false2024Q1000176169612-310.01667P1Mxbrli:sharesiso4217:USDiso4217:USDxbrli:sharesiso4217:CNYxbrli:sharesxbrli:purecrkn:segmentcrkn:reportingUnitcrkn:employeecrkn:slantWellcrkn:noteHoldercrkn:investorutr:Ycrkn:consultantutr:sqft00017616962024-01-012024-03-3100017616962024-05-1500017616962024-03-3100017616962023-12-310001761696us-gaap:SeriesAPreferredStockMember2023-12-310001761696us-gaap:SeriesAPreferredStockMember2024-03-310001761696us-gaap:SeriesBPreferredStockMember2023-12-310001761696us-gaap:SeriesBPreferredStockMember2024-03-310001761696us-gaap:SeriesCPreferredStockMember2024-03-310001761696us-gaap:SeriesCPreferredStockMember2023-12-310001761696us-gaap:SeriesDPreferredStockMember2024-03-310001761696us-gaap:SeriesDPreferredStockMember2023-12-310001761696us-gaap:SeriesEPreferredStockMember2024-03-310001761696us-gaap:SeriesEPreferredStockMember2023-12-310001761696us-gaap:SeriesFPreferredStockMember2023-12-310001761696us-gaap:SeriesFPreferredStockMember2024-03-310001761696crkn:SeriesF1PreferredStockMember2024-03-310001761696crkn:SeriesF1PreferredStockMember2023-12-310001761696crkn:SeriesF2PreferredStockMember2023-12-310001761696crkn:SeriesF2PreferredStockMember2024-03-3100017616962023-01-012023-03-310001761696us-gaap:SeriesAPreferredStockMember2024-01-012024-03-310001761696us-gaap:SeriesAPreferredStockMember2023-01-012023-03-310001761696us-gaap:SeriesBPreferredStockMember2024-01-012024-03-310001761696us-gaap:SeriesBPreferredStockMember2023-01-012023-03-310001761696us-gaap:SeriesCPreferredStockMember2024-01-012024-03-310001761696us-gaap:SeriesCPreferredStockMember2023-01-012023-03-310001761696us-gaap:SeriesDPreferredStockMember2024-01-012024-03-310001761696us-gaap:SeriesDPreferredStockMember2023-01-012023-03-310001761696us-gaap:SeriesFPreferredStockMember2024-01-012024-03-310001761696us-gaap:SeriesFPreferredStockMember2023-01-012023-03-310001761696crkn:SeriesF1PreferredStockMember2024-01-012024-03-310001761696crkn:SeriesF1PreferredStockMember2023-01-012023-03-310001761696crkn:SeriesF2PreferredStockMember2024-01-012024-03-310001761696crkn:SeriesF2PreferredStockMember2023-01-012023-03-310001761696us-gaap:PreferredStockMemberus-gaap:SeriesAPreferredStockMember2023-12-310001761696us-gaap:PreferredStockMemberus-gaap:SeriesBPreferredStockMember2023-12-310001761696us-gaap:SeriesCPreferredStockMemberus-gaap:PreferredStockMember2023-12-310001761696us-gaap:PreferredStockMemberus-gaap:SeriesDPreferredStockMember2023-12-310001761696us-gaap:PreferredStockMemberus-gaap:SeriesEPreferredStockMember2023-12-310001761696us-gaap:PreferredStockMemberus-gaap:SeriesFPreferredStockMember2023-12-310001761696us-gaap:PreferredStockMembercrkn:SeriesF1PreferredStockMember2023-12-310001761696us-gaap:PreferredStockMembercrkn:SeriesF2PreferredStockMember2023-12-310001761696us-gaap:CommonStockMemberus-gaap:CommonStockMember2023-12-310001761696us-gaap:AdditionalPaidInCapitalMember2023-12-310001761696us-gaap:RetainedEarningsMember2023-12-310001761696us-gaap:CommonStockMemberus-gaap:CommonStockMember2024-01-012024-03-310001761696us-gaap:CommonStockMember2024-01-012024-03-310001761696us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-310001761696us-gaap:RetainedEarningsMember2024-01-012024-03-310001761696us-gaap:PreferredStockMemberus-gaap:SeriesAPreferredStockMember2024-03-310001761696us-gaap:PreferredStockMemberus-gaap:SeriesBPreferredStockMember2024-03-310001761696us-gaap:SeriesCPreferredStockMemberus-gaap:PreferredStockMember2024-03-310001761696us-gaap:PreferredStockMemberus-gaap:SeriesDPreferredStockMember2024-03-310001761696us-gaap:PreferredStockMemberus-gaap:SeriesEPreferredStockMember2024-03-310001761696us-gaap:PreferredStockMemberus-gaap:SeriesFPreferredStockMember2024-03-310001761696us-gaap:PreferredStockMembercrkn:SeriesF1PreferredStockMember2024-03-310001761696us-gaap:PreferredStockMembercrkn:SeriesF2PreferredStockMember2024-03-310001761696us-gaap:CommonStockMemberus-gaap:CommonStockMember2024-03-310001761696us-gaap:AdditionalPaidInCapitalMember2024-03-310001761696us-gaap:RetainedEarningsMember2024-03-310001761696us-gaap:PreferredStockMemberus-gaap:SeriesAPreferredStockMember2022-12-310001761696us-gaap:PreferredStockMemberus-gaap:SeriesBPreferredStockMember2022-12-310001761696us-gaap:SeriesCPreferredStockMemberus-gaap:PreferredStockMember2022-12-310001761696us-gaap:PreferredStockMemberus-gaap:SeriesDPreferredStockMember2022-12-310001761696us-gaap:PreferredStockMemberus-gaap:SeriesEPreferredStockMember2022-12-310001761696us-gaap:CommonStockMemberus-gaap:CommonStockMember2022-12-310001761696us-gaap:AdditionalPaidInCapitalMember2022-12-310001761696us-gaap:RetainedEarningsMember2022-12-3100017616962022-12-310001761696us-gaap:CommonStockMemberus-gaap:CommonStockMember2023-01-012023-03-310001761696us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310001761696us-gaap:RetainedEarningsMember2023-01-012023-03-310001761696us-gaap:PreferredStockMemberus-gaap:SeriesEPreferredStockMember2023-01-012023-03-310001761696us-gaap:PreferredStockMemberus-gaap:SeriesAPreferredStockMember2023-03-310001761696us-gaap:PreferredStockMemberus-gaap:SeriesBPreferredStockMember2023-03-310001761696us-gaap:SeriesCPreferredStockMemberus-gaap:PreferredStockMember2023-03-310001761696us-gaap:PreferredStockMemberus-gaap:SeriesDPreferredStockMember2023-03-310001761696us-gaap:PreferredStockMemberus-gaap:SeriesEPreferredStockMember2023-03-310001761696us-gaap:CommonStockMemberus-gaap:CommonStockMember2023-03-310001761696us-gaap:AdditionalPaidInCapitalMember2023-03-310001761696us-gaap:RetainedEarningsMember2023-03-3100017616962023-03-310001761696us-gaap:RevolvingCreditFacilityMember2024-03-3100017616962023-08-152023-08-1500017616962022-08-120001761696crkn:PurchaseWarrantMember2022-08-120001761696crkn:PurchaseWarrantMember2024-03-310001761696us-gaap:SeriesAPreferredStockMember2024-01-012024-03-310001761696us-gaap:SeriesAPreferredStockMember2023-01-012023-03-310001761696us-gaap:SeriesBPreferredStockMember2024-01-012024-03-310001761696us-gaap:SeriesBPreferredStockMember2023-01-012023-03-310001761696us-gaap:SeriesCPreferredStockMember2024-01-012024-03-310001761696us-gaap:SeriesCPreferredStockMember2023-01-012023-03-310001761696us-gaap:SeriesDPreferredStockMember2024-01-012024-03-310001761696us-gaap:SeriesDPreferredStockMember2023-01-012023-03-310001761696us-gaap:SeriesEPreferredStockMember2024-01-012024-03-310001761696us-gaap:SeriesEPreferredStockMember2023-01-012023-03-310001761696crkn:ConvertibleNotesMember2024-01-012024-03-310001761696crkn:ConvertibleNotesMember2023-01-012023-03-310001761696us-gaap:SeriesFPreferredStockMember2024-01-012024-03-310001761696us-gaap:SeriesFPreferredStockMember2023-01-012023-03-310001761696crkn:SeriesF1PreferredStockMember2024-01-012024-03-310001761696crkn:SeriesF1PreferredStockMember2023-01-012023-03-310001761696crkn:SeriesF2PreferredStockMember2024-01-012024-03-310001761696crkn:SeriesF2PreferredStockMember2023-01-012023-03-310001761696crkn:WarrantsToPurchaseCommonStockexcludingPennyWarrantsMember2024-01-012024-03-310001761696crkn:WarrantsToPurchaseCommonStockexcludingPennyWarrantsMember2023-01-012023-03-310001761696crkn:WarrantsToPurchaseSeriesEPreferredStockMember2024-01-012024-03-310001761696crkn:WarrantsToPurchaseSeriesEPreferredStockMember2023-01-012023-03-310001761696crkn:OptionsToPurchaseCommonStockMember2024-01-012024-03-310001761696crkn:OptionsToPurchaseCommonStockMember2023-01-012023-03-310001761696crkn:UnvestedRestrictedStockUnitsMember2024-01-012024-03-310001761696crkn:UnvestedRestrictedStockUnitsMember2023-01-012023-03-310001761696crkn:CommitmentSharesMember2024-01-012024-03-310001761696