deploy liquidity generated from the securities sale, supported the favorable remix of the balance sheet. We redeployed a portion of the proceeds from the securities portfolio into cash and US treasuries while also reducing higher cost broker deposits by $617 million and prepaying $200 million of FHLB term advances. Our available liquidity at the end of the fourth quarter totaled approximately $9.9 billion.

We did see some customer deposit outflows and mix shift during the fourth quarter, which included seasonal outflows related to business tax payments. Not surprisingly, some clients continue to pursue higher yielding nonbank alternatives. Ultimately, we saw non-maturity deposits increase to 84.7% of total deposits. Our constant emphasis on cultivating high quality client relationships and disciplined deposit pricing resulted in a well-controlled cost of non-maturity deposits of 102 basis points.

On the asset side of the balance sheet, we saw slight growth in our overall loan portfolio balances due to increased line utilization from commercial borrowers. Prepayment activity was similar to the third quarter as business and commercial real estate clients continued to deploy excess cash reserves to pay down debt. Our bankers remain focused on generating high quality relationships that meet our risk adjusted return requirements.

As always, we are proactive in terms of portfolio management and credit monitoring. We have ongoing communication with our clients relative to market trends in their businesses and industries. These updates on our clients' financial performance, liquidity and collateral values inform our approach to managing individual credits. Our year end asset quality metrics remain solid as delinquencies were 0.08% of total loans and nonperforming assets were 0.13% of total assets.

We are closely monitoring the trends in commercial real estate markets and proactively identifying and managing potentially weaker credits. Overall, our loan portfolio is well managed in all facets across the organization.

With that, I will turn the call over to Ron to provide a few more details on our fourth quarter financial results.

Ron Nicolas

Thanks, Steve, and good morning. For comparison purposes, my comments today are on a linked quarter basis unless otherwise noted.

Let's begin with the quarter's results. For the fourth quarter, we recorded a net loss of $135.4 million or $1.44 per share. Our reported results included the impact from two nonrecurring items, the $1.26 billion AFS securities sale that had a net after-tax loss of $182.3 million and $2.1 million of additional noninterest expense due to the special FDIC assessment. Excluding these two items, our operating results were net income of $48.4 million or $0.51 per diluted share, which yielded a return on average assets of 0.99% and a return on average tangible common equity of 11.9%.

Our operating efficiency ratio came in at 58.8% and our adjusted pre-provision net revenue as a percentage of average assets was 1.34% for the quarter. Please refer to our non-GAAP reconciliation in our investor presentation and earnings release for more details.

Taking a closer look at the income statement, net interest income of $146.8 million was negatively impacted by lower average earning asset levels, partially offset by a favorable mix shift toward higher yielding earning assets as a result of the securities repositioning and the reduction of higher cost wholesale funding sources. Our actions led to 16 basis points of net

Pacific Premier Bancorp

January 29, 2024, at 12:00 p.m. Eastern

interest margin expansion to 3.28% due to an increase of 38 basis points on the investment securities for the quarter as well as 8 basis points of higher loan yields.

On a spot basis, excluding fees and discounts, the weighted average rate on our loan portfolio increased 11 basis points to 4.87%, reflecting higher lines of credit draws for the quarter. Overall, cost of funds was up only 2 basis points to 1.69%, reflecting the favorable mix change from paying down higher cost wholesale funding. And our non-maturity deposits increased to 84.7% of total deposits, while costs were well controlled at 1.02% with our cumulative total deposit beta of 29%, illustrating our disciplined pricing actions throughout this rate cycle. Notably, our spot deposit costs were 1.55% and ended the quarter 1 basis point lower than the average total deposit costs for the quarter of 1.56%.

For the first quarter, we expect further balance sheet optimization through a combination of lower cash levels and a reduction in higher cost wholesale funding. Namely, we expect both brokered deposits and FHLB advances to trend lower from year end levels. We believe the combination of these items will help partially mitigate net interest margin pressures in the first quarter.

