0001738177falseCAMBIUM NETWORKS CORP00017381772024-01-182024-01-18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): January 18, 2024 |

CAMBIUM NETWORKS CORPORATION

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Cayman Islands |

001-38952 |

00-0000000 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

c/o Cambium Networks, Inc. 3800 Golf Road, Suite 360 |

|

Rolling Meadows, Illinois |

|

60008 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 345 814-7600 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Ordinary shares, $0.0001 par value |

|

CMBM |

|

Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Item 2.02 Results of Operations and Financial Condition.

On January 18, 2024, Cambium Networks Corporation (the "Company") issued a press release announcing certain preliminary financial results for the three-month period ended December 31, 2023. The press release contains forward-looking statements regarding the Company, and includes cautionary statements identifying important factors that could cause actual results to differ materially from those anticipated.

The press release dated January 18, 2024, is furnished herewith as Exhibit 99.1. The information in this Item 2.02, including Exhibit 99.1, is being furnished and shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act") or otherwise subject to the liability of that Section, nor shall such information be deemed to be incorporated by reference in any registration statement or other document filed under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

(b) On January 16, 2024, Andrew Bronstein, Chief Financial Officer of Cambium Networks Corporation (the “Company”) notified the Company that he will resign as the Company’s Chief Financial Officer, effective February 2, 2024, in order to pursue other opportunities. Mr. Bronstein’s departure from the Company is not a result of any disagreement with the Company’s independent auditors or any member of management on any matter of accounting principles or practices, financial statement disclosure, or internal controls.

(c) On January 18, 2024, the Board of Directors of the Company appointed John Becerril, age 57, as interim Acting Chief Financial Officer and principal financial officer for the period between Mr. Bronstein’s resignation effective February 2, 2024 and the commencement of employment of a new Chief Financial Officer. Mr. Becerril has served as the Company’s Global Controller and principal accounting officer since September, 2022. From February 2019 to September 2022, Mr. Becerril was senior director and corporate controller at Elkay Manufacturing, a privately held global plumbing products manufacturing company. Elkay Manufacturing recently merged with Zurn Water Solutions to create Zurn Elkay Water Solutions. From May 2018 to February 2019 Mr. Becerril was corporate controller at Duravant, LLC, a global packaging equipment manufacturing company, and from May 2004 to May 2018, he held various positions of increasing responsibility for accounting and finance with Cabot Microelectronics Corporation, a publicly traded company and leading supplier of CMP polishing slurries and CMP pad supplier to the semiconductor industry, including director of accounting from July 2013 to May 2018 and assistant corporate controller from March 2007 to July 2013. Mr. Becerril holds a B.S. degree in Accounting from Northeastern Illinois University, Chicago and an M.B.A. from Loyola University of Chicago, Quinlan School of Business.

No change to Mr. Becerril’s compensation or benefits has been made as a result of this interim appointment. There are no family relationships between Mr. Becerril and any director, executive officer or person nominated or chosen by the Company to become a director or executive officer of the Company within the meaning of Item 401(d) of Regulation S-K under the U.S. Securities Act of 1933 ("Regulation S-K") and he has no direct or indirect material interest in any transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K.

(e) In connection with Mr. Bronstein’s separation, Mr. Bronstein and the Company entered into a separation agreement, which provides for a lump sum payment of $280,000 to Mr. Bronstein in exchange for his agreement to remain employed through February 2, 2024, and his execution and non-revocation of a release of claims in favor of the Company.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

CAMBIUM NETWORKS CORPORATION |

|

|

|

|

Date: |

January 18, 2024 |

By: |

/S/ Sally J. Rau |

|

|

Name: Title: |

Sally J. Rau

Secretary and General Counsel |

Exhibit 99.1

Cambium Networks Corporation Announces Preliminary Fourth Quarter 2023 Revenues, Reporting Date and CFO Transition

ROLLING MEADOWS, Ill., Jan. 18, 2024 — Cambium Networks Corporation (“Cambium Networks”) (NASDAQ: CMBM), a leading provider of wireless networking infrastructure solutions, today announced preliminary revenues for the fourth quarter 2023 ended December 31, 2023. Cambium plans to report full financial results on Thursday, Feb. 15, 2024.

