Filed

Pursuant to Rule 424(b)(3)

Registration

No. 333-252819

PROSPECTUS

Vinco

Ventures, Inc.

24,480,000

Shares of Common Stock

Pursuant

to this prospectus, the selling shareholders identified herein (each a “Selling Shareholder” and, collectively, the

“Selling Shareholders”) are offering on a resale basis, up to 24,480,000 shares of common stock, par value

$0.001 per share (the “common stock”) of Vinco Ventures, Inc. (the “Company,” “Vinco Ventures,”

“we,” “our” or “us”). These shares include: (i) 6,000,000 shares of common stock

underlying a senior convertible note issued in the Hudson Bay financing, and (ii) 15,000,000 shares of common stock

underlying a warrant issued in connection with the Hudson Bay financing, and (iii) 1,500,000 shares of common stock issued in

connection with the BHP Securities Purchase Agreement, and (iv) 1,500,000 shares of common stock underlying a warrant issued in

connection with the BHP financing, and (v) 480,000 shares of common stock underlying a warrant issued in connection with the placement

of the Hudson Bay financing. We are not selling any shares under this prospectus, and we will not receive any proceeds from

the sales of shares by the Selling Shareholders. We will, however, receive the exercise price of the Warrants, if and when such

Warrants are exercised for cash by the holders of such Warrants.

The

shares included in this prospectus may be offered and sold directly by the Selling Shareholders in accordance with one or more

of the methods described in the “Plan of Distribution,” which begins on page 33 of this prospectus. To the

extent the Selling Shareholders decide to sell their shares, we will not control or determine the price at which the shares are

sold.

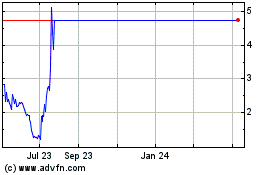

Our

common stock is listed on The Nasdaq Capital Market under the symbol “BBIG.” On February 16, 2021, the last

reported sale price of our common stock was $3.74 per share.

This

offering will terminate on the earlier of (i) the date when all of the shares have been sold pursuant to this prospectus or Rule

144 under the Securities Act of 1933, as amended (the “Securities Act”), and (ii) the date that all of the securities

may be sold pursuant to Rule 144 without volume or manner-of-sale restrictions, unless we terminate it earlier.

We

are an “emerging growth company” as defined under U.S. federal securities laws and, as such, we have elected to comply

with certain reduced public company reporting requirements for this prospectus and future filings. See “Prospectus Summary

— Implications of Being an Emerging Growth Company.”

Investing

in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 18 of this prospectus

for a discussion of the risks that you should consider in connection with an investment in our securities.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or

determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus is February 16, 2021.

TABLE

OF CONTENTS

No

dealer, salesperson or other person is authorized to give any information or to represent anything not contained in this prospectus.

You must not rely on any unauthorized information or representations. This prospectus is an offer to sell only the shares of common

stock offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained

in this prospectus is current only as of its date.

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement that we filed on behalf of the Selling Shareholders with the United States Securities

and Exchange Commission (the “SEC”) to permit the Selling Shareholders to sell the shares described in this prospectus

in one or more transactions. The Selling Shareholders and the plan of distribution of the shares being offered by them are described

in this prospectus under the headings “Selling Shareholders” and “Plan of Distribution.”

You

should rely only on the information contained in this document and any free writing prospectus we provide to you. Neither we nor

the Selling Shareholders have authorized anyone to provide any information or to make any representations other than those contained

in this prospectus or in any free writing prospectuses we have prepared. We and the Selling Shareholders take no responsibility

for and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is

an offer to sell only the common stock offered hereby, but only under circumstances and in jurisdictions where it is lawful to

do so. The information contained in this prospectus is current only as of its date.

Use

of Industry and Market Data

This

prospectus includes market and industry data that we have obtained from third-party sources, including industry publications,

as well as industry data prepared by our management on the basis of its knowledge of and experience in the industries in which

we operate (including our management’s estimates and assumptions relating to such industries based on that knowledge). Management

has developed its knowledge of such industries through its experience and participation in these industries. While our management

believes the third-party sources referred to in this prospectus are reliable, neither we nor our management have independently

verified any of the data from such sources referred to in this prospectus or ascertained the underlying economic assumptions relied

upon by such sources. Furthermore, internally prepared and third-party market prospective information, in particular, are estimates

only and there will usually be differences between the prospective and actual results, because events and circumstances frequently

do not occur as expected, and those differences may be material. Also, references in this prospectus to any publications, reports,

surveys or articles prepared by third parties should not be construed as depicting the complete findings of the entire publication,

report, survey or article. The information in any such publication, report, survey or article is not incorporated by reference

in this prospectus.

Trademarks,

Trade Names and Service Marks

“Vinco

Ventures” and other trademarks or service marks of Vinco

Ventures, Inc. appearing in this prospectus are the property of Vinco Ventures, Inc. The other trademarks, trade names

and service marks appearing in this prospectus are the property of their respective owners. Solely for convenience, the trademarks

and trade names in this prospectus are referred to without the ® and ™ symbols, but such references should

not be construed as any indicator that their respective owners will not assert, to the fullest extent under applicable law, their

rights thereto.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and

Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These statements relate to future

events including, without limitation, the terms, timing and closing of our proposed acquisitions or our future financial performance.

We have attempted to identify forward-looking statements by using terminology such as “anticipates,” “believes,”

“expects,” “can,” “continue,” “could,” “estimates,” “expects,”

“intends,” “may,” “plans,” “potential,” “predict,” “should,”

“will,” or the negative of these terms or other comparable terminology. These statements are only predictions; uncertainties

and other factors may cause our actual results, levels of activity, performance, or achievements to be materially different from

any future results, levels or activity, performance, or achievements expressed or implied by these forward-looking statements.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future

results, levels of activity, performance, or achievements. Our expectations are as of the date this prospectus is filed, and we

do not intend to update any of the forward-looking statements after the date this prospectus is filed to confirm these statements

to actual results, unless required by law.

You

should not place undue reliance on forward looking statements. The cautionary statements set forth in this prospectus identify

important factors which you should consider in evaluating our forward-looking statements. These factors include, among other things:

|

|

Our

ability to effectively execute our business plan;

|

|

|

●

|

Our

ability to manage our expansion, growth and operating expenses;

|

|

|

|

|

|

|

●

|

Our

ability to protect our brands and reputation;

|

|

|

|

|

|

|

●

|

Our

ability to repay our debts;

|

|

|

|

|

|

|

●

|

Our

ability to rely on third-party suppliers outside of the United States;

|

|

|

|

|

|

|

●

|

Our

ability to evaluate and measure our business, prospects and performance metrics;

|

|

|

|

|

|

|

●

|

Our

ability to compete and succeed in a highly competitive and evolving industry;

|

|

|

|

|

|

|

●

|

Our

ability to respond and adapt to changes in technology and customer behavior;

|

|

|

|

|

|

|

●

|

Risks

in connection with completed or potential acquisitions, dispositions and other strategic growth opportunities and initiatives;

|

|

|

|

|

|

|

●

|

Risks

related to the anticipated timing of the closing of any potential acquisitions;

|

|

|

|

|

|

|

●

|

Risks

related to the integration with regards to potential or completed acquisitions;

|

|

|

|

|

|

|

●

|

Various

risks related to health epidemics, pandemics and similar outbreaks, such as the coronavirus disease 2019 (“COVID-19”)

pandemic, which may have material adverse effects on our business, financial position, results of operations and/or cash flows;

and

|

|

|

|

|

|

|

●

|

Our

ability to take advantage of opportunities under the Coronavirus Aid, Relief, and Economic Security Act, or the CARES Act,

and the potential impact of the CARES Act on our business, results of operations, financial condition or liquidity.