Our core fee-based businesses had a solid quarter. Excluding the securities sale loss of $254.1 million, our noninterest income came in at $19.9 million. Our fundamental fee income trends were favorable as trust income came in at $9.4 million, and escrow and exchange fee income at $1.1 million, both up slightly over the prior quarter. For the first quarter of 2024, we expect our total noninterest income to be in the range of $20 million to $21 million with the benefit of PPT's annual tax fees.

Noninterest expense increased slightly to $102.8 million. Compensation and benefits expense decreased to $2.2 million, reflecting the benefit from the staff realignment across certain business lines during the quarter.

From a staffing perspective, we ended the quarter with head count of 1,345 compared to 1,355 as of September 30th as our staffing levels continue to track with the overall size of the balance sheet. We remain focused on tightly managing our operating expenses and we expect first quarter expenses in the range of $102 million to $103 million with the anticipated higher first quarter payroll taxes.

Our provision for credit losses of $1.7 million decreased from the prior quarter as our ACL coverage ratio increased 3 basis points to 1.45%, consistent with the fourth quarter's loan composition, level of new loan commitment activity and our economic outlook.

Turning now to the balance sheet, we finished the quarter at $19 billion in total assets with loans flat to the prior quarter. As noted, lower cash and securities enabled us to pay down higher cost wholesale funding in the form of brokered CDs and FHLB term borrowings.

Total loans held for investment increased $19 million, driven by net draws on existing lines of credit of $355 million and new commitments of $128 million, offsetting prepayments, sales and maturities of $455 million.

Total deposits ended the quarter at $15 billion, a decrease of $1 billion, driven mostly by a $617 million reduction in broker deposits. Other deposit categories fell $395 million as we continued to see clients redeploying funds into higher yielding alternatives, prepaying loans, as well as the impact of fourth quarter seasonal tax related outflows. Even with the continued mix shift, our noninterest bearing deposits remain a robust 33% of total deposits, reflecting our strong client relationship business model.

The successful execution of our deposit pricing strategies is evident as our non-maturity deposits ended the year at 1.04%, only 2 basis points above the quarter's average of 1.02%, generating positive momentum for us heading into the first quarter.

Pacific Premier Bancorp

January 29, 2024, at 12:00 p.m. Eastern

The securities portfolio decreased $783 million to $2.9 billion, and the average yield on our investment portfolio increased 38 basis points to 3.8%, partially benefiting from the purchase of $539 million of short term US treasuries. We stand to benefit from a full quarter of the reinvested proceeds in the first quarter as the spot rate on our securities portfolio ended the year at 3.48%. Not surprising, given the rally in the yield curve late in 2023 and combined with the securities sold, our pretax accumulated other comprehensive loss on the total AFS portfolio improved to $36 million at December 31st.

Our capital ratios remain significantly higher than the required well capitalized thresholds. With our CET1 and Tier 1 capital ratios at 14.32% and our total risk based capital at 17.29%, we continue to rank in the top tier relative to our peers. In addition, our tangible common equity ratio now stands at a very healthy 10.72% and our tangible book value per share grew $0.33 to $20.22.

And lastly, from an asset quality standpoint, asset quality across all measurables remain solid. Nonperforming assets were flat at 0.13% and total delinquency was also flat compared to the prior quarter at just 8 basis points. Our total classified loans decreased 5 basis points to 1.07%. And our allowance for credit losses finished the quarter at $192.5 million with our coverage ratio increasing to 1.45%. Our total loss absorption, which includes the fair value discount on acquired loans, ended the quarter up 1 basis point at 1.77%.

With that, I'll turn the call back over to Steve.

Steve Gardner

Great. Thanks, Ron. I'll conclude with a few comments about our outlook.

We believe the actions we have taken over the past two years to purposefully moderate growth rates and prioritize capital and liquidity management have positioned us well. We were encouraged by the stabilization in the loan portfolio at year end. However, we anticipate muted loan demand in what may be a lingering higher interest rate environment. We will continue to monitor our loan portfolio closely and we are ready to respond decisively should we see elevated stresses.