crkn:CommitmentSharesMember2023-01-012023-03-310001761696crkn:Amerigen7Member2023-01-032023-01-030001761696crkn:Amerigen7Member2023-01-0300017616962023-01-030001761696crkn:Amerigen7Member2024-03-310001761696us-gaap:EquipmentMember2024-03-310001761696us-gaap:EquipmentMember2023-12-310001761696us-gaap:LeaseholdImprovementsMember2024-03-310001761696us-gaap:LeaseholdImprovementsMember2023-12-310001761696us-gaap:VehiclesMember2024-03-310001761696us-gaap:VehiclesMember2023-12-310001761696us-gaap:ComputerEquipmentMember2024-03-310001761696us-gaap:ComputerEquipmentMember2023-12-310001761696us-gaap:FurnitureAndFixturesMember2024-03-310001761696us-gaap:FurnitureAndFixturesMember2023-12-310001761696us-gaap:ConstructionInProgressMember2024-03-310001761696us-gaap:ConstructionInProgressMember2023-12-310001761696us-gaap:StandbyLettersOfCreditMember2024-03-310001761696us-gaap:StandbyLettersOfCreditMember2023-12-310001761696us-gaap:RevolvingCreditFacilityMember2023-12-310001761696us-gaap:LineOfCreditMember2024-03-310001761696us-gaap:LineOfCreditMember2023-12-310001761696us-gaap:StandbyLettersOfCreditMember2024-01-012024-03-310001761696us-gaap:StandbyLettersOfCreditMember2023-01-012023-03-310001761696us-gaap:RevolvingCreditFacilityMember2023-07-310001761696us-gaap:RevolvingCreditFacilityMember2024-01-012024-03-310001761696us-gaap:CommercialPaperMember2024-01-012024-03-310001761696us-gaap:CommercialPaperMember2023-01-012023-03-310001761696crkn:VistaSerenaS.DeR.L.DeC.V.Member2024-03-310001761696crkn:VistaSerenaS.DeR.L.DeC.V.Member2024-01-012024-03-3100017616962024-04-012024-03-310001761696crkn:Convertible2022NotesMember2022-10-310001761696crkn:Convertible2022NotesMember2022-10-012022-10-310001761696crkn:Convertible2022NotesMember2023-02-012023-02-280001761696crkn:Convertible2022NotesMember2023-03-310001761696crkn:Convertible2022NotesMemberus-gaap:CommonStockMember2023-03-310001761696crkn:Convertible2022NotesMember2023-03-012023-03-310001761696crkn:Convertible2022NotesMember2023-01-012023-12-310001761696crkn:Convertible2022NotesMember2024-01-012024-03-310001761696crkn:Convertible2022NotesMembercrkn:InvestorsTrancheOneMember2023-05-310001761696crkn:Convertible2022NotesMembercrkn:InvestorsTrancheOneMember2023-05-012023-05-310001761696crkn:Convertible2022NotesMembercrkn:InvestorsTrancheTwoMember2023-05-310001761696crkn:Convertible2022NotesMembercrkn:InvestorsTrancheTwoMember2023-05-012023-05-310001761696crkn:Convertible2022NotesMember2024-03-310001761696crkn:Convertible2022NotesMember2023-06-012023-06-300001761696crkn:SeniorSecuredNotesMember2023-01-310001761696crkn:SeniorSecuredNotesMember2023-01-012023-01-310001761696crkn:SeniorSecuredNotesMemberus-gaap:CommonStockMember2023-01-310001761696crkn:SeniorSecuredNotesMember2023-05-012023-05-310001761696crkn:SeniorSecuredNotesMember2023-01-012023-12-310001761696crkn:SeniorSecuredNotesMember2023-06-040001761696crkn:SeniorSecuredNotesMember2023-06-042023-06-040001761696crkn:SeniorSecuredNotesMemberus-gaap:SeriesFPreferredStockMember2023-06-040001761696crkn:SeniorSecuredNotesMember2023-06-302023-06-300001761696crkn:SeniorSecuredNotesMember2023-07-100001761696crkn:SeniorSecuredNotesMember2023-07-102023-07-100001761696crkn:SeniorSecuredNotesMember2024-03-310001761696crkn:SecuredPromissoryNoteMember2023-02-280001761696crkn:Note2023Member2023-02-012023-02-280001761696crkn:Note2023Member2023-02-280001761696crkn:Note2023Member2023-04-300001761696crkn:Note2023Member2023-04-012023-04-300001761696crkn:Note2023Memberus-gaap:SeriesEPreferredStockMember2023-05-150001761696crkn:Note2023Member2023-05-152023-05-150001761696crkn:Note2023Memberus-gaap:SeriesEPreferredStockMember2023-05-152023-05-150001761696crkn:Note2023Member2023-05-160001761696crkn:Note2023Member2023-05-162023-05-160001761696crkn:Note2023Member2023-05-260001761696crkn:Note2023Member2023-05-262023-05-260001761696crkn:Note2023Memberus-gaap:SeriesEPreferredStockMember2023-05-260001761696crkn:Note2023Member2023-06-132023-06-130001761696crkn:Note2023Memberus-gaap:SeriesEPreferredStockMember2023-06-302023-06-300001761696crkn:Note2023Memberus-gaap:CommonStockMember2023-06-302023-06-300001761696us-gaap:SeriesEPreferredStockMember2023-06-300001761696crkn:Note2023Member2023-06-300001761696crkn:Note2023Member2023-06-302023-06-300001761696crkn:Note2023Memberus-gaap:SeriesEPreferredStockMember2023-06-300001761696crkn:Note2023Member2023-07-012023-07-310001761696crkn:Note2023Member2024-03-310001761696crkn:DemandNoteMember2023-05-180001761696crkn:DemandNoteMember2023-05-172023-05-180001761696crkn:DemandNoteMember2023-05-300001761696us-gaap:CommonStockMembercrkn:DemandNoteMember2023-05-302023-05-300001761696crkn:DemandNoteMember2023-07-250001761696crkn:DemandNoteMember2023-07-252023-07-250001761696crkn:DemandNoteMember2024-03-310001761696crkn:CemenTechCapitalLLCMember2023-12-280001761696crkn:CemenTechCapitalLLCMember2023-03-310001761696us-gaap:FairValueInputsLevel1Member2024-03-310001761696us-gaap:FairValueInputsLevel2Member2024-03-310001761696us-gaap:FairValueInputsLevel3Member2024-03-310001761696us-gaap:MeasurementInputExpectedDividendRateMember2024-03-310001761696us-gaap:MeasurementInputPriceVolatilityMember2024-03-310001761696us-gaap:MeasurementInputRiskFreeInterestRateMember2024-03-310001761696us-gaap:MeasurementInputExpectedTermMember2024-03-310001761696crkn:Convertible2022NotesMember2023-03-012023-03-310001761696crkn:Convertible2022NotesMember2023-06-300001761696us-gaap:SeriesFPreferredStockMember2023-06-012023-06-300001761696crkn:Convertible2022NotesMember2023-02-280001761696crkn:Convertible2022NotesMember2023-02-012023-02-280001761696crkn:Convertible2022NotesMember2023-05-3100017616962023-07-012023-07-310001761696crkn:WarrantLiabilitiesMember2023-12-310001761696crkn:WarrantLiabilitiesMember2024-01-012024-03-310001761696crkn:WarrantLiabilitiesMember2024-03-310001761696us-gaap:WarrantMember2024-03-310001761696crkn:ExchangeAgreementsMember2024-01-012024-03-310001761696crkn:SeniorSecuredNotesMember2024-03-310001761696us-gaap:SeriesEPreferredStockMember2023-02-280001761696crkn:SeriesF1AndF2IssuancesMember2024-03-310001761696us-gaap:MeasurementInputExpectedDividendRateMembercrkn:SeriesFF1F2Member2024-03-310001761696us-gaap:MeasurementInputExpectedDividendRateMembercrkn:TwoThousandTwentyTwoNotesMember2024-03-310001761696us-gaap:MeasurementInputExpectedDividendRateMembercrkn:WarrantsSeniorSecuredNoteMember2024-03-310001761696us-gaap:MeasurementInputExpectedDividendRateMembercrkn:WarrantsSeriesELOCMember2024-03-310001761696crkn:WarrantsMar.12024Memberus-gaap:MeasurementInputExpectedDividendRateMember2024-03-310001761696crkn:SeriesFF1F2Memberus-gaap:MeasurementInputPriceVolatilityMember2024-03-310001761696us-gaap:MeasurementInputPriceVolatilityMembercrkn:TwoThousandTwentyTwoNotesMember2024-03-310001761696us-gaap:MeasurementInputPriceVolatilityMembercrkn:WarrantsSeniorSecuredNoteMember2024-03-310001761696us-gaap:MeasurementInputPriceVolatilityMembercrkn:WarrantsSeriesELOCMember2024-03-310001761696crkn:WarrantsMar.12024Memberus-gaap:MeasurementInputPriceVolatilityMember2024-03-310001761696crkn:SeriesFF1F2Memberus-gaap:MeasurementInputRiskFreeInterestRateMember2024-03-310001761696us-gaap:MeasurementInputRiskFreeInterestRateMembercrkn:TwoThousandTwentyTwoNotesMember2024-03-310001761696us-gaap:MeasurementInputRiskFreeInterestRateMembercrkn:WarrantsSeniorSecuredNoteMember2024-03-310001761696us-gaap:MeasurementInputRiskFreeInterestRateMembercrkn:WarrantsSeriesELOCMember2024-03-310001761696crkn:WarrantsMar.12024Memberus-gaap:MeasurementInputRiskFreeInterestRateMember2024-03-310001761696crkn:SeriesFF1F2Memberus-gaap:MeasurementInputExpectedTermMember2024-01-012024-03-310001761696crkn:TwoThousandTwentyTwoNotesMemberus-gaap:MeasurementInputExpectedTermMember2024-01-012024-03-310001761696crkn:WarrantsSeniorSecuredNoteMemberus-gaap:MeasurementInputExpectedTermMember2024-01-012024-03-310001761696crkn:WarrantsSeriesELOCMemberus-gaap:MeasurementInputExpectedTermMember2024-01-012024-03-310001761696crkn:WarrantsMar.12024Memberus-gaap:MeasurementInputExpectedTermMember2024-01-012024-03-310001761696us-gaap:SeriesEPreferredStockMember2023-02-010001761696us-gaap:SeriesEPreferredStockMember2023-02-020001761696us-gaap:SeriesEPreferredStockMember2023-02-022023-02-020001761696us-gaap:LineOfCreditMember2023-02-022023-02-020001761696crkn:A2022NotesMemberus-gaap:SeriesFPreferredStockMember2023-07-040001761696us-gaap:SeriesFPreferredStockMember2023-07-040001761696crkn:SeniorSecuredNotesMemberus-gaap:SeriesFPreferredStockMember2023-07-040001761696crkn:DemandNoteHoldersMemberus-gaap:SeriesFPreferredStockMember2023-07-040001761696us-gaap:SeriesDPreferredStockMember2023-07-042023-07-040001761696us-gaap:SeriesFPreferredStockMember2023-07-042023-07-040001761696crkn:A2022NotesMemberus-gaap:SeriesFPreferredStockMember2024-03-310001761696crkn:SeniorSecuredNotesMemberus-gaap:SeriesFPreferredStockMember2024-03-310001761696crkn:DemandNoteHoldersMemberus-gaap:SeriesFPreferredStockMember2024-03-310001761696crkn:SeriesFPreferredStockToCommonStockMemberus-gaap:SeriesFPreferredStockMember2023-07-012023-07-310001761696us-gaap:CommonStockMembercrkn:SeriesFPreferredStockToCommonStockMember2023-07-012023-07-310001761696crkn:SeriesF1PreferredStockMember2023-06-130001761696crkn:SeriesF1PreferredStockMember2023-06-132023-06-130001761696crkn:SeriesF1PreferredStockMembercrkn:F1WarrantMember2024-03-310001761696crkn:SeriesF1PreferredStockMember2023-07-310001761696crkn:SeriesF2PreferredStockMember2022-06-140001761696crkn:SeriesF2PreferredStockMember2022-06-142022-06-140001761696crkn:SeriesF2PreferredStockMembercrkn:F2WarrantMember2024-03-310001761696crkn:SeriesF2PreferredStockMember2023-06-140001761696us-gaap:CommonStockMember2024-03-310001761696us-gaap:WarrantMember2024-01-012024-03-310001761696us-gaap:WarrantMember2024-03-310001761696crkn:AtTheMarketOfferingMember2024-01-012024-03-310001761696crkn:AtTheMarketOfferingMembersrt:WeightedAverageMember2024-03-3100017616962023-07-202023-07-200001761696crkn:ELOCPurchaseAgreementMember2023-07-202024-03-310001761696crkn:ELOCPurchaseAgreementMembersrt:WeightedAverageMember2024-03-310001761696crkn:TwoThousandSixteenEquityIncentivePlanMember2019-06-130001761696crkn:TwoThousandSixteenEquityIncentivePlanMember2019-06-140001761696crkn:TwoThousandTwentyLongTermIncentivePlanMember2020-12-160001761696crkn:TwoThousandTwentyLongTermIncentivePlanMember2020-12-162020-12-160001761696crkn:TwoThousandTwentyTwoLongTermIncentivePlanMember2022-12-2200017616962023-01-012023-12-310001761696us-gaap:EmployeeStockOptionMember2024-01-012024-03-310001761696us-gaap:EmployeeStockOptionMember2024-03-310001761696us-gaap:ResearchAndDevelopmentExpenseMember2024-01-012024-03-310001761696us-gaap:ResearchAndDevelopmentExpenseMember2023-01-012023-03-310001761696us-gaap:SellingGeneralAndAdministrativeExpensesMember2024-01-012024-03-310001761696us-gaap:SellingGeneralAndAdministrativeExpensesMember2023-01-012023-03-310001761696us-gaap:RestrictedStockMember2023-12-310001761696us-gaap:RestrictedStockMember2024-01-012024-03-310001761696us-gaap:RestrictedStockMember2024-03-310001761696us-gaap:LineOfCreditMember2024-03-310001761696us-gaap:LineOfCreditMembercrkn:AscentArtVenturesLLCMember2024-03-310001761696crkn:FiveOceansCapitalLLCMemberus-gaap:LineOfCreditMember2024-03-310001761696crkn:TwoThousandTwentyTwoNotesMember2024-03-310001761696us-gaap:WarrantMember2023-12-310001761696crkn:TwoThousandTwentyTwoNotesMembercrkn:WaiverAgreementWarrantsMember2023-02-280001761696crkn:ExchangeWarrantMemberus-gaap:SeriesDPreferredStockMember2024-03-310001761696crkn:ExchangeWarrantMemberus-gaap:SeriesDPreferredStockMember2024-01-012024-03-310001761696crkn:SeriesF1PreferredStockMembercrkn:F1WarrantMember2024-01-012024-03-310001761696crkn:SeriesF2PreferredStockMembercrkn:F2WarrantMember2024-01-012024-03-310001761696crkn:OregonStateUniversityMember2016-03-080001761696crkn:OregonStateUniversityMember2023-01-190001761696srt:MinimumMembercrkn:OregonStateUniversityMember2023-01-200001761696crkn:OregonStateUniversityMember2023-01-202023-01-200001761696crkn:Hudson11601WilshireLLCMember2021-03-040001761696crkn:HPInc.Member2021-05-040001761696srt:MinimumMembercrkn:HPInc.Member2021-05-040001761696crkn:HPInc.Membersrt:MaximumMember2021-05-040001761696crkn:PacificN.W.PropertiesLLCMember2021-10-050001761696crkn:PacificN.W.PropertiesLLCMember2023-04-070001761696crkn:PacificN.W.PropertiesLLCMember2023-04-012023-06-300001761696crkn:PacificN.W.PropertiesLLCMember2023-06-300001761696us-gaap:LandMembercrkn:Burnham182LLCMember2023-10-160001761696crkn:Burnham182LLCMember2023-10-160001761696crkn:Months112Member2024-01-012024-03-310001761696crkn:Months1324Member2024-01-012024-03-310001761696crkn:Months2536Member2024-01-012024-03-310001761696crkn:NFSLeasingInc.Member2023-11-300001761696crkn:NFSLeasingInc.Member2023-11-012023-11-300001761696crkn:FilmSegmentMember2024-01-012024-03-310001761696crkn:FilmSegmentMember2023-01-012023-03-310001761696crkn:FiberOpticsSegmentMember2024-01-012024-03-310001761696crkn:FiberOpticsSegmentMember2023-01-012023-03-310001761696us-gaap:OperatingSegmentsMembercrkn:FilmSegmentMember2024-01-012024-03-310001761696us-gaap:OperatingSegmentsMembercrkn:FiberOpticsSegmentMember2024-01-012024-03-310001761696us-gaap:CorporateNonSegmentMember2024-01-012024-03-310001761696us-gaap:OperatingSegmentsMembercrkn:FilmSegmentMember2023-01-012023-03-310001761696us-gaap:OperatingSegmentsMembercrkn:FiberOpticsSegmentMember2023-01-012023-03-310001761696us-gaap:CorporateNonSegmentMember2023-01-012023-03-310001761696crkn:FilmSegmentMember2024-03-310001761696crkn:FilmSegmentMember2023-03-310001761696crkn:FiberOpticsSegmentMember2024-03-310001761696crkn:FiberOpticsSegmentMember2023-03-310001761696us-gaap:NotesReceivableMember2024-03-310001761696us-gaap:SubsequentEventMembercrkn:ELOCPurchaseAgreementMember2024-04-012024-05-150001761696us-gaap:SubsequentEventMembercrkn:ELOCPurchaseAgreementMembersrt:WeightedAverageMember2024-05-150001761696crkn:SeriesFPreferredStockConvertedToCommonStockMemberus-gaap:SubsequentEventMemberus-gaap:SeriesFPreferredStockMember2024-05-152024-05-150001761696crkn:SeriesFPreferredStockConvertedToCommonStockMemberus-gaap:CommonStockMemberus-gaap:SubsequentEventMember2024-05-152024-05-150001761696crkn:SeriesFPreferredStockConvertedToCommonStockMemberus-gaap:SubsequentEventMember2024-05-152024-05-150001761696crkn:SeriesF1PreferredStockMemberus-gaap:SubsequentEventMembercrkn:SeriesF1PreferredStockConvertedToCommonStockMember2024-05-152024-05-150001761696us-gaap:CommonStockMemberus-gaap:SubsequentEventMembercrkn:SeriesF1PreferredStockConvertedToCommonStockMember2024-05-152024-05-150001761696us-gaap:SubsequentEventMembercrkn:SeriesF1PreferredStockConvertedToCommonStockMember2024-05-152024-05-150001761696crkn:SeriesF2PreferredStockConvertedToCommonStockMemberus-gaap:SubsequentEventMembercrkn:SeriesF2PreferredStockMember2024-05-152024-05-150001761696crkn:SeriesF2PreferredStockConvertedToCommonStockMemberus-gaap:CommonStockMemberus-gaap:SubsequentEventMember2024-05-152024-05-150001761696crkn:SeriesF2PreferredStockConvertedToCommonStockMemberus-gaap:SubsequentEventMember2024-05-152024-05-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended March 31, 2024

