Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

February 18 2020 - 5:29PM

Edgar (US Regulatory)

Filed Pursuant to Rule 433

Registration Statement 333-236351

February 18, 2020

Amgen Inc.

PRICING TERM SHEET

Dated

February 18, 2020

$500,000,000 1.900% Senior Notes due 2025 (the “2025” Notes)

$750,000,000 2.200% Senior Notes due 2027 (the “2027” Notes)

$1,250,000,000 2.450% Senior Notes due 2030 (the “2030” Notes)

$1,250,000,000 3.150% Senior Notes due 2040 (the “2040” Notes)

$1,250,000,000 3.375% Senior Notes due 2050 (the “2050” Notes)

This term sheet relates only to the securities described below and supplements and should be read together with the preliminary prospectus supplement, dated

February 18, 2020, and the accompanying prospectus (including the documents incorporated by reference in the accompanying prospectus) relating to these securities.

|

|

|

|

|

Issuer:

|

|

Amgen Inc.

|

|

|

|

|

Ranking:

|

|

Senior Unsecured

|

|

|

|

|

Principal Amount:

|

|

2025 Notes: $500,000,000 aggregate principal amount

2027 Notes: $750,000,000 aggregate principal amount

2030 Notes:

$1,250,000,000 aggregate principal amount

2040 Notes: $1,250,000,000 aggregate principal amount

2050 Notes: $1,250,000,000 aggregate principal amount

|

|

|

|

|

Maturity Date:

|

|

2025 Notes: February 21, 2025

2027 Notes:

February 21, 2027

2030 Notes: February 21, 2030

2040 Notes: February 21, 2040

2050 Notes: February 21,

2050

|

|

|

|

|

Coupon:

|

|

2025 Notes: 1.900% per annum, accruing from and including February 21, 2020

2027 Notes: 2.200% per annum, accruing from and including February 21, 2020

2030 Notes: 2.450% per annum, accruing from and including February 21, 2020

2040 Notes: 3.150% per annum, accruing from and including February 21, 2020

2050 Notes: 3.375% per annum, accruing from and including February 21, 2020

|

|

|

|

|

Price to Public:

|

|

2025 Notes: 99.796% of principal amount

2027

Notes: 99.787% of principal amount

2030 Notes: 99.965% of principal amount

2040 Notes: 99.603% of principal amount

2050 Notes: 99.962% of

principal amount

|

|

|

|

|

Benchmark Treasury:

|

|

2025 Notes: 1.375% due January 31, 2025

2027 Notes: 1.500% due January 31, 2027

2030 Notes: 1.500%

due February 15, 2030

2040 Notes: 2.375% due November 15, 2049

2050 Notes: 2.375% due November 15, 2049

|

1

|

|

|

|

|

|

|

|

Benchmark Treasury

Price / Yield:

|

|

2025 Notes:

99-291⁄4 / 1.393%

2027 Notes: 100-03+ / 1.483%

2030 Notes: 99-16 / 1.554%

2040 Notes: 108-06+ / 2.007%

2050 Notes: 108-06+ / 2.007%

|

|

|

|

|

Spread to Benchmark:

|

|

2025 Notes: 55 bps

2027 Notes: 75 bps

2030 Notes: 90 bps

2040 Notes: 117 bps

2050 Notes: 137 bps

|

|

|

|

|

Yield to Maturity:

|

|

2025 Notes: 1.943%

2027 Notes: 2.233%

2030 Notes: 2.454%

2040 Notes: 3.177%

2050 Notes: 3.377%

|

|

|

|

|

Interest Payment Dates:

|

|

2025 Notes: February 21 and August 21 of each year, commencing on August 21, 2020

2027 Notes: February 21 and August 21 of each year, commencing on August 21, 2020

2030 Notes: February 21 and August 21 of each year, commencing on August 21, 2020

2040 Notes: February 21 and August 21 of each year, commencing on August 21, 2020

2050 Notes: February 21 and August 21 of each year, commencing on August 21, 2020

|

|

|

|

|

Reinvestment Rate (for make whole call):

|

|

2025 Notes: 10 bps;

2027 Notes: 15 bps;

2030 Notes: 15 bps;

2040 Notes: 20 bps;

2050 Notes: 25 bps;

in each case plus the weekly yield for the most recent week set forth in the most recent Statistical Release for the constant maturity U.S. Treasury security

(rounded to the nearest month) corresponding to the remaining life to maturity, as of the payment date of the principal being redeemed or paid.

