false

0001867066

0001867066

2023-12-27

2023-12-27

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

December 27, 2023

Journey Medical Corporation

(Exact Name of Registrant as Specified in Charter)

| Delaware | |

001-41063 | |

47-1879539 |

(State or Other Jurisdiction

of Incorporation) | |

(Commission File Number) | |

(IRS

Employer Identification No.) |

9237 E Via de Ventura Blvd., Suite 105

Scottsdale, AZ 85258

(Address of Principal Executive Offices)

(480) 434-6670

(Registrant’s telephone number, including

area code)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications

pursuant to Rule 425 under the Securities Act.

¨ Soliciting material pursuant

to Rule 14a-12 under the Exchange Act.

¨ Pre-commencement communications

pursuant to Rule 14d-2b under the Exchange Act.

¨ Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act.

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which

registered |

| Common Stock |

DERM |

Nasdaq Capital Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter). x

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

| Item 1.01 | Entry into a Material Definitive Agreement. |

On December 27, 2023 (the “Closing Date”),

Journey Medical Corporation (the “Company”) entered into a Credit Agreement (the “Credit Agreement”),

by and among the Company and SWK Funding LLC and the other the financial institutions party thereto from time to time, as lenders.

The Credit Agreement provides for a term loan

facility (the “Credit Facility”) in the original principal amount of up to $20 million. On the Closing Date, the Company

drew $15 million. The remaining $5 million may be drawn upon request by the Company within 12 months after the Closing Date. Loans under

the Credit Facility (the “Term Loans”) mature on December 27, 2027 (the “Maturity Date”) unless

the Credit Facility is otherwise terminated pursuant to the terms of the Credit Agreement. Beginning in February 2026, the Company is

required to repay the outstanding principal of the Term Loans quarterly in an amount equal to 7.5% of the principal amount of funded Term

Loans. If the total revenue of the Company, measured on a trailing twelve-month basis, is greater than $70 million as of December 31,

2025, principal repayment is not required until February 2027, at which point the Company is required to repay the outstanding principal

of the Term Loans quarterly in an amount equal to 15% of the principal amount of funded Term Loans.

The Term Loans bear interest at a rate per annum

equal to the three-month term SOFR (subject to a SOFR floor of 5%) plus 7.75% (the “Loan Rate”). Upon an event

of default under the Credit Agreement, the outstanding principal amounts of the Term Loans will accrue interest at a rate per annum equal

to the Loan Rate plus three percent (3%), but in no event in excess of the maximum rate of interest allowed under applicable law. All

accrued but unpaid interest on the outstanding Term Loans is payable quarterly until the Maturity Date when the then-outstanding principal

balance of the Term Loans and all accrued but unpaid interest thereon becomes due and payable.

At the Company’s option, the Company may

at any time prepay the outstanding principal balance of the Term Loans in whole or in part. Prepayment of the Term Loans is subject to

payment of a prepayment premium equal to (i) 2% of the Term Loans prepaid plus the amount of interest that would have been due through

the first anniversary of the Closing Date if the Term Loans are prepaid prior to the first anniversary of the Closing Date, (ii) 1% of

the Term Loans prepaid if the Term Loans are prepaid on or after the first anniversary of the Closing Date but prior to the second anniversary

of the Closing Date, or (iii) 0% if prepaid thereafter. Upon repayment in full of the Term Loans, the Company will pay an exit fee equal

to 5% of the original principal amount of the Term Loans.

On the Closing Date, the Company paid an origination

fee equal to $200,000.

The obligations under the Credit Facility are

secured by all or substantially all of the Company’s assets and the assets of the Company’s subsidiaries.

The Credit Agreement contains customary representations

and warranties and includes affirmative and negative covenants applicable to the borrowers thereto and their respective subsidiaries.

The affirmative covenants include, among others, covenants requiring the Company to maintain its legal existence and governmental compliance,

deliver certain financial reports and maintain insurance coverage. The Company is also required to maintain compliance at all times with

a minimum liquidity covenant and minimum total revenue covenant at the levels and subject to cure rights as more fully set forth in the

Credit Agreement. The negative covenants include, among others, restrictions on indebtedness, liens, investments, mergers, dispositions,

prepayment of other indebtedness and dividends and other distributions.

