0000788920

false

0000788920

2023-11-02

2023-11-02

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

November 2, 2023

PRO-DEX, INC.

(Exact name of registrant as specified in charter)

| Colorado |

0-14942 |

84-1261240 |

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification Number) |

2361 McGaw Avenue

Irvine, California 92614

(Address of principal executive offices, zip

code)

(949) 769-3200

(Registrant’s telephone number including

area code)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12(b) under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Exchange Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, no par value |

PDEX |

NASDAQ Capital Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

| Emerging growth company ☐ |

|

If an emerging growth company, indicate by checkmark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

| Item 2.02. | Results of Operations and Financial Condition. |

The information in

this Item 2.02 of this Form 8-K, as well as Exhibit 99.1 attached hereto, shall not be deemed “filed” for purposes of

Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), nor shall it be deemed incorporated

by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by

specific reference in such a filing.

On November 2, 2023,

Pro-Dex, Inc. (the “Company”) is issuing a press release announcing its financial performance for the first quarter and three

months ended September 30, 2023. A copy of the press release is attached to this Form 8-K as Exhibit 99.1, which is incorporated herein

by this reference.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: November 2, 2023 |

Pro-Dex, Inc. |

| |

|

| |

|

|

| |

By: |

/s/ Alisha K. Charlton |

| |

|

Alisha K. Charlton |

| |

|

Chief Financial Officer |

Exhibit 99.1

Contact: Richard L. Van Kirk,

Chief Executive Officer

(949) 769-3200

For Immediate Release

PRO-DEX, INC. ANNOUNCES FISCAL 2024 FIRST QUARTER

RESULTS

IRVINE, CA, November 2,

2023 - PRO-DEX, INC. (NasdaqCM: PDEX) today announced financial results for its fiscal 2024 first quarter ended September 30, 2023. The

Company also filed its Quarterly Report on Form 10-Q for the first quarter of fiscal year 2024 with the Securities and Exchange Commission

today.

Net

sales for the three months ended September 30, 2023, increased $851,000, or 8%, to $11.9 million from $11.1 million for the three

months ended September 30, 2022. The increase is driven primarily by $1.8 million in increased repairs

of the surgical handpiece we sell to our largest customer offset primarily by a decrease of $0.7 million in sales of our NRE & proto-type

offerings.

Gross

profit for the three months ended September 30, 2023, increased $702,000, or 24%, compared to the year-ago period. Gross margin increased

by 4 percentage points to 31% during the three months ended September 30, 2023, compared to 27% during the corresponding year-ago period,

due primarily to the prior year cost of sales including approximately $450,000 in repair costs to upgrade the handpiece we sell our largest

customer at no additional costs. We had no similar expenses in the current fiscal year.

Operating expenses (which include

selling, general and administrative, and research and development expenses) for the quarter ended September 30, 2023, decreased $181,000

from the corresponding year-ago period. The decrease resulted from decreased research and development expenses as we have fewer expenses

related to internal development projects in the first quarter of fiscal 2024 compared to the corresponding period of the prior fiscal

year.

Net loss for the quarter ended

September 30, 2023, was $615,000, or $0.17 per diluted share, compared to net income of $1.2 million, or $0.33 per diluted share, for

the quarter ended September 30, 2022. Our net loss includes non-operating expense of $2.7 million for the quarter ended September 30,

2023, consisting primarily of unrealized losses on investments of $2.6 million. Most of the unrealized loss on investments relates to

our Warrant to purchase common stock of Monogram Orthopaedics Inc. (NasdaqCM: MGRM), which had a $2.5 million reduction in estimated fair

value for the first quarter ended September 30, 2023, but still has an estimated fair value of $3.7 million as of September 30, 2023.

Our investments are recorded at estimated fair value, and the valuation can be highly volatile.

CEO Comments

Richard L. (“Rick”)

Van Kirk, the Company’s President and Chief Executive Officer, commented, “We are pleased with our first quarter results and

excited to share that sales for the first quarter ended September 30, 2023, includes approximately $1.1 million related to the launch

of a new product in our Thoracic driver product line.” Mr. Van Kirk concluded, “We are confident that with our assembly and

repairs operations fully transitioned to the Franklin facility we are poised for continued long-term growth.”

About Pro-Dex, Inc.:

Pro-Dex, Inc. specializes in the

design, development, and manufacture of autoclavable, battery-powered and electric, multi-function surgical drivers and shavers used primarily

in the orthopedic, thoracic, and maxocranial facial markets. We have patented adoptive torque-limiting software and proprietary sealing

solutions that appeal to our customers, primarily medical device distributors. Pro-Dex also sells compact pneumatic air motors for a variety

of industrial applications. Pro-Dex's products are found in hospitals and medical engineering labs around the world. For more information,

visit the Company's website at www.pro-dex.com.

Statements herein concerning the

Company's plans, growth, and strategies may include 'forward-looking statements' within the context of the federal securities laws. Statements

regarding the Company's future events, developments, and future performance, as well as management's expectations, beliefs, plans, estimates

or projections relating to the future, are forward-looking statements within the meaning of these laws. The Company's actual results may

differ materially from those suggested as a result of various factors. Interested parties should refer to the risk factors and other disclosures

concerning the operational and business concerns of the Company set forth in the Company's filings with the Securities and Exchange Commission.