|

This

prospectus also contains estimates and other statistical data made by independent parties and by us relating to market size and

growth and other industry data. This data involves a number of assumptions and limitations, and you are cautioned not to give

undue weight to such estimates. We have not independently verified the statistical and other industry data generated by independent

parties and contained in this prospectus and, accordingly, we cannot guarantee their accuracy or completeness, though we do generally

believe the data to be reliable. In addition, projections, assumptions, and estimates of our future performance and the future

performance of the industries in which we operate are necessarily subject to a high degree of uncertainty and risk due to a variety

of factors. Our actual results could differ materially from those anticipated in the forward-looking statements for many reasons,

including, but not limited to, the possibility that we may fail to preserve our expertise in consumer product development; that

existing and potential distribution partners may opt to work with, or favor the products of, competitors if our competitors offer

more favorable products or pricing terms; that we may be unable to maintain or grow sources of revenue; that we may be unable

maintain profitability; that we may be unable to attract and retain key personnel; or that we may not be able to effectively manage,

or to increase, our relationships with customers; and that we may have unexpected increases in costs and expenses. These and other

factors could cause results to differ materially from those expressed in the estimates made by the independent parties and by

us.

PROSPECTUS

SUMMARY

This

summary highlights selected information contained elsewhere in this prospectus. This summary does not contain all of the information

that you should consider before deciding to invest in our common stock. You should read the entire prospectus carefully, including

the “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,”

and our combined financial statements and the related notes thereto that are included elsewhere in this prospectus, before making

an investment decision.

Unless

the context requires otherwise, “Vinco Ventures,” the “Company,” “we,” “us,”

and “our,” refer to Vinco Ventures, Inc. and its subsidiaries.

Overview

Our

Company was incorporated on July 18, 2017 in the State of Nevada under the name of Idea Lab X Products, Inc, On September 12,

2017, we filed an Amendment to our Articles of Incorporation changing the name to Xspand Products Lab, Inc., and then on September

7, 2018 we filed an Amendment to our Articles of Incorporation changing the name to Edison Nation, Inc. On November 5, 2020, the

Company (the “Parent”) and its wholly owned subsidiary, Vinco Ventures, Inc. (the “Merger Sub”), entered

into an Agreement and Plan of Merger (the “Agreement”). Under the terms of the Agreement, the Merger Sub merged with

and into the Parent and the Parent became the surviving corporation of the Merger (the “Surviving Corporation”). The

name of the Surviving Corporation became Vinco Ventures, Inc. The transaction closed on November 10, 2020.

Vinco

Ventures seeks to be involved with every step of the consumer

product life cycle- from ideation, to research and development, manufacturing, sales, packaging and fulfillment. The Company also

seeks to raise awareness of the Vinco Ventures brand name as a diversified consumer products business through a number

of media channels.

The

first stage of development for any consumer product is the impetus to turn an idea into a salable commodity. Considered to be

the “go-to” resource for independent innovators with great consumer product invention ideas, Vinco Ventures

maintains a consumer-facing online presence whereby innovators can submit ideas for consideration by us. If an idea is successfully

chosen, Vinco Ventures will apply its proprietary, web-enabled new product development (“NPD”) and commercialization

platform that can take a product from idea through e-commerce final sale in a matter of months versus a year or more for capital

intensive and inefficient new product development protocols traditionally used by legacy manufacturers serving “big box”

retailers. Vinco Ventures presently engages with over 180,000 registered online innovators and entrepreneurs interested

in accessing the Company’s NPD platform to bring innovative, new products to market focusing on high-interest, high-velocity

consumer categories. The Company generates revenue from its web presence by charging a fee for each idea submission, and also

through subscription-based plans for innovators that wish to submit high volumes of ideas.

Since

its inception, Vinco Ventures has received over 200,000 idea submissions, with products selling in excess of $250 million

at retail through the management of over 300 client product campaigns with distribution across diverse channels including e-commerce,

mass merchandisers, specialty product chains, entertainment venues, national drug chains, and tele-shopping. These clients include

many of the largest manufacturers and retailers in the world including Amazon, Bed Bath and Beyond, HSN, Rite Aid, P&G, and

Black & Decker. The Company generates revenue from licensing agreements with such manufacturers and retailers, which such

agreements are entered into when innovators submit their ideas through Vinco Ventures’ web portal. Occasionally,

the Company also generates revenue from innovators that wish to use the Company’s product development resources, but license

or distribute products themselves.

Vinco

Ventures has a number of internally developed brands “EN

Brands” which act as a launchpad for new innovative items that have matriculated through the innovation portal. These EN

Brands include Cloud B, Pirasta, Uber Mom, Best Party Concepts, Lily and Grey, Sol and Salud, Trillion Trees, Eco Quest, Smarter

Specs, Barkley Lane, and Ngenious Fun. Additionally, the Company offers a partnership model for entrepreneurs and businesses that

are seeking to elevate their existing brands. Recent partnerships for Vinco Ventures include 4Keeps Roses and Mother K.

Within the partnership model, the Company seeks to identify new lines of distribution and provide innovation through development

of new item that enhance the brands overall image and consumer adoption,

In

addition to developing products for its EN Brands, the Company develops and manufactures products for well-known brands in the

entertainment and theme park industry. For over 20 years, the Company has developed, manufactured and supplied the entertainment

and amusement park industry with exclusive products that are often only available to consumers inside venues such as Disney Parks

and Resorts, Disney Stores, Universal Resorts, Sea World, Sesame Place, Busch Gardens, Merlin Entertainment, and Madison Square

Garden. For the customers listed above, the Company has developed products for core brands such as Harry Potter, Frozen, Marvel,

and Star Wars.

Once

most consumer products are ideated, developed, manufactured, and possibly even licensed, they must be packaged and distributed.

Therefore, we lease a packaging and logistics center in Alpha, New Jersey. The Company generates revenue from the sale of custom

packaging for many of the products that have run through our NPD or in-house product development process. The Company also sells

packaging products to a number of other entities that are not related to the Company’s product development process, including

pharmaceutical and e-commerce companies. When packaging of products is complete, we typically ship products using our own trucks

rather than relying on a common carrier. For packaging products, the Company does not have long-term agreements with customers,

and instead manufactures and sells its packaging products subject to purchase orders from its customers.

Once

a product is ready for distribution, consumer awareness must be raised in order to the sell the product. Accordingly, the Company

has begun to pursue a three-prong media strategy. First, the Company is seeking to re-release episodes of the ‘Everyday

Edisons’ television program, while simultaneously seeking a distribution partner for forthcoming episodes. The Company intends

to generate revenue from the Everyday Edisons brand by entering into a contract with a broadcast network or online streaming service.

Second, the Company is developing a proprietary e-learning platform. The Company intends to generate revenue from the e-learning

platform through the sale of subscription-based plans. Third, the Company is seeking to expand its web presence by acquiring or

creating other innovator-facing internet media properties. The Company intends to generate revenue from such internet media through

the display of paid advertisements on its properties.

COVID-19

COVID-19

has caused and continues to cause significant loss of life and disruption to the global economy, including the curtailment of

activities by businesses and consumers in much of the world as governments and others seek to limit the spread of the disease,

and through business and transportation shutdowns and restrictions on people’s movement and congregation.

As

a result of the pandemic, we have experienced, and continue to experience, weakened demand for our traditional products. Many

of our customers have been unable to sell our products in their stores and theme parks due to government-mandated closures and

have deferred or significantly reduced orders for our products. We expect these trends to continue until such closures are significantly

curtailed or lifted. In addition, the pandemic has reduced foot traffic in the stores where our products are sold that remain

open, and the global economic impact of the pandemic has temporarily reduced consumer demand for our products as they focus on

purchasing essential goods.

