This prospectus, any

accompanying prospectus supplement and the documents incorporated by reference herein and therein may contain “forward-looking

statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements are generally identified

by use of words such as “will likely result,” “are expected to,” “will continue,” “is

anticipated,” “estimated,” “believe,” “intend,” “plan,” “projection,”

“outlook,” “target,” “seek,” or words of similar meaning. These forward-looking statements

include, but are not limited to, statements regarding future opportunities for the Company and the Company’s estimated future

results. Such forward-looking statements are based upon the current beliefs and expectations of our management and are inherently

subject to significant business, economic and competitive uncertainties and contingencies, many of which are difficult to predict

and generally beyond our control. Actual results and the timing of events may differ materially from the results anticipated in

these forward-looking statements.

In addition to

factors previously disclosed in prior reports filed with the Commission and those identified elsewhere in this prospectus, the

following risks, among others, could cause actual results and the timing of events to differ materially from the anticipated results

or other expectations expressed in the forward-looking statements: the benefits of the Business Combination; the future financial

performance of the Company and its subsidiaries, including Newco (as defined below); changes in the market in which the Company

competes; expansion and other plans and opportunities; the effect of the COVID-19 pandemic on the Company’s business; the

Company’s ability to raise financing in the future; the Company’s ability to maintain the listing of its Common Stock

on Nasdaq; other factors detailed under the section titled “Risk Factors” in this Amendment No. 2 to Form S-3

on Form S-1 Registration Statement (the “Registration Statement”).

Actual results, performance

or achievements may differ materially, and potentially adversely, from any projections and forward-looking statements and the assumptions

on which those forward-looking statements are based. There can be no assurance that the data contained herein is reflective of

future performance to any degree. You are cautioned not to place undue reliance on forward-looking statements as a predictor of

future performance. All information set forth herein speaks only as of the date hereof, in the case of information about the Company,

or as of the date of such information, in the case of information from persons other than the Company, and we disclaim any intention

or obligation to update any forward-looking statements as a result of developments occurring after the date of this prospectus.

Forecasts and estimates regarding the Company’s industry and end markets are based on sources we believe to be reliable,

however there can be no assurance these forecasts and estimates will prove accurate in whole or in part. Annualized, pro forma,

projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results.

SUMMARY FINANCIAL AND OTHER DATA OF

GPAQ

The following table

sets forth selected historical financial information derived from GPAQ’s unaudited financial statements as of and for the

six months ended June 30, 2020 and 2019 and GPAQ’s audited financial statements as of and for the years ended December 31,

2019 and 2018, each of which is included elsewhere in this prospectus. Such financial information should be read in conjunction

with the audited financial statements and related notes included elsewhere in this prospectus.

The historical results

presented below are not necessarily indicative of the results to be expected for any future period. You should carefully read the

following selected financial information in conjunction with the section entitled “Management’s Discussion and Analysis

of Financial Condition and Results of Operations of GPAQ” and GPAQ’s financial statements and the related notes

appearing elsewhere in this prospectus.

|

|

|

Six Months Ended

June

30,

2020

|

|

|

Six Months Ended

June

30,

2019

|

|

|

Year Ended

December 31,

2019

|

|

|

Year Ended

December 31,

2018

|

|

|

Statement of Operations Data:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating costs

|

|

$

|

1,893,499

|

|

|

$

|

323,167

|

|

|

$

|

1,415,881

|

|

|

$

|

780,534

|

|

|

Loss from operations

|

|

|

(1,893,499

|

)

|

|

|

(323,167

|

)

|

|

|

(1,415,881

|

)

|

|

|

(780,534

|

)

|

|

Other income

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income on marketable securities

|

|

|

310,441

|

|

|

|

1,504,270

|

|

|

|

2,651,036

|

|

|

|

2,132,976

|

|

|

Unrealized gain on marketable securities

|

|

|

—

|

|

|

|

3,217

|

|

|

|

9,588

|

|

|

|

13,795

|

|

|

Provision for income taxes

|

|

|

(4,439

|

)

|

|

|

(251,097

|

)

|

|

|

(424,383

|

)

|

|

|

(284,958

|

)

|

|

Net(loss)income

|

|

$

|

(1,587,497

|

)

|

|

$

|

933,223

|

|

|

$

|

820,360

|

|

|

$

|

1,081,279

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted net(loss)income per common share

|

|

$

|

(0.39

|

)

|

|

$

|

(0.04

|

)

|

|

$

|

(0.25

|

)

|

|

$

|

(0.12

|

)

|

|

Weighted average shares outstanding, basic and

diluted

|

|

|

4,393,098

|

|

|

|

4,057,156

|

|

|

|

4,098,986

|

|

|

|

3,953,561

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance Sheet Data:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash

|

|

$

|

55,896

|

|

|

$

|

53,359

|

|

|

$

|

2,122

|

|

|

$

|

89,557

|

|

|

Marketable securities held in Trust Account

|

|

$

|

—

|

|

|

$

|

129,140,984

|

|

|

$

|

117,285,210

|

|

|

$

|

128,396,771

|

|

|

Total assets

|

|

$

|

31,167,908

|

|

|

$

|

129,240,593

|

|

|

$

|

117,308,755

|

|

|

$

|

128,492,855

|

|

|

Common stock subject to possible redemption

|

|

$

|

15,367,151

|

|

|

$

|

119,384,346

|

|

|

$

|

104,308,846

|

|

|

$

|

118,451,128

|

|

|

Total stockholders’ equity

|

|

$

|

5,000,011

|

|

|

$

|

5,000,009

|

|

|

$

|

5,000,001

|

|

|

$

|

5,000,004

|

|

UNAUDITED PRO FORMA COMBINED FINANCIAL

INFORMATION

Introduction

The following unaudited

pro forma combined financial information is provided to aid you in your analysis of the financial aspects of the Business Combination.

The unaudited pro

forma combined balance sheet as of June 30, 2020 gives pro forma effect to the Business Combination as if it had been consummated

as of that date. The unaudited pro forma combined statements of operations for the six months ended June 30, 2020 and for the year

ended December 31, 2019 give pro forma effect to the Business Combination as if it had occurred as of January 1, 2019. This information

should be read together with “Management’s Discussion and Analysis of Financial Condition and Results of Operations

of HOF Village,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations

of GPAQ” and HOF Village’s and GPAQ’s respective audited and unaudited financial statements and related notes

included elsewhere in this prospectus.

