false

0000788920

0000788920

2023-12-29

2023-12-29

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

December 29, 2023

PRO-DEX, INC.

(Exact name of registrant as specified in charter)

| Colorado |

0-14942 |

84-1261240 |

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification Number) |

2361 McGaw Avenue

Irvine, California 92614

(Address of principal executive offices, zip

code)

(949) 769-3200

(Registrant’s telephone number including

area code)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12(b) under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Exchange Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, no par value |

PDEX |

NASDAQ Capital Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

| Emerging growth company ☐ |

|

If an emerging growth company, indicate by checkmark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

| Item

1.01. |

Entry

into a Material Definitive Agreement. |

Amendment

to Credit Agreement, Amended and Restated Revolving Credit Note & Supplemental Revolving Credit Note

On

December 29, 2023 (the “Amendment Date”), Pro-Dex, Inc. (the “Company”) entered into Amendment No. 3 to Amended

and Restated Credit Agreement (the “Amendment”) with Minnesota Bank and Trust, a division of HTLF Bank (“MBT”),

successor by merger to Minnesota Bank and Trust, which amends the Company’s Amended and Restated Credit Agreement, (as amended,

the “Credit Agreement”). The Amendment extends the maturity date of the Company’s Amended and Restated Revolving Credit

Note (the “Revolving Note”) and the Supplemental Revolving Note (the “Supplemental Note”) with MBT from December

29, 2024, to December 29, 2025. The Revolving Note may be borrowed against from time to time by the

Company through its maturity date on the terms set forth in the Credit Agreement. As of the date of this Current Report on Form 8-K, the

Company’s has drawn $2,500,000 against the Revolving Note, the entire amount of which remains outstanding. Loan origination fees

and legal fees in the amount of $17,535 have been paid to MBT in conjunction with the Revolving Note and Supplemental Note.

The

purpose of the Supplemental Note is for financing acquisitions and repurchasing shares of the Company’s common stock. The Supplemental

Note may be borrowed against from time to time by the Company through its maturity date of December 29, 2025, on the terms set forth in

the Credit Agreement. No amounts have been drawn on the Supplemental Note as of the date of this Current Report on Form 8-K.

The

Revolving Note and Supplemental Note (collectively the “Notes”) bear interest at an annual rate equal to the greater of (a)

5.0% or (b) SOFR for a one-month period from the website of the CME Group Benchmark Administration Limited (“CBA”) plus 2.5%

(the “Adjusted Term SOFR Rate”). Commencing on the first day of each month after the Company initially borrows against the

Revolving Note and/or Supplemental Note and each month thereafter until maturity, the Company is required to pay all accrued and unpaid

interest on the Notes through the date of payment. Any principal on the Notes that is not previously prepaid by the Company shall be due

and payable in full on the maturity date (or earlier termination of the Notes).

Upon

the occurrence and during the continuance of an event of default, the interest rate of the Notes is increased by 3% and MBT may, at its

option, declare the Notes immediately due and payable in full.

The

Credit Agreement, Revolving Note and Supplemental Note contain representations and warranties, affirmative, negative and financial covenants,

and events of default that are customary for loans of this type.

A

copy of the Amendment is attached as an exhibit to this Current Report on Form 8-K. The Amended and Restated Revolving Credit Note and

the Supplemental Revolving Credit Note were filed as Exhibits on Form 8-K filed with the Securities and Exchange Commission on January

3, 2023. The above descriptions are qualified by reference to the complete text of the Amendment and Notes. The representations, warranties,

and covenants contained in those documents were made only for purposes of the transactions represented thereby as of the specific dates

therein, are solely for the benefit of the Company and MBT, may be subject to limitations agreed upon by the Company and MBT, including,

among others, being qualified by disclosures made for the purposes of allocating contractual risk between the parties instead of establishing

these matters as facts, and may be subject to standards of materiality applicable to the contracting parties that differ from those applicable

to investors. Investors are not third-party beneficiaries under those documents and should not rely on the representations, warranties

and covenants, or any descriptions thereof, as characterizations of the actual state of facts or condition of the Company. Moreover, information

concerning the subject matter of representations and warranties contained in those documents may change after the date of those documents,

which subsequent information may or may not be fully reflected in the Company’s public disclosures. Rather, investors and the public

should look to the disclosures contained in the Company’s reports under the Securities Exchange Act of 1934, as amended, for information

concerning the Company.

| Item

2.03 |

Creation

of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant. |

The

disclosures concerning the Amendment contained in Item 1.01 above are incorporated into this Item 2.03 by this reference.

| Item 9.01. | Financial Statements

and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: January 3, 2024 |

Pro-Dex, Inc. |

| |

|

| |

|

|

| |

By: |

/s/ Alisha K. Charlton |

| |

|

Alisha K. Charlton |

| |

|

Chief Financial Officer |

EXHIBIT 10.1

AMENDMENT

NO.

