UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-A

FOR REGISTRATION OF CERTAIN CLASSES OF SECURITIES

PURSUANT TO SECTION 12(b) OR (g) OF

THE SECURITIES EXCHANGE ACT OF 1934

Citi Trends, Inc.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

52-2150697 |

| (State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

|

104 Coleman Boulevard

Savannah, Georgia |

|

31408 |

| (Address of principal executive offices) |

|

(Zip Code) |

Securities to be registered pursuant to Section 12(b) of the Act:

Title of each class

to be so registered |

|

Name of each exchange on which

each class is to be registered |

| Preferred Stock Purchase Rights |

|

Nasdaq Stock Market |

If this form

relates to the registration of a class of securities pursuant to Section 12(b) of the Exchange Act and is effective pursuant to General

Instruction A.(c) or (e), check the following box. x

If this form

relates to the registration of a class of securities pursuant to Section 12(g) of the Exchange Act and is effective pursuant to General

Instruction A(d) or (e), check the following box. ¨

If this form

relates to the registration of a class of securities concurrently with a Regulation A offering, check the following box. ¨

Securities Act registration statement or Regulation A offering statement

file number to which this form relates: Not Applicable (if applicable)

Securities to be registered pursuant to Section 12(g) of the Act:

| Item 1. |

Description of the Registrant’s Securities to Be Registered. |

On December 6, 2023, the Board of Directors (the

“Board”) of Citi Trends, Inc., a Delaware corporation (the “Company”), declared

a dividend of one preferred share purchase right (a “Right”) for each of the Company’s issued and outstanding

shares of common stock, par value $0.01 per share (“Common Stock”). The dividend will be paid to the stockholders

of record at the close of business on December 18, 2023 (the “Record Time”). Each Right entitles the registered

holder, subject to the terms of the Rights Agreement (as defined below), to purchase from the Company one ten-thousandth of a share of

the Company’s Series A Junior Participating Preferred Stock, par value $0.01 per share (the “Preferred Stock”),

at a price of $120.00, subject to certain adjustments (as adjusted from time to time, the “Exercise Price”).

The description and terms of the Rights are set forth in the Stockholder Protection Rights Agreement, dated as of December 6, 2023 (the

“Rights Agreement”), by and between the Company and Equiniti Trust Company, LLC (the “Rights Agent”).

Subject

to certain exceptions, the Rights will not be exercisable until the close of business on the earlier to occur of (i) the tenth business

day after a public announcement or filing that a person, or a group of affiliated or associated persons, has become an “Acquiring

Person,” which is generally defined as a person, or a group of affiliated or associated persons, who, at any time after

the date of the Rights Agreement, has acquired, or obtained the right to acquire, beneficial ownership of 16% (20% in the case of a Passive

Investor (as defined below)) or more of the Company’s outstanding shares of Common Stock, subject to certain exceptions, or (ii) the

tenth business day after the date on which any person, or group of affiliated or associated persons, commences a tender offer or exchange

offer, which, if consummated, would result in such person or group becoming an Acquiring Person (the earlier of such dates being called

the “Separation Time”).

The

Rights Agreement provides that an “Acquiring Person” shall not include any person, together with affiliates and associates

of such person, who or which is the beneficial owner of Common Stock representing less than 20% of the Common Stock then outstanding,

and is entitled to file, and files, a statement on Schedule 13G pursuant to Rule 13d-1(b) of the Securities Exchange Act of

1934, as amended, and the general rules and regulations thereunder (the “Exchange Act”), with respect to the

Common Stock beneficially owned by such person (a “Passive Investor”), subject to certain limitations as provided

in the Rights Agreement.

The Rights Agreement provides that, until the

Separation Time (or the earlier expiration or redemption of the Rights), the Rights will be transferred with and only with the Common

Stock. Until the Separation Time (or the earlier expiration or redemption of the Rights), new Common Stock certificates issued after the

Record Time upon transfer or new issuances of Common Stock will contain a legend incorporating the Rights Agreement by reference, and

notice of such legend will be furnished to holders of book entry shares. Until the Separation Time (or the earlier expiration or redemption

of the Rights), the surrender for transfer of any certificates for shares of Common Stock (or book entry shares of Common Stock) outstanding

as of the Record Time will also constitute the transfer of the Rights associated with the shares of Common Stock represented by such certificate

or registered in book entry form. At or after the Separation Time, separate certificates evidencing the Rights (the “Rights

Certificates”) will be mailed to holders of record of the Common Stock as of the Separation Time, and such separate Rights

Certificates alone will evidence the Rights.

The Rights are not exercisable until the Separation

Time. The Rights will expire prior to the earliest of (i) the close of business on December 4, 2024; (ii) the time at which the Rights

are redeemed pursuant to the Rights Agreement; (iii) the time at which the Rights are exchanged pursuant to the Rights Agreement;

and (iv) upon the occurrence of certain transactions.

Each one ten-thousandth of a share of Preferred

Stock (i) will not be redeemable; (ii) will entitle holders of such one ten-thousandth of a share to quarterly dividend payments

of an amount equal to the dividend paid on one share of Common Stock and an amount per whole share of Preferred Stock equal to the excess

(if any) of $300.00 over the aggregate dividends paid per whole share of Preferred Stock during the quarterly period; (iii) will

entitle holders upon liquidation to receive an amount equal to the greater of $0.01 per one ten-thousandth of a share or an amount equal

to the payment made on one share of Common Stock, together with accrued dividends to such distribution or payment date; (iv) if shares

of Common Stock are exchanged for or changed into other stock or securities, cash and/or any other property via merger, consolidation,

statutory share exchange reclassification or a similar transaction, will entitle holders to receive an amount of such other stock or securities,

cash and/or any other property that a holder of one share of Common Stock would be entitled to receive; and (v) will entitle holders to

the same voting power as one share of Common Stock.

