0000878927false00008789272024-05-152024-05-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 15, 2024

OLD DOMINION FREIGHT LINE, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

Virginia |

0-19582 |

56-0751714 |

(State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

|

|

500 Old Dominion Way |

|

|

Thomasville, North Carolina |

|

27360 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s Telephone Number, Including Area Code: (336) 889-5000

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common Stock ($0.10 par value) |

|

ODFL |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On May 15, 2024, the Board of Directors (the “Board”) of Old Dominion Freight Line, Inc. (the “Company”) elected Clayton G. Brinker to serve as Vice President – Accounting and Finance of the Company and designated Mr. Brinker as the principal accounting officer of the Company, each effective August 2, 2024 (the “Effective Date”). As previously disclosed, Kimberly S. Maready, who currently serves as Vice President – Accounting and Finance of the Company and is designated as the principal accounting officer of the Company, notified the Company that she will be retiring from the Company on the Effective Date.

Mr. Brinker, age 39, is a certified public accountant and has served as Director – Financial Reporting since he joined the Company in March 2016. Prior to joining the Company, Mr. Brinker served as Corporate Controller – Solar Materials at SunEdison from January 2015 to March 2016. Prior to that role, Mr. Brinker served as a Manager at PricewaterhouseCoopers LLP, where he was employed from August 2008 to January 2015. There are no arrangements or understandings between Mr. Brinker and any other person pursuant to which he was selected as an officer. Mr. Brinker does not have any family relationship with any director or other executive officer of the Company or any person nominated or chosen by the Company to become a director or executive officer, and there are no transactions in which Mr. Brinker has an interest requiring disclosure under Item 404(a) of Regulation S-K.

Item 5.07. Submission of Matters to a Vote of Security Holders.

The Company held its Annual Meeting of Shareholders (the “Annual Meeting”) on May 15, 2024. The following matters, which are described in more detail in the Company’s definitive proxy statement filed with the Securities and Exchange Commission on April 15, 2024, were voted upon by the Company’s shareholders at the Annual Meeting. The final voting results are reported below.

Proposal 1 – Election of Twelve Directors

Each of the following individuals were elected by the shareholders to serve as directors for one-year terms and until their respective successors have been elected and qualified or until their death, resignation, removal or disqualification or until there is a decrease in the number of directors, and received the number of votes set opposite their respective names:

|

|

|

|

|

|

|

Nominee |

|

For |

|

Withheld |

|

Broker Non-Votes |

Sherry A. Aaholm |

|

95,272,882 |

|

2,326,892 |

|

2,725,398 |

David S. Congdon |

|

92,507,355 |

|

5,092,419 |

|

2,725,398 |

John R. Congdon, Jr. |

|

93,058,554 |

|

4,541,220 |

|

2,725,398 |

Andrew S. Davis |

|

97,044,567 |

|

555,207 |

|

2,725,398 |

Kevin M. Freeman |

|

96,604,616 |

|

995,158 |

|

2,725,398 |

Bradley R. Gabosch |

|

94,048,221 |

|

3,551,553 |

|

2,725,398 |

Greg C. Gantt |

|

93,301,122 |

|

4,298,652 |

|

2,725,398 |

John D. Kasarda |

|

89,583,739 |

|

8,016,035 |

|

2,725,398 |

Cheryl S. Miller |

|

97,385,275 |

|

214,499 |

|

2,725,398 |

Wendy T. Stallings |

|

96,594,000 |

|

1,005,774 |

|

2,725,398 |

Thomas A. Stith, III |

|

94,242,014 |

|

3,357,760 |

|

2,725,398 |

Leo H. Suggs |

|

90,469,639 |

|

7,130,135 |

|

2,725,398 |

Proposal 2 – Approval, on an Advisory Basis, of the Compensation of the Company's Named Executive Officers

The compensation of the Company’s named executive officers was approved, on an advisory basis, by the shareholders based on the following vote:

|

|

|

|

|

|

|

For |

|

Against |

|

Abstain |

|

Broker Non-Votes |

94,432,207 |

|

3,092,241 |

|

75,326 |

|

2,725,398 |

Proposal 3 – Approval of an Amendment to the Company’s Amended and Restated Articles of Incorporation to Increase the Number of Authorized Shares of the Company’s Common Stock

