Current Report Filing (8-k)

November 14 2022 - 9:05AM

Edgar (US Regulatory)

Israel 4672408 L3 4672408 false 0001828016 0001828016 2022-11-10 2022-11-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 10, 2022

Commission File Number: 001-39896

PLAYTIKA HOLDING CORP.

(Exact Name of Registrant as Specified in its Charter)

|

|

|

| Delaware |

|

81-3634591 |

(State of other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer

Identification No.) |

|

| c/o Playtika Ltd. HaChoshlim St 8 Herzliya Pituach, Israel 4672408 972-73-316-3251 |

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☒ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Common Stock, $0.01 par value |

|

PLTK |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b 2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On November 10, 2022, the Compensation Committee of the Board of Directors (the “Board”) of Playtika Holding Corp. (“Playtika” or the “Company”) approved an amendment (the “PSU Amendment”) to the outstanding performance stock units (“PSUs”) granted to our named executive officers on February 7, 2022. The PSU Amendment amends the “Annual Revenue Growth Rate” targets for purposes of the performance vesting schedule of the PSUs as follows:

|

|

|

|

|

| Annual Revenue Growth Rate for the First Annual Performance Period |

|

Revenue

Growth

Achievement

Percentage |

|

| Less than 1% |

|

|

0 |

% |

| 1% |

|

|

50 |

% |

| 7.5% |

|

|

75 |

% |

| 9% or more |

|

|

100 |

% |

|

|

|

|

|

| Annual Revenue Growth Rate for the Second, Third and Fourth Annual Performance

Periods |

|

Revenue

Growth

Achievement

Percentage |

|

| Less than 1% |

|

|

0 |

% |

| 1% |

|

|

50 |

% |

| 3% |

|

|

75 |

% |

| 5% or more |

|

|

100 |

% |

The foregoing description of the PSU Amendment is a summary only and does not describe all terms and conditions applicable to the PSUs. The description is subject to and qualified in its entirety by the terms of the PSU Amendment, a copy of which is filed as Exhibit 10.1 and incorporated herein by reference.

Item 8.01 Other Events.

On November 14, 2022, Playtika announced that eligible service providers of Playtika and its majority-owned subsidiaries will be invited to participate in a voluntary, one-time stock option exchange program (the “Option Exchange”) pursuant to which eligible service providers will be able to exchange outstanding stock options for a lesser amount of new restricted stock units (“RSUs”) to be issued under Playtika’s 2020 Incentive Award Plan. A service provider must remain with Playtika or one of its majority-owned subsidiaries, and not have provided notice of termination, through the expiration of the Option Exchange to be eligible to participate.

No members of the Board hold outstanding stock options and therefore will not participate in the Option Exchange. Service providers will receive one RSU for every 2.5 shares of Playtika common stock underlying the eligible options surrendered. This “exchange ratio” (2.5-for-1) will be applied on a grant-by-grant basis.

The Option Exchange commenced on November 14, 2022, and will be made pursuant to the terms and conditions set forth in the Tender Offer Statement on Schedule TO, including the Offer to Exchange Certain Outstanding Stock Options for Restricted Stock Units, and other related materials filed with the Securities and Exchange Commission (“SEC”) and sent to eligible participants. At the time the Option Exchange commenced, Playtika provided eligible participants with written materials explaining the terms of the Option Exchange. Eligible participants should read these written materials carefully because they contain important information about the Option Exchange.

Playtika also filed these written materials with the SEC as part of a Tender Offer Statement upon commencement of the Option Exchange. These materials are available free of charge at www.sec.gov or by emailing Playtika at to@playtika.com.

Additional Information and Where to Find It

The Company has filed with the United States Securities and Exchange Commission (the “SEC”) a tender offer statement on Schedule TO with respect to the Option Exchange, including an offer to exchange, a related letter of transmittal and related materials. The Option Exchange will only be made pursuant to the offer to exchange, the related letter of transmittal and other related materials filed as part of the issuer tender offer statement on Schedule TO, in each case as may be amended or supplemented from time to time. This communication is not an offer to buy nor a solicitation of an offer to sell or exchange any securities of the Company. Investors are able to obtain a free copy of these materials and all other documents filed by the Company with the SEC at the website maintained by the SEC at www.sec.gov. Investors may also obtain, at no charge, any such documents filed with or furnished to the SEC by the Company under the “Investors” section of the Company’s website at www.playtika.com. INVESTORS AND SECURITY HOLDERS ARE ADVISED TO READ THESE DOCUMENTS, INCLUDING THE TENDER OFFER STATEMENT OF THE COMPANY AND ANY AMENDMENTS THERETO, AS WELL AS ANY OTHER DOCUMENTS RELATING TO THE OPTION EXCHANGE THAT ARE FILED WITH THE SEC, CAREFULLY AND IN THEIR ENTIRETY PRIOR TO MAKING ANY DECISIONS WITH RESPECT TO WHETHER TO EXCHANGE SECURITIES IN CONNECTION WITH THE OPTION EXCHANGE BECAUSE THEY CONTAIN IMPORTANT INFORMATION, INCLUDING THE TERMS AND CONDITIONS OF THE OPTION EXCHANGE.

Forward-Looking Statements

The statements included above that are not a description of historical facts are forward-looking statements. Words or phrases such as “believe,” “may,” “could,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “seek,” “plan,” “expect,” “should,” “would” or similar expressions are intended to identify forward-looking statements. These forward-looking statements include without limitation statements regarding the Option Exchange. Risks and uncertainties that could cause results to differ from expectations include: (i) uncertainties as to the timing and terms of the Option Exchange; (ii) the risk that the Option Exchange may not be completed in a timely manner or at all; (iii) the possibility that any or all of the various conditions to the consummation of the Option Exchange may not be satisfied or waived; (iv) the occurrence of any event, change or other circumstance that could give rise to the termination of the Option Exchange; (v) the effect of the announcement or pendency of the Option Exchange on the Company’s ability to retain and hire key personnel, its ability to maintain relationships with its customers, suppliers and others with whom it does business, its operating results and business generally or the trading market for its common stock; (vi) risks related to the Option Exchange diverting management’s attention from the Company’s ongoing business operations; (vii) the risk that stockholder litigation in connection with the Option Exchange may result in significant costs of defense, indemnification and liability; (viii) the Company’s ability to achieve the benefits contemplated by the Option Exchange; and (ix) risks and uncertainties pertaining to the Company’s business, including the risks and uncertainties detailed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022 and its other filings with the SEC, as well as the tender offer materials to be filed by the Company in connection with the Option Exchange.

You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. All forward-looking statements are qualified in their entirety by this cautionary statement, and the Company undertakes no obligation to revise or update these statements to reflect events or circumstances after the date hereof, except as required by law.

| Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

PLAYTIKA HOLDING CORP. |

|

|

|

|

|

|

Registrant |

|

|

|

|

| Date: November 14, 2022 |

|

|

|

By: |

|

/s/ Craig Abrahams |

|

|

|

|

|

|

Craig Abrahams |

|

|

|

|

|

|

President and Chief Financial Officer |

Playtika (NASDAQ:PLTK)

Historical Stock Chart

From Aug 2024 to Sep 2024

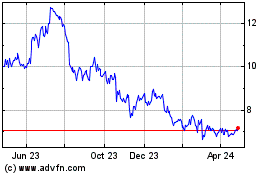

Playtika (NASDAQ:PLTK)

Historical Stock Chart

From Sep 2023 to Sep 2024