Form 8-K - Current report

February 12 2024 - 4:22PM

Edgar (US Regulatory)

false000183003300018300332024-02-102024-02-100001830033us-gaap:CommonStockMember2024-02-102024-02-100001830033us-gaap:WarrantMember2024-02-102024-02-100001830033us-gaap:MemberUnitsMember2024-02-102024-02-10

United States

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 10, 2024

| | | | | | | | |

| PureCycle Technologies, Inc. | |

| (Exact Name of Registrant as Specified in its Charter) | |

| | | | | | | | | | | | | | | | | | | | |

| Delaware | | 001-40234 | | 86-2293091 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | |

| | |

| | |

| | | | | | |

| | | | | | | | | | | | | | | | | |

| 5950 Hazeltine National Drive, | Suite 300, | Orlando | | 32822 |

| Florida | |

| (Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (877) 648-3565

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| | | | |

| Common Stock, par value $0.001 per share | | PCT | | The Nasdaq Stock Market LLC |

| Warrants, each exercisable for one share of common stock, $0.001 par value per share, at an exercise price of $11.50 per share | | PCTTW | | The Nasdaq Stock Market LLC |

| Units, each consisting of one share of common stock, $0.001 par value per share, and three quarters of one warrant | | PCTTU | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (Sec.230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (Sec.240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events.

On February 10, 2024, PureCycle: Ohio LLC (“PCO”), an indirect wholly-owned subsidiary of PureCycle Technologies, Inc (the “Company”), reached an agreement in principle with holders of a majority (the “Majority Holders”) of the Southern Ohio Port Authority Exempt Facility Revenue Bonds (PureCycle Project), Tax-Exempt Series 2020A (the “Series 2020A Bonds”), to an adjustment in the previously disclosed purchase price of $1,030 per $1,000 principal amount of Bonds (as defined below) purchased (the “Purchase”) to $1,050 per $1,000 principal amount of Bonds purchased (the “Purchase Price”). In addition to the Majority Holders, additional holders of the Series 2020A Bonds, as well as Southern Ohio Port Authority Subordinate Exempt Facility Revenue Bonds (PureCycle Project), Tax-Exempt Series 2020B (the “Series 2020B Bonds), and Southern Ohio Port Authority Subordinate Exempt Facility Revenue Bonds (PureCycle Project), Taxable Series 2020C (the “Series 2020C Bonds” and, the Series 2020A Bonds, Series 2020B Bonds and Series 2020C Bonds collectively, the “Bonds,”) may participate in the Purchase. Terms used but not defined herein have the meanings ascribed thereto in the Indenture (as defined below).

Holders of Bonds that participate in the Purchase will be required to consent (each a “Consent” and collectively, the “Consents”) to certain proposed amendments (the “Proposed Amendments”) to the Bond Documents and closing of the Purchase will require that no less than Majority Holders participate in the Purchase and provide their Consents. The Consents will become effective upon closing of the Purchase.

As additional consideration from Sellers for the increased Purchase Price, the Proposed Amendments to the Indenture of Trust, dated as of October 1, 2020 (as amended, restated, supplemented or otherwise modified from time to time, the “Indenture”), between Southern Ohio Port Authority (the “Issuer”) and UMB Bank, N.A., as trustee (“Trustee”) and the Loan Agreement, dated as of October 1, 2020 (as amended, restated, supplemented or otherwise modified from time to time, the “Loan Agreement”), by and between the Issuer and PCO, will eliminate a substantial portion of the covenants, Events of Default and other material terms and protections for the benefit of the Holders contained in the Indenture, the Loan Agreement, the Guaranty and other transaction documents that are permitted by the terms of the Indenture and/or the Loan Agreement to be eliminated with the consent of Majority Holders. The Proposed Amendments would, without limitation, (i) eliminate the Operating Revenue Escrow Fund so that revenues will be available to PCO as such revenues are generated from operations of the Ironton Project and (ii) provide for a potentially earlier release of funds from the Liquidity Reserve Escrow Fund. Without limiting the foregoing, the Proposed Amendments would also, without limitation, permit the release of funds (solely to the extent such release may be effectuated with the consent of the Majority Holders) on deposit in accounts in the Trust Estate in a proportionate amount to the percentage of the aggregate principal amount of Bonds that are submitted for Purchase (with such released funds being used by PCO, together with other available funds of the Company or PCO, to effectuate the Purchase). As a further condition to the effectiveness of the Purchase, PCO will reimburse the Trustee and applicable Bondholders for all reasonable and documented out-of-pocket costs and expenses (including attorneys’ fees) incurred by the Trustee and such Bondholders in connection with the Purchase, prior transactions, or otherwise incurred in connection with the general enforcement of rights and remedies under the Indenture, Loan Agreement, or other Financing Documents or Bond Documents. One of the Proposed Amendments (the “Specified Amendment”) addresses voting rights of the PCO following the Purchase of the Bonds and may require the consent of Holders of three-quarters of the Series 2020A Bonds to be effective.

Assuming the inclusion of the Specified Amendment, PCO would constitute the Majority Holders (including for approval voting and consent purposes) after consummation of the Purchase.

The Purchase will not occur unless the Majority Holders participate in the Purchase and provide Consents to the Proposed Amendments. The Purchase will be funded with funds released from the Trust Estate and available cash.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit Number | | Description of Exhibit |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

PURECYCLE TECHNOLOGIES, INC.

Date: February 12, 2024 By: /s/ Jeffrey R. Fieler____________________

Name: Jeffrey R. Fieler

Title: Interim Chief Financial Officer

v3.24.0.1

Cover

|

Feb. 10, 2024 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 10, 2024

|

| Entity Registrant Name |

PureCycle Technologies, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-40234

|

| Entity Tax Identification Number |

86-2293091

|

| Entity Address, Address Line One |

5950 Hazeltine National Drive,

|

| Entity Address, Address Line Two |

Suite 300,

|

| Entity Address, City or Town |

Orlando

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

32822

|

| City Area Code |

877

|

| Local Phone Number |

648-3565

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001830033

|

| Common Stock |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

PCT

|

| Security Exchange Name |

NASDAQ

|

| Warrants |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Warrants, each exercisable for one share of common stock, $0.001 par value per share, at an exercise price of $11.50 per share

|

| Trading Symbol |

PCTTW

|

| Security Exchange Name |

NASDAQ

|

| Units |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Units, each consisting of one share of common stock, $0.001 par value per share, and three quarters of one warrant

|

| Trading Symbol |

PCTTU

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_WarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_MemberUnitsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

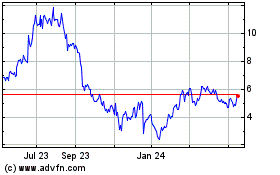

PureCycle Technologies (NASDAQ:PCT)

Historical Stock Chart

From Mar 2024 to Apr 2024

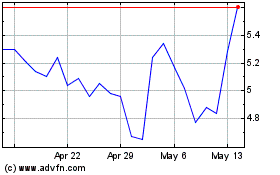

PureCycle Technologies (NASDAQ:PCT)

Historical Stock Chart

From Apr 2023 to Apr 2024