For the near term, pressure on deposit costs appear to have moderated. Future rate cuts, if they were to materialize in 2024, would aid our ability to push funding costs down. Capital accumulation over balance sheet growth remains a priority. However, as you saw with the securities repositioning transaction, we are regularly evaluating opportunities to deploy capital and optimize the balance sheet to create long term value for shareholders. Although challenges remain, thanks to the strength and expertise of the entire Pacific Premier team, some of the most talented in the industry, we remain in a position to act quickly to take advantage of opportunities if and when they arise.

In conclusion, as an industry, we will continue to face a significant amount of uncertainty in 2024 on various fronts. That said, we are optimistic and believe we are well positioned to leverage our organizational excellence and discipline to continue to deliver long term value for our shareholders, clients, employees and the communities we serve.

That concludes our prepared remarks. We'd be happy to answer any questions. Gary, please open up the call for questions.

QUESTION AND ANSWER

Operator

We will now begin the question and answer session. To ask a question, you may press star then one on your telephone keypad. If you are using a speakerphone, please pick up your handset before pressing the keys. To withdraw your question, please press star then two. At this time, we will pause momentarily to assemble our roster.

Pacific Premier Bancorp

January 29, 2024, at 12:00 p.m. Eastern

Our first question is from David Feaster with Raymond James.

David Feaster

Good morning. I just want to start on the margin outlook. You guys have been incredibly active managing the balance sheet. It sounds like there's more coming in the first quarter. Curious how you think about the margin trajectory? If I hear your comments, Ron, it sounds like maybe some modest compression in the first quarter might be coming, but just curious how you think about the margin trajectory going forward, especially considering potential rate cuts given that seems like to be the expectation near term?

Steve Gardner

Ron, I'm happy to take it, or you can offer up some thoughts.

Ron Nicolas

Sure. David, I would tell you that here in the first quarter, we don't anticipate, we're not modeling ourselves internally here any rate cuts, but I will say we'll see. I mean, as evidenced here in the fourth quarter, we've done a pretty good job at managing our deposit costs, continue to manage the balance sheet and that's going to be pretty much the continuation.

I will highlight, though, that, of course, we saw a nice yield uptick and that was driven by variable rate draws on lines of credit. We'll see how that plays itself out here as we move through the first quarter. So those are kind of my initial thoughts there. Steve?

Steve Gardner

I don't know that I have much to add. I think that covered it relatively well.

David Feaster

Look, you've taken a pretty conservative standpoint for some time now. Great to see the increase in loans. Curious, do you think this marks an inflection point? And if so, what's giving you confidence here maybe to start putting more capital to work in terms of loans? Just kind of your thoughts on what you're seeing from a market dynamic and improving demand and those types of things.

Steve Gardner

Well, as I said, for the foreseeable future, we see pretty muted demand, David. I think until we have better clarity and certainty about the direction of rates, from all indications that we have from all the clients that we're talking to, whether it's small business or real estate investors, there remains to be a level of caution out there, so our expectation is muted demand. We're going to maintain our discipline on the quality of credits and the relationships that we're bringing into the bank. But I think as you saw in the fourth quarter, we certainly benefited from some of those line draws that Ron just mentioned. The production picked up a little bit. We'll see how those trends materialize here in the first half of the year.

David Feaster

And maybe last one for me. Nice to hear about some modest uptick and some benefits in the fee income lines, I know that's been a big focus for you all. Just curious some of the underlying trends that you're seeing in the trust business, it sounds like some tax benefits there, and what you're seeing in the escrow side? And then just high level thoughts, I know you guys have been investing a lot in technology. Curious whether you're seeing any tangible benefits there and kind of your thoughts on investment on that front.

