0001680873false00016808732024-02-062024-02-060001680873us-gaap:CommonStockMember2024-02-062024-02-060001680873us-gaap:PreferredStockMember2024-02-062024-02-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 6, 2024

HF FOODS GROUP INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

Delaware (State or other Jurisdiction of incorporation) | 001-38180 (Commission File No.) | 81-2717873 (IRS Employer Identification No.) |

| | | | | |

6325 South Rainbow Boulevard, Suite 420 Las Vegas, Nevada (Address of principal executive offices) | 89118 (Zip Code) |

Registrant’s telephone number, including area code: (888)-905-0998

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, $0.0001 par value | HFFG | Nasdaq Capital Market |

| Preferred Share Purchase Rights | N/A | Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On February 6, 2024, HF Foods Group Inc. (the “Company”) and certain of its subsidiaries (collectively, the “Borrowers”) entered into that certain Amendment No. 1 to Third Amended and Restated Credit Agreement (the “Amendment”) with the lenders party thereto (the “Lenders”) and JPMorgan Chase Bank, N.A., a national banking association, as administrative agent for the Lenders (in such capacity, the “Administrative Agent”). The Amendment amends the Third Amended and Restated Credit Agreement, dated as of March 31, 2022, by and among the Borrowers, the other loan parties thereto, the Lenders party thereto and the Administrative Agent (as amended, the “Credit Agreement”).

The Amendment amends the Credit Agreement to (i) remove a cap on permitted indebtedness in respect of capital lease obligations, subject to certain enumerated conditions; (ii) create a reserve in the amount of $2,750,000 on the borrowing base, which will be reduced on a dollar-for-dollar basis once the Company has made expenditures in excess of such amount relating to the development and construction of certain real property, and which amounts shall be excluded from certain financial covenants under the Credit Agreement and; (iii) remove certain sublease income from various financial covenants.

The foregoing description of the Amendment does not purport to be complete and is subject to and qualified in its entirety by the full text of the Amendment, a copy of which is attached hereto as Exhibit 10.1 and incorporated herein by reference.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Appointment of President

On February 9, 2024, the Company announced that its Board of Directors (the “Board”) had appointed Xi Lin (aka Felix Lin) to serve as President and Chief Operating Officer of the Company, effective February 12, 2024.

In connection with his appointment as President of the Company, Mr. Lin’s base salary will be increased to $495,000.

Mr. Lin, age 35, has served as the Company’s Chief Operating Officer since May 1, 2022. Mr. Lin also previously served as an independent director of the Company from November 2019 to April 2022.

Leave of Absence of Chief Financial Officer

On February 9, 2024, the Company announced that Carlos Rodriguez, the Company’s Chief Financial Officer, is taking a leave of absence for personal reasons, effective February 12, 2024. In connection with Mr. Rodriguez’s leave of absence, effective February 12, 2024, the Board appointed Mr. Lin to serve as Interim Chief Financial Officer. Mr. Lin will receive an additional $20,000 for each month he serves as the Company’s Interim Chief Financial Officer.

Item 8.01 Other Events.

On February 9, 2024, the Company filed a press release announcing Mr. Lin’s appointment as President of the Company. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated by reference in this Item 8.01.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

Exhibit Number | Description of Exhibits |

| |

| |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| HF FOODS GROUP INC. | |