The unaudited pro

forma combined balance sheet as of June 30, 2020 has been prepared using the following:

|

|

●

|

HOF Village’s unaudited historical condensed consolidated balance sheet as of June 30, 2020,

as included elsewhere in this prospectus; and

|

|

|

●

|

GPAQ’s unaudited historical consolidated balance sheet as of June 30, 2020, as included elsewhere

in this prospectus.

|

The unaudited pro

forma combined statement of operations for the six months ended June 30, 2020 has been prepared using the following:

|

|

●

|

HOF Village’s unaudited historical consolidated statement of operations for the six months

ended June 30, 2020, as included elsewhere in this prospectus; and

|

|

|

●

|

GPAQ’s unaudited historical statement of operations for the six months ended June 30, 2020,

as included elsewhere in this prospectus.

|

The unaudited pro

forma combined statement of operations for the year ended December 31, 2019 has been prepared using the following:

|

|

●

|

HOF Village’s audited historical consolidated statement of operations for the year ended

December 31, 2019, as included elsewhere in this prospectus; and

|

|

|

●

|

GPAQ’s audited historical consolidated statement of operations for the year ended December

31, 2019, as included elsewhere in this prospectus.

|

Description of the Business Combination

GPAQ acquired 100%

of the issued and outstanding securities of Newco (the “Newco Units”), in exchange for 18,120,907 shares of Common

Stock of Hall of Fame Resort & Entertainment Company (formerly GPAQ Acquisition Holdings, Inc.). For more information about

the Business Combination, please see the section entitled “Summary of Prospectus -- Background” above. Copies

of the Merger Agreement, Amendment No. 1 to the Agreement and Plan of Merger, Amendment No. 2 to the Agreement and Plan of Merger

and Amendment No. 3 to the Agreement and Plan of Merger are included as exhibits to the Registration Statement in which this prospectus

is included.

Accounting for the Business Combination

The Business Combination

will be accounted for as a reverse merger in accordance with U.S. GAAP. Under this method of accounting, GPAQ will be treated as

the “acquired” company for financial reporting purposes. This determination was primarily based on the holders of Newco

Units expecting to have a majority of the voting power of HOFRE, Newco’s senior management comprising substantially all of

the senior management of HOFRE, the relative size of Newco compared to GPAQ, and Newco’s operations comprising the ongoing

operations of HOFRE. Accordingly, for accounting purposes, the Business Combination will be treated as the equivalent of a capital

transaction in which Newco is issuing stock for the net assets of GPAQ. The net assets of GPAQ will be stated at historical cost,

with no goodwill or other intangible assets recorded. Operations prior to the Business Combination will be those of HOF Village.

Basis of Pro Forma Presentation

The historical financial

information has been adjusted to give pro forma effect to events that are related and/or directly attributable to the Business

Combination, are factually supportable, and as it relates to the unaudited pro forma combined statement of operations, are expected

to have a continuing impact on the results of HOFRE. The adjustments presented on the unaudited pro forma combined financial statements

have been identified and presented to provide relevant information necessary for an accurate understanding of HOFRE upon consummation

of the Business Combination.

The unaudited pro

forma combined financial information is for illustrative purposes only. The financial results may have been different had the companies

always been combined. You should not rely on the unaudited pro forma combined financial information as being indicative of the

historical financial position and results that would have been achieved had the companies always been combined or the future financial

position and results that HOFRE will experience. HOF Village and GPAQ have not had any historical relationship prior to the Business

Combination. Accordingly, no pro forma adjustments were required to eliminate activities between the companies.

There is no historical

activity with respect to Acquiror Merger Sub, GPAQ Acquisition Holdings, Inc., or Company Merger Sub, and accordingly, no adjustments

were required with respect to these entities in the pro forma combined financial statements.

Included in the shares

outstanding and weighted average shares outstanding as presented in the pro forma combined financial statements are 18,120,907

shares of Common Stock issued to HOF Village stockholders.

PRO FORMA

COMBINED BALANCE SHEET

AS OF JUNE 30, 2020

(UNAUDITED)

|

|

|

(A)

HOF Village

|

|

|

(B)

GPAQ

|

|

|

Pro Forma

Adjustments

|

|

|

Pro Forma

Balance Sheet

|

|

|

Assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash

|

|

$

|

2,149,500

|

|

|

$

|

55,896

|

|

|

$

|

31,043,986

|

(1)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(6,233,473

|

)(3)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(278,938

|

)(5)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7,000,000

|

(6)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(15,500,000

|

)(7)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(9,205

|

)(8)

|

|

$

|

18,227,766

|

|

|

Restricted cash

|

|

|

11,460,679

|

|

|

|

-

|

|

|

|

-

|

|

|

|

11,460,679

|

|

|

Accounts receivable, net

|

|

|

1,701,554

|

|

|

|

-

|

|

|

|

-

|

|

|

|

1,701,554

|

|

|

Prepaid expenses and other current assets

|

|

|

5,843,579

|

|

|

|

68,026

|

|

|

|

-

|

|

|

|

5,911,605

|

|

|

Cash held in Trust Account

|

|

|

-

|

|

|

|

31,043,986

|

|

|

|

(31,043,986

|

)(1)

|

|

|

-

|

|

|

Property and equipment, net

|

|

|

129,621,854

|

|

|

|

-

|

|

|

|

-

|

|

|

|

129,621,854

|

|

|

Project development costs

|

|

|

105,461,050

|

|

|

|

-

|

|

|

|

-

|

|

|

|

105,461,050

|

|

|

Total Assets

|

|

$

|

256,238,216

|

|

|

$

|

31,167,908

|

|

|

$

|

(15,021,616

|

)

|

|

$

|

272,384,508

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities and Shareholders’ Equity