OR

o TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________ to __________

Commission file number: 333-232426

Crown Electrokinetics Corp.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | | 47-5423944 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

1110 NE Circle Blvd., Corvallis, Oregon 97330

(Address of principal executive offices) (Zip Code)

213.660.4250

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | o | Accelerated filer | o |

| Non-accelerated filer | x | Smaller reporting company | x |

| | Emerging growth company | x |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. o

Indicate by check mark whether registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

The number of shares of common stock, $0.0001 par value per share, outstanding as of May 15, 2024 was 281,930,398.

| | | | | | | | | | | | | | |

| Common Stock, $0.0001 par value | | CRKN | | The Nasdaq Capital Market |

CROWN ELECTROKINETICS CORP.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS AND INDUSTRY DATA

This Quarterly Report on Form 10-Q contains forward-looking statements which are made pursuant to the safe harbor provisions of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These statements may be identified by such forward-looking terminology as “may,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” “continue” or the negative of these terms or other comparable terminology. Our forward-looking statements are based on a series of expectations, assumptions, estimates and projections about our company, are not guarantees of future results or performance and involve substantial risks and uncertainty. We may not actually achieve the plans, intentions or expectations disclosed in these forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in these forward-looking statements. Our business and our forward-looking statements involve substantial known and unknown risks and uncertainties.

All of our forward-looking statements are as of the date of this Quarterly Report on Form 10-Q only. In each case, actual results may differ materially from such forward-looking information. We can give no assurance that such expectations or forward-looking statements will prove to be correct. An occurrence of, or any material adverse change in, one or more of the risk factors or risks and uncertainties referred to in this Quarterly Report on Form 10-Q or included in our other public disclosures or our other periodic reports or other documents or filings filed with or furnished to the U.S. Securities and Exchange Commission (the “SEC”) could materially and adversely affect our business, prospects, financial condition and results of operations. Except as required by law, we do not undertake or plan to update or revise any such forward-looking statements to reflect actual results, changes in plans, assumptions, estimates or projections or other circumstances affecting such forward-looking statements occurring after the date of this Quarterly Report on Form 10-Q, even if such results, changes or circumstances make it clear that any forward-looking information will not be realized. Any public statements or disclosures by us following this Quarterly Report on Form 10-Q that modify or impact any of the forward-looking statements contained in this Quarterly Report on Form 10-Q will be deemed to modify or supersede such statements in this Quarterly Report on Form 10-Q.

PART I - FINANCIAL INFORMATION

Item 1. - Financial Statements.

CROWN ELECTROKINETICS CORP.

Condensed Consolidated Balance Sheets

(in thousands, except share and per share amounts)

| | | | | | | | | | | | | | |

| March 31,

2024 | | December 31,

2023 | |

| (Unaudited) | | | |

| ASSETS | | | | |

| Current assets: | | | | |

| Cash | $ | 290 | | | $ | 1,059 | | |

| Prepaid and other current assets | 813 | | | 728 | | |

| Accounts receivable, net | 776 | | | 83 | | |

| Note receivable | 576 | | | — | | |

| Total current assets | 2,455 | | | 1,870 | | |

| Property and equipment, net | 3,036 | | | 3,129 | | |

| Intangible assets, net | 1,326 | | | 1,382 | | |

| Right-of-use assets | 1,533 | | | 1,701 | | |

| Deferred debt issuance costs | 362 | | | 1,306 | | |

| Other assets | 165 | | | 139 | | |

| TOTAL ASSETS | $ | 8,877 | | | $ | 9,527 | | |

| | | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | |

| | | | |

| Current liabilities: | | | | |

| Accounts payable | $ | 2,297 | | | $ | 1,500 | | |

| Accrued expenses | 962 | | | 1,190 | | |

| Lease liabilities - current portion | 606 | | | 655 | | |

| Warrant liability | 23 | | | — | | |

| Notes payable - Current | 93 | | | 429 | | |

| Deferred revenue | 1,260 | | | — | | |

| Warranty customer liability | 20 | | | 2 | | |

| Total current liabilities | 5,261 | | | 3,776 | | |

| Notes payable - non-current | 328 | | | — | | |

| Lease liabilities - non-current portion | 950 | | | 1,072 | | |

| Warranty customer liability long term | 20 | | | 2 | | |

| Total liabilities | 6,559 | | | 4,850 | | |

| | | | |

| Commitments and Contingencies (Note 14) | | | | |

| | | | |

| STOCKHOLDERS’ EQUITY: | | | | |

Preferred stock, par value $0.0001; 50,000,000 shares authorized, no shares outstanding | - | | | - | | |

Series A preferred stock, par value $0.0001; 300 shares authorized, 251 shares outstanding as of March 31, 2024 and December 31, 2023; liquidation preference $266 as of March 31, 2024 and $261 as of December 31, 2023 | - | | | - | | |

Series B preferred stock, par value $0.0001; 1,500 shares authorized, 1,443 shares outstanding as of March 31, 2024 and December 31, 2023; liquidation preference $1,530 as of March 31, 2024 and $1,501 as of December 31, 2023 | - | | | - | | |

Series C preferred stock, par value $0.0001; 600,000 shares authorized, 500,756 shares outstanding as of March 31, 2024 and December 31, 2023; liquidation preference $541 as of March 31, 2024 and $531 as of December 31, 2023 | - | | | - | | |

Series D preferred stock, par value $0.0001; $7,000 shares authorized, no shares issued and outstanding as of March 31, 2024 and December 31, 2023; liquidation preference zero as of March 31, 2024 and December 31, 2023 | - | | | - | | |

Series E preferred stock, par value $0.0001; 77,000 shares authorized, no shares issued and outstanding as of March 31, 2024 and December 31, 2023. | - | | | - | | |

Series F preferred stock, par value $0.0001; 9,073 shares authorized, 4,448 shares outstanding as of March 31, 2024 and 4,448 shares outstanding as of December 31, 2023; liquidation preference $4,931 as of March 31, 2024 and $4,753 as of December 31, 2023. | - | | | - | | |

Series F-1 preferred stock, par value $0.0001; 9,052 shares authorized, 653 shares outstanding as of March 31, 2024 and 653 shares outstanding as of December 31, 2023; liquidation preference $722 as of March 31, 2024 and $696 as of December 31, 2023. | - | | | - | | |

Series F-2 preferred stock, par value $0.0001; 9,052 shares authorized, 1,153 shares outstanding as of March 31, 2024 and 1,153 shares outstanding as of December 31, 2023; liquidation preference $1,267 as of March 31, 2024 and $1,371 as of December 31, 2023. | - | | | - | | |

Common stock, par value $0.0001; 800,000,000 shares authorized; 51,702,229 and 25,744,158 shares outstanding as of March 31, 2024 and December 31, 2023, respectively | 10 | | | 7 | | |

| Additional paid-in capital | 123,915 | | | 121,665 | | |

| Accumulated deficit | (121,607) | | | (116,995) | | |

| Total stockholders’ equity | 2,318 | | | 4,677 | | |

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | $ | 8,877 | | | $ | 9,527 | | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

CROWN ELECTROKINETICS CORP.

