false

0001893311

0001893311

2024-02-16

2024-02-16

0001893311

luxh:CommonStockParValue0.00001PerShareMember

2024-02-16

2024-02-16

0001893311

luxh:SeriesACumulativeRedeemablePreferredMember

2024-02-16

2024-02-16

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): February 16, 2024

| LuxUrban Hotels Inc. |

| (Exact Name of Registrant as Specified in Charter) |

| Delaware |

|

001-41473 |

|

82-3334945 |

|

(State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

| 212 Biscayne Blvd, Suite 253, Miami, Florida |

|

33137 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (877) 269-5952

| N/A |

| (Former Name or Former Address, if Changed Since Last Report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e 4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Ticker symbol(s) |

|

Name of each exchange on which registered |

|

Common Stock, par value $0.00001 per share |

|

LUXH |

|

The Nasdaq Stock Market LLC |

|

13.00%

Series A Cumulative Redeemable Preferred Stock $0.00001 |

|

LUXHP |

|

The Nasdaq Stock Market LLC |

| Item 5.02. |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

Effective as of February 20, 2024, Jimmie Chatmon voluntarily resigned from the Board of Directors (the “Board”) of LuxUrban Hotels Inc. (the “Company”) and the Board appointed and elected Elan Blutinger to fill the resulting vacancy. In connection with his election, Mr. Blutinger also was appointed by the Board to serve on the Nominating and Corporate Governance Committee of the Board. The Board has determined that Mr. Blutinger is an independent director under the listing rules of The Nasdaq Stock Market LLC. Mr. Chatmon’s resignation and the election of Mr. Blutinger is part of the Company’s plan to achieve a more balanced board-management relationship and to provide the board with further industry expertise amongst its independent directors in the hotel management and online hotel booking services industries. Mr. Chatmon continues as an officer of the Company.

Elan

Blutinger has served as the Managing Director of Alpine Consolidated, LLC since 1996, a firm he co-founded that specializes in

consolidating travel and technology companies. He was the co-founder of Alpine Acquisition Corp, (NASDAQ:REVU), a special purpose

acquisition company in the lodging and entertainment industry and served as that company’s Chairman from December 2021

until April 2023. He was the Chairman and Chief Executive Officer of Espresoh Tech, an EU-based, software product development

company, from April 2019 until the sale of the company in December 2021. Mr. Blutinger was the Chairman and Chief

Executive Officer of AudioNow Holdings, a global mobile distribution platform for in-language media, from 2010 to May 2018.

From 2004 to 2012, Mr. Blutinger served as lead director (and chairman of each of the corporate governance committee and

compensation committee of the board) of Great Wolf Resorts (NASDAQ: WOLF), a family entertainment resorts company.

Mr. Blutinger served as Chairman of VRGateway, an online lodging technology company, from 2004 until its sale to Kinderhook

Industries in 2008. From 2000 until 2003, he was a member of the board of directors of Hotels.Com (NYSE: HOTEL), a leading provider

of online hotel booking services, and served on the board’s special committee in connection with the sale of the company to

IAC/Interactive in 2003. Mr. Blutinger was also a founder and director of ResortQuest International, (NYSE: RQI) from 1997 to

2003, of Travel Services International (NASDAQ: TRVL) from 1996 to 2001, and of London-based Online Travel Services (LSE: OTC) from

2000 to 2004. Mr. Blutinger earned a BA from the American University, a MA from the University of California at Berkeley, and a

JD from the American University’s Washington College of Law. He is a member of the Advisory Board of American

University’s Washington College of Law and a member of the East Carolina University Advisory Board for the Study of

Sustainable Tourism at that ECU School of Business.

As

a non-employee director of the Company, Mr. Blutinger will receive the compensation awarded to all non-employee directors of the

Company, which, as of the date of this Report, is $180,000 per year comprised of $72,000 in cash and the issuance of shares of the Company’s

common stock in two semi-annual tranches of $54,000 each (based on the market value of the Company’s common stock on the last trading

day prior to the grant of each tranche). In addition, the Company has entered into a customary directors’ indemnification agreement

with Mr. Blutinger. Mr. Blutinger has not engaged in any transactions with the Company that are required to be reported pursuant

to Item 404(a) of Regulation S-K.

| Item 7.01 |

Regulation FD Disclosure. |

On February 24, 2024, LuxUrban Hotels Inc. (the “Company”) issued a press release announcing the resignation of Mr. Chatmon and the election of Mr. Blutinger to the board of directors, a copy of which the Company is furnishing as Exhibit 99.1 to this Current Report on Form 8-K.