The Board shall have the right to adjust, among

other things, the Exercise Price, as well as the number of outstanding Rights, to prevent dilution that may occur from a stock dividend,

a stock split, a reclassification or other event affecting the outstanding Common Stock.

Prior to the Expiration Time, upon (i) the

first date of a public announcement by the Company or an Acquiring Person that a person or group of affiliated or associated persons has

become an Acquiring Person, or (ii) such later date and time as the Board may fix by resolution, each Right will constitute the right

to purchase from the Company, the number of shares of Common Stock having an aggregate market price (as determined in the Rights Agreement)

equal to twice the Exercise Price for an amount in cash equal to the Exercise Price. On such date, any Rights that are beneficially owned

by any Acquiring Person (and such Acquiring Person’s affiliates or associates and, in each case, any transferee thereof) will become

null and void.

Prior to the Expiration Time, if (i) there

exists an Acquiring Person that controls the Board or beneficially owns 90% or more of the Common Stock, and the Company is involved in

a merger, consolidation or statutory share exchange and either (a) any term of, or arrangement concerning, the treatment of shares

of capital stock in such merger, consolidation or share exchange relating to the Acquiring Person is not identical to the terms and arrangements

relating to other holders of the Common Stock, or (b) such transaction is with the Acquiring Person or any of its affiliates or associates,

or (ii) a sale or transfer to any person or to a group of associated or affiliated persons (other than the Company and its subsidiaries)

occurs of (x) more than 50% of the Company’s and its subsidiaries’ assets or (y) assets generating more than 50%

of the operating income or cash flow of the Company and its subsidiaries, and at the time of such sale or transfer, the Acquiring Person

controls the Board, each Right will constitute the right to purchase from the acquiring or other appropriate entity, as applicable, that

number of shares of common stock of such entity having an aggregate market price equal to twice the Exercise Price for an amount in cash

equal to the Exercise Price.

At any time after the Flip-in Date (as defined

in the Rights Agreement) and prior to the time that an Acquiring Person becomes the beneficial owner of more than 50% of the outstanding

shares of Common Stock, the Board may exchange all (but not less than all) of the Rights (other than Rights beneficially owned by such

Acquiring Person and certain transferees thereof which will have become null and void) for shares of Common Stock at an exchange ratio

of one share of Common Stock per Right.

At any time prior to the Flip-In Date, the Board

may redeem all (but not less than all) of the Rights at a redemption price of $0.01 per Right (the “Redemption Price”),

subject to adjustment as provided in the Rights Agreement, payable, at the option of the Company, in cash, shares of Common Stock or other

securities of the Company as the Board shall determine. Immediately upon the action of the Board ordering the redemption of the Rights,

the right to exercise the Rights will terminate and the only right of the holders of Rights will be to receive the Redemption Price.

Until a Right is exercised or exchanged, the holder

thereof, as such, will have no rights as a stockholder of the Company, including, without limitation, the right to vote or to receive

dividends.

Prior to the Flip-In Date, the Company and the

Rights Agent may from time to time supplement or amend the Rights Agreement in any respect without the approval of any holders of Rights.

At any time on or after the Flip-In Date, the Company and the Rights Agent may supplement or amend the Rights Agreement without the approval

of any holders of Rights to make any changes that the Company may deem necessary or desirable (i) that shall not materially adversely

affect the interests of the holders of Rights generally (other than the Acquiring Person or any affiliate or associate thereof), (ii) in

order to cure any ambiguity or to correct or supplement any provision of the Rights Agreement that may be inconsistent with any other

provisions of the Rights Agreement or otherwise be defective or (iii) in order to satisfy any applicable law, rule or regulation.

In connection with the adoption of the Rights

Agreement, the Company adopted a Certificate of Designation of Series A Junior Participating Preferred Stock (the “Certificate

of Designation”). The Certificate of Designation was filed with the Secretary of State of the State of Delaware on December

6, 2023.

The Rights Agreement is attached hereto as

Exhibit 4.1 and is incorporated herein by reference. The Certificate of Designation is attached hereto as Exhibit 3.1 and is

incorporated herein by reference. The description of the Rights Agreement herein does not purport to be complete and is qualified in

its entirety by reference to Exhibit 4.1. The description of the Certificate of Designation herein does not purport to be complete and is qualified in its entirety by reference

to Exhibit 3.1.

| 3.1 |

|

Certificate of Designation of Series A Junior Participating Preferred Stock of Citi Trends, Inc. (incorporated by reference to Exhibit 3.1 of Citi Trends, Inc.’s Current Report on Form 8-K filed December 8, 2023). |

| |

|

|

| 4.1 |

|

Stockholder Protection Rights Agreement, dated as of December 6, 2023, between Citi Trends, Inc. and Equiniti Trust Company, LLC, as Rights Agent (incorporated by reference to Exhibit 4.1 of Citi Trends, Inc.’s Current Report on Form 8-K filed December 8, 2023). |

SIGNATURE

Pursuant

to the requirements of Section 12 of the Securities Exchange Act of 1934, the registrant has duly caused this registration statement to

be signed on its behalf by the undersigned, thereto duly authorized.

| |

CITI TRENDS, INC. |

| |

|

|

| Date: December 8, 2023 |

By: |

/s/ David N. Makuen |

| |

Name: |

David N. Makuen |

| |

Title: |

Chief Executive Officer |

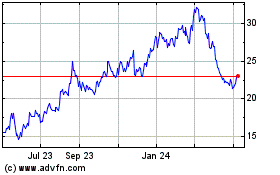

Citi Trends (NASDAQ:CTRN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Citi Trends (NASDAQ:CTRN)

Historical Stock Chart

From Apr 2023 to Apr 2024