| | |

| Date: February 9, 2024 | /s/ Xiao Mou Zhang | |

| Xiao Mou Zhang | |

| Chief Executive Officer | |

AMENDMENT NO. 1 TO THIRD AMENDED AND RESTATED CREDIT AGREEMENT

This AMENDMENT NO. 1 TO THIRD AMENDED AND RESTATED CREDIT AGREEMENT (this "Amendment") is entered into as of February 6, 2024, by and among HF FOODS GROUP INC., a Delaware corporation ("HF"), B&R GLOBAL HOLDINGS, INC., a Delaware corporation ("B&R"), RONGCHENG TRADING, LLC, a California limited liability company ("Rongcheng"), CAPITAL TRADING, LLC, a Utah limited liability company ("Capital"), WIN WOO TRADING, LLC, a California limited liability company ("Win Woo"), R & C TRADING L.L.C., an Arizona limited liability company ("R & C"), GREAT WALL SEAFOOD LA, LLC, a California limited liability company ("Great Wall"), B & L TRADING, LLC, a Washington limited liability company ("B & L"), MOUNTAIN FOOD, LLC, a Colorado limited liability company ("Mountain"), MIN FOOD INC., a California corporation ("Min Food"), MONTEREY FOOD SERVICE, LLC, a California limited liability company ("Monterey"), HAN FENG, INC., a North Carolina corporation ("Han Feng"), NEW SOUTHERN FOOD DISTRIBUTORS, INC., a Florida corporation ("NSFD"), KIRNLAND FOOD DISTRIBUTION, INC., a Georgia corporation ("Kirnland"), GREAT WALL SEAFOOD IL, L.L.C., an Illinois limited liability company ("Great Wall IL"), GREAT WALL SEAFOOD TX, L.L.C., a Texas limited liability company ("Great Wall TX"), GREAT WALL SEAFOOD VA, L.L.C., a Virginia limited liability company ("Great Wall VA"; HF, B&R, Rongcheng, Capital, Win Woo, R & C, Great Wall, B & L, Mountain, Min Food, Monterey, Han Feng, NSFD, Kirnland, Great Wall IL, Great Wall TX and Great Wall VA are collectively referred to as the "Working Capital Borrowers"), B & R REALTY, LLC, a California limited liability company ("Realty"), LUCKY REALTY, LLC, a California limited liability company ("Lucky"), GENSTAR REALTY, LLC, a California limited liability company ("Genstar"), MURRAY PROPERTIES, LLC, a Utah limited liability company ("Murray"), FORTUNE LIBERTY, LLC, a Utah limited liability company ("Fortune"), A & KIE, LLC, an Arizona limited liability company("A & Kie"), LENFA FOOD, LLC, a Colorado limited liability company ("Lenfa"), BIG SEA REALTY, LLC, a Washington limited liability company ("Big Sea"; Realty, Lucky, Genstar, Murray, Fortune, A & Kie, Lenfa and Big Sea are collectively referred to as the "Real Estate Borrowers"; the Working Capital Borrowers and the Real Estate Borrowers, each a "Borrower" and collectively, the "Borrowers"), the Lenders party hereto (which constitute Required Lenders) and JPMORGAN CHASE BANK, N.A., as administrative agent for the Lenders (in such capacity, "Administrative Agent").

W I T N E S S E T H:

WHEREAS, the Borrowers, the other Loan Parties party thereto, the Lenders party thereto and Administrative Agent are parties to that certain Third Amended and Restated Credit Agreement dated as of March 31, 2022 (as amended, restated, supplemented or otherwise modified to date and from time to time, including hereby, the "Credit Agreement"; capitalized terms used herein but not otherwise defined shall have the meanings set forth in the Credit Agreement); and

WHEREAS, the Borrowers have requested that Required Lenders agree to amend the Credit Agreement as specified herein, and Required Lenders have agreed to such request, subject to the terms and conditions of this Amendment.

NOW THEREFORE, in consideration of the mutual conditions and agreements set forth in the Credit Agreement and this Amendment, and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto hereby agree as follows:

1.Amendments to Credit Agreement. Subject to the satisfaction of the conditions precedent set forth in Section 2 below, and in reliance on the representations and warranties set forth in Section 3 below:

(a)Section 1.01 of the Credit Agreement is hereby amended by adding the following defined terms in the appropriate alphabetical order:

"273 Fifth Avenue" means 273 Fifth Avenue, LLC, a Delaware limited liability company.

"Anheart 273 Build Out" means, the development and construction of certain buildings and related facilities on the Anheart 273 Property by B&R Services pursuant to and in accordance with the Anheart 273 Ground Lease.

"Anheart 273 Build Out Reserve" means an amount equal to $2,750,000; provided, however, that, concurrently with delivery to Administrative Agent of written evidence (in form and substance reasonably acceptable to Administrative Agent) of such expenditure, such amount shall be reduced dollar-for-dollar by the amount of any expenditures in excess of $2,750,000 made by the Loan Parties in connection with the Anheart 273 Build Out until the amount of the Anheart 273 Build Out Reserve equals $0.