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Notes payable, net

|

|

$

|

204,202,428

|

|

|

$

|

-

|

|

|

$

|

(31,992,266

|

)(5)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(13,721,293

|

)(6)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(15,500,000

|

)(7)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(52,068,245

|

)(9)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(3,500,000

|

)(9)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(2,300,000

|

)(5)

|

|

$

|

85,120,624

|

|

|

Convertible notes payable

|

|

$

|

-

|

|

|

$

|

-

|

|

|

|

20,721,293

|

(6)

|

|

|

20,721,293

|

|

|

Accounts payable and accrued expenses

|

|

|

17,082,645

|

|

|

|

1,604,508

|

|

|

|

(1,674,872

|

)(3)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(100,000

|

)(4)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(3,580,471

|

)(5)

|

|

|

13,331,810

|

|

|

Due to affiliate

|

|

|

12,015,489

|

|

|

|

-

|

|

|

|

(11,566,557

|

)(4)

|

|

|

448,932

|

|

|

Promissory note - related party

|

|

|

-

|

|

|

|

4,744,958

|

|

|

|

(4,744,958

|

)(2)

|

|

|

-

|

|

|

Other liabilities

|

|

|

7,125,402

|

|

|

|

3,780

|

|

|

|

(2,916,477

|

)(9)

|

|

|

4,212,705

|

|

|

Deferred underwriting fees

|

|

|

-

|

|

|

|

4,375,000

|

|

|

|

(4,375,000

|

)(3)

|

|

|

-

|

|

|

Deferred legal fee payable

|

|

|

-

|

|

|

|

72,500

|

|

|

|

(72,500

|

)(3)

|

|

|

-

|

|

|

Total Liabilities

|

|

|

240,425,964

|

|

|

|

10,800,746

|

|

|

|

(127,391,346

|

)

|

|

|

123,835,364

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commitments and Contingencies

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common stock subject to redemption

|

|

|

-

|

|

|

|

15,367,151

|

|

|

|

(15,367,151

|

)(8)

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shareholders’ Equity

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Members’ equity

|

|

|

15,812,252

|

|

|

|

-

|

|

|

|

(15,812,252

|

)(9)

|

|

|

-

|

|

|

Class A common stock

|

|

|

-

|

|

|

|

145

|

|

|

|

51

|

(2)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

229

|

(4)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

487

|

(5)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

144

|

(8)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,812

|

(9)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

313

|

(10)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

716

|

(11)

|

|

|

3,897

|

|

|

Class F common stock

|

|

|

-

|

|

|

|

313

|

|

|

|

(313

|

)(10)

|

|

|

-

|

|

|

Additional paid in capital

|

|

|

-

|

|

|

|

4,687,827

|

|

|

|

4,744,907

|

(2)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

22,053,168

|

(4)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

40,505,076

|

(5)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15,357,802

|

(8)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(716

|

)(11)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

122,142,490

|

(9)

|

|

|

209,490,554

|

|

|

Retained earnings (Accumulated deficit)

|

|

|

-

|

|

|

|

311,726

|

|

|

|

(111,101

|

)(3)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(10,386,840

|

)(4)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(2,911,764

|

)(5)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(47,847,328

|

)(9)

|

|

|

(60,945,307

|

)

|

|

Total Shareholders’ Equity

|

|

|

15,812,252

|

|

|

|

5,000,011

|

|

|

|

127,736,881

|

|

|

|

148,549,144

|

|

|

Total Liabilities and Shareholders’ Equity

|

|

$

|

256,238,216

|

|

|

$

|

31,167,908

|

|

|

$

|

(15,021,616

|

)

|

|

$

|

272,384,508

|

|

Pro Forma Adjustments to the Unaudited

Combined Balance Sheet

|

|

(A)

|

Derived from the unaudited condensed consolidated balance sheet of HOF Village as of June 30, 2020.

See HOF Village’s financial statements and the related notes appearing elsewhere in this prospectus.

|

|

|

(B)

|

Derived from the unaudited consolidated balance sheet of GPAQ as of June 30, 2020. See GPAQ’s

financial statements and the related notes appearing elsewhere in this prospectus.

|

|

|

(1)

|

Reflects the release of cash from marketable securities held in the trust account.

|

|

|

(2)

|

Reflects

the conversion of promissory notes in the aggregate amount of $4,744,958 due to Gordon Pointe Management, LLC into 510,772

shares of Common Stock of HOFRE.

|

|

|

(3)

|

Reflects the payment of fees and expenses related to the Business Combination, including the deferred

underwriting fee of $4,375,000, the deferred legal fee of $72,500, and legal, financial advisory, accounting and other professional

fees. Transaction related expenses of $1,604,508 are classified in accounts payable for GPAQ and $70,364 for HOF Village as of

June 30, 2020. The direct, incremental costs of the Business Combination related to the legal, financial advisory, accounting and

other professional fees of $111,101 is reflected as an adjustment to retained earnings and is not shown as an adjustment to the

statement of operations since it is a nonrecurring charge resulting directly from the Business Combination.

|

|

|

(4)

|

Reflects (a) the issuance of 1,078,984 shares of Common Stock at $10.00 per share to The Klein

Group, LLC in satisfaction of outstanding fees and expenses in the aggregate amount of $10,789,840, of which $10,289,840 is reflected

as an adjustment to retained earnings and $500,000 is reflected as an adjustment to due to affiliates, (b) the issuance of 610,000

shares of Common Stock at $10.00 per share to IRG, LLC in satisfaction of outstanding fees and expenses in the aggregate amount

of $6,100,000, which is reflected as an adjustment to due to affiliates, (c) the issuance of 580,000 shares of Common Stock at

$10.00 per share, or $5,800,000, to the PFHOF in satisfaction of outstanding fees and expenses, of which $4,966,557 is reflected

as an adjustment to due to affiliates and $833,443 is reflected as an adjustment to additional paid in capital and (d) the issuance

of 23,640 shares of Common Stock at $10.00 per share to a vendor in satisfaction of outstanding fees and expenses in the aggregate

amount of $197,000, of which $100,000 is reflected as an adjustment to accounts payable and $97,000 is reflected as an adjustment

to retained earnings. Direct, incremental costs of $10,386,840 is reflected as an adjustment to retained earnings and is not shown

as an adjustment to the statement of operations since it is a nonrecurring charge resulting directly from the Business Combination.

|

|

|

(5)

|

Reflects the issuance of an aggregate of 4,872,604 shares of Common Stock in satisfaction of prior

existing debt in the amount of $35,454,742 and related accrued interest in the amount of $3,364,228 and the corresponding amortization

of the related remaining deferred financing costs in connection with the Business Combination. Of such amount, 2,172,186 shares

were issued at $10.00 per share in satisfaction of $15,000,000 of bridge loans and $3,101,550 of accrued interest after giving

effect to the Exchange Ratio (as defined in the Merger Agreement), 1,493,286 shares were issued at $10.00 per share in satisfaction

of $12,181,272 of “Company Convertible Notes” and $262,678 of accrued interest after giving effect to the Exchange

