falseQ320230000720858December 31true00007208582023-01-012023-09-300000720858us-gaap:CommonStockMember2023-01-012023-09-300000720858itic:RightsToPurchaseSeriesAJuniorParticipatingPreferredStockMember2023-01-012023-09-3000007208582023-10-25xbrli:shares00007208582023-09-30iso4217:USD00007208582022-12-31iso4217:USDxbrli:shares00007208582023-07-012023-09-3000007208582022-07-012022-09-3000007208582022-01-012022-09-300000720858us-gaap:CommonStockMember2022-06-300000720858us-gaap:RetainedEarningsMember2022-06-300000720858us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-06-3000007208582022-06-300000720858us-gaap:RetainedEarningsMember2022-07-012022-09-300000720858us-gaap:CommonStockMember2022-07-012022-09-300000720858us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-07-012022-09-300000720858us-gaap:CommonStockMember2022-09-300000720858us-gaap:RetainedEarningsMember2022-09-300000720858us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-09-3000007208582022-09-300000720858us-gaap:CommonStockMember2023-06-300000720858us-gaap:RetainedEarningsMember2023-06-300000720858us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-3000007208582023-06-300000720858us-gaap:RetainedEarningsMember2023-07-012023-09-300000720858us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-012023-09-300000720858us-gaap:CommonStockMember2023-09-300000720858us-gaap:RetainedEarningsMember2023-09-300000720858us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-09-300000720858us-gaap:CommonStockMember2021-12-310000720858us-gaap:RetainedEarningsMember2021-12-310000720858us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-3100007208582021-12-310000720858us-gaap:RetainedEarningsMember2022-01-012022-09-300000720858us-gaap:CommonStockMember2022-01-012022-09-300000720858us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-09-300000720858us-gaap:CommonStockMember2022-12-310000720858us-gaap:RetainedEarningsMember2022-12-310000720858us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310000720858us-gaap:RetainedEarningsMember2023-01-012023-09-300000720858us-gaap:CommonStockMember2023-01-012023-09-300000720858us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-09-3000007208582022-01-012022-12-31xbrli:pure0000720858itic:StockAppreciationRightsShareSettledSARSMembersrt:MaximumMember2023-01-012023-09-300000720858itic:StockAppreciationRightsShareSettledSARSMember2021-12-310000720858itic:StockAppreciationRightsShareSettledSARSMember2021-01-012021-12-310000720858itic:StockAppreciationRightsShareSettledSARSMember2022-01-012022-12-310000720858itic:StockAppreciationRightsShareSettledSARSMember2022-12-310000720858itic:StockAppreciationRightsShareSettledSARSMember2023-01-012023-09-300000720858itic:StockAppreciationRightsShareSettledSARSMember2023-09-300000720858itic:StockAppreciationRightsShareSettledSARSMember2022-07-012022-09-300000720858itic:StockAppreciationRightsShareSettledSARSMember2023-01-012023-06-300000720858itic:StockAppreciationRightsShareSettledSARSMember2022-01-012022-06-300000720858itic:StockAppreciationRightsShareSettledSARSMember2022-01-012022-09-300000720858itic:StockAppreciationRightsShareSettledSARSMembersrt:MinimumMember2023-01-012023-09-30itic:segment0000720858itic:TitleInsuranceMemberus-gaap:OperatingSegmentsMember2023-07-012023-09-300000720858us-gaap:AllOtherSegmentsMemberus-gaap:OperatingSegmentsMember2023-07-012023-09-300000720858us-gaap:IntersegmentEliminationMember2023-07-012023-09-300000720858itic:TitleInsuranceMemberus-gaap:OperatingSegmentsMember2023-09-300000720858us-gaap:AllOtherSegmentsMemberus-gaap:OperatingSegmentsMember2023-09-300000720858us-gaap:IntersegmentEliminationMember2023-09-300000720858itic:TitleInsuranceMemberus-gaap:OperatingSegmentsMember2022-07-012022-09-300000720858us-gaap:AllOtherSegmentsMemberus-gaap:OperatingSegmentsMember2022-07-012022-09-300000720858us-gaap:IntersegmentEliminationMember2022-07-012022-09-300000720858itic:TitleInsuranceMemberus-gaap:OperatingSegmentsMember2022-09-300000720858us-gaap:AllOtherSegmentsMemberus-gaap:OperatingSegmentsMember2022-09-300000720858us-gaap:IntersegmentEliminationMember2022-09-300000720858itic:TitleInsuranceMemberus-gaap:OperatingSegmentsMember2023-01-012023-09-300000720858us-gaap:AllOtherSegmentsMemberus-gaap:OperatingSegmentsMember2023-01-012023-09-300000720858us-gaap:IntersegmentEliminationMember2023-01-012023-09-300000720858itic:TitleInsuranceMemberus-gaap:OperatingSegmentsMember2022-01-012022-09-300000720858us-gaap:AllOtherSegmentsMemberus-gaap:OperatingSegmentsMember2022-01-012022-09-300000720858us-gaap:IntersegmentEliminationMember2022-01-012022-09-300000720858us-gaap:SovereignDebtMember2023-09-300000720858us-gaap:USStatesAndPoliticalSubdivisionsMember2023-09-300000720858itic:IssuerObligationsUsStatesAndPoliticalSubdivisionsDebtSecuritiesSpecialRevenuesMember2023-09-300000720858us-gaap:CorporateDebtSecuritiesMember2023-09-300000720858us-gaap:DebtSecuritiesMember2023-09-300000720858us-gaap:SovereignDebtMember2022-12-310000720858us-gaap:USStatesAndPoliticalSubdivisionsMember2022-12-310000720858itic:IssuerObligationsUsStatesAndPoliticalSubdivisionsDebtSecuritiesSpecialRevenuesMember2022-12-310000720858us-gaap:CorporateDebtSecuritiesMember2022-12-310000720858us-gaap:DebtSecuritiesMember2022-12-310000720858us-gaap:FixedIncomeSecuritiesMember2023-09-300000720858us-gaap:FixedIncomeSecuritiesMember2022-12-310000720858us-gaap:CommonStockMember2023-09-300000720858us-gaap:CommonStockMember2022-12-310000720858itic:VariableInterestEntityNotPrimaryBeneficiaryRealEstateLLCorLPMemberMemberus-gaap:OtherInvestmentsMember2023-09-300000720858itic:VariableInterestEntityNotPrimaryBeneficiarySmallBusinessInvestmentLPMemberMemberus-gaap:OtherInvestmentsMember2023-09-300000720858us-gaap:OtherInvestmentsMember2023-09-300000720858us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:FairValueInputsLevel1Member2023-09-300000720858us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:FairValueInputsLevel2Member2023-09-300000720858us-gaap:FairValueInputsLevel3Memberus-gaap:USStatesAndPoliticalSubdivisionsMember2023-09-300000720858us-gaap:USStatesAndPoliticalSubdivisionsMember2023-09-300000720858us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Member2023-09-300000720858us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2023-09-300000720858us-gaap:FairValueInputsLevel3Memberus-gaap:CorporateDebtSecuritiesMember2023-09-300000720858us-gaap:CorporateDebtSecuritiesMember2023-09-300000720858us-gaap:FairValueInputsLevel1Member2023-09-300000720858us-gaap:FairValueInputsLevel2Member2023-09-300000720858us-gaap:FairValueInputsLevel3Member2023-09-300000720858us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:FairValueInputsLevel1Member2022-12-310000720858us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:FairValueInputsLevel2Member2022-12-310000720858us-gaap:FairValueInputsLevel3Memberus-gaap:USStatesAndPoliticalSubdivisionsMember2022-12-310000720858us-gaap:USStatesAndPoliticalSubdivisionsMember2022-12-310000720858us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Member2022-12-310000720858us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2022-12-310000720858us-gaap:FairValueInputsLevel3Memberus-gaap:CorporateDebtSecuritiesMember2022-12-310000720858us-gaap:CorporateDebtSecuritiesMember2022-12-310000720858us-gaap:FairValueInputsLevel1Member2022-12-310000720858us-gaap:FairValueInputsLevel2Member2022-12-310000720858us-gaap:FairValueInputsLevel3Member2022-12-310000720858us-gaap:LimitedLiabilityCompanyMember2023-09-300000720858us-gaap:LimitedLiabilityCompanyMember2022-12-310000720858us-gaap:LimitedLiabilityCompanyMember2023-07-012023-09-300000720858us-gaap:LimitedLiabilityCompanyMember2022-07-012022-09-300000720858us-gaap:LimitedLiabilityCompanyMember2023-01-012023-09-300000720858us-gaap:LimitedLiabilityCompanyMember2022-01-012022-09-300000720858us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2023-06-300000720858us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-06-300000720858us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2023-07-012023-09-300000720858us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-07-012023-09-300000720858us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2023-09-300000720858us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-09-300000720858us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2022-06-300000720858us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-06-300000720858us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2022-07-012022-09-300000720858us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-07-012022-09-300000720858us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2022-09-300000720858us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-09-300000720858us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2022-12-310000720858us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-12-310000720858us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2023-01-012023-09-300000720858us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-01-012023-09-300000720858us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2021-12-310000720858us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-12-310000720858us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2022-01-012022-09-300000720858us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-01-012022-09-300000720858us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2023-07-012023-09-300000720858us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2023-07-012023-09-300000720858us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2022-07-012022-09-300000720858us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2022-07-012022-09-300000720858us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2023-01-012023-09-300000720858us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2023-01-012023-09-300000720858us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2022-01-012022-09-300000720858us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2022-01-012022-09-300000720858itic:EscrowTitleRelatedAndOtherFeesMember2023-07-012023-09-300000720858itic:EscrowTitleRelatedAndOtherFeesMember2022-07-012022-09-300000720858itic:EscrowTitleRelatedAndOtherFeesMember2023-01-012023-09-300000720858itic:EscrowTitleRelatedAndOtherFeesMember2022-01-012022-09-300000720858itic:NonTitleServicesMember2023-07-012023-09-300000720858itic:NonTitleServicesMember2022-07-012022-09-300000720858itic:NonTitleServicesMember2023-01-012023-09-300000720858itic:NonTitleServicesMember2022-01-012022-09-300000720858itic:NetPremiumsWrittenMember2023-07-012023-09-300000720858itic:NetPremiumsWrittenMember2022-07-012022-09-300000720858itic:NetPremiumsWrittenMember2023-01-012023-09-300000720858itic:NetPremiumsWrittenMember2022-01-012022-09-300000720858itic:InvestmentRelatedRevenueMember2023-07-012023-09-300000720858itic:InvestmentRelatedRevenueMember2022-07-012022-09-300000720858itic:InvestmentRelatedRevenueMember2023-01-012023-09-300000720858itic:InvestmentRelatedRevenueMember2022-01-012022-09-300000720858itic:OtherResourcesMiscellaneousMember2023-07-012023-09-300000720858itic:OtherResourcesMiscellaneousMember2022-07-012022-09-300000720858itic:OtherResourcesMiscellaneousMember2023-01-012023-09-300000720858itic:OtherResourcesMiscellaneousMember2022-01-012022-09-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| | | | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2023