"Anheart 273 Ground Lease" means that certain Agreement of Lease, dated as of July 2, 2018, with respect to the Anheart 273 Property, by and between Premier 273 Fifth, LLC, as landlord, and 273 Fifth Avenue, as tenant and as assignee of Anheart Inc., a New York corporation ("Anheart"), pursuant to that certain Assignment and Assumption of Lease Agreement, dated as of January 1, 2021, by and between Anheart and 273 Fifth Avenue, as such Anheart 273 Ground Lease may be amended, restated, supplemented or otherwise modified from time to time.

"Anheart 273 Property" means that certain real property located at 273 Fifth Avenue, New York, New York 10016.

"Anheart 273 Rent Obligations" means any and all rent obligations owing by 273 Fifth Avenue or any other Loan Party in its capacity as a tenant, assignee or guarantor under the Anheart 273 Ground Lease.

"Anheart 273 Rental Income" means any and all income received by 273 Fifth Avenue in its capacity as landlord or lessor under any lease or sublease of the Anheart 273 Property to any third party subtenant or lessee.

"Anheart 275 Lease" means that certain Lease, dated as of July 2, 2018, with respect to the Anheart 275 Property, by and between 825 Broadway Realty, LLC, as landlord, and Anheart, as tenant, as such Anheart 275 Lease may be amended, restated, supplemented or otherwise modified from time to time.

"Anheart 275 Property" means that certain real property located at 275 Fifth Avenue, New York, New York 10016.

"Anheart 275 Rent Obligations" means any and all rent obligations owing by HF Holding in its capacity as a tenant, assignee or guarantor under the Anheart 275 Lease.

"Anheart 275 Rental Income" means any and all income received by either (i) Anheart, in its capacity as landlord or lessor under any lease or sublease of the Anheart 275 Property, solely to the extent such income is actually paid to the landlord thereunder or (ii) HF Holding, solely in its capacity as guarantor or assignee under the Anheart 275 Lease, under any lease or sublease of the Anheart 275 Property.

"B&R Services" means B&R Global Services, LLC, a Delaware limited liability company.

(b)Section 1.01 of the Credit Agreement is hereby further amended by amending and restating in their entirety each of the following definitions as set forth below:

"Borrowing Base" means, at any time, the sum of (a) 85% of Eligible Accounts at such time, plus (b) the lesser of (i) 65% of Eligible Inventory, at such time, valued at the lower of cost or market value, determined on a first-in-first-out basis and (ii) the product of 85% multiplied by the Net Orderly Liquidation Value percentage identified in

the most recent Inventory appraisal ordered by the Administrative Agent multiplied by Eligible Inventory, valued at the lower of cost or market value, determined on a first-in-first-out basis; provided, that until the Administrative Agent obtains an initial appraisal with respect to the Inventory of Great Wall Illinois, Great Wall Texas and Great Wall Virginia, clause (b) with respect to the Inventory of Great Wall Illinois, Great Wall Texas and Great Wall Virginia shall be equal to 65% of Eligible Inventory of Great Wall Illinois, Great Wall Texas and Great Wall Virginia, valued at the lower of cost or market value, determined on a first-in-first-out basis, plus (c) the Special Advance Amount, minus (d) the Anheart 273 Build Out Reserve minus (e) all other Reserves. The Administrative Agent may, in its Permitted Discretion, reduce the advance rates set forth above, adjust the Anheart 273 Build Out Reserve, adjust any other Reserves or reduce one or more of the other elements used in computing the Borrowing Base.