On February 16, 2024, LuxUrban Hotels Inc. (“Company”) entered into a letter agreement with Greenle Partners LLC Series Alpha P.S., a Delaware limited liability company (“Greenle Alpha”), and Greenle Partners LLC Series Beta P.S., a Delaware limited liability company (“Greenle Beta” and together with Greenle Alpha, “Greenle”) holders of certain warrants to purchase the Company’s common stock (“Warrants”), which were issued in private placements from time to time as previously reported by the Company. Under the terms of the letter agreement, in consideration of the agreement of Greenle to exercise 50% of the Warrants originally issued by the Company on November 6, 2023 (the “November Warrants”) within three (3) business days of the date of the letter agreement and 50% of the November Warrants on or prior to February 23, 2024, the exercise price of the November Warrants has been reduced from $4.00 to $2.00 and the exercise price of all of the other Warrants held by Greenle has been reduced from $5.00 and $5.50, as applicable, to $2.50. Except as described above, the Warrants remain unchanged. The exercise of the November Warrants shall generate gross proceeds of $1 million to the Company.

The information contained in this Item 7.01 and Exhibits 10.1 and 99.1 attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended and shall not be deemed incorporated by reference in any filing with the Securities and Exchange Commission under the Securities Exchange Act of 1934, as amended or the Securities Act of 1933, as amended whether made before or after the date hereof and irrespective of any general incorporation language in such filings.

| Item 9.01 |

Financial Statements and Exhibits |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Dated: February 20, 2024 |

LUXURBAN HOTELS INC. |

| |

|

| |

By: |

/s/ Shanoop Kothari |

| |

|

Name: |

Shanoop Kothari |

| |

|

Title: |

Chief Financial Officer, President and Secretary |

Exhibit 10.1

LUXURBAN HOTELS INC.

2125 Biscayne Boulevard, Suite 253

Miami, Florida 33137

February 16, 2024

Greenle Partners LLC Series Alpha P.S.

156 W Saddle River Road

Saddle River, New Jersey 07458

Greenle Partners LLC Series Beta P.S.

156 W Saddle River Road

Saddle River, New Jersey 07458

Gentlemen:

Reference is made to the stock purchase warrants (each a “Warrant” and collectively, the “Warrants”) of LuxUrban Hotels Inc., a Delaware corporation (the “Company”), listed on Annex A hereto owned by Greenle Partners LLC Series Alpha P.S., a Delaware limited liability company (“Greenle Alpha”), and Greenle Partners LLC Series Beta P.S., a Delaware limited liability company (“Greenle Beta”).

This letter will confirm our understanding and agreement that, in consideration of the respective agreements of Greenle Alpha and Greenle Beta to exercise 50% of the Warrants originally issued on November 6, 2023 and amended by the terms hereof (the “November Warrants”) within three (3) business days of the date hereof and 50% on or prior to February 23, 2024, the Exercise Price of the November Warrants is hereby amended and reduced to $2.00 and the Exercise Price of all of the other Warrants is hereby amended and reduced to $2.50. Except as so amended, the Warrants shall remain unchanged. The Company covenants to keep its registration statement on Form S-3 (Registration No. 333-275647) current and effective until all shares of common stock of the Company issuable upon exercise of the November Warrants have been sold thereunder.

If the foregoing accurately sets forth our understanding and agreement as to the matters set forth above, please acknowledge your agreement by signing below and returning to us a copy of this letter.

|

LuxUrban Hotels Inc. |

| |

|

|

| |

By: |

/s/ Brian Ferdinand |

| |

|

Name: |

Brian Ferdinand |

| |

|

Title: |

CEO |

| |

|

|

|

Greenle Partners LLC Series Alpha P.S. |

| |

|

|

| |

By: |

/s/ Alan Uryniak |

| |

|

Name: |

Alan Uryniak |

| |

|

Title: |

Manager |

| |

|

|

| |

Greenle Partners LLC Series Beta P.S. |

| |

|

|

| |

By: |

/s/ Alan Uryniak |

| |

|

Name: |

Alan Uryniak |

| |

|

Title: |

Manager |

ANNEX A

Greenle Partners LLC Series Alpha P.S.