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ___________________ to ___________________

Commission File Number: 0-11774

INVESTORS TITLE COMPANY

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | | | | |

| North Carolina | | | | 56-1110199 | |

| (State of incorporation) | | | | (I.R.S. Employer Identification No.) | |

121 North Columbia Street, Chapel Hill, North Carolina 27514

(Address of principal executive offices) (Zip Code)

(919) 968-2200

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Securities Exchange Act of 1934:

| | | | | | | | | | | | | | |

| Title of each class | | Trading symbol(s) | | Name of each exchange on which registered |

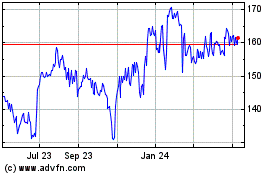

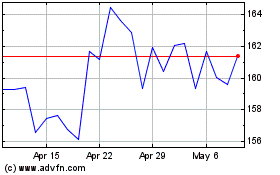

| Common Stock, no par value | | ITIC | | The Nasdaq Stock Market LLC |

| Rights to Purchase Series A Junior Participating Preferred Stock | | | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | | ☐ | | Accelerated filer | | ☒ | |

| | | | | | | | |

| Non-accelerated filer | | ☐ | | Smaller reporting company | | ☒ | |

| | | | | | | | |

| | | | | Emerging growth company | | ☐ | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of October 25, 2023, there were 1,890,623 common shares of the registrant outstanding.

INVESTORS TITLE COMPANY

AND SUBSIDIARIES

INDEX

| | | | | | | | |

| PART I. | FINANCIAL INFORMATION | |

| | | |

| Item 1. | Financial Statements (unaudited): | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | | |

| | |

| | | |

| | |

| | | |

| PART II. | OTHER INFORMATION | |

| | |

| | |

| | |

| Risk Factors | |

| | | |

| | |

| | |

| Item 3. | Defaults Upon Senior Securities | |

| | |

| Item 4. | Mine Safety Disclosures | |

| | |

| Item 5. | Other Information | |

| | | |

| | |

| | |

| | |

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

Investors Title Company and Subsidiaries

Consolidated Balance Sheets

As of September 30, 2023 and December 31, 2022

(in thousands)

(unaudited)

| | | | | | | | | | | |

| | September 30,

2023 | | December 31,

2022 |

| Assets | | | |

| Cash and cash equivalents | $ | 30,411 | | | $ | 35,311 | |

| Investments: | | | |

Fixed maturity securities, available-for-sale, at fair value (amortized cost: September 30, 2023: $65,766; December 31, 2022: $53,775) | 64,640 | | | 53,989 | |

Equity securities, at fair value (cost: September 30, 2023: $19,424; December 31, 2022: $25,278) | 31,831 | | | 51,691 | |

Short-term investments | 103,959 | | | 103,649 | |

Other investments | 20,144 | | | 18,368 | |

Total investments | 220,574 | | | 227,697 | |

| | | |

| Premiums and fees receivable | 17,322 | | | 19,047 | |

| Accrued interest and dividends | 1,111 | | | 872 | |

| Prepaid expenses and other receivables | 14,888 | | | 11,095 | |

| Property, net | 22,093 | | | 17,785 | |

| Goodwill and other intangible assets, net | 16,588 | | | 17,611 | |

| Lease assets | 6,432 | | | 6,707 | |

| Other assets | 2,496 | | | 2,458 | |

| Current income taxes recoverable | — | | | 1,174 | |

Total Assets | $ | 331,915 | | | $ | 339,757 | |

| | | |

| Liabilities and Stockholders’ Equity | | | |

| Liabilities: | | | |

Reserve for claims | $ | 37,494 | | | $ | 37,192 | |

Accounts payable and accrued liabilities | 30,719 | | | 47,050 | |

| Lease liabilities | 6,639 | | | 6,839 | |

Current income taxes payable | 1,008 | | | — | |

Deferred income taxes, net | 3,387 | | | 7,665 | |

Total liabilities | 79,247 | | | 98,746 | |

| | | |

| Commitments and Contingencies | — | | | — | |

| | | |

| Stockholders’ Equity: | | | |

Preferred stock (1,000 authorized shares; no shares issued) | — | | | — | |

Common stock – no par value (10,000 authorized shares; 1,891 and 1,897 shares issued and outstanding as of September 30, 2023 and December 31, 2022, respectively, excluding in each period 292 shares of common stock held by the Company) | — | | | — | |

Retained earnings | 253,423 | | | 240,811 | |

| Accumulated other comprehensive (loss) income | (755) | | | 200 | |

Total stockholders' equity | 252,668 | | | 241,011 | |

Total Liabilities and Stockholders’ Equity | $ | 331,915 | | | $ | 339,757 | |

Refer to notes to the Consolidated Financial Statements.

Investors Title Company and Subsidiaries

Consolidated Statements of Operations

For the Three and Nine Months Ended September 30, 2023 and 2022

(in thousands, except per share amounts)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| | | 2023 | | 2022 | | 2023 | | 2022 |

| Revenues: | | | | | | | | |

| Net premiums written | | $ | 49,822 | | | $ | 66,658 | | | $ | 132,793 | | | $ | 199,409 | |

| Escrow and other title-related fees | | 4,683 | | | 6,136 | | | 12,942 | | | 17,461 | |

| Non-title services | | 4,636 | | | 3,679 | | | 14,513 | | | 8,889 | |

| Interest and dividends | | 2,313 | | | 1,229 | | | 6,537 | | | 3,055 | |

| Other investment income | | 514 | | | 2,173 | | | 2,915 | | | 4,616 | |

| Net investment (losses) gains | | (815) | | | (2,154) | | | 720 | | | (16,456) | |

| Other | | 257 | | | 277 | | | 647 | | | 924 | |

| Total Revenues | | 61,410 | | | 77,998 | | | 171,067 | | | 217,898 | |

| | | | | | | | |

| Operating Expenses: | | | | | | | | |

| Commissions to agents | | 23,806 | | | 33,478 | | | 63,735 | | | 97,161 | |

| Provision for claims | | 1,838 | | | 1,966 | | | 3,897 | | | 3,452 | |

| Personnel expenses | | 19,083 | | | 21,586 | | | 58,451 | | | 63,738 | |

| Office and technology expenses | | 4,209 | | | 4,274 | | | 13,122 | | | 12,930 | |

| Other expenses | | 3,864 | | | 6,606 | | | 11,845 | | | 19,783 | |

| Total Operating Expenses | | 52,800 | | | 67,910 | | | 151,050 | | | 197,064 | |

| | | | | | | | |

| Income before Income Taxes | | 8,610 | | | 10,088 | | | 20,017 | | | 20,834 | |

| | | | | | | | |

| Provision for Income Taxes | | 1,526 | | | 2,175 | | | 4,167 | | | 4,457 | |

| | | | | | | | |

| Net Income | | $ | 7,084 | | | $ | 7,913 | | | $ | 15,850 | | | $ | 16,377 | |

| | | | | | | | |

| Basic Earnings per Common Share | | $ | 3.75 | | | $ | 4.17 | | | $ | 8.37 | | | $ | 8.63 | |

| | | | | | | | |

| Weighted Average Shares Outstanding – Basic | | 1,891 | | | 1,897 | | | 1,894 | | | 1,897 | |

| | | | | | | | |

| Diluted Earnings per Common Share | | $ | 3.75 | | | $ | 4.17 | | | $ | 8.37 | | | $ | 8.63 | |

| | | | | | | | |

| Weighted Average Shares Outstanding – Diluted | | 1,891 | | | 1,897 | | | 1,894 | | | 1,898 | |

Refer to notes to the Consolidated Financial Statements.