"Fixed Charge Coverage Ratio" means the ratio, determined as of the end of each fiscal quarter of HF Foods for the four fiscal quarter period then ended, of (a) EBITDA minus (i) Unfinanced Capital Expenditures (other than up to an aggregate of $5,500,000 of Unfinanced Capital Expenditures made in connection with the Anheart 273 Build Out) minus (ii) the sum of (x) the amount by which the Anheart 273 Rental Income exceeds Anheart 273 Rent Obligations plus (y) the amount by which the Anheart 275 Rental Income exceeds Anheart 275 Rent Obligations; provided that in no event shall the aggregate amount deducted from EBITDA pursuant to this clause (ii) exceed the product of 1.10 multipled by the sum of Anheart 273 Rent Obligations plus Anheart 275 Rent Obligations to (b) Fixed Charges, all calculated for HF Foods and its Subsidiaries on a consolidated basis in accordance with GAAP. It is further agreed and understood by the parties hereto that, for purposes of calculating the Fixed Charge Coverage Ratio for any applicable period, such calculation shall exclude the Fixed Charges of any Person accrued prior to the date it becomes a Subsidiary or is merged into or consolidated with HF Foods or any of its Subsidiaries.

"Payment Condition" shall be deemed to be satisfied in connection with a Restricted Payment, a Permitted Acquisition, incurrence of Indebtedness under Section 6.01(e), or other transaction if:

(a) no Default or Event of Default has occurred and is continuing or would result immediately after giving effect to such Restricted Payment, Permitted Acquisition, incurrence of Indebtedness or other transaction;

(b) immediately after giving effect to and at all times during the 90-day period immediately prior to such Restricted Payment, Permitted Acquisition, incurrence of Indebtedness or other transaction, the Working Capital Borrowers shall have Availability calculated on a pro forma basis after giving effect to such Restricted Payment, Permitted Acquisition, incurrence of Indebtedness or other transaction of not less than the greater of (i) $12,500,000 and (ii) 12.5% of the Revolving Commitment;

(c) immediately after giving effect to such Restricted Payment, Permitted Acquisition, incurrence of Indebtedness or other transaction, the Fixed Charge Coverage Ratio for the most recently completed four fiscal quarter period prior to the date of such Restricted Payment, Permitted Acquisition, incurrence of Indebtedness or other transaction for which the Borrowers are then required to have delivered interim financial statements to the Administrative Agent in accordance with the terms hereof, calculated on a pro forma basis, is not less than 1.10 to 1.00; and

(d) the Borrower Representative shall have delivered to the Administrative Agent a certificate in form and substance reasonably satisfactory to the Administrative Agent certifying as to the items described in (a), (b) and (c) above and attaching calculations for items (b) and (c).

(c)Section 6.01(e) of the Credit Agreement is hereby amended and restated in its entirety as follows:

(e) on and after the Effective Date, Indebtedness of any Borrower or any Subsidiary incurred to finance the acquisition, construction or improvement of any fixed or capital assets (whether or not constituting purchase money Indebtedness), including Capital Lease Obligations and any Indebtedness assumed in connection with the acquisition of any such assets or secured by a Lien on any such assets prior to the acquisition thereof, and extensions, renewals and replacements of any such Indebtedness in accordance with clause (f) below, so long as, on a pro forma basis after giving effect to the incurrence of such Indebtedness each Payment Condition is satisfied; provided that such Indebtedness is incurred prior to or within 90 days after such acquisition or the completion of such construction or improvement;

2.Conditions to Effectiveness. The effectiveness of Section 1 of this Amendment is subject to the following conditions precedent:

(a)Administrative Agent shall have received a copy of this Amendment executed by each Borrower, Administrative Agent and Required Lenders;

(b)Administrative Agent shall have received all fees, costs and expenses due and payable as of the date hereof under the Credit Agreement and the other Loan Documents (including (i) the Amendment Fee (as defined below) and (ii) the reasonable fees and expenses of legal counsel to the extent invoiced on or prior to the date hereof); and

(c)immediately after giving effect to this Amendment, no Default or Event of Default shall have occurred and be continuing or shall be caused by the transactions contemplated by this Amendment.

3.Representations and Warranties. To induce Administrative Agent and the Lenders party hereto to enter into this Amendment, each of the Borrowers hereby represents and warrants to Administrative Agent and the Lenders that: (i) the execution, delivery and performance of this Amendment has been duly authorized by all requisite action on the part of such Borrower and this Amendment has been duly executed and delivered by such Borrower; (ii) immediately before and after giving effect to the consummation of the transactions contemplated by this Amendment, each of the representations and warranties of the Loan Parties set forth in the Credit Agreement and each of the other Loan Documents are true and correct in all material respects (except that such materiality qualifier shall not be applicable to any representations and warranties that already are qualified or modified by materiality in the text thereof) as of the date hereof (except to the extent they relate to an earlier date, in which case they shall have been true and correct in all material respects (except that such materiality qualifier shall not be applicable to any representations and warranties that already are qualified or modified by materiality in the text thereof) as of such earlier date); and (iii) immediately after giving effect to this Amendment, no Default or Event of Default has occurred and is continuing.