The Credit Agreement also includes customary events

of default, including, among other things, non-payment defaults, covenant defaults, inaccuracy of representations and warranties, defaults

under any of the loan documents, certain cross-defaults to other indebtedness, certain bankruptcy and insolvency events, invalidity of

guarantees or grant of security interest, certain ERISA-related transactions and events, certain orders of forfeiture, change of control,

certain undischarged attachments, sequestrations, or similar proceedings, and certain undischarged or non-stayed judgments, in certain

cases subject to certain thresholds and grace periods. The occurrence of an event of default could result in the acceleration of the obligations

under the Credit Agreement of the Company or other borrowers.

The foregoing description of the Credit Agreement

is qualified in its entirety by reference to the full text of the Credit Agreement to be filed with a subsequent periodic report of the

Company.

| Item 2.03. | Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant. |

The disclosures set forth in Item 1.01 of

this Current Report on Form 8-K are incorporated by reference herein.

On January 2, 2024, the

Company issued a press release announcing the entry into the Credit Agreement. The full text of the press release is attached as Exhibit

99.1 to this Current Report on Form 8-K and incorporated herein by reference.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits.

The following exhibits are furnished herewith:

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly

authorized.

|

Journey Medical Corporation |

|

(Registrant) |

| |

|

| Date: January 2, 2024 |

|

|

| |

|

|

|

By: |

/s/ Claude Maraoui |

| |

|

Claude Maraoui |

| |

|

Chief Executive Officer, President and Director |

Exhibit 99.1

Journey Medical Corporation Secures Credit Facility

with SWK Holdings for up to $20 Million

Provides additional capital for general corporate

purposes including funding to support the potential launch of DFD-29

Scottsdale, AZ – January 2, 2024

– Journey Medical Corporation (Nasdaq: DERM) (“Journey Medical” or “the Company”), a commercial-stage pharmaceutical

company that primarily focuses on the selling and marketing of U.S. Food and Drug Administration (“FDA”)-approved prescription

pharmaceutical products for the treatment of dermatological conditions, today announced that the Company has entered into a credit facility

with an affiliate of SWK Holdings Corporation (“SWK”), a specialized finance company with a focus on the global healthcare

sector, providing for borrowings of up to $20 million (“Credit Facility”).

“This financing strengthens Journey Medical’s

balance sheet and provides us with additional operational flexibility. The funding will support general corporate purposes, as well as

anticipated expenses for DFD-29, including an upcoming New Drug Application submission and preparation for its potential commercial launch,

pending FDA approval,” said Claude Maraoui, Co-Founder, President and Chief Executive Officer of Journey Medical.

The Credit Facility provides for an initial term

loan of $15 million that the Company intends to use to fund general corporate operations and commercial and DFD-29 product development

initiatives. The Credit Facility is expected to mature four years from funding and has an initial interest-only period for the first two

years, which may be extended to three years based on the achievement of a specified revenue threshold. The Company also has the option

to draw an additional tranche of $5 million under the Credit Facility, subject to the achievement of specified operational and financial

metrics, in the twelve months following the date of the credit facility.

About Journey Medical Corporation

Journey Medical Corporation (Nasdaq: DERM) (“Journey

Medical”) is a commercial-stage pharmaceutical company that primarily focuses on the selling and marketing of U.S. Food and Drug

Administration-approved prescription pharmaceutical products for the treatment of dermatological conditions through its efficient sales

and marketing model. The company currently markets eight branded and two generic products that help treat and heal common skin conditions.

The Journey Medical team comprises industry experts with extensive experience in developing and commercializing some of dermatology’s

most successful prescription brands. Journey Medical is located in Scottsdale, Arizona and was founded by Fortress Biotech, Inc. (Nasdaq:

FBIO). Journey Medical’s common stock is registered under the Securities Exchange Act of 1934, as amended, and it files periodic

reports with the U.S. Securities and Exchange Commission (“SEC”). For additional information about Journey Medical, visit

www.journeymedicalcorp.com.

Forward-Looking Statements

This press release may contain

“forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended. As used below and throughout this press release, the words “the

Company”, “we”, “us” and “our” may refer to Journey Medical. Such statements include, but

are not limited to, any statements relating to our growth strategy and product development programs and any other statements that

are not historical facts. The words “anticipate,” “believe,” “estimate,” “may,”

“expect,” “will,” “could,” “project,” “intend,” “potential”

and similar expressions are generally intended to identify forward-looking statements. Forward-looking statements are based on

management’s current expectations and are subject to risks and uncertainties that could negatively affect our business,

operating results, financial condition and stock price. Factors that could cause actual results to differ materially from those

currently anticipated include: the fact that our products and product candidates are subject to time and cost intensive regulation

and clinical testing and as a result, may never be successfully developed or commercialized; a substantial portion of our sales

derive from products that may become subject to third- party generic competition, the introduction of new competitor products, or an

increase in market share of existing competitor products, any of which could have a significant adverse impact on our operating

income; we operate in a heavily regulated industry, and we cannot predict the impact that any future legislation or administrative

or executive action may have on our operations; our revenue is dependent mainly upon sales of our dermatology products and any

setback relating to the sale of such products could impair our operating results; competition could limit our products’

commercial opportunity and profitability, including competition from manufacturers of generic versions of our products; the risk

that our products do not achieve broad market acceptance, including by government and third-party payors; our reliance third parties

for several aspects of our operations; our dependence on our ability to identify, develop, and acquire or in-license products and

integrate them into our operations, at which we may be unsuccessful; the dependence of the success of our business, including our

ability to finance our company and generate additional revenue, on the successful development and regulatory approval of the DFD-29

product candidate and any future product candidates that we may develop, in-license or acquire; clinical drug development is very

expensive, time consuming, and uncertain and our clinical trials may fail to adequately demonstrate the safety and efficacy of our

current or any future product candidates; our competitors could develop and commercialize products similar or identical to ours;

risks related to the protection of our intellectual property and our potential inability to maintain sufficient patent protection

for our technology and products; our business and operations would suffer in the event of computer system failures, cyber-attacks,

or deficiencies in our or our third parties’ cybersecurity; the substantial doubt about our ability to continue as a going

concern; the effects of major public health issues, epidemics or pandemics on our product revenues and any future clinical trials;

our potential need to raise additional capital; Fortress controls a voting majority of our common stock, which could be detrimental

to our other shareholders; as well as other risks described in Part I, Item 1A, “Risk Factors,” in our Annual Report on

Form 10-K for the year ended December 31, 2022, subsequent Reports on Form 10-Q, and our other filings we make with the SEC. We

expressly disclaim any obligation or undertaking to release publicly any updates or revisions to any forward- looking statements

contained herein to reflect any change in our expectations or any changes in events, conditions or circumstances on which any such

statement is based, except as may be required by law, and we claim the protection of the safe harbor for forward-looking statements

contained in the Private Securities Litigation Reform Act of 1995.

Company Contact:

Jaclyn Jaffe

(781) 652-4500

ir@jmcderm.com

Media Relations Contact:

Tony Plohoros

6 Degrees

(908) 591-2839

tplohoros@6degreespr.com

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

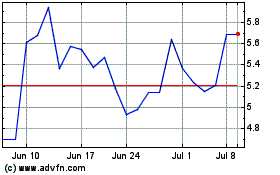

Journey Medical (NASDAQ:DERM)

Historical Stock Chart

From Mar 2024 to Apr 2024

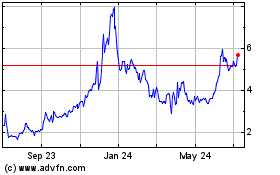

Journey Medical (NASDAQ:DERM)

Historical Stock Chart

From Apr 2023 to Apr 2024