Investors Title Company and Subsidiaries

Consolidated Statements of Comprehensive Income

For the Three and Nine Months Ended September 30, 2023 and 2022

(in thousands)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended

September 30, | Nine Months Ended

September 30, |

| | | 2023 | | 2022 | 2023 | | 2022 |

| Net income | | $ | 7,084 | | | $ | 7,913 | | $ | 15,850 | | | $ | 16,377 | |

| Other comprehensive loss, before income tax: | | | | | | | |

| Accumulated postretirement (benefit) expense obligation adjustment | | (7) | | | 17 | | 127 | | | 228 | |

| Net unrealized losses on investments arising during the period | | (1,250) | | | (1,595) | | (1,547) | | | (5,537) | |

| Reclassification adjustment for sale of securities included in net income | | — | | | 58 | | — | | | 104 | |

| Reclassification adjustment for write-down of securities included in net income | | 96 | | | 35 | | 208 | | | 162 | |

| Other comprehensive loss, before income tax | | (1,161) | | | (1,485) | | (1,212) | | | (5,043) | |

| Income tax (benefit) expense related to postretirement health benefits | | (1) | | | 4 | | 27 | | | 48 | |

| Income tax benefit related to net unrealized losses on investments arising during the period | | (266) | | | (338) | | (332) | | | (1,173) | |

| Income tax expense related to reclassification adjustment for sale of securities included in net income | | — | | | 12 | | — | | | 22 | |

| Income tax expense related to reclassification adjustment for write-down of securities included in net income | | 22 | | | 8 | | 48 | | | 37 | |

| Net income tax benefit on other comprehensive loss | | (245) | | | (314) | | (257) | | | (1,066) | |

| Other comprehensive loss | | (916) | | | (1,171) | | (955) | | | (3,977) | |

| Comprehensive Income | | $ | 6,168 | | | $ | 6,742 | | $ | 14,895 | | | $ | 12,400 | |

Refer to notes to the Consolidated Financial Statements.

Investors Title Company and Subsidiaries

Consolidated Statements of Stockholders’ Equity

For the Three and Nine Months Ended September 30, 2023 and 2022

(in thousands, except per share amounts)

(unaudited) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Common Stock | | Retained Earnings | | Accumulated Other Comprehensive (Loss) Income | | Total

Stockholders’

Equity |

| | Shares | | Amount | | | |

Balance, June 30, 2022 | 1,897 | | | $ | — | | | $ | 232,759 | | | $ | 420 | | | $ | 233,179 | |

| Net income | | | | | 7,913 | | | | | 7,913 | |

Dividends paid ($0.46 per share) | | | | | (873) | | | | | (873) | |

| Repurchases of common stock | — | | | | | (86) | | | | | (86) | |

Share-based compensation expense related to stock appreciation rights | | | | | 79 | | | | | 79 | |

| Accumulated postretirement benefit obligation adjustment, net of tax | | | | | | | 13 | | | 13 | |

| Net unrealized loss on investments | | | | | | | (1,184) | | | (1,184) | |

Balance, September 30, 2022 | 1,897 | | | $ | — | | | $ | 239,792 | | | $ | (751) | | | $ | 239,041 | |

| | | | | | | | | |

Balance, June 30, 2023 | 1,891 | | | $ | — | | | $ | 247,092 | | | $ | 161 | | | $ | 247,253 | |

| Net income | | | | | 7,084 | | | | | 7,084 | |

Dividends paid ($0.46 per share) | | | | | (870) | | | | | (870) | |

Share-based compensation expense related to stock appreciation rights | | | | | 117 | | | | | 117 | |

| Accumulated postretirement benefit obligation adjustment, net of tax | | | | | | | (6) | | | (6) | |

| Net unrealized loss on investments | | | | | | | (910) | | | (910) | |

Balance, September 30, 2023 | 1,891 | | | $ | — | | | $ | 253,423 | | | $ | (755) | | | $ | 252,668 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Consolidated Statements of Stockholders’ Equity, continued |

| Common Stock | | Retained Earnings | | Accumulated Other Comprehensive (Loss) Income | | Total

Stockholders’

Equity |

| Shares | | Amount | | | |

Balance, December 31, 2021 | 1,895 | | | $ | — | | | $ | 225,861 | | | $ | 3,226 | | | $ | 229,087 | |

| Net income | | | | | 16,377 | | | | | 16,377 | |

Dividends paid ($1.38 per share) | | | | | (2,618) | | | | | (2,618) | |

| Repurchases of common stock | — | | | | | (86) | | | | | (86) | |

Exercise of stock appreciation rights | 2 | | | | | (1) | | | | | (1) | |

| Share-based compensation expense related to stock appreciation rights | | | | | 259 | | | | | 259 | |

| Accumulated postretirement benefit obligation adjustment, net of tax | | | | | | | 180 | | | 180 | |

| Net unrealized loss on investments | | | | | | | (4,157) | | | (4,157) | |

Balance, September 30, 2022 | 1,897 | | | $ | — | | | $ | 239,792 | | | $ | (751) | | | $ | 239,041 | |

| | | | | | | | | |

Balance, December 31, 2022 | 1,897 | | | $ | — | | | $ | 240,811 | | | $ | 200 | | | $ | 241,011 | |

| Net income | | | | | 15,850 | | | | | 15,850 | |

Dividends paid ($1.38 per share) | | | | | (2,616) | | | | | (2,616) | |

| Repurchases of common stock | (7) | | | | | (959) | | | | | (959) | |

Exercise of stock appreciation rights | 1 | | | | | — | | | | | — | |

Share-based compensation expense related to stock appreciation rights | | | | | 337 | | | | | 337 | |

| Accumulated postretirement benefit obligation adjustment, net of tax | | | | | | | 100 | | | 100 | |

| Net unrealized loss on investments | | | | | | | (1,055) | | | (1,055) | |

Balance, September 30, 2023 | 1,891 | | | $ | — | | | $ | 253,423 | | | $ | (755) | | | $ | 252,668 | |

Refer to notes to the Consolidated Financial Statements.

Investors Title Company and Subsidiaries

Consolidated Statements of Cash Flows

For the Nine Months Ended September 30, 2023 and 2022

(in thousands)

(unaudited)

| | | | | | | | | | | | | | |

| | | Nine Months Ended

September 30, |

| | | 2023 | | 2022 |

| Operating Activities | | | | |

| Net income | | $ | 15,850 | | | $ | 16,377 | |

| Adjustments to reconcile net income to net cash (used in) provided by operating activities: | | | | |

| Depreciation | | 2,005 | | | 1,679 | |

| (Accretion) Amortization of investments, net | | (2,663) | | | 270 | |

| Amortization of other intangible assets, net | | 982 | | | 967 | |

| Share-based compensation expense related to stock appreciation rights | | 337 | | | 259 | |

| Net gain on disposals of property | | (99) | | | (50) | |

| Net investment (gains) losses | | (720) | | | 16,456 | |

| Net earnings from other investments | | (2,445) | | | (2,976) | |

| Provision for claims | | 3,897 | | | 3,452 | |

| Benefit for deferred income taxes | | (4,021) | | | (4,250) | |

| Changes in assets and liabilities: | | | | |

| Decrease (increase) in premium and fees receivable | | 1,725 | | | (241) | |

| Increase in other assets | | (4,029) | | | (873) | |

| Decrease (increase) in lease assets | | 275 | | | (1,056) | |

| Decrease (increase) in current income taxes receivable | | 1,174 | | | (3,164) | |

| Decrease in accounts payable and accrued liabilities | | (16,204) | | | (1,702) | |

| (Decrease) increase in lease liabilities | | (200) | | | 1,060 | |

| Increase (decrease) in current income taxes payable | | 1,008 | | | (3,329) | |

| Payments of claims, net of recoveries | | (3,595) | | | (2,576) | |

| Net cash (used in) provided by operating activities | | (6,723) | | | 20,303 | |

