Current Report Filing (8-k)

August 07 2019 - 7:33AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 1, 2019

CTI INDUSTRIES CORPORATION

(Exact name of registrant as specified in its charter)

Illinois

(State or other jurisdiction of incorporation)

|

000-23115

|

36-2848943

|

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

|

|

|

22160 N. Pepper Road Lake Barrington, Illinois

|

60010

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant's telephone number, including area code:

(847) 382-1000

Not applicable

(Former name or former address, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common

|

CTIB

|

Nasdaq

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (l7 CFR 230.425)

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-1 2)

|

|

|

☐

|

Pre-commencement communications pursuant to Rule l4d-2(b) under the Exchange Act (17 CFR 240. l 4d-2 (b))

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13c-4(c) under the Exchange Act (17 CFR 240. l 3c-4 (c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item

2.04

|

Triggering Events That Accelerate or Increase a Direct Financial Obligation.

|

On August 1, 2019, PNC Bank, National Association (“PNC”) sent a Notice of Default and Reservation of Rights communication (“Notice”) to CTI Industries Corporation under and with respect to (i) that certain Revolving Credit, Term Loan and Security Agreement (“Loan Agreement”) dated December 14, 2017 by and among CTI Industries Corporation, and its subsidiaries Flexo Universal, S.de R.L. de C.V. and CTI Supply, Inc. (collectively, “the Company”) and (ii) that certain Amendment No. 3 and Forbearance Agreement (“Amendment”) dated March 4, 2019 among PNC and the Company with respect to the Loan Agreement in which the Company acknowledged certain defaults on its part under the Loan Agreement and PNC agreed to forbear, during the Forbearance Period, from exercising its rights and remedies under the Loan Agreement with respect to such defaults.

In the Notice, PNC gave notice to the Company that the Forbearance Period ended on July 31, 2019 in accordance with the Amendment.

In the Notice, PNC stated that, by reason of the expiration of the Forbearance Period and the occurrence and continuation of defaults by the Company under the Loan Agreement, PNC is entitled to exercise immediately all of its rights and remedies under the Loan Agreement including ceasing to make further advances to the Company, implementing the Default Rate and declaring all obligations under the Loan Agreement to be immediately due and payable. The aggregate amount owed by the Company to PNC is approximately $16 million.

Further, in the Notice, PNC stated that it is willing to continue making certain advances to the Company, in its sole and absolute discretion, subject to relevant terms and conditions outlined in the Notice.

The Company continues to engage in efforts to enter into a major capital event with one or more institutions and also continues to engage in efforts to obtain sufficient financing. The Company does not have any commitment for any such capital event or refinancing, and there can be no assurance that the Company will be able to conclude any such capital event or re-financing.

This Notice is attached hereto.

Item No. 9.01 – Financial Statements and Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, CTI Industries Corporation has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized, in the Village of Lake Barrington, Illinois, August 7, 2019.

|

|

CTI INDUSTRIES CORPORATION

|

|

|

|

|

|

|

|

|

By:

|

/s/ Jeffrey S. Hyland

|

|

|

|

Jeffrey S. Hyland, Chief Executive Officer and President

|

EXHIBIT INDEX

|

Exhibit Number

|

Description

|

|

|

|

|

10.1

|

Notice of Default and Reservation of Rights dated August 1, 2019

|

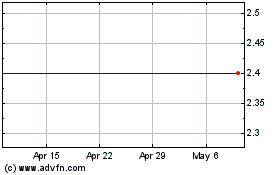

Yunhong CTI (NASDAQ:CTIB)

Historical Stock Chart

From Mar 2024 to Apr 2024

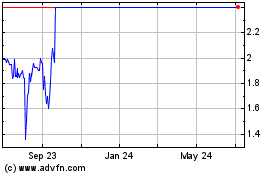

Yunhong CTI (NASDAQ:CTIB)

Historical Stock Chart

From Apr 2023 to Apr 2024