The amendment to the Company’s Amended and Restated Articles of Incorporation to increase the number of authorized shares of the Company’s common stock was approved by the shareholders based on the following vote:

|

|

|

|

|

For |

|

Against |

|

Abstain |

97,224,417 |

|

3,075,641 |

|

25,114 |

Proposal 4 – Ratification of the Appointment of the Company’s Independent Registered Public Accounting Firm

The ratification of the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2024 was approved by the shareholders based on the following vote:

|

|

|

|

|

For |

|

Against |

|

Abstain |

96,791,415 |

|

3,482,856 |

|

50,901 |

Proposal 5 – Shareholder Proposal

A shareholder proposal regarding greenhouse gas reduction targets was not approved by the shareholders based on the following vote:

|

|

|

|

|

|

|

For |

|

Against |

|

Abstain |

|

Broker Non-Votes |

23,760,668 |

|

73,487,605 |

|

351,501 |

|

2,725,398 |

Item 8.01. Other Events.

On May 20, 2024, the Company issued a press release announcing that the Board had declared a quarterly cash dividend of $0.26 per share of common stock, payable on June 19, 2024, to shareholders of record at the close of business on June 5, 2024. The press release is attached hereto as Exhibit 99.1 and incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

OLD DOMINION FREIGHT LINE, INC. |

|

|

|

|

|

|

By: |

/s/ Kimberly S. Maready |

|

|

|

Kimberly S. Maready |

|

|

|

Vice President – Accounting & Finance |

|

|

|

(Principal Accounting Officer) |

Date: May 20, 2024

Exhibit 99.1

|

|

|

|

Contact: |

Adam N. Satterfield |

|

Executive Vice President and Chief Financial Officer |

|

(336) 822-5721 |

OLD DOMINION FREIGHT LINE ANNOUNCES

$0.26 PER SHARE QUARTERLY CASH DIVIDEND

THOMASVILLE, N.C. – (May 20, 2024) – Old Dominion Freight Line, Inc. (Nasdaq: ODFL) today announced that its Board of Directors has declared a quarterly cash dividend of $0.26 per share of common stock, payable on June 19, 2024, to shareholders of record at the close of business on June 5, 2024. After giving effect to the Company’s March 2024 two-for-one stock split, this dividend payment represents a 30% increase to the quarterly cash dividend paid in June 2023.

Forward-looking statements in this news release are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. We caution the reader that such forward-looking statements involve risks and uncertainties that could cause actual events and results to be materially different from those expressed or implied herein, including, but not limited to, the following: (1) the challenges associated with executing our growth strategy, and developing, marketing and consistently delivering high-quality services that meet customer expectations; (2) changes in our relationships with significant customers; (3) our exposure to claims related to cargo loss and damage, property damage, personal injury, workers’ compensation and healthcare, increased self-insured retention or deductible levels or premiums for excess coverage, and claims in excess of insured coverage levels; (4) reductions in the available supply or increases in the cost of equipment and parts; (5) various economic factors such as inflationary pressures or downturns in the domestic economy, and our inability to sufficiently increase our customer rates to offset the increase in our costs; (6) higher costs for or limited availability of suitable real estate; (7) the availability and cost of third-party transportation used to supplement our workforce and equipment needs; (8) fluctuations in the availability and price of diesel fuel and our ability to collect fuel surcharges, as well as the effectiveness of those fuel surcharges in mitigating the impact of fluctuating prices for diesel fuel and other petroleum-based products; (9) seasonal trends in the less-than-truckload (“LTL”) industry, harsh weather conditions and disasters; (10) the availability and cost of capital for our significant ongoing cash requirements; (11) decreases in demand for, and the value of, used equipment; (12) our ability to successfully consummate and integrate acquisitions; (13) various risks arising from our international business relationships; (14) the costs and potential adverse impact of compliance with anti-terrorism measures on our business; (15) the competitive environment with respect to our industry, including pricing pressures; (16) our customers’ and suppliers’ businesses may be impacted by various economic factors such as recessions, inflation, downturns in the economy, global uncertainty and instability, changes in international trade policies, changes in U.S. social, political, and regulatory conditions or a disruption of financial markets; (17) the negative impact of any unionization, or the passage of legislation or regulations that could facilitate unionization, of our employees; (18) increases in the cost of employee compensation and benefit packages used to address general labor market challenges and to