| | | | |

| Investing Activities | | | | |

| Purchases of fixed maturities | | (18,445) | | | (350) | |

| Purchases of equity securities | | (7,934) | | | (5,585) | |

| Purchases of short-term investments | | (113,548) | | | (59,072) | |

| Purchases of other investments | | (2,765) | | | (1,300) | |

| Purchases of subsidiary, net of cash | | — | | | (4,927) | |

| Proceeds from sales and maturities of fixed maturity securities | | 6,312 | | | 18,870 | |

| Proceeds from sales of equity securities | | 28,836 | | | 13,970 | |

| Proceeds from sales and maturities of short-term investments | | 115,829 | | | 24,372 | |

| Proceeds from sales and distributions of other investments and assets | | 3,327 | | | 4,523 | |

| Purchases of property | | (6,621) | | | (3,980) | |

| Proceeds from the sale of property | | 407 | | | 93 | |

| Net cash provided by (used in) investing activities | | 5,398 | | | (13,386) | |

| | | | |

| Financing Activities | | | | |

| Repurchases of common stock | | (959) | | | (86) | |

| Exercise of stock appreciation rights | | — | | | (1) | |

| Dividends paid | | (2,616) | | | (2,618) | |

| Net cash used in financing activities | | (3,575) | | | (2,705) | |

| | | | |

| Net (Decrease) Increase in Cash and Cash Equivalents | | (4,900) | | | 4,212 | |

| Cash and Cash Equivalents, Beginning of Period | | 35,311 | | | 37,168 | |

| Cash and Cash Equivalents, End of Period | | $ | 30,411 | | | $ | 41,380 | |

| | | | | | | | | | | | | | |

| Consolidated Statements of Cash Flows, continued | | |

| | | Nine Months Ended

September 30, |

| | | 2023 | | 2022 |

| Supplemental Disclosures: | | | | |

| Cash Paid During the Year for: | | | | |

| Income tax payments, net | | $ | 6,968 | | | $ | 15,200 | |

| Non-Cash Investing and Financing Activities: | | | | |

Non-cash net unrealized loss on investments, net of deferred tax benefit of $284 and $1,114 for September 30, 2023 and 2022, respectively | | $ | 1,055 | | | $ | 4,157 | |

Adjustments to postretirement benefits obligation, net of deferred tax expense of $(27) and $(48) for September 30, 2023 and 2022, respectively | | $ | (100) | | | $ | (180) | |

| | | | | | | | | | | | | | |

| Changes in Financial Statement Amounts Related to Purchase of Subsidiaries, Net of Cash Received: | | | | |

| Goodwill and other intangibles acquired | | $ | — | | | $ | (3,028) | |

| Title plant acquired | | — | | | (500) | |

| Prepaid and other assets acquired | | — | | | (77) | |

| Fixed assets acquired | | — | | | (1,322) | |

| Purchase of subsidiary, net of cash received | | $ | — | | | $ | (4,927) | |

Refer to notes to the Consolidated Financial Statements.

INVESTORS TITLE COMPANY

AND SUBSIDIARIES

Notes to Consolidated Financial Statements

September 30, 2023

(unaudited)

Note 1 – Basis of Presentation and Significant Accounting Policies

Reference should be made to the “Notes to Consolidated Financial Statements” appearing in the Annual Report on Form 10-K for the year ended December 31, 2022 of Investors Title Company (the “Company”) for a complete description of the Company’s significant accounting policies.

Principles of Consolidation – The accompanying unaudited Consolidated Financial Statements include the accounts and operations of Investors Title Company and its subsidiaries, and have been prepared in accordance with accounting principles generally accepted in the United States ("GAAP") for interim financial information, with the instructions to Form 10-Q and with Article 10 of Regulation S-X. Accordingly, certain information and footnote disclosures normally included in annual consolidated financial statements have been condensed or omitted. All intercompany balances and transactions have been eliminated in consolidation.

In the opinion of management, all adjustments considered necessary for a fair presentation of the financial position, results of operations and cash flows of the Company in the accompanying unaudited Consolidated Financial Statements have been included. All such adjustments are of a normal recurring nature. Operating results for the three- and nine-month periods ended September 30, 2023 are not necessarily indicative of the financial condition and results that may be expected for the year ending December 31, 2023 or any other interim period.

Reclassifications – Certain amounts have been reclassified for consistency with the current period presentation. The reclassifications were between revenue lines of the unaudited Consolidated Statements of Operations. These reclassifications are not considered an accounting change and had no effect on the reported results of operations.

Use of Estimates and Assumptions – The preparation of the Company’s unaudited Consolidated Financial Statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, and disclosures of contingent assets and liabilities, at the date of the unaudited Consolidated Financial Statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates and assumptions used.

Subsequent Events – The Company has evaluated and concluded that there were no material subsequent events requiring adjustment or disclosure to its unaudited Consolidated Financial Statements.

Note 2 – Reserve for Claims

Activity in the reserve for claims for the nine-month period ended September 30, 2023 and the year ended December 31, 2022 are summarized as follows:

| | | | | | | | | | | |

| (in thousands) | September 30, 2023 | | December 31, 2022 |

| Balance, beginning of period | $ | 37,192 | | | $ | 36,754 | |

| Provision charged to operations | 3,897 | | | 4,255 | |

| Payments of claims, net of recoveries | (3,595) | | | (3,817) | |

Balance, end of period | $ | 37,494 | | | $ | 37,192 | |

The total reserve for all reported and unreported losses the Company incurred through September 30, 2023 is represented by the reserve for claims on the unaudited Consolidated Balance Sheets. The Company's reserves for unpaid losses and loss adjustment expenses are established using estimated amounts required to settle claims for which notice has been received (reported) and the amount estimated to be required to satisfy claims that have been incurred but not yet reported (“IBNR”). Despite the variability of such estimates, management believes that the total reserve for claims is adequate to cover claim losses which might result from pending and future claims under title insurance policies issued through September 30, 2023. Management continually reviews and adjusts its reserve for claims estimates to reflect its loss experience and any new information that becomes available. Adjustments resulting from such reviews could be significant.

A summary of the Company’s reserve for claims, broken down into its components of known title claims and IBNR, follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| (in thousands, except percentages) | September 30, 2023 | | % | | December 31, 2022 | | % |

| Known title claims | $ | 3,292 | | | 8.8 | | | $ | 3,250 | | | 8.7 | |

| IBNR | 34,202 | | | 91.2 | | | 33,942 | | | 91.3 | |

Total reserve for claims | $ | 37,494 | | | 100.0 | | | $ | 37,192 | | | 100.0 | |

Claims and losses paid are charged to the reserve for claims. Although claims losses are typically paid in cash, occasionally claims are settled by purchasing the interest of the insured or the claimant in the real property. When this event occurs, the Company carries assets at the lower of cost or estimated fair value, net of any indebtedness on the property.

Note 3 – Earnings Per Common Share and Share Awards

Basic earnings per common share is computed by dividing net income by the weighted average number of common shares outstanding during the reporting period. Diluted earnings per common share is computed by dividing net income by the combination of dilutive potential common stock, comprised of shares issuable under the Company’s share-based compensation plans, and the weighted average number of common shares outstanding during the reporting period. Dilutive common share equivalents include the dilutive effect of in-the-money share-based awards, which are calculated based on the average share price for each period using the treasury stock method. Under the treasury stock method, when share-based awards are assumed to be exercised, (a) the exercise price of a share-based award and (b) the amount of compensation cost, if any, for future services that the Company has not yet recognized, are assumed to be used to repurchase shares in the current period.

The following table sets forth the computation of basic and diluted earnings per share for the three- and nine-month periods ended September 30:

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, | Nine Months Ended

September 30, |

(in thousands, except per share amounts) | | 2023 | | 2022 | 2023 | | 2022 |

| Net income | | $ | 7,084 | | | $ | 7,913 | | $ | 15,850 | | | $ | 16,377 | |

| Weighted average common shares outstanding – Basic | | 1,891 | | | 1,897 | | 1,894 | | | 1,897 | |

Incremental shares outstanding assuming the exercise of dilutive SARs (share-settled) | | — | | | — | | — | | | 1 | |

Weighted average common shares outstanding – Diluted | | 1,891 | | | 1,897 | | 1,894 | | | 1,898 | |

| Basic earnings per common share | | $ | 3.75 | | | $ | 4.17 | | $ | 8.37 | | | $ | 8.63 | |

| Diluted earnings per common share | | $ | 3.75 | | | $ | 4.17 | | $ | 8.37 | | | $ | 8.63 | |

There were 24 thousand and 26 thousand potential shares excluded from the computation of diluted earnings per share for the three-month periods ended September 30, 2023 and 2022, respectively, due to the out-of-the-money status of the related share-based awards. There were 24 thousand and 13 thousand potential shares excluded from the computation of diluted earnings per share for the nine-month periods ended September 30, 2023 and 2022, respectively, due to the out-of-the-money status of the related share-based awards.