3 TO AMENDED

AND RESTATED

CREDIT

AGREEMENT

This

AMENDMENT NO. 3 TO AMENDED AND RESTATED

CREDIT

AGREEMENT dated as of December 29,

2023 (the “Amendment”), between Pro-Dex, Inc., a Colorado

corporation (the “Borrower”), and Minnesota Bank &

Trust, a division

of HTLF Bank, successor by merger to

Minnesota Bank and Trust (the “Lender”).

RECITALS:

A.

The Borrower and the Lender are parties

to that certain Amended and Restated Credit Agreement dated as of November

6, 2020, as amended by that certain Amendment

No. 1 to Amended and Restated Credit Agreement dated as of November

5, 2021, and by that certain Amendment No. 2 to Amended

and Restated Credit Agreement dated as of December

29, 2022 (as so amended, the “Original Agreement”).

B.

The Borrower has requested that

the Lender amend certain terms of the Original Agreement.

C.

Subject to the terms and conditions of this

Amendment, the Lender will agree to the foregoing

request of the Borrower.

NOW,

THEREFORE, the parties agree as follows:

1.

Defined Terms. All capitalized terms used in this Amendment

shall, except where the context otherwise requires, have the meanings set forth in

the Original Agreement as amended hereby.

2.

Amendment. The Original Agreement

is hereby amended as follows:

(a)

The definitions of the terms “Revolving

Credit Termination Date” and “Supplemental Revolving Credit Termination Date” defined in Section

1.01 of the Original Agreement is hereby amended

in its entirety to read as follows:

“Revolving

Credit Termination Date’ means the earliest to occur of (a) December

29, 2025, (b) the date the Revolving

Credit Commitment is reduced to zero pursuant

to Section 2.04, and (c) the termination of

the Revolving Credit Commitment pursuant to Section

8.02.

‘Supplemental

Revolving Credit Termination Date’ means the earliest to occur of (a)

December 29, 2025, (b) the date the Supplemental

Revolving Credit Commitment is reduced to zero pursuant to

Section 2.04, and (c) the termination

of the Supplemental Revolving Credit Commitment pursuant to Section

8.02.”

(b)

Section 7.13(b) of the Original Agreement is hereby amended by deleting

the occurrence of the phrase “on any subsequent

Measurement Date” in such Section.

(c)

Article IX of the Original Agreement is hereby amended by adding

a new Section 9.15 to read as follows:

“ Section

9.15 Arbitration.

(a)

Disputes. Lender and Borrower hereby agree that all disputes, claims and controversies

between them whether individual or joint in nature,

whether arising from the agreement, or any related

note or agreement, whether in tort, contract

or equitable, and now existing or hereafter

arising (collectively, “Disputes”) shall be arbitrated

pursuant to the Rules of the American Arbitration Association

in effect at the time the claim is filed, upon

request of either party. The Federal

Arbitration Act shall apply to the construction, interpretation, and enforcement of

this arbitration provision. The Arbitration provision

is a material inducement for the parties entering

into the transactions relating to this agreement. Any

party who fails or refuses to submit to

arbitration following a demand by any other party shall

bear all costs and expenses incurred by such other

party in compelling arbitration. DISPUTES SUBMITTED TO ARBITRATION

ARE NOT RESOLVED IN COURT BY A JUDGE OR JURY. TO THE

EXTENT ALLOWED BY APPLICABLE LAW, THE PARTIES

IRREVOCABLY AND VOLUNTARILY WAIVE ANY RIGHT THEY MAY HAVE

TO A TRIAL BY JURY WITH RESPECT

TO ANY DISPUTE ARBITRATED PURSUANT TO ARBITRATION.

No party hereto shall be entitled to join or consolidate

Disputes by or against others in any arbitration, or

to include in any arbitration any Dispute as

a representative or member of a class,

or to act in any arbitration in the

interest of the general public or in a private

attorney general capacity.

(b)

Governing Rules. If a Dispute cannot be settled

through negotiation, the parties agree first to try

in good faith to settle the Dispute by mediation

administered by the American Arbitration Association under its Commercial Mediation Procedures

before resorting to arbitration, litigation, or some other Dispute

resolution procedure. Any arbitration proceeding in which

the amount in controversy is: (i)

at least $1,000,000.00 shall be conducted

in accordance with the AAA’s optional procedures

for large, complex commercial Disputes; (ii) $5,000,000.00 or less will

be decided by a single arbitrator who shall

not render an award of greater than $5,000,000.00;

and (iii) $5,000,000.00 or more shall be decided

by majority vote of a panel of three arbitrators;

provided however, that all three arbitrators must actively participate in all

hearings and deliberations. Every arbitrator

shall be a neutral practicing attorney or a retired

member of the state or federal judiciary,

in either case with a minimum of ten

years’ experience in the substantive law applicable

to the subject matter of the Dispute. No arbitrator

or other party to an arbitration proceeding

may disclose the existence, content or results

thereof, except for disclosures of information by a party

required in the ordinary course of its business

or by applicable law or regulation. The Arbitration

provision shall survive the repayment of the Notes and the termination,

amendment, or expiration of any of the

documents or any relationship between the parties.

