false

0001337068

0001337068

2024-01-25

2024-01-25

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): January 25, 2024

MAGYAR BANCORP, INC.

(Exact Name of Registrant as Specified in Charter)

| Delaware |

0-51726 |

20-4154978 |

| (State or Other Jurisdiction) |

(Commission File No.) |

(I.R.S. Employer |

| of Incorporation) |

|

Identification No.) |

| |

|

|

| |

|

|

| 400 Somerset Street, New Brunswick, New Jersey |

|

08901 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant's telephone number, including area code:

(732) 342-7600

Not Applicable

(Former name or former address, if changed since last

report)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

|

Trading Symbol(s) |

|

Name of Each Exchange

on Which Registered |

|

Common

Stock, par value $0.01 per share |

|

MGYR |

|

The NASDAQ Stock Market, LLC |

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is

an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 2.02 |

Results of Operations and Financial Condition |

On January 25, 2024, Magyar Bancorp,

Inc. (the "Company") issued a press release regarding its results of operations and financial condition at and for the three months

ended December 31, 2023. The text of the press release is included as Exhibit 99.1 to this report. The information included in the press

release text is considered to be "furnished" under the Securities Exchange Act of 1934. The Company will include final financial

statements and additional analyses at and for the three months ended December 31, 2023, as part of its Form 10-Q.

|

Item 9.01 |

Financial Statements and Exhibits |

|

(a) |

Financial Statements of businesses acquired. Not Applicable. |

|

(b) |

Pro forma financial information. Not Applicable. |

|

(c) |

Shell Company Transactions. Not Applicable |

The following Exhibit is attached as part

of this report:

SIGNATURES

Pursuant to the requirements of

the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto

duly authorized.

| |

|

MAGYAR BANCORP, INC. |

| |

|

|

| |

|

|

| |

|

|

| DATE: January 25, 2024 |

By: |

/s/ John S. Fitzgerald |

| |

|

John S. Fitzgerald |

| |

|

President and Chief Executive Officer |

|

News |

400 Somerset St., New Brunswick, NJ 08901

732.342.7600

MAGYAR BANCORP, INC. ANNOUNCES FIRST QUARTER FINANCIAL

RESULTS

AND DECLARES DIVIDEND

New Brunswick, New Jersey, January 25, 2024

– Magyar Bancorp (NASDAQ: MGYR) (“Company”), parent company of Magyar Bank, reported today the results of its operations

for the three months ended December 31, 2023.

The Company reported net income for the three months

ended December 31, 2023 of $1.7 million. Net income declined 8.7% from $1.8 million for the three months ended December 31, 2022.

Basic and diluted earnings per share were $0.26 for

the three months ended December 31, 2023 compared to $0.28 for the three months ended December 31, 2022.

The Company also announced that its Board of

Directors declared a quarterly cash dividend of $0.05 per share, which will be paid on February 22, 2024 to stockholders of

record as of February 8, 2024.

“We are pleased to report a strong start to

our 2024 fiscal year,” stated John Fitzgerald, President and Chief Executive Officer of Magyar Bancorp. “Despite the continued

inverted yield curve and pressure on our net interest margin due to increased costs for deposits, Magyar was able to grow our loan portfolio

4.5% which helped offset some of the higher deposit acquisition and retention costs. Our strong liquidity position will enable the Bank

to fund its loan pipeline, which we expect will continue to remain strong throughout the year.”

Results of Operations

Net income decreased $158,000, or 8.7%, to $1,652,000

during the three-month period ended December 31, 2023 compared with $1,810,000 during the three-month period ended December 31, 2022,

due to higher provisions for loan loss and other expenses, partially offset by higher net interest income.

The Company’s net interest and dividend income

increased $353,000, or 5.1%, to $7.2 million for the quarter ended December 31, 2023 from $6.9 million for the quarter ended December

31, 2022. The increase was attributable to a $112.3 million increase in the average balance of interest-earning assets between periods,

partially offset by a 31 basis point decrease in the Company’s net interest margin to 3.29% for the three months ended December

31, 2023 from 3.60% for the three months ended December 31, 2022.

Interest and dividend income increased $3.1 million,

or 35.9%, to $11.6 million for the three months ended December 31, 2023 compared with $8.5 million for the three months ended December

31, 2022. The increase was attributable to an 82 basis point increase in the yield on earning assets to 5.26% for the three months ended

December 31, 2023 from 4.44% for the three months ended December 31, 2022 as well as a $112.3 million, or 14.8%, increase in the average

balance of interest-earning assets. The increase in yield on the Company’s assets was attributable to higher market interest rates

between periods.

Interest expense increased $2.7 million, or 167.9%,

to $4.3 million for the three months ended December 31, 2023 from $1.6 million for the three months ended December 31, 2022. The cost

of interest-bearing liabilities increased 153 basis points to 2.80% for the three months ended December 31, 2023 compared with 1.27% for

the three months ended December 31, 2022 resulting primarily from higher market interest rates. In addition, the average balance of interest-bearing

liabilities increased $109.0 million, or 21.7%, to $611.2 million.

The Company’s provision for credit losses was

$481,000 for the three months ended December 31, 2023 compared to $317,000 for the three months ended December 31, 2022. Provisions for

on-balance sheet credit losses were $385,000 from growth in total loans receivable during the quarter. Reserves for off-balance sheet

credit losses were $96,000 from growth in unfunded loan commitments during the quarter. The Company recorded $481 in net recoveries during

the three months ended December 31, 2023 compared with $0 in net recoveries during the three months ended December 31, 2022.

Other income increased $12,000, or 2.0%, to $609,000

during the three months ended December 31, 2023 compared to $597,000 for the three months ended December 31, 2022.

Other expenses increased $439,000, or 9.6%, to $5.0

million during the three months ended December 31, 2023. The increase was primarily attributable to higher compensation and benefit expense,

which increased $226,000, or 8.6%, to $2.8 million, due to fewer open positions between periods and the addition of a commercial lender

in September 2023. Also contributing to the increase were higher FDIC deposit insurance premiums and other expenses. Deposit insurance

premiums increased $49,000, or 90.7%, from deposit growth and higher insurance assessment rates implemented by the FDIC for all insured

institutions effective January 1, 2023. Other expenses increased $100,000, or 20.3%, from higher loan origination and servicing costs,

higher losses on fraudulent checks, and higher OREO expenses.

The Company recorded tax expense of $700,000 on pre-tax

income of $2.4 million for the three months ended December 31, 2023, compared to $780,000 on pre-tax income of $2.6 million for the three

months ended December 31, 2022. The Company’s effective tax rate for the three months ended December 31, 2023 was 29.8% compared

with 30.1% for the three months ended December 31, 2022.

Balance Sheet Comparison

Total assets increased $9.6 million, or 1.1%, to $916.9

million at December 31, 2023 from $907.3 million at September 30, 2023. The increase was attributable to higher balances of loans receivable,

net of allowance for credit loss, offset by lower interest-earning deposits with banks.

Cash and interest-earning deposits with banks decreased

$21.4 million, or 29.5% to $51.1 million at December 31, 2023 from $72.5 million at September 30, 2023 resulting primarily from deployment

of these fund into loans receivable during the three months ended December 31, 2023.

At December 31, 2023, investment securities totaled

$96.6 million, reflecting an increase of $646,000, or 0.7%, from September 30, 2023. There were no other-than-temporary-impairment charges

for the Company’s investment securities for the three months ended December 31, 2023.

Total loans receivable increased $31.3 million, or

4.5%, to $729.5 million at December 31, 2023 from $698.2 million at September 30, 2023. The increase in total loans receivable during

the quarter ended December 31, 2023 occurred in commercial real estate loans, which increased $19.1 million, construction loans, which

increased $10.0 million, and one-to four-family residential real estate loans (including home equity lines of credit), which increased

$5.4 million. Partially offsetting these increases were commercial business loans, which decreased $3.1 million and other loans, which

decreased $85,000 during the quarter.

Total non-performing loans decreased $233,000, or

4.6%, to $4.9 million at December 31, 2023 from $5.1 million at September 30, 2023. The ratio of non-performing loans to total loans decreased

to 0.66% at December 31, 2023 from 0.73% at September 30, 2023.