Condensed Consolidated Statements of Operations

(Unaudited)

(in thousands, except share and per share amounts)

| | | | | | | | | | | | | | | | | | |

| Three Months Ended

March 31, | | | |

| 2024 | | 2023 | | | | | |

| Revenue | $ | 682 | | | $ | 22 | | | | | | |

| | | | | | | | |

| Cost of revenue, excluding depreciation and amortization | (1,636) | | | (31) | | | | | | |

| Depreciation and amortization | (212) | | | (182) | | | | | | |

| Research and development | (756) | | | (541) | | | | | | |

| General and administrative | (1,783) | | | (3,394) | | | | | | |

| Loss from operations | (3,705) | | | (4,126) | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Other income (expense): | | | | | | | | |

| Interest expense | (860) | | | (2,017) | | | | | | |

| Loss on extinguishment of warrant liability | - | | | (504) | | | | | | |

| | | | | | | | |

| Gain on issuance of convertible notes | - | | | 64 | | | | | | |

| Change in fair value of warrants | (23) | | | 5,606 | | | | | | |

| Change in fair value of notes | - | | | (117) | | | | | | |

| | | | | | | | |

| Other expense | (24) | | | (1,206) | | | | | | |

| Total other income (expense) | (907) | | | 1,826 | | | | | | |

| | | | | | | | |

| Loss before income taxes | (4,612) | | | (2,300) | | | | | | |

| | | | | | | | |

| Income tax expense | - | | | - | | | | | | |

| | | | | | | | |

| Net loss | (4,612) | | | (2,300) | | | | | | |

| Deemed dividend on Series D preferred stock | - | | | (6) | | | | | | |

| Cumulative dividends on Series A preferred stock | (5) | | | (4) | | | | | | |

| Cumulative dividends on Series B preferred stock | (29) | | | (20) | | | | | | |

| Cumulative dividends on Series C preferred stock | (10) | | | - | | | | | | |

| Cumulative dividends on Series D preferred stock | - | | | (86) | | | | | | |

| Cumulative dividends on Series F preferred stock | (178) | | | - | | | | | | |

| Cumulative dividends on Series F-1 preferred stock | (26) | | | - | | | | | | |

| Cumulative dividends on Series F-2 preferred stock | (35) | | | | | | | | |

| Net loss attributable to common stockholders | $ | (4,895) | | | $ | (2,416) | | | | | | |

| | | | | | | | |

| Net loss per share attributable to common stockholders | $ | (0.13) | | | $ | (4.88) | | | | | | |

| | | | | | | | |

| Weighted average shares outstanding, basic and diluted: | 36,675,540 | | 494,918 | | | | | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

CROWN ELECTROKINETICS CORP.

Condensed Consolidated Statements of Stockholders’ Equity

(Unaudited)

(in thousands, except share and per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Series A

Preferred Stock | | Series B

Preferred Stock | | Series C

Preferred Stock | | Series D

Preferred Stock | | Series E

Preferred Stock | | Series F

Preferred Stock | | Series F-1

Preferred Stock | | Series F-2

Preferred Stock | | Common Stock | | Additional

Paid-in

Capital | | Accumulated

Deficit | | Total

Stockholders’

Equity | |

| Number | | Amount | | Number | | Amount | | Number | | Amount | | Number | | Amount | | Number | | Amount | | Number | | Amount | | Number | | Amount | | Number | | Amount | | Number | | Amount | | | | |

| Balance as of December 31, 2023 | 251 | | $ | - | | | 1,443 | | $ | - | | | 500,756 | | $ | - | | | 0 | | $ | - | | | - | | $ | - | | | 4,448 | | $ | - | | | 653 | | $ | - | | | 1,153 | | $ | - | | | 25,744,158 | | $ | 7 | | | $ | 121,665 | | | $ | (116,995) | | | $ | 4,677 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Issuance of common stock in connection with equity line of credit | - | | - | | | - | | - | | | - | | - | | | - | | - | | | - | | - | | | - | | - | | | - | | - | | | - | | - | | | 21,133,689 | | 3 | | | 1,388 | | | - | | | 1,391 | | |

| Issuance of common stock/at-the-market offering, net of offering costs | - | | - | | | - | | - | | | - | | - | | | - | | - | | | - | | - | | | - | | - | | | - | | - | | | - | | - | | | 4,824,382 | | - | | | 588 | | | - | | | 588 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Stock-based compensation | - | | - | | | - | | - | | | - | | - | | | - | | - | | | - | | - | | | - | | - | | | - | | - | | | - | | - | | | | | | | 274 | | | - | | | 274 | | |

| Net loss | - | | - | | | - | | - | | | - | | - | | | - | | - | | | - | | - | | | - | | - | | | - | | - | | | - | | - | | | - | | - | | | - | | | (4,612) | | | (4,612) | | |

| Balance as of March 31, 2024 (unaudited) | 251 | | $ | - | | | 1,443 | | $ | - | | | 500,756 | | $ | - | | | - | | $ | - | | | - | | $ | - | | | 4,448 | | $ | - | | | 653 | | $ | - | | | 1,153 | | $ | - | | | 51,702,229 | | $ | 10 | | | $ | 123,915 | | | $ | (121,607) | | | $ | 2,318 | | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

CROWN ELECTROKINETICS CORP.

Condensed Consolidated Statements of Stockholders’ Equity (Continued)

(Unaudited)

(in thousands, except share and per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Series A

Preferred Stock | | Series B

Preferred Stock | | Series C

Preferred Stock | | Series D

Preferred Stock | | Series E

Preferred Stock | | Common Stock | | Additional

Paid-in

Capital | | Accumulated

Deficit | | Total

Stockholders’

Equity

(Deficit) | |

| Number | | Amount | | Number | | Amount | | Number | | Amount | | Number | | Amount | | Number | | Amount | | Number | | Amount | | | | |

| Balance as of December 31, 2022 | 251 | | $ | - | | | 1,443 | | $ | - | | | 500,756 | | $ | - | | | 1,058 | | $ | - | | | - | | $ | - | | | 338,033 | | $ | 2 | | | $ | 88,533 | | | $ | (88,005) | | | $ | 530 | | |

| Exercise of common stock warrants | - | | - | | | - | | - | | | - | | - | | | - | | - | | | - | | - | | | 109,257 | | 1 | | | 2,061 | | | - | | | 2,062 | | |

| Issuance of common stock in connection with conversion of notes | - | | - | | | - | | - | | | - | | - | | | - | | - | | | - | | - | | | 31,466 | | | | 516 | | | - | | | 516 | | |

| Commitment to issue shares of common stock in connection with March waiver agreement | - | | - | | | - | | - | | | - | | - | | | - | | - | | | - | | - | | | - | | - | | | 298 | | | - | | | 298 | | |

| Deemed dividend for repricing of Series D preferred stock | - | | - | | | - | | - | | | - | | - | | | - | | - | | | - | | - | | | - | | - | | | 6 | | | (6) | | | - | | |

| Issuance of common stock/at-the-market offering, net of offering costs | - | | - | | | - | | - | | | - | | - | | | - | | - | | | - | | - | | | 211,667 | | 1 | | | 2,106 | | | - | | | 2,107 | | |

| Issuance of Series E preferred stock in connection with LOC | - | | - | | | - | | - | | | - | | - | | | - | | - | | | 5,000 | | | | | | | | 4,350 | | | | | 4,350 | | |

| Stock-based compensation | - | | - | | | - | | - | | | - | | - | | | - | | - | | | - | | - | | | 38,335 | | - | | | 181 | | | - | | | 181 | | |

| Net loss | - | | - | | | - | | - | | | - | | - | | | - | | - | | | - | | - | | | - | | - | | | - | | | (2,300) | | | (2,300) | | |

| Balance as of March 31, 2023 (Unaudited) | 251 | | $ | - | | | 1,443 | | $ | - | | | 500,756 | | $ | - | | | 1,058 | | $ | - | | | 5,000 | | $ | - | | | 728,758 | | $ | 4 | | | $ | 98,051 | | | $ | (90,311) | | | $ | 7,744 | | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

CROWN ELECTROKINETICS CORP.

Condensed Consolidated Statements of Cash Flows

(Unaudited)

(in thousands)

| | | | | | | | | | | | | | |

| Three months ended

March 31, | |

| 2024 | | 2023 | |

| CASH FLOWS FROM OPERATING ACTIVITIES | | | | |

| Net loss | $ | (4,612) | | | $ | (2,300) | | |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | | |

| Stock-based compensation | 274 | | | 181 | | |

| Depreciation and amortization | 212 | | | 182 | | |

| Loss on extinguishment of warrant liability | - | | | 504 | | |

| Change in fair value of warrant liability | 23 | | | (5,606) | | |

| | | | |

| Gain on issuance of convertible note | - | | | (64) | | |

| | | | |

| Amortization of debt discount | - | | | 374 | | |

| Change in fair value of notes | - | | | 117 | | |

| Amortization of deferred debt issuance costs | 944 | | | 1,635 | | |

| Amortization of right-of-use assets | 168 | | | 133 | | |

| | | | |

| Other expenses | - | | | 1,206 | | |

| Changes in operating assets and liabilities: | | | | |

| Prepaid and other assets | (111) | | | (161) | | |

| Accounts receivable | (693) | | | — | | |

| Note receivables | (576) | | | — | | |

| Deferred revenue | 1,260 | | | — | | |

| Accounts payable | 797 | | | 125 | | |

| Accrued expenses | (228) | | | (920) | | |

| Lease liabilities | (171) | | | (134) | | |

| Warranty customer liability | 36 | | | — | | |

| Net cash used in operating activities | (2,677) | | | (4,728) | | |

| CASH FLOWS FROM INVESTING ACTIVITIES | | | | |

| Cash paid for acquisition of Amerigen 7 | - | | | (645) | | |

| Purchase of equipment | (63) | | | (435) | | |

| Net cash used in investing activities | (63) | | | (1,080) | | |

| CASH FLOWS FROM FINANCING ACTIVITIES | | | | |

| Proceeds from the exercise of warrants | - | | | 2,062 | | |

| Proceeds from the issuance of common stock and warrants, net of fees | - | | | - | | |