In

the United States and Asia, many of our key accounts remain closed or are operating at significantly reduced volumes. As a result,

we have made the strategic decision to expand our operations through our Edison Nation Medical (“Ed Med”) division.

Through Ed Med, the Company wholesales Personal Protective Equipment (“PPE”) products through an online portal for

hospitals, government agencies and distributors.

Given

these factors, the Company anticipates that the greatest impact from the COVID-19 pandemic in fiscal 2020 occurred in the

first quarter of 2020 which resulted in a significant net sales decline as compared to the first quarter of 2019. The

Company was able to recover in the second quarter and third quarter of 2020 related to sales of personal protective equipment

and a rebound of some of our legacy product business.

In

addition, some of our suppliers and the manufacturers of certain products were adversely impacted by COVID-19. As a result,

we faced delays or difficulty sourcing products, which negatively affected our business and financial results. Even if we are

able to find alternate sources for such products, they may cost more and cause delays in our supply chain, which could adversely

impact our profitability and financial condition.

We

have taken actions to protect our employees in response to the pandemic, including closing our corporate offices and requiring

our office employees to work from home. At our distribution centers, certain practices are in effect to safeguard workers, including

a staggered work schedule, and we are continuing to monitor direction from local and national governments carefully. Additionally,

our two retail locations have been closed until further notice.

As

a result of the impact of COVID-19 on our financial results, and the anticipated future impact of the pandemic, we have implemented

cost control measures and cash management actions, including:

●

Terminating a significant portion of our employees; and

●

Implementing 20% salary reductions across our executive team and other members of upper-level management; and

●

Executing reductions in operating expenses, planned inventory levels and non-product development capital expenditures; and

●

Proactively managing working capital, including reducing incoming inventory to align with anticipated sales.

Market

Strategy

The

process for developing and launching consumer products has changed significantly in recent years. Previously, Fortune 500 and

other companies maintained multimillion-dollar research and development divisions to develop and launch products to be sold primarily

on retail shelves and supported by large television and print advertising investment. The emergence of e-commerce giants, including

Amazon.com, has caused retail shelf space to no longer be a requirement to launch a new product. Crowdfunding sites like Kickstarter

enable solo entrepreneurs to inexpensively produce an advertising video and quickly introduce a new product to many millions of

potential customers, and to quickly gain those customers for a low cost of acquisition relative to the cost and time required

in prior years as expensive advertising investment is no longer required to gain market awareness. For example, according to Statista.com,

crowdfunded sales of products will exceed $18.9 billion in 2021. The consumer shift away from brick and mortar retailers toward

e-commerce has resulted in the bankruptcy or downsizing of many iconic retailers which sold toys, including Toys R Us, Sears,

Kmart, and K-B Toys, with the resultant loss in shelf space and available locations helping to drive our market opportunity. By

utilizing the opportunities to market products over the internet, rather than through traditional, commercial channels, we believe

we can reach a much broader market for our brands and products.

Leveraging

Evolving Market Opportunities for Growth

The

Company believes that its anticipated growth will be driven by five macroeconomic factors:

|

|

●

|

The

significant growth of ecommerce (14% compound annual growth rate, estimated to reach

$4.9 trillion by 2021 (eMarketer 2018));

|

|

|

●

|

The

increasing velocity of “brick and mortar” retail closures, now surpassing

Great Recession levels (Cushman & Wakefield/Moody’s Analytics 2018);

|

|

|

●

|

Product

innovation and immediate delivery gratification driving consumer desire for next-generation

products with distinctive sets of features and benefits without a reliance on brand awareness

and familiarity;

|

|

|

●

|

The

marriage of media-based entertainment and consumer goods;

|

|

|

●

|

The

rapid adoption of crowdsourcing to expedite successful new product launches; and

|

|

|

●

|

The

opportunity to market products over the internet and television, rather than through

traditional, commercial channels, to reach a much broader, higher qualified target market

for brands, and products.

|

In

addition, we intend to acquire more small brands that have achieved approximately $1 million in retail sales over the trailing

twelve-month period with a track record of generating free cash flow. By leveraging our expertise in helping companies launch

thousands of new products and our ability to create unique, customized packaging, we will seek to elevate the value of these acquired

brands by improving each part of their launch process, based on our own marketing methodologies.

We

believe our acquisition strategy will allow us to acquire small brands using a combination of shares of our common stock, cash

and other consideration, such as earn-outs. We intend to use our acquisition strategy in order to acquire up to ten or more small

brands per year for the next three years. In situations where we deem that a brand is not a “fit” for acquisition

or partnership, we may provide the brand with certain manufacturing or consulting services that will assist the brand to achieve

its goals.

One

example of a brand that we have recently acquired is Cloud B, Inc. (“Cloud B”), a leading manufacturer of products

and accessories that help parents and children sleep better. Cloud B distributes its products nationally and in over 100 countries

worldwide.

Founded

in 2002 and acquired by Vinco Ventures in October 2018, Cloud B’s highly regarded, award-winning products are developed

in consultation with an advisory board of pediatricians and specialists. Cloud B recently won the Toy of the Year award from The

Toy Association. Cloud B’s best-known products are Twilight Turtle™ and Sleep Sheep™.

Cloud

B’s products can be purchased online (through its own e-commerce site and other online retailers), in specialty boutiques,

gift stores, and worldwide at major retailers including Barnes & Noble, Bloomingdale’s, Dillard’s, Nordstrom,

Von Maur, Harrods, and Fnac in France.

Immediate

synergies include expanding Vinco Ventures’ West Coast footprint by leveraging Cloud B’s sizable distribution,

sales and fulfillment operations. The initial focus for Cloud B has been to optimize existing product performance while helping

to develop new product lines leveraging the Vinco Ventures NPD platform. In addition, Cloud B is leveraging Vinco Ventures’

Hong Kong-based manufacturer sourcing and management capabilities, as well as the Company’s marketing and packaging

resources.

Summary

of Risk Factors

Our

business is subject to numerous risks and uncertainties, including those in the section captioned “Risk Factors”

beginning on page 18 and elsewhere in this prospectus. These risks include, but are not limited to, the following:

|

|

●

|

our

limited operating history and may not be able to operate our business successfully or

generate sufficient revenue to make or sustain distributions to our shareholders;

|

|

|

●

|

the

loss of key personnel or the inability of replacements to quickly and successfully perform

in their new roles could adversely affect our business;

|

|

|

●

|

our

financial statements may be materially affected if our estimates prove to be inaccurate

as a result of our limited experience in making critical accounting estimates;

|

|

|

●

|

we

may require additional financing to sustain or grow our operations;

|

|

|

●

|

if

we fail to manage our growth, our business and operating results could be harmed;

|

|

|

●

|

our

growth strategy includes pursuing opportunistic acquisitions of additional brands, and

we may not find suitable acquisition candidates or successfully operate or integrate

any brands that we may acquire;

|

|

|

●

|

an

inability to develop and introduce products in a timely and cost-effective manner may

damage our business;

|

|

|

●

|

our

success will depend on the reliability and performance of third-party distributors, manufacturers,

and suppliers;

|

|

|

●

|

we

have debt financing arrangements, which could have a material adverse effect on our financial

health and our ability to obtain financing in the future and may impair our ability to

react quickly to changes in our business; and

|

|

|

|

|

|

|

●

|

Various

risks related to health epidemics, pandemics and similar outbreaks, such as the coronavirus

disease 2019 (“COVID-19”) pandemic, which may have material adverse effects

on our business. Due to the continued uncertainties and the fluid impacts of COVID-19,

expectations could be affected by heightened effects from the pandemic.

|

Recent

Developments

Hudson

Bay Financing

On

January 25, 2021 (the “Effective Date”), the Company consummated the closing of a private placement offering (the

“Offering”) whereby pursuant to the Securities Purchase Agreement (the “Purchase Agreement”) entered into

by the Company on January 21, 2021 with Hudson Bay Master Fund, Ltd (the “Investor”), the Company issued a Senior

Convertible Note for the purchase price of $12,000,000 (the “Note”) and a five (5) year warrant (the “Warrant”)

to purchase shares of the Company’s common stock, par value $0.001 per share (“Common Stock”).