|

|

|

|

|

Par Call Dates:

|

|

2025 Notes: January 21, 2025

2027 Notes:

December 21, 2026

2030 Notes: November 21, 2029

2040 Notes: August 21, 2039

2050 Notes: August 21,

2049

|

|

|

|

|

Trade Date:

|

|

February 18, 2020

|

|

|

|

|

Settlement Date:

|

|

February 21, 2020 (T+3)

|

|

|

|

|

CUSIP / ISIN:

|

|

2025 Notes: 031162 CV0 / US031162CV00

2027

Notes: 031162 CT5 / US031162CT53

2030 Notes: 031162 CU2 / US031162CU27

2040 Notes: 031162 CR9 / US031162CR97

2050 Notes: 031162 CS7 /

US031162CS70

|

|

|

|

|

Denominations:

|

|

$2,000 x $1,000

|

|

|

|

|

Expected Ratings*:

|

|

Baa1 (stable) / A- (stable) (Moody’s / S&P)

|

2

|

|

|

|

|

|

|

|

Joint Book-Running Managers:

|

|

Citigroup Global Markets Inc.

Goldman

Sachs & Co. LLC

Barclays Capital Inc.

Morgan Stanley & Co. LLC

BofA Securities, Inc.

J.P. Morgan Securities LLC

HSBC Securities (USA) Inc.

Mizuho Securities USA

LLC

|

|

|

|

|

Co-Managers:

|

|

BNP Paribas Securities Corp.

Credit Suisse

Securities (USA) LLC

Deutsche Bank Securities Inc.

MUFG

Securities Americas Inc.

RBC Capital Markets, LLC

Sumitomo

Mitsui Financial Group, Inc.

Wells Fargo Securities, LLC

Samuel A. Ramirez & Company, Inc.

|

Changes to Preliminary Prospectus Supplement

The second paragraph of the section entitled “Use of Proceeds” is revised in its entirety to read as set forth below. (Additional conforming

changes will be made to the Preliminary Prospectus Supplement consistent with these changes.)

“We intend to use the net proceeds from this

offering to (i) redeem in full our outstanding 3.45% Senior Notes due 2020 in an aggregate outstanding principal amount of $900 million, which have a stated maturity date of October 1, 2020, (ii) redeem in full our 4.10% Senior Notes

due 2021 in an aggregate outstanding principal amount of $1.0 billion, which have a stated maturity date of June 15, 2021, (iii) redeem in full our 1.85% Senior Notes due 2021 in an aggregate outstanding principal amount of

$750 million, which have a stated maturity date of August 19, 2021 and (iv) redeem $300 million aggregate principal amount of our 3.875% Senior Notes due 2021 (of which $1.75 billion aggregate principal amount of such Notes

is currently outstanding), which have a stated maturity date of November 15, 2021. The redemption of each series of notes will include the payment of a make-whole amount and accrued and unpaid interest on the notes to, but not including, the

date of redemption. We intend to use any remaining net proceeds from this offering to repay our outstanding indebtedness and for general corporate purposes.”

Amgen Inc. has filed a registration statement (including a prospectus dated as of February 10, 2020) and a prospectus supplement dated as of

February 18, 2020 with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement, the prospectus supplement and other documents Amgen Inc. has filed with the

SEC for more complete information about the issuer and this offering. You should rely on the prospectus, prospectus supplement and any relevant free writing prospectus or term sheet for complete details. You may get these documents for free by

visiting the SEC web site at www.sec.gov. Alternatively, copies of the prospectus and the prospectus supplement may be obtained from (i) Citigroup Global Markets Inc. toll-free at

1-800-831-9146, (ii) Goldman Sachs & Co. LLC. toll-free at 1-866-471-2526, (iii) Barclays Capital Inc. toll-free at

1-888-603-5847 and (iv) Morgan Stanley & Co. LLC toll-free at 1-866-718-1649.

|

*

|

The security ratings above are not a recommendation to buy, sell or hold the securities offered hereby. The

ratings may be subject to revision or withdrawal at any time by Moody’s and S&P. Each of the security ratings above should be evaluated independently of any other security rating.

|

Any disclaimer or other notice that may appear below is not applicable to this communication and should be disregarded (other than any statement relating to

the identity of the legal entity authorizing or sending this communication in a non-US jurisdiction). Such disclaimer or notice was automatically generated as a result of this communication being sent by

Bloomberg or another e-mail system.

3

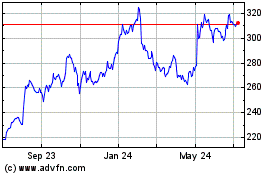

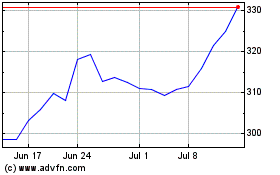

Amgen (NASDAQ:AMGN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Amgen (NASDAQ:AMGN)

Historical Stock Chart

From Apr 2023 to Apr 2024