Ratio, 130,000 shares were issued at $10.00 per share in satisfaction of $1,300,000 of “New Company Convertible Notes”

and an aggregate of 849,308 shares were issued at $10.00 per share in satisfaction of $7,073,470 of syndicated unsecured term loan,

of which $100,000 is reflected as an adjustment to due to affiliates, after giving effect to the Exchange Ratio and an aggregate

of 227,824 shares were issued at $10.00 per share in satisfaction of $2,278,233 of “New ACC Debt” which is classified

in notes payable. The amortization of the deferred financing costs in the aggregate amount of $2,911,764 is reflected as an adjustment

to retained earnings and is not shown as an adjustment to the statement of operations since it is a nonrecurring charge resulting

directly from the Business Combination. In addition, holders of $278,938 of Company Convertible Notes of HOF Village elected to

receive cash at the time of the closing of the Business Combination.

|

|

|

(6)

|

Reflects the issuance of convertible debt in connection with the PIPE Notes for $7,000,000 in

cash and the conversion of prior existing notes payable. Of the prior existing notes payable, $9,000,000 of the IRG November

Note, $3,471,293 of Company Convertible Notes, $750,000 of New Company Convertible Notes and $500,000 of sponsor loans were

converted into an aggregate of $13,721,293 of convertible loans in connection with the PIPE Notes.

|

|

|

(7)

|

Reflects the repayment of $15,500,000 of the Bridge Loan at the consummation of the Business Combination.

|

|

|

(8)

|

Reflects the cancellation of 852 shares of Common Stock for stockholders who elected cash conversion

for payment of $9,205 and the reclassification of 1,421,721 shares of Common Stock subject to redemption to permanent equity for

those stockholders who did not exercise their redemption rights.

|

|

|

(9)

|

Reflects the recapitalization of HOF Village through (a) the contribution of all the share capital

in HOF Village to GPAQ in the amount of $15,812,252, (b) the conversion of the redemption value of the preferred members’

equity in the amount of $99,603,847, of which $3,500,000 is reflected as an adjustment to notes payable, net of the amortization

of the related remaining deferred financing costs in the amount of $47,535,602, and related preferred equity dividends in the amount

of $2,916,477, (c) the issuance of 18,120,907 shares of Common Stock and (d) the elimination of the historical retained earnings

of GPAQ, the accounting acquire in the amount of $311,726.

|

|

|

(10)

|

Reflects the conversion of 3,125,000 shares of Class F common stock into Class A common stock,

on a one-for-one basis, at the consummation of the Business Combination.

|

|

|

(11)

|

Reflects entries for stock issued as a part of Michael Crawford’s stock based compensation.

|

PRO FORMA

COMBINED STATEMENT OF OPERATIONS

SIX MONTHS ENDED JUNE 30, 2020

(UNAUDITED)

|

|

|

(A)

HOF Village

|

|

|

(B)

GPAQ

|

|

|

Pro Forma

Adjustments

|

|

|

Pro Forma

Income

Statement

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total revenues

|

|

$

|

3,667,126

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

3,667,126

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Property operating expenses

|

|

|

9,112,269

|

|

|

|

-

|

|

|

|

1,510,610

|

(6)

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(2,244,800

|

)(1)

|

|

|

8,378,079

|

|

|

Commission expense

|

|

|

1,057,980

|

|

|

|

-

|

|

|

|

-

|

|

|

|

1,057,980

|

|

|

Depreciation expense

|

|

|

5,445,423

|

|

|

|

-

|

|

|

|

-

|

|

|

|

5,445,423

|

|

|

Operating expenses

|

|

|

-

|

|

|

|

1,893,499

|

|

|

|

(1,604,193

|

)(1)

|

|

|

289,306

|

|

|

Loss from operations

|

|

|

(11,948,546

|

)

|

|

|

(1,893,499

|

)

|

|

|

2,338,383

|

|

|

|

(11,503,662

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expense):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income

|

|

|

-

|

|

|

|

310,441

|

|

|

|

(310,441

|

)(2)

|

|

|

-

|

|

|

Interest expense

|

|

|

(4,209,795

|

)

|

|

|

-

|

|

|

|

2,623,421

|

(3)

|

|

|

(1,586,374

|

)

|

|

Amortization of discount on note payable

|

|

|

(6,677,746

|

)

|

|

|

-

|

|

|

|

5,923,305

|

(3)

|

|

|

(754,441

|

)

|

|

Loss before income taxes

|

|

|

(22,836,087

|

)

|

|

|

(1,583,058

|

)

|

|

|

10,574,668

|

|

|

|

(13,844,477

|

)

|

|

Provision for income taxes

|

|

|

-

|

|

|

|

(4,439

|

)

|

|

|

4,439

|

(4)

|

|

|

-

|

|

|

Net loss

|

|

$

|

(22,836,087

|

)

|

|

$

|

(1,587,497

|

)

|

|

$

|

10,579,107

|

|

|

$

|

(13,844,477

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding, basic and diluted

|

|

|

18,120,907

|

|

|

|

4,398,098

|

|

|

|

28,136,907

|

(5)

|

|

|

32,535,005

|

|

|

Basic and diluted net loss per share

|

|

$

|

(1.26

|

)

|

|

$

|

(0.39

|

)

|

|

|

|

|

|

$

|

(0.43

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding, diluted

|

|

|

18,120,907

|

|

|

|

4,398,098

|

|

|

|

28,136,907

|

(5)

|

|

|

32,535,005

|

|

|

Diluted net income (loss) per share

|

|

$

|

(1.26

|

)

|

|

$

|

(0.39

|

)

|

|

|

|

|

|

$

|

(0.43

|

)

|

PRO FORMA

COMBINED STATEMENT OF OPERATIONS

YEAR ENDED DECEMBER 31, 2019

(UNAUDITED)

|

|

|

(C)

HOF Village

|

|

|

(D)