The

Note carries an interest rate of 6% per annum and matures on the 12-month anniversary of the Issuance Date (as defined in the

Note). The Note contains a voluntary conversion mechanism whereby the Noteholder may convert at any time after the Issuance Date,

in whole or in part, the outstanding balance of the Note into shares of the Common Stock at a conversion price of $2.00 per share

(the “Conversion Shares”). The Note shall be a senior obligation of the Company and its subsidiaries. The Note contains

customary events of default (each an “Event of Default”). If an Event of Default occurs, interest under the Note will

accrue at a rate of twelve percent (12%) per annum and the outstanding principal amount of the Note, plus accrued but unpaid interest,

liquidated damages and other amounts owing with respect to the Note will become, at the Note holder’s election, immediately

due and payable in cash. Upon completion of a Change of Control (as defined in the Note), the Note’s holder may require

the Company to purchase any outstanding portion of the Note in cash at a price in accordance with the terms of the Note.

Pursuant

to the Purchase Agreement, the Investor received a Warrant in an amount equal to 250% of the shares of Common Stock initially

issuable to each Investor pursuant to the Investor’s Note. The Warrant contains an exercise price of $2.00 per share. In

connection with the closing of the Offering, the Warrant was issued to purchase an aggregate of 15,000,000 shares of Common Stock

(the “Warrant Shares”).

The

Company also entered into a Registration Rights Agreement with the Investor (the “Registration Rights Agreement”).

The Registration Rights Agreement provides that the Company shall (i) file with the Securities and Exchange Commission (the “Commission”)

a Registration Statement by 30 days following the Closing Date to register the Conversion Shares and Warrant Shares (the “Registration

Statement”); and (ii) use all commercially reasonable efforts to have the Registration Statement declared effective by the

Commission within 60 days following the Closing Date or at the earliest possible date, or 75 days following the Closing Date if

the Registration Statement receives comments from the Commission.

Palladium

Capital Group, LLC (the “Placement Agent”) acted as placement agent for the Offering. The Placement Agent received

cash compensation of $1,080,000 (8% of the gross proceeds to the Company plus an additional 1% of the gross proceeds to the Company

for non-accountable expenses). The Placement Agent also received a Warrant in an amount equal to 8% of the shares of Common Stock

initially issuable to each Investor pursuant to the Investor’s Note.

BHP

Financing

On

January 28, 2021 (the “Effective Date”), the Company consummated the closing of a private placement offering (the

“Offering”) whereby pursuant to the Securities Purchase Agreement (the “SPA”) entered into by the Company

on January 28, 2021 with BHP Capital NY Inc (the “Investor”), the Company issued 1,500,000 shares of restricted common

stock and a five (5) year warrant (the “Warrant”) to purchase shares of the Company’s common stock, par value

$0.001 per share (“Common Stock”).

Pursuant

to the SPA, the Investor received a Warrant in an amount equal to 100% of the shares of Common Stock issued to the Investor under

the SPA. The Warrant contains an exercise price of $2.20 per share. In connection with the closing of the Offering, the Warrant

was issued to purchase an aggregate of 1,500,000 shares of Common Stock (the “Warrant Shares”).

The

Company also entered into a Registration Rights Agreement with the Investor (the “Registration Rights Agreement”).

The Registration Rights Agreement provides that the Company shall (i) file with the Securities and Exchange Commission (the “Commission”)

a Registration Statement by 30 days following the Closing Date to register the Conversion Shares and Warrant Shares (the “Registration

Statement”); and (ii) use all commercially reasonable efforts to have the Registration Statement declared effective by the

Commission within 60 days following the Closing Date or at the earliest possible date, or 75 days following the Closing Date if

the Registration Statement receives comments from the Commission.

Agreement to Complete a Merger with

Zash Global Media and Entertainment Corporation

On January 20, 2021, the Company, and its

newly formed wholly owned subsidiary, Vinco Acquisition Corporation (the “Merger Sub”), entered into an Agreement

to Complete a Plan of Merger (the “Agreement to Complete”) with ZASH Global Media and Entertainment Corporation (“ZASH”).

The Agreement contemplates a reverse triangular

merger of Merger Sub with and into ZASH in a transaction intended to qualify as a tax-free reorganization under Sections 368(a)(l)(A)

and 368(a)(2)(E) of the Code. Under the terms of the Agreement to Complete, ZASH’s holders of common stock, par value $0.001,

shall receive shares of Common Stock of the Company in exchange for all issued and outstanding ZASH shares of common stock. ZASH

will then become an indirect wholly-owned subsidiary of the Company. The Company will engage a third-party valuation firm to perform

a valuation of ZASH and to issue a Transaction Fairness Opinion. The valuation report is expected before the end of February

and will set the resulting post-closing ownership ratio. Upon completion of the closing, ZASH will be the controlling entity.

The certificate of incorporation of the

Company will be amended and restated at and as of the Effective Time, in substantial conformance with the certificate of incorporation

of ZASH immediately prior to the closing, and the name of the Company will be changed to “ZASH Global Media and Entertainment

Corporation.” The bylaws of the Company will be amended and restated at and as of the Closing to become the equivalent of

the bylaws of ZASH immediately prior to the closing. At the closing, certain officers and directors of the Company and the Merger

Sub immediately prior to the Effective Time shall resign and the officers and directors of ZASH immediately prior to the closing

will be appointed as officers and directors of the Company and the surviving corporation, in each case until their respective

successors are duly elected or appointed and qualified; provided, however that the Company shall have the right to appoint two

(2) person to serve as a member of the Board of Directors of the surviving corporation and ZASH shall have the right to appoint

three (3) persons to serve as members of the Board of Directors of the surviving company.

Contribution

Agreement with Zash Global Media and Entertainment Corporation

On

January 19, 2021, Vinco Ventures, Inc. (“Vinco Ventures”), ZVV Media Partners, LLC (the “Company”) and

Zash Global Media and Entertainment Corporation (“ZASH”) entered into a Contribution Agreement (the “Agreement”).

Vinco Ventures and ZASH desire to establish the newly formed Company in order to engage in the development and production of consumer

facing content and related activities.

Under

the terms of the Agreement, Vinco Ventures and ZASH shall contribute certain assets (the “Contributed Assets”) to

the Company. At Closing, Vinco Ventures and ZASH shall enter into a limited liability operating agreement of the Company and a

content distribution agreement with American Syndication Media Corporation (“ASMC”). The Company shall not assume

any liabilities of either Vinco Ventures or ZASH except those liabilities arising in or specifically relating to periods, events

or occurrences happening with respect to the Contributed Assets on or after the Closing Date. In consideration of the Contributed

Assets, the Company shall issue to Vinco Ventures and ZASH 5,000 Units. The transaction closed on January 19, 2021.

Stock

Exchange Agreement for Sale of SRM Entertainment, LTD

On

November 30, 2020, the Company (the “Seller”) and its wholly owned subsidiary, SRM Entertainment, LTD (“SRM”)

entered into a Stock Exchange Agreement (the “Exchange Agreement”) with Jupiter Wellness, Inc. (“Jupiter”)(the

“Buyer”). Under the terms of the Exchange Agreement, the Buyer agreed to purchase all outstanding shares of common

stock (the “Exchange Shares”) issued by SRM from the Seller. As consideration for the purchase of the Exchange Shares,

the Buyer agreed to exchange 200,000 shares of its restricted common stock (the “Consideration Shares”), symbol JUPW

as listed on NASDAQ Capital Markets.