The allowance for credit losses was unchanged at $8.3

million during the three months ended December 31, 2023. Upon adoption of ASU 2016-13 on October 1, 2023, the Company’s allowance

for credit losses decreased $492,000. Growth in loans receivable and loan commitments during the quarter resulted in additional provisions

for credit loss totaling $481,000. The Company’s allowance for on-balance sheet credit losses decreased to $7.7 million at December

31, 2023 from $8.3 million at September 30, 2023 while its reserve for off-balance sheet commitments increased to $637,000 at December

31, 2023 from $0 at September 30, 2023.

The allowance for credit losses as a percentage of

non-performing loans increased to 171.5% at December 31, 2023 from 163.9% at September 30, 2023. Our allowance for credit losses as a percentage

of total loans was 1.14% at December 31, 2023 compared with 1.19% at September 30, 2023. Future increases in the allowance for credit

losses may be necessary based on possible future increases in non-performing loans and charge-offs, the possible deterioration of collateral

values, and the possible deterioration of the current economic environment.

Total deposits increased $8.1 million, or 1.1%, to

$763.5 million at December 31, 2023. The inflow in deposits occurred in money market accounts, which increased $22.0 million, or 7.7%,

to $306.9 million, in certificates of deposit (including individual retirement accounts), which increased $7.8 million, or 7.4%, to $112.5

million and in interest-bearing checking accounts (NOW), which increased $4.6 million, or 4.0%, to $119.7 million. Partially offsetting

these increases were decreases in non-interest bearing checking accounts, which decreased $24.1 million, or 12.8%, to $164.4 million and

savings accounts, which decreased $2.2 million, or 3.5%, to $60.0 million. Included in the certificates of deposit were $13.8 million

in brokered certificates of deposit at December 31, 2023, which was unchanged from September 30, 2023.

The Company’s book value per share increased

to $16.03 at December 31, 2023 from $15.70 at September 30, 2023. The increase was due to the Company’s results from operations,

partially offset by $0.11 in dividends paid and 19,232 shares repurchased during the quarter at an average share price of $9.97.

About Magyar Bancorp

Magyar Bancorp is the parent company of Magyar Bank,

a community bank headquartered in New Brunswick, New Jersey. Magyar Bank has been serving families and businesses in Central New Jersey

since 1922 with a complete line of financial products and services. Magyar operates seven branch locations in New Brunswick, North Brunswick,

South Brunswick, Branchburg, Bridgewater, and Edison (2). Please visit us online at www.magbank.com.

Forward Looking Statements

This press release contains statements about future

events that constitute forward-looking statements within the meaning of the Section 27A of the Securities Act of 1933 and Section 21E

of the Securities Exchange Act of 1934. Such forward-looking statements may be identified by reference to a future period or periods,

or by the use of forward- looking terminology, such as “may,” “will,” “believe,” “expect,”

or similar terms or variations on those terms, or the negative of those terms. Forward-looking statements are subject to numerous risks

and uncertainties, including, but not limited to, those risks previously disclosed in the Company’s filings with the SEC, general

economic conditions, changes in interest rates, regulatory considerations, competition, technological developments, retention and recruitment

of qualified personnel, and market acceptance of the Company’s pricing, products and services, and with respect to the loans extended

by the Bank and real estate owned, the following: risks related to the economic environment in the market areas in which the Bank operates,

particularly with respect to the real estate market in New Jersey; the risk that the value of the real estate securing these loans may

decline in value; and the risk that significant expense may be incurred by the Company in connection with the resolution of non-performing

loans. The Company wishes to caution readers not to place undue reliance on any such forward-looking statements, which speak only as of

the date made. The Company does not undertake and specifically declines any obligation to publicly release the result of any revisions

that may be made to any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect

the occurrence of anticipated or unanticipated events.