4.Amendment Fee. Borrowers shall pay to Administrative Agent, for the ratable benefit of the Lenders, a non-refundable amendment fee equal to $10,000 (the "Amendment Fee"), which shall be fully earned and payable on the date hereof.

5.Release.

(a)In consideration of the agreements of Administrative Agent and the Lenders contained herein and for other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, each Borrower, on behalf of itself, each of its Subsidiaries, and each of its and their respective successors, assigns, and other legal representatives (each such Borrower and all such other Persons being hereafter referred to collectively as the "Releasors" and individually as a "Releasor"), hereby absolutely, unconditionally and irrevocably releases, remises and forever discharges Administrative Agent and the Lenders, and each of their successors and assigns, and each of their present and former shareholders, affiliates, subsidiaries, divisions, predecessors, directors, officers, attorneys,

employees, agents, other representatives (Administrative Agent and the Lender and all such other Persons being hereinafter referred to collectively as the "Releasees" and individually as a "Releasee"), of and from all demands, actions, causes of action, suits, controversies, damages and any and all other claims, counterclaims, defenses, rights of set-off and liabilities whatsoever, including claims for breach of contract, (individually, a "Claim" and collectively, "Claims") of every name and nature, known or unknown, suspected or unsuspected, both at law and in equity, which any Releasor may now own, hold, have or claim to have against the Releasees or any of them for, upon, or by reason of any circumstance, action, cause or thing whatsoever which arises at any time on or prior to the day and date of this Amendment for or on account of, or in relation to, or in any way in connection with the Credit Agreement or any of the other Loan Documents or transactions thereunder or related thereto; provided that nothing in this paragraph shall modify, amend, or terminate the Credit Agreement, any of the other Loan Documents, or any other contract or agreement to which a Releasor is a party or of which the Releasor is a beneficiary and further provided that nothing in this paragraph shall release, remise or discharge any Releasee from liability for future performance due under any such contracts or agreements or with respect to any demand deposit account.

(b)Each Releasor understands, acknowledges and agrees that the release set forth above may be pleaded as a full and complete defense and may be used as a basis for an injunction against any action, suit or other proceeding which may be instituted, prosecuted or attempted in breach of the provisions of such release.

(c)Each Releasor agrees that no fact, event, circumstance, evidence or transaction which could now be asserted or which may hereafter be discovered shall affect in any manner the final, absolute and unconditional nature of the release set forth above.

6.Severability. Any provision of this Amendment held to be invalid, illegal or unenforceable in any jurisdiction shall, as to such jurisdiction, be ineffective to the extent of such invalidity, illegality or unenforceability without affecting the validity, legality and enforceability of the remaining provisions thereof; and the invalidity of a particular provision in a particular jurisdiction shall not invalidate such provision in any other jurisdiction.

7.References. Any reference to the Credit Agreement contained in any Loan Document or any other document, instrument or agreement executed in connection with the Credit Agreement shall be deemed to be a reference to the Credit Agreement as modified by this Amendment.

8.Counterparts. This Amendment may be executed in one or more counterparts, each of which shall constitute an original, but all of which taken together shall be one and the same instrument. Delivery by telecopy or electronic portable document format (i.e., "pdf") transmission of executed signature pages hereof from one party hereto to another party hereto shall be deemed to constitute due execution and delivery by such party.

9.Ratification. The terms and provisions set forth in this Amendment shall modify and supersede all inconsistent terms and provisions of the Credit Agreement and shall not be deemed to be a consent to the modification or waiver of any other term or condition of the Credit Agreement or any of the other Loan Documents. Except as expressly modified and superseded by this Amendment, the terms and provisions of the Credit Agreement are ratified and confirmed and shall continue in full force and effect.

