Filed by First Advantage Corporation

pursuant to Rule 425 under the Securities Act of 1933

Subject Company: Sterling Check Corp.

Commission File No.: 001-40829

Date: February 29, 2024

[The following is a transcript of an employee video made by Scott Staples, Chief Executive Officer]

FA Employee Video Script Transcript

What was announced

•Hi, First Advantage Team. I’m proud to share exciting news with you all.

•Moments ago, First Advantage announced that we have reached an agreement to acquire Sterling Check. This is a transformative step for us that will significantly enhance the value we bring to our customers.

•With this acquisition, we will be able to extend our high-quality and cost-effective background screening, identity, and verification technology solutions for the benefit of customers of all sizes across industry verticals and geographies.

•I wanted to address each of you directly to share my excitement and perspective on this announcement. I’ll start by sharing a bit of background on Sterling, and why we are so confident this acquisition is the right path forward for First Advantage.

About Sterling

•As a background screening and identity services provider, Sterling should be familiar to many of you.

•They complete over 100 million screens annually, serving over 50,000 customers worldwide, and have outstanding customer retention.

•Most importantly, Sterling shares many of our same values as well as our commitment to innovation, technological excellence, and elevated customer experiences.

Strategic Rationale

•While we may be culturally similar, our two companies each have our own respective strengths and complementary technology solutions and services.

•By bringing together our diverse strengths, we will enable companies across the healthcare, retail & ecommerce, transportation, manufacturing, financial services, and other industries to hire smarter and onboard faster.

•The combination also unlocks efficiencies and opportunities to fuel incremental growth and invest in new technology solutions, including AI-driven automation and next-generation Digital Identification, while further diversifying our business for greater resilience.

•We’re excited about the opportunity to accelerate innovation, providing our customers access to more products and solutions to meet their needs and to fuel growth of the combined company.

•The financial and operational benefits we can achieve as a combined company will also help position First Advantage for long-term value creation.

What’s next

•I’m really excited about the opportunities this acquisition will bring, but today’s announcement is just the first step in the process toward closing, and later, integration.

•The transaction is subject to required government regulatory approvals and clearances before we can officially acquire Sterling, and we expect closing on the acquisition will happen in approximately the third quarter of 2024.

•It’s important to understand that a transaction like this is a highly regulated government process. So, until the transaction closes, First Advantage and Sterling will continue to operate separately, as independent companies, like we always have.

•I’ve shared detailed guidelines and instructions about the process in my email to the entire First Advantage team, but I’d like to reinforce a few key points:

oFirst: that it is absolutely critical that we conduct business as usual, our day-to-day does not change. Our FA 4.0 Strategy and goals are just as important today as they were yesterday, and we must continue to operate as First Advantage, standalone, just as we always have.

oSecond: The way we talk about this news is very important. Please stick closely to the talking points we’re providing – we need to speak with one voice. That applies to everyone and anybody – internally or externally, with customers, partners and so on... in emails, and on calls.

oAnd third, it is important that you do not post any original content on social media. We have created a LinkedIn post that you may re-share, but please do not comment or create any original content beyond our company issued social posts. We also ask that you do not forward or share any communications you receive about the transaction.

What lies ahead – integration and beyond

•Later on, after we close the transaction, we will begin the integration process. To do so, we will lean on our strong track record of successful acquisitions and integrations to ensure a smooth process for our employees and for our customers.

•It’s too early to talk about the specifics of how that will look, exactly. But I can tell you that a dedicated team will develop the roadmap for bringing together the strong leadership and talent from these two high-performing cultures and for using best practices from both companies. We will communicate regularly with you regarding our progress.

•I will have the privilege of continuing to lead First Advantage, and we’ll offer Sterling CEO Joshua Peirez a board seat.

•We also know the combined company will continue to operate as First Advantage and we will remain headquartered in Atlanta, with no changes to our “remote-first” work policy.

•And finally, but very importantly: we know the First Advantage culture is a strength of ours. We will continue to nurture it – always. We will continue to work with our clients and each other with the respect and values that makes First Advantage a great place to work.

Thank you

•Before I wrap up, I want to express how proud I am of our team and your dedication that got us to this point. We are making this bold, strategic move because of your hard work and commitment.

•I am confident the addition of Sterling positions us better than ever to serve the dynamic needs of our customers by accelerating innovation, uncovering opportunities to reduce costs, and delivering an enhanced customer and applicant experience.

•Moving forward, we will make every effort to keep you informed as the transaction progresses.

•Thanks again for your continued support.

No Offer or Solicitation

This communication is for informational purposes only and is not intended to and does not constitute, or form a part of, an offer, invitation or the solicitation of an offer or invitation to purchase, otherwise acquire, subscribe for, sell or otherwise dispose of any securities, or a solicitation of any vote or approval in any jurisdiction, pursuant to the proposed transaction or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in which such sale, issuance or transfer of securities would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made, except by means of a prospectus meeting the requirements of Section 10 of the Securities Act.