Upon

closing, Jupiter delivered 150,000 of the Consideration Shares and held 50,000 of the Consideration Shares in escrow (“Escrow

Shares”). Jupiter shall release the Escrow Shares upon SRM generating $200,000 in cash receipts and revenue prior to January

15, 2021. As of the date of the Registration Statement, the Company has received all Exchange Shares.

As

a performance based incentive, the Buyer shall pay to the Seller two percent (2%) of gross sales of Jupiter’s private label

sun care products if such gross sales are in excess of twelve million dollars ($12,000,000) earned during the 2021 calendar year.

At

Closing, the Company (as “Stockholder”) and Jupiter entered into a Leak Out Agreement, whereby the Company was limited

in the sales of the Consideration Shares upon the following terms: (i) As such time as the Stockholder is able to resell the Consideration

Shares in accordance with the provisions of Rule 144 of the Securities Act (the “Expiration of the Holding Period”),

the Stockholder agrees to limit the resales of such Shares in the public market as follows:

|

|

a.

|

No

shares in any one day more than ten percent (10%) of the average of the daily trading volume on all trading markets on which

the Consideration Shares are then quoted or listed for the five trading days preceding the sale of the Consideration Shares,

and;

|

|

|

|

|

|

|

b.

|

Any

permitted resales by the Stockholder shall be at the then current bid price of the Common Stock.

|

Edison

Nation Holdings, LLC Transaction

On

September 4, 2018, the Company completed the acquisition of all of the voting membership interest of Edison Nation Holdings, LLC

(“EN”) for a total purchase price of $11,776,696 comprised of (i) $700,000 in cash to Edison Nation ($550,000 of which

was subsequently used to purchase the membership interests of Access Innovation, LLC, which membership interests were then distributed

to the Members), and $250,000 in cash used to pay off a portion of the indebtedness owed by EN to holders of certain senior convertible

debt), (ii) the assumption of the remaining balance of EN’s senior convertible debt through the issuance of new 4%, 5-year

senior convertible notes (the “New Convertible Notes”), in the aggregate principal and interest amount of $1,428,161

(which amount was previously disclosed in the Company’s Current Report on Form 8-K filed with the SEC on September 6, 2018

as $1,436,159 due to final adjustments for principal and accrued interest), which are convertible into 285,632 shares of the Company’s

common stock, at the option of the holder of the New Convertible Notes, (iii) the reservation of 990,000 shares of the Company’s

common stock that may be issued in exchange for the redemption of certain non-voting membership interests of EN, and (iv) the

issuance of 557,084 shares of the Company’s common stock in satisfaction of the indebtedness represented by promissory notes

payable by EN with a total principal balance of $4,127,602. On August 19, 2020, the Company issued the 990,000 shares of common

stock to the members of EN, resulting in the Company owning 100% of EN.

Letter

of Intent for Sale of Assets of CBAV1, LLC

On

October 30, 2020, the Company received a letter of intent from a prospective purchaser dated October 22, 2020 setting forth the

terms of an offer to purchase Cloud b assets from CBAV1, LLC (“CBAV1”), the Company’s wholly owned subsidiary

(the “LOI”). The Cloud b assets include but are not limited to intellectual property, know how, brand names, trade

names, patents, models, internet websites, domains, social network assets, production facilities, including the molds of all products,

and inventory (“Cloud b Assets”).

By

way of background, the Cloud b Assets were pledged as collateral (“Collateral”) to secure a promissory note from East

West Bank dated in or around May 25, 2011, along with amendments and modifications to the loan agreement (“Secured Note”).

On June 4, 2018, CBAV1 acquired the Secured Note in accordance with the Cloud B Assignment of Loan and Security Agreement from

East West Bank. On October 30, 2018, pursuant to the Stock Purchase Agreement, the Company became the beneficial owner of 72.16%

of Cloud b, Inc.’s shares of common stock. CBAV1 provided Notification of Disposition of Collateral (pursuant to its notice

of default dated August 7, 2018 to Cloud b, Inc.) and scheduled a Public Sale of the Collateral to the highest qualified bidder

for February 11, 2019 (“Public Sale”). CBAV1 submitted the highest bid for the Collateral at the Public Sale and inured

to the benefit of the Cloud b Assets. On February 17, 2020, the Company entered into the Agreement for The Purchase and Sale of

Common Stock of Cloud b, Inc. and pursuant therewith, sold its ownership interest in Cloud b, Inc. to the buyer.

To

effectuate the sale of the Cloud b assets to the prospective purchaser, the Company has determined that it is in the best interests

of the company and its shareholders for CBAV1 and the prospective buyer to utilize the jurisdiction and protections of the bankruptcy

court to effectuate the sale of the Cloud b Assets free and clear of any obligations.

The

current assets of CBAV1 were estimated to be in excess of $2,000,000 and the current liabilities were estimated to be less than

$100,000.

By

utilizing the jurisdiction of the bankruptcy court, the Cloud b Assets can be transferred to the prospective purchaser free and

clear of liens and obligations. Any unsecured creditors or minority shareholders of Cloud b, Inc. will have the opportunity to

assert any claims or actions within the sale proceeding under the jurisdiction of the bankruptcy court.

Cloud

B, Inc. Transaction

On

October 29, 2018, the Company entered into a Stock Purchase Agreement with a majority of the shareholders (the “Cloud B

Sellers”) of Cloud B, Inc., a California corporation (“Cloud B”). Pursuant to the terms of such Stock Purchase

Agreement, the Company purchased 72.15% of the outstanding capital stock of Cloud B in exchange for 489,293 shares of restricted

common stock of the Company. In addition, the Company entered into an Earn Out Agreement with the Cloud B Sellers, whereby, beginning

in 2019, the Company will pay the Cloud B Sellers an annual amount equal to 8% multiplied by the incremental gross sales of Cloud

B over its 2018 gross sales level. The Earn Out Agreement expires on December 31, 2021. CBAV1, LLC, a wholly-owned subsidiary

of Edison Nation, Inc., owns the senior secured position on the promissory note to Cloud B, Inc. in the amount of $2,270,000.

In February 2019, CBAV1, LLC, pursuant to an Article 9 foreclosure action, perfected its secured UCC interest in all the assets

of Cloud B, Inc. to partially satisfy the outstanding balance on the note and thereby making any payments of such Cloud B trade

payables and notes unlikely in the future.

On

February 17, 2020, the Company divested its Cloud B, Inc. subsidiary and entered into an Agreement for the Purchase and Sale of

Cloud B, Inc.(the “Purchase Agreement”), with Pearl 33 Holdings, LLC (the “Buyer”), pursuant to which

the Buyer purchased from the Company (and the Company sold and assigned) 80,065 shares of common stock of Cloud B (the “Cloud

B Shares”) for $1.00, constituting a 72.15% ownership interest in Cloud B, based on 110,964 shares of Cloud B’s common

stock outstanding as of February 17, 2020. In accordance with the agreement, all of the liabilities of Cloud B were assumed by

Pearl 33.

On

February 17, 2020, the Company entered into an indemnification agreement with Pearl 33 Holdings, LLC in connection with the divestiture

of Cloud B, Inc., whereby pursuant to such agreement the Company is limited to the issuance of 150,000 shares of the Company’s

common stock to the Buyer for indemnification of claims against Cloud B Inc. Please see Note 3 — Acquisitions and

Divestitures within the Company’s financial statements for the nine months ended September 30, 2020 for

further information.

Impairment

For

the year end December 31, 2029, the Company recorded an impairment charge of $4,443,000 related to our annual impairment assessment.