10.Governing Law. This Amendment shall be governed by and construed in accordance with the internal laws (and not the law of conflicts) of the State of Illinois, but giving effect to federal laws applicable to national banks.

[Signature pages follow]

IN WITNESS WHEREOF, the parties hereto have caused this Amendment to be duly executed and delivered by their respective duly authorized officers on the date first written above.

| | |

BORROWERS:

HF FOODS GROUP INC.

By: /s/ Carlos Rodriguez

Name: Carlos Rodriguez

Title: Chief Financial Officer |

B&R GLOBAL HOLDINGS, INC.

By: /s/ Carlos Rodriguez

Name: Carlos Rodriguez

Title: Chief Financial Officer |

RONGCHENG TRADING, LLC

By: /s/ Carlos Rodriguez

Name: Carlos Rodriguez

Title: Chief Financial Officer |

CAPITAL TRADING, LLC

By: /s/ Carlos Rodriguez

Name: Carlos Rodriguez

Title: Chief Financial Officer |

WIN WOO TRADING, LLC

By: /s/ Carlos Rodriguez

Name: Carlos Rodriguez

Title: Chief Financial Officer |

R & C TRADING L.L.C.

By: /s/ Carlos Rodriguez

Name: Carlos Rodriguez

Title: Chief Financial Officer |

| | |

GREAT WALL SEAFOOD LA, LLC

By: /s/ Carlos Rodriguez

Name: Carlos Rodriguez

Title: Chief Financial Officer |

B & L TRADING, LLC

By: /s/ Carlos Rodriguez

Name: Carlos Rodriguez

Title: Chief Financial Officer |

MOUNTAIN FOOD, LLC

By: /s/ Carlos Rodriguez

Name: Carlos Rodriguez

Title: Chief Financial Officer |

MIN FOOD INC.

By: /s/ Carlos Rodriguez

Name: Carlos Rodriguez

Title: Chief Financial Officer |

MONTEREY FOOD SERVICE, LLC

By: /s/ Carlos Rodriguez

Name: Carlos Rodriguez

Title: Chief Financial Officer |

HAN FENG, INC.

By: /s/ Carlos Rodriguez

Name: Carlos Rodriguez

Title: Chief Financial Officer |

| | |

NEW SOUTHERN FOOD DISTRIBUTORS, INC.

By: /s/ Carlos Rodriguez

Name: Carlos Rodriguez

Title: Chief Financial Officer |

KIRNLAND FOOD DISTRIBUTION, INC.

By: /s/ Carlos Rodriguez

Name: Carlos Rodriguez

Title: Chief Financial Officer |

GREAT WALL SEAFOOD TX, L.L.C.

By: /s/ Carlos Rodriguez

Name: Carlos Rodriguez

Title: Chief Financial Officer |

GREAT WALL SEAFOOD IL, L.L.C.

By: /s/ Carlos Rodriguez

Name: Carlos Rodriguez

Title: Chief Financial Officer GREAT WALL SEAFOOD VA, L.L.C.