GPAQ

|

|

|

Pro Forma

Adjustments

|

|

|

Pro Forma

Income

Statement

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total revenues

|

|

$

|

7,861,331

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

7,861,331

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Property operating expenses

|

|

|

16,707,537

|

|

|

|

-

|

|

|

|

3,021,220

|

(7)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(320,681

|

)(1)

|

|

|

19,408,076

|

|

|

Commission expense

|

|

|

1,003,226

|

|

|

|

-

|

|

|

|

-

|

|

|

|

1,003,226

|

|

|

Depreciation expense

|

|

|

10,915,839

|

|

|

|

-

|

|

|

|

-

|

|

|

|

10,915,839

|

|

|

Loss on abandonment of project development costs

|

|

|

12,194,783

|

|

|

|

-

|

|

|

|

-

|

|

|

|

12,194,783

|

|

|

Operating expenses

|

|

|

-

|

|

|

|

1,415,881

|

|

|

|

(769,247

|

)(1)

|

|

|

646,634

|

|

|

Loss from operations

|

|

|

(32,960,054

|

)

|

|

|

(1,415,881

|

)

|

|

|

(1,931,292

|

)

|

|

|

(36,307,227

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expense):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income

|

|

|

-

|

|

|

|

2,651,036

|

|

|

|

(2,651,036

|

)(2)

|

|

|

-

|

|

|

Unrealized gain on marketable securities

|

|

|

-

|

|

|

|

9,588

|

|

|

|

(9,588

|

)(2)

|

|

|

-

|

|

|

Interest expense

|

|

|

(9,416,099

|

)

|

|

|

-

|

|

|

|

5,252,496

|

(3)

|

|

|

(4,163,603

|

)

|

|

Amortization of discount on note payable

|

|

|

(13,274,793

|

)

|

|

|

-

|

|

|

|

10,274,086

|

(3)

|

|

|

(3,000,707

|

)

|

|

Other loss

|

|

|

(252,934

|

)

|

|

|

-

|

|

|

|

-

|

|

|

|

(252,934

|

)

|

|

(Loss) income before income taxes

|

|

|

(55,903,880

|

)

|

|

|

1,244,743

|

|

|

|

10,934,666

|

|

|

|

(43,724,471

|

)

|

|

Provision for income taxes

|

|

|

-

|

|

|

|

(424,383

|

)

|

|

|

424,383

|

(4)

|

|

|

-

|

|

|

Net (loss) income

|

|

$

|

(55,903,880

|

)

|

|

$

|

820,360

|

|

|

$

|

11,359,049

|

|

|

$

|

(43,724,471

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding, basic and diluted

|

|

|

18,120,907

|

|

|

|

4,098,986

|

|

|

|

28,436,019

|

(5)

|

|

|

32,535,005

|

|

|

Basic and diluted net (loss) income per share

|

|

$

|

(3.09

|

)

|

|

$

|

(0.25

|

)

|

|

|

|

|

|

$

|

(1.34

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding, diluted

|

|

|

18,120,907

|

|

|

|

4,098,986

|

|

|

|

28,436,019

|

(5)

|

|

|

32,535,005

|

|

|

Diluted net income (loss) per share

|

|

$

|

(3.09

|

)

|

|

$

|

(0.25

|

)

|

|

|

|

|

|

$

|

(1.34

|

)

|

Pro Forma Adjustments to the Unaudited

Combined Statements of Operations

|

|

(A)

|

Derived from the unaudited condensed consolidated statement of operations of HOF Village for the

six months ended June 30, 2020. See HOF Village’s financial statements and the related notes appearing elsewhere in this

prospectus.

|

|

|

(B)

|

Derived from the unaudited consolidated statement of operations of GPAQ for the six months ended

June 30, 2020. See GPAQ’s financial statements and the related notes appearing elsewhere in this prospectus.

|

|

|

(C)

|

Derived from the audited consolidated statement of operations of HOF Village for the year ended

December 31, 2019. See HOF Village’s financial statements and the related notes appearing elsewhere in this prospectus.

|

|

|

(D)

|

Derived from the audited statement of operations of GPAQ for the year ended December 31, 2019.

See GPAQ’s financial statements and the related notes appearing elsewhere in this prospectus.

|

|

|

(1)

|

Represents an adjustment to eliminate direct, incremental costs of the Business Combination which

are reflected in the historical financial statements of HOF Village and GPAQ in the amount of $2,244,800 and $1,604,193, respectively,

for the six months ended June 30, 2020 and $320,681 and $769,247, respectively, for the year ended December 31, 2019.

|

|

|

(2)

|

Represents an adjustment to eliminate interest income and unrealized gain on marketable securities

held in the trust account as of the beginning of the period.

|

|

|

(3)

|

Represents an adjustment to eliminate interest expense on certain of HOF Village’s notes

payable as of the beginning of the period, as these were repaid upon consummation of the Business Combination.

|

|

|

(4)

|

To record normalized blended statutory income tax benefit rate of 21% for pro forma financial presentation

purposes resulting in the recognition of an income tax benefit, which however, has been offset by a full valuation allowance as

HOFRE expects to incur continuing losses.

|

|

|

(5)

|

The calculation of weighted average shares outstanding for basic and diluted net loss per share

assumes that GPAQ’s initial public offering occurred as of January 1, 2019. In addition, as the Business Combination is being

reflected as if it had occurred on this date, the calculation of weighted average shares outstanding for basic and diluted net

loss per share assumes that the shares have been outstanding for the entire period presented. This calculation is retroactively

adjusted to eliminate the number of shares redeemed in the Business Combination for the entire period.

|

|

|

(6)

|

Reflects a stock based compensation expense of $1,510,610 for shares to Michael Crawford.

|

|

|

(7)

|

Reflects a stock based compensation expense of $3,021,220 for shares issued to Michael Crawford.

|

The following presents

the calculation of basic and diluted weighted average common shares outstanding. The computation of diluted loss per share excludes

the effect of 17,400,000 Warrants to purchase 24,731,196 shares of Common Stock because the inclusion of these securities would

be anti-dilutive.

|

|

|

Combined

|

|

|

Weighted average shares calculation, basic and diluted

|

|

|

|

|

GPAQ public shares

|

|

|

4,082,910

|

|

|

GPAQ Sponsor shares, net of cancelled shares

|

|

|

2,035,772

|

|

|

GPAQ Sponsor shares transferred to HOF Village

|

|

|

414,259

|

|

|

GPAQ shares issued in satisfaction of outstanding fees and expenses

|

|

|

2,292,624

|

|

|

GPAQ shares issued in satisfaction of prior existing debt

|

|

|

4,872,604

|

|

|

Stock based compensation shares

|

|

|

715,929

|

|

|

GPAQ shares issued in the Business Combination

|

|

|

18,120,907

|

|

|

Weighted average shares outstanding

|

|

|

32,535,005

|

|

|

Percent of shares owned by Newco

|

|

|

80.8

|

%

|

|

Percent of shares owned by GPAQ

|

|

|

19.2

|

%

|

COMPARATIVE

SHARE INFORMATION

The following table

sets forth the historical comparative share information for HOF Village and GPAQ on a stand-alone basis and the unaudited pro forma

combined share information for the six months ended June 30, 2020 and the year ended December 31, 2019, after giving effect to

the Business Combination.