The Company historically has adopted employee stock award plans under which restricted stock, options or stock appreciation rights ("SARs") exercisable for the Company's stock may be granted to key employees or directors of the Company. There is currently one active plan from which the Company may grant share-based awards. The awards eligible to be granted under the active plan are limited to SARs, and the maximum aggregate number of shares of common stock of the Company available pursuant to the plan for the grant of SARs is 250 thousand shares. SARs give the holder the right to receive stock equal to the appreciation in the value of shares of stock from the grant date for a specified period of time, and as a result, are accounted for as equity instruments.

As of September 30, 2023, the only outstanding awards under the plans were SARs, which expire within seven years or less from the date of grant. All outstanding SARs vest and are exercisable within five years or less from the date of grant, and all SARs issued to date have been share-settled only. There have been no stock options or SARs granted where the exercise price was less than the market price on the date of grant.

A summary of share-based award transactions for all share-based award plans follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| (in thousands, except weighted average exercise price and average remaining contractual term) | Number

Of Shares | | Weighted

Average

Exercise Price | | Average Remaining

Contractual

Term (Years) | | Aggregate

Intrinsic

Value |

Outstanding as of January 1, 2022 | 35 | | | $ | 150.36 | | | 3.96 | | $ | 1,643 | |

| SARs granted | 10 | | | 155.16 | | | | | |

| SARs exercised | (6) | | | 94.44 | | | | | |

| Outstanding as of December 31, 2022 | 39 | | | $ | 159.39 | | | 4.10 | | $ | 243 | |

| SARs granted | 5 | | | 142.88 | | | | | |

| SARs exercised | (2) | | | 93.87 | | | | | |

| Outstanding as of September 30, 2023 | 42 | | | $ | 160.83 | | | 3.94 | | $ | 166 | |

| | | | | | | |

| Exercisable as of September 30, 2023 | 32 | | | $ | 166.57 | | | 3.52 | | $ | 110 | |

| | | | | | | |

| Unvested as of September 30, 2023 | 10 | | | $ | 142.51 | | | 5.28 | | $ | 56 | |

During the third quarter of 2023, the Company did not issue share-settled SARs to either employees or directors of the Company. During the third quarter of 2022, the Company issued 5 thousand share-settled SARs to employees of the Company. During the first two quarters of 2023, the Company issued 5 thousand share-settled SARs to directors of the Company. During the first two quarters of 2022, the Company issued 5 thousand share-settled SARs to directors of the Company. The fair value of each award is estimated on the date of grant using the Black-Scholes option valuation model. Expected volatilities are based on both the implied and historical volatility of the Company’s stock. The Company uses historical data to project SAR exercises and pre-exercise forfeitures within the valuation model. The expected term of awards represents the period of time that SARs granted are expected to be outstanding. The interest rate assumed for the expected life of the award is based on the U.S. Treasury yield curve in effect at the time of the grant. The weighted average fair value for the SARs issued during 2023 and 2022 were $55.52 and $62.60, respectively, and were estimated using the weighted average assumptions shown in the table below:

| | | | | | | | | | | | | | | | | | | | | | | |

| 2023 | | 2022 |

| Expected Life in Years | 6.2 | - | 7.0 | | 7.0 |

| Volatility | 36.6% | | 35.6% |

| Interest Rate | 3.7% | | 3.2% |

| Yield Rate | 1.2% | | 0.6% |

There was approximately $337 thousand and $259 thousand of compensation expense relating to SARs vesting on or before September 30, 2023 and 2022, respectively, included in personnel expenses in the unaudited Consolidated Statements of Operations. As of September 30, 2023, there was $494 thousand of unrecognized compensation expense related to unvested share-based compensation arrangements granted under the Company’s stock award plans.

Note 4 – Segment Information

The Company has one reportable segment, title insurance services. The remaining immaterial segments have been combined into a group called “All Other.”

The title insurance segment primarily issues title insurance policies through approved attorneys from underwriting offices and through independent issuing agents. Title insurance policies insure titles to real estate.

Provided below is selected financial information about the Company's operations by segment for the periods ended September 30, 2023 and 2022:

| | | | | | | | | | | | | | | | | | | | | | | |

Three Months Ended

September 30, 2023 (in thousands) | Title

Insurance | | All

Other | | Intersegment Eliminations | | Total |

| Insurance and other services revenues | $ | 59,182 | | | $ | 5,057 | | | $ | (4,841) | | | $ | 59,398 | |

| Net investment income | 1,037 | | | 975 | | | — | | | 2,012 | |

| Total revenues | $ | 60,219 | | | $ | 6,032 | | | $ | (4,841) | | | $ | 61,410 | |

| Operating expenses | 54,809 | | | 2,660 | | | (4,669) | | | 52,800 | |

| Income before income taxes | $ | 5,410 | | | $ | 3,372 | | | $ | (172) | | | $ | 8,610 | |

| Total assets | $ | 226,105 | | | $ | 105,810 | | | $ | — | | | $ | 331,915 | |

| | | | | | | | | | | | | | | | | | | | | | | |

Three Months Ended

September 30, 2022 (in thousands) | Title

Insurance | | All

Other | | Intersegment Eliminations | | Total |

| Insurance and other services revenues | $ | 78,812 | | | $ | 4,102 | | | $ | (6,164) | | | $ | 76,750 | |

| Net investment income | 600 | | | 648 | | | — | | | 1,248 | |

| Total revenues | $ | 79,412 | | | $ | 4,750 | | | $ | (6,164) | | | $ | 77,998 | |

| Operating expenses | 71,516 | | | 2,406 | | | (6,012) | | | 67,910 | |

| Income before income taxes | $ | 7,896 | | | $ | 2,344 | | | $ | (152) | | | $ | 10,088 | |

| Total assets | $ | 250,116 | | | $ | 82,687 | | | $ | — | | | $ | 332,803 | |

| | | | | | | | | | | | | | | | | | | | | | | |

Nine Months Ended

September 30, 2023 (in thousands) | Title

Insurance | | All

Other | | Intersegment Eliminations | | Total |

| Insurance and other services revenues | $ | 159,382 | | | $ | 15,881 | | | $ | (14,368) | | | $ | 160,895 | |

| Net investment income | 7,616 | | | 2,556 | | | — | | | 10,172 | |

Total revenues | $ | 166,998 | | | $ | 18,437 | | | $ | (14,368) | | | $ | 171,067 | |

| Operating expenses | 156,694 | | | 8,208 | | | (13,852) | | | 151,050 | |

| Income before income taxes | $ | 10,304 | | | $ | 10,229 | | | $ | (516) | | | $ | 20,017 | |

Total assets | $ | 226,105 | | | $ | 105,810 | | | $ | — | | | $ | 331,915 | |

| | | | | | | | | | | | | | | | | | | | | | | |

Nine Months Ended

September 30, 2022 (in thousands) | Title

Insurance | | All

Other | | Intersegment Eliminations | | Total |

| Insurance and other services revenues | $ | 235,355 | | | $ | 10,081 | | | $ | (18,753) | | | $ | 226,683 | |

| Net investment loss | (8,061) | | | (724) | | | — | | | (8,785) | |

Total revenues | $ | 227,294 | | | $ | 9,357 | | | $ | (18,753) | | | $ | 217,898 | |

| Operating expenses | 206,938 | | | 8,424 | | | (18,298) | | | 197,064 | |

| Income before income taxes | $ | 20,356 | | | $ | 933 | | | $ | (455) | | | $ | 20,834 | |

Total assets | $ | 250,116 | | | $ | 82,687 | | | $ | — | | | $ | 332,803 | |

Note 5 – Retirement Agreements and Other Postretirement Benefits

The Company’s subsidiary, Investors Title Insurance Company ("ITIC"), is a party to employment agreements with key executives that provide for the continuation of certain employee benefits and other payments due under the agreements upon retirement, estimated to total $15.1 million and $15.0 million as of September 30, 2023 and December 31, 2022, respectively. The executive employee benefits include health, dental, vision and life insurance and are unfunded. These amounts are classified as accounts payable and accrued liabilities in the unaudited Consolidated Balance Sheets. The following sets forth the net periodic benefit cost for the executive benefits for the periods ended September 30, 2023 and 2022:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| (in thousands) | 2023 | | 2022 | | 2023 | | 2022 |

| Service cost – benefits earned during the year | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| Interest cost on the projected benefit obligation | 10 | | | 5 | | | 30 | | | 19 | |

| Amortization of unrecognized (gain) loss | (7) | | | 4 | | | (21) | | | — | |

| Net periodic benefit cost | $ | 3 | | | $ | 9 | | | $ | 9 | | | $ | 19 | |

Note 6 – Investments and Estimated Fair Value

Investments in Fixed Maturity Securities

The estimated fair value, gross unrealized holding gains, gross unrealized holding losses and amortized cost for fixed maturity securities by major classification are as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| As of September 30, 2023 (in thousands) | Amortized