The impairment was a result of decreased profitability as compared to anticipated profitability in our businesses acquired in

2018. The Company utilized the simplified test for goodwill impairment. The amount recognized for impairment is equal to the difference

between the carrying value and the asset’s fair value. The valuation methods used in the quantitative fair value assessment

was a discounted cash flow method and required management to make certain assumptions and estimates regarding certain industry

trends and future profitability of our reporting units.

Non-Employee

Director Compensation

On

September 26, 2018, the Compensation Committee of the board of directors approved the terms of compensation to be paid to non-employee

directors for fiscal year 2018. Compensation for non-employee directors includes an annual retainer of $15,000, an annual committee

meeting fee of $5,000, if such director chairs a committee of the board of directors, and an award of options to purchase 20,000

shares of the Company’s common stock (the “Options”). The restricted stock underlying such Options were to vest

one year after the grant date. However, the Options were never granted.

Accordingly,

on November 15, 2019, in lieu of granting the Options, the Company granted the board of directors restricted stock units of 20,000

shares which vested immediately. In addition, on November 15, 2019, the Company granted each non-employee director restricted

stock units of 30,000 shares, which vested on January 1, 2020.

Acquisition

of Pirasta, LLC

On

December 31, 2018, the Company completed the acquisition of all of the voting membership interest of Pirasta, LLC from NL Penn

Capital, LP in exchange for the satisfaction of $470,000 due from related party. NL Penn Capital, LP is owned by Christopher B.

Ferguson, our Chairman and Chief Executive Officer. Accordingly, the consolidated financial statements of the Company reflect

the accounting of the combined acquired subsidiary at historical carrying values, except that equity reflects a distribution for

the excess of consideration paid over the net carrying amount of assets.

Acquisition

of Best Party Concepts, LLC

On

December 31, 2018, the Company completed the acquisition of 50% of the voting membership interest of Best Party Concepts, LLC

from NL Penn Capital, LP in exchange for the satisfaction of $500,000 due from related party. NL Penn Capital, LP is owned by

Christopher B. Ferguson, our Chairman and Chief Executive Officer. Accordingly, the consolidated financial statements of the Company

reflect the accounting of the combined acquired subsidiary at historical carrying values, except that equity reflects a distribution

for the excess of consideration paid over the net carrying amount of assets.

FirstFire

Securities Purchase Agreement

On

March 6, 2019, the Company entered into a securities purchase agreement (the “FirstFire SPA”) with an accredited investor

(the “Investor”) pursuant to which the Investor purchased a 2% unsecured, senior convertible promissory note (the

“FirstFire Note”) from the Company. The Company issued 15,000 shares of its common stock to the Investor as additional

consideration for the purchase of the FirstFire Note. Under the terms of the FirstFire SPA, the Investor had piggyback registration

rights in the event the Company files a Form S-1 or Form S-3 within six months from March 6, 2019, as well as a pro rata right

of first refusal in respect of participation in any debt or equity financings undertaken by the Company during the 18 months following

March 6, 2019. The Company was also subject to certain customary negative covenants under the FirstFire SPA, including but not

limited to, the requirement to maintain its corporate existence and assets subject to certain exceptions, and to not to make any

offers or sales of any security under circumstances that would have the effect of establishing rights or otherwise benefitting

other investors in a manner more favorable in any material respect than those rights and benefits established in favor of the

Investor under the terms of the FirstFire SPA and the FirstFire Note. The maturity date of the Note was six months from March

6, 2019. All principal amounts and the interest thereon were convertible into shares common stock only in the event that an Event

of Default occurred (as such term was defined in the FirstFire Note).

On

June 17, 2019, the Company entered into that certain Settlement and Release Agreement with the Investor (the “Settlement

Agreement”) whereby the Company and the Investor agreed to terminate the FirstFire SPA, FirstFire Note, and all other documents

entered into in connection therewith. Pursuant to the terms of the Settlement Agreement, the Company paid $566,000 and issued

15,000 shares of restricted common stock to the Investor (the “Settlement Amount”). Upon receipt of the Settlement

Amount, the Investor and the Company have agreed to terminate the FirstFire SPA, FirstFire Note, and all other documents entered

into in connection therewith, and to release, waive, and forever discharge the other party from, including, but not limited to,

any claim, right, or legal action, whether past, current, or future, which may arise directly or indirectly out of such documents.

Tiburon

Loan Agreement

On

June 14, 2019, the Company entered into that certain Loan Agreement (the “Loan Agreement”) with Tiburon Opportunity

Fund (the “Lender”), dated June 14, 2019 (the “Loan”). Pursuant to the terms of the Loan Agreement, the

Lender agreed to loan the Company $250,000. The Loan bore interest at the rate of 1.5% per month through the term of the Loan.

Additionally, the Loan Agreement provided that the Company would pay the Lender the entire unpaid principal and all accrued interest

upon thirty days’ notice to the Company, but in any event, the notice shall not be sooner than August 11, 2019. The Loan

proceeds were used to fund general working capital needs of the Company. If the Company defaulted on the performance of any obligation

under the Loan Agreement, the Lender would have declared the principal amount of the Loan owing under the Loan Agreement at the

time of default to be immediately due and payable. Furthermore, the Loan Agreement granted the Lender a collateral interest in

certain accounts receivable of SRM Entertainment Ltd. (“SRM”), a subsidiary of the Company. The outstanding principal

and interest on the note were repaid on December 27, 2019.

On

January 2, 2020, the Company entered into that certain Loan Agreement (the “Second Loan Agreement”) with Tiburon Opportunity

Fund (the “Lender”), dated January 2, 2020 (the “Second Loan”). Pursuant to the terms of the Second Loan

Agreement, the Lender agreed to loan the Company $400,000. The Second Loan bears interest at the rate of 1.5% per month through

the term of the Second Loan. Additionally, the Second Loan Agreement provides that the Company shall pay the Lender the entire

unpaid principal and all accrued interest upon thirty days’ notice to the Company, but in any event, the notice shall not

be sooner than June 1, 2020. The Second Loan proceeds are being used to fund general working capital needs of the Company. If

the Company defaults on the performance of any obligation under the Second Loan Agreement, the Lender may declare the principal

amount of the Second Loan owing under the Second Loan Agreement at the time of default to be immediately due and payable. Furthermore,

the Second Loan Agreement grants the Lender a collateral interest in certain accounts receivable of SRM. On April 24, 2020, the

Company and Lender entered into a Debt Conversion Agreement whereby the Lender was given the right and elected to exercise that

right to convert principal and interest of $424,000 of funds loaned to the Company into shares of the Company’s common stock.

The fair value of the Company’s common stock was $2.08 on the date of conversion and the conversion price was $2.00 per

share for a total of 212,000 shares of restricted common stock issued by the Company.

Labrys

Securities Purchase Agreement

On

August 26, 2019, the Company entered into a securities purchase agreement (the “Labrys SPA”) with Labrys Fund, LP

(“Labrys”) pursuant to which Labrys purchased a 12% Convertible Promissory Note (the “Labrys Note”) from

the Company. Unless there is a specific Event of Default (as such term is defined in the Labrys Note) or the Labrys Note remains

unpaid by the Maturity Date, then Labrys shall not have the ability to convert the principal and interest under the Labrys Notes

into shares of common stock. The per share conversion price into which the principal amount and interest under the Labrys Note

may be converted is equal to the lesser of (i) 80% multiplied by the lowest Trade Price (as such term is defined in the Labrys

Note) of our common stock during the 20 consecutive trading days ending on the latest complete trading day prior to the date of

issuance of the Labrys Note, and (ii) 80% multiplied by the lowest Market Price (as such term is defined in the Labrys Note) of

our common stock during the 20 trading day period ending on the latest complete trading day prior to the Conversion Date (as such

term is defined in the Labrys Note).