| Issue Date |

|

Expiration |

|

|

Exercise

Price |

|

|

Warrants

Outstanding |

|

| 11/6/23 |

|

11/6/28 |

|

|

$ |

4.00 |

|

|

|

185,000 |

|

| 12/17/23 |

|

12/17/28 |

|

|

$ |

5.00 |

|

|

|

1,610,000 |

|

| 12/27/23 |

|

12/27/28 |

|

|

$ |

5.50 |

|

|

|

805,000 |

|

| |

|

|

|

|

|

| Total |

|

|

|

2,600,000 |

|

Greenle Partners LLC Series Beta P.S.

| Issue Date |

|

Expiration |

|

|

Exercise

Price |

|

|

Warrants

Outstanding |

|

| 11/6/23 |

|

11/6/28 |

|

|

$ |

4.00 |

|

|

|

315,000 |

|

| 12/17/23 |

|

12/17/28 |

|

|

$ |

5.00 |

|

|

|

390,000 |

|

| 12/27/23 |

|

12/27/28 |

|

|

$ |

5.50 |

|

|

|

195,000 |

|

| |

|

|

|

|

|

| Total |

|

|

|

900,000 |

|

Exhibit 99.1

LuxUrban Hotels Appoints Travel and Hospitality Industry Veteran Elan Blutinger to Board of Directors

MIAMI, FL, - February 20, 2024 - LuxUrban Hotels Inc. (“LuxUrban” or the “Company”) (Nasdaq: LUXH), a hospitality company which utilizes an asset-light business model to lease entire hotels on a long-term basis in partnership with Wyndham Hotels & Resorts, today announced the appointment of Elan Blutinger as an independent member of the Company’s Board of Directors. Mr. Blutinger also will serve on the Nominating and Corporate Governance Committee.

A serial entrepreneur and investor, Mr. Blutinger is Managing Director of Alpine Consolidated, LLC, a merchant bank he co-founded in 1996. Through Alpine, he has founded, built, and led initial public offerings for multiple public technology and travel companies in the United States and United Kingdom. His experience includes:

|

● |

Lead Director, and Chairman of each of the Corporate Governance Committee and Compensation Committee for Great Wolf Resorts, a family entertainment resorts company, which was acquired by Apollo Global Management in 2012; |

|

● |

Founder and a Director of ResortQuest International, a provider of full-service vacation rentals in the US, which was acquired by Wyndham Hotels & Resorts in 2010; |

|

● |

Director and Chairman of the Compensation Committee for Hotels.com, and Chairman of the Special Committee of the Board in connection with the sale of that company to IAC/InteractiveCorp. in 2003; and |

|

● |

Co-Founder and Lead Director of Travel Services International, which he founded, led to a successful initial public offering, and later sold to Airtours PLC in 2000. |

Mr. Blutinger also served as Lead Director, Member of the Board, and Chairman of the Remuneration Committee for Online Travel Corporation PLC; Chairman of the Board and CEO of Espresoh Tech, an EU-based, software product development company, from April 2019 until the sale of the company in December 2021; and Founder and Chairman of the Board of AudioNow Holdings, a global mobile distribution platform for in-language media, from 2010 until its acquisition in 2018.

Mr. Blutinger earned a BA in International Relations from the American University, a MA in Political Economy from the University of California at Berkeley, and a Juris Doctor from the American University’s Washington College of Law. He is a member of the Advisory Board of American University’s Washington College of Law and a member of the East Carolina University Advisory Board for the Study of Sustainable Tourism at ECU’s School of Business.

“Elan has helped to define the industry landscape by marrying technology with travel to elevate and expand the experience for people around the world,” said Brian Ferdinand, Chairman of the Board and Co-CEO of the Company. “We are fortunate to have access to his insights, counsel, and acumen and believe that he will be an invaluable addition to the Board as we continue to expand our industry presence.”

Mr. Ferdinand continued, “In 2023 we partnered with Wyndham Hotels & Resorts, which has delivered vital financial support along with best-in-class services in the areas of marketing, distribution, sales, sourcing, and technology. As we continue to scale the business, Elan’s appointment is the next, but likely not last, logical step in our ongoing evolution and a reflection of our commitment to strengthening industry representation across the enterprise and maturing as an organization.”