Cambium Networks expects revenues of approximately $40.0 million compared to the previous outlook of $45.0-$50.0 million provided on Nov. 2, 2023. While the company shipped $51 million in product revenues during the quarter, this was offset in part by an $11 million reduction to revenues as the result of incentives provided to distributors during the fourth quarter of 2023, offering aggressive Enterprise product discounts to clear excess channel inventories. The company records revenues from sell-in to distributors. Point-of-sale revenues—representing the sales of Cambium’s products out of the distribution channel as reported by Cambium’s distributors—are significantly higher for the fourth quarter 2023 than Cambium’s reported revenues, indicating a continued decrease in channel inventories.

The outlook for Cambium Networks’ fourth quarter 2023 net loss and loss per share are expected to be below the low end of the previous GAAP and non-GAAP ranges. The gross margin will also be below the low end of the range due to increased excess and obsolete inventory reserves. Cash is expected to be approximately $18 million; and while the company did negotiate new interim debt covenants during Q4’23, it did not draw on any of its $45 million revolving credit line with Bank of America during the fourth quarter 2023.

The company expect full year 2024 revenues of between $215 million to $245 million.

In addition, Cambium announced today that Andrew Bronstein, Cambium's chief financial officer, will be leaving the company effective February 2, 2024, to pursue an outside opportunity. Cambium is working to find a permanent replacement. In the interim, John Becerril, Cambium’s chief accounting

officer, will assume the responsibilities as acting chief financial officer. Andrew has agreed to assist in the transition to a new chief financial officer following his departure.

"I want to thank Andrew for his time and dedication to Cambium over his tenure and for his assistance in my onboarding over the past six months where we have developed a strong relationship," said Morgan Kurk, president and CEO. “Andrew's leadership, combined with a number of financial and operational improvements, leave Cambium stronger than it was when he joined in April 2022."

Conference Call and Webcast

Cambium Networks will host a live webcast and conference call to discuss its financial results and Q&A at 4:30 p.m. ET, on Thursday, Feb. 15, 2024. On the call will be Morgan Kurk, president and CEO, and John Becerril, interim CFO. The call will be moderated by Peter Schuman, VP of investor & industry analyst relations.

To join the financial results live webcast and view additional materials which will be posted to the investor website, listeners should access the investor page of Cambium Networks website https://investors.cambiumnetworks.com/. Following the live webcast, a replay will be available in the event archives at the same web address for a period of one year.

To access the live conference call by phone, listeners should register in advance at https://edge.media-server.com/mmc/p/bw2siubc. Upon registration, telephone participants will receive a confirmation email detailing how to join the conference call, including the dial-in number and a unique passcode.

About Cambium Networks

Cambium Networks enables service providers, enterprises, industrial organizations, and governments to deliver exceptional digital experiences, and device connectivity, with compelling economics. Our ONE Network platform simplifies management of Cambium Networks wired and wireless broadband and network edge technologies. Our customers can focus more resources on managing their business rather than the network. We deliver connectivity that just works.

Cautionary Note Regarding Forward-Looking Statements

This release contains certain forward-looking statements within the meaning of the federal securities laws, including statements concerning our expected third quarter revenues, net income, cash and available borrowings. All statements other than statements of historical fact contained in this document, including statements regarding our future results of operations and financial position, business strategy and plans and objectives of management for future operations, are forward-looking statements. These

statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance, or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements.