You should read the

information in the following table in conjunction with the selected historical financial information summary and the historical

financial statements of HOF Village and GPAQ and related notes that are included elsewhere in this prospectus. The unaudited pro

forma combined share information is derived from, and should be read in conjunction with, the unaudited pro forma combined financial

statements and related notes included above.

The unaudited

pro forma combined share information below does not purport to represent what the actual results of operations or the

earnings per share would have been had the companies been combined during the periods presented, nor to project the

Company’s results of operations or earnings per share for any future date or period. The unaudited pro forma combined

stockholders’ equity per share information below does not purport to represent what the value of HOF Village and GPAQ

would have been had the companies been combined during the periods presented.

|

|

|

HOF Village

|

|

|

GPAQ

|

|

|

Combined

|

|

|

Six Months Ended June 30, 2020

|

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

$

|

(22,836,087

|

)

|

|

$

|

(1,587,497

|

)

|

|

$

|

(13,844,477

|

)

|

|

Total stockholders’ equity(1)

|

|

$

|

15,812,252

|

|

|

$

|

5,000,011

|

|

|

$

|

148,549,144

|

|

|

Weighted average shares outstanding – basic and diluted

|

|

|

18,120,907

|

|

|

|

4,398,098

|

|

|

|

32,535,005

|

|

|

Basic and diluted net loss per share

|

|

$

|

(1.26

|

)

|

|

$

|

(0.39

|

)

|

|

$

|

(0.43

|

)

|

|

Stockholders’ equity(1)per share – basic and diluted

|

|

$

|

0.87

|

|

|

$

|

1.14

|

|

|

$

|

4.57

|

|

|

|

(1)

|

Stockholders’ equity is used as a proxy for book value in the above table.

|

|

|

|

HOF Village

|

|

|

GPAQ

|

|

|

Combined

|

|

|

Year Ended December 31, 2019

|

|

|

|

|

|

|

|

|

|

|

Net (loss) income

|

|

$

|

(55,903,880

|

)

|

|

$

|

820,360

|

|

|

$

|

(43,724,471

|

)

|

|

Weighted average shares outstanding – basic and diluted

|

|

|

18,120,907

|

|

|

|

4,098,986

|

|

|

|

32,535,005

|

|

|

Basic and diluted net loss per share

|

|

$

|

(3.09

|

)

|

|

$

|

(0.25

|

)

|

|

$

|

(1.34

|

)

|

MARKET PRICE, TICKER SYMBOL AND DIVIDEND

INFORMATION

Market Price and Ticker Symbol

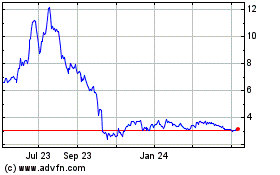

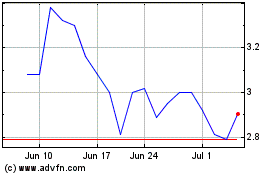

Our Common Stock and

Warrants are currently listed on Nasdaq under the symbols “HOFV,” and “HOFVW,” respectively.

The closing price

of the Common Stock and Warrants on September 21, 2020, was $3.14 and $0.40, respectively.

Holders

As of September

21, 2020, there were 40 holders of record of our Common Stock and 4 holders of record of our Warrants. Such numbers do not include

beneficial owners holding our securities through nominee names.

Dividend Policy

We have not paid any

cash dividends on our Common Stock to date. Any future dividend payments are within the absolute discretion of our board of directors

and will depend on, among other things, our results of operations, working capital requirements, capital expenditure requirements,

financial condition, level of indebtedness, contractual restrictions with respect to payment of dividends, business opportunities,

anticipated cash needs, provisions of applicable law and other factors that our board of directors may deem relevant.

RISK FACTORS

Investing in

our Common Stock involves a high degree of risk. Before you make a decision to buy our Common Stock, you should carefully

consider the risks described in this prospectus, as well as the risks described in any prospectus supplement or the reports

filed or subsequently filed with the Commission that are incorporated by reference herein. If any of these risks actually

occur, it may materially harm our business, financial condition, liquidity and results of operations. As a result, the market

price of our Common Stock could decline, and you could lose all or part of your investment. Additionally, the risks and

uncertainties described in this prospectus, any prospectus supplement or in any document incorporated by reference herein or

therein are not the only risks and uncertainties that we face. Additional risks and uncertainties not presently known to us

or that we currently believe to be immaterial may become material and adversely affect our business.

Unless the context

otherwise indicates or requires, as used in this section, the term “HOF Village” shall refer to HOF Village, LLC prior

to the Business Combination and Newco following the consummation of the Business Combination.

Risk Related to Our Business

We may not be able to continue

as a going concern.

We

have sustained recurring losses and negative cash flows from operations through June 30, 2020. In addition, our Bridge Loan matures

on November 30, 2020. Since inception, our operations have been funded principally through the issuance of debt. Our cash losses

from operations, in addition to our Bridge Loan, raise substantial doubt about our ability to continue operations as a going concern.