The statute of limitations, estoppel, waiver, laches,

and similar doctrines which would otherwise be applicable

in an action brought by a party

shall be applicable in any

arbitration

proceeding, and the commencement of an arbitration

proceeding shall be deemed the commencement

of an action for these purposes. Judgment upon any

award rendered by any arbitrator may be entered

in any court having jurisdiction.

(c)

Self Help, Provisional Remedies and Foreclosure. No action by any

party to take or dispose of any collateral shall

constitute a waiver of this arbitration agreement

or be prohibited by this arbitration agreement.

This includes, without limitation, obtaining injunctive relief or a temporary

restraining order; foreclosing against real property, invoking a power of sale

under any deed of trust or mortgage;

obtaining a writ of attachment or imposition

of a receiver; or exercising any rights relating

to personal property, including taking or disposing

of such property with or without judicial process pursuant

to Article 9 of the Uniform Commercial Code.

(d)

Small Claims Court. Any party may require that a Dispute be resolved

in Small Claims Court if the Dispute and related claims are fully

within that court’s jurisdiction.

(e)

Real Property Collateral. Notwithstanding anything herein to the contrary,

no Dispute shall be submitted to arbitration

if the Dispute concerns indebtedness secured directly

or indirectly, in whole or in part,

by any real property located in a state which

recognizes a one action rule unless any conditions

for arbitration that are set forth in the mortgage

or deed of trust are satisfied; if any such

Disputes are not referred to arbitration,

then any provision in the mortgage or deed of trust

providing for the referral of Disputes

to a referee or master shall be applicable

to such Disputes.

(f)

Self Help, Provisional Remedies and Foreclosure. No action by any

party to take or dispose of any collateral securing

any Note shall constitute a waiver of this arbitration

agreement or be prohibited by this arbitration

agreement. This includes, without limitation, obtaining injunctive relief or a temporary

restraining order; invoking a power of sale

under any deed of trust or mortgage; foreclosing

against real property; obtaining a writ of attachment

or imposition of a receiver; or exercising

any rights relating to personal property, including taking or disposing of such property

with or without judicial process pursuant to Article

9 of the Uniform Commercial Code. Any disputes, claims,

or controversies concerning the lawfulness or

reasonableness of any act, or exercise of any right,

concerning any collateral securing any Note, including any claim to rescind, reform,

or otherwise modify any agreement relating to

the collateral securing any Note, shall also be arbitrated,

provided however that no arbitrator shall have the right

or the power to enjoin or restrain any act of

any party.”

3.

Conditions to Effectiveness.

This Amendment shall become effective on the

date (the “Effective Date”) when, and only

when, the Lender shall have received:

(a)

this Amendment, duly executed

by the Borrower;

(b)

a non-refundable Revolving Credit extension fee in the

amount of $10,000,

payable in immediately

available funds;

(c)

a non-refundable Supplemental Revolving Credit extension fee in the amount

of $6,000, payable in immediately available funds;

(d)

evidence that the Borrower is in good standing

in the States of California and Colorado; and

(e)

such other documents as the Lender may

reasonably request.

4.

Representations and Warranties. To

induce the Lender to enter into this Amendment,

the Borrower represents and warrants to the Lender

as follows:

(a)

The execution, delivery and performance by the Borrower

of this Amendment and each other Loan Document to which

the Borrower is a party have been duly authorized

by all necessary corporate action, do not require

any approval or consent of, or any registration,

qualification or filing with, any government

agency or authority or any approval or

consent of any other person (including, without limitation,

any shareholder), do not and will not conflict

with, result in any violation of or constitute any default under, any

provision of the Borrower’s articles of incorporation

or bylaws, any agreement binding on or applicable

to the Borrower or any of its property, or any

law or governmental regulation or court decree

or order, binding upon or applicable to the

Borrower or of any of its property and will not result

in the creation or imposition of any security interest

or other lien or encumbrance in or on any of

its property pursuant to the provisions of any

agreement applicable to the Borrower or any

of its property;

(b)