Contact: John Reissner, 732.214.2083

MAGYAR BANCORP, INC. AND SUBSIDIARY

Selected Financial Data

(Dollars In Thousands,

Except for Per-Share Amounts)

| | |

Three Months Ended | |

| | |

December 31, | |

| | |

2023 | | |

2022 | |

| | |

(Unaudited) | |

| Income Statement Data: | |

| | | |

| | |

| Interest and dividend income | |

$ | 11,557 | | |

$ | 8,501 | |

| Interest expense | |

| 4,313 | | |

| 1,610 | |

| Net interest and dividend income | |

| 7,244 | | |

| 6,891 | |

| Provision for credit losses | |

| 481 | | |

| 317 | |

| Net interest and dividend income after | |

| | | |

| | |

| provision for credit losses | |

| 6,763 | | |

| 6,574 | |

| Other income | |

| 609 | | |

| 597 | |

| Other expense | |

| 5,020 | | |

| 4,581 | |

| Income before income tax expense | |

| 2,352 | | |

| 2,590 | |

| Income tax expense | |

| 700 | | |

| 780 | |

| Net income | |

$ | 1,652 | | |

$ | 1,810 | |

| | |

| | | |

| | |

| Per Share Data: | |

| | | |

| | |

| Net income per share-basic | |

$ | 0.26 | | |

$ | 0.28 | |

| Net income per share-diluted | |

$ | 0.26 | | |

$ | 0.28 | |

| Book value per share, at period end | |

$ | 16.03 | | |

$ | 14.82 | |

| | |

| | | |

| | |

| Selected Ratios (annualized): | |

| | | |

| | |

| Return on average assets | |

| 0.72% | | |

| 0.90% | |

| Return on average equity | |

| 6.19% | | |

| 7.21% | |

| Net interest margin | |

| 3.29% | | |

| 3.60% | |

| | |

December 31, | | |

September 30, | |

| | |

2023 | | |

2023 | |

| | |

(Unaudited) | |

| | |

(Dollars in Thousands) | |

| Balance Sheet Data: | |

| | | |

| | |

| Assets | |

$ | 916,877 | | |

$ | 907,292 | |

| Total loans receivable | |

| 729,494 | | |

| 698,206 | |

| Allowance for credit losses | |

| 8,320 | | |

| 8,330 | |

| Investment securities - available for sale, at fair value | |

| 12,273 | | |

| 10,125 | |

| Investment securities - held to maturity, at cost | |

| 84,333 | | |

| 85,835 | |

| Deposits | |

| 763,548 | | |

| 755,453 | |

| Borrowings | |

| 28,796 | | |

| 29,515 | |

| Shareholders' Equity | |

| 106,677 | | |

| 104,790 | |

| | |

| | | |

| | |

| Asset Quality Data: | |

| | | |

| | |

| Non-performing loans | |

$ | 4,851 | | |

$ | 5,084 | |

| Other real estate owned | |

| 328 | | |

| 328 | |

| Total non-performing assets | |

$ | 5,179 | | |

$ | 5,412 | |

| Allowance for credit losses to non-performing loans | |

| 171.50% | | |

| 163.85% | |

| Allowance for credit losses to total loans receivable | |

| 1.14% | | |

| 1.19% | |

| Non-performing loans to total loans receivable | |

| 0.66% | | |

| 0.73% | |

| Non-performing assets to total assets | |

| 0.56% | | |

| 0.60% | |

| Non-performing assets to total equity | |

| 4.85% | | |

| 5.16% | |

v3.23.4

Cover

|

Jan. 25, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 25, 2024

|

| Entity File Number |

0-51726

|

| Entity Registrant Name |

MAGYAR BANCORP, INC.

|

| Entity Central Index Key |

0001337068

|

| Entity Tax Identification Number |

20-4154978

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

400 Somerset Street

|

| Entity Address, City or Town |

New Brunswick

|

| Entity Address, State or Province |

NJ

|

| Entity Address, Postal Zip Code |

08901

|

| City Area Code |

(732)

|

| Local Phone Number |

342-7600

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, par value $0.01 per share

|

| Trading Symbol |

MGYR

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Information, Former Legal or Registered Name |

Not Applicable

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

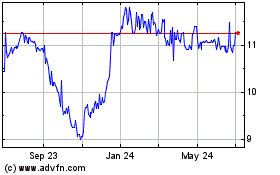

Magyar Bancorp (NASDAQ:MGYR)

Historical Stock Chart

From Mar 2024 to Apr 2024

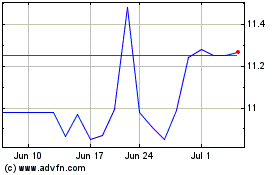

Magyar Bancorp (NASDAQ:MGYR)

Historical Stock Chart

From Apr 2023 to Apr 2024