As of June 30, 2020, we had approximately $2.2 million of unrestricted cash. On July 1, 2020, HOF Village consummated its Business

Combination with GPAQ, whereby HOF Village’s then outstanding convertible notes were converted into equity, $15.0 million

of the Bridge Loan was converted into equity and $15.5 million of the Bridge Loan was repaid. The balance of approximately $34.5

million of the Bridge Loan is guaranteed by an affiliate of Industrial Realty Group. In the event that Industrial Realty Group

or one or more of its affiliates advances funds to the Company to pay off the Bridge Loan, under the terms of the guaranty, Industrial

Realty Group will become a lender to the Company with a maturity date of August 2021. On July 1, 2020, concurrently with the closing

of the Business Combination, the Company entered into the Note Purchase Agreement with the Purchasers, pursuant to which the Company

sold to the Purchasers in a private placement $20,721,293 in aggregate principal amount of the Company’s PIPE Notes. The

Company believes that, as a result of such recent events, it currently has sufficient cash and financing commitments to meet its

funding requirements over the next year. The Company expects that it will need to

raise additional financing to accomplish its development plan over the next several years. There can be no assurance as to the

availability or terms upon which such financing and capital might be available. Due to these and other factors, in management’s

opinion, there is substantial doubt of our ability to continue as a going concern within

one year after the date of the June 30, 2020 consolidated financial statements. Furthermore, HOF Village’s independent

auditor included an explanatory paragraph in their audit opinion as of December 31, 2019 concluding that there was substantial

doubt about HOF Village’s ability to continue as a going concern. If we are unable to continue as a going concern, we may

have to liquidate our assets, or be foreclosed upon, and may receive less than the value at which those assets are carried on

our consolidated financial statements, and it is likely that investors in our Common Stock will lose all or a part of their investment.

We are an early stage company

with a minimal track record and limited historical financial information available, and an investment in the offering is highly

speculative.

HOF Village was formed

as a limited liability company on December 16, 2015 by certain affiliates of Industrial Realty Group and a subsidiary of PFHOF,

to own and operate the Hall of Fame Village powered by Johnson Controls

in Canton, Ohio, as a premiere destination resort and entertainment company leveraging the expansive popularity of professional

football and the PFHOF. As a result of the Business Combination, HOF Village became a wholly owned subsidiary of HOFRE. As of the

date hereof, we anticipate that the Hall of Fame Village powered by Johnson

Controls will have the following major components:

Phase I:

|

|

●

|

Tom Benson Hall of Fame Stadium

|

|

|

●

|

National Youth Football & Sports Complex

|

|

|

●

|

Hall of Fame Village Media

|

Phase II:

|

|

●

|

Hall of Fame Indoor Waterpark (“Hall of Fame Indoor Waterpark”)

|

|

|

●

|

Constellation Center for Excellence (Office Building, Auditorium and Dining)

|

|

|

●

|

Center for Performance (Field House and Convention Center)

|

|

|

●

|

Hall of Fame retail promenade

|

Phase III:

|

|

●

|

Hall of Fame Experience (an immersive VR/AR experience)

|

|

|

●

|

Hotel including retail space

|

While the components

in Phase I are substantially complete, to date most components of Phase II and Phase III are still in the planning stage, and have

not commenced operations or generated any revenues. The components of the Hall

of Fame Village powered by Johnson Controls that have been developed in Phase I have limited operating history and business

track record. In addition, our business strategy is broad and may be subject to significant modifications in the future. Our current

strategy may not be successful, and if not successful, we may be unable to modify it in a timely and successful manner. A company

with this extent of operations still in the planning stage, and thus your investment in the offering, is highly speculative and

subject to an unusually high degree of risk. Prior to investing in the offering, you should understand that there is a significant

possibility of the loss of your entire investment.

Because we are in

the early stages of executing our business strategy, we cannot assure you that, or when, we will be profitable. We will need to

make significant investments to develop and operate the Hall of Fame Village

powered by Johnson Controls and expect to incur significant expenses in connection with operating components of the Hall

of Fame Village powered by Johnson Controls, including costs for entertainment, talent fees, marketing, salaries and maintenance

of properties and equipment. We expect to incur significant capital, operational and marketing expenses for a number of years in

connection with our planned activities. Any failure to achieve or sustain profitability may have a material adverse impact on the

value of the shares of our Common Stock.

Our ability to implement our

proposed business strategy may be materially and adversely affected by many known and unknown factors.

Our business strategy

relies upon our future ability to successfully develop and operate the Hall

of Fame Village powered by Johnson Controls. Our strategy assumes that we will be able to, among other things: secure sufficient

capital to repay our indebtedness; continue to lease or to acquire additional property in Canton, Ohio at attractive prices and

develop such property into efficient and profitable operations; and maintain our relationships with key partners, including PFHOF,

the general contractors for the Hall of Fame Village powered by Johnson

Controls, and various other design firms, technology consultants, managers and operators and vendors that we are relying

on for the successful development and operation of the Hall of Fame Village

powered by Johnson Controls, as well as to develop new relationships and partnerships with third parties that will be necessary

for the success of the Hall of Fame Village powered by Johnson Controls.

These assumptions, which are critical to our prospects for success, are subject to significant economic, competitive, regulatory

and operational uncertainties, contingencies and risks, many of which are beyond our control. These uncertainties are particularly

heightened by the fact that we have significantly limited historical financial results or data on which financial projections might

be based.

Our future ability

to execute our business strategy and develop the various components of the Hall

of Fame Village powered by Johnson Controls is uncertain, and it can be expected that one or more of our assumptions will

prove to be incorrect and that we will face unanticipated events and circumstances that may adversely affect our proposed business.

Any one or more of the following factors, or other factors which may be beyond our control, may have a material adverse effect

on our ability to implement our proposed strategy:

|

|

●

|

the impact of the pandemic involving the novel strain of coronavirus, COVID-19, governmental reactions

thereto, and economic conditions resulting from such governmental reactions to the pandemic on our business strategy, operations,

financial results, as well as on our future ability to access debt or equity financing;

|

|

|

●

|

inability to secure short-term liquidity in order to meet operating capital requirements and to

secure capital to make principal payments on our Bridge Loan, together with any interest due thereunder, which would result in

a default under the Bridge Loan and a likely suspension of development and construction for the Hall

of Fame Village powered by Johnson Controls. We previously received notices of default under the Bridge Loan, which is secured

by substantially all of our assets. Although the loan documents were amended to extend the time within which we must make principal

payments and bring the loan back into performing status and an affiliate of Industrial Realty Group has guaranteed certain payment

obligations under the Bridge Loan, there can be no assurance that we will be able to repay the obligation upon maturity or otherwise

avoid a future default;

|

|

|

●

|

failure to continue to lease or acquire additional property in Canton, Ohio at the level of prices

estimated;

|

|

|

●

|

inability to complete development and construction on schedule, on budget or otherwise in a timely