In some cases, you can identify forward-looking statements by terms such as "may," "should," "expects," "plans," "anticipates," "could," "intends," "target," "projects," "contemplates," "believes," "estimates," "predicts," "potential" or "continue" or the negative of these terms or other similar expressions. The forward-looking statements in this document are only predictions. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our business, financial condition and results of operations. These forward-looking statements speak only as of the date of this document and are subject to a number of risks, uncertainties and assumptions including those described in the "Risk factors" section and elsewhere in our 2022 Annual Report on Form 10-K filed with the Securities and Exchange Commission on February 27, 2023, and our Quarterly Reports on Form 10-Q filed on May 9, 2023, August 2, 2023, and November 3, 2023. Because forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified, you should not rely on these forward-looking statements as predictions of future events. The events and circumstances assumed in our forward-looking statements may not be achieved or occur and actual results could differ materially from those projected in the forward-looking statements. Some of the key factors that could cause actual results to differ from our expectations include: the unpredictability of our operating results; uncertainties with respect to the timing of new government orders, the velocity at which our distributors will sell down current inventories of our products and macro-economic conditions in our target markets; our inability to predict and respond to emerging technological trends and network operators' changing needs; the impact of the tensions between Russia and Ukraine, which may disrupt our sales and product design activities in the region; our reliance on third-party manufacturers, which subjects us to risks of product delivery delays and reduced control over product costs and quality; our reliance on distributors and value-added resellers for the substantial majority of our sales; the inability of our third-party logistics and warehousing providers to deliver products to our channel partners and network operators in a timely manner; our or our distributors' and channel partners' inability to attract new network operators or sell additional products to network operators that currently use our products; our channel partners' inability to effectively manage inventory of our products, timely resell our products or estimate expected future demand; our inability to manage our growth and expand our operations; unpredictability of sales and revenues due to lengthy sales cycles; our inability to maintain an effective system of internal controls,

produce timely and accurate financial statements or comply with applicable regulations; our reliance on the availability of third-party licenses; risks associated with international sales and operations; current or future unfavorable economic conditions, both domestically and in foreign markets and political tensions among the U.S. and China; and our inability to obtain intellectual property protections for our products.

Except as required by applicable law, we do not plan to publicly update or revise any forward-looking statements contained herein, whether as a result of any new information, future events or otherwise.

Contacts:

Investors:

Peter Schuman, IRC

VP Investor & Industry Analyst Relations

Cambium Networks

+1 (847) 264-2188

Peter.schuman@cambiumnetworks.com

v3.23.4

Document And Entity Information

|

Jan. 18, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 18, 2024

|

| Entity Registrant Name |

CAMBIUM NETWORKS CORP

|

| Entity Central Index Key |

0001738177

|

| Entity Emerging Growth Company |

true

|

| Entity File Number |

001-38952

|

| Entity Incorporation, State or Country Code |

E9

|

| Entity Tax Identification Number |

00-0000000

|

| Entity Address, Address Line One |

c/o Cambium Networks, Inc.

|

| Entity Address, Address Line Two |

3800 Golf Road, Suite 360

|

| Entity Address, City or Town |

Rolling Meadows

|

| Entity Address, State or Province |

IL

|

| Entity Address, Postal Zip Code |

60008

|

| City Area Code |

345

|

| Local Phone Number |

814-7600

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Ex Transition Period |

true

|

| Title of 12(b) Security |

Ordinary shares, $0.0001 par value

|

| Trading Symbol |

CMBM

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

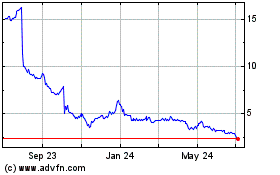

Cambium Networks (NASDAQ:CMBM)

Historical Stock Chart

From Mar 2024 to Apr 2024

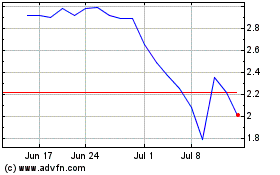

Cambium Networks (NASDAQ:CMBM)

Historical Stock Chart

From Apr 2023 to Apr 2024