Cisco CFO Plans to Step Down

August 12 2020 - 9:45PM

Dow Jones News

By Nina Trentmann and Mark Maurer

Cisco Systems Inc. on Wednesday said finance chief Kelly Kramer

plans to leave the network-equipment company after more than five

years in the position.

Ms. Kramer, who took on the role of chief financial officer in

January 2015, will stay on until a successor has been found and

will assist with the recruitment process, Chief Executive Chuck

Robbins said during the company's earnings call.

"Kelly has made the decision to retire from Cisco," Mr. Robbins

said, according to a transcript. Ms. Kramer didn't immediately

respond to a request for comment.

She joined the San Jose, Calif.-based company in 2012 as senior

vice president of corporate finance and became senior vice

president of business technology and operations finance before

ascending to the CFO position.

Before her time at Cisco, Ms. Kramer worked at General Electric

Co. for about 20 years, including a 10-year stint at the company's

health care arm.

Ms. Kramer led Cisco through dozens of acquisitions, including

most recently of Modcam, a video analytics company, and

ThousandEyes Inc., a network intelligence firm. Under her

leadership, Cisco developed a record of successfully integrating

other businesses.

"Kelly has led the effort to improve our financial performance,

focused on investor confidence, and helped position Cisco for

success," Mr. Robbins said on the earnings call.

It is not clear yet what Ms. Kramer's exit package will look

like. She made $13.6 million in total compensation in 2019, which

included a salary of $850,000. She earned a total of $8.8 million

in 2017 and $11.5 million in 2018, according to Cisco's most recent

proxy statement.

The news of her departure came as Cisco reported a 9% decline in

sales in its latest quarter and said it would restructure its

operations. The company didn't specify how many jobs it would shed

but forecast charges of about $900 million before taxes, according

to a filing with regulators.

Cisco cut costs earlier in the year amid declining sales and

said some customers had reduced technology investments because of

economic uncertainty and the impact of the coronavirus

pandemic.

A new CFO will have to develop strategies for revenue growth and

allocate funds to acquire new customers, said Amit Daryanani, an

analyst at advisory firm Evercore ISI.

"The timing of her leaving, while maybe not optimal, doesn't

reflect on the challenge of this company," Mr. Daryanani said,

referring to Ms. Kramer. "The challenges they have are revenue

centric," he added, pointing to the coronavirus pandemic and the

weakening of the U.S. economy.

The average tenure of chief financial officers at S&P 500

and Fortune 500 companies has been trending lower and stood at 4.46

years in 2019, down from 5.1 in 2018, according to the Crist|Kolder

Volatility Report, which tracks recruitment trends in corporate

leadership.

Write to Nina Trentmann and Mark Maurer at

Nina.Trentmann@wsj.com

and Mark. Maurer@wsj.com

(END) Dow Jones Newswires

August 12, 2020 21:30 ET (01:30 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

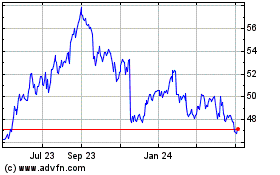

Cisco Systems (NASDAQ:CSCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

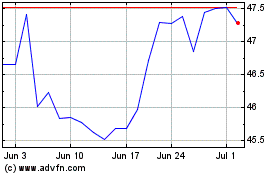

Cisco Systems (NASDAQ:CSCO)

Historical Stock Chart

From Apr 2023 to Apr 2024