and cost-effective manner;

|

|

|

●

|

issues impacting the brand of the PFHOF;

|

|

|

●

|

inability to secure and maintain relationships and sponsorships with key partners, or a failure

by key partners to fulfill their obligations;

|

|

|

●

|

failure to manage rapidly expanding operations in the projected time frame;

|

|

|

●

|

our or our partners’ ability to provide innovative entertainment that competes favorably

against other entertainment parks and similar enterprises on the basis of price, quality, design, appeal, reliability and performance;

|

|

|

●

|

failure of investments in technology and machinery, including our investments in virtual reality

in connection with the proposed Hall of Fame Experience, to perform as expected;

|

|

|

●

|

increases in operating costs, including capital improvements, insurance premiums, general taxes,

real estate taxes and utilities, affecting our profit margins;

|

|

|

●

|

general economic, political and business conditions in the United States and, in particular, in

the Midwest and the geographic area around Canton, Ohio;

|

|

|

●

|

inflation, appreciation of the real estate and fluctuations in interest rates; or

|

|

|

●

|

existing and future governmental laws and regulations, including changes in our ability to use

or receive Tourism Development District (“TDD”) funds, tax-increment financing (“TIF”) funds or other grants

and tax credits (including Ohio Film Tax Credits).

|

We are relying on various forms

of public financing to finance the Company.

We currently expect

to obtain a portion of the capital required for the development and operations of the Hall

of Fame Village powered by Johnson Controls from various forms of public financing, including TDD funds, TIF funds, grants

and tax credits (including Ohio Film Tax Credits), which depend, in part, on factors outside of our control. The concept of a TDD

was created under state law specifically for Canton, Ohio and the Hall

of Fame Village powered by Johnson Controls. Canton City Council was permitted to designate up to 200 acres as a TDD and

to prove the collection of additional taxes within that acreage to be used to foster tourism development. Canton City Council passed

legislation allowing the collection of a 5% admissions tax and an additional 2% gross receipts tax and agreed to give the revenue

from its 3% municipal lodging tax collected at any hotels built in the TDD to the Hall of Fame Village powered by Johnson Controls

for 30 years. Our ability to obtain funds from TDD depends on, among other things, ticket sales (including parking lots, garages,

stadiums, auditoriums, museums, athletic parks, swimming pools and theaters), wholesale, retail and some food sales within the

TDD and revenues from our hotels within the TDD. For TIF funds, the amount of property tax that a specific district generates is

set at a base amount and as property values increase, property tax growth above that base amount, net of property taxes retained

by the school districts, can be used to fund redevelopment projects within the district. Our ability to obtain TIF funds is dependent

on the value of developed property in the specific district, the collection of general property taxes from property owners in the

specific district, the time it takes the tax assessor to update the tax rolls and market interest rates at the time the tax increment

bonds are issued.

If we are unable to

realize the expected benefits from these various forms of public financing, we may need to obtain alternative financing through

other means, including private transactions. If we are required to obtain alternative financing, such alternative financing may

not be available at all or may not be available in a timely manner or on terms substantially similar or as favorable to public

financing, which could significantly affect our ability to develop the Hall of Fame Village powered by Johnson Controls, increase

our cost of capital and have a material adverse effect on our results of operations, cash flows and financial position.

If we were to obtain

financing through private investment in public equity investments or other alternative financing, it could subject us to risks

that, if realized, would adversely affect us, including the following:

|

|

●

|

our cash flows from operations could be insufficient to make required payments of principal of

and interest on any debt financing, and a failure to pay would likely result in acceleration of such debt and could result in cross

accelerations or cross defaults on other debt;

|

|

|

●

|

such debt may increase our vulnerability to adverse economic and industry conditions;

|

|

|

●

|

to the extent that we generate and use any cash flow from operations to make payments on such debt,

it will reduce our funds available for operations, development, capital expenditures and future investment opportunities or other

purposes;

|

|

|

●

|

debt covenants may limit our ability to borrow additional amounts, including for working capital,

capital expenditures, debt service requirements, executing our development plan and other purposes;

|

|

|

●

|

restrictive debt covenants may limit our flexibility in operating our business, including limitations

on our ability to make certain investments; incur additional indebtedness; create certain liens; incur obligations that restrict

the ability of our subsidiaries to make payments to us; consolidate, merge or transfer all or substantially all of our assets;

or enter into transactions with affiliates; and

|

|

|

●

|

to the extent that such debt bears interest at a variable rate, we would be exposed to the risk

of increased interest rates.

|

We are still assembling our

management team and our leadership may change significantly.

The success of

our business depends on our ability to hire and retain key employees and members of management who have extensive experience in

project development and relationships with key partners. In late 2018, we hired CEO, Michael Crawford, to lead HOF Village and

in September 2019, we hired a new Chief Financial Officer, Jason Krom. In December 2019, we hired an Executive Vice President

for Public Affairs, Anne Graffice, to oversee community, investor, media and government relations, and manage all corporate social

responsibility initiatives for the Company. In June 2020, we hired a President of Operations, Mike Levy, to be responsible for

day-to-day operations of all on- and off-site assets owned by the Company. Moving forward, Mr. Levy will provide key operational

input for all new construction development as the Company continues to execute Phase II of its project. In August 2020, we hired

a Vice President, Human Resources, Lisa Gould and at the end of August 2020, we hired a General Counsel, Tara Charnes. In September

2020, we hired an Executive Vice President of New Business Development/Marketing and Sales, Erica Muhleman.

The ability of new

members of our management team to quickly expand their knowledge of the Company,

our business plans, operations, strategies and challenges will be critical to their ability to make informed decisions about our

strategy and operations. If our management team is not sufficiently informed to make such decisions, our ability to compete effectively

and profitably could be adversely affected. In addition, changes in our management team may be disruptive to, or cause uncertainty

in, our business and the vision of the Company, and could have

a negative impact on our ability to complete the construction and development components of the Hall

of Fame Village powered by Johnson Controls in a timely and cost-effective manner and to manage and grow our business effectively.

Any such disruption or uncertainty or difficulty in efficiently and effectively filling key management roles could have a material

adverse impact on our business and results of operations.

Our business depends on the

brand of the Pro Football Hall of Fame.

The success of our

business is substantially dependent upon the continued success of the brand of the PFHOF, and our ability to continue to secure