Cost | | Gross

Unrealized

Gains | | Gross

Unrealized

Losses | | Estimated Fair

Value |

| Fixed maturity securities, available-for-sale, at fair value: | | | | | | | |

| Government obligations | $ | 2,199 | | | $ | — | | | $ | (6) | | | $ | 2,193 | |

General obligations of U.S. states, territories and political subdivisions | 9,452 | | | — | | | (260) | | | 9,192 | |

Special revenue issuer obligations of U.S. states, territories and political subdivisions | 26,886 | | | 3 | | | (527) | | | 26,362 | |

| Corporate debt securities | 27,229 | | | 250 | | | (586) | | | 26,893 | |

Total | $ | 65,766 | | | $ | 253 | | | $ | (1,379) | | | $ | 64,640 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| As of December 31, 2022 (in thousands) | Amortized

Cost | | Gross

Unrealized

Gains | | Gross

Unrealized

Losses | | Estimated Fair

Value |

| Fixed maturity securities, available-for-sale, at fair value: | | | | | | | |

| Government obligations | $ | 4,329 | | | $ | — | | | $ | (7) | | | $ | 4,322 | |

General obligations of U.S. states, territories and political subdivisions | 8,561 | | | 21 | | | (36) | | | 8,546 | |

Special revenue issuer obligations of U.S. states, territories and political subdivisions | 30,123 | | | 106 | | | (219) | | | 30,010 | |

| Corporate debt securities | 10,762 | | | 417 | | | (68) | | | 11,111 | |

Total | $ | 53,775 | | | $ | 544 | | | $ | (330) | | | $ | 53,989 | |

The special revenue category for both periods presented includes approximately 30 individual fixed maturity securities with revenue sources from a variety of industry sectors.

The scheduled maturities of fixed maturity securities at September 30, 2023 are as follows:

| | | | | | | | | | | |

| | Available-for-Sale |

| (in thousands) | Amortized

Cost | | Estimated Fair

Value |

| Due in one year or less | $ | 16,207 | | | $ | 16,282 | |

| Due one year through five years | 26,465 | | | 25,963 | |

| Due five years through ten years | 15,473 | | | 15,022 | |

| Due after ten years | 7,621 | | | 7,373 | |

Total | $ | 65,766 | | | $ | 64,640 | |

Expected maturities will differ from contractual maturities as borrowers may have the right to call or prepay obligations with or without penalties.

The following table presents the gross unrealized losses on fixed maturity securities and the estimated fair value of the related securities, aggregated by investment category and length of time that individual securities have been in a continuous loss position at September 30, 2023 and December 31, 2022:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Less than 12 Months | | 12 Months or Longer | | Total |

| As of September 30, 2023 (in thousands) | Estimated

Fair

Value | | Unrealized

Losses | | Estimated

Fair

Value | | Unrealized

Losses | | Estimated

Fair

Value | | Unrealized

Losses |

| Government obligations | $ | 2 | | | $ | (6) | | | $ | — | | | $ | — | | | $ | 2 | | | $ | (6) | |

| General obligations of U.S. states, territories and political subdivisions | 9,094 | | | (256) | | | 98 | | | (4) | | | 9,192 | | | (260) | |

Special revenue issuer obligations of U.S. states, territories and political subdivisions | 15,800 | | | (263) | | | 4,385 | | | (264) | | | 20,185 | | | (527) | |

| Corporate debt securities | 18,677 | | | (577) | | | 491 | | | (9) | | | 19,168 | | | (586) | |

| Total | $ | 43,573 | | | $ | (1,102) | | | $ | 4,974 | | | $ | (277) | | | $ | 48,547 | | | $ | (1,379) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Less than 12 Months | | 12 Months or Longer | | Total |

| As of December 31, 2022 (in thousands) | Estimated

Fair

Value | | Unrealized

Losses | | Estimated

Fair

Value | | Unrealized

Losses | | Estimated

Fair

Value | | Unrealized

Losses |

| Government obligations | $ | 4,322 | | | $ | (7) | | | $ | — | | | $ | — | | | $ | 4,322 | | | $ | (7) | |

| General obligations of U.S. states, territories and political subdivisions | 3,221 | | | (36) | | | — | | | — | | | 3,221 | | | (36) | |

Special revenue issuer obligations of U.S. states, territories and political subdivisions | 12,568 | | | (216) | | | 1,100 | | | (3) | | | 13,668 | | | (219) | |

Corporate debt securities | 6,498 | | | (68) | | | — | | | — | | | 6,498 | | | (68) | |

| Total | $ | 26,609 | | | $ | (327) | | | $ | 1,100 | | | $ | (3) | | | $ | 27,709 | | | $ | (330) | |

Management evaluates available-for-sale fixed maturity securities in unrealized loss positions to determine whether the impairment is due to credit-related factors or noncredit-related factors. The decline in estimated fair value of the fixed maturity securities can be attributed primarily to changes in market interest rates and changes in credit spreads over Treasury securities.

Factors considered in determining whether a loss is credit-related include the financial condition and prospects of the issuer (including credit ratings and analyst reports) and macro-economic changes. A total of 98 and 51 fixed maturity securities had unrealized losses at September 30, 2023 and December 31, 2022, respectively. The Company does not intend to sell any of these securities and believes that it is more likely than not that the Company will not have to sell any such securities before a recovery of cost. The fair value is expected to recover as the securities approach their maturity date or repricing date or if market yields for such investments decline. The Company believes that the unrealized losses detailed in the previous table are due to noncredit-related factors, including changes in market interest rates and other market conditions, and therefore the unrealized loss is recorded in accumulated other comprehensive (loss) income.

Reviews of the values of fixed maturity securities are inherently uncertain and the value of the investment may not fully recover, or may decline in future periods, resulting in a realized loss. The Company recorded impairment charges related to fixed maturity securities totaling $96 thousand and $208 thousand for the three- and nine-month periods ended September 30, 2023, respectively, and $35 thousand and $162 thousand for the three- and nine-month periods ended September 30, 2022, respectively. Expenses related to impairments are recorded in net investment (losses) gains in the unaudited Consolidated Statements of Operations when recognized.

Investments in Equity Securities

The cost and estimated fair value of equity securities are as follows:

| | | | | | | | | | | |

As of September 30, 2023 (in thousands) | Cost | | Estimated Fair

Value |

| Equity securities, at fair value: | | | |

| Common stocks | $ | 19,424 | | | $ | 31,831 | |

Total | $ | 19,424 | | | $ | 31,831 | |

| | | | | | | | | | | |

As of December 31, 2022 (in thousands) | Cost | | Estimated Fair

Value |

| Equity securities, at fair value: | | | |

| Common stocks | $ | 25,278 | | | $ | 51,691 | |

Total | $ | 25,278 | | | $ | 51,691 | |

Unrealized holding gains and losses are recorded net in net investment (losses) gains in the unaudited Consolidated Statements of Operations.

Net Investment (Losses) Gains

Gross realized gains and losses on sales of investments and unrealized holding gains and losses for the three and nine-months ended September 30, 2023 and 2022 are summarized as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| (in thousands) | 2023 | | 2022 | | 2023 | | 2022 |

| Gross realized gains from securities: | | | | | | | |

Common stocks | $ | 1,749 | | | $ | 2,564 | | | $ | 15,449 | | | $ | 7,120 | |

Total | $ | 1,749 | | | $ | 2,564 | | | $ | 15,449 | | | $ | 7,120 | |

| Gross realized losses from securities: | | | | | | | |

Corporate debt securities | $ | — | | | $ | (58) | | | $ | — | | | $ | (104) | |

Common stocks | (77) | | | (20) | | | (400) | | | (209) | |

| Write-down of securities | (96) | | | (35) | | | (208) | | | (162) | |

Total | $ | (173) | | | $ | (113) | | | $ | (608) | | | $ | (475) | |

| Net realized gains from securities | $ | 1,576 | | | $ | 2,451 | | | $ | 14,841 | | | $ | 6,645 | |

| Gross realized gains (losses) on other investments: | | | | | | | |

| Gains on other investments | $ | 5 | | | $ | 30 | | | $ | 5 | | | $ | 30 | |

| Losses on other investments | (4) | | | — | | | (120) | | | (409) | |

Total | $ | 1 | | | $ | 30 | | | $ | (115) | | | $ | (379) | |

| Net realized investment gains | $ | 1,577 | | | $ | 2,481 | | | $ | 14,726 | | | $ | 6,266 | |

| Changes in the estimated fair value of equity security investments | $ | (2,392) | | | $ | (4,635) | | | $ | (14,006) | | | $ | (22,722) | |

| Net investment (losses) gains | $ | (815) | | | $ | (2,154) | | | $ | 720 | | | $ | (16,456) | |

Realized gains and losses are determined on the specific identification method.