Pursuant

to the Labrys SPA, the Company agreed to issue and sell to Labrys the Note, in the principal amount of $560,000, with an original

issue discount in the amount of $60,000. The Labrys Note is due and payable February 26, 2020 (the “Maturity Date”).

Additionally, the Company issued 181,005 shares of common stock to Labrys as a commitment fee, of which 153,005 shares of common

stock must be returned to the Company in the event the Labrys Note is fully paid and satisfied prior to the Maturity Date. The

proceeds from the Labrys Note were used for general working capital and to fund new product launches.

The

Company is also subject to certain customary negative covenants under the Labrys SPA, including but not limited to, the requirement

to maintain its corporate existence and assets subject to certain exceptions, and to not to make any offers or sales of any security

under circumstances that would have the effect of establishing rights or otherwise benefitting other investors in a manner more

favorable in any material respect than those rights and benefits established in favor of the Investor under the terms of the Labrys

SPA and the Labrys Notes. The Company agreed at all times to have authorized and reserved two times the number of shares of common

stock that are issuable upon full conversion of the Labrys Note. Initially, the Company instructed its transfer agent to reserve

700,000 shares of common stock in the name of Labrys for issuance upon conversion.

On

January 24, 2020, the Company repaid the Labrys Note in full. Upon repayment of the Labrys Note, Labrys returned to the Company

for cancellation the 153,005 shares of Common Stock that had been originally issued to as a portion of the commitment fee paid

in connection with the Labrys Note and allowed the Company to cancel the reservation of the 875,000 shares of Common Stock that

had been reserved pursuant to the Labrys SPA and Labrys Note.

32E

Financing

On

December 4, 2019, the Company agreed to issue and sell to 32 Entertainment LLC (“32E”) a 10% Senior Secured Note (the

“32E Note”), in the principal amount of $250,000. The maturity date of the 32E Note is December 4, 2020. In addition,

the Company issued to 32E 10,000 shares of common stock as an inducement to 32E to purchase the 32E Note. The $250,000 of proceeds

from the 32E Note was used for general working capital needs of the Company and the repayment of debt related to Horberg Enterprises.

Pursuant

to the terms of the 32E Note, on December 4, 2019, the Company also issued 32E a Common Stock Purchase Warrant (the “32E

Warrant”) to purchase 50,000 shares of common stock at an exercise price of $1.50 per share. The 32E Warrant expires on

December 4, 2024. The 32E Warrant contains price protection provisions, as well as a provision allowing 32E to purchase the number

of shares that 32E could have acquired if it held the number of shares of common stock acquirable upon complete exercise of the

32E Warrant, in the event that the Company grants, issues or sells common stock, common stock equivalents, rights to purchase

common stock, warrants, securities or other property pro rate to holders of any class of the Company’s securities. If there

is no effective registration statement registering the resale of the shares of common stock underlying the 32E Warrant, then the

32E Warrant may be exercised cashlessly, based on a cashless exercise formula. The 32E Warrant also contains a conversion limitation

provision, which prohibits 32E from exercising the 32E Warrant in an amount that would result in the beneficial ownership of greater

than 4.9% of the total issued and outstanding shares of common stock, provided that (i) such exercise limitation may be waived

by 32E with 61 days prior notice, and (ii) 32E cannot waive the exercise limitation if conversion of the 32E Warrant would result

in 32E having beneficial ownership of greater than 9.9% of the total issued and outstanding shares of common stock.

In

connection with the sale of the 32E Note, also on December 4, 2019, the Company entered into a registration rights agreement whereby

the Company agreed to register the 10,000 shares of common stock issued to 32E as an inducement on a registration statement on

Form S-1 with the SEC. The Company was required to have such registration statement declared effective by the SEC within 90 calendar

days (or 180 calendar days in the event of a “full review” by the SEC) following the earlier of 30 days from December

4, 2019 or the filing date of the registration statement on Form S-1, which such registration statement has not been filed or

timely declared effective. If the registration statement is not filed or declared effective within the timeframe set forth in

the registration rights agreement, the Company was supposed to be obligated to pay to 32E a monthly amount equal to 1% of the

total subscription amount paid by 32E until such failure is cured. The Company has not made any such payment 32E. The registration

rights agreement also contains mutual indemnifications by the Company and each investor, which the Company believes are customary

for transactions of this type.

On

May 19, 2020, the Company entered into an Amendment (the “Amendment”) to the 32E Note. Under the terms of the Amendment,

the Company issued to 32E an Amended Subordinate Secured Note (the “Replacement Note”) in the principal amount of

$200,000 that accrues interest at 16% annually and matures on May 21, 2021. On May 28, 2020, the Company paid $50,000 toward the

principal plus interest in the amount of $6,250 for a total of $56,250. 32E shall also receive 40,000 restricted stock units and

surrender the warrant issued to it in the December 4, 2019 financing transaction. The Company accounted for the Amendment as a

modification.

PIPE

Financing

On

October 2, 2019, the Company entered into a Share Purchase Agreement (the “PIPE Purchase Agreement”) with certain

accredited investors for the private placement of 1,050,000 shares of the Company’s common stock at a purchase price of

$2.00 per share (the “PIPE Financing”). In a series of four closings, the Company sold a total of 1,175,000 shares

of common stock at a purchase price of $2.00 per share (the “PIPE Shares”), for an aggregate amount sold in the PIPE

Financing of $2,350,000. The PIPE Purchase Agreement contains certain closing conditions relating to the sale of securities, representations

and warranties by the Company and the applicable investors, as well as covenants of the Company and the investors (including indemnifications

from the Company in the event of breaches of its representations and warranties), all of which the Company believes are customary

for transactions of this type of transaction. The PIPE Purchase Agreement contains a prohibition on equity sales by the Company,

which prohibition was violated by the Greentree Financing (defined below). As of August 27, 2020, none of the investors in the

PIPE Financing have taken adverse action as a result of such prohibition.

In

connection with the sale, the Company entered into a registration rights agreement whereby the Company agreed to register all

PIPE Shares and file this registration statement on a Form S-1 with the SEC. The Company was required to have such registration

statement declared effective by the SEC within 90 calendar days (or 120 calendar days in the event of a “full review”

by the SEC) following the applicable closing date of the PIPE Financing, which such registration statement has not been timely

declared effective. If the registration statement is not filed or declared effective within the timeframe set forth in the registration

rights agreement, the Company was supposed to be obligated to pay the investors in the PIPE Financing an amount equal to 1% of

the total purchase price of the common stock per month (up to a maximum of 8% in the aggregate) until such failure is cured. The

Company has not made any such payment to the investors in the PIPE Financing. As of August 27, 2020, none of the investors in

the PIPE Financing, have taken adverse action as a result of this delay. The registration rights agreement also contains mutual

indemnifications by the Company and each investor, which the Company believes are customary for transactions of this type.

Furthermore,

the Company issued warrants to the placement agent in the PIPE Financing of a value equal to six percent (6%) of the aggregate

number of PIPE Shares, whereby the exercise price is 125% of the price at which the shares were issued in such offering. For additional

information regarding the PIPE Financing, see “Private Placement of Securities” on page 31.

Acquisition

of HMNRTH, LLC Assets

On

March 11, 2020, the Company and its wholly owned subsidiary, Scalematix, LLC (together the “Buyer”), entered into

an Asset Purchase Agreement (the “Agreement”) with HMNRTH, LLC (the “Seller”) and TCBM Holdings, LLC (the

“Owner”) (together Seller and Owner the “Selling Parties”) for the purchase of certain assets in the health

wellness industry and related consumer products industry. Under the terms of the Agreement, Buyer is to remit $70,850 via wire

transfer at Closing and shall issue to a representative of the Selling Parties Two Hundred Thirty-Eight Thousand Seven Hundred

and Fifty (238,750) shares of restricted common stock. The shares were issued on March 16, 2020 and valued at $477,500.