Steve Gardner

So there is a lot of subjects to cover there, David. That's all right. First, as far as the trust team, we have invested pretty heavily in the trust team, and we were very pleased with the results that they were able to put up last year in a number of different areas. I think we're finally approaching that operational excellence that we expect and have had at the bank level for some time, and that's helping, I think, from the production side with the team and their confidence level in speaking to clients. We have developed some great relationships with some of the largest

Pacific Premier Bancorp

January 29, 2024, at 12:00 p.m. Eastern

wealth managers in the industry. And really, as they get to better understand our capabilities and how that plays in to their business, we've seen some nice growth in new accounts, and we expect that to continue here this year and incremental improvement every month and every quarter.

On the escrow business side, that frankly has really slowed down over the last couple of years, a reflection of much lower activity in the commercial real estate markets and transactions overall. I think that business, until we get some movement in rates and some better clarity on the commercial real estate markets more broadly, we'd expect that activity to be relatively muted as well.

And then lastly, from the technology side, we are always investing in the business, and that's technology, that's employees. We continue to improve in those areas. And I think as we move further away from some of the disruptions that occurred in the first and second quarter of last year and have that stabilization, we'll be able to play a little bit more offense and we certainly have the technology and resources there that aid our teams throughout the organization.

Operator

The next question is from Chris McGratty with KBW.

Chris McGratty

Ron, maybe a question just on broader net interest income given the actions you took and the benefit on the margin but the smaller balance sheet. Maybe thoughts on trough of NII, if we're not there, maybe when? And also, if we do stay in a higher for longer environment, maybe how the balance sheet pro forma now reacts to higher for longer versus kind of the futures market that's calling for more cuts?

Ron Nicolas

I'll just echo a little bit, Chris, on what I stated earlier. We did see a nice expansion to 16 basis points. I wouldn't go as far as to say that was the trough, but we've got some favorable aspects going here. Obviously, the reinvestment, the securities repositioning, that's going to add some lift here in the first quarter as well and some of the pay down on the wholesale side that we've been doing and looking to continue to do I think is going to offer up some additional benefits.

The big wild card, of course, is going to be the deposit costs and deposit flows in the mix. The industry continues to see challenges across that aspect of it. And despite the fact we've done a really nice job managing our deposit costs, again, I wouldn't go so far as to say that we've conquered that or slayed that dragon at this point in time. I think we'll still see some pressures in that area, but we're cautiously optimistic on that front.

Chris McGratty

And Steve, maybe for you on capital, you talked about the flexibility and the actions you've taken. Do you expect opportunities to arise in 2024 at the industry level, given some of the stress on rates and maybe how you would maybe update us on your ranks of capital year for 2024?

Steve Gardner

Sure. I would say we do expect opportunities to rise, but I thought that in 2023 as well, so we'll just see how the year plays out here. I think as I mentioned, given all the uncertainties in the environment, whether it's around the commercial real estate markets or a variety of other areas and just how the economy develops given all of the geopolitical risks, intentions out there, I think our approach is going to continue to be that we're going to retain capital where we see opportunities to put it to work where it benefits the organization long term, we're going to do that. But overall, there's a level of uncertainty and we are very comfortable having strong levels of capital.

Operator

The next question is from Gary Tenner with D.A. Davidson.

Pacific Premier Bancorp

January 29, 2024, at 12:00 p.m. Eastern

Gary Tenner

Good morning, guys. I wanted to ask about the fourth quarter noninterest bearing outflow. Can you parse maybe how much of that you would chalk up to tax payment seasonality versus kind of the ongoing shift in mix, and a sense of timing of how rapidly the seasonality piece of it could come back on balance sheet?

Steve Gardner

It's hard to put a specific measurement on it, Gary, as far as the tax payments and all of the movements that are going on. As Ron mentioned, we're seeing clients continue to pay down or pay off loans and so that impacts both sides of the balance sheet naturally. Certainly, in 2023, in the state of California, we saw later tax payments come out, some of the impacts on commerce escrow. Our sense is though that, that magnitude, we don't expect to see that as we move through the year and typically, some of those funds begin to return in the first half of the year.