Additional Information about the Proposed Transaction and Where to Find It

In connection with the proposed transaction, First Advantage intends to file with the SEC a registration statement on Form S-4 that will include an information statement of Sterling and that also constitutes a prospectus of First Advantage. Each of First Advantage and Sterling may also file other relevant documents with the SEC regarding the proposed transaction. This document is not a substitute for the information statement/prospectus or registration statement or any other document that First Advantage or Sterling may file with the SEC. The information statement/prospectus (if and when available) will be mailed to stockholders of First Advantage and Sterling. INVESTORS AND SECURITY HOLDERS OF FIRST ADVANTAGE AND STERLING ARE URGED TO READ THE REGISTRATION STATEMENT, INFORMATION STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT MAY BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders will be able to obtain free copies of the registration statement and information statement/prospectus (if and when available) and other documents containing important information about First Advantage, Sterling and the proposed transaction, once such documents are filed with the SEC through the website maintained by the SEC at www.sec.gov. Copies of the documents filed with the SEC by First Advantage will be available free of charge on First Advantage’s website at https://fadv.com/ or by contacting First Advantage’s Investor Relations department at investors@fadv.com. Copies of the documents filed with the SEC by Sterling will be available free of charge on Sterling’s website at https://www.sterlingcheck.com/ or by contacting Sterling’s Investor Relations department at IR@sterlingcheck.com.

Forward-Looking Statements

This report and any documents referred to in this report contain forward-looking statements within the meaning of Section 27A of the Securities Act, and Section 21E of the Exchange Act, and it is intended that all forward-looking statements that Sterling or First Advantage make will be subject to the safe harbor protections created thereby. Forward-looking statements can be identified by forward-looking terminology such as “aim,” “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “potential,” “predict,” “projection,” “seek,” “should,” “will” or “would,” or the negative thereof or other variations thereon or comparable terminology. In particular, statements that address First Advantage’s and Sterling’s future performance, business strategy, future operations, estimates and projections of revenues, losses, costs, expenses, returns, cash flow, and financial position, anticipated benefits of strategic transactions (including acquisitions and divestitures), and plans and objectives of management (including plans for future cash flow from operations), contained in this report or any documents referred to herein are forward-looking statements. These statements also include, but are not limited to, statements regarding the expected benefits of the proposed transaction to First Advantage and Sterling and each of their stockholders and the anticipated timing thereof. First Advantage and Sterling have based these forward-looking statements on current expectations, assumptions, estimates and projections. Such forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond First Advantage and Sterling’s control. Many factors could cause actual future events to differ materially from the forward-looking statements in this report, including but not limited to: (i) the risk that the proposed transaction may not be completed in a timely manner or at all, (ii) the failure to satisfy the conditions to the consummation of the proposed transaction, including the receipt of certain governmental and regulatory approvals, (iii) the occurrence of any event, change or other circumstance that could give rise to the termination of the Merger Agreement, (iv) the effect of the announcement or pendency of the proposed transaction on First Advantage’s business relationships, operating results, and business generally, (v) risks that the proposed transaction disrupts current plans and operations of First Advantage or Sterling and potential difficulties in First Advantage employee retention as a result of the proposed transaction, (vi) risks related to diverting management’s attention from First Advantage’s ongoing business operations, (vii) unexpected costs, charges or expenses resulting from the proposed transaction and (viii) the outcome of any legal proceedings that may be instituted against Sterling or against First Advantage related to the Merger Agreement or the proposed transaction. These and other important factors contained in First Advantage and Sterling’s filings with the SEC, including their respective Forms 10-K, 10-Q and 8-K, may cause actual results, performance or achievements to differ materially from those expressed or implied by these forward-looking statements. The forward-looking statements contained in this report are not guarantees of future performance and actual results of operations, financial condition, and liquidity, and the development of the industry in which each of First Advantage and Sterling operates, may differ materially from the forward-looking statements contained in this report. Any forward-looking statement made in this report speaks only as of the date of such statement. Except as required by law, neither First Advantage nor Sterling undertakes any obligation to update or revise, or to publicly announce any update or revision to, any of the forward-looking statements, whether as a result of new information, future events or otherwise, after the date of this report.

First Advantage (NASDAQ:FA)

Historical Stock Chart

From Mar 2024 to Apr 2024

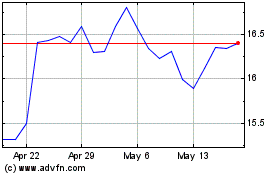

First Advantage (NASDAQ:FA)

Historical Stock Chart

From Apr 2023 to Apr 2024