Variable Interest Entities

The Company holds investments in variable interest entities ("VIEs") that are not consolidated in the Company's financial statements as the Company is not the primary beneficiary. These entities are considered VIEs as the equity investors at risk, including the Company, do not have the power over the activities that most significantly impact the economic performance of the entities; this power resides with a third-party general partner or managing member that cannot be removed except for cause and no participation rights exist. The following table sets forth details about the Company's variable interest investments in VIEs, which are structured either as limited partnerships ("LPs") or limited liability companies ("LLCs"), as of September 30, 2023:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in thousands) | | Balance Sheet Classification | | Carrying Value | | Estimated Fair Value | | Maximum Potential Loss (a) |

| Real estate LLCs or LPs | | Other investments | | $ | 4,346 | | | $ | 4,762 | | | $ | 5,658 | |

| Small business investment LPs | | Other investments | | 9,298 | | | 10,914 | | | 13,080 | |

Total | | | | $ | 13,644 | | | $ | 15,676 | | | $ | 18,738 | |

| | | | | | | | |

| (a) | | Maximum potential loss is calculated as the total investment in the LLC or LP, including any capital commitments that may have not yet been called. The Company is not exposed to any loss beyond the total commitment of its investment. |

Valuation of Financial Assets

The Financial Accounting Standards Board ("FASB") has established a valuation hierarchy for disclosure of the inputs used to measure estimated fair value of financial assets and liabilities, such as securities. This hierarchy categorizes the inputs into three broad levels as follows. Level 1 inputs are quoted prices (unadjusted) in active markets for identical assets or liabilities. Level 2 inputs are quoted prices for similar assets and liabilities in active markets or inputs that are observable for the asset or liability, either directly or indirectly through market corroboration, for substantially the full term of the financial instrument. Level 3 inputs are unobservable inputs based on the Company’s own assumptions intended to represent market participant assumptions used to measure assets and liabilities at fair value.

A financial instrument’s classification within the valuation hierarchy is based upon the lowest level of input that is significant to the fair value measurement – consequently, if there are multiple significant valuation inputs that are categorized in different levels of the hierarchy, the instrument’s hierarchy level is the lowest level (with Level 3 being the lowest level) within which any significant input falls.

The Level 1 category includes equity securities and U.S. Treasury securities that are measured at estimated fair value using quoted active market prices.

The Level 2 category includes fixed maturity securities such as corporate debt securities, U.S. government obligations, and obligations of U.S. states, territories, and political subdivisions. Estimated fair value is principally based on market values obtained from a third-party pricing service. Factors that are used in determining estimated fair market value include benchmark yields, reported trades, broker/dealer quotes, issuer spreads, two-sided markets, benchmark securities, bids, offers and reference data. The Company receives one quote per security from a third-party pricing service, although as discussed below, the Company does consult other pricing resources when confirming that the prices it obtains reflect the fair values of the instruments in accordance with GAAP. Generally, quotes obtained from the pricing service for instruments classified as Level 2 are not adjusted and are not binding. As of September 30, 2023 and December 31, 2022, the Company did not adjust any Level 2 fair values.

A number of the Company’s investment grade corporate debt securities are frequently traded in active markets, and trading prices are consequently available for these securities. However, these securities are classified as Level 2 because the pricing service from which the Company has obtained estimated fair values for these instruments uses valuation models that use observable market inputs in addition to trading prices. Substantially all of the input assumptions used in the service’s model are observable in the marketplace or can be derived or supported by observable market data.

In the measurement of the estimated fair value of certain financial instruments, other valuation techniques were utilized if quoted market prices were not available. These derived fair value estimates are significantly affected by the assumptions used. Additionally, certain financial instruments, including those related to insurance contracts, pension and other postretirement benefits, and equity method investments are excluded from the scope of disclosures.

In estimating the fair value of the financial instruments presented, the Company used the following methods and assumptions:

Cash and cash equivalents

The carrying amount for cash and cash equivalents is a reasonable estimate of fair value due to the short-term maturity of these investments.

Measurement alternative equity investments

The measurement alternative method requires investments without readily determinable fair values to be recorded at cost, less impairments, and plus or minus any changes resulting from observable price changes. The Company monitors any events or changes in circumstances that may have had a significant adverse effect on the fair value of these investments and makes any necessary adjustments.

Notes Receivable

Notes receivable are recorded at amortized cost and are included in prepaid expenses and other receivables in the unaudited Consolidated Balance Sheets. The amortized cost is the amount at which a receivable is originated and adjusted for applicable accrued interest, accretion, or amortization of premium, discount, and net deferred fees or costs, collection of cash, writeoffs, foreign exchange, and fair value hedge accounting adjustments. The Company monitors any events or changes in circumstances that may have had a significant adverse effect on the fair value of these investments and makes any necessary adjustments.

Accrued interest and dividends

The carrying amount for accrued interest and dividends is a reasonable estimate of fair value due to the short-term maturity of these assets.

The following table presents, by level, fixed maturity securities carried at estimated fair value as of September 30, 2023 and December 31, 2022:

| | | | | | | | | | | | | | | | | | | | | | | |

| As of September 30, 2023 (in thousands) | Level 1 | | Level 2 * | | Level 3 | | Total |

| Fixed maturity securities: | | | | | | | |

| Obligations of U.S. states, territories and political subdivisions | $ | 2,193 | | | $ | 35,554 | | | $ | — | | | $ | 37,747 | |

| Corporate debt securities | — | | | 26,893 | | | — | | | 26,893 | |

Total | $ | 2,193 | | | $ | 62,447 | | | $ | — | | | $ | 64,640 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| As of December 31, 2022 (in thousands) | Level 1 | | Level 2 * | | Level 3 | | Total |

| Fixed maturity securities: | | | | | | | |

| Obligations of U.S. states, territories and political subdivisions | $ | 4,322 | | | $ | 38,556 | | | $ | — | | | $ | 42,878 | |

| Corporate debt securities | — | | | 11,111 | | | — | | | 11,111 | |

Total | $ | 4,322 | | | $ | 49,667 | | | $ | — | | | $ | 53,989 | |

*Denotes fair market value obtained from pricing services.

The following table presents, by level, estimated fair values of equity investments and other financial instruments as of September 30, 2023 and December 31, 2022:

| | | | | | | | | | | | | | | | | | | | | | | |

| As of September 30, 2023 (in thousands) | Level 1 | | Level 2 | | Level 3 | | Total |

| Financial assets: | | | | | | | |

Cash and cash equivalents | $ | 30,411 | | | $ | — | | | $ | — | | | $ | 30,411 | |

Accrued interest and dividends | 1,111 | | | — | | | — | | | 1,111 | |

| Equity securities, at fair value: | | | | | | | |

Common stocks | 31,831 | | | — | | | — | | | 31,831 | |

| Short-term investments: | | | | | | | |

| Money market funds and U.S. Treasury bills | 103,959 | | | — | | | — | | | 103,959 | |

Total | $ | 167,312 | | | $ | — | | | $ | — | | | $ | 167,312 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| As of December 31, 2022 (in thousands) | Level 1 | | Level 2 | | Level 3 | | Total |

| Financial assets: | | | | | | | |

Cash and cash equivalents | $ | 35,311 | | | $ | — | | | $ | — | | | $ | 35,311 | |

Accrued interest and dividends | 872 | | | — | | | — | | | 872 | |

| Equity securities, at fair value: | | | | | | | |

Common stocks | 51,691 | | | — | | | — | | | 51,691 | |

| Short-term investments: | | | | | | | |

| Money market funds and U.S. Treasury bills | 103,649 | | | — | | | — | | | 103,649 | |

Total | $ | 191,523 | | | $ | — | | | $ | — | | | $ | 191,523 | |

The Company did not hold any Level 3 category debt or marketable equity investment securities as of September 30, 2023 or December 31, 2022.

There were no transfers into or out of Levels 1, 2 or 3 during the periods presented.

To help ensure that estimated fair value determinations are consistent with GAAP, prices from our pricing services go through multiple review processes to ensure appropriate pricing. Pricing procedures and inputs used to price each security include, but are not limited to, the following: unadjusted quoted market prices for identical securities such as stock market closing prices; non-binding quoted prices for identical securities in markets that are not active; interest rates; yield curves observable at commonly quoted intervals; volatility; prepayment speeds; loss severity; credit risks; and default rates. The Company reviews the procedures and inputs used by its pricing services, and verifies a sample of the services’ quotes by comparing them to values obtained from other pricing resources. In the event the Company disagrees with a price provided by its pricing services, the respective service reevaluates the price to corroborate the market information and then reviews inputs to the evaluation in light of potentially new market data.