In

addition, the Selling Parties shall have the right to additional earn out compensation based upon the following metrics: (i) at

such time as the purchased assets achieve cumulative revenue of $2,500,000, the Selling Parties shall earn One Hundred Twenty-Five

Thousand (125,000) shares of common stock; and (ii) at such time as the purchased assets achieve cumulative revenue of $5,000,000,

the Selling Parties shall earn One Hundred Twenty-Five Thousand (125,000) shares of common stock. The transaction closed on March

11, 2020.

Global

Clean Solutions Agreement and Plan of Share Exchange

On

May 20, 2020 (the “Effective Date”), Edison Nation, Inc. (the “Company”) entered into an Agreement and

Plan of Share Exchange (the “Share Exchange Agreement”) with PPE Brickell Supplies, LLC, a Florida limited liability

company (“PPE”), and Graphene Holdings, LLC, a Wyoming limited liability company (“Graphene”, and together

with PPE, the “Sellers”), whereby the Company purchased 25 membership units of Global Clean Supplies, LLC, a Nevada

limited liability company (“Global”) from each of PPE and Graphene, for a total of fifty (50) units, representing

fifty percent (50%) of the issued and outstanding units of Global (the “Purchase Units”). The Company issued 250,000

shares of its restricted common stock, $0.001 par value per share (the “Common Stock”) to PPE, and 50,000 shares of

Common Stock to Graphene, in consideration for the Purchase Units.

Pursuant

to the terms of the Share Exchange Agreement, the Sellers may earn additional shares of Common Stock upon Global realizing the

following revenue targets: (i) In the event that Global’s total orders equal or exceed $1,000,000, Graphene shall receive

200,000 shares of Common Stock; (ii) In the event that Global’s total orders equal or exceed $10,000,000, PPE shall receive

100,000 shares of restricted Common Stock; and (iii) In the event that Global’s total orders equal or exceed $25,000,000,

Graphene shall receive 125,000 shares of restricted Common Stock. Additionally, the Company shall be entitled to appoint two managers

to the Board of Managers of Global.

Amended

Limited Liability Company Agreement

On

the Effective Date, the Company entered into an Amended Limited Liability Company Agreement of Global (the “Amended LLC

Agreement”). The Amended LLC Agreement amends the original Limited Liability Company Agreement of Global, dated May 13,

2020. The Amended LLC Agreement defines the operating rules of Global and the ownership percentage of each member: Edison Nation,

Inc. 50%, PPE 25% and Graphene 25%.

Secured

Line of Credit Agreement

On

the Effective Date, the Company (as “Guarantor”) entered into a Secured Line of Credit Agreement (the “Credit

Agreement”) with Global and PPE. Under the terms of the Credit Agreement, PPE is to make available to Global a revolving

credit loan in a principal aggregate amount at any one time not to exceed $2,500,000. Upon each drawdown of funds against the

credit line, Global shall issue a Promissory Note (the “Note”) to PPE. The Note shall accrue interest at 3% per annum

and have a maturity date of six (6) months. In the event of a default, any and all amounts due to PPE by Global, including principal

and accrued but unpaid interest, shall increase by forty (40%) percent and the interest shall increase to five (5%) percent (the

“Default Interest”).

Security

Agreement

On

the Effective Date, the Company (as “Guarantor”) entered into a Security Agreement (the “Security Agreement”)

with Global (as “Borrower”) and PPE (as “Secured Party”), whereby the Company placed 1,800,000 shares

of Common Stock (the “Reserve Shares”) in reserve with its transfer agent in the event of default under the Credit

Agreement. In the event of a default that is not cured by the defined cure period, the PPE may liquidate the Reserve Shares until

the Global’s principal, interest and associated expenses are recovered. The number of Reserve Shares may be increased through

the issuance of True-Up shares in the event the original number of Reserve Shares is insufficient.

Acquisition

of TBD Safety, LLC

On

September 29, 2020, the Company (as “Purchaser”) entered into a Purchase and Sale Agreement (the “Agreement”)

with Graphene Holdings, LLC, Mercury FundingCo, LLC, Ventus Capital, LLC and Jetco Holdings, LLC (together the “Sellers”)

to acquire all outstanding Membership Units (the “Units”) of TBD Safety, LLC (“TBD”). Collectively, the

Sellers own all outstanding Units of TBD. Under the terms of the Agreement, the Company is to issue a total of Two Million Two

Hundred Ten Thousand Three Hundred Eighty-Two (2,210,382) shares of the Company’s common stock and a total of Seven Hundred

Sixty-Four Thousand Six Hundred Eighteen (764,618) shares of a newly designated Preferred Stock (the “Preferred”).

In addition, the Company and Sellers shall enter into a Registration Rights Agreement (the “Registration Rights Agreement”)

in favor of the Sellers obligating the Company to register such Common Stock and shares of Common Stock to be issued upon conversion

of the Preferred within 120 days after the Closing. The Sellers shall have an Earn Out Consideration - At such time as the Assets

purchased in the Agreement achieve cumulative revenue of $10,000,000, the Sellers shall earn a total of One Hundred Twenty-Five

Thousand (125,000) shares of Common Stock. The Closing of the transaction occurred on October 16, 2020.

Edison

Nation Medical Operations

Edison

Nation Holdings, LLC formed Edison Nation Medical (“EN Medical”) in May of 2012. It was a partnership between Edison

Nation and Carolinas Healthcare Systems (now called Atrium). Atrium is the 2nd largest healthcare system in the US. Carolina Health

(Atrium) wanted a way to aggregate and commercialize the healthcare related innovations that were coming from their physicians,

nurses, and patients, and Edison Nation offered a platform to provide that function.

EN

Medical built out a separate platform, leveraging the Edison Nation model to look for ideas that improved patient care and lowered

costs. Over the past three years, EN Medical collected some great ideas, but the market shifted and EN found that the licensing

model was very difficult as big medical device companies wanted to acquire companies with sales versus just buying IP and prototypes.

In 2019, certain less complex devices such as Ezy Dose were licensed to third parties by the Company. Additionally, EN Medical

has continued to explore opportunities in the health and wellness space for products that do not require FDA approval. Examples

of product lines in the health wellness space that are currently being evaluated include an organic skin care line, essential

oils, supplements for breast feeding, and an all-natural nutritional supplement.

Based

upon the emergence of COVID 19 and the increased demand for certain medical supplies, hand sanitizers and personal protective

equipment, Edison Nation made the strategic decision to have EN Medical develop an online portal granting hospitals, government

agencies and distributors access to its catalog of medical supplies and hand sanitizers. EN Medical’s website is located

at www.edisonnationmedical.com. For purposes of this business description, the activities of EN Medical are inclusive

of Global Clean Solutions (“Global”) as well.

EN

Medical is focused primarily on its proprietary brand of hand sanitizer, Purple Mountain Clean, that is being produced and sold

by the operating subsidiary, Global. The Purple Mountain Clean Brand is 100% USA Made and is offered in both gel and liquid formulas.

The Purple Mountain Clean sanitizer is produced with 70% Ethyl Alcohol and is FDA certified. EN Medical offers a variety of sizes

and pumps for Purple Mountain Clean and recently initiated the production of sanitizer stands that can be customized with a customer’s

logo or other promotional artwork. The launching of our EN Medical’s brand of sanitizer did delay certain shipments for

the second quarter in 2020 as EN Medical needed to develop EN Medical’s specific formulas and packaging for Purple Mountain

Clean.

As

a secondary focus, EN Medical offers medical supplies and personal protective equipment to government agencies, counties, municipalities