How much will come back is uncertain. Again, I think it in part has to deal with the yield curve, how businesses are feeling about the overall environment, so we'll see how things play out here. I think one of the benefits we have is just the number of new accounts that we've opened in 2023. And as those get fully implemented and on-boarded, we may pick up some benefit there.

Gary Tenner

Appreciate that. And bigger picture on the funding side, pre-pandemic you all often operated the company at or at times slightly above 100% loan deposit ratio. Even with the wholesale reductions in the fourth quarter and the net deposit moves there, you're back up but only 89%. So, as you're thinking about the longer term management of the balance sheet, how are your thoughts on that today relative to where they were a few years ago?

Steve Gardner

I think that when you think about it pre-pandemic, we were also quite a bit smaller in total assets. I don't see us running the business, we don't think it would be prudent at 100% loan-to-deposit ratio, but we could certainly see in the low to mid-90% range. Certainly, we'd like to get there by growing both sides of the balance sheet, both the loans and deposit side to increase that over time prudently.

Gary Tenner

And one last question for me, if I could. Ron, in terms of the hedges, I know you added some in the third quarter, it doesn't look like you added any here in the fourth quarter. But can you just remind us kind of what the maturity schedule is of those swaps?

Ron Nicolas

We've got about $1.3 billion in totality in the swap book and approximately half of those hedges will mature by the end of this year. And then we've got another tranche, if you will, another 25% early in 2025. And then the rest are just laddered out just a little bit longer.

Operator

Again, if you have a question, please press star then one. The next question is from Andrew Terrell with Stephens.

Andrew Terrell

Good morning. First question, Ron, can you just remind us the $600 million of termed FHLB advances you've got in outstanding right now, what's the maturity schedule look like for those?

Ron Nicolas

Well, we've got a third of that tranche maturing this quarter, so we'll see that come off. And then I think we've got another tranche late in the year and then next year.

Andrew Terrell

Pacific Premier Bancorp

January 29, 2024, at 12:00 p.m. Eastern

And then I'm trying to figure out what kind of the right cash position is on the balance sheet and then how you pair that against, I would assume that you’d use cash to pay down some of the termed FHLB that matures this quarter, potentially some more brokered. Can you just talk to us kind of about the cash balance where you'd like to see it sit and then what the uses of that cash would be?

Ron Nicolas

Sure. So obviously, coming out of the post pandemic and given the rapid rate rise, us and many in the industry went much more heavily into the cash. I'd say under our normal operating levels, we're probably in the $400 million, $500 million range. We're more than double that today. And so, I could see us over time depending upon deposit flows, loan growth as we've talked a little bit about, we could see that coming back down to those normal levels as we move throughout the remainder of 2024. Of course, notwithstanding any other challenges that come about from a macro standpoint.

Andrew Terrell

And then on the securities portfolio, do you have just what the spot yield was on the securities book at 12/31?

Ron Nicolas

Yes, 3.48%.

Andrew Terrell

And then one more question on the margin. I think in the third quarter, there was an interest accrual that was a headwind in the third quarter. So, all else equal, that was I think, if I recall, 4 or 6 basis points positive to 4Q loan yields, just the falling off of that. So, I guess the question is about kind of loan yields going into 2024 and just on a quarterly or annual basis, just as loans are coming up for renewal, what type of loan yield improvement you would expect kind of throughout the year just as adjustable rate loans reprice or the lower yielding fixed rate loans come off?

Steve Gardner

There's a lot of moving pieces there, Andrew, to come up and we don't have an estimate out there that we've stated publicly. But obviously, a lot of moving parts about how much of the maturing loans we end up retaining; how borrowers, what their decisions are around loans that are adjusting; frankly, some of the higher yielding stuff is paying off faster than some of the lower yielding loans. Certainly, what is the rate and volume of new production? Certainly, we like the yield of new loans that we're putting on today, they're pretty attractive from a risk-adjusted basis. But as I mentioned, demand is pretty muted. Ron, do you have anything to add there, in particular?

