Tikehau Capital to Launch Tikehau Impact Credit

July 12 2021 - 2:20AM

Business Wire

- Tikehau Capital launches high yield impact credit fund in

latest addition to impact platform

- Fund will focus on lowering companies’ carbon footprint to help

facilitate the transition towards a net zero carbon economy

Regulatory News:

Tikehau Capital (Paris:TKO), the global alternative asset

management group today announces the launch of Tikehau Impact

Credit (“TIC”), pioneering an impact approach in the high yield

universe. The fund’s objective is to help expand impact investing

in fixed income, a key step towards addressing climate change and

contributing to reaching the goals laid out in the Paris Agreement.

This new fund will sit alongside Tikehau Capital’s private assets

impact strategies, marking another major step forward for the

Group’s global impact platform.

The fund’s mission is to finance and actively engage with

companies across a diverse range of sectors which have the

potential to enable the global shift towards a net zero carbon

economy. Tikehau Capital will leverage its impact investment

expertise to define “impact cases” for each investment and help

issuers go down the path towards a more sustainable future.

TIC will focus on three buckets of investments and issuers:

Green or Sustainability-linked bonds or climate pure-players

already involved in the energy and ecological transition (bucket

A); issuers who have signed an international pledge towards climate

change (bucket B); and a sector-agnostic approach to companies with

the potential to contribute positively to climate change mitigation

or adaptation or to reduce other highly material environmental

externalities (bucket C).

TIC will build on industry-recognised standards to set key

impact goals including:

- a 30% carbon intensity reduction target compared to the High

Yield ESG index (ICE Global High Yield ESG Tilt Index)

- a minimum 25% invested in issuers highly exposed to climate

change which need to accelerate their transition and where impact

can be meaningful (eg. manufacturing, agriculture,

transportation)

- a contribution towards an annual 5% self-decarbonisation by

sector as a best-effort

Tikehau Capital has developed a proactive ESG-by-design approach

that is embedded in its portfolio management process and is at the

heart of its investment philosophy. Active and continuous

engagement with issuers will also be key to help these companies

accelerate their transition toward a more sustainable future.

Consistent with its policy of strong alignment of interests,

Tikehau Capital has committed €30 million of initial capital to

this fund.

Raphaël Thuin, Head of Capital Markets Strategies for Tikehau

Capital, said:

"We are thrilled to further expand our impact platform with the

launch of our high yield impact credit fund. In 2020, commitments

to reach net zero emissions from businesses have roughly doubled.

The next step is now for impact investing to reach the shores of

the fixed income market. We are committed to deploying an

engagement strategy contributing to the global initiative for

companies to achieve net zero emissions by 2050 or sooner and will

seek to give our investors the opportunity to reach both ambitious

financial and extra-financial goals through their fixed income

allocation.”

ABOUT TIKEHAU CAPITAL

Tikehau Capital is a global alternative asset management group

with €29.4 billion of assets under management (as of 31 March

2021). Tikehau Capital has developed a wide range of expertise

across four asset classes (private debt, real assets, private

equity and capital markets strategies) as well as multi-asset and

special opportunities strategies.

Tikehau Capital is a founder led team with a differentiated

business model, a strong balance sheet, proprietary global deal

flow and a track record of backing high quality companies and

executives.

Deeply rooted in the real economy, Tikehau Capital provides

bespoke and innovative alternative financing solutions to companies

it invests in and seeks to create long-term value for its

investors, while generating positive impacts on society. Leveraging

its strong equity base (€2.8 billion of shareholders’ equity as of

31 December 2020), the firm invests its own capital alongside its

investor-clients within each of its strategies.

Controlled by its managers alongside leading institutional

partners, Tikehau Capital is guided by a strong entrepreneurial

spirit and DNA, shared by its 607 employees (as of 31 March 2021)

across its 12 offices in Europe, Asia and North America. Tikehau

Capital is listed in compartment A of the regulated Euronext Paris

market (ISIN code: FR0013230612; Ticker: TKO.FP).

For more information, please visit: www.tikehaucapital.com

DISCLAIMER:

This document does not constitute an offer of securities for

sale or investment advisory services. It contains general

information only and is not intended to provide general or specific

investment advice. Past performance is not a reliable indicator of

future earnings and profit, and targets are not guaranteed.

Certain statements and forecasted data are based on current

forecasts, prevailing market and economic conditions, estimates,

projections and opinions of Tikehau Capital and/or its affiliates.

Due to various risks and uncertainties. actual results may differ

materially from those reflected or expected in such forward-looking

statements or in any of the case studies or forecasts. All

references to Tikehau Capital’s advisory activities in the US or

with respect to US persons relate to Tikehau Capital North

America.

TIC is a sub-fund of the SICAV Tikehau Fund and is managed by

Tikehau Investment Management (AMF authorisation number:

GP-07000006), the main asset management platform of Tikehau

Capital.

The main risks of TIC are: the risk of capital loss, the

liquidity risk, the equity risk, the credit risk, the risk linked

to the investment in speculative high yield securities, the

interest rate risk, the risk linked to the commitment of forward

financial instruments, the counterparty risk, the exchange rate

risk and sustainability risks.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210711005030/en/

PRESS CONTACTS: Tikehau Capital: Valérie Sueur – +33 1 40 06 39

30 UK – Prosek Partners: Henrietta Dehn – +44 7717 281 665 USA –

Prosek Partners: Trevor Gibbons – +1 646 818 9238

press@tikehaucapital.com

SHAREHOLDER AND INVESTOR CONTACT: Louis Igonet – +33 1 40 06 11

11 shareholders@tikehaucapital.com

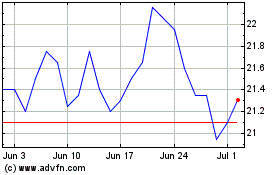

Tikehau Capital (EU:TKO)

Historical Stock Chart

From Mar 2024 to Apr 2024

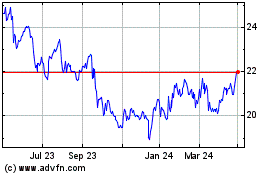

Tikehau Capital (EU:TKO)

Historical Stock Chart

From Apr 2023 to Apr 2024