(tables follow)

PRO-DEX, INC. AND SUBSIDIARY

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

(In thousands, except share amounts)

| | |

September 30,

2023 | | |

June 30,

2023 | |

| ASSETS | |

| | | |

| | |

| Current Assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 1,904 | | |

$ | 2,936 | |

| Investments | |

| 1,010 | | |

| 1,134 | |

| Accounts receivable, net of allowance for credit losses of $0 at September 30, 2023 and at June 30, 2023, respectively | |

| 11,034 | | |

| 9,952 | |

| Deferred costs | |

| 591 | | |

| 494 | |

| Income taxes receivable | |

| 420 | | |

| — | |

| Inventory | |

| 16,264 | | |

| 16,167 | |

| Prepaid expenses and other current assets | |

| 201 | | |

| 296 | |

| Total current assets | |

| 31,424 | | |

| 30,979 | |

| Land and building, net | |

| 6,226 | | |

| 6,249 | |

| Equipment and leasehold improvements, net | |

| 4,952 | | |

| 5,079 | |

| Right-of-use asset, net | |

| 1,774 | | |

| 1,872 | |

| Intangibles, net | |

| 75 | | |

| 81 | |

| Investments | |

| 5,092 | | |

| 7,521 | |

| Other assets | |

| 42 | | |

| 42 | |

| Total assets | |

$ | 49,585 | | |

$ | 51,823 | |

| | |

| | | |

| | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | |

| | | |

| | |

| Current Liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 2,740 | | |

$ | 2,261 | |

| Accrued liabilities | |

| 2,701 | | |

| 3,135 | |

| Income taxes payable | |

| — | | |

| 453 | |

| Notes payable | |

| 2,840 | | |

| 3,827 | |

| Total current liabilities | |

| 8,281 | | |

| 9,676 | |

| Lease liability, net of current portion | |

| 1,529 | | |

| 1,638 | |

| Deferred income taxes, net | |

| 8 | | |

| 8 | |

| Notes payable, net of current portion | |

| 8,572 | | |

| 8,911 | |

| Total non-current liabilities | |

| 10,109 | | |

| 10,557 | |

| Total liabilities | |

| 18,390 | | |

| 20,233 | |

| | |

| | | |

| | |

Shareholders’ Equity: | |

| | | |

| | |

| Common stock; no par value; 50,000,000 shares authorized; 3,547,330 and 3,545,309 shares issued and outstanding at September 30, 2023 and June 30, 2023, respectively | |

| 6,987 | | |

| 6,767 | |

| Retained earnings | |

| 24,208 | | |

| 24,823 | |

| Total shareholders’ equity | |

| 31,195 | | |

| 31,590 | |

| Total liabilities and shareholders’ equity | |

$ | 49,585 | | |

$ | 51,823 | |

PRO-DEX, INC. AND SUBSIDIARY

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

(In thousands, except share and per share amounts)

| | |

Three Months Ended September 30, | |

| | |

2023 | | |

2022 | |

| | |

| | |

(as restated) | |

| | |

| | |

| |

| Net sales | |

$ | 11,938 | | |

$ | 11,087 | |

| Cost of sales | |

| 8,280 | | |

| 8,131 | |

| Gross profit | |

| 3,658 | | |

| 2,956 | |

| | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | |

| Selling expenses | |

| 25 | | |

| 53 | |

| General and administrative expenses | |

| 995 | | |

| 1,024 | |

| Research and development costs | |

| 805 | | |

| 929 | |

| Total operating expenses | |

| 1,825 | | |

| 2,006 | |

| Operating income | |

| 1,833 | | |

| 950 | |

| Other income (expense): | |

| | | |

| | |

| Interest and dividend income | |

| 24 | | |

| 218 | |

| Realized gain on sale of marketable equity investments | |

| — | | |

| 6 | |

| Unrealized gain on marketable equity investments | |

| (2,553 | ) | |

| 425 | |

| Interest expense | |

| (133 | ) | |

| (130 | ) |

| Total other income | |

| (2,662 | ) | |

| 519 | |

| | |

| | | |

| | |

| Income before income taxes | |

| (829 | ) | |

| 1,469 | |

| Provision for income taxes | |

| (214 | ) | |

| 266 | |

| Net income | |

$ | (615 | ) | |

$ | 1,203 | |

| | |

| | | |

| | |

| Basic and diluted net income per share: | |

| | | |

| | |

| Basic net income per share | |

$ | (0.17 | ) | |

$ | 0.33 | |

| Diluted net income per share | |

$ | (0.17 | ) | |

$ | 0.33 | |

| | |

| | | |

| | |

| Weighted average common shares outstanding: | |

| | | |

| | |

| Basic | |

| 3,546,737 | | |

| 3,616,392 | |

| Diluted | |

| 3,546,737 | | |

| 3,694,959 | |

| Common shares outstanding | |

| 3,547,330 | | |

| 3,606,422 | |

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

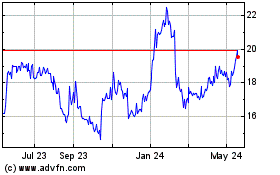

ProDex (NASDAQ:PDEX)

Historical Stock Chart

From Mar 2024 to Apr 2024

ProDex (NASDAQ:PDEX)

Historical Stock Chart

From Apr 2023 to Apr 2024