| Proceeds from the issuance of common stock / at-the-market offering, net of offering costs | 588 | | | 2,107 | | |

| | | | |

| | | | |

| Proceeds from issuance of notes in connection with Line of Credit | - | | | 2,000 | | |

| Proceeds from issuance of January promissory notes, net of fees paid | - | | | 970 | | |

| | | | |

| | | | |

| | | | |

| | | | |

| Repayment of notes payable | (8) | | | (14) | | |

| Proceeds from the issuance of common stock in connection with equity line of credit, net of offering costs | 1,391 | | | - | | |

| Net cash provided by financing activities | 1,971 | | | 7,125 | | |

| | | | | |

| Net increase / decrease in cash | (769) | | | 1,317 | | |

| Cash — beginning of period | 1,059 | | | 821 | | |

| Cash — end of period | $ | 290 | | | $ | 2,138 | | |

| SUPPLEMENTAL DISCLOSURE OF NON-CASH INVESTING AND FINANCING ACTIVITIES: | | | | |

| Issuance of Series E preferred stock in connection with line of credit | $ | - | | | $ | 4,350 | | |

| | | | |

| | | | |

| Issuance of common stock in connection with conversion of notes | $ | - | | | $ | 516 | | |

| | | | |

| | | | |

| | | | |

| Commitment to issue shares of common stock in connection with March Waiver agreement | $ | - | | | $ | 298 | | |

| | | | |

| | | | |

| | | | |

| Deemed dividend for repricing of series D preferred stock | $ | - | | | $ | 6 | | |

| Unpaid equipment included in accounts payable | $ | - | | | $ | 156 | | |

| | | | |

| SUPPLEMENTAL CASH FLOW INFORMATION | | | | |

| Cash paid for interest | $ | - | | | $ | 8 | | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

Notes to the Condensed Consolidated Financial Statements

(Unaudited)

Note 1 – Nature of Business and Liquidity

Organization

Crown Electrokinetics Corp. (the “Company”) was incorporated in the State of Delaware on April 20, 2015. Effective October 6, 2017, the Company’s name was changed to Crown Electrokinetics Corp. from 3D Nanocolor Corp. (“3D Nanocolor”).

The Company is commercializing technology for smart or dynamic glass. The Company’s electrokinetic glass technology is an advancement on microfluidic technology that was originally developed by HP Inc.

On December 20, 2022, the Company incorporated Crown Fiber Optics Corp., a Delaware based entity, to own and operate its acquired business from the acquisition of Amerigen 7, LLC (“Amerigen 7”) in January 2023. Crown Fiber Optics Corp. is accounted for as a wholly-owned subsidiary of Crown Electrokinetics, Corp.

Initial Public Offering

On January 26, 2021, the Company completed its public offering, and its common stock began trading on the Nasdaq Capital Market (“Nasdaq”) under the symbol CRKN.

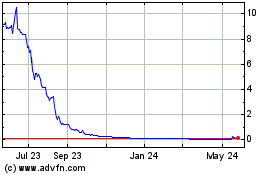

Reverse Stock Split

On August 11, 2023, the Company’s board of directors authorized a reverse stock split (‘Reverse Stock Split”) at an exchange ratio of one-for-60 basis. The Reverse Stock Split was effective on August 15, 2023, such that every 60 shares of common stock have been automatically converted into one share of common stock. The Company did not issue fractional certificates for post-reverse split shares in connection with the Reverse Stock Split. Rather, all shares of common stock that were held by a stockholder were aggregated and each stockholder was entitled to receive the number of whole shares resulting from the combination of the shares so aggregated. Any fractions resulting from the Reverse Stock Split computation were rounded up to the next whole share.

The number of authorized shares and the par value of the common stock was not adjusted as a result of the Reverse Stock Split. In connection with the Reverse Stock Split, the conversion ratio for the Company’s outstanding convertible preferred stock was proportionately adjusted such that the common stock issuable upon conversion of such preferred stock was decreased in proportion to the Reverse Stock Split. All references to common stock and options to purchase common stock share data, per share data and related information contained in the condensed consolidated financial statements have been adjusted to reflect the effect of the Reverse Stock Split.

Liquidity and Going Concern

The Company has incurred substantial operating losses since its inception and expects to continue to incur significant operating losses for the foreseeable future and may never become profitable. As reflected in the condensed consolidated financial statements, the Company had an accumulated deficit of approximately $121.6 million and cash of approximately $0.3 million as of March 31, 2024, a net loss of approximately $4.6 million, and approximately $2.7 million of net cash used in operating activities for the three months ended March 31, 2024.

The accompanying condensed consolidated financial statements have been prepared on a going concern basis, which contemplates the realization of assets and satisfaction of liabilities in the normal course of business. The condensed consolidated financial statements do not include any adjustments relating to the recoverability and classification of recorded asset amounts or the amounts and classification of liabilities that might result from the outcome of this uncertainty.

The Company has obtained additional capital through the sale of debt or equity financings or other arrangements to fund operations including through its existing at-the-market offering, and $50.0 million equity line of credit; however, there can be no assurance that the Company will be able to raise needed capital under acceptable terms, if at all. The sale of additional equity may dilute existing stockholders and newly issued shares may contain senior rights and preferences compared to currently outstanding shares of common stock. Issued debt securities may contain covenants and limit the Company’s ability to pay dividends or make other distributions to stockholders. If the Company is unable to obtain such additional financing, future operations would need to be scaled back or discontinued. Due to the uncertainty in the

Company’s ability to raise capital, management believes that there is substantial doubt in the Company’s ability to continue as a going concern for twelve months from the issuance of these condensed consolidated financial statements.

Note 2 – Basis of Presentation and Significant Accounting Policies

Basis of Presentation

The Company’s condensed consolidated financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (“GAAP”) and include all adjustments necessary for the fair presentation of the Company’s financial position for the periods presented.

The condensed consolidated balance sheet as of March 31, 2024, the condensed consolidated statements of operations, stockholders’ equity for the three months ended March 31, 2024 and 2023 and the condensed consolidated statements of cash flows for the three months ended March 31, 2024 and 2023 are unaudited. These unaudited condensed consolidated financial statements have been prepared on the same basis as the annual consolidated financial statements and, in the opinion of management, reflect all adjustments, which include only normal recurring adjustments, necessary to present fairly the Company’s consolidated financial position, results of operations and cash flows for the interim period presented. The financial data and the other financial information contained in these notes to the condensed consolidated financial statements related to the three month periods are also unaudited. The results of operations for the three months ended March 31, 2024 are not necessarily indicative of the results to be expected for the year ending December 31, 2024 or for any other future annual or interim period. The condensed consolidated balance sheet as of December 31, 2023 included herein was derived from the audited financial statements as of that date. These unaudited condensed consolidated financial statements should be read in conjunction with the Company's audited consolidated financial statements included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC on April 1, 2024.

Use of Estimates

The preparation of condensed financial statements in conformity with GAAP requires management to make certain estimates, judgments and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the condensed financial statements and the reported amounts of revenue and expenses during the reporting periods. Accounting estimates and assumptions are inherently uncertain. Management bases its estimates and assumptions on current facts, historical experience and various other factors believed to be reasonable under the circumstances. Actual results could differ materially and adversely from these estimates. Significant estimates and assumptions made in the accompanying condensed consolidated financial statements include, but not limited to, valuation of its business combination, estimated fair value of convertible notes, estimated fair value of warrant liability, Series F/F-1/F-2 preferred stock, stock option awards for stock-based compensation and operating lease right-of-use assets and liabilities.

Risks and Uncertainties

The Company is currently operating in a period of economic uncertainty and capital markets disruption, which has been significantly impacted by geopolitical instability due to the ongoing military conflict between Russia and Ukraine, as well as Israel and Hamas. The Company’s financial condition and results of operations may be materially adversely affected by any negative impact on the global economy and capital markets resulting from the conflict in Ukraine or any other geopolitical tensions.

The condensed consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Summary of Significant Accounting Policies

Reference is made to Note 3 Basis of Presentation and Significant Accounting Policies in our 2023 Form 10-K filed on April 1, 2024 for a detailed description of significant accounting policies. There have been no significant changes to our accounting policies as disclosed in our 2023 Form 10-K.

Revenue Recognition

The Company recognizes revenue when promised goods or services are transferred to customers in an amount that reflects the consideration to which the Company expects to be entitled in exchange for those goods or services by following a five-step process:

•Step 1: Identify the contract with the customer

•Step 2: Identify the performance obligations in the contract

•Step 3: Determine the transaction price

•Step 4: Allocate the transaction price to the performance obligations in the contract

•Step 5: Recognize revenue when the company satisfies a performance obligation

The Company has elected the practical expedient to not adjust the promised amount of consideration for the effects of a significant financing component when the time between the goods or service being transferred to the customer and the customer pays is one year or less,

The Company generates revenue from providing fiber splicing services as required based on short-term work orders assigned by customers. The Company is required to complete the description of work described in the work order and test the service provided prior to any recognition of revenue and invoicing. The short-term work orders are generally completed within two weeks. The Company is required to adhere to the rules and regulations that are outlined in the Agreement between the Company and the Customer.