Mr. Blutinger succeeds Jimmie Chatmon, a founding executive of LuxUrban who also had served as a director of the Company since November 2021. Mr. Chatmon voluntarily resigned his board position to accommodate the appointment of Mr. Blutinger; as such, the Company’s board will remain at seven members, five of whom are independent.

“I am proud that our Company’s growth and maturation has allowed us to attract an executive of Elan’s caliber to the board,” said Mr. Chatmon. “His appointment adds industry depth and improves our governance profile. It has been an honor to serve with such a purpose-driven group of individuals as a member of LuxUrban’s board, and I look forward to our continuing collaboration as a member of the executive team.”

LuxUrban Hotels Inc.

LuxUrban Hotels Inc. utilizes an asset light business model to secure the long-term operating rights for entire hotels through Master Lease Agreements (MLA) and rents out, on a short-term basis, hotel rooms to business and vacation travelers. The Company is aggressively building a portfolio of hotel properties in destination cities by capitalizing on the dislocation in commercial real estate markets and the large amount of debt maturity obligations on those assets coming due with a lack of available options for owners of those assets. LuxUrban’s MLA allows owners to hold onto their assets and retain their equity value while LuxUrban operates and owns the cash flows of the operating business for the life of the MLA. Through its partnership with Wyndham Hotels & Resorts, the largest hotel company in the world by rooms, LuxUrban gains several competitive advantages including joint branding for marketing, sales, and distribution, capital allocation from Wyndham for each hotel it acquires, and ongoing customer support and training across its portfolio.

Forward Looking Statements

This press release contains certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 (set forth in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended). The statements contained in this release that are not purely historical are forward-looking statements. Forward-looking statements include, but are not limited to, statements regarding expectations, hopes, beliefs, intentions or strategies regarding the future. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. Generally, the words “anticipates,” “believes,” “continues,” “could,” “estimates,” “expects,” “intends,” “may,” “might,” “plans,” “possible,” “potential,” “predicts,” “projects,” “should,” “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. Forward-looking statements in this release may include, for example, statements with respect to the success of the Company’s collaboration with Wyndham Hotels & Resorts, scheduled property openings, expected closing of noted lease transactions, the Company’s ability to continue closing on additional leases for properties in the Company’s pipeline, as well the Company’s anticipated ability to commercialize efficiently and profitably the properties it leases and will lease in the future. The forward-looking statements contained in this release are based on current expectations and belief concerning future developments and their potential effect on the Company. There can be no assurance that future developments will be those that have been anticipated. These forward-looking statements are subject to a number of risks, uncertainties (some of which are beyond our control) or other assumptions that may cause actual results of performance to be materially different from those expressed or implied by these forward-looking statements, including those set forth under the caption “Risk Factors” in our public filings with the SEC, including in Item 1A of our Annual Report on Form 10-K for the year ended December 31, 2022, and any updates to those factors as set forth in subsequent Quarterly Reports on Form 10-Q or other public filings with the SEC. The forward-looking information and forward-looking statements contained in this press release are made as of the date of this press release, and the Company does not undertake to update any forward-looking information and/or forward-looking statements that are contained or referenced herein, except in accordance with applicable securities laws.

Contact

| Shanoop Kothari |

Devin Sullivan |

| President, Co-Chief Executive Officer & Chief Financial Officer |

Managing Director |

| LuxUrban Hotels Inc. |

The Equity Group Inc. |

| shanoop@luxurbanhotels.com |

dsullivan@equityny.com |

| |

|

| |

Conor Rodriguez, Analyst |

| |

crodriguez@equityny.com |

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=luxh_CommonStockParValue0.00001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=luxh_SeriesACumulativeRedeemablePreferredMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

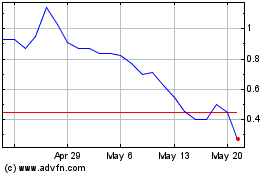

LuxUrban Hotels (NASDAQ:LUXH)

Historical Stock Chart

From Mar 2024 to Apr 2024

LuxUrban Hotels (NASDAQ:LUXH)

Historical Stock Chart

From Apr 2023 to Apr 2024