The representations and warranties contained in the Original

Agreement are true and correct as of the date

hereof as though made on that date except: (i) to the extent

that such representations and warranties relate

solely to an earlier date; and (ii) that

the representations and warranties set forth in Section 5.04 of the Original

Agreement to the audited annual financial statements

and internally-prepared interim financial statements of the Borrower

shall be deemed to be a reference to

the audited financial statements and interim financial statements, as the case

may be, of the Borrower most recently delivered

to the Lender pursuant to Section 6.01(a) or 6.01(b) of the Original

Agreement;

(c)

No events have taken place and no circumstances

exist at the date hereof which would give the Borrower

the right to assert a defense, offset

or counterclaim to any claim by the Lender for

payment of the Obligations;

(d)

The Original Agreement, as amended

by this Amendment, and each other Loan Document

to which the Borrower is a party are the legal,

valid and binding obligations of the

Borrower and are enforceable in accordance with their respective terms, subject only

to bankruptcy, insolvency, reorganization, moratorium

or similar laws, rulings or decisions

at the time in effect affecting the enforceability

of rights of creditors generally and to general

equitable principles which may limit the right to obtain equitable remedies; and

(e)

Before and after giving effect to this Amendment,

there does not exist any

Default

or Event of Default.

5.

Release. The Borrower hereby releases

and forever discharges the Lender and its successors,

assigns, directors, officers, agents, employees and participants from any and all

actions, causes of action, suits, proceedings,

debts, sums of money, covenants, contracts, controversies, claims and demands,

at law or in equity, which the Borrower ever had

or now has against the Lender or its successors, assigns,

directors, officers, agents, employees or participants by virtue

of the Lender’s relationship to the Borrower

in connection with the Loan Documents and the transactions related thereto

6.

Reference

to and Effect

on the Loan Documents.

(a)

From and after the date of this

Amendment, each reference in the Original Agreement

to “this Agreement”, “hereunder”, “hereof”, “herein”

or words of like import referring to the Original

Agreement, and each reference to the “Credit

Agreement”, the “Credit Agreement”, “thereunder”, “thereof”,

“therein” or words of like import

referring to the Original Agreement in any

other Loan Document shall mean and be a reference

to the Original Agreement as amended hereby;

and except as specifically set forth above, the Original

Agreement remains in full force and effect and is hereby

ratified and confirmed.

(b)

The execution, delivery and effectiveness

of this Amendment shall not, except as expressly

provided herein, operate as a waiver of any

right, power or remedy of the Lender

under the Agreement or any other Loan Document,

nor constitute a waiver of any

provision of the Agreement or any such other

Loan Document.

7.

Costs, Expenses and Taxes. The Borrower

agrees to pay on demand all costs and expenses

of the Lender in connection with the preparation, reproduction,

execution and delivery of this Amendment and

the other documents to be delivered hereunder

or thereunder, including their reasonable attorneys’ fees and legal expenses. In addition,

the Borrower shall pay any and all stamp and other

taxes and fees payable or determined

to be payable in connection with the execution and delivery,

filing or recording of this Amendment and

the other instruments and documents to be delivered

hereunder and agrees to save the Lender harmless from

and against any and all liabilities with respect to, or resulting from, any delay

in the Borrower’s paying or omission

to pay, such taxes or fees.

8.

Governing Law. THE VALIDITY, CONSTRUCTION AND ENFORCEABILITY

OF THIS AMENDMENT SHALL BE GOVERNED BY

THE INTERNAL LAWS OF THE STATE OF MINNESOTA, WITHOUT

GIVING EFFECT TO CONFLICT OF LAWS PRINCIPLES

THEREOF.

9.

Headings. Section headings in this Amendment

are included herein for convenience of reference

only and shall not constitute a part of this

Amendment for any other purpose.

10.

Counterparts. This Amendment

may be executed in counterparts and by separate parties

in separate counterparts, each of which shall

be an original and all of which taken together shall

constitute one and the same document. Receipt

by telecopy, pdf file or other

electronic means of any executed signature page to this Amendment shall constitute effective

delivery of such

signature page.

11.

Recitals. The Recitals hereto

are incorporated herein by reference and constitute

a part of this Amendment.

[signature

page follows]

IN WITNESS WHEREOF,

the parties hereto have caused this Amendment

to be executed as of the date first above.

BORROWER:

LENDER:

[signature

page Amendment No. 3 to Amended and Restated Credit Agreement]

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

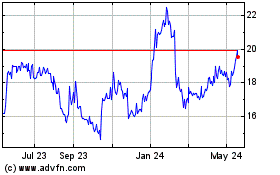

ProDex (NASDAQ:PDEX)

Historical Stock Chart

From Mar 2024 to Apr 2024

ProDex (NASDAQ:PDEX)

Historical Stock Chart

From Apr 2023 to Apr 2024