- Tikehau Capital announces its ambition to manage at least €5

billion of assets by 2025 dedicated solely to combatting climate

change.

- The Group’s newly launched Climate Action Centre will mobilise

expertise and innovation to transform and coordinate Tikehau

Capital’s global climate approach and strategy.

- Pierre Abadie is appointed as Group Climate Director to lead

the Centre, in addition to his current role as Co-head of Tikehau

Capital's T2 Energy Transition private equity fund.

Regulatory News:

Tikehau Capital (Paris:TKO), the global alternative asset

management group, today announces its ambition to manage at least

€5 billion of AUM dedicated exclusively to the fight against

climate change by 2025. This will provide Tikehau Capital with

sizable means to invest in companies and projects driving the

decarbonisation of the economy to a more sustainable future. This

significant commitment demonstrates the continued ambition of the

Group to invest global savings towards a more resilient and

inclusive economy, creating sustainable value for all.

For almost ten years, Tikehau Capital has been financing

companies that actively support the energy transition, already

attracting more than €1.5 billion in capital commitments to combat

climate change across multiple investment strategies including

private equity, private debt and capital markets strategies.

These strategies are classified “Article 9” as per the European

Sustainable Finance Disclosure Regulation (SFDR), a set of EU rules

which aim to make the sustainability profile of funds more

comparable and better understood by end-investors. Going forward,

the investment strategies that will allow Tikehau Capital to

fulfill its ambition to exceed €5bn of AUM dedicated to the fight

against climate change by 2025 will all be classified “Article 9”

as per the SFDR.

As part of Tikehau Capital’s continued commitment to furthering

a positive climate agenda, the Group has also today launched the

Climate Action Centre, a platform that will harness financial

innovation and focus on decarbonisation, biodiversity, sustainable

agriculture and food, the circular economy and sustainable

consumption. The Climate Action Centre will initially convene more

than 30 investment professionals, ESG experts and senior advisors

who are already working to deploy existing climate-focused

investment strategies. In the coming months, the Center will be

strengthened with the addition of several climate and sustainable

finance specialists.

The Climate Action Centre will be headed by Pierre Abadie, who

has been appointed Group Climate Director, in addition to his

existing role as Co-head of Tikehau Capital's T2 Energy Transition

Private Equity fund. Pierre will work closely with Cécile Cabanis,

Group Deputy CEO, to ensure that the Group’s climate-related

objectives are fully integrated into Tikehau Capital's impact

strategy and ESG approach.

Pierre Abadie, Group Climate Director of Tikehau Capital

said: "The decarbonisation of our economy is essential in

limiting global warming to below 1.5°C. With the launch of the

Climate Action Centre, we want to accelerate our commitment towards

combatting climate change across our investment strategies with the

objective of contributing to halving CO2 emissions by 2030."

These developments demonstrate Tikehau Capital’s ambition to

build upon its existing expertise and advance its efforts in

tackling the climate emergency. The Group is a longstanding pioneer

of climate action, as demonstrated by the numerous initiatives

launched over the past decade, including:

- A series of investments in renewable energy

providers that have collectively contributed close to 5 gigawatts

of production capacity.

- The launch of the T2 Energy Transition

Private Equity fund in 2018, one of the first funds singularly

committed to the energy transition and the decarbonisation of the

economy. To date, the Europe-focused climate strategy, which

manages more than €1 billion, has deployed more than €500 million

by investing in nine SMEs and SMIs driving the energy

transition.

- The launch of several dedicated

climate-focused investment strategies, including an impact lending

private debt fund and a high-yield impact credit fund, both of

which are designed to finance companies which have the potential to

enable the global shift towards a net zero carbon economy.

- In March 2021, Tikehau Capital successfully

issued its inaugural sustainable bond issuance raising €500

million, the first public sustainable benchmark bond issued by an

alternative asset management firm in Europe. The proceeds of the

bond, which was placed with more than 100 investors globally, will

be used to invest in sustainable assets or in the Group’s

ESG-focused investment funds. Following this successful issuance,

and taking into account the refinancing of the Group’s undrawn

revolving credit facility in July 2021, ESG-linked debt account for

around 60% of the Group’s total debt to date.

