Canadian Dollar Higher After BoC Holds Rate Steady

June 03 2020 - 7:07AM

RTTF2

The Canadian dollar advanced against its most major counterparts

in the New York session on Wednesday, after the Bank of Canada left

its interest rate unchanged, saying that the impact of the COVID-19

pandemic seemed to have peaked.

The BOC maintained its benchmark rate at 0.25 percent, as

expected.

The Canadian economy appeared to have avoided the most severe

scenario presented in the bank's April Monetary Policy Report, the

bank said in the accompanying statement.

"Decisive and targeted fiscal actions, combined with lower

interest rates, are buffering the impact of the shutdown on

disposable income and helping to lay the foundation for economic

recovery," it said.

Although the outlook for the second half and beyond remained

heavily clouded, the bank expects the economy to resume growth in

the third quarter, it added.

Extending early rally, the loonie jumped to a 3-month high of

80.63 versus yen. The loonie is poised to challenge resistance

around the 81.5 mark.

The loonie rose back to 1.3485 versus the greenback, not far

from a 1-year peak of 1.3480 seen in the Asian session. The loonie

is likely to face resistance around the 1.33 region, if it gains

again.

The loonie bounced off to 1.5132 versus the euro, from a 2-day

low of 1.5200 hit at 9:45 am ET. Next key resistance for the loonie

is likely seen around the 1.49 level.

Survey results from IHS Markit showed that the euro area private

sector contracted sharply in May, but improved from April as

lockdown restrictions implemented to prevent the spread of

coronavirus loosened in many economies.

The final composite output index rose to 31.9 in May from

April's record low of 13.6. The score was above the flash reading

of 30.5.

In contrast, the loonie held steady against the aussie, after

having recovered from a 1-year low of 0.9415 set in the Asian

session. At Tuesday's close, the pair was valued at 0.9323.

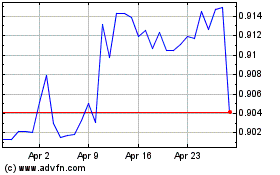

US Dollar vs CHF (FX:USDCHF)

Forex Chart

From Mar 2024 to Apr 2024

US Dollar vs CHF (FX:USDCHF)

Forex Chart

From Apr 2023 to Apr 2024