Cost of revenue is based on individual work orders and detailed description of work to be performed. All of the revenue is recognized immediately upon completion of each work order. A 5% retainage will be withheld by the Customer upon payment of invoices and will be paid to the Company within one year after termination of the contract. The retainage can be utilized by Customer for any claims that may arise after work is completed up through one year after completion.

Revenue recognized during the three months ended March 31, 2024 was generated by the Company’s wholly-owned subsidiary, Crown Fiber Optics Corporation, and was $0.7 million. During the three months ended March 31, 2023, revenue generated was approximately $22,000.

Segment and Reporting Unit Information

Operating segments are defined as components of an entity for which discrete financial information is available that is regularly reviewed by the Chief Operating Decision Maker (“CODM”) in deciding how to allocate resources to an individual segment and in assessing performance. The Company’s Chief Executive Officer is determined to be the CODM. The Company has two operating segments and two reportable segments as of March 31, 2024, which includes film group and fiber optics group. Revenue recognized during the three months ended March 31, 2024 relates to the fiber optics group.

Business Combinations

The Company accounts for business combinations using the acquisition method of accounting by recognizing the identifiable tangible and intangible assets acquired and liabilities assumed, and any non-controlling interest in the acquired business, measured at their acquisition date fair values. Goodwill as of the acquisition date is measured as the excess of consideration transferred over the aforementioned amounts.

Accounting for business combinations requires management to make significant estimates and assumptions, especially at the acquisition date, including estimates for intangible assets. Although the Company believes the assumptions and estimates made have been reasonable and appropriate, they are based in part on historical experience and information obtained from management of the acquired companies and are inherently uncertain. Critical estimates in valuing certain intangible assets we have acquired include future expected cash flows from customer contracts. Unanticipated events and circumstances may occur that may affect the accuracy or validity of such assumptions, estimates, or actual results. The initial purchase price may be adjusted as needed per the terms of the arrangement agreement. The allocation of purchase price, including any fair value of the assets acquired and liabilities assumed as of the acquisition date has not been completed.

Acquisition-related expenses are recognized separately from the business combination and are expensed as incurred.

Deferred Debt Issuance Costs

The Company accounts for debt issuance costs related to its line of credit and equity line of credit as a deferred asset on the condensed consolidated balance sheets, which is amortized over the life of the line of credit and equity line of credit. Since the Company has elected the fair value option for its convertible notes (see Note 10), upon a draw down, a portion of the deferred asset balance will be amortized and recognized as other income (expense) on the condensed consolidated statements of operations. On the issuance date of the Company’s line of credit, the cost related to issuance of the Series E preferred shares and the warrant to purchase Series E preferred shares was recorded as a deferred asset. On the issuance date of the Company’s equity line of credit, the cost related to issuance of common stock was recorded as a deferred asset.

Notes Payable at Fair Value

The Company has elected the fair value option for the recognition of its convertible notes and notes payable, with changes in fair value recognized in the statements of operations. As a result of applying the fair value option, direct costs and fees related to the convertible notes and notes payable are recognized in other income (expense) in the condensed consolidated statements of operations. The Company includes the interest expense as a component of the notes fair value.

Warrants

The Company accounts for certain common stock warrants outstanding as a liability at fair value and adjusts the fair value of the instruments at each reporting period. The liability is subject to remeasurement at each balance sheet date until exercised, and any change in fair value is recognized in the Company’s condensed consolidated statements of operations. The fair value of the warrants issued by the Company was estimated using the Black-Scholes model.

SLOC

The Company accounts for its warrants related to the SLOC as stockholders’ equity, and therefore, the warrants are not revalued after issuance. The Company uses the Black-Scholes model to value the warrants at issuance.

As of March 31, 2024, since no loan amounts were drawn down, the SLOC warrant is recorded as a deferred asset on the condensed consolidated balance sheets at fair value and will be amortized over the life of the SLOC. Upon a draw down, the remaining balance of the deferred asset would be reclassified to debt discount and amortized under the effective interest method over the one-year term of the loan.

Purchase Order Warrants

On August 12, 2022, the Company entered into two Purchase Orders (PO’s) with Hudson Pacific Properties, L.P. (“Hudson”) for the purchase of the Company’s Smart Window Inserts™ (“Inserts”). The PO’s have a value of $0.1 million and represent the first orders the Company has received prior to the launch of its Inserts. As additional consideration for the PO’s, the Company issued a warrant to Hudson to purchase 5,000 shares of the Company’s common stock at $45.00 per share. The warrant has a five-year life and expires on August 12, 2027.

Because Hudson is a customer, the Company accounts for the PO’s and warrants under ASC 606. As the performance obligations have not yet been satisfied, the Company has not recognized any revenue in connection with Hudson during the year ended March 31, 2024.

The Company measured the fair value of the warrant using the Black-Scholes valuation model on the issuance date, with the value being recognized as a prepaid asset up to the recoverable value represented by the value of the contract.

The fair value of the warrant on the issuance date totaled $0.2 million, and as of March 31, 2024, the Company recorded a prepaid asset of $0.1 million, representing the recoverable value from the PO’s, which is included in prepaid and other current assets on the consolidated balance sheet.

Net Loss per Share Attributable to Common Stockholders

Basic net loss per share attributable to common stockholders is computed using the weighted-average number of shares of common stock outstanding during the period. Diluted net loss per share attributable to common stockholders is computed using the sum of the weighted-average number of shares of common stock outstanding during the period and the effect of dilutive securities.

As the Company was in a net loss position for the three months ended March 31, 2024 and 2023, diluted net loss per share attributable to common stockholders is the same as basic net loss per share attributable to common stockholders because the effects of potentially dilutive securities are antidilutive.

Securities that could potentially dilute loss per share in the future that were not included in the computation of diluted loss per share at March 31, 2024 and 2023 are as follows:

| | | | | | | | | | | | | | |

| March 31, | |

| 2024 | | 2023 | |

| | | | |

| Series A preferred stock | 3,146 | | 190,994 | |

| Series B preferred stock | 33,883 | | 2,047,359 | |

| Series C preferred stock | 9,346 | | 560,757 | |

| Series D preferred stock | - | | 2,289,247 | |

| Series E preferred stock | - | | 5,000,000 | |

| Convertible notes | - | | 216,530 | |

| Series F preferred stock | 501,579 | | - | |

| Series F-1 preferred stock | 72,631 | | - | |

| Series F-2 preferred stock | 124,946 | | - | |

| Warrants to purchase common stock (excluding penny warrants) | 2,470,078 | | 599,576 | |

| Warrants to purchase Series E preferred stock | 750,000 | | 750,000 | |

| Options to purchase common stock | 632,779 | | 157,058 | |

| Unvested restricted stock units | 1,124,527 | | 8,299 | |

| Commitment shares | 212,890 | | 31,724 | |

| Total | 5,935,805 | | 11,851,544 | |

Warranty Customer Liability

The Company provides warranties depending on the terms of the arrangement with the customer. This warranty covers defects in materials and workmanship under normal use and conditions. It is applicable to projects completed by Crown's fiber optics segment, which includes services provided by Crown Fiber Optics Corporation, a wholly-owned subsidiary of Crown. The standard warranty period ranges for up to two years from the project completion date. The Company accrues for warranty costs as part of the cost of revenues at the time the revenue is recognized based on historical experience and any current known trends that might affect future costs. Total warranty expense recognized during the period ended March 31, 2024 and 2023 was $36,000 and $nil, respectively.

Retainage

The Company’s customers have a contractual right to withhold payment of a retainage amount, typically 5%. The retainage can be utilized by customers for any claims that may arise after work is completed through one year after project completion. The retainage amount is recorded as an accounts receivable in the balance sheet and is expected to be collected upon the project's completion and acceptance by the customer. As of March 31, 2024 and December 31, 2023, the Company has recorded a retainage receivable of $0.1 million and zero, respectively, which is included in the accounts receivable balance in the condensed consolidated balance sheet

Note 3 – Acquisitions

On January 3, 2023, the Company acquired certain assets and assumed liabilities from Amerigen 7, which was accounted for as a business combination as the Company concluded that the transferred set of activities and assets related to the acquisition constituted a business. The Company paid cash consideration of approximately $0.7 million which included approximately 12 employees, customer contracts, and certain operating liabilities.

The following table summarizes the allocation of the purchase price to the assets acquired and liabilities assumed for the Amerigen 7 acquisition (in thousands):

| | | | | | | | |

| Property and equipment | $ | 655 | | |

| Intangible assets | 200 | | |

| Security deposits | 5 | | |

| Accrued expenses | (529) | | |

| Notes payable | (338) | | |

| Total identifiable assets and liabilities acquired | (7) | | |

| Goodwill | 652 | | |

| Total purchase consideration | $ | 645 | | |

The Company engaged an independent valuation specialist to conduct a valuation analysis of the identifiable intangible assets acquired by the Company with the objective of estimating the fair value of such assets as of January 3, 2023. The valuation specialist utilized the income approach, specifically the multi-period excess earnings method, to value the existing customer relationship.