ODFL Announces Quarterly Dividend

Page 2

May 20, 2024

attract or retain qualified employees, including drivers and maintenance technicians; (19) our ability to retain our key employees and continue to effectively execute our succession plan; (20) potential costs and liabilities associated with cyber incidents and other risks with respect to our information technology systems or those of our third-party service providers, including system failure, security breach, disruption by malware or ransomware or other damage; (21) the failure to adapt to new technologies implemented by our competitors in the LTL and transportation industry, which could negatively affect our ability to compete; (22) the failure to keep pace with developments in technology, any disruption to our technology infrastructure, or failures of essential services upon which our technology platforms rely, which could cause us to incur costs or result in a loss of business; (23) disruption in the operational and technical services (including software as a service) provided to us by third parties, which could result in operational delays and/or increased costs; (24) the Compliance, Safety, Accountability initiative of the Federal Motor Carrier Safety Administration (“FMCSA”), which could adversely impact our ability to hire qualified drivers, meet our growth projections and maintain our customer relationships; (25) the costs and potential adverse impact of compliance with, or violations of, current and future rules issued by the Department of Transportation, the FMCSA and other regulatory agencies; (26) the costs and potential liabilities related to compliance with, or violations of, existing or future governmental laws and regulations, including environmental laws; (27) the effects of legal, regulatory or market responses to climate change concerns; (28) emissions-control and fuel efficiency regulations that could substantially increase operating expenses; (29) expectations relating to environmental, social and governance considerations and related reporting obligations; (30) the increase in costs associated with healthcare and other mandated benefits; (31) the costs and potential liabilities related to legal proceedings and claims, governmental inquiries, notices and investigations; (32) the impact of changes in tax laws, rates, guidance and interpretations; (33) the concentration of our stock ownership with the Congdon family; (34) the ability or the failure to declare future cash dividends; (35) fluctuations in the amount and frequency of our stock repurchases; (36) volatility in the market value of our common stock; (37) the impact of certain provisions in our articles of incorporation, bylaws, and Virginia law that could discourage, delay or prevent a change in control of us or a change in our management; and (38) other risks and uncertainties described in our most recent Annual Report on Form 10-K and other filings with the SEC. Our forward-looking statements are based upon our beliefs and assumptions using information available at the time the statements are made. We caution the reader not to place undue reliance on our forward-looking statements as (i) these statements are neither a prediction nor a guarantee of future events or circumstances and (ii) the assumptions, beliefs, expectations and projections about future events may differ materially from actual results. We undertake no obligation to publicly update any forward-looking statement to reflect developments occurring after the statement is made, except as otherwise required by law.

Old Dominion Freight Line, Inc. is one of the largest North American LTL motor carriers and provides regional, inter-regional and national LTL services through a single integrated, union-free organization. Our service offerings, which include expedited transportation, are provided through an expansive network of service centers located throughout the continental United States. The Company also maintains strategic alliances with other carriers to provide LTL services throughout North America. In addition to its core LTL services, the Company offers a range of value-added services including container drayage, truckload brokerage and supply chain consulting.

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

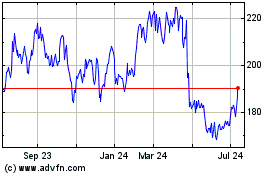

Old Dominion Freight Line (NASDAQ:ODFL)

Historical Stock Chart

From May 2024 to Jun 2024

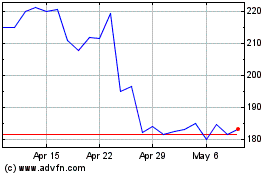

Old Dominion Freight Line (NASDAQ:ODFL)

Historical Stock Chart

From Jun 2023 to Jun 2024