Certain equity investments under the measurement alternative and notes receivable are measured at estimated fair value on a non-recurring basis and are reviewed for impairment quarterly. If any such investment is determined to be impaired, an impairment charge is recorded against such investment and reflected in the unaudited Consolidated Statements of Operations. There were no impairments of such investments made during the nine-month period ended September 30, 2023 or the twelve-month period ended December 31, 2022. The following table presents assets measured at fair value on a non-recurring basis as of September 30, 2023 and December 31, 2022:

| | | | | | | | | | | | | | | | | | | | | | | |

As of September 30, 2023 (in thousands) | Level 1 | | Level 2 | | Level 3 | | Total |

| Financial assets: | | | | | | | |

| Equity investments in unconsolidated affiliates, measurement alternative | $ | — | | | $ | — | | | $ | 9,478 | | | $ | 9,478 | |

| Notes receivable | — | | | — | | | 2,339 | | | 2,339 | |

Total | $ | — | | | $ | — | | | $ | 11,817 | | | $ | 11,817 | |

| | | | | | | | | | | | | | | | | | | | | | | |

As of December 31, 2022 (in thousands) | Level 1 | | Level 2 | | Level 3 | | Total |

| Financial assets: | | | | | | | |

| Equity investments in unconsolidated affiliates, measurement alternative | $ | — | | | $ | — | | | $ | 8,915 | | | $ | 8,915 | |

| Notes receivable | — | | | — | | | 1,921 | | | 1,921 | |

| Total | $ | — | | | $ | — | | | $ | 10,836 | | | $ | 10,836 | |

Note 7 – Commitments and Contingencies

Legal Proceedings – The Company and its subsidiaries are involved in legal proceedings that are incidental to their business. In the Company’s opinion, based on the present status of these proceedings, any potential liability of the Company or its subsidiaries with respect to these legal proceedings is not expected to, in the aggregate, be material to the Company’s consolidated financial condition or operations.

Regulation – The Company’s title insurance and trust subsidiaries are regulated by various federal, state and local governmental agencies and are subject to various audits and inquiries. It is the opinion of management based on its present expectations that these audits and inquiries will not have a material impact on the Company’s consolidated financial condition or operations.

Escrow and Trust Deposits – As a service to its customers, the Company, through ITIC, administers escrow and trust deposits representing earnest money received under real estate contracts, escrow funds received under escrow agreements, undisbursed amounts received for settlement of mortgage loans and indemnities against specific title risks. These amounts are not considered assets of the Company and, therefore, are excluded from the accompanying unaudited Consolidated Balance Sheets; however, the Company remains contingently liable for the disposition of these deposits.

Like-Kind Exchanges Proceeds – In administering tax-deferred like-kind exchanges pursuant to § 1031 of the Internal Revenue Code, the Company’s wholly owned subsidiary, Investors Title Exchange Corporation (“ITEC”), serves as a qualified intermediary, holding the net sales proceeds from relinquished property to be used for purchase of replacement property. Another Company wholly owned subsidiary, Investors Title Accommodation Corporation (“ITAC”), serves as exchange accommodation titleholder and, through LLCs that are wholly owned subsidiaries of ITAC, holds property in reverse exchange transactions. Like-kind exchange deposits and reverse exchange property totaled approximately $263.6 million and $432.0 million as of September 30, 2023 and December 31, 2022, respectively. These amounts are not considered assets of the Company and, therefore, are excluded from the accompanying unaudited Consolidated Balance Sheets; however, the Company remains contingently liable for the disposition of the transfers of property, disbursements of proceeds and the return on the proceeds at the agreed upon rate. Exchange services revenue includes earnings on these deposits; therefore, investment income is shown as other income rather than investment income. These like-kind exchange funds are primarily invested in money market funds and other short-term investments.

Note 8 – Related Party Transactions

The Company does business with, and has investments in, unconsolidated LLCs that are primarily title insurance agencies. The Company utilizes the equity method to account for its investment in these LLCs. The following table sets forth the approximate values by year found within each financial statement classification:

| | | | | | | | |

Financial Statement Classification,

Consolidated Balance Sheets (unaudited)

(in thousands) | As of

September 30, 2023 | As of

December 31, 2022 |

| Other investments | $ | 5,636 | | $ | 4,420 | |

| Premium and fees receivable | $ | 881 | | $ | 735 | |

| | | | | | | | | | | | | | |

Financial Statement Classification,

Consolidated Statements of Operations (unaudited)

(in thousands) | Three Months Ended

September 30, | Nine Months Ended

September 30, |

|

| 2023 | 2022 | 2023 | 2022 |

| Net premiums written | $ | 6,285 | | $ | 6,935 | | $ | 16,692 | | $ | 20,921 | |

| Non-title services and other investment income | $ | 598 | | $ | 1,237 | | $ | 3,095 | | $ | 3,493 | |

| Commissions to agents | $ | 4,288 | | $ | 4,969 | | $ | 11,134 | | $ | 14,501 | |

Note 9 – Intangible Assets, Goodwill and Title Plants

Intangible Assets

The estimated fair values of intangible assets recognized as the result of title insurance agency acquisitions are principally based on values obtained from an independent third-party valuation service and are all Level 3 inputs. Management determined that no events or changes in circumstances occurred during the three or nine-month periods ended September 30, 2023 and 2022 that would indicate the carrying amounts may not be recoverable, and therefore, determined that no identifiable intangible assets were impaired.

Identifiable intangible assets consist of the following:

| | | | | | | | |

| (in thousands) | As of

September 30, 2023 | As of

December 31, 2022 |

| Referral relationships | $ | 8,898 | | $ | 8,898 | |

| Non-compete agreements | 3,155 | | 3,155 | |

| Tradename | 747 | | 747 | |

Total | 12,800 | | 12,800 | |

| Accumulated amortization | (5,837) | | (4,814) | |

Identifiable intangible assets, net | $ | 6,963 | | $ | 7,986 | |

The following table provides the estimated aggregate amortization expense, as of September 30, 2023, for each of the five succeeding fiscal years:

| | | | | |

| Year Ended (in thousands) | |

| 2023 | $ | 338 | |

| 2024 | 1,178 | |

| 2025 | 1,095 | |

| 2026 | 1,095 | |

| 2027 | 679 | |

| Thereafter | 2,391 | |

Total | $ | 6,776 | |

Goodwill and Title Plants

As of September 30, 2023, the Company recognized $9.6 million in goodwill and $1.5 million in title plants, net of impairments, as the result of title insurance agency acquisitions. The title plants are included with other assets in the unaudited Consolidated Balance Sheets. The fair values of goodwill and the title plants as of the date of acquisition, both Level 3 inputs, were principally based on values obtained from an independent third-party valuation service. In accordance with FASB's Accounting Standards Codification ("ASC") 350, the Company determined that no events or changes in circumstances occurred during the nine-month periods ended September 30, 2023 and 2022 that would indicate the carrying amounts may not be recoverable, and therefore, determined that there were no goodwill or title plant impairments.

Note 10 – Accumulated Other Comprehensive (Loss) Income

The following table provides changes in the balances of each component of accumulated other comprehensive (loss) income, net of tax, for the three- and nine-month periods ended September 30, 2023 and 2022:

| | | | | | | | | | | | | | | | | |

Three Months Ended

September 30, 2023 (in thousands) | Unrealized Gains and

Losses

On Available-for-Sale

Securities | | Postretirement

Benefits Plans | | Total |

Beginning balance at June 30, 2023 | $ | 19 | | | $ | 142 | | | $ | 161 | |

| Other comprehensive loss before calculations | (984) | | | (6) | | | (990) | |

Amounts reclassified from accumulated other comprehensive (loss) income | 74 | | | — | | | 74 | |

| Net current-period other comprehensive loss | (910) | | | (6) | | | (916) | |

| Ending balance | $ | (891) | | | $ | 136 | | | $ | (755) | |

| | | | | | | | | | | | | | | | | |

Three Months Ended

September 30, 2022 (in thousands) | Unrealized Gains and

Losses

On Available-for-Sale

Securities | | Postretirement

Benefits Plans | | Total |

Beginning balance at June 30, 2022 | $ | 397 | | | $ | 23 | | | $ | 420 | |

| Other comprehensive (loss) income before calculations | (1,257) | | | 13 | | | (1,244) | |

Amounts reclassified from accumulated other comprehensive (loss) income | 73 | | | — | | | 73 | |

| Net current-period other comprehensive (loss) income | (1,184) | | | 13 | | | (1,171) | |

Ending balance | $ | (787) | | | $ | 36 | | | $ | (751) | |

| | | | | | | | | | | | | | | | | |

Nine Months Ended

September 30, 2023 (in thousands) | Unrealized Gains and

Losses

On Available-for-Sale

Securities | | Postretirement

Benefits Plans | | Total |

Beginning balance at January 1, 2023 | $ | 164 | | | $ | 36 | | | $ | 200 | |

| Other comprehensive (loss) income before calculations | (1,215) | | | 100 | | | (1,115) | |

Amounts reclassified from accumulated other comprehensive (loss) income | 160 | | | — | | | 160 | |

| Net current-period other comprehensive (loss) income | (1,055) | | | 100 | | | (955) | |

| Ending balance | $ | (891) | | | $ | 136 | | | $ | (755) | |

| | | | | | | | | | | | | | | | | |

Nine Months Ended

September 30, 2022 (in thousands) | Unrealized Gains and

Losses

On Available-for-Sale

Securities | | Postretirement

Benefits Plans | | Total |