Canadian Dollar Weakens Amid Falling Oil Prices As U.S. Weighs Plan To Release Oil From Reserves

March 30 2022 - 11:16PM

RTTF2

The Canadian dollar fell against its most major counterparts in

the Asian session on Thursday, following a drop in oil prices as

President Joe Biden prepared a plan to release oil from U.S.

reserves to control inflation.

The Biden administration is planning to release up to 180

million barrels of oil from strategic reserves for several

months.

Biden is expected to make an announcement later today, when he

will give remarks on gas prices from the White House.

West Texas Intermediate futures on the NYMEX have slipped to

near $100 per barrel ahead of the OPEC meeting.

The Organization of the Petroleum Exporting Countries and their

allies, known as OPEC+, is expected to maintain policy steady and

boost output by 400,000 barrels per day in April.

Hopes of de-escalation in Ukraine conflict faded after Russia

said that there were no breakthroughs following in-person

negotiations in Turkey.

The loonie fell to a 2-day low of 1.2520 against the greenback

and near a 2-week low of 1.3980 against the euro, reversing from

its early highs of 1.2476 and 1.3918, respectively. The loonie may

challenge support around 1.28 against the greenback and 1.42

against the euro.

The loonie edged down to 97.26 against the yen, after rising to

98.01 earlier in the session. The loonie may find support around

the 94.00 mark.

In contrast, the loonie recovered to 0.9351 against the aussie,

from a low of 0.9404 seen at 8:45 pm ET. The loonie is likely to

face resistance around 0.92 the region, if it gains again.

Looking ahead, German jobless rate for March and Eurozone

jobless rate for February are due in the European session.

U.S. weekly jobless claims for the week ended March 26, personal

income and spending data for February will be published in the New

York session.

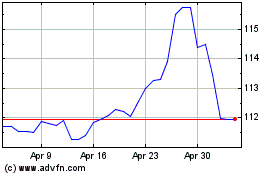

CAD vs Yen (FX:CADJPY)

Forex Chart

From Aug 2024 to Sep 2024

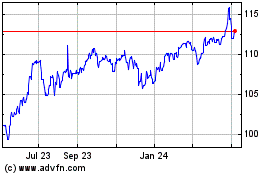

CAD vs Yen (FX:CADJPY)

Forex Chart

From Sep 2023 to Sep 2024