By: /s/ Carlos Rodriguez

Name: Carlos Rodriguez

Title: Chief Financial Officer |

B & R REALTY, LLC

By: /s/ Carlos Rodriguez

Name: Carlos Rodriguez

Title: Chief Financial Officer |

LUCKY REALTY, LLC

By: /s/ Carlos Rodriguez

Name: Carlos Rodriguez

Title: Chief Financial Officer |

GENSTAR REALTY, LLC

By: /s/ Carlos Rodriguez

Name: Carlos Rodriguez

Title: Chief Financial Officer |

| | |

MURRAY PROPERTIES, LLC

By: /s/ Carlos Rodriguez

Name: Carlos Rodriguez

Title: Chief Financial Officer |

FORTUNE LIBERTY, LLC

By: /s/ Carlos Rodriguez

Name: Carlos Rodriguez

Title: Chief Financial Officer |

A & KIE, LLC

By: /s/ Carlos Rodriguez

Name: Carlos Rodriguez

Title: Chief Financial Officer |

LENFA FOOD, LLC

By: /s/ Carlos Rodriguez

Name: Carlos Rodriguez

Title: Chief Financial Officer |

BIG SEA REALTY, LLC

By: /s/ Carlos Rodriguez

Name: Carlos Rodriguez

Title: Chief Financial Officer |

| | |

JPMORGAN CHASE BANK, N.A., as Administrative Agent and a Lender

By: /s/ Jason Ward

Name: Jason Ward

Title: Vice President |

| | |

COMERICA BANK, as a Lender

By: /s/ Alma Vargas

Name: Alma Vargas

Title: Vice President |

HF Foods Appoints Felix Lin as President of the Company

LAS VEGAS, Feb. 9, 2024 (GLOBE NEWSWIRE) — HF Foods Group Inc. (NASDAQ: HFFG), a leading food distributor to Asian restaurants throughout the United States (“HF Foods”, or the “Company”), is pleased to announce the appointment of Mr. Xi Lin (aka Felix Lin) as President of the Company, in addition to his current role as the Company’s Chief Operating Officer, effective February 12, 2024.

Mr. Lin has served as the Company’s Chief Operating Officer since May 1, 2022. He also previously served as an Independent Board Member for the Company from November 2019 to April 2022.

Mr. Lin’s experience includes serving as Vice President and a Senior Strategy Officer for Blue Bird Corporation (the leading school bus manufacturer in North America), overseeing Human Resources, Corporate and Operations Training, Government Relations, Compliance, and Strategy. During his time at Blue Bird Corporation, Mr. Lin also held leadership positions in Manufacturing Operations, Supply Chain, Finance, and Accounting. Earlier in his career, Mr. Lin worked as a key member of the China and Middle East business development team for Blue Bird Corporation under Cerberus Capital Management, LLP.

Peter Zhang, CEO of HF Foods added: “I am pleased to announce that Felix Lin, Chief Operating Officer, will assume the additional role of President for HF Foods. As President and Chief Operating Officer of HF Foods, Felix will lead the cross-functional collaboration internally in achieving our strategic business objectives. In this new role, Felix will continue to report directly to me.”

About HF Foods Group, Inc.

HF Foods Group Inc. is a leading marketer and distributor of fresh produce, frozen and dry food, and non-food products to primarily Asian/Chinese restaurants and other foodservice customers throughout the United States. HF Foods aims to supply the increasing demand for Asian American restaurant cuisine, leveraging its nationwide network of distribution centers and its strong relations with growers and suppliers of fresh, high-quality specialty restaurant food products and supplies in the US, South America, and China. Headquartered in Las Vegas, Nevada, HF Foods trades on Nasdaq under the symbol “HFFG”. For more information, please visit www.hffoodsgroup.com.

Forward-Looking Statements

All statements in this news release other than statements of historical facts are forward-looking statements which contain our current expectations about our future results. We have attempted to identify any forward-looking statements by using words such as “believes,” “intends,” and other similar expressions. Although we believe that the expectations reflected in all of our forward-looking statements are reasonable, we can give no assurance that such expectations will prove to be correct. Such statements are not guarantees of future performance or events and are subject to known and unknown risks and uncertainties that could cause the Company’s actual results, events or financial positions to differ materially from those included within or implied by such forward-looking statements. Such factors include, but are not limited to, statements of assumption underlying any of the foregoing, and other factors disclosed under the caption “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2022 and other filings with the SEC. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date made. Except as required by law, we undertake no obligation to disclose any revision to these forward-looking statements.

Investor Relations Contact:

HFFG Investor Relations

hffoodsgroup@icrinc.com

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_PreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

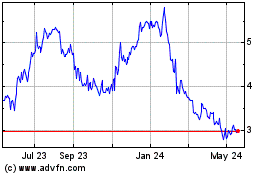

HF Foods (NASDAQ:HFFG)

Historical Stock Chart

From Mar 2024 to Apr 2024

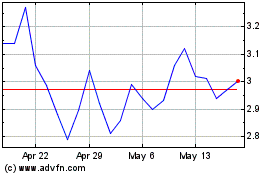

HF Foods (NASDAQ:HFFG)

Historical Stock Chart

From Apr 2023 to Apr 2024