During the year ended December 31, 2023, all the acquired assets and assumed liabilities that relate to the original Amerigen7 acquisition were written off and all the key employees terminated. Due to these key qualitative changes to the Fiber Optics Group after the acquisition, the Company concluded that the goodwill balance associated with the Amerigen7 acquisition was fully impaired as there were no future expected cash flows from the acquired Amerigen7 business. The Company has no goodwill balance as of March 31, 2024.

Note 4 – Prepaid and Other Current Assets

Prepaid and other current assets consist of the following (in thousands):

| | | | | | | | | | | | | | |

| March 31,

2024 | | December 31,

2023 | |

| | | | |

| License fees | $ | 114 | | | $ | 158 | | |

| | | | |

| Professional fees | 142 | | | 53 | | |

| General liability insurance | 60 | | | 26 | | |

| Hudson warrant * | 86 | | | 86 | | |

Prepaid rent | 60 | | | 277 | | |

| Other | 351 | | | 128 | | |

| Total | $ | 813 | | | $ | 728 | | |

*Fair value of warrant issued to Hudson Pacific Properties, L.P. (See Note 14)

Note 5 – Property & Equipment, Net

Property and equipment, net, consists of the following (in thousands):

| | | | | | | | | | | | | | |

| March 31,

2024 | | December 31,

2023 | |

| | | | |

| Equipment | $ | 3,280 | | | $ | 3,155 | | |

| Leasehold improvements | 362 | | | 362 | | |

| Vehicles | 410 | | | 395 | | |

| Computers | 56 | | | 56 | | |

| Furniture and Fixtures | 3 | | | 3 | | |

| Construction-in-progress | - | | | 77 | | |

| Total | 4,111 | | | 4,048 | | |

| Less: accumulated depreciation | (1,075) | | | (919) | | |

| Property and equipment, net | $ | 3,036 | | | $ | 3,129 | | |

Depreciation expense for the three months ended March 31, 2024 and 2023 was $0.1 million and $0.1 million, respectively.

Note 6 – Intangible Assets, Net

Intangible assets, net, consists of the following (in thousands):

| | | | | | | | | | | | | | |

| March 31,

2024 | | December 31,

2023 | |

| | | | |

| Patents | $ | 1,800 | | | $ | 1,800 | | |

| Research license | 375 | | | 375 | | |

| Customer relationships | 4 | | | 4 | | |

| Total | 2,179 | | | 2,179 | | |

| Less: accumulated amortization | (853) | | | (797) | | |

| Intangible assets, net | $ | 1,326 | | | $ | 1,382 | | |

The following table represents the total estimated amortization of intangible assets for the five succeeding years and thereafter as of March 31, 2024 (in thousands):

| | | | | | | | |

| Estimated

Amortization

Expense | |

| | |

| Nine months ended December 31, 2024 | $ | 179 | | |

| Year ended December 31, 2025 | 234 | | |

| Year ended December 31, 2026 | 197 | | |

| Year ended December 31, 2027 | 194 | | |

| Year ended December 31, 2028 | 195 | | |

| Thereafter | 327 | | |

| Total | $ | 1,326 | | |

For the three months ended March 31, 2024 and 2023, amortization expense was approximately $0.1 million and $0.1 million, respectively.

Note 7 – Deferred Debt Issuance Costs

Deferred debt issuance costs consist of the following (in thousands):

| | | | | | | | | | | | | | |

| March 31,

2024 | | December 31,

2023 | |

| Standing letter of credit | $ | 150 | | | $ | 150 | | |

| Equity letter of credit | 554 | | | 554 | | |

| Line of credit | $ | 9,943 | | | 9,943 | | |

| Total | 10,647 | | | 10,647 | | |

| Accumulated amortization | (10,285) | | | (9,341) | | |

| Deferred debt issuance costs | $ | 362 | | | $ | 1,306 | | |

SLOC

For the three months ended March 31, 2024 and 2023, the Company recognized amortization expense of approximately $0.8 million and $41,000, respectively.

Equity line of credit

In July 2023, the Company entered into the equity line of credit (“ELOC”) for the right to sell common stock shares to an investor and recorded deferred debt issuance costs of approximately $0.6 million. For the three months ended March 31, 2024, the Company recognized amortization expense of approximately $0.1 million.

Line of Credit

During the three months ended March 31, 2024, in connection with the $2.4 million draw down and issuance of the convertible promissory notes, the Company recognized amortization expense of approximately $0.9 million. During the three months ended March 31, 2023, the Company recognized amortization expense of approximately $1.8 million.

Note 8 – Accrued Expenses

Accrued expenses consisted of the following (in thousands):

| | | | | | | | | | | | | | |

| March 31,

2024 | | December 31,

2023 | |

| | | | |

| Payroll and related expenses | $ | 118 | | | $ | 112 | | |

| Bonus | 700 | | | 1,000 | | |

| Taxes | 96 | | | 51 | | |

| | | | |

| Other expenses | 48 | | | 27 | | |

| Total | $ | 962 | | | $ | 1,190 | | |

Note 9 - Contracts with Customers and Revenue Concentration

Concentration of Credit Risk and Accounts Receivable

Crown Electrokinetics Corp. assesses and monitors the creditworthiness of its customers continually and maintains an allowance for estimated credit losses based on historical experience, current conditions, and reasonable and supportable forecasts. As of March 31, 2024, the Company had accounts receivable of $776,000, net of an allowance for doubtful accounts, compared to $83,000 as of December 31, 2023. The significant increase in receivables is primarily due to increased activity in fiber splicing services and extended payment terms offered to certain customers.

No single customer accounted for 10% or more of the net accounts receivable balance as of March 31, 2024, and no significant concentrations of credit risk were noted.

Deferred Revenue and Transaction Price Allocated to Remaining Performance Obligations

As of March 31, 2024, Crown Electrokinetics Corp. has recorded deferred revenue totaling $1.3 million. This amount represents the advance payments received under the Fixed Price Construction Agreement with Vista Serena, S. de R.L. de C.V., dated March 1, 2024. The contract stipulates the construction of two slant wells at Santa Maria Bay, with Crown Fiber Optics Corp. serving as the contractor.

The total contract price is $3.6 million, of which an advance payment of $1.3 million collected as of March 31, 2024. The revenue associated with this project is expected to be recognized as Crown Fiber Optics Corp. fulfills its performance obligations under the contract, specifically as construction milestones are completed in accordance with the agreed project schedule.

Approximately $2.3 million of the contract price is anticipated to be recognized within the next 12 months as construction progresses. This projection includes considerations for potential adjustments such as material changes or force majeure events that could alter the timing of revenue recognition. The remaining balance will be recognized as the final stages of the project are completed, with the entire project expected to be finalized by the date specified in the project schedule, unless modifications are necessitated by unforeseen circumstances as outlined in the agreement. Revenue is expected to be recognized based on the costs incurred relative to the total estimated costs at completion, following the percentage of completion method.

Note 10 – Notes Payable

Convertible Notes

2022 Notes

In October 2022, the Company issued convertible notes (the “2022 Notes”) with a principal balance of approximately $5.4 million and warrants to purchase 362,657 shares of the Company’s common stock for net proceeds of $3.5 million. The 2022 Notes is non-interest bearing and secured by the Company’s assets. The maturity date is the earlier of (i) twelve months from the date of issuance or (ii) the closing of a change of control transaction. The 2022 Notes are convertible into shares of the Company’s common stock at a conversion price of $29.70 per share. The warrants have an exercise price of $19.32 per share and expire five years from the issuance date.

In February 2023, the Company entered into waiver agreements with holders of the 2022 Notes which extended the maturity date of the 2022 Notes from October 19, 2023 to April 18, 2024. As consideration for this agreement, the Company issued 96,890 warrants to purchase shares of the Company’s common stock (See Note 11).

In March 2023, the Company entered into the waiver agreements with holders of the 2022 Notes to eliminate the minimum pricing covenant as it relates to Company’s at-the-market facility. As consideration for this agreement, the Company provided the holders with two options to choose from (i) to take an additional five percent original issue discount (“OID”) on their 2022 Note principal or (ii) to be issued shares of common stock with a value equal to the five percent OID, and to issue total shares of 31,724 as converted using the Nasdaq minimum price of $9.42. During 2023, six of the note holders elected option (i), and the Company increased the respective principal balance of the notes by approximately $0.2 million. The remaining noteholders elected option (ii), and as of March 31, 2024, no shares of common stock have been issued. The Company recorded expense of $0.3 million associated with the commitment to issue shares of the Company’s common stock.

In May 2023, the Company entered into an inducement agreements with the investors to reduce the conversion price of the 2022 Notes in an aggregate principal amount equal to $1.5 million, convertible into 161,603 shares of the Company’s common stock at $9.28 per share. The remaining investors agreed to reduce the conversion price of the 2022 Notes in an aggregate principal amount equal to $1.4 million, convertible into 127,393 shares of the Company’s common stock at $10.93 per share.