Ron Nicolas

No, I think that's good, Steve. I was just going to confirm that the impact last quarter was 4 basis points on that nonaccrual, so we did get some lift from that item alone. But I agree with what you just stated.

Andrew Terrell

Perfect. Last, but not a question. Steve, I got a LinkedIn notification this morning reminding me to congratulate you on 24 years at Pacific Premier. I'm not sure what exactly the bank looked like in 2000, but I know there's been a lot of progress made since then, so congratulations.

Steve Gardner

Thank you, it's a team effort.

Operator

Once again, if you have a question, please press star then one. The next question is a follow-up from Gary Tenner with D.A. Davidson.

Pacific Premier Bancorp

January 29, 2024, at 12:00 p.m. Eastern

Gary Tenner

I just had a quick question on credit. In your slide deck where you have the ACL kind of waterfall, you talked about adding $20 million related to the economic broadcasts and other updates. If my math is right, your ACL or the allowance for unfunded commitments then came down, again, if my math is correct. So I'm curious about kind of the dynamics there of increasing the ACL on the funded piece and maybe bringing it down the unfunded. Also, it was just a function of commitment levels?

Ron Nicolas

You nailed it, Gary, there at the end with your last comment. The unfunded did come down, I think, $4 million or $5 million and that was directly a function of lower commitment levels. We saw, again, with $355 million of new draws, it effectively shifted that $355 million from the unfunded bucket, if you will, to the funded bucket. So that was, if you will, kind of the shift between those two elements of the ACL.

Gary Tenner

So, if some of those were seasonal kind of just temporarily over year end, you might just see that swing back in the other direction?

Steve Gardner

I mean on the funding side, yes, that's a possibility.

Operator

The next question is from Adam Butler with Piper Sandler.

Adam Butler

This is Adam on for Matthew Clark. I'm not sure if this was touched on, but in terms of the origination rates on new loans this quarter, is there a reason why there was a step down?

Steve Gardner

Some of it was the mix. We did, for various existing clients, some multifamily and that had an impact on the yield.

Adam Butler

And then it was nice to see capital increased TCE quarter-over-quarter. In terms of outside supporting organic growth and loan growth, if that doesn't shape out your expectations, do you have any excess capital deployment initiatives outside of that?

Steve Gardner

No, not specific. We obviously pay a very healthy dividend. And although we have a stock buyback plan in place, we haven't exercised it for a couple of years and really owing to the uncertain environment. Like everything, that changes over time. We'll see how things play out. But right now, we continue to retain higher levels of capital, given the environment, but where we see opportunities such as the securities repositioning transaction, in large measure, given our high levels of capital, we were able to do a rather significant transaction there that over the long term will benefit shareholders, and that's going to continue to be our approach here for the foreseeable future.

CONCLUSION

Operator

This concludes our question-and-answer session. I would like to turn the conference back over to Steven Gardner for any closing remarks.

Steve Gardner

Thanks again, Gary. And thank you all for joining us today. Have a nice afternoon.

Operator

Pacific Premier Bancorp

January 29, 2024, at 12:00 p.m. Eastern

The conference has now concluded. Thank you for attending today's presentation. You may now disconnect.

Pacific Premier Bancorp

January 29, 2024, at 12:00 p.m. Eastern

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

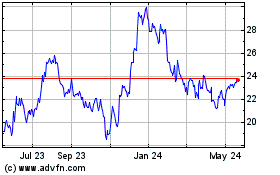

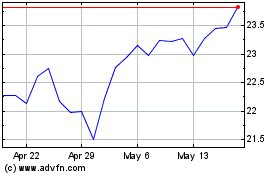

Pacific Premier Bancorp (NASDAQ:PPBI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Pacific Premier Bancorp (NASDAQ:PPBI)

Historical Stock Chart

From Apr 2023 to Apr 2024