- In April 2021, Tikehau Capital announced

the launch of a private equity strategy dedicated to

decarbonisation in North America that aims to replicate the success

and investment philosophy of the European T2 Energy Transition

private equity fund.

Antoine Flamarion and Mathieu Chabran, co-founders of Tikehau

Capital, said: "We strongly believe that we can have a

significant impact on climate change through our investment

approach, which is why we are committing to increase our investment

in fighting the climate emergency. With the launch of our Climate

Action Centre, we want to channel the Group's expertise,

entrepreneurial spirit and agility towards the decarbonisation of

the economy. Pierre Abadie's climate expertise and conviction,

combined with the teams that are working across our climate

strategies, will be key to the success of this major project."

ABOUT TIKEHAU CAPITAL

Tikehau Capital is a global alternative asset management group

with €30.9 billion of assets under management (as of 30 June 2021).

Tikehau Capital has developed a wide range of expertise across four

asset classes (private debt, real assets, private equity and

capital markets strategies) as well as multi-asset and special

opportunities strategies.

Tikehau Capital is a founder led team with a differentiated

business model, a strong balance sheet, proprietary global deal

flow and a track record of backing high quality companies and

executives.

Deeply rooted in the real economy, Tikehau Capital provides

bespoke and innovative alternative financing solutions to companies

it invests in and seeks to create long-term value for its

investors, while generating positive impacts on society. Leveraging

its strong equity base (€2.9 billion of shareholders’ equity as of

30 June 2021), the firm invests its own capital alongside its

investor-clients within each of its strategies.

Controlled by its managers alongside leading institutional

partners, Tikehau Capital is guided by a strong entrepreneurial

spirit and DNA, shared by its 629 employees (as of 30 June 2021)

across its 12 offices in Europe, Asia and North America. Tikehau

Capital is listed in compartment A of the regulated Euronext Paris

market (ISIN code: FR0013230612; Ticker: TKO.FP).

For more information, please visit: www.tikehaucapital.com

Our latest Sustainability Report is available here.

DISCLAIMER:

This document does not constitute an offer of securities for

sale or investment advisory services. It contains general

information only and is not intended to provide general or specific

investment advice. Past performance is not a reliable indicator of

future earnings and profit, and targets are not guaranteed.

Certain statements and forecasted data are based on current

forecasts, prevailing market and economic conditions, estimates,

projections and opinions of Tikehau Capital and/or its affiliates.

Due to various risks and uncertainties. actual results may differ

materially from those reflected or expected in such forward-looking

statements or in any of the case studies or forecasts. All

references to Tikehau Capital’s advisory activities in the US or

with respect to US persons relate to Tikehau Capital North

America.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20211003005080/en/

PRESS CONTACTS: Tikehau Capital: Valérie Sueur – +33 1 40 06 39

30 UK – Prosek Partners: Henrietta Dehn – +44 7717 281 665 USA –

Prosek Partners: Trevor Gibbons – +1 646 818 9238

press@tikehaucapital.com

SHAREHOLDER AND INVESTOR CONTACT: Louis Igonet – +33 1 40 06 11

11 shareholders@tikehaucapital.com

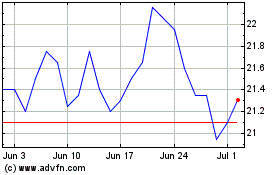

Tikehau Capital (EU:TKO)

Historical Stock Chart

From Mar 2024 to Apr 2024

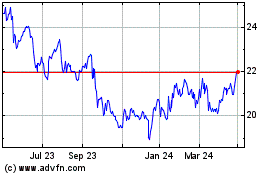

Tikehau Capital (EU:TKO)

Historical Stock Chart

From Apr 2023 to Apr 2024