false

0001318484

0001318484

2024-01-08

2024-01-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section

13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date

of earliest event reported): January 8, 2024

Citi Trends, Inc.

(Exact name of

registrant as specified in its charter)

| Delaware |

|

000-51315 |

|

52-2150697 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

| 104 Coleman Boulevard, Savannah, Georgia |

|

31408 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (912) 236-1561

Former

name or former address, if changed since last report: Not applicable

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (See General Instruction A.2 below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre- commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section

12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common stock, $0.01 par value |

CTRN |

Nasdaq Stock Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 7.01. |

Regulation FD Disclosure. |

On January 8, 2024, Citi Trends, Inc.

(the “Company”) provided its unaudited sales results for the quarter-to-date period ending January 6, 2024 and reaffirmed

its guidance for fiscal 2023 (the “Press Release”). A copy of the Press Release is attached to this Current Report on Form 8-K

(the “Current Report”) as Exhibit 99.1 and is incorporated herein by reference.

The information contained in this Item 7.01, including

the Press Release, is being “furnished” and shall not be deemed “filed” for purposes of Section 18 of the

Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of such section.

The information in this Item 7.01, including the Press Release, shall not be incorporated by reference into any filings under the Securities

Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in any such filing.

| Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

CITI TRENDS, INC. |

| |

|

| Date: January 8, 2024 |

By: |

/s/ Heather Plutino |

| |

Name: |

Heather Plutino |

| |

Title: |

Chief Financial Officer |

Exhibit 99.1

CITI TRENDS ANNOUNCES 2023 HOLIDAY SALES RESULTS

FOR QUARTER-TO-DATE THROUGH JANUARY 6, 2024

Total Holiday Sales for the quarter-to-date period ending January 6,

2024 of $179.5 million, at the high end of expectations

Comp sales decreased -0.3% compared to Fiscal 2022, a significant

trend improvement

Reaffirms 2023 guidance including expected year end cash balance

of $80 million to $90 million

SAVANNAH, GA (January 8, 2024) — Citi Trends, Inc.

(NASDAQ: CTRN), a leading specialty value retailer of apparel, accessories and home trends for way less spend primarily for African American

and multicultural families in the United States, today announced results for its holiday selling period.

Total sales for the quarter-to-date period ending January 6, 2024

of $179.5 million compared to $181.9 million in the same period in 2022. Comparable store sales for the quarter-to-date period ending

January 6, 2024 were down -0.3% versus the same period in 2022.

David Makuen, Chief Executive Officer,

said, "I am pleased to report that our holiday sales were at the high end of our expectations as our Ready. Set. GIFT! Campaign

resonated well with the families we serve. Our nearly flat comp was driven by strategic inventory investments while continuing to generate

strong gross margin. Importantly, our holiday sales results represent a significant trend change to the prior quarter with an improvement

in comp sales performance of approximately 600 basis points."

Mr. Makuen continued, "I would

like to thank the entire Citi Crew for their continued hard work and dedication, especially our store teams who once again amazed our

loyal customers throughout the holiday season. As we look forward, we are excited about setting up our spring selling season with a potent

mix of basics, fashion and trend to drive comp store productivity. Additionally, we are moving full steam ahead with leveraging our new

ERP system, incorporating marketing into the mix and beginning some exciting remodels across the fleet. We look to the new fiscal year

with optimism as we continue to advance our strategic initiatives while prudently managing what is in our control."

Guidance

The Company is reaffirming its outlook for fiscal 2023 as follows:

| · | Full year total sales are expected to be down mid-single digits as compared

to fiscal 2022 |

| · | Full year gross margin is expected to be in the high thirties |

| · | Full year EBITDA* is expected to be in the range of $1 million to $7 million |

| · | Full year capex is expected to be in the range of $17 million to $20 million |

| · | Year end cash balance is expected to be in the range of $80 million to $90

million |

The Company’s implied fourth quarter total sales are expected

to be approximately flat to up low-single digits vs. Q4 2022 with comp store sales now expected to be in the range of down low-single

digits to flat to last year and Q4 EBITDA in the range of $9 million to $15 million.

About Citi Trends

Citi Trends, Inc. is a leading specialty

value retailer of apparel, accessories and home trends for way less spend primarily for African American and multicultural families in

the United States. The Company operates 603 stores located in 33 states. For more information, visit www.cititrends.com

or your local store.

*Non-GAAP Financial Measures

The Company is unable to provide a full reconciliation of the forward-looking

non-GAAP financial measure used in 2023 guidance without unreasonable effort because it is not possible to predict certain of its adjustment

items with a reasonable degree of certainty. This information is dependent upon future events and may be outside of the Company’

control and its unavailability could have a significant impact on its financial results.

Forward-Looking Statements

All statements other than historical

facts contained in this news release, including statements regarding the Company’s future financial results and position, business

policy and plans, objectives and expectations of management for future operations and capital allocation expectations, are forward-looking

statements that are subject to material risks and uncertainties. The words "believe," "may," "could," "plans,"

"estimate," “expects,” "continue," "anticipate," "intend," "expect," “upcoming,”

“trend” and similar expressions, as they relate to the Company, are intended to identify forward-looking statements, although

not all forward-looking statements contain such language. Statements with respect to earnings, sales or new store guidance are forward-looking

statements. Investors are cautioned that any such forward-looking statements are subject to the finalization of the Company’s quarter-end

financial and accounting procedures, are not guarantees of future performance or results, and are inherently subject to risks and uncertainties,

some of which cannot be predicted or quantified. Actual results or developments may differ materially from those included in the forward-looking

statements as a result of various factors which are discussed in our Annual Reports and Quarterly Reports on Forms 10-K and 10-Q, respectively,

and any amendments thereto, filed with the Securities and Exchange Commission. These risks and uncertainties include, but are not limited

to, uncertainties relating to general economic conditions, including inflation, energy and fuel costs, unemployment levels, and any deterioration

whether caused by acts of war, terrorism, political or social unrest (including any resulting store closures, damage or loss of inventory)

or other factors; changes in market interest rates and market levels of wages; natural disasters such as hurricanes; uncertainty and economic

impact of pandemics, epidemics or other public health emergencies such as the ongoing COVID-19 pandemic; transportation and distribution

delays or interruptions; changes in freight rates; the Company’s ability to attract and retain workers; the Company’s ability

to negotiate effectively the cost and purchase of merchandise inventory risks due to shifts in market demand; the Company’s ability

to gauge fashion trends and changing consumer preferences; changes in consumer confidence and consumer spending patterns; competition

within the industry; competition in our markets; the duration and extent of any economic stimulus programs; changes in product mix; interruptions

in suppliers’ businesses; the ongoing assessment and impact of the cyber disruption we identified on January 14, 2023, including

legal, reputational, financial and contractual risks resulting from the disruption, and other risks related to cybersecurity, data privacy

and intellectual property; temporary changes in demand due to weather patterns; seasonality of the Company’s business; changes in

market interest rates and market levels of wages; the results of pending or threatened litigation; delays associated with

building, remodeling, opening and operating new stores; and delays associated with building and opening or expanding new or existing distribution

centers. Any forward-looking statements by the Company, with respect to guidance, the repurchase of shares pursuant to a share repurchase

program, or otherwise, are intended to speak only as of the date such statements are made. Except as required by applicable law,

including the securities laws of the United States and the rules and regulations of the Securities and Exchange Commission, the Company

does not undertake to publicly update any forward-looking statements in this news release or with respect to matters described herein,

whether as a result of any new information, future events or otherwise.

Contact:

Tom

Filandro/Rachel Schacter

ICR, Inc.

CitiTrendsIR@icrinc.com

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

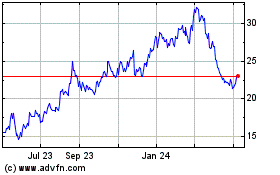

Citi Trends (NASDAQ:CTRN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Citi Trends (NASDAQ:CTRN)

Historical Stock